Route Optimization Software Market by Component (Software & Services), Vertical (On-Demand Food Delivery, Ride Hailing & Taxi Services, Field Services, and Retail & FMCG), Organization Size, Deployment Type, and Region - Global Forecast to 2023

[124 Pages Report] The route optimization software market was valued at USD 2.50 billion in 2017 and is expected to reach USD 5.07 billion by 2023, at a CAGR) of 11.4% during the forecast period.

Route optimization software finds the applicability in the fleet management systems deployed at the users end. This software includes GPS tracking capability and advanced reporting features that provide the dispatchers with the cost-efficient route, aid in planning more fuel-efficient routes, prevent unplanned stops, and reduce bottlenecks within the delivery network. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Market Dynamics

Drivers

- Increasing use of logistics-specific solutions

- Declining hardware and connectivity costs

Restraints

- Handling structured and unstructured data

Opportunities

- Growth of Software as a Service (SaaS) model

- Real-time location data analysis

Challenges

- Security concerns

Increasing use of logistics-specific solutions is driving the growth of the market

The increase in the number of solution providers for cloud-based platforms, solutions, and other services to the logistics industry will allow fleet organizations to choose route optimization software from multiple solution providers at an affordable price. New software providers aim to provide affordable solutions and offer monthly, quarterly, and yearly options to allow fleet service providers to adopt this solution globally. New entrants are playing a crucial role by acquiring market share from leading software providers through new business models based on data analytics, blockchain, and other technologies, which include the real-time scenario of traffic congestion. These advanced technological features enable fleet service providers to provide optimized routes and plan the journey in advance to save time and fuel. Startups are offering last-mile delivery and crowd-delivery solutions to provide the differentiating factor from other leading solution providers. These startups collaborate with end customers and complement their service offers. This factor enables fleet management vendors to benefit from cloud-based route optimization software from the startups to provide scalable solutions that cater to changing customer needs.

The following are the major objectives of the study:

- To determine and forecast the global route optimization software market based on component, deployment type, organization size, vertical, and region from 2018 to 2023

- To forecast the size of market segments with respect to 5 main regions, namely North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze each submarket with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile key market players, provide comparative analysis based on business overviews, product offerings, regional presence, business strategies, and key financials with the help of in-house statistical tools to understand the competitive landscape

- To track and analyze competitive developments, such as new product launches & product enhancements, agreements, collaborations & partnerships, acquisitions, and expansions in the route optimization software market

The research methodology used to estimate and forecast the route optimization software market size begins with obtaining data of key vendor revenues through secondary research such as annual reports, white papers, certified publications, databases, such as Factiva and D&B Hoovers, press releases, and investor presentations of route optimization software vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure is used to arrive at the overall global market size from the revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

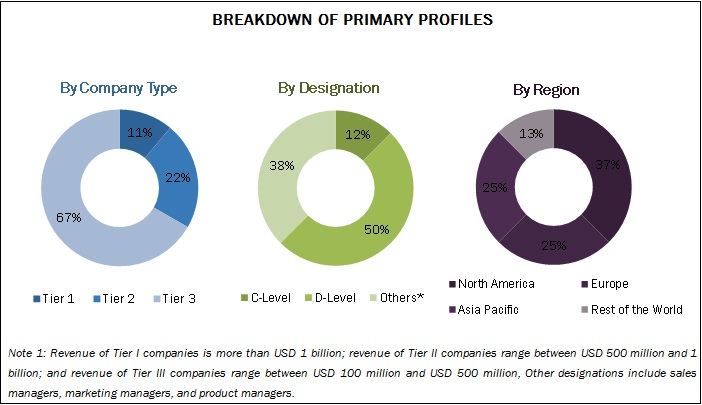

The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The route optimization software market ecosystem includes key players, such as the ALK Technologies (US), AMCS (Ireland), Caliper (US), Descartes (Canada), Esri (US), FLS (Germany), Geoconcept (France), Google (US), Portatour (Austria), Llamasoft (US), Maxoptra (UK), Microlise (UK), Omnitracs (US), Optimoroute (US), ORTEC (Netherlands), Paragon Software (UK), PTV Group (Germany), Quintiq (Netherlands), FarEye (India), Route4me (US), RouteSolutions (US), Routific (Canada), Scientific Logistics (US), Truckstops (UK), Verizon Connect (US), and Workwave (US).Major Market Developments

- In July 2018, The Greater Jakarta Transportation Agency, partnered with Google to launch a special feature on its Google Maps platform. Google Maps is working with third-party providers, public sources, and user contributors regarding the update of the product.

- In July 2018, Paragon Software enhanced its routing and scheduling software to interface with more than 40 different vehicle tracking systems, with a number of new technology partnerships with telematics providers. This functionality would aid transport operations to use real-time information that will improve their transport planning process.

- In May 2018, Google updated its Google Maps API platform for developers with a new name, Google Maps Platform.

- In August 20167, Descartes acquired MacroPoint, an electronic transportation network providing location-based truck tracking and predictive freight capacity data content. This acquisition helped customers research, plan, execute, and monitor multi-modal shipments around the world.

- In February 2017, Omnitracs launched its integrated Routing, Dispatching, and Compliance (RDC) solution. RDC seamlessly combines routing, dispatching, trip management, proof of delivery, hours of service, and Driver-Vehicle Inspection Report (DVIR) compliance. RDC provides fleets with real-time information about routing efficiency, tracking, safety, and compliance.

Key Target Audience for Route Optimization Software Market

- Route Optimization Software Providers

- System Integrators

- Value-added Resellers

- Distributors

- Channel Partners

- Investors and Venture Capitalists

- Cloud Service Provides

- Logistics and Transportation Firms

Scope of the Route Optimization Software Market Research Report

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

Market, by Component

- Software

- Services

- Consulting

- Map Integration & Software Deployment

- Support & Maintenance

Market, by Deployment

- On-premises

- Cloud

Route Optimization Software Market, by Organization Size

- Small & Medium Enterprises

- Large Enterprises

Market, by Vertical

- On-demand Food Delivery

- Retail & FMCG

- Field Services

- Ride Hailing & Taxi Services

- Others

Market, by Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Critical questions which the report answers - What are key strategies the route optimization companies have undertaken to increase overall route efficiency for the end users?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Along with the market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the US market, by component

- Further breakdown of the UK market, by component

Company Information

- Detailed analysis and profiles of additional market players

The route optimization software market size is expected to grow from to grow from USD 2.95 billion in 2018 to USD 5.07 billion by 2023, at a CAGR of 11.4% from 2018 to 2023. The major drivers of the market include the increasing use of logistics-specific solutions and declining hardware and connectivity costs.

The scope of the report covers the route optimization software market analysis by component (software and services), deployment type, organization size, vertical, and region. The software segment is expected to account for a larger share during the forecast period as compared to the services segment, owing to the increasing need for route optimization software amidst the rising traffic congestion and rising need of improving customer service delivery. The services segment is expected to grow at a higher CAGR owing to the need of all the service components throughout the pre-and post-software deployment cycle.

The on-premises deployment type is expected to hold a larger market size during the forecast period, owing to the need for customized software that can address complex requirements and the need of data control and security. The cloud deployment type is expected to record a higher growth rate during the forecast period, owing to the cost benefits and scalability it offers.

By organization size, the large enterprise organization segment is expected to hold a larger market size during the forecast period, owing to the large-scale implementation of customized software and increased operations. The SMEs segment is expected to record a higher growth rate during the forecast period, owing to the increased adoption of cloud-based route optimization software.

The retail & fast-moving consumer goods (FMCG) vertical is expected to hold a larger market size during the forecast period, owing to the need of greater need to reduce the service delivery time and cut cost related to delivery and time took. The field services segment is expected to grow at the highest CAGR during the forecast period, owing to the vitality of routes taken to complete multiple jobs within a stipulated time.

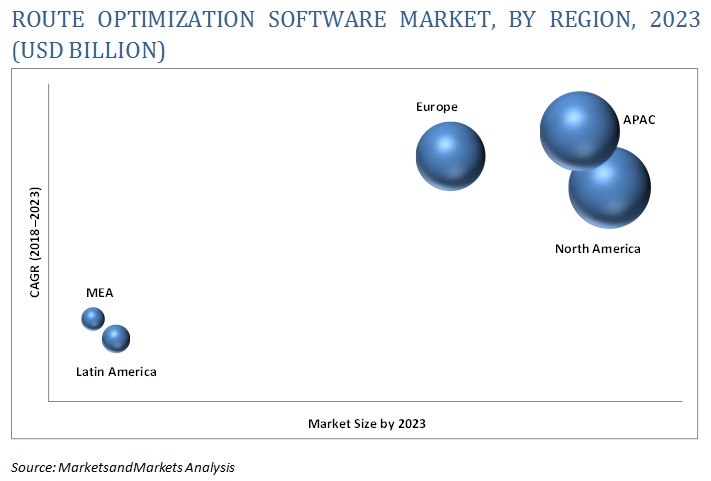

As per the geographic analysis, the route optimization software market in the APAC region is expected to grow at the highest rate during the forecast period, due to the increasing adoption of route optimization software amidst growing traffic congestion, the increasing vehicle sales in countries, and the growing implementation of smart transportation projects. North America is expected to hold the largest market size during the forecast period, owing to the large-scale investments in implementing route optimization software to address the growing need for delivery efficiency and better driver convenience.

Route optimization software adoption across retail and FMCG drives the growth of the market

On-Demand Food Delivery

The on-demand food delivery platforms and applications allow customers to order food from a wide-array of restaurants or food chains with a single tap on mobile phones. Simplified commercial vehicle operations and visibility into the food supply chain help on-demand food delivery service providers to acquire more customers. Route optimization software enabled the food delivery service providers to check the drivers status on long & short routes, manage multiple stops for food delivery, and ensure timely delivery of food.

RETAIL & FMCG

Route optimization software helps manufacturers, wholesalers, and retailers to better track and optimize their omnichannel strategies, decrease the Cost to Service (CTS), increase operational efficiency, and offer enhanced customer satisfaction and experience and thereby deliver better customer service. The deployment of route optimization software in the retail sector help retailers track their assets and fleet, optimize the route based on frequencies, customer visit patterns, and seasonal variations, perform dynamic route planning on a daily basis, and aids in the selection of optimal depots and multi-depot visits for vehicles.

FIELD SERVICES

The route optimization software helps the field services segment with the most efficient routes and reduce the time drivers spend traveling between different sites. This leads to the fulfillment of a maximum number of jobs within a minimal distance and time. Other benefits include improved vehicle mileage, reduced maintenance costs, and fuel consumption.

Critical questions the report answers:

- Which are the key verticals that will adopt route optimization solutions in the mid to long term?

- What are the regional trends for the route optimization vendors?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Market

4.2 North America: Market By Component

4.3 Europe: Market By Deployment Type

4.4 Asia Pacific: Market By Organization Size

4.5 Route Optimization Software Market, By Services & Top 3 Regions

5 Market Overview & Industry Trends (Page No. - 31)

5.1 Market Dynamics

5.1.1 Introduction

5.1.2 Drivers

5.1.2.1 Increasing Use of Logistics-Specific Solutions

5.1.2.2 Declining Hardware and Connectivity Costs

5.1.3 Restraints

5.1.3.1 Handling Structured and Unstructured Data

5.1.4 Opportunities

5.1.4.1 Growth of the Software as A Service (SaaS) Model

5.1.4.2 Real-Time Location Data Analysis

5.1.5 Challenges

5.1.5.1 Security Concerns

5.2 Industry Trends

5.2.1 Case Studies

5.2.1.1 Fidelitone Implemented Llamasoft Transportation Optimization Solution to Improve the Efficiency of Its Delivery Routing and Frequency

5.2.1.2 American Newspaper Solutions Chose Route4me to Obtain Immediate Route Optimization and Locate Addresses

5.2.1.3 Returpack Chose AMCS Intelligent Optimisation Suite for Better Transport Overview and Highly Improved Customer Service

6 Route Optimization Software Market, By Component (Page No. - 36)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Consulting

6.3.2 Map Integration & Software Deployment

6.3.3 Support & Maintenance

7 Market By Deployment Type (Page No. - 42)

7.1 Introduction

7.2 Cloud

7.3 On-Premises

8 Route Optimization Software Market, By Organization Size (Page No. - 46)

8.1 Introduction

8.2 Small & Medium Enterprises

8.3 Large Enterprises

9 Route Optimization Software Market, By Vertical (Page No. - 50)

9.1 Introduction

9.2 On-Demand Food Delivery

9.3 Retail & FMCG

9.4 Field Services

9.5 Ride Hailing & Taxi Services

9.6 Others

10 Regional Analysis (Page No. - 53)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Rest of Asia Pacific

10.5 Middle East & Africa (MEA)

10.5.1 Saudi Arabia

10.5.2 Qatar

10.5.3 Rest of Middle East & Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 71)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches & Product Enhancements

11.2.2 Agreements, Collaborations & Partnerships

11.2.3 Acquisitions

11.2.4 Expansions

11.3 Market Ranking of Key Players

12 Company Profiles (Page No. - 78)

(Business Overview, Solutions/Services Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 ALK Technologies

12.2 Caliper

12.3 Descartes

12.4 ESRI

12.5 Google

12.6 Llamasoft

12.7 Microlise

12.8 Omnitracs

12.9 Ortec

12.10 Paragon Software Systems

12.11 PTV Group

12.12 Quintiq

12.13 Route4me

12.14 Routific

12.15 Verizon Connect

12.16 Workwave

*Details on Business Overview, Solutions/Services Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12.17 Key Innovators

12.17.1 AMCS

12.17.2 Blujay Solutions

12.17.3 Fareye

12.17.4 FLS

12.17.5 Geoconcept

12.17.6 Maxoptra

12.17.7 Optimoroute

12.17.8 Portatour

12.17.9 Routesolutions

12.17.10 Scientific Logistics

12.17.11 Truckstops

13 Appendix (Page No. - 117)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (45 Tables)

Table 1 Route Optimization Software Market Size, By Component, 20162023 (USD Million)

Table 2 Software: Market Size By Region, 20162023 (USD Million)

Table 3 Services: Market Size By Service Type, 20162023 (USD Million)

Table 4 Services: Market Size By Region, 20162023 (USD Million)

Table 5 Consulting: Market Size By Region, 20162023 (USD Million)

Table 6 Map Integration & Software Deployment: Market Size By Region, 20162023 (USD Million)

Table 7 Support & Maintenance: Market Size By Region, 20162023 (USD Million)

Table 8 Route Optimization Software Market Size, By Deployment Type, 2016-2023 (USD Million)

Table 9 Cloud: Market Size By Region, 20162023 (USD Million)

Table 10 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 11 Market Size By Organization Size, 20162023 (USD Million)

Table 12 Small & Medium Enterprises: Market Size By Region, 2016-2023 (USD Million)

Table 13 Large Enterprises: Market Size By Region, 2016-2023 (USD Million)

Table 14 Route Optimization Software Market Size, By Vertical, 2016-2023 (USD Million)

Table 15 Market Size By Region, 20162023 (USD Million)

Table 16 North America: Market Size By Country, 20162023 (USD Million)

Table 17 North America: Market Size By Component, 20162023 (USD Million)

Table 18 North America: Market Size By Service Type, 20162023 (USD Million)

Table 19 North America: Market Size By Deployment Type, 20162023 (USD Million)

Table 20 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 21 Europe: Route Optimization Software Market Size, By Country, 20162023 (USD Million)

Table 22 Europe: Market Size By Component, 20162023 (USD Million)

Table 23 Europe: Market Size By Service Type, 20162023 (USD Million)

Table 24 Europe: Market Size By Deployment Type, 20162023 (USD Million)

Table 25 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 26 Asia Pacific: Route Optimization Software Market Size, By Country, 20162023 (USD Million)

Table 27 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size By Service Type, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size By Deployment Type, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 31 Middle East & Africa: Route Optimization Software Market Size, By Country, 20162023 (USD Million)

Table 32 Middle East & Africa: Market Size By Component, 20162023 (USD Million)

Table 33 Middle East & Africa: Market Size By Service Type, 20162023 (USD Million)

Table 34 Middle East & Africa: Market Size By Deployment Type, 20162023 (USD Million)

Table 35 Middle East & Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 36 Latin America: Route Optimization Software Market Size, By Country, 20162023 (USD Million)

Table 37 Latin America: Market Size By Component, 20162023 (USD Million)

Table 38 Latin America: Market Size By Service, 20162023 (USD Million)

Table 39 Latin America: Market Size By Deployment Type, 20162023 (USD Million)

Table 40 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 41 Market Evaluation Framework

Table 42 New Product Launches & Product Enhancements, February 2018- July 2018

Table 43 Agreements, Collaborations & Partnerships, August 2017- July 2018

Table 44 Acquisitions, November 2016- June 2018

Table 45 Expansions, January 2016-July 2018

List of Figures (29 Figures)

Figure 1 Market Segmentation: Route Optimization Software Market

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Route Optimization Software Market is Expected to Witness Significant Growth During the Forecast Period

Figure 8 Top 3 Leading Segments in the Route Optimization Software Market, 2018

Figure 9 Route Optimization Software Regional Market Scenario

Figure 10 Growing Demand for Logistics Specific Solutions is Driving the Route Optimization Software Market

Figure 11 Services Segment Projected to Grow at A Higher CAGR as Compared to Software Segment During Forecast Period

Figure 12 Cloud Segment Expected to Grow at A Higher CAGR Compared to On-Premises Segment During Forecast Period

Figure 13 Small & Medium Enterprises Segment Expected to Grow at A Higher CAGR Compared to Large Enterprises Segment During Forecast Period

Figure 14 North America Estimated to Lead Market in 2018

Figure 15 Route Optimization Software Market: Drivers, Restraints, Opportunities & Challenges

Figure 16 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period as Compared to Software Segment

Figure 17 On-Premises Segment Estimated to Lead Market in 2018

Figure 18 Large Enterprises Segment Estimated to Lead Market in 2018

Figure 19 Retail & FMCG Segment Estimated to Lead Market in 2018

Figure 20 North America is Estimated to Be the Largest Market for Route Optimization Software in 2018

Figure 21 Route Optimization Software Market in Asia Pacific Projected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Companies Adopted New Product Launches & Product Enhancements as Key Growth Strategies Between January 2016 and July 2018

Figure 25 Market Ranking of Key Players in Route Optimization Software Market, 2017

Figure 26 Descartes: Company Snapshot

Figure 27 Descartes: SWOT Analysis

Figure 28 Google: Company Snapshot

Figure 29 Google: SWOT Analysis

Growth opportunities and latent adjacency in Route Optimization Software Market