Vessel Traffic Management Market by End User (Commercial, Defense), Component (Equipment, Solution, Service), Investment (Brownfield, Greenfield), Onboard Components (Equipment, Solution), System, and Region - Global Forecast to 2027

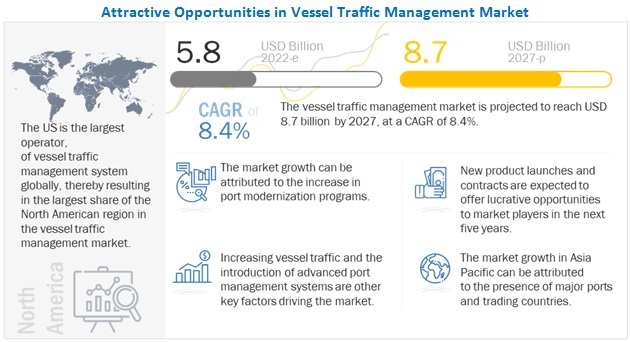

The Vessel Traffic Management Market size is projected to grow from USD 5.8 billion in 2022 to USD 8.7 billion by 2027, at a CAGR of 8.4% during the forecast period.

The shipping business, like the rest of the globe, is constantly evolving. There is a greater emphasis on enhancing shipping's green image as well as efficiency through innovative technology. The commercial shipping business has been changing for a long time, with several pushes for innovation. Even the most recent few years have been fascinating. Environmental protection and globalization are two trends that have altered the industry's landscape and will continue to do so for the foreseeable future. These developments are making the commercial shipping business a lot more fascinating, providing new challenges and ideas for industry professionals to tackle. The increase in modernization programs across ports and the need for advanced port management systems to drive the demand for the Vessel Traffic Management Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Vessel Traffic Management Market

The COVID-19 outbreak has led to several challenges for various industries such as aviation, shipping and marine. These industries faced many economic problems post the COVID-19 outbreak. Since the beginning of the outbreak, the shipping and maritime industry has been among the most severely hit sectors globally. This outbreak has put the shipping and marine industries in the worst possible position since their workforces have been shut down for the sake of safety and preventing the spread of COVID-19. This delay has also been created by the halt of all types of cargos through water or air during the quarantine period (isolation period), as the transit of such cargos on ships or by air might potentially spread the virus from one port to another. This worldwide epidemic has taken a toll on the shipping and marine industries, not just at China's ports (where the virus is thought to have originated), but also in ports across the world. The FTA has published guidelines in order to guarantee that orders be followed, and that failing to do so would result in the imposition of severe fines on those who break them. All of these instructions are controlled in conjunction with the appropriate authorities and must be followed in order to avoid the spread and breakout of this infectious illness, as well as to maintain the security and safety of those who operate in such transportation facilities.

Vessel Traffic Management Market Dynamics:

Driver: Increased Vessel congestion at ports

Port congestion is one of the most significant supply chain concerns that Fleet Operations managers encounter. Many ports have seen increased port congestion as a result of Covid-19 and strong demand. These delays are a problem because, aside from inefficiencies in terms of time, primarily result in greater costs at all stages of freight transport and delivery. Fleet Operations Managers may assess the amount of time spent at a major port, estimate probable delays, and make voyage-related choices, such as reducing speed to conserve fuel and improve vessel efficiency. Vessel Traffic Management solutions will assist ports in keeping track of vessels as they travel across the seas, planning efficient operations while accounting for bunkering costs and weather, and reviewing visual voyage reports to analyze incidents, performance, and charter party compliance.

Restraint: Effect of natural disasters on ports

Natural catastrophes such as hurricanes, typhoons, and earthquakes wreak havoc throughout the world on a regular basis, wreaking havoc on national and regional economy. High population density, economic expansion, and climate change are all factors contributing to natural catastrophes' rising economic toll. Firms, businesses, and people struggle to repair and rebuild their livelihoods in the aftermath of a disaster during the recovery phase. This involves a company's capacity to bring its goods to export markets, guaranteeing that it can continue to operate. Disasters in coastal locations, particularly port cities, will damage not just the companies in the devastated city, but also those in the surrounding region that use the city's port services. The subsequent interruptions have the potential to extend across supply systems, causing massive economic damage.

Opportunity: Next gen Vessel Traffic Management System

Singapore’s ST Engineering and Kongsberg Norcontrol have established a center to develop digital technologies and decision-making tools for marine operators, such as vessel route analysis, traffic hotspot forecast, and collision detection. ST Engineering and Kongsberg Norcontrol unveiled the Next Generation Vessel Traffic Management System, which costs S$9.9 million ($7.3 million). The MPA Living Lab program is funded by the Maritime and Port Authority of Singapore's Maritime Innovation and Technology Fund. Smart algorithms will be used at the facility to forecast high-traffic areas and avert potential collisions. The system, which is expected to be completed in 2021, will enable maritime authorities to improve navigational safety, handle higher vessel traffic volumes within congested shipping lanes with increased safety, security, and efficiency, and enable seamless and autonomous information exchange between unmanned vessels. The new lab will focus on research, discovery, conceptualization, and validation of novel operational ideas, procedures, business rules, and technology pertaining to vessel traffic management in order to keep the VTMS at the forefront of the industry.

Challenge: VTMS Facility Location

To conduct the monitoring function, the VTS radar sends out an electromagnetic wave that is reflected by the monitored water region. Because the VTS system primarily relies on the radar station to track ships, the radar station's location has a significant impact on the overall efficiency and efficacy of the system. As a result, research into VTS radar station optimization is critical in order to improve the system's capability and assure ship navigation safety. Obstacles in the real-world geographic environment, such as woods, islands, and mountains, will obstruct the transmission of VTS radar's electromagnetic waves, reducing the radar's monitoring capability. Environmental occlusion is the term for this occurrence. In addition, when electromagnetic waves pass through water or air, they look attenuated, impairing the VTS radar's monitoring performance. Given the circular nature of radar, it is reasonable to include a covering location model in the design of VTS radar sites. The lack of studies on optimal location is a major restraint for the most efficient use of VTMS.

Vessel Traffic Management Market Ecosystem

Surveillance Equipment manufacturers, suppliers of vessel traffic management systems, companies providing maintenance services, and end consumers such as commercial ports and navy ports are the key stakeholders in the vessel traffic management market ecosystem. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

The Commercial sector is estimated to lead the vessel traffic management market in 2021

Based on End User, the Commercial Sector of the vessel traffic management market is accounted for the largest share during the forecast period. Commercial ports are majorly used for trade between countries and comparatively there are more commercial ports than there are navy ports. Hence these factors drive the growth of the market.

The Brownfield segment is expected to grow at the highest CAGR during the forecast period

Based on Investment, the vessel traffic management market is segmented into below brownfield and greenfield. The brownfield segment of the vessel traffic management market is expected to grow at the highest CAGR during the forecast period. The investments are majorly happening for port expansion and modernization programs. These factors drive the market growth.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

The presence of major trading countries like China, India, Singapore and Australia is contributing to the higher CAGR growth for the region. Major port expansion and modernization projects are also being undertaken in this region. Due to these factors the region has higher CAGR growth.

Key Market Players

The Vessel Traffic Management Companies are dominated by a few globally established players such as Kongsberg Gruppen (Norway), Saab SA (Sweden), Leonardo S.p.A. (Italy), Wartsila (Finland), Thales Group (France), among others. These key players offer VTMS solutions and services to different key stakeholders.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Value

|

USD 5.8 billion in 2022 |

| Projected Value | USD 8.7 billion by 2027 |

| Growth Rate | CAGR of 8.4% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Investment, End User, System, Onboard Component and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, Latin America and Africa. |

|

Companies covered |

Kongsberg Gruppen (Norway), Saab SA (Sweden), Leonardo S.p.A. (Italy), Wartsila (Finland), Thales Group (France), among others |

This research report categorizes the vessel traffic management market into Component, Investment, End User, System, Onboard Component, and Region.

By End User

- Commercial Sector

- Defense Sector

By Component

- Equipment

- Solution

- Service

By Investment

- Brownfield

- Greenfield

By System

- Port Management Information System

- Global Maritime Safety System

- River Information System

- ATON Management & Health Monitoring System

- Others

By Onboard Component

- Equipment

- Solution

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In May 2021, PortLink, Wärtsilä and Tanger Med have formed a partnership in which they will co-develop a next generation "Port Management Information System". The Wärtsilä Navi-Harbour VTS System, which includes the PortLink Port Management Information System, IALA Advanced Coastal Surveillance Radars, VHF Radio Sub-System, Automatic Identification System, Operator Workstation, Network Systems, Ancillary Equipment, and a five-year service and support contract, will be delivered and installed as part of the joint initiative.

- In March 2019, Thales won a contract to supply two coastal surveillance radars to the French Defense Procurement Agency that will enhance their maritime threat detection abilities.

Frequently Asked Questions (FAQ):

What is the current size of the aircraft nacelle and thrust reverser market?

The Vessel Traffic Management Market is projected to grow from USD 5.8 billion in 2022 to USD 8.7 billion by 2027, at a CAGR of 8.4% during the forecast period.

Who are the winners and small enterprises in the aircraft nacelle and thrust reverser market?

Major players operating in the vessel traffic management market include Kongsberg Gruppen (Norway), Saab SA (Sweden), Leonardo S.p.A. (Italy), Wartsila (Finland), Thales Group (France), among others. These key players offer VTMS solutions and services to different key stakeholders.

What is the COVID-19 impact on aircraft nacelle and thrust reverser manufacturers?

The COVID-19 outbreak has led to several challenges for various industries such as aviation, shipping and marine. These industries faced many economic problems post the COVID-19 outbreak. Since the beginning of the outbreak, the shipping and maritime industry has been among the most severely hit sectors globally. This outbreak has put the shipping and marine industries in the worst possible position since their workforces have been shut down for the sake of safety and preventing the spread of COVID-19.

What are some of the technological advancements in the market?

Fujitsu Limited revealed the findings of a collaborative field study with the Japan Coast Guard to employ AI technology to anticipate vessel collisions, proving its utility in recognizing collision hazards early and reducing the probability of such incidents. The experiment in Japan was held at the Tokyo Wan Vessel Traffic Service Center, which provides navigation support services under an outsourcing contract with the Japan Coast Guard, from December 2019 to March 2020. This technology can identify near-miss collisions between ships and anticipate regions in Tokyo Bay where collision risks are high. Fujitsu has established that by incorporating this technology into the Vessel Traffic Services (VTS) system, which is utilized in marine traffic management operations, it may help vessels avoid danger and improve maritime traffic safety.

What are the factors driving the growth of the market?

Increase in port expansion and port modernization programs are one of the factors driving the market. The need for advanced and smart port management systems are also contributing to the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VESSEL TRAFFIC MANAGEMENT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 VESSEL TRAFFIC MANAGEMENT MARKET REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN VESSEL TRAFFIC MANAGEMENT MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 3 VESSEL TRAFFIC MANAGEMENT MARKET TO GROW AT HIGHER RATE THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 4 RESEARCH PROCESS FLOW

FIGURE 5 VESSEL TRAFFIC MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 DEMAND & SUPPLY-SIDE ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Port expansion and modernization programs across regions to influence market growth

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Next-gen vessel traffic management system

2.3 MARKET SIZE ESTIMATION

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.2 VESSEL TRAFFIC MANAGEMENT MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.3 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 9 SERVICE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

FIGURE 10 PORT MANAGEMENT INFORMATION SYSTEM SEGMENT ACQUIRED LARGER MARKET SHARE IN 2022

FIGURE 11 VESSEL TRAFFIC MANAGEMENT MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN VESSEL TRAFFIC MANAGEMENT MARKET

FIGURE 12 INCREASING PORT MODERNIZATION AND INTRODUCTION OF ADVANCED PORT MANAGEMENT SYSTEMS EXPECTED TO DRIVE MARKET FROM 2O22 TO 2027

4.2 VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER

FIGURE 13 COMMERCIAL SECTOR SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.3 VESSEL TRAFFIC MANAGEMENT MARKET END USER, BY COMMERCIAL SECTOR

FIGURE 14 INLAND PORT SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

4.4 VESSEL TRAFFIC MANAGEMENT MARKET, BY INVESTMENT

FIGURE 15 BROWNFIELD INVESTMENT SEGMENT PROJECTED TO HAVE HIGHEST MARKET SHARE FROM 2022 TO 2027

4.5 VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY

FIGURE 16 VESSEL TRAFFIC MANAGEMENT MARKET IN DENMARK PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased vessel congestion at ports

5.2.1.2 Need for automation

5.2.2 RESTRAINTS

5.2.2.1 Effect of natural disasters on ports

5.2.3 OPPORTUNITIES

5.2.3.1 Next-generation vessel traffic management systems

5.2.3.2 Technological advances in maritime traffic management

5.2.4 CHALLENGES

5.2.4.1 VTMS facility location

5.2.4.2 Automated identification system (AIS) disadvantages

5.3 COVID-19 IMPACT SCENARIOS

5.4 COVID-19 IMPACT ON VESSEL TRAFFIC MANAGEMENT MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 AI IN VTS

5.5.2 E-NAVIGATION IN VESSEL TRAFFIC MANAGEMENT

5.5.3 GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.7 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE RANGE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY EQUIPMENT (USD)

FIGURE 19 PRICING ANALYSIS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM, BY EQUIPMENT (USD THOUSAND)

5.8 MARKET ECOSYSTEM

5.8.1 PROMINENT COMPANIES

5.8.2 PRIVATE AND SMALL ENTERPRISES

5.8.3 END USERS

FIGURE 20 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET ECOSYSTEM

TABLE 3 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS OF VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET

FIGURE 21 VALUE CHAIN ANALYSIS

5.10 TRADE DATA

5.10.1 TRADE ANALYSIS

TABLE 4 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 5 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.11 PORTER’S FIVE FORCES MODEL

5.11.1 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.2 THREAT OF NEW ENTRANTS

5.11.3 THREAT OF SUBSTITUTES

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 BARGAINING POWER OF BUYERS

5.11.6 COMPETITION IN THE INDUSTRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM (%)

5.12.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR VESSEL TRAFFIC MANAGEMENT SYSTEMS

TABLE 7 KEY BUYING CRITERIA FOR VESSEL TRAFFIC MANAGEMENT SYSTEMS

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF REGULATORY LANDSCAPE FOR SHIPPING INDUSTRY

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 73)

6.1 INTRODUCTION

6.2 EMERGING INDUSTRY TRENDS

6.2.1 AI AND MACHINE LEARNING

6.2.2 MARINE IOT

6.2.3 BLOCKCHAIN AND BIG DATA ANALYTICS

6.2.4 CYBERSECURITY

6.3 INNOVATIONS AND PATENTS REGISTRATIONS, 2018-2021

6.4 IMPACT OF MEGATRENDS

7 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT (Page No. - 76)

7.1 INTRODUCTION

FIGURE 24 SERVICE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 13 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 14 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 EQUIPMENT

FIGURE 25 NAVIGATION SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 15 VESSEL TRAFFIC MANAGEMENT MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 16 VESSEL TRAFFIC MANAGEMENT MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

7.2.1 COMMUNICATION

TABLE 17 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY COMMUNICATION, 2018–2021 (USD MILLION)

TABLE 18 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY COMMUNICATION, 2022–2027 (USD MILLION)

7.2.1.1 VHF communication systems

7.2.1.1.1 Increasing usage in short-range communication to drive the segment

7.2.1.2 RF communications

7.2.1.2.1 Increasing usage for wireless data transfer and voice transfer applications to drive the segment

7.2.1.3 Microwave and network

7.2.1.3.1 Increasing usage for satellite communications, radar signals, smartphones, and navigational applications to drive the segment

7.2.1.4 Human machine interface (HMI)

7.2.1.4.1 Increasing usage of HMI on ports and harbors to drive the segment

7.2.1.5 Servers

7.2.1.5.1 New technological trends to drive the segment

7.2.2 NAVIGATION

TABLE 19 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY NAVIGATION, 2018–2021 (USD MILLION)

TABLE 20 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY NAVIGATION, 2022–2027 (USD MILLION)

7.2.2.1 Automatic identification system (AIS) receivers and base stations

7.2.2.1.1 Increasing usage of AIS receivers and base stations creates efficient link between the sea and monitoring center

7.2.2.2 Direction finders

7.2.2.2.1 Increasing usage by ports to provide navigational aid for ships

7.2.2.3 Radar

7.2.2.3.1 Increasing usage to detect illegal activities across shore and coastline to drive the segment

7.2.3 SURVEILLANCE & MONITORING

TABLE 21 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY SURVEILLANCE & MONITORING, 2018–2021 (USD MILLION)

TABLE 22 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY SURVEILLANCE & MONITORING, 2022–2027 (USD MILLION)

7.2.3.1 Unmanned aerial vehicles

7.2.3.1.1 Increasing usage of UAVs at ports to make security more efficient and reactive

7.2.3.2 CCTV surveillance camera

7.2.3.2.1 Need for latest technology CCTV cameras to provide optimum security

7.2.3.3 Sensors

7.2.3.3.1 Advanced sensor technologies used to prevent port accidents

7.3 SOLUTION

FIGURE 26 ROUTING MONITOR SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 23 VESSEL TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 24 VESSEL TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.3.1 SENSOR INTEGRATOR

7.3.1.1 Sensor integrator key to providing efficient navigation and decision-making capabilities

7.3.2 ELECTRONIC NAVIGATION CHART (ENC)

7.3.2.1 ENCs provide an array of advantages for planning, monitoring, and executing voyages

7.3.3 MULTI-SENSOR TRACKER

7.3.3.1 Ensures flexible sensor input filtering to provide efficient data to create traffic maps

7.3.4 ROUTING MONITOR

7.3.4.1 Increasing usage to reduce risk and minimize transit time

7.3.5 OTHERS

7.4 SERVICE

FIGURE 27 OPERATION SERVICE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 25 VESSEL TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 26 VESSEL TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

7.4.1 MAINTENANCE SERVICE

7.4.1.1 Periodic upkeep of equipment vital for offering decision making support to operators

7.4.2 OPERATION SERVICE

7.4.2.1 Provides critical support for decision making to operators through various data points

8 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER (Page No. - 88)

8.1 INTRODUCTION

FIGURE 28 COMMERCIAL SECTOR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 27 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 28 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

8.2 COMMERCIAL SECTOR

TABLE 29 VESSEL TRAFFIC MANAGEMENT SYSTEM END USER MARKET, BY COMMERCIAL SECTOR, 2018–2021 (USD MILLION)

TABLE 30 VESSEL TRAFFIC MANAGEMENT SYSTEM END USER MARKET, BY COMMERCIAL SECTOR, 2022–2027 (USD MILLION)

8.2.1 PORTS AND HARBOR

8.2.1.1 Ports serve as commerce transfer centers and are typically located near natural harbors

8.2.2 INLAND PORT

8.2.2.1 Increasing usage for leisure purposes and ferries and fishing operations to drive the segment

8.2.3 FISHING PORT

8.2.3.1 Fishing ports are frequently marketed as ports that are primarily utilized for recreational or aesthetic purposes

8.2.4 OFFSHORE

8.2.4.1 Increasing adoption of advanced technologies in offshore ports to ensure safe operations

8.3 DEFENSE SECTOR

8.3.1 NEED TO PREVENT PIRACY AND OTHER ILLEGAL ACTIVITIES TO DRIVE THE SEGMENT

9 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM (Page No. - 93)

9.1 INTRODUCTION

FIGURE 29 PORT MANAGEMENT INFORMATION SYSTEM SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 31 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 32 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

9.2 PORT MANAGEMENT INFORMATION SYSTEM

9.2.1 PMI IS SINGLE SOURCE OF ADEQUATE AND ACCURATE INFORMATION

9.3 GLOBAL MARITIME DISTRESS SAFETY SYSTEM (GMDSS)

9.3.1 SHIPS FITTED WITH GMDSS EQUIPMENT ARE SAFER AT SEA AND MORE LIKELY TO RECEIVE ASSISTANCE IN EVENT OF DISTRESS

9.4 RIVER INFORMATION SYSTEM

9.4.1 RIS COMBINES EQUIPMENT AND RELATED HARDWARE AND SOFTWARE DESIGNED TO OPTIMIZE TRAFFIC AND TRANSPORT PROCESSES

9.5 ATON MANAGEMENT & HEALTH MONITORING SYSTEM

9.5.1 GOAL OF ATON SYSTEMS IS TO PROMOTE SAFE NAVIGATION ON WATERWAYS

9.6 OTHERS

10 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT (Page No. - 97)

10.1 INTRODUCTION

FIGURE 30 BROWNFIELD SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 33 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 34 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

10.2 GREENFIELD

10.2.1 MAJOR BUSINESSES ADOPT GREENFIELD INVESTMENT STRATEGY TO BREAKDOWN ENTRANCE BARRIERS

10.3 BROWNFIELD

10.3.1 BROWNFIELD INVESTMENT USED TO JOIN A NEW FOREIGN MARKET THROUGH COMPANIES THAT ALREADY HAVE A PRESENCE THERE

11 VESSEL TRAFFIC MANAGEMENT MARKET, BY ONBOARD COMPONENT (Page No. - 100)

11.1 INTRODUCTION

11.2 EQUIPMENT

11.2.1 COMMUNICATION

11.2.1.1 VHF communication systems

11.2.1.1.1 Increasing usage in short-range communication to drive the segment

11.2.1.2 RF communications

11.2.1.2.1 Increasing usage for wireless data transfer and voice transfer applications to drive the segment

11.2.1.3 Microwave and network

11.2.1.3.1 Increasing usage for satellite communications, radar signals, smartphones, and navigational applications to drive the segment

11.2.1.4 Human machine interface (HMI)

11.2.1.4.1 Increasing need for advanced and reliable HMI systems on ship bridges to drive the segment

11.2.2 NAVIGATION

11.2.2.1 Automatic identification system (AIS) receivers

11.2.2.1.1 Increasing usage of AIS receivers to create efficient link between sea and monitoring center

11.2.2.2 Direction finders

11.2.2.2.1 Increasing usage by ships to establish efficient navigation paths

11.2.2.3 Radar

11.2.2.3.1 Increasing usage to detect illegal activities around the vicinity of the ship

11.2.3 SURVEILLANCE & MONITORING

11.2.3.1 CCTV Surveillance Camera

11.2.3.1.1 Need for latest technology CCTV cameras to provide optimum security onboard ships

11.2.3.2 Sensors

11.2.3.2.1 Advanced sensor technologies used for navigation and ship stability

11.3 SOLUTION

11.3.1 SENSOR INTEGRATOR

11.3.1.1 Sensor integrator key to providing efficient navigation and decision-making capabilities

11.3.2 ELECTRONIC NAVIGATION CHART (ENC)

11.3.2.1 ENCs provide an array of advantages for planning, monitoring, and executing voyages

11.3.3 MULTI-SENSOR TRACKER

11.3.3.1 Ensures flexible sensor input filtering to provide efficient data to create traffic maps

11.3.4 ROUTING MONITOR

11.3.4.1 Increasing usage to reduce risk and minimize transit time

12 REGIONAL ANALYSIS (Page No. - 104)

12.1 INTRODUCTION

FIGURE 31 VESSEL TRAFFIC MANAGEMENT MARKET: REGIONAL SNAPSHOT

12.2 COVID-19 IMPACT ON VESSEL TRAFFIC MANAGEMENT MARKET

TABLE 35 VESSEL TRAFFIC MANAGEMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 VESSEL TRAFFIC MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

12.3.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 37 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.2 US

12.3.2.1 Increasing fleet size and recreational sea transport to drive the market

TABLE 43 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 44 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 45 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 46 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Investments in upgrade of indigenous marine industry to drive the market

TABLE 47 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 48 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 49 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 50 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4 EUROPE

FIGURE 33 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

12.4.1 PESTLE ANALYSIS

TABLE 51 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 54 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 55 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.2 UK

12.4.2.1 Increasing investments in port development programs to drive the market

TABLE 57 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 58 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 59 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 60 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.3 NORWAY

12.4.3.1 Strategic regional to drive the market

TABLE 61 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 62 NORWAY VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 63 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 64 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.4 SWEDEN

12.4.4.1 Benefit of sea trade as environmental-friendly alternative to drive the market

TABLE 65 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 66 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 67 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 68 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.5 DENMARK

12.4.5.1 Increase in fleet sizes and tonnage to drive the market

TABLE 69 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 70 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 71 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 72 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.6 FRANCE

12.4.6.1 Increasing funding by government to develop competitive trading to drive the market

TABLE 73 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 74 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 75 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 76 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 77 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 78 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 80 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 81 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 84 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.2 CHINA

12.5.2.1 Increasing trade of essential and industrial goods through maritime transport to drive the market

TABLE 87 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 88 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 89 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 90 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.3 INDIA

12.5.3.1 Increasing maritime activity to drive Vessel traffic

TABLE 91 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 92 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 93 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 94 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.4 SINGAPORE

12.5.4.1 Port Development of Tuas mega-port to incorporate increasing vessel traffic

TABLE 95 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 96 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 97 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 98 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.5 INDONESIA

12.5.5.1 Increasing trading activity and vessel traffic to drive requirement for VTM systems

TABLE 99 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 100 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 101 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 102 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.6 SOUTH KOREA

12.5.6.1 Increasing international trade to drive the market

TABLE 103 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 104 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 105 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 106 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.7 AUSTRALIA

12.5.7.1 Strategic location in South Pacific to drive the market

TABLE 107 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 108 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 109 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 110 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.8 REST OF ASIA PACIFIC

TABLE 111 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6 MIDDLE EAST

12.6.1 PESTLE ANALYSIS

TABLE 115 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 118 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 119 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 120 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.2 SAUDI ARABIA (KSA)

12.6.2.1 Increasing maritime development outlining the Kingdom’s Vision 2030 to drive the market

TABLE 121 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 122 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 123 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 124 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.3 UAE

12.6.3.1 Advantage of being a logistics and marine center to drive the market

TABLE 125 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 126 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 127 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 128 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.4 QATAR

12.6.4.1 Increasing investments in transportation industry to drive the market

TABLE 129 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 130 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 131 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 132 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.5 REST OF MIDDLE EAST

TABLE 133 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 134 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 135 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.7 LATIN AMERICA

12.7.1 PESTLE ANALYSIS

TABLE 137 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 138 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 140 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 141 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 142 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.7.2 BRAZIL

12.7.2.1 Thriving and dominant port trade to drive the market

TABLE 143 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 144 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 145 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 146 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

12.7.3 ARGENTINA

12.7.3.1 Growing trade relations with countries across the world to drive the market

TABLE 147 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 148 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 149 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 150 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.7.4 REST OF LATIN AMERICA

TABLE 151 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 152 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 153 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 154 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.8 AFRICA

12.8.1 PESTLE ANALYSIS: AFRICA

TABLE 155 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 158 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 159 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 160 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.8.2 SOUTH AFRICA

12.8.2.1 Strategic position in sea commerce route to drive the market

TABLE 161 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 162 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 163 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 164 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

12.8.3 EGYPT

12.8.3.1 Geostrategic location at crossroads of three continents to drive the market

TABLE 165 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 166 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 167 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 168 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

12.8.4 ALGERIA

12.8.4.1 Increasing investments in freight transport to drive the market

TABLE 169 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 170 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 171 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 172 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

12.8.5 REST OF AFRICA

12.8.5.1 Increasing investments in transportation help increase the economy of the countries in the region

TABLE 173 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 174 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 175 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 176 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

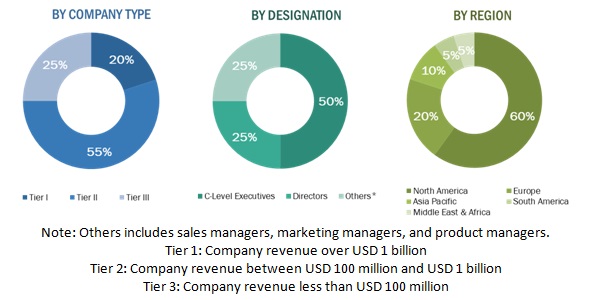

The research study conducted on the vessel traffic management market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the vessel traffic management market. The primary sources considered included industry experts from the vessel traffic management market as well as raw material providers, vessel traffic management system manufacturers, solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the vessel traffic management market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the vessel traffic management market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the vessel traffic management market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

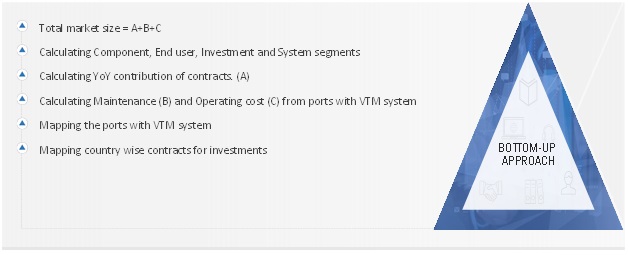

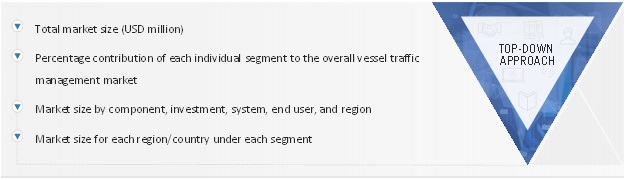

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the vessel traffic management market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the vessel traffic management market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the VTM market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-Down approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the vessel traffic management market based on component, investment, end user, system, onboard component and region

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 6 main regions: North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America

- To analyze technological advancements and new product launches in the market from 2018 to 2022

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vessel Traffic Management Market

Hello Team, I require in-depth analysis of the COVID-19 impact on the Vessel Traffic Management Market, covering automation and digitization by customers. Thanks.