High Pressure Processing Equipment Market by Orientation Type (Horizontal and Vertical), Vessel Volume, Application (Fruits & Vegetables, Meat, Juice & Beverages, Seafood), End User Category, and Region - Global Forecast to 2022

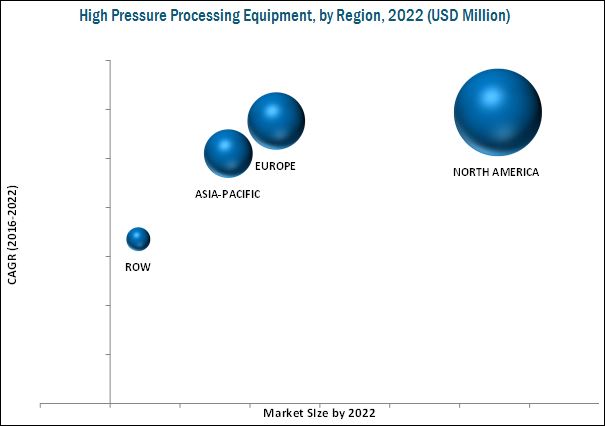

The high pressure processing equipment market is projected to grow at a CAGR of 11.26% from 2016, to reach USD 500.3 Million by 2022. The base year considered for the study is 2015 and the forecast years include 2016 to 2022. The global market has been segmented on the basis of orientation type into horizontal and vertical. On the basis of region, it has been segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). There is an increased adoption rate for high pressure processing equipment in countries such as the U.S., Canada, Spain, China, and Chile, which has caused the market for high pressure processing equipment market to expand. The vessel volume of the high pressure processing equipment has been segmented into less than 100L, 100 to 250L, 250 to 500L, and more than 500L. The basic objective of the report is to provide a detailed insight about the key factors influencing the growth of the market such as drivers, restraints, opportunities and challenges. The report also analyzes the opportunities in the market for stakeholders, along with providing competitive landscape and strategic company profiling.

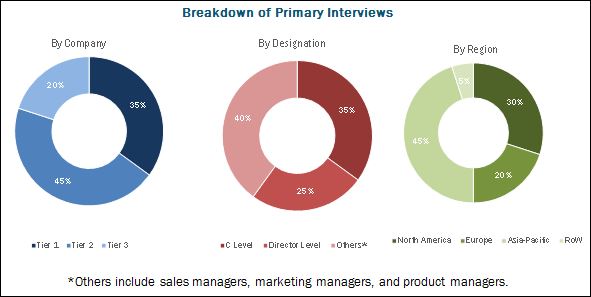

This report includes estimations of market sizes for value (USD million). Both, top-down and bottom-up approaches have been conducted to estimate and validate the size of the global high pressure processing equipment market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. The figure below shows the breakdown of profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the supply chain of high pressure processing equipment market are high pressure processing equipment manufacturers and food business operators. The key players profiled in the report include The Avure Technologies Inc. (U.S.), Hiperbaric Espana (Spain), Bao Tou KeFa High Pressure Technology, Co., Ltd. (China), CHIC FresherTech (China), Kobe Steel, Ltd. (Japan), Multivac Sepp Haggenmuller Se & Co. KG (Germany), Stansted Fluid Power Ltd (U.K.), Universal Pasteurization Co. (U.S.), Next HPP (U.S.) and ThyssenKrupp AG (Germany).

This report is targeted at the existing players in the industry, which include the following:

- Manufacturers and suppliers of HPP equipment

- Research organizations

- Raw material suppliers

- Government authorities

“The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments”.

Scope of the Report

On the basis of Orientation Type, the market has been segmented as follows:

- Horizontal

- Vertical

On the basis of Vessel Volume Type, the market has been segmented as follows:

- Less than 100L

- 100 to 250L

- 250 to 500L

- More than 500L

On the basis of End User Category, the market has been segmented as follows:

- Small and medium enterprises

- Large production plants

- Groups

On the basis of Application, the market has been segmented as follows:

- Fruits & vegetables

- Meat

- Juice & beverages

- Seafood

- Others (which include dairy products, grains, and packaged condiments)

On the basis of Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- Further country specific data and its market analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

The high pressure processing equipment market is projected to grow at a CAGR of 11.26% from 2016, to reach a projected value of USD 500.3 Million by 2022. High pressure processing equipment has become prominent in recent years due to the increased use of different volumes of vessels, growing awareness regarding the types of products that can benefit from the use of high pressure processing technology, and the increasing research activities regarding the importance of using cold processing techniques

Depending upon the application of high pressure processing equipment, the market was led by fruits & vegetables, followed by meat and juice & beverages, respectively. Juice & beverages are expected to have the highest growth rate due to the adoption of the technology for processing of packaged beverages by major multi-national companies. Hence, with the growth in the consumption of packaged food and beverages, the use of HPP technology is expected to increase.

In terms of vessel volume, the high pressure processing market was led by the 100 to250L category in 2015. The primary reason behind the large share of this segment is the lower cost of the equipment, which is affordable to food manufacturers operating on a small or medium scale. The fastest-growing segment is expected to be the less than 100L category of equipment, as it requires lesser manpower to operate.

The global market, in terms of end user category, is led by the large production plants segment in 2015. This is due to the presence of a large number of packaged meat producers of this category who adopted this technology in order to minimize the usage of preservatives in their products.

In terms of orientation type, horizontal equipment accounted for the largest-market share in 2015. Horizontal high pressure processing equipment is used to the largest extent globally. This segment is also the fastest growing as it is easy to assemble and disassemble, install, and ensures more throughput. Therefore, most high pressure processing equipment is horizontal. The horizontal segment dominated this market in 2015, owing to its large-scale application in meat, fruits & vegetables, and juice & beverages in the North American region.

North America accounted for the largest market share for high pressure processing equipment, U.S. being the fastest growing in the region, from 2016 to 2022. North America is also projected to be the fastest-growing market for the period considered for this study, due to the high adoption rate of novel food processing technologies and high level of exports of HPP products to other regions.

Limited use in vertical orientation segment is one of the restraints for high pressure processing equipment market. The use of vertical orientation segment is limited as is time consuming and requires excess time to load and unload products.

Hiperbaric Espana is one of the prominent players in the high pressure processing equipment market. It focuses on strengthening its equipment portfolio by acquiring companies that help in expanding its production capacity of different types of equipment. The company’s core competencies are strong product portfolio for high pressure processing equipment and global footprint. Recently, the company expanded its manufacturing facilities and assembly workshops in India, Malaysia, Estonia, and Dominican Republic.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.4 Years Considered for the Study

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in this Market

4.2 Market, By Vessel Volume

4.3 North America: High Pressure Processing Equipment Market

4.4 Market: Major Countries

4.5 Market, By Application

4.6 Market: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Orientation Type

5.2.2 By Vessel Volume

5.2.3 By End User Category

5.2.4 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Consumption of Packaged Foods

5.3.1.2 Increased Production of Ready-To-Cook Meat

5.3.2 Restraints

5.3.2.1 Requirement of High Capital Investment

5.3.2.2 Existing Stringent Food Safety Regulations

5.3.3 Opportunities

5.3.3.1 Government Assistance Towards Developing Food Technologies

5.3.3.2 Growth in the Usage of HPP Toll Processors

5.3.4 Challenges

5.3.4.1 High Usage of Thermal Processing Technology

5.3.4.2 Reducing Energy Consumption of HPP Equipment

6 High Pressure Processing Equipment Market, By Orientation Type (Page No. - 42)

6.1 Introduction

6.2 Horizontal HPP Equipment

6.3 Vertical HPP Equipment

7 High Pressure Processing Equipment Market, By Vessel Volume (Page No. - 47)

7.1 Introduction

7.2 Less Than 100l

7.3 100l to 250l

7.4 250l to 500l

7.5 More Than 500l

8 High Pressure Processing Equipment Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Fruits & Vegetables

8.3 Meat

8.4 Juices & Beverages

8.5 Seafood

8.6 Others

9 High Pressure Processing Equipment Market, By End-User Category (Page No. - 61)

9.1 Introduction

9.2 Large Production Plants

9.3 Small & Medium Enterprises

9.4 Groups

10 High Pressure Processing Equipment Market, By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Spain

10.3.2 Italy

10.3.3 Germany

10.3.4 U.K.

10.3.5 France

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 South Korea

10.4.3 New Zealand

10.4.4 Australia

10.4.5 China

10.4.6 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Chile

10.5.2 Peru

10.5.3 Others in RoW

11 Competitive Landscape (Page No. - 91)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation & Trends

11.3.1 Expansions

11.3.2 Agreements & Joint Ventures

11.3.3 New Product Launches

11.3.4 Acquisitions

12 Company Profiles (Page No. - 96)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Avure Technologies Inc.

12.2 BAO TOU Kefa High Pressure Technology Co., Ltd

12.3 Chic Freshertech

12.4 Hiperbaric Espana

12.5 Kobe Steel Ltd.

12.6 Multivac Sepp Haggenmüller Se & Co. Kg

12.7 Stansted Fluid Power Ltd.

12.8 Thyssenkrupp AG

12.9 Universal Pasteurization Co.

12.10 Next HPP

“ * The companies listed are a representative sample of the market’s ecosystem and in no particular order”

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 111)

13.1 Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (67 Tables)

Table 1 High Pressure Processing Equipment Market, By Orientation Type, 2016–2022 (USD Million)

Table 2 Horizontal HPP Equipment Market, By Region, 2016–2022 (USD Million)

Table 3 Vertical Market Size, By Region, 2016–2022 (USD Million)

Table 4 Vessel Size of HPP Equipment

Table 5 High Pressure Processing Equipment Market Size, By Vessel Volume, 2016–2022 ( USD Million)

Table 6 Less Than 100l Equipment Market Size, By Region, 2016–2022 (USD Million)

Table 7 100l to 250l Equipment Market Size, By Region, 2016–2022 (USD Million)

Table 8 250l to 500l Equipment Market Size, By Region, 2016–2022 (USD Million)

Table 9 More Than 500l Equipment Market Size, By Region, 2016–2022 (USD Million)

Table 10 High Pressure Processing Equipment Market Size, By Application, 2016–2022 (USD Million)

Table 11 Fruits & Vegetables Market Size, By Region, 2016–2022 (USD Million)

Table 12 Fruits & Vegetables Market Size, By Type, 2016–2022 (USD Million)

Table 13 Meat Market Size, By Region, 2016–2022 (USD Million)

Table 14 Meat Market Size, By Type, 2016–2022 (USD Million)

Table 15 Juices & Beverages Market Size, By Region, 2016–2022 (USD Million)

Table 16 Juices & Beverages Market Size, By Type, 2016–2022 (USD Million)

Table 17 Seafood Market Size, By Region, 2016–2022 (USD Million)

Table 18 Seafood Market Size, By Type, 2016–2022 (USD Million)

Table 19 Other Applications Market Size, By Region, 2016–2022 (USD Million)

Table 20 HPP Equipment: End User Category

Table 21 High Pressure Processing Equipment Market Size, By End User Category, 2016–2022 ( USD Million)

Table 22 Large Production Plants Market Size, By Region, 2016–2022 (USD Million)

Table 23 Small & Medium Enterprises Market Size, By Region, 2016–2022 (USD Million)

Table 24 Groups Market Size, By Region, 2016–2022 (USD Million)

Table 25 High Pressure Processing Equipment Market Size, By Region, 2014-2022 (USD Million)

Table 26 North America: High Pressure Processing Equipment Market Size, By Country, 2014-2022 (USD Million)

Table 27 North America: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 28 North America: Market Size, By End-User Category, 2014-2022 (USD Million)

Table 29 North America: Market Size, By Application, 2014-2022 (USD Million)

Table 30 North America: Market Size, By Vessel Volume, 2014-2022 (USD Million)

Table 31 U.S.: High Pressure Processing Equipment Market Size, By Orientation Type, 2014–2022 (USD Million)

Table 32 Canada: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 33 Mexico: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 34 Europe: Market Size, By Country, 2014-2022 (USD Million)

Table 35 Europe: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 36 Europe: Market Size, By End-User Category, 2014-2022 (USD Million)

Table 37 Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 38 Europe: Market Size, By Vessel Volume, 2014-2022 (USD Million)

Table 39 Spain: High Pressure Processing Equipment Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 40 Italy: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 41 Germany: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 42 U.K.: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 43 France: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 44 Rest of Europe: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 45 Asia-Pacific: High Pressure Processing Equipment Size, By Country, 2014-2022 (USD Million)

Table 46 Asia-Pacific: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 47 Asia-Pacific: Market Size, By End-User Category, 2014-2022 (USD Million)

Table 48 Asia-Pacific: Market Size, By Application, 2014-2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Vessel Volume, 2014-2022 (USD Million)

Table 50 Japan: High Pressure Processing Equipment Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 51 South Korea: Market Size, By Orientation Type, 2014-2021 (USD Million)

Table 52 New Zealand: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 53 Australia: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 54 China: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 55 Rest of Asia-Pacific: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 56 RoW: High Pressure Processing Equipment Market Size, By Country, 2014-2022 (USD Million)

Table 57 RoW: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 58 RoW: Market Size, By End-User Category, 2014-2022 (USD Million)

Table 59 RoW: Market Size, By Application, 2014-2022 (USD Million)

Table 60 RoW: Market Size, By Vessel Volume, 2014-2022 (USD Million)

Table 61 Chile: High Pressure Processing Equipment Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 62 Peru: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 63 Others in RoW: Market Size, By Orientation Type, 2014-2022 (USD Million)

Table 64 Expansions, 2010–2015

Table 65 Agreements & Joint Ventures, 2010–2015

Table 66 New Product Launches, 2010–2015

Table 67 Acquisitions, 2010–2015

List of Figures (40 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 North America is Expected to Dominate this Market From 2016 to 2022

Figure 7 High Pressure Processing Equipment Market Size, By Vessel Volume, 2016 vs 2022

Figure 8 Fruits & Vegetables Segment is Projected to Hold the Largest Market Share By 2022

Figure 9 Large Production Plants Segment is Projected to Hold the Largest Market Share By 2022

Figure 10 Increasing Applicability of High Pressure Processing Equipment Provides Opportunities for This Market

Figure 11 Less Than 100l Segment to Grow at the Highest Rate

Figure 12 North American Region Was the Largest Market for High Pressure Processing Equipment in 2015

Figure 13 South Korea is Projected to Be the Fastest-Growing Country-Level Market for High Pressure Processing Equipment From 2016 to 2022

Figure 14 North America Dominated this Market for Meat in 2015

Figure 15 The High Pressure Processing Equipment Market in North America is Experiencing Rapid Growth

Figure 16 High Pressure Processing Equipment Market Segmentation, By Orientation Type

Figure 17 Market Segmentation, By Vessel Volume

Figure 18 Market Segmentation, By End Users

Figure 19 Market Segmentation, By Application

Figure 20 Increased Consumption of Packaged Foods Drives the Global Market Growth

Figure 21 Market Value of Packaged Food in the U.S., 2011-2015

Figure 22 Broiler Meat Production, By Country, 2012-2016

Figure 23 Horizontal Orientation Type is Expected to Dominate the Market Throughout the Forecast Period

Figure 24 North America to Gain A Large Market Share During the Forecast Period

Figure 25 100l-250l Vessels are Expected to Dominate the Market Throughout the Forecast Period

Figure 26 North America to Gain A Large Market Share During the Forecast Period

Figure 27 Applications in Fruit & Vegetables is Expected to Dominate the Market Throughout the Forecast Period

Figure 28 North America to Grow at the Highest Rate During the Forecast Period

Figure 29 Large Production Plants are Expected to Dominate the Market Throughout the Forecast Period

Figure 30 North America to Dominate the Market During the Forecast Period

Figure 31 Regional Snapshot: Markets in North America and Europe are Emerging as Hotspots

Figure 32 North American High Pressure Processing Equipment Market Snapshot: U.S. is Projected to Be the Leader Between 2016 & 2022

Figure 33 European High Pressure Processing Equipment Market Snapshot: Spain is the Largest Market

Figure 34 Key Companies Preferred Strategies Such as Expansions & Agreements, From 2011 to 2016

Figure 35 Market Share Analysis (2015) : High Pressure Processing Equipment

Figure 36 Key Players Adopted Expansions to Accelerate Growth in this Market, From 2011 to 2016

Figure 37 Avure Technologies Inc. : SWOT Analysis

Figure 38 Hiperbaric Espana.: SWOT Analysis

Figure 39 Kobe Steel Ltd.: Company Snapshot

Figure 40 Thyssenkrupp AG: Company Snapshot

Growth opportunities and latent adjacency in High Pressure Processing Equipment Market