Air Traffic Management Market by Airspace (ATS, ATFM, ASM, AIM), Application (Communication, Navigation, Surveillance, Automation), End Use (Commercial, Military), Investment Type, Offering, Service, Airport Size and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Air Traffic Management (ATM) market is experiencing significant growth, driven by increasing global air travel demand and the need for enhanced safety and efficiency in airspace operations. Technological advancements, such as the integration of automation, artificial intelligence, and advanced communication systems, are transforming air traffic control and management processes. These innovations improve real-time data sharing, optimize flight routes, and enhance decision-making, leading to reduced delays and fuel consumption. As air traffic continues to rise, there is a growing demand for modernized ATM solutions to ensure seamless and safe airspace management, especially in high-traffic regions.

The Air Traffic Management Market is expected to reach USD 11.8 billion by 2027 from USD 8.0 billion in 2022 to grow at a CAGR of 8.1% during forecast period. Air Traffic Management (ATM) comprises contact with ground systems, effective use of airspace, and ensuring flight safety. The demand for advanced ATM is majorly driven by the increase in air passenger traffic, as more aircraft use the same available airspace. The aviation industry is constantly changing due to the development of advanced technologies and increasing investments in airport infrastructure, which is expected to lead to an increase in demand for ATM Industry.

A safe, secure, efficient, and environmentally sustainable air navigation system is required to maintain the sustainability of airports. This requires the implementation of an ATM system that provides enhanced capabilities due to technological advancements. With technological advancements, developments in ATM are taking place at a much higher pace due to the increasing demand for better safety measures to prevent accidents.

To know about the assumptions considered for the study, Request for Free Sample Report

Air traffic management Market Dynamics

Driver: Launch of SESAR 3 joint undertaking to modernize European air traffic management

The first Single European Sky ATM Research (SESAR) Joint undertaking (JU) program, known as SESAR 1, ran from 2008 to 2016. SESAR members ran over 400 projects, conducted 350 validations and 30,000 flight trials, and invested 20 million hours in ensuring that the results of the program would meet the operational needs of ATM providers who must implement their ATM products, services, and solutions. SESAR 1 is known to be the development phase. In the deployment phase, the validated ATM solutions are to be produced and implemented on a large scale. This phase, known as SESAR 2, lasted from 2014 to 2020.

The SESAR 3 joint undertaking is an institutionalized European partnership between private and public sector partners set up to accelerate the delivery of the digital European sky program through research and innovation. In order to implement this, SESAR is harnessing, developing, and accelerating the take up of the most cutting-edge technological solutions to manage conventional aircraft, drones, air taxis, and vehicles flying at higher altitudes.

Restrains: Stringent regulatory norms associated with aircraft operation

Stringent regulatory norms serve as one of the major restraints affecting the growth of the ATM market. Various countries across the globe have regulatory bodies governing safety levels associated with the operation of aircraft. For instance, the Irish Aviation Authority (IAA) safety regulation division manages the regulatory function for airworthiness certification and registration of ATM components and services, licensing of personnel and organizations involved in the maintenance of these components, and approval and monitoring of ATM operating standards. This division also carries out inspections and audits of ATM components, airports, airport suppliers, and suppliers of inflight services. In addition, the International Civil Aviation Organization (ICAO) has laid down regulations to be adhered to globally. All aircraft components and systems must meet the regulatory requirements implemented by the ICAO to ensure the safety of aircraft operations and control the risks associated with defective components.

These stringent rules and regulations must be adhered to by ATM component manufacturers to meet all safety norms and produce the highest quality air traffic management systems. Rising cyber threats and increasing pressure on restricting the use of airspace by homeland security of air management systems are also affecting the growth of the market.

Opportunities: Growing understanding of digitalization and its role within aviation industry

The new concept of the remote virtual tower has been introduced in the air traffic management market trends. Remote virtual towers allow controllers to perform all functions of a control tower from anywhere in the world. These towers ensure streamlined access, reduced delays, and increased safety margins compared to non-towered airports. Airports and air navigation service providers (ANSPs) are considering the possibilities of advancements in visual observation aided by the introduction of ICAO's Procedures for Air Navigation Services (PANS) ATM amendments. These amendments state that visual observation shall be achieved through direct out-of-the-window observation or indirect observation utilizing a visual surveillance system specifically approved for the purpose by the appropriate ATS authority. This would undoubtedly encourage several countries to implement remote and digital towers. These towers occupy a smaller footprint, cost less, are technically effective, and are often more resilient and secure in comparison to a conventional control tower. In addition, they can provide aerodrome control services for more than one aerodrome, where dedicated local air traffic services are not considered sustainable or cost effective.

Challenges: Risk of cyber threat due to Automatic Dependent Surveillance–Broadcast (ADS–B) in air traffic management

Air traffic control systems based on the ADS-B standard have been widely adopted in civil aviation to the point that they are now considered the de-facto standard. ADS-B provides major benefits to airports and airlines by increasing the safety of air traffic management and control and allowing more flights to travel near busy airports. However, the ADS-B technology lacks sufficient security measures. The system is vulnerable and exposed to cyberattacks. It lacks security features, i.e., all the ADS-B messages are unauthenticated and unencrypted. This allows the injection of false flight data, jamming the wireless communications between airplanes and control towers, and preventing the detection of commercial aircraft by ADS-B ground stations, control towers, and other aircraft.

Connecting traffic with ground-based ATM systems through CPDLC is driving the Application segment

The hardware components within CPDLC facilitate communication between the ATC and pilots via a data link. Components such as a router, radio transceivers, and computer form this data link between the ATC and the pilot to share digital information. CPDLC provides a two-way communication link through which a controller can send messages to aircraft as an alternative to communication via voice. The pilot can read the messages on display on the flight deck. The CPDLC application provides air-ground data communication, enabling the exchange of information, clearance, and request messages corresponding to voice phraseology employed by air traffic control procedures.

In November 2021, The Federal Aviation Administration's (FAA) awarded SITA Group (Switzerland) its Oceanic Data Link (ODL) contract for FANS 1/A-based managed ATC services in US-controlled oceanic airspace. Under the ODL contract, SITA Group’s Automatic-Dependent Surveillance-Contract (ADS-C) and Controller-Pilot Data Link Communication (CPDLC) managed services are used by aircraft throughout the US domestic and oceanic airspace.

Increasing use of automated sensor recording, monitoring, and evaluation system to drive the offering segment

With the increasing development in air traffic management systems, sensors play a vital role in the application area of air traffic management. The infrared sensors for air traffic control applications at airports as an alternative to radar-based solutions. When the sensors are triggered, and controllers receive the alarm through an HMI, an instant visual or audible alarm can be sent to the receivers through the audio function of the warning system.

Asia Pacific likely to emerge as the largest air traffic management market Share

The Asia Pacific market has always been the largest for air traffic management. China and India have a strong political influence on the industrial policies of various sectors. Countries in the region are rapidly transforming from a conservative one-party political system to a western-style democratic system. However, China, Malaysia, and Singapore still hold firmly to the one-party political system. These countries are under constant pressure to transform into the western government systems, leading to a favorable environment for foreign companies seeking to invest in the region. The countries in this region have always supported initiatives such as NextGen and SESAR, which means this air traffic management market has high growth potential.

To know about the assumptions considered for the study, download the pdf brochure

Top Air Traffic Management Companies - Key Market Players

The air traffic management market is dominated by a few globally established players such as Thales Group (France), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc. (US), Indra Sistemas, S.A. (Spain) and Saab AB (Sweden) among others.

Scope of the Air Traffic Management Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 8.0 Billion |

|

Projected Market Size |

USD 11.8 Billion |

| Growth Rate |

8.1% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Airspace, By Investment Type, By Application, By Offering, By Service, By End Use, By Airport Size |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Thales Group (France), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc. (US), Indra Sistemas, S.A. (Spain) and Saab AB (Sweden) are some of the major players of air traffic management market. (25 Companies) |

The study categorizes the air traffic management market share based on airspace, investment type, application, offering, service, end use, airport size, and region.

By Airspace

- Air Traffic Services (ATS)

- Air Traffic Flow Management (ATFM)

- Airspace Management (ASM)

- Aeronautical Information Management (AIM)

By Investment Type

- New Installation

- Modernization & Upgradation

By Application

- Communication

- Navigation

- Surveillance

- Automation

By End Use

- Commercial

- Military

By Offering

- Hardware

- Software & Solutions

By Service

- ATM as a service

- Maintenance Service

- Support Service

By Airport Size

- Large

- Medium

- Small

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

Recent Developments

- In May 2022, Qatar Civil Aviation Authority (QCAA) has selected Frequentis AG (Austria) to upgrade its existing voice communication system (VCS) and modernize its air traffic control (ATC) tower operation to meet air traffic demand resulting from the World Cup in the country in 2022.

- In May 2022, Indra Sistemas, S.A. (Spain) will digitize and upgrade the Sal Island oceanic air traffic control center and control towers at Santiago, Boa Vista, São Vicente, and Sal, Africa, with state-of-the-art technology to bring air traffic management performance and safety to the highest level.

- In April 2022, Raytheon Intelligence & Space, a Raytheon Technologies business, completed the installation of the first Global Aircrew Strategic Network Terminal system for the US Air Force. The terminal system modernizes existing protected communications systems while adding new capabilities for nuclear and non-nuclear command and control.

- In April 2022, SITA implemented the airport management solution at Athens International Airport to deliver significantly improved airport processes and operational and cost efficiencies.

- In March 2022, Dubai Aviation Engineering Projects (DAEP) has selected TopSky – Air Traffic Control (ATC), an advanced ATM system by Thales, to enhance the safety, capacity, and efficiency of air navigation services.

- In February 2022, ANWS selected Thales to replace 3 airport surveillance systems in Taitung, Hualien, and Songshan, Taiwan, with the STAR NG primary surveillance radars, combined with the RSM NG secondary radars.

- In February 2022, Saab Digital Air Traffic Solutions (SDATS) has signed a contract to deliver a digital tower to provide air navigation services at the Brasov-Ghimbav International Airport in Romania, which will be operated by ROMATSA.

- In December 2021, The company took ownership of Saab Digital Air Traffic Solutions AB (SDATS). The Swedish Civil Aviation Administration (LFV) has previously owned 41% of the company, with Saab AB owning 59%.

Frequently Asked Questions (FAQ):

Which are the major companies in the air traffic management market? What are their major strategies to strengthen their market presence?

The air traffic management market is dominated by a few globally established players such as Thales Group (France), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc. (US), Indra Sistemas, S.A. (Spain) and Saab AB (Sweden) among others.

Contracts were the main strategy adopted by leading players to sustain their position in the air traffic management market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced air traffic management equipment.

What are the drivers and opportunities for the air traffic management market?

The market for air traffic management has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and procurement of new air traffic managements in countries such as China, India, and Japan, will offer several opportunities for air traffic management industry. The rising R&D activities to develop air traffic management are also expected to boost the growth of the market around the world. Advancement in Unmanned Traffic Management is also driving demand for unmanned aerial vehicles.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2022 to 2027, showcasing strong demand for use of air traffic management system in the region.

Which type of air traffic management segment is expected to significantly lead in the coming years?

Offering segment of the air traffic management market is projected to witness the highest CAGR The growth of the air traffic management market can be attributed to the increased demand for advanced software and solutions.

What are some of the technological advancements in the market?

Various research activities have been conducted by OEMs across the globe to enhance air traffic management. At the World ATM Congress 2021, Adacel Technologies, Ltd. showcased its latest Aurora and MaxSim system developments. Aurora is the leading air traffic management solution offered by the company for managing procedural airspace in a surveillance environment used for oceanic, en-route, approach, and tower air space environments. MaxSim is the premier air traffic simulation and Training system. The company demonstrated MaxSim’s new immersive virtual reality experience and presented its latest cloud-based solution. In addition, the company is excited to introduce AeroScene–the new state-of-the-art Image Generation (IG) solution that delivers unprecedented visual capabilities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved various activities in estimating the current size of the air traffic management market. Exhaustive secondary research was done to collect information on the air traffic management market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the air traffic management market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to, for this research study include financial statements of companies offering air traffic management systems, services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the air traffic management market, which was validated by primary respondents.

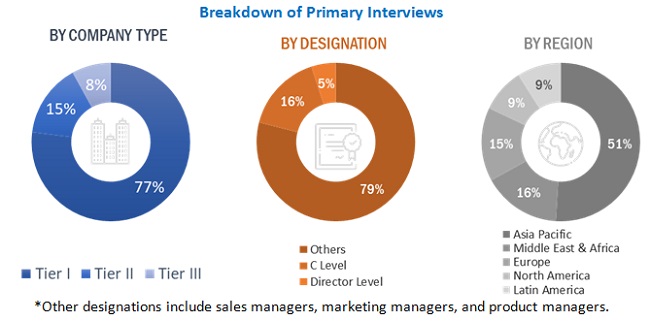

Primary Research

Extensive primary research was conducted after acquiring information regarding the air traffic management market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Air Traffic Management Market Size Estimation

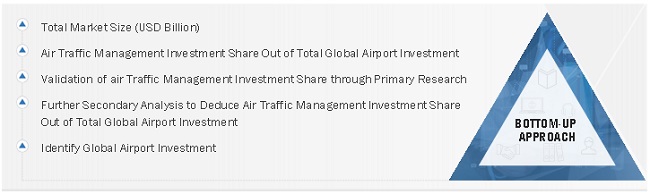

Both top-down and bottom-up approaches were used to estimate and validate the size of the air traffic management market. The research methodology used to estimate the size of the market includes the following details:

The key players in the air traffic management market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as CEOs, directors, and marketing executives of leading companies operating in the air traffic management market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the air traffic management market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Air traffic management Market Size: Bottom-Up Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the air traffic management market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, the demand and supply sides. The market size was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the air traffic management market based on airspace, investment type, application, offering, service, end use, airport size, and region

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the air traffic management market

- To analyze the macro and micro indicators of the market and provide a factor analysis

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with the major countries in each region

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches & developments of key players in the air traffic management market

- To identify detailed financial positions, key products, and key developments of leading companies in the air traffic management market

- To identify industry trends, market trends, and technology trends currently prevailing in the air traffic management market

- To strategically analyze micromarkets with respect to individual technological trends and prospects of the air traffic management market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the air traffic management market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the air traffic management market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Traffic Management Market

I am interested in Value analysis for air transport system in africa

Good Morning, We are looking for a safe supplier of an ATM system. And we would like some suggestions from the key players on the market. Best Regards, Aguinaldo Madureira

Hi! I'd like to know the size of our ATC market, on which way we are now, and what problems are faced by different ATC markets in other countries. Thank you!