Railway Management System Market Size, Share, Growth Opportunities & Latest Trends

Railway Management System Market By Solution (Rail Operations Management, Rail Traffic Management, Asset Management, Intelligent In-train Solutions, Passenger Information Systems, Network Management, Security and Surveillance) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

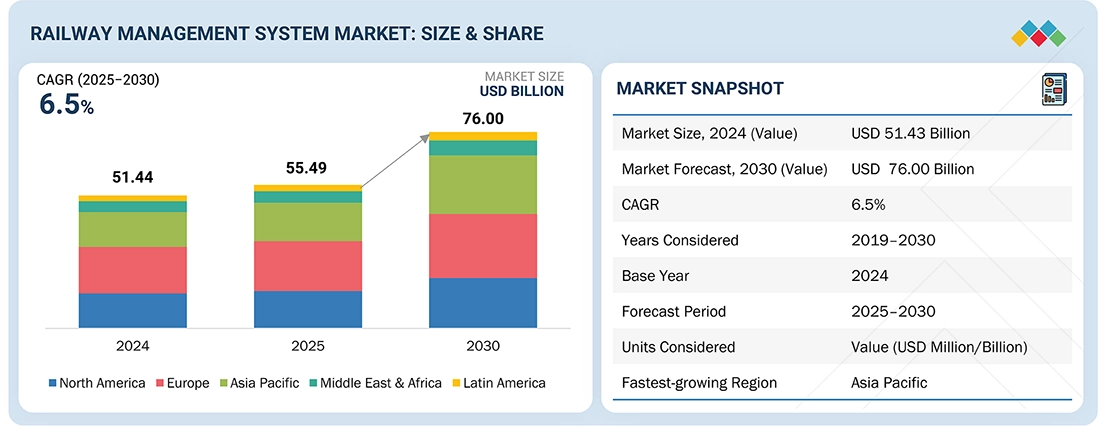

The railway management system market is projected to reach USD 76,001.3 million by 2030 from USD 55,493.2 million in 2025, at a CAGR of 6.5%. The growth of the market is driven by growing demand for safer, more efficient rail operations, increasing urbanization, rising passenger and freight volumes, and the need to modernize aging infrastructure. Digitalization, automation, predictive maintenance, and government investments in smart mobility and sustainable transport further accelerate adoption.

KEY TAKEAWAYS

-

By RegionThe European railway management system market accounted for a 26.3% revenue share in 2024.

-

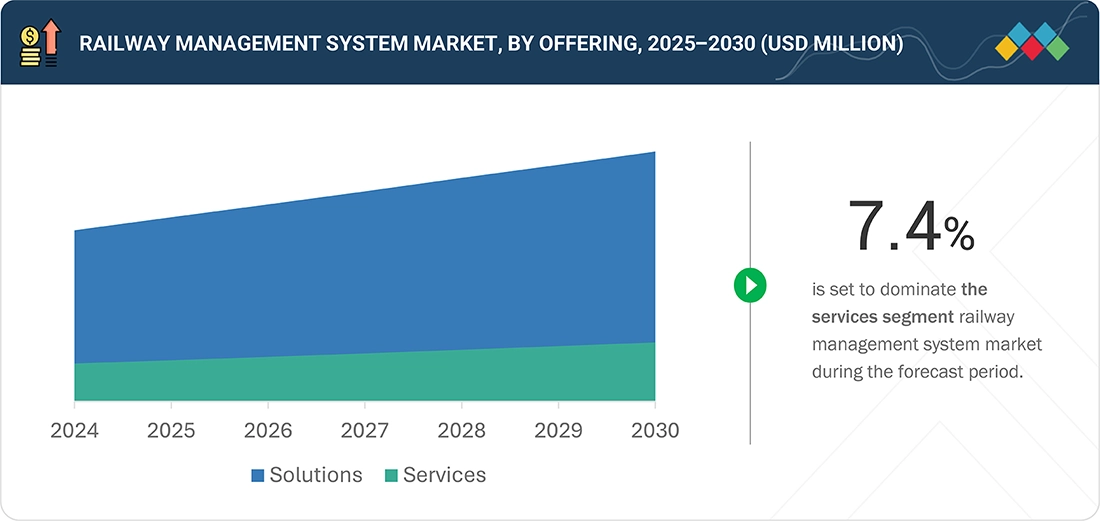

By OfferingBy offering, the services segment is set to register the highest CAGR of 7.4%.

-

By Railway TypeBy railway type, the passenger segment is expected to dominate the market.

-

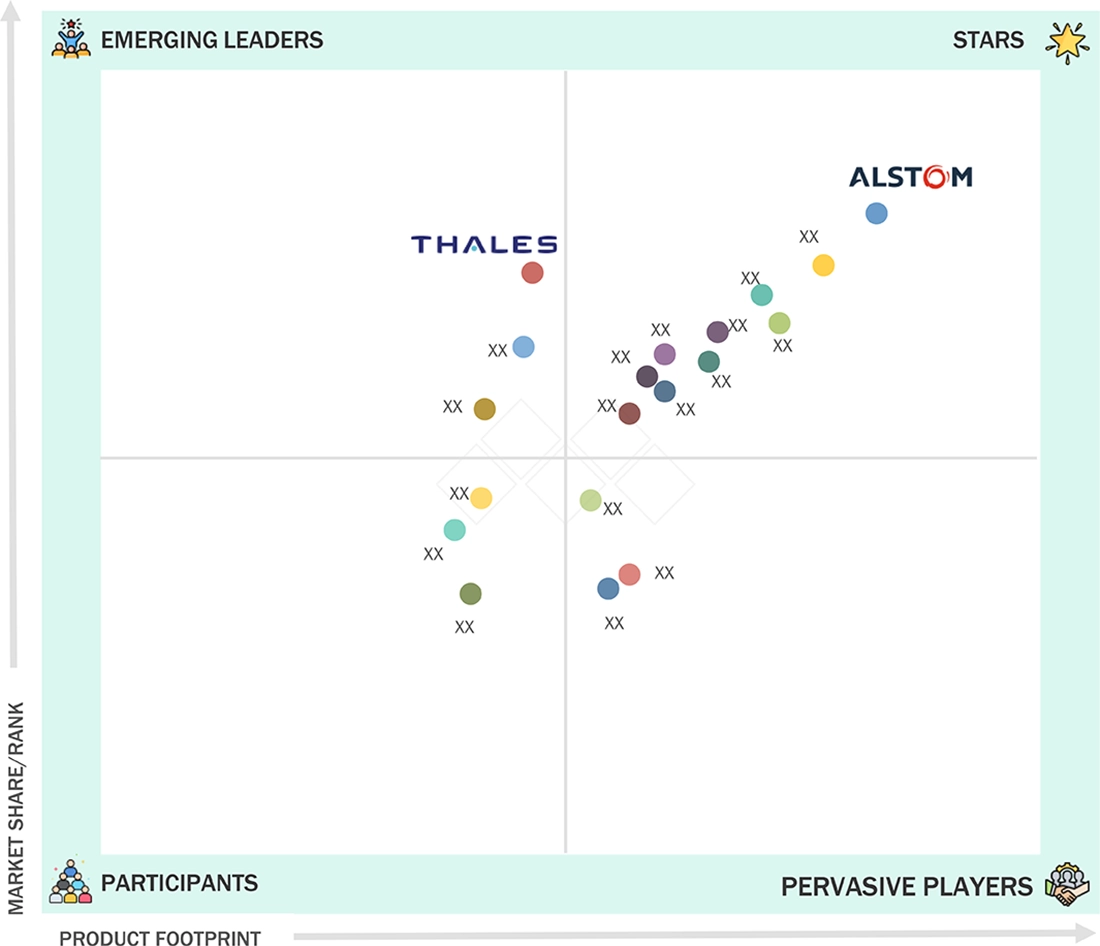

Competitive LandscapeAlstom, Hitachi, and Huawei were identified as some of the star players in the railway management system market, given their strong market share and product footprint.

-

Competitive LandscapeFrequentis, Eurotech, and Uptake have distinguished themselves among startups and SMEs by combining real-time edge-to-cloud data integration, domain-specific predictive analytics, and interoperable platform design; they deliver scalable decision-support and asset-optimization capabilities that drive higher safety, uptime, and operational efficiency across complex rail networks.

The railway management system market is witnessing steady growth, driven by the increasing demand for efficient, safe, and reliable rail operations, fueled by urbanization and rising passenger/freight volumes. This growth is further propelled by the adoption of digital technologies like IoT, AI, and big data for real-time monitoring and predictive maintenance. Government investments in modernizing rail infrastructure also play a key role.

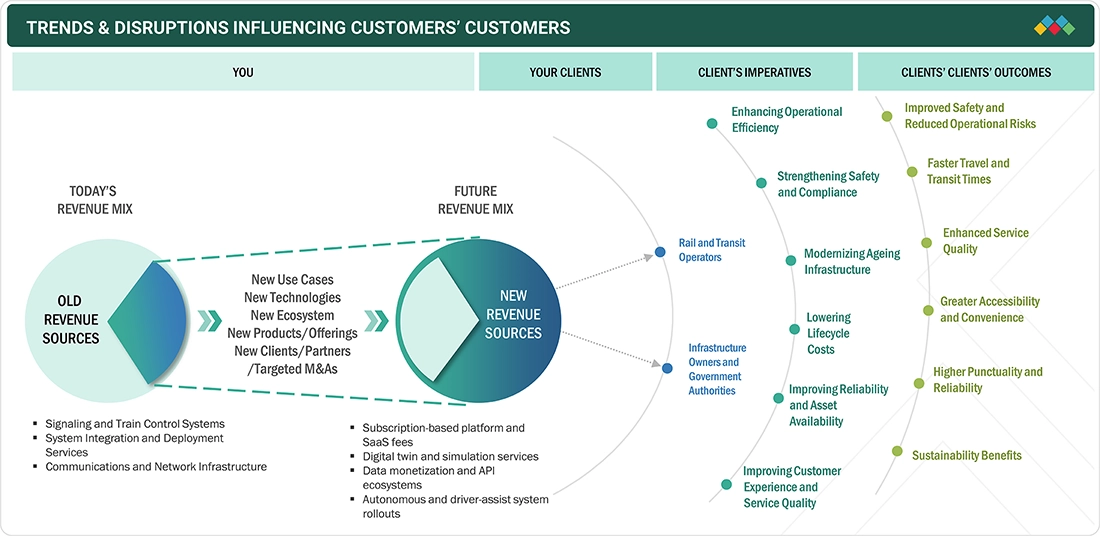

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As providers transition from traditional revenue streams such as signaling, system integration, and communications toward digital, service-driven business models, customers’ customers experience tangible improvements. New technologies, digital twins, automation, and data ecosystems create faster, safer, and more reliable rail journeys. These advancements enable operators and authorities to enhance punctuality, modernize ageing infrastructure, and boost asset availability. In turn, passengers and freight clients gain shorter travel and transit times, better service quality, real-time visibility, and greater accessibility. The emphasis on sustainability, automation, and predictive capabilities further reduces operational risks and environmental impact. Overall, the evolving revenue mix accelerates a passenger- and freight-centric value proposition built on efficiency, reliability, and improved mobility experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Favorable government initiatives and public-private partnerships

-

Rising global urbanization and passenger demand

Level

-

Fragmented legacy infrastructure

-

High upfront hardware and integration costs

Level

-

Integration of intelligent solutions in transportation infrastructure

-

Real-time data analytics and business intelligence services

Level

-

Stringent safety and regulatory standards

-

Data security and privacy issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising global urbanization and passenger demand

Rising global urbanization and growing passenger demand are major drivers of growth in the railway management system market. As cities expand and populations concentrate in urban corridors, pressure increases on existing rail networks to deliver higher capacity, improved punctuality, and safer operations. Rail operators are turning to advanced management systems such as automated signaling, traffic optimization, predictive maintenance, and real-time passenger information to handle escalating ridership efficiently. Additionally, governments are investing heavily in mass transit expansion to reduce congestion and lower carbon emissions, further accelerating the adoption of digital rail technologies. This surge in mobility needs reinforces the importance of modern, data-driven management systems that can enhance service quality, operational efficiency, and network reliability.

Restraint: Fragmented legacy infrastructure

Fragmented legacy infrastructure remains a significant restraint for the railway management system market. Many rail networks operate with outdated signaling, disparate control systems, and equipment from multiple generations, making integration of modern digital solutions complex and costly. Compatibility issues often require extensive customization, phased upgrades, or full system replacements, leading to long deployment cycles and higher capital expenditure. Older assets may also lack the connectivity and data interfaces needed to support advanced functions such as predictive maintenance or real-time traffic optimization. This fragmentation slows digital transformation efforts and limits the ability of operators to achieve seamless, networkwide modernization. As a result, legacy infrastructure challenges continue to hinder rapid adoption of next-generation railway management technologies.

Opportunity: Integration of intelligent solutions in transportation infrastructure

The integration of intelligent solutions into transportation infrastructure presents a significant opportunity for the railway management system market. As rail networks evolve toward connected and automated operations, demand is rising for advanced signaling, predictive maintenance, real-time monitoring, and data-driven traffic management platforms. Intelligent infrastructure enables operators to optimize network capacity, reduce delays, and enhance safety through automated decision-making and continuous asset health assessment. It also supports seamless multimodal coordination, improving overall mobility efficiency. With governments prioritizing smart infrastructure investments and sustainability goals, railway operators are increasingly adopting AI, IoT, digital twins, and cloud-based systems to modernize legacy assets. This shift toward intelligent, integrated operations positions railway management solutions as essential enablers of next-generation transport ecosystems.

Challenge: Stringent safety and regulatory standards

Stringent safety and regulatory standards act as a significant constraint for the railway management system market. Rail operators and technology providers must comply with complex, evolving regulations covering signaling, interoperability, cybersecurity, environmental impact, and operational safety. Meeting these requirements often demands extensive certification processes, rigorous testing, and long validation cycles, which increase project timelines and development costs. Regulatory misalignment across regions further complicates deployment, requiring system customization and additional compliance efforts for each market. These factors can slow down technology adoption, delay modernization initiatives, and limit the flexibility of vendors to introduce innovative solutions quickly. As a result, while essential for safe operations, strict regulatory frameworks can create barriers that hinder rapid market expansion.

railway-management-system-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed IBM Instana with partner Ibis Solutions to provide AI-enriched observability across its bespoke ticketing platform, web apps, IIS, and databases, enabling end-to-end monitoring and rapid incident detection across a hybrid IT stack | Instana delivered near-instant root-cause insights, freed a lean IT team for development work, and eliminated production downtime for the ticketing system, improving user experience, availability, and operational resilience. |

|

Implemented Hitachi’s Skyline fully automated elevated rail system, including driverless trains, control-center integration, station systems, and smart-card interfacing to create a high-capacity, integrated urban transit corridor | The solution increased network capacity, reduced road congestion and emissions, improved accessibility and safety through automation and surveillance, and enabled seamless multimodal travel with system-wide ticketing. |

|

Rolled out a Cisco industrial IoT network using Industrial Ethernet switches and integrated services routers to relay real-time track and infrastructure data along a 22-mile corridor, supporting PTC and multiple rail applications on a single network | The new self-healing network improved physical and cyber safety, boosted on-time performance toward 99 percent, accelerated deployment of new services, enhanced asset tracking, and enabled predictive, data-driven maintenance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem for the railway management system market is built on the coordinated contribution of critical stakeholder groups, each enabling the efficient development, deployment, and long-term operation of modern rail networks. Solution providers form the technological backbone by designing and supplying core systems such as signaling, control platforms, automation technologies, and digital operations software. Their innovations set the pace for network modernization and performance optimization. Service providers play an equally vital role by integrating these systems, delivering engineering expertise, maintenance services, and digital transformation support that ensure reliable implementation and sustained operational efficiency. Security providers safeguard increasingly connected infrastructure through advanced cybersecurity, surveillance, and risk-mitigation solutions, addressing the rising complexity and threats associated with digital rail operations. Railway operating bodies act as the operational and regulatory anchor of the ecosystem, establishing standards, ensuring compliance, overseeing infrastructure, and guiding long-term development strategies. Together, these constituents create a resilient, technology-driven ecosystem that supports safer, smarter, and more efficient railway operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Railway Management System Market, by Offering

The services segment is estimated to record the highest CAGR in the railway management system market because rail operators increasingly require ongoing support to manage complex, digitally enabled networks. As signaling, traffic management, predictive maintenance, and integrated control systems become more sophisticated, demand rises for system integration, maintenance, upgrades, and operations outsourcing. Modernization of legacy infrastructure further drives long-term service contracts, while cloud migration and data-driven operations expand the need for managed services, cybersecurity support, and continuous software updates. Additionally, operators are prioritizing lifecycle cost optimization, making service-based models more attractive than large upfront investments. This shift toward recurring, outcome-based service engagements positions the services segment for accelerated growth throughout the forecast period.

Railway Management System Market, by Solution

Rail traffic management solutions are estimated to account for the largest market share because operators increasingly prioritize real-time control, higher capacity utilization, and improved punctuality across busy passenger and freight corridors. In the past two years, leading vendors have advanced major deployments that highlight this demand. Alstom’s implementation of its ICONIS platform for KiwiRail has enhanced real-time scheduling, disruption management, and network visibility. Hitachi has expanded its HMAX digital traffic and asset management capabilities for metro systems such as Copenhagen, improving service reliability and reducing maintenance-related downtime. Siemens has continued delivering integrated traffic management and control-center solutions for large national rail networks, supporting standardized operations and scalable digital oversight. Wabtec has strengthened its traffic planning and optimization portfolio by integrating telematics and network-wide decision-support tools. These developments show why traffic management remains central to operational efficiency, capacity expansion, and long-term digital transformation, driving its dominant market share.

Railway Management System Market, by Railway Type

The freight railway segment is poised for the highest CAGR because global trade growth and supply chain reshoring drive sustained demand for high-capacity, cost-efficient inland transport. Shippers and logistics providers favor rail for reliability, lower carbon intensity, and predictable transit times versus road. Investments in dedicated freight corridors, longer trains, and advanced telematics enhance throughput and reduce unit costs. Digital freight management, predictive maintenance, and automated yard orchestration further improve asset utilization and shorten transportation times, tapping new commercial cases. Port-rail connectivity projects and private sector investments in terminal automation accelerate adoption, making freight a rapid-growth segment for railway management solutions.

REGION

Asia Pacific to be fastest-growing region in global railway management system market during forecast period

Asia Pacific is estimated to be the fastest-growing region in the global railway management system market due to sustained government investments, large-scale infrastructure expansion, and rapid urbanization. Countries across the region are accelerating digital rail modernization to improve safety, capacity, and operational efficiency. China continues to expand its high-speed and urban transit networks, driving demand for advanced signaling, traffic management, and predictive maintenance systems. India is advancing major national initiatives focused on corridor development, station modernization, and indigenous signaling technologies, all of which require modern traffic control, centralized operations, and asset-management platforms. Southeast Asian nations are investing in new metro lines, cross-border rail corridors, and elevated rail systems, creating strong demand for integrated control centers, automated operations, and real-time monitoring tools. Regional policies targeting multimodal integration, electrification, and safety enhancement further accelerate adoption. In addition, increased participation from global suppliers through local partnerships, manufacturing expansion, and technology transfer programs is strengthening the ecosystem, supporting sustained growth for railway management systems across the Asia Pacific.

railway-management-system-market: COMPANY EVALUATION MATRIX

In the railway management system market matrix, Alstom (Star) leads with a strong market share and extensive product footprint, driven by its strong global footprint, comprehensive signaling and digital mobility portfolio, major turnkey project wins, and strategic integrations that expand capabilities, enhance service depth, and strengthen leadership across modern rail management systems. Thales (Emerging Leader) is gaining visibility with its sophisticated digital signaling expertise, ERTMS Level 2/3 leadership, AI-based traffic management systems, and resilient cybersecurity structures. While Alstom dominates through scale and a diverse portfolio, Thales shows significant potential to move toward the stars’ quadrant as demand for railway management systems rises.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Alstom (France)

- Huawei Technologies (China)

- Siemens (Germany)

- Hitachi (Japan)

- Wabtec Corporation (US)

- Cisco Systems (US)

- ABB (Switzerland)

- Indra Sistemas (Spain)

- IBM (US)

- Honeywell International (US)

- CAF (Spain)

- WSP (Canada)

- Kyosan Electric (Japan)

- Advantech (Taiwan)

- Thales (France)

- Amadeus IT Group (Spain)

- AtkinsRealis (UK)

- DXC Technology (US)

- Fujitsu (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 51.43 Billion |

| Market Forecast, 2030 (Value) | USD 76.00 Billion |

| Growth Rate | CAGR of 6.5% from 2025 to 2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

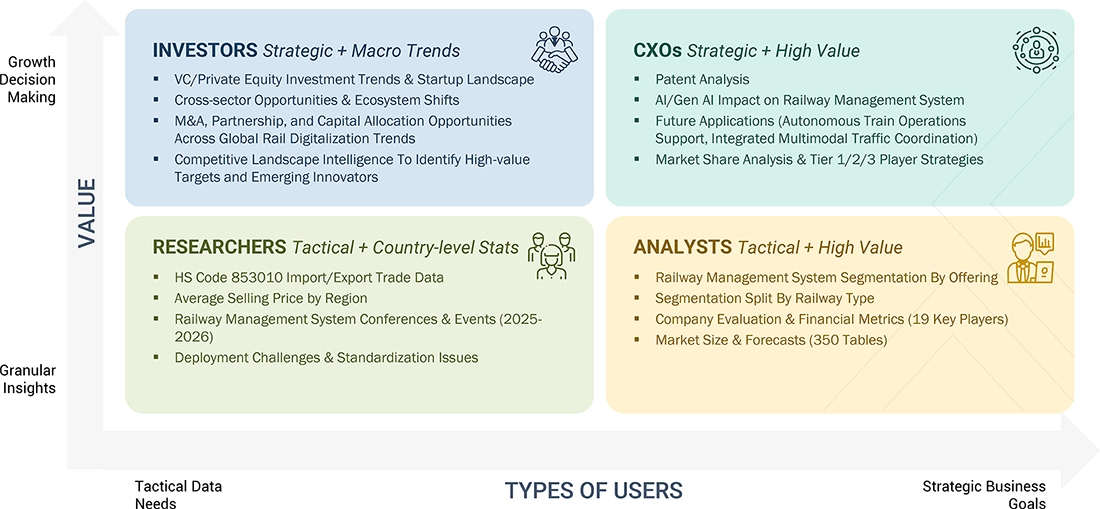

WHAT IS IN IT FOR YOU: railway-management-system-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| System Integrator and EPC Contractor |

|

|

| Rail and Transit Operator |

|

|

RECENT DEVELOPMENTS

- July 2025 : Wabtec signed an exclusive distribution agreement with Intermodal Telematics to bring IMT’s railcar telematics solutions to European freight markets. The partnership combined IMT’s sensors, gateways, and connectivity with Wabtec’s market reach, enabling real-time monitoring, smarter maintenance, enhanced safety, and fleet visibility while supporting large-scale telematics deployment and long-term service continuity across Europe.

- August 2025 : Hitachi Rail completed the acquisition of Omnicom, a specialist in rail monitoring and digital inspection technologies, strengthening Hitachi’s HMAX digital asset management suite. The deal accelerated condition-based maintenance, expanded monitoring and analytics capabilities, and deepened Hitachi’s offering for remote inspection, predictive diagnostics, and lifecycle optimization across rail networks and asset portfolios.

- February 2025 : Siemens Mobility, together with partner Leonhard Weiss, secured a major long-term volume framework contract from Deutsche Bahn to deliver modern digital control and safety technology, including DSTW and ETCS rollouts across Germany. The USD 3.2 billion consortium share underwrote scaled delivery, standardized interfaces, offered faster implementation, and extended maintenance and acceptance obligations over multiple call-offs.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

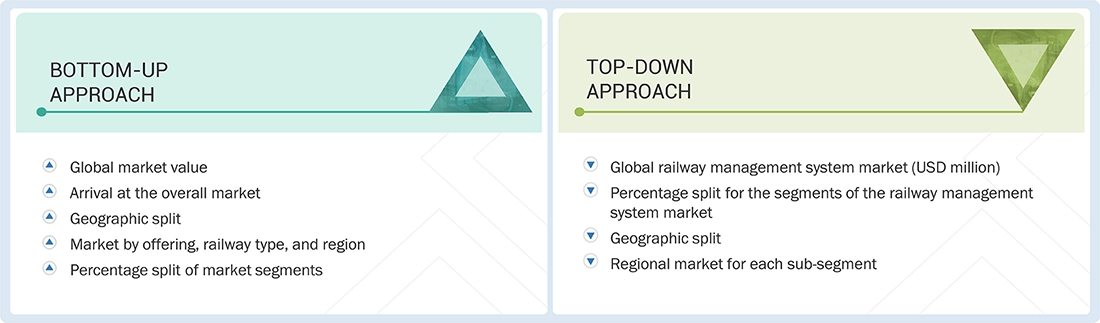

The study involved four major activities in estimating the current size of the global railway management system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total railway management system market size. After that, the data triangulation technique was used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering railway management system solutions to various end-users was determined based on secondary data available through paid and unpaid sources, as well as an analysis of the product portfolios of major companies in the ecosystem, where companies were rated based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was primarily used to gather critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends, down to the most granular level, including regional markets and key developments from both market and technology-oriented perspectives.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the railway management system market.

Primary interviews were conducted to gather insights, including market statistics, revenue data from software and services, market segmentations, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use railway management system, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of railway management system solutions and services, which is expected to affect the overall railway management system market growth.

Note 1: Tier 1 companies have revenues over USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million and USD 1 billion; and Tier 3 companies’ revenue ranges between USD 500 million and USD 1 billion.

Note 2: Others include senior-level managers, sales executives, and independent consultants.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the railway management system market, as well as other dependent submarkets, the top-down and bottom-up approaches were employed. The bottom-up approach was used to determine the overall market size of the global railway management system market, based on the revenue and offerings of key companies in the market. The research methodology used to estimate the market size includes the following:

- MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Significant developments in the critical market area were considered.

- The recent and upcoming developments in the Railway management system market, including investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships, were tracked. The market size was projected based on these developments and other critical parameters.

- The overall market was segmented into various market segments.

- The estimates were validated at every level through discussions with key opinion leaders, including chief executives (CXOs), directors, and operations managers, and ultimately with domain experts at MarketsandMarkets.

Railway Management System Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the above estimation process, the railway management systems market was segmented into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and derive the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

The railway management system market size was validated using top-down and bottom-up approaches

Market Definition

A railway management system integrates solutions and associated services to enhance the speed, safety, and reliability of rail services, resulting in more efficient railway infrastructure utilization. The railway management system leverages a combination of technology, planning, and greater intelligence to harness the power of data, meeting consumers’ demand for better services and safer travel, and helping rail management authorities manage optimal routes, schedules, and capacity in real-time.

Key Stakeholders

- Railway management system vendors

- Network and system integrators (SIs)

- Cloud service providers

- Railway infrastructure providers

- Railway support service providers

- National railway governing authorities/regulators/bodies

- Railway operators and agencies

- Value-added resellers (VARs) and distributors

Report Objectives

- To determine, segment, and forecast the global railway management system market based on offering, railway type, and region in terms of value

- To forecast the size of the market segments in five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the railway management system market

- To study the complete value chain and related industry segments, and perform a value chain analysis of the railway management system market landscape

- To strategically analyze the macro and micro markets, individual growth trends, prospects, and contributions to the total railway management system market

- To analyze the industry trends, patents, and innovations related to the railway management system market

- To analyze opportunities for stakeholders by identifying high-growth segments in the railway management system market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the Middle East African market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of an additional market player (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Railway Management System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Railway Management System Market