This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the non-thermal pasteurization market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to, in order to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

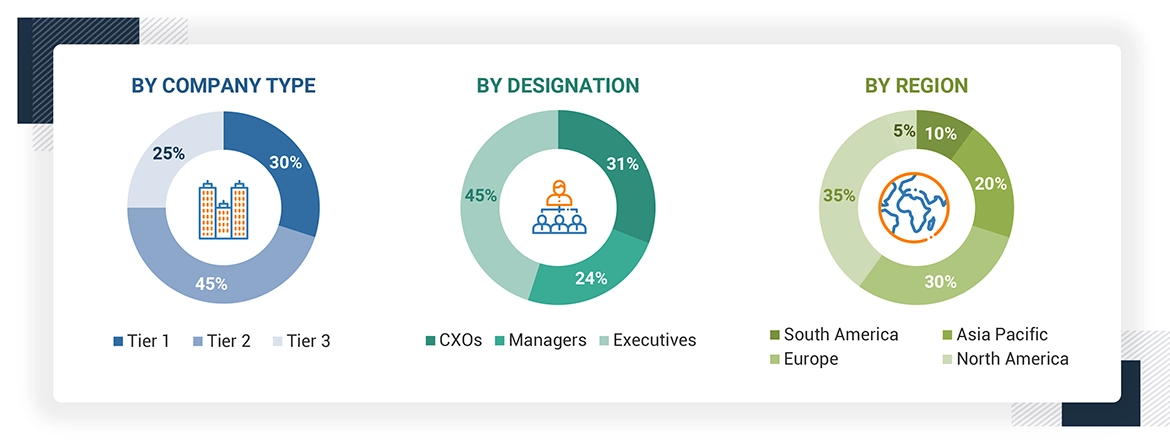

The non-thermal pasteurization market comprises several stakeholders, including equipment manufacturers and suppliers, food & beverages manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of sports and golf landscape developing companies through questionnaires, emails, and telephonic interviews.

Note: Tier 1: Revenue > USD 500 million; Tier 2: USD 100 million to USD 500 million; Tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the non-thermal pasteurization market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

-

The key industry and market players were identified through extensive secondary research.

-

The industry's supply chain and market size were determined through primary and secondary research.

-

All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

-

Bottom-up approach:

-

The market size was analyzed based on the share of each type of non-thermal pasteurization and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

-

Other factors include demand within the supply chain including food & beverage industry; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall non-thermal pasteurization market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Non-thermal pasteurization is an alternative food processing technology that involves the sterilization of food & beverages and other applications without using heat. Also known as cold pasteurization, this process helps retain the essential nutrients, taste, appearance, and other organoleptic features, leading to the increased shelf life of food in a cost-effective manner. Non-thermal pasteurization technologies used for food processing include high-pressure processing (HPP), ultraviolet and pulsed light, microwave volumetric heating (MVH), pulsed electric field (PEF), ultrasonic, irradiation, and others.

Non-thermal pasteurization technologies are widely used for food safety and food preservation through various processes such as sterilization and decontamination by acting on the cells of microorganisms. They are also widely used in the pharmaceutical sector for disaggregation and controlled re-naturalization of proteins of therapeutic interest and inactivation of pathogens (such as bacteria and viruses) in vaccines while retaining their antigen response.

Stakeholders

-

Manufacturers, importers & exporters, traders, distributors, and suppliers of non-thermal pasteurizing equipment

-

Food & beverage processing equipment importers and exporters

-

Food product manufacturers, processors, distributors, and traders

-

Beverage product manufacturers, processors, distributors, and traders

-

Food & beverage ingredient manufacturers, processors, distributors, and traders

-

Raw material suppliers

-

Regulatory bodies, which include the following:

-

Food and Agriculture Organization (FAO)

-

Environmental Protection Agency (EPA)

-

Food Safety Council (FSC)

-

European Federation of National Associations of Measurement, and Testing and Analytical Laboratories (EUROLAB)

-

Government and research organizations

-

Trade associations and industry bodies

Report Objectives

MARKET INTELLIGENCE

-

Determining and projecting the size of the non-thermal pasteurization market based on technique, form, application, and region over a five-year period ranging from 2023 to 2028.

-

Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

-

Impact of macro- and micro-economic factors on the market

-

Shifts in demand patterns across different subsegments and regions.

-

Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

-

To strategically profile the key players and comprehensively analyze their core competencies.

-

To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the non-thermal pasteurization market

COMPETITIVE INTELLIGENCE

-

Identifying and profiling the key market players in the non-thermal pasteurization market

-

Providing a comparative analysis of the market leaders based on the following:

-

Product offerings

-

Business strategies

-

Strengths and weaknesses

-

Key financials

-

Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

-

Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

-

Providing insights into the key investments and product innovations and technology in the non-thermal pasteurization market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

-

Further breakdown of the Rest of European Non-thermal pasteurization market, by key country

-

Further breakdown of the Rest of South America Non-thermal pasteurization market, by key country

COMPANY INFORMATION

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Non-thermal Pasteurization Market