Traffic Management Market Size, Share, Growth & Latest Trends

Traffic Management Market by Solution (Traffic Monitoring & Analytics, Adaptive Traffic Control, Traffic Enforcement Management, Incident Detection & Management) and End-User (Government, Private) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Traffic management market is expected to reach USD 75.74 billion by 2029 from USD 43.53 billion in 2024, at a CAGR of 11.7 % during 2024–2029. The growth of the traffic management market is driven by the rapid adoption of smart city initiatives, increasing urban congestion, and the need for real-time traffic monitoring. Advancements in AI, IoT, and cloud-based analytics are further enhancing traffic flow optimization and safety management.

KEY TAKEAWAYS

- The Europe traffic management market accounted for a 36.1% revenue share in 2024.

- By offering, the services segment is expected to register the highest CAGR of 13.2%.

- By application, the inter-urban segment is projected to grow at the fastest rate from 2024 to 2029.

- Company Huawei, Mundys SpA, and Swarco, were identified as some of the star players in the traffic management market (global), given their strong market share and product footprint.

- Companies INRIX, TagMaster, and Miovision among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The traffic management market is witnessing steady growth, driven by rising investments in intelligent transportation systems, government focus on reducing road accidents, and the integration of connected vehicle technologies. Additionally, the demand for sustainable mobility solutions and efficient public transport coordination is fueling market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on vendors in the traffic management ecosystem arises from growing urbanization and smart city initiatives. Government agencies and infrastructure developers act as clients of traffic management solution providers, while commuters and logistics users are the clients’ clients. Shifts such as connected mobility, real-time analytics, and AI-driven traffic optimization are improving transport efficiency and safety. These advancements affect commuter experiences and city operations, ultimately influencing the revenue and investment priorities of traffic management providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing concerns related to public safety

-

Growing urban population, rising number of vehicles, and inadequate infrastructure

Level

-

Slow growth in the infrastructure sector

-

Lack of standardized and uniform technologies

Level

-

Evolving 5G technology and transformation of traffic management system

-

Design and development of smart vehicles compatible with advanced technologies

Level

-

Security threats and hacking challenges

-

High expenses associated with equipment installation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing concerns related to public safety

With the increase in population and the need to drive, road safety has become a priority for all citizens. According to the WHO, approximately 1.3 million people die yearly because of road traffic crashes, costing around 3% of the total GDP of some countries. To minimize this, the United Nations General Assembly has set a target of half the global number of accidents and injuries from road accidents by 2030 (A/RES/74/299). Individual country governments are also taking initiatives to minimize road crashes by making laws for public safety. For instance, the Indian government has launched an app called “Sukhad Yatra 1033,” enabling highway travelers to report potholes or other safety hazards on national highways. Facilities, such as foot over bridges and underpasses, are also provided by the government for pedestrians’ safety.

Restraint: Slow growth in the infrastructure sector

The traffic management system needs high data speed for real-time data analysis. Because of this requirement, the infrastructure needed to deploy the new technology is not growing simultaneously. The high cost of updating existing equipment requires enormous investments. The governments of various countries limit their capabilities to invest in road infrastructure. The presence of existing infrastructure provides an opportunity for traffic management companies to approach the governments of various countries to upgrade the traffic system and minimize traffic congestion in their country. The traffic management system also requires continuous upgrades and infrastructural deployments. More investment in traffic management systems would affect the country’s budget capacity and other industries.

Opportunity: Evolving 5G technology and transformation of traffic management system

For the traffic management market, 5G technology unlocks the efficiency of communications among people, vehicles, and traffic management authorities. Low latency delivers minimal delay between messages, allowing traffic control authorities to surface vital data insights quickly. Real-time communication powered by 5G enables traffic management authorities to improve overall traffic operations while helping in real-time traffic congestion. Traffic management authorities can use more data to make well-informed real-time decisions that speed up a time to value. When data is synthesized and contextualized, it provides visibility, risk prediction analytics, forecasting, and accessible reports for the traffic management ecosystem. Traffic operators can use this information to make better decisions about routes.

Challenge: Security threats and hacking challenges

The traffic management market has significant growth potential. However, maintaining data security and privacy is a key challenge players face in this market. The installed smart devices and sensors continuously generate a huge amount of data. This is expected to help organizations handling data gain insights into the market position of their competitors. This data is analyzed to generate actionable business insights; most of this data is processed at the edge and stored in the cloud occasionally. Most IoT-enabled devices are connected to various networks, such as mobile connectivity, public Wi-Fi, and office Wide Area Networks (WAN). The public networks may not be as protected as they are required to be at an enterprise level. Thus, privacy and security are two closely related issues for IoT devices in a large-scale deployment. The business data collected in the cloud and IoT-enabled devices can be accessed through various cyber threats and breaches

Traffic Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Buenos Aires deployed the SGIM software in conjunction with Kapsch’s EcoTrafiX platform, which serves as an overarching system designed to interface with current systems and support future upgrades, ultimately unifying the existing UTC systems. | Facilitated coordination between stakeholders | Enabled multi-modal transport | A modern, state-of-the-art integrated control center | An efficient congestion management |

|

To tackle Lahore’s burgeoning traffic problem, Huawei helped the City develop a new ITMS consisting of more than 900 sets of ePolice facilities, 200 traffic checkpoints, and more than 100 traffic signal sites, with a signal control system and more than 70 traffic guidance screens. Huawei’s FusionInsight big data platform and AI-based license plate recognition algorithm were deployed to solve the problems posed by unstandardized license plates. | Within one year of Huawei’s ITMS deployment, the results were clear to all on the streets. The system generated more than 60 million traffic violation records and issued more than 130,000 electronic tickets. The number of red-light running incidents decreased by 66%. The number of traffic accidents fell by 83%. And road congestion is today substantially reduced. |

|

The Romanian City of Timi?oara wanted a new traffic control center, including control & video surveillance, without exceeding the budget of USD 4.5 million. Timi?oara opted for SWARCO’s integrated traffic control and video surveillance system. | The implementation of SWARCO’s Innovative Smart Mobility solutions and safe traffic management has ensured the smooth flow of traffic. Networked information platforms ensured maximum transparency, now keeping all road users in Timi?oara up to date. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The traffic management ecosystem integrates platform and software providers for traffic control, supported by analytical tools for data insights. Communication and surveillance providers ensure connectivity and monitoring, with system integrators coordinating seamless implementation for urban mobility.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Traffic Management Market, By Solution

The adaptive traffic control system solution is projected to register the highest CAGR during the forecast period. ATCS adjusts traffic signals automatically to match changing road conditions. ATCS observes intersection traffic patterns through sensor readings and Internet of Things (IoT) devices alongside camera data. The system's advanced analysis software uses traffic data to update signal timing, improving traffic flow and preventing delays while decreasing congestion. This system works well in urban and suburban areas by adjusting traffic signals to match changing traffic levels during busy times and specific events. ATCS helps achieve environmental targets through less fuel usage and decreased vehicle emissions during idle periods. The system improves both traffic flow and safety to become a vital part of smart traffic control technology.

Traffic Management Market, By Area of Application

During the forecast period, the urban area of application contributed the largest market share in the traffic management market. Urban areas use traffic management systems to improve traffic flow while decreasing delays and making roads safer. The system manages traffic flow by adjusting signals to match current traffic volume and provides smart parking directions to help drivers find empty spots faster. Urban traffic management integrates public transportation systems into operations to make travel easier for everyone. Additionally, eco-friendly initiatives, such as emissions monitoring, encourage people to switch to electric vehicles as part of sustainability programs. These applications work together to improve cities by improving traffic movement while protecting public safety and the environment.

Traffic Management Market, By End User

The government agencies and municipalities segment is expected to hold the largest market size during the forecast period. Governments and state agencies work to make cities more mobile, safer, and environmentally friendly. These entities manage and operate traffic technology to solve traffic problems and make roads safer while cutting emissions. Local governments focus on smart city projects using Internet of Things sensors and data analysis to better manage traffic and design infrastructure more effectively. Governments use methods like charging a toll fee based on traffic congestion and electronic payment systems to control traffic movement. Government agencies and municipalities invest in advanced traffic solutions to help citizens live better by making transportation greener and more effective

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

The Asia Pacific region is set to undergo significant growth opportunities in the coming years, with countries such as India, China, Australia, and New Zealand expected to experience high growth rates. The region's governments are investing in advanced traffic solutions to reduce traffic problems. The Smart City Kochi project in India and the Gateway WA Perth Airport and Freight Access Project in Australia demonstrate how nations use modern technologies to improve their transportation networks. New technology lets us instantly collect traffic data through sensors connecting to internet networks. This data drives important traffic management projects. Real-time traffic data helps create advanced traffic management systems while providing drivers updates to make better travel choices during their journeys.

Traffic Management Market: COMPANY EVALUATION MATRIX

In the traffic management market matrix, Huawei (Star) leads the traffic management market with its cutting-edge Intelligent Transportation System (ITS), leveraging AI, IoT, and big data to optimize traffic flow, reduce congestion, enhance safety, and deliver real-time, city-scale traffic intelligence for smart and sustainable urban mobility. Q-Free (Emerging Leader) is rapidly advancing in the market by offering innovative Intelligent Traffic Systems that enable adaptive traffic control, efficient tolling, and smart city integration, helping municipalities address modern congestion and mobility challenges. While Huawei dominates through scale and a diverse portfolio, Q-Free shows significant potential to move toward the leaders’ quadrant as demand for traffic management continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 38.82 Billion |

| Market Forecast in 2029 (Value) | USD 75.74 Billion |

| Growth Rate | CAGR of 11.7% from 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering, Areas of Application, End-user, and Region |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Traffic Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- September 2024 : Teledyne Technologies introduced the TrafiBot Dual AI multispectral camera system. This advanced closed-circuit traffic camera is specifically designed to enhance bridge and tunnel safety. The system utilizes artificial intelligence to analyze real-time traffic conditions, mitigating risks such as collisions with unseen objects and rapid vehicle fires.

- July 2024 : SWARCO acquired the Irish company Elmore Group, which provides various traffic management solutions, including LED traffic lights and maintenance services. This acquisition strengthens SWARCO's presence in the Irish ITS market, allowing it to offer enhanced turnkey solutions and better serve customers like Dublin City Council.

- February 2024 : Yunex Traffic Italy partnered with Municipia SpA, part of the Engineering Group, to advance mobility and traffic management digitalization across Italian cities. This collaboration formalized through a Memorandum of Understanding (MoU), aims to reduce CO2 emissions and improve urban traffic efficiency

- July 2023 : Mundys and ACS Group formed a strategic collaboration agreement to bolster Abertis' global leadership in transport infrastructure concessions. The collaboration aims to support an investment plan to expand Abertis' asset portfolio and drive growth and value creation.

- July 2022 : TomTom partnered with the Dutch Ministry of Infrastructure and Water Management to increase road safety. Through three-year-long cooperation with the Dutch Ministry and ANWB, Be-Mobile, Inrix, Hyundai, and Kia, Dutch drivers rely on TomTom traffic services.

Table of Contents

Methodology

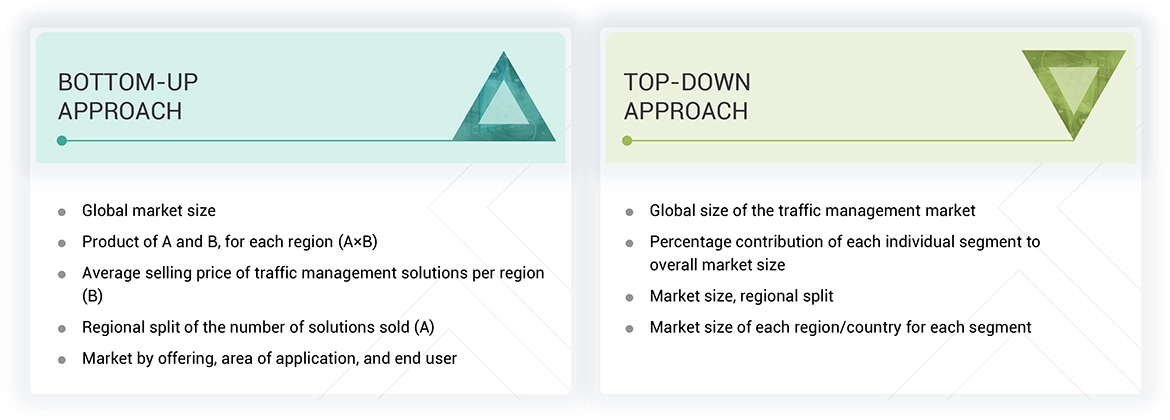

The research study involved four major activities in estimating the traffic management market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering traffic management solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations, such as the International Road Federation (IRF), International Traffic Safety Data and Analysis Group (IRTAD), The World Road Association (PIARC), the American Traffic Safety Services Association (ATSSA), and the Traffic Management Association of Australia (TMAA) were also referred to.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-oriented and technology-oriented perspectives.

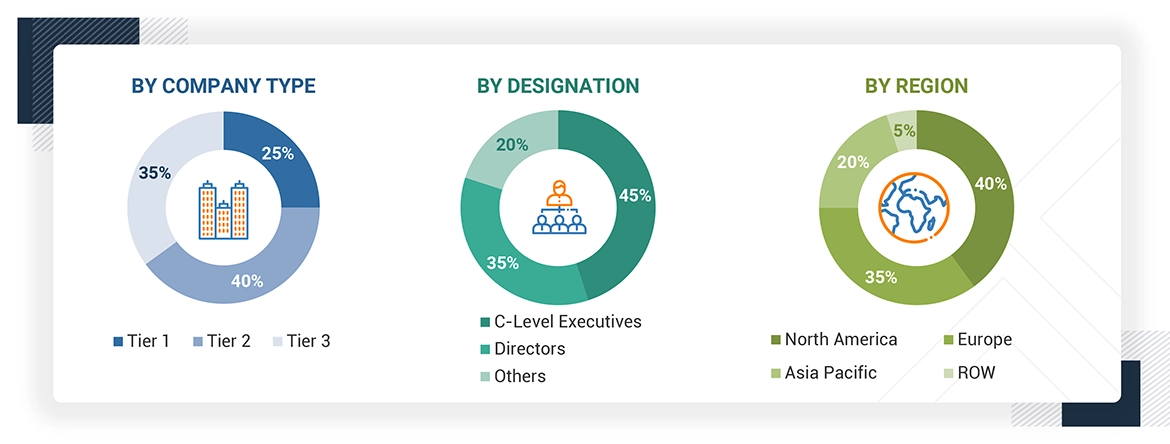

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, Such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from Traffic management solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Traffic management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Traffic management solutions which is expected to affect the overall Traffic management market growth.

Note 1: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies range between USD 500

million and 1 billion in overall revenues, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Traffic management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Traffic Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the Traffic management market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The Traffic management market size has been validated using top-down and bottom-up approaches.

Market Definition

According to PIARC (World Road Association), traffic management refers to the combination of measures that serve to preserve traffic capacity and improve the security, safety, and reliability of the overall road transport system. These measures use intelligent transportation systems (ITS), services, and projects in day-to-day operations that impact road network performance.

Stakeholders

- Original Equipment Manufacturers (OEMs)

- Internet of Things (IoT) Technology Vendors

- Technology Vendors

- Managed Service Providers (MSPs)

- Networking and Communications Service Providers (CSPs)

- Consulting and Advisory Firms

- Regional Department of Public Transport Authorities

- Governments and Urban Planning Agencies

- Regional Associations

- Investors and Venture Capitalists

- Independent Software Vendors

- Value-Added Resellers (VARs) and Distributors

Report Objectives

- To determine, segment, and forecast the traffic management market based on offering, area of application, end-user, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Traffic Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Traffic Management Market

Vilde

Jun, 2019

Interested in LiDAR (Lighting Detection And Ranging) in the traffic.

Tommaso

Jun, 2018

Understanding the market segments of Traffic Management Market.

Alp

Jun, 2019

Intersted in Traffic management market.

James

Sep, 2013

Interseted in Traffic management market.

sandrine

Jun, 2017

Interested in sensor technology in traffic management market.

Ayanda

Feb, 2015

Interested in traffic management market in south africa .

Constantinos

Oct, 2018

Understanding the market size and growth in traffic management system and itelligent transport systems..

Thierry

Jul, 2016

Interseted in Traffic management market.

G

May, 2019

Interested in Trafiic control market.

Bogdan

Mar, 2019

Interested in Traffic management market in south africa .

Dimitry

Jun, 2019

Understanding the market segments of Traffic Management Market.

Fedor

Jun, 2019

Interested in Traffic Management Market.

Akshay

Dec, 2018

Understanding the close-loop traffic light control system market.

Dimitry

Jun, 2019

Understanding the market segments of Traffic Management Market.

Elif

Apr, 2019

Market prediction and future scope of traffic management system.

Richard

Feb, 2015

Segments and players in the solution segments.

Lukas

Oct, 2017

Interested in Traffic management market in south africa .

Bogdan

Aug, 2019

Interested in Traffic management market in south africa .

Claire

Jul, 2016

Interested in data on toll management solutions.

Govardhan

Jul, 2014

Interseted in Traffic management market.

DEVARAJU

Feb, 2019

Interested in Traffic Survey Market.

Tobias

Jan, 2019

Interested in market size and forecast of traffic management market.