The study involved significant activities in estimating the current market size for the ultrasonic testing market. Exhaustive secondary research was done to collect information on the ultrasonic testing industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Ultrasonic testing market.

Secondary Research

The market for the companies offering ultrasonic testing solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to determine and collect information related to the scope of the study. Secondary sources included annual reports, press releases, investor presentations of ultrasonic testing equipment manufacturers, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOS), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the ultrasonic testing market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of ultrasonic testing solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report.

Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

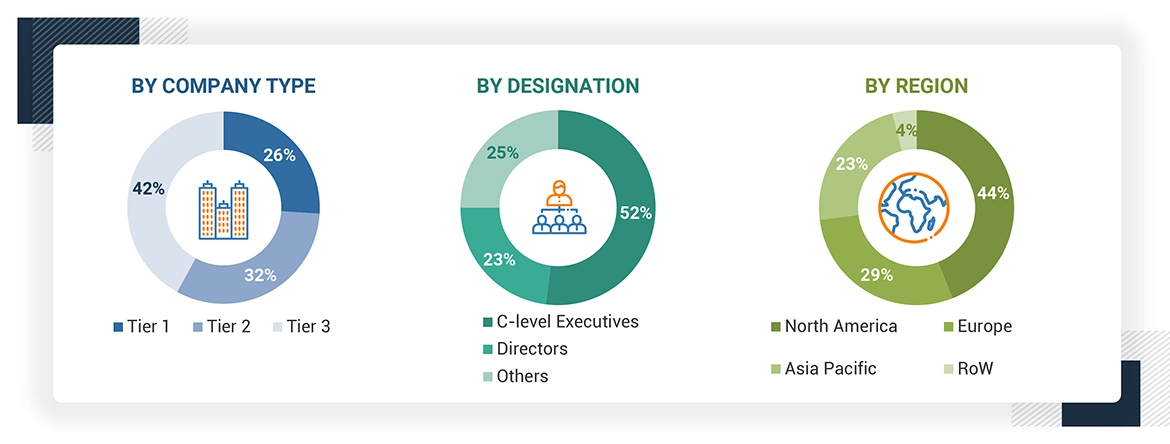

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market engineering process extensively employed the top-down and bottom-up approaches. Various data triangulation methods were utilized to forecast and estimate the market segments and subsegments covered in the report. Multiple qualitative and quantitative analyses were conducted during the market engineering to extract key insights throughout the report.

Secondary research helped identify key players in the ultrasonic testing market. Their revenues were determined through a combination of primary and secondary research, analyzed both geographically and by market segment, using financial statements and annual reports. Insights were further enriched through interviews with CEOs, VPs, directors, and marketing executives.

Market shares were estimated using this combined research approach. The data was then consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Ultrasonic Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Ultrasonic testing is a type of volumetric nondestructive testing technique that helps to identify internal flaws in the material that may not be detected using any surface inspection techniques. This process uses an ultrasonic transducer to transmit high-frequency sound waves into the material, and reflected ultrasound from defects is displayed graphically.

Ultrasonic testing provides valuable information regarding the size, diameter, composition, and direction of any defects observed and is also used to measure the thickness of material such as pipe wall thickness. Ultrasonic testing is available in a frequency range from 0.1 up to 15 MHz; in this method, ultrasonic testing is performed through various instruments such as ultrasonic probes or gauges. UT is mainly applied to measure thicknesses, but it can easily check the wood, concrete, and many more with higher efficiency.

Key Stakeholders

-

Associations, organizations, and alliances related to NDT

-

Government bodies such as regulating authorities and policymakers

-

Original equipment manufacturers (OEMs)

-

Providers of ultrasonic testing services

-

Research organizations and consulting companies

-

Suppliers of related accessories for ultrasonic testing equipment

-

Distributors and suppliers of ultrasonic testing equipment

-

Venture capitalists and private equity firms

Report Objectives

-

To define, describe, and forecast the size of the ultrasonic testing market by type, equipment, service type, vertical, and region in terms of value

-

To describe and forecast the size of the ultrasonic testing market by equipment, in terms of volume

-

To forecast the market for various segments with respect to main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To provide macroeconomic outlooks with respect to main regions namely North America, Europe, Asia Pacific, and Rest of the World (RoW)

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

-

To provide a detailed overview of the ultrasonic testing market value chain, industry trends, technology trends, use cases, regulatory landscape, and Porter’s five forces

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To provide ecosystem analysis, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, key conferences & events, Gen AI/ AI impact, and regulations related to the ultrasonic testing market

-

To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players.

-

To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

-

To analyze the competitive developments, such as product launches and acquisitions carried out by market players

-

To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product developments and acquisitions

-

To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Country-wise information for Asia Pacific

-

Detailed analysis and profiling of additional market players (up to five)

malcolmconnolly

Aug, 2019

Size and proportion of the Ultrasonic inspection market that is UT Gauging (i.e. spot thickness reading ) only. Does your study cover it?.

Julio

Dec, 2017

I have an interest in knowing about the developments in the ultrasonic testing market. Also would like to understand how ultrasonic sensors are associated with the future trends in IoT or IIoT, as industrial applications is the major segment which we serve. .

ASHWANI

Feb, 2017

What is the scope and verticals which you have considered. Also would like to understand the major applications that are catered to this market. .

Jinyeong

Sep, 2017

I am interested in knowing the market share for the verticals that you have provided in the scope. Also would like to understand the trends in ultrasonic testing market. .

Mark

May, 2018

I am interested specific in the laser Ultrasonic inspection machines market for composite and generally in the ultrasonic NDI for metal and composite. Does the scope include theses?.