Food Processing & Handling Equipment Market by Type (Food Processing, Food Service, Food Packaging), Application (Meat & Poultry, Bakery & Confectionery, Alcoholic, Non-alcoholic Beverages, Dairy), End-product Form, and Region - Global Forecast to 2026

The food processing and handling equipment market is projected to surge from USD 130.6 billion in 2021 to USD 175.1 billion in 2026, with a CAGR of 6.0% during the forecast period.

The food processing and handling equipment market is experiencing tremendous growth due to a combination of factors, including a surging demand for processed and packaged food, a growing need for efficient and hygienic processing methods, and the adoption of cutting-edge technology and automation in the food and beverage industry. This report delves into the key drivers of this growth, as well as the trends, challenges, and growth opportunities present in the market.

The food processing and handling equipment market is witnessing substantial growth as the food industry expands, driven by increasing demand for processed foods such as meat products, baked goods, convenience food, and more. The development of new technologies, like non-thermal processing, is streamlining the production process and reducing waste, time, and costs. Innovations in processing technology, the demand for healthy and functional foods, and the growth of food manufacturing capacities in emerging economies are all contributing factors to the market's growth. The food and beverage industry is being transformed by advancements in food processing, creating opportunities for manufacturers to meet the growing demand for healthy and functional products using cutting-edge equipment.

The multi-dimensional beverage industry is growing on a global scale, and therefore, there is a visible increase in the demand for beverages, be it alcoholic, non-alcoholic, or dairy beverages. An increasing processing industry, especially in the developing regions, growing craft breweries, and the development of new technologies in the food processing and handling industry are prominent factors driving the food processing and handling equipment industry. However, rising power & energy costs are a concern to the industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Processing and Handling Equipment Market Dynamics

Drivers : Rising demand for meat, poultry, bakery, dairy, and confectionery products

Meat, dairy, bakery, and confectionery products are some of the major applications of food processing and handling equipment. The growing consumption of protein-based food products, frozen meat, frozen bakery products, and fruits & vegetables; and the growing preference for healthy food products in developed countries drive the demand for higher food production. This growth in demand for various food products will, in turn, drive the demand for food processing and handling equipment. There have been various product launches in snack and bakery product categories, with health claims such as gluten-free and non-GMO in the European market.

Similarly, snacks and bakery products require cutting, coating, slicing, and thermal equipment for manufacturing end products, adding taste and texture, and extending the shelf life. The growth of the bakery & confectionery industry in Europe and other developed countries is also expected to drive the demand for food processing and handling equipment.

Bakery, meat, poultry, and seafood are the major applications of food processing and handling equipment. In the last decade, the changing and busy lifestyles of consumers due to rapid urbanization have led to high demand for processed and convenience meat products. Moreover, processed meat products require less time and effort to cook and have enhanced nutrition and durability. Meat processing involves a wide range of physical and chemical treatment methods, generally combining a variety of methods. Various processing methods that include cutting, blending, stuffing & filling, grinding, drying, slicing, smoking, grinding, and massaging are performed with the help of different equipment.

Similarly, in the dairy industry, the demand for various equipment for a range of applications is driving the food processing & handling equipment market growth. According to the dairy index from Tetra Pak Global consumption of products, such as milk, cheese, and butter, is expected to rise by 36% in the next decade, reaching more than 710 million tons of liquid milk equivalent by 2024. The booming demand for dairy products is majorly witnessed in emerging economies, such as India, China, and Latin American countries. This demand is fueled by population growth, rapid urbanization, increased disposable income, and the emergence & modernization of cold chain facilities such as refrigerated transport & storage.

Restraints : Increasing cost of production due to rise in energy and labor costs

Increasing energy cost is one of the major constraints faced by food & beverage manufacturers to run their plants continuously. Equipment such as homogenizers, heaters, and ovens used in the food & food processing and handling industry consume significantly high energy and power. Automatic equipment is considered to be advanced, but needs an uninterrupted electric supply to function efficiently, which leads to higher energy consumption. The higher usage of automatic non-stop food & food processing and handling equipment needs to be checked to reduce the production cost, which can be ensured by using technologically advanced equipment and implementation of manufacturing best practices. The high cost of running this processing equipment and scarcity of non-renewable energy sources are dissuading small food & beverage processors from installing advanced processing systems.

Opportunities : Rise in demand from developing countries, such as China and India

Emerging economies, such as BRIC (Brazil, Russia, India, and China), offer several growth opportunities for food packaging equipment manufacturers. Growth in these regions is mainly driven by the consumers’ inclination toward ready-to-eat and convenience food products. Some of the key factors driving the demand for packaged or processed food products are as follows: changing lifestyles of the consumers, rapidly rising disposable income, rising brand awareness, an increasing number of working women, and increased concerns about the quality of the food products. These emerging economies across the globe will act as new revenue pockets for the food packaging industry. According to Agriculture and Agri-Food Canada (AAFC). It grew at a CAGR of 11.5% between 2017 and 2018 to reach USD 347 billion by 2018. This is expected to provide growth opportunities for the packaged food industry, which, in turn, will lead to the growth of the food packaging technology & equipment market.

Challenges : Infrastructural challenges in developing countries

The saturated markets of developed regions such as Europe and North America compel manufacturers of food processing equipment to search for untapped markets and expand their consumer base. This requires substantial investments in many aspects of business expansion, especially with regard to the establishment of new facilities in developing countries. Apart from internal investments in facilities, manufacturers also need to spend heavily on the development of efficient supply chain management and storage of raw materials and finished goods. Although low raw material prices and labor costs benefit processing companies entering into developing countries, the investment costs for infrastructural development are a major challenge.

Many developing countries still lack proper infrastructure facilities such as lack of cold storages facilities, non-availability of refrigerated transport, and non-availability of electric supply and road and rail connectivity. These challenges need to be addressed by the respective governments and manufacturers to support the growth of the food & food processing and handling equipment market in developing regions.

Food processing segment is estimated to dominate the global food processing and handling equipment market

Advancements in the food processing industry, innovation in processing technology, and continuous growth in the demand for processed food are some factors expected to support the growth of the food & beverage processing equipment market. With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. The expansion of food manufacturing capacities and growth of the food processing industry in emerging economies will also support the growth of the food processing & handling equipment market.

The solid segment is estimated to account for the largest share in the food processing and handling equipment market

The solid segment dominated the global food processing & handling equipment market due to the rising consumption of solid food products, such as bread, processed meat, and processed vegetables, in regular diets. Changing consumer preferences and the adoption of upgraded technologies to enhance the shelf life of products are also driving the growth of the solid segment. Customizations and innovations in the bakery and dessert industries, along with the rising demand for processed fruit and vegetable products, provide huge opportunities for the manufacturers to grow in the food processing & handling equipment market.

To know about the assumptions considered for the study, download the pdf brochure

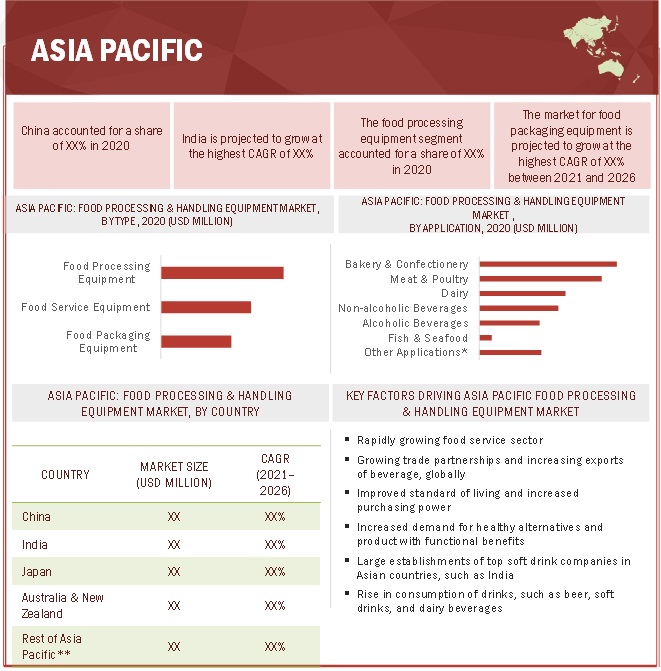

The Asia Pacific market dominated the food processing and handling equipment market during the forecast period

The food industry in Asia Pacific is gigantic. In the region, product innovations and technological advances have put increasing pressures on the quality standards at all levels, with a growing emphasis on food safety, integrity, quality, and nutritional and health impacts. Growth in the demand for processed foods, the rapid rise in supermarkets, and retail outlets are some of the positive factors shaping the growth of the food and beverages industry in the region. With the rising urban incomes and higher consumption proportions of animal products, there is a demand for a more varied range of foodstuffs. Changing demand for processed food and gradual liberalization of the international food trade has resulted in the rise of multinational food retailers.

Food Processing & Handling Equipment Market Key Players:

The key players in this market include GEA Group (Germany), ALFA LAVAL (Sweden), Bühler Holding AG (Switzerland), JBT Corporation (US), SPX Flow (US), Robert Bosch (Germany), IMA Group (Italy), Multivac (Germany), Krones Group (Germany), Tetra Laval International S.A. (Switzerland), Middleby Corporation (US), Dover Corporation (US), Ali Group S.r.l (Italy), Electrolux (Sweden), and Hoshizaki (Japan). Manufacturers are adopting strategies such as new product launches, expansion & investments, mergers & acquisitions, agreements, and partnerships to strengthen their position in the market.

Target Audience:

- Manufacturers, dealers, and suppliers of food processing & handling equipment

- Beverage product manufacturers

- Packaging equipment suppliers

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

- Regulatory bodies and institutions:

- Logistics providers & transporters

- Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sectors

Scope of the Report

|

Report Metric |

Details |

|

Market demand in 2021 |

USD 130.6 billion |

|

Growth forecast in 2026 |

USD 175.1 billion |

|

Growth Rate |

CAGR of 6.0% From 2021 - 2026 |

|

Market size available for years |

2017-2026 |

|

Base Year for estimation |

2020 |

|

Segmentation |

Type, Application, End-Product Form, Region |

|

By Equipment Type |

|

|

By End-product Form |

|

|

By Application |

|

|

By Region |

|

|

Food Processing and Handling Equipment Market Drivers |

|

|

Key companies profiled |

|

This research report categorizes the food processing and handling equipment market based on type, application, end-product form and region.

Food Processing and Handling Equipment Market By Type

- Food Processing Equipment

- Food Service Equipment

- Food Packaging Equipment

By End-product Form

- Solid

- Liquid

- Semi-solid

Food Processing and Handling Equipment Market By Application

-

- Bakery & Confectionery

- Meat & Poultry

- Fish & Seafood

- Dairy Products

- Alcoholic Beverages

- Non-alcoholic Beverages

-

Other Applications*

*Other Applications include grains and cereals, fruits and vegetables, ready-to-eat meals, sauces, dressings, and condiments.

By Region:

- North America

- Europe

- Asia Pacific

-

Rest of the World (RoW)

- South America

- Middle East

- Africa

Recent Developments

- In November 2021, JBT Corporation acquired Urtasun Tecnología Alimentaria S.L provides solutions for fruit and vegetable processing. This acquisition expanded the existing product offering of JBT in the fruits and vegetable processing domain. This would increase its market presence in the packaged and frozen market sector.

- In September 2021, the Middleby Corporation company (US) acquired Imperial commercial cooking equipment company (US), a manufacturer of a range of fryers, ovens, countertop equipment.

- In January 2019, GEA Group launched DairyRobot R9500, which helps enhance the milking process. The launch of the product made the group a pioneer in the industry to launch Somatic Cell Count (SCC) monitors to continually analyze the milk flow from each quarter.

- In February 2019, Alfa Laval introduced a twin-screw pump added to the company’s hygienic pump portfolio for use in the dairy, food, and personal care industries. This launch aimed at simplifying the operation and leading to a reduction in the cost.

- In January 2018, GEA Group acquired Vipoll (Slovenia), a beverage filling technology and equipment company. This acquisition helped GEA in broadening and strengthening its position in the beverage industry by adding beverage packaging equipment & technology to its product portfolio.

Report Objectives:

- Determining and projecting the size of the food processing and handling equipment market, with respect to type, application, end-product form regional markets, over seven years, ranging from 2019 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling the key market players in the food processing and handling equipment market

-

Providing a comparative analysis of the market leaders based on the following parameters:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the food processing and handling equipment market

Frequently Asked Questions (FAQ):

What is the projected market value of the global food processing and handling equipment market?

The global food processing and handling equipment market as per revenue was estimated to be worth $130.6 billion in 2021 and is poised to reach $175.1 billion by 2026, growing at a CAGR of 6.0% from 2021 to 2026.

What is the estimated growth rate (CAGR) of the global food processing and handling equipment market for the next five years?

The global food processing and handling equipment market is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2021 to 2026

What are the major revenue pockets in the food processing and handling equipment market currently?

The food industry in Asia Pacific is gigantic. In the region, product innovations and technological advances have put increasing pressures on the quality standards at all levels, with a growing emphasis on food safety, integrity, quality, and nutritional and health impacts.

What is driving the growth of the food processing and handling equipment market?

The growth of the food processing and handling equipment market is driven by factors such as increasing demand for processed and packaged food products, rising consumer preference for convenient and ready-to-eat foods, and the need for efficient and automated manufacturing processes to improve productivity and reduce costs.

What are some key trends in the food processing and handling equipment market?

Some key trends in the food processing and handling equipment market include the adoption of automation and robotics to improve efficiency and reduce labor costs, the development of new materials and technologies to improve equipment performance and durability, and the increasing use of data analytics and machine learning to optimize production processes and improve product quality.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FOOD PROCESSING & HANDLING EQUIPMENT: MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 GEOGRAPHIC SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2016–2020

1.5 STAKEHOLDERS

1.6 INTRODUCTION TO COVID-19

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 3 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7 SCENARIO-BASED MODELLING

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 12 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021 VS. 2026

FIGURE 13 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021 VS. 2026

FIGURE 14 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 15 ASIA PACIFIC DOMINATED THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

FIGURE 16 EMERGING ECONOMIES OFFERING ATTRACTIVE OPPORTUNITIES IN THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

4.2 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION

FIGURE 17 BAKERY & CONFECTIONERY PRODUCTS SEGMENT EXPECTED TO DOMINATE THE MARKET IN 2020

4.3 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM & COUNTRY

FIGURE 18 SOLID SEGMENT TO DOMINATE THE MARKET IN 2020

4.4 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE & REGION

FIGURE 19 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE IN THE FOOD PACKAGING SEGMENT IN 2020

4.5 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY KEY SUB-REGIONAL MARKETS

FIGURE 20 INDIA IS EXPECTED TO ACHIEVE THE HIGHEST CAGR IN THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 TECHNOLOGICAL INNOVATIONS AND THE RISING CONSUMPTION OF READY-TO-EAT FOOD DRIVING THE MARKET

5.2.1 DRIVERS

FIGURE 22 INDIAN FOOD SERVICE INDUSTRY, BY CATEGORY, 2017

5.2.1.1 Rising demand for meat, poultry, bakery, dairy, and confectionery products

5.2.1.2 Rise in focus on production and operational efficiency, processing time, and quality of food products

5.2.1.3 Increase in demand for hygienic food packaging

5.2.1.4 Shift toward convenient food packaging

5.2.2 RESTRAINTS

5.2.2.1 Increasing cost of production due to rise in energy and labor costs

5.2.2.2 Stringent environmental regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in investment opportunities for the development of new food & beverage processing technologies

5.2.3.2 Rise in demand from developing countries, such as China and India

5.2.4 CHALLENGES

5.2.4.1 Infrastructural challenges in developing countries

5.2.4.2 Ensuring the correct mixture of gases in controlled environment packaging

6 INDUSTRY TRENDS (Page No. - 73)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 23 FOOD PROCESSING & HANDLING EQUIPMENT: VALUE CHAIN ANALYSIS

6.3 MARKET ECOSYSTEM & SUPPLY CHAIN

FIGURE 24 FOOD PROCESSING & HANDLING EQUIPMENT: SUPPLY CHAIN ANALYSIS

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 INPUTS

6.3.3 PRODUCTION

6.3.4 LOGISTICS & DISTRIBUTION

6.3.5 MARKETING & SALES

6.3.6 END-USER INDUSTRY

FIGURE 25 FOOD PROCESSING & HANDLING EQUIPMENT: MARKET MAP

6.4 TECHNOLOGY ANALYSIS

6.5 REGULATORY POLICIES FOR FOOD PROCESSING & HANDLING EQUIPMENT

6.5.1 REGULATIONS OF THE FOOD PROCESSING EQUIPMENT MARKET

6.5.2 REGULATIONS OF THE FOODSERVICE EQUIPMENT MARKET

6.5.3 REGULATIONS OF THE FOOD PACKAGING EQUIPMENT MARKET

6.5.3.1 US

6.5.3.2 Europe

6.5.3.3 India

6.6 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

6.7 PORTER’S FIVE FORCES ANALYSIS

6.7.1 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.2 THREAT OF NEW ENTRANTS

6.7.3 THREAT OF SUBSTITUTES

6.7.4 BARGAINING POWER OF SUPPLIERS

6.7.5 BARGAINING POWER OF BUYERS

6.7.6 INTENSITY OF COMPETITIVE RIVALRY

6.8 TRADE ANALYSIS

TABLE 2 EXPORT DATA OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2019 (VALUE)

TABLE 3 IMPORT DATA OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2019 (VALUE)

FIGURE 27 TOP EXPORTERS OF BEVERAGES, BY VALUE, 2016–2020 (USD BILLION)

FIGURE 28 TOP IMPORTERS OF BEVERAGES, BY VALUE, 2016–2020 (USD BILLION)

6.9 PATENT ANALYSIS

FIGURE 29 TOP 10 APPLICANTS IN THE LAST 10 YEARS

TABLE 4 PATENTS PERTAINING TO FOOD PROCESSING & HANDLING EQUIPMENT, 2015-2021

TABLE 5 LIST OF IMPORTANT PATENTS FOR FOOD PROCESSING EQUIPMENT, 2019-2020

6.10 CASE STUDIES

6.10.1 GROWING DEMAND FOR BETTER PASTEURIZATION TECHNIQUES

TABLE 6 GROWING DEMAND FOR BETTER-AUTOMATED DAIRY MANUFACTURING EQUIPMENT FOR A COMPANY IN THE UAE

6.10.2 OPTIMAL MAINTENANCE COST AND INCREASED RELIABILITY WITHIN JUICE PRODUCTION

TABLE 7 GROWING DEMAND FOR QUALITY DEMAND RELIABILITY AND OPTIMAL MAINTENANCE COST WITHIN THE PRODUCTION LINE OF AN AFRICAN PLAYER MANUFACTURING JUICES, NECTAR, AND STILL DRINKS

7 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 30 FOOD PROCESSING EQUIPMENT SEGMENT EXPECTED TO DOMINATE THE MARKET BY 2026

TABLE 8 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 9 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE

TABLE 10 OPTIMISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 11 REALISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 12 PESSIMISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

7.3 FOOD PROCESSING EQUIPMENT

TABLE 13 FOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 FOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3.1 PRE-PROCESSING EQUIPMENT

TABLE 15 FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.3.1.1 Sorting & grading

7.3.1.1.1 Increasing usage of sorting equipment to maintain quality and save time

7.3.1.2 Cutting, peeling, grinding, slicing, and washing

7.3.1.2.1 Reduction in food waste and increased consistency

7.3.1.3 Mixing and blending

7.3.1.3.1 Shift from all-purpose blenders and mixers to highly tuned equipment for specialized products

7.3.2 PRIMARY PROCESSING EQUIPMENT

TABLE 17 FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.3.2.1 Forming equipment

7.3.2.1.1 Growing innovations to produce appealing designs and increased processed food consumption

7.3.2.2 Extruding equipment

7.3.2.2.1 Extrusion helping the production of functional food produce

7.3.2.3 Coating equipment

7.3.2.3.1 Innovations in edible coating to improve the shelf life of fresh produce such as fruits

7.3.2.4 Drying, cooling, and freezing

7.3.2.4.1 Use of spray drying technology in food products

7.3.2.5 Thermal equipment

7.3.2.5.1 Rising consumption of processed foods and beverages accelerating the thermal equipment type market

7.3.2.6 Homogenizer

7.3.2.6.1 Homogenizer may assist in capitalizing on new ongoing health trends

7.3.2.7 Filters

7.3.2.7.1 Filters – important equipment amid rising food safety concerns

7.3.2.8 Pressing

7.3.2.8.1 Transition from using time-consuming manual power to machinery for pressing

7.4 FOOD SERVICE EQUIPMENT

TABLE 19 FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 20 FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 21 FOOD SERVICE EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 FOOD SERVICE EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4.1 COOKING EQUIPMENT

7.4.1.1 Baking industry to drive the growth

7.4.2 STORAGE AND REFRIGERATION EQUIPMENT

7.4.2.1 Initiatives to improve cold chain logistics driving demand in developing countries

7.4.3 FOOD PREPARATION EQUIPMENT

7.4.3.1 Rising popularity of buffet and self-service customer

7.4.4 WAREWASHING EQUIPMENT

7.4.4.1 Shortage of labor in developed economies encouraging the use of washing equipment

7.4.5 SERVING EQUIPMENT

7.4.5.1 Increasing number of QSRs and fast-food joints

7.5 FOOD PACKAGING EQUIPMENT

TABLE 23 FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 24 FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 25 FOOD PACKAGING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 FOOD PACKAGING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5.1 FORM-FILL-SEAL

7.5.1.1 Rising demand for multi-functional form-fill-seal equipment

7.5.2 FILLING & DOSING

7.5.2.1 Rising consumption of processed foods

7.5.3 CARTONING

7.5.3.1 Rising demand for sustainable packaging

7.5.4 CASE PACKING

7.5.4.1 Reduced labor cost

7.5.5 WRAPPING & BUNDLING

7.5.5.1 Increasing expectation of consumers in terms of external looks of products

7.5.6 LABELING & CODING

7.5.6.1 Increasing transparency and trending of labels conveying health and wellness

7.5.7 INSPECTING, DETECTING, AND CHECK-WEIGHING MACHINES

7.5.7.1 Rise in imports and exports of food products

7.5.8 OTHER TYPES

7.5.8.1 Rising demand for packaging machines, such as palletizing, capping, & sealing machines

8 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION (Page No. - 112)

8.1 INTRODUCTION

FIGURE 31 BAKERY & CONFECTIONERY SEGMENT EXPECTED TO DOMINATE THE MARKET BY 2026

TABLE 27 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 28 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 COVID-19 IMPACT ON FOOD PROCESSING & HANDLING EQUIPMENT, BY APPLICATION

TABLE 29 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 30 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 31 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

8.3 BAKERY & CONFECTIONERY

8.3.1 CHANGING LIFESTYLE AND INCREASING DEMAND FOR BREAD AND BAKERY PRODUCTS IN THE ASIA PACIFIC REGION DRIVING THE MARKET

TABLE 32 BAKERY & CONFECTIONERY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 BAKERY & CONFECTIONERY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 MEAT & POULTRY

8.4.1 INCREASING INNOVATIONS AND ENHANCEMENTS IN MEAT AND POULTRY EQUIPMENT

TABLE 34 MEAT & POULTRY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MEAT & POULTRY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 FISH & SEAFOOD

8.5.1 RISING CONSUMER DEMAND AND INCREASED PENETRATION IN DEVELOPING COUNTRIES LEADING TO A SURGE IN DEMAND FOR FISH-BASED AND SEAFOOD PRODUCTS

TABLE 36 FISH & SEAFOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 FISH & SEAFOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.6 DAIRY

8.6.1 GROWING DEMAND FOR CUSTOMIZED DAIRY AND DAIRY-BASED PRODUCTS

TABLE 38 DAIRY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 DAIRY PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.7 ALCOHOLIC BEVERAGES

8.7.1 RISING TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN CRAFT BREWERIES DUE TO THE GROWING DEMAND FOR CUSTOMIZED CRAFT BEER AND RELATED PRODUCTS

TABLE 40 ALCOHOLIC BEVERAGES PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 ALCOHOLIC BEVERAGES PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.8 NON-ALCOHOLIC BEVERAGES

8.8.1 CONTINUOUS DEVELOPMENTS AND NEW PRODUCT LAUNCHES DRIVING THE NEED FOR NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT

TABLE 42 NON-ALCOHOLIC BEVERAGES PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 NON-ALCOHOLIC BEVERAGES PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

8.9 OTHER APPLICATIONS

8.9.1 COATING EQUIPMENT WITNESSING HIGH DEMAND DUE TO THE RAPIDLY GROWING SNACKS INDUSTRY

TABLE 44 OTHER PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 OTHER PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

9 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM (Page No. - 126)

9.1 INTRODUCTION

FIGURE 32 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021 VS. 2026 (USD MILLION)

TABLE 46 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2017–2020 (USD MILLION)

TABLE 47 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON FOOD PROCESSING & HANDLING EQUIPMENT, BY END-PRODUCT FORM

TABLE 48 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2021 (USD MILLION)

TABLE 49 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2021 (USD MILLION)

TABLE 50 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2021 (USD MILLION)

9.2 SOLID FORM

9.2.1 RISING CONSUMPTION OF PROCESSED FOODS

TABLE 51 SOLID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 SOLID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LIQUID FORM

9.3.1 RISING CONSUMPTION OF NON-ALCOHOLIC BEVERAGES DUE TO INCREASING HEALTH-CONSCIOUSNESS

TABLE 53 LIQUID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 LIQUID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 SEMI-SOLID

9.4.1 INCREASING PREFERENCE FOR YOGURTS, JELLIES, PUDDINGS, AND SPREADS

TABLE 55 SEMI-SOLID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 SEMI-SOLID PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

10 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION (Page No. - 134)

10.1 INTRODUCTION

FIGURE 33 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 57 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 34 INDIA EXPECTED TO ACHIEVE THE HIGHEST GROWTH DURING THE FORECAST PERIOD

10.2 COVID-19 IMPACT ON THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION

TABLE 59 OPTIMISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 REALISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 PESSIMISTIC SCENARIO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

10.3 NORTH AMERICA

TABLE 62 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: FOOD PRE-PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: FOOD PRIMARY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 73 NORTH AMERICA: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021–2026 (USD MILLION)

10.3.1 US

10.3.1.1 The US accounted for the largest market share in North America

TABLE 78 US: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 79 US: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Significant imports of meat processing machinery

TABLE 80 CANADA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 CANADA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Rising growth of the full-service restaurant sector

TABLE 82 MEXICO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 83 MEXICO: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 EUROPE

TABLE 84 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 87 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 88 EUROPE: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 89 EUROPE: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 90 EUROPE: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 91 EUROPE: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 92 EUROPE: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 EUROPE: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 EUROPE: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2017–2020 (USD MILLION)

TABLE 99 EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 IOT-capable packaging machine technology gaining trends in the German food processing & handling equipment market

TABLE 100 GERMANY: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 101 GERMANY: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.2 UK

10.4.2.1 Bolstering food service demand driving the sales of food service equipment

TABLE 102 UK: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 103 UK: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 French bakery processing equipment market expected to witness significant growth due to changing consumer expectations

TABLE 104 FRANCE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 FRANCE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Growing ice-cream industry anticipated to accelerate dairy processing equipment market growth

TABLE 106 ITALY: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 107 ITALY: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.5 SPAIN

10.4.5.1 Increasing import of bakery products expected to boost the domestic bakery industry

TABLE 108 SPAIN: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 109 SPAIN: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.6 REST OF EUROPE

10.4.6.1 High standards of living and increasing per capita consumption of frozen foods

TABLE 110 REST OF EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 REST OF EUROPE: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 112 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: FOODSERVICE EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: FOODSERVICE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 ASIA PACIFIC: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2017–2020 (USD MILLION)

TABLE 127 ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021–2026 (USD MILLION)

10.5.1 CHINA

10.5.1.1 China dominating the Asia Pacific food processing & handling equipment market

TABLE 128 CHINA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 CHINA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.2 INDIA

10.5.2.1 Value-addition in products driving the growth of the food processing & handling equipment market

TABLE 130 INDIA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 131 INDIA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.3 JAPAN

10.5.3.1 Japanese food & beverage sector driving packaging innovation and focusing on quality improvement

TABLE 132 JAPAN: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 133 JAPAN: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.4 AUSTRALIA & NEW ZEALAND

10.5.4.1 Two-speed food processing industry redefining the food & beverages sector

TABLE 134 AUSTRALIA & NEW ZEALAND: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 135 AUSTRALIA & NEW ZEALAND: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.5 REST OF ASIA PACIFIC

TABLE 136 REST OF ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 138 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 139 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 140 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 142 ROW: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 ROW: FOOD PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 144 ROW: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 ROW: FOOD PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 ROW: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 ROW: FOOD SERVICE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 ROW: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 ROW: FOOD PACKAGING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 151 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 152 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2017–2020 (USD MILLION)

TABLE 153 ROW: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2021–2026 (USD MILLION)

10.6.1 SOUTH AMERICA

10.6.1.1 South America expected to retain the fruit and vegetable pre-processing demand dominance within the industry

TABLE 154 SOUTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 155 SOUTH AMERICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.6.2 MIDDLE EAST

10.6.2.1 Automation in the bakery & confectionery sector driving the growth of the food processing & handling equipment market

TABLE 156 MIDDLE EAST: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 157 MIDDLE EAST: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.6.3 AFRICA

10.6.3.1 Convenience food demand driving the growth of the food processing equipment

TABLE 158 AFRICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 159 AFRICA: FOOD PROCESSING & HANDLING EQUIPMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 193)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2020

TABLE 160 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

11.3 KEY PLAYER STRATEGIES

11.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 36 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

11.5 COVID-19-SPECIFIC COMPANY RESPONSE

11.5.1 TETRA LAVAL (SWITZERLAND)

11.5.2 GEA GROUP (GERMANY)

11.5.3 JBT CORPORATION (US)

11.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 37 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.6.5 PRODUCT FOOTPRINT

TABLE 161 COMPANY EQUIPMENT TYPE FOOTPRINT

TABLE 162 COMPANY APPLICATION FOOTPRINT

TABLE 163 COMPANY REGIONAL FOOTPRINT

TABLE 164 OVERALL COMPANY FOOTPRINT

11.7 FOOD PROCESSING & HANDLING EQUIPMENT, START-UP/SME EVALUATION QUADRANT, 2020

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 38 FOOD PROCESSING & HANDLING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SME)

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 PRODUCT LAUNCHES

TABLE 165 PRODUCT LAUNCHES, 2021

11.8.2 DEALS

TABLE 166 DEALS, 2019–2021

11.8.3 OTHERS

TABLE 167 OTHERS, 2019–2021

12 COMPANY PROFILES (Page No. - 209)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 GEA GROUP

TABLE 168 GEA GROUP: BUSINESS OVERVIEW

FIGURE 39 GEA GROUP: COMPANY SNAPSHOT

TABLE 169 GEA GROUP: PRODUCTS OFFERED

TABLE 170 GEA GROUP: DEALS, 2018

TABLE 171 GEA GROUP: PRODUCT LAUNCHES, 2018-2021

12.2 BÜHLER GROUP

TABLE 172 BÜHLER GROUP: BUSINESS OVERVIEW

FIGURE 40 BÜHLER GROUP: COMPANY SNAPSHOT

TABLE 173 BÜHLER GROUP: PRODUCTS OFFERED

TABLE 174 BÜHLER GROUP: DEALS, 2019–2021

TABLE 175 BÜHLER GROUP: OTHERS, 2020

12.3 ALFA LAVAL

TABLE 176 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 41 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 177 ALFA LAVAL: PRODUCTS OFFERED

TABLE 178 ALFA LAVAL: DEALS, 2019-2021

TABLE 179 ALFA LAVAL: PRODUCT LAUNCHES

TABLE 180 ALFA LAVAL: OTHERS

12.4 JBT CORPORATION

TABLE 181 JBT CORPORATION: BUSINESS OVERVIEW

FIGURE 42 JBT CORPORATION: COMPANY SNAPSHOT

TABLE 182 JBT CORPORATION: PRODUCTS OFFERED

TABLE 183 JBT CORPORATION: DEALS

12.5 SPX FLOW

TABLE 184 SPX FLOW: BUSINESS OVERVIEW

FIGURE 43 SPX FLOW.: COMPANY SNAPSHOT

TABLE 185 SPX FLOW: DEALS

TABLE 186 SPX FLOW: PRODUCT LAUNCHES

TABLE 187 SPX FLOW: OTHERS

12.6 ROBERT BOSCH

TABLE 188 ROBERT BOSH: BUSINESS OVERVIEW

FIGURE 44 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 189 ROBERT BOSCH: PRODUCTS OFFERED

TABLE 190 ROBERT BOSCH: PRODUCT LAUNCHES, 2019-2018

12.7 IMA GROUP

TABLE 191 IMA GROUP: BUSINESS OVERVIEW

FIGURE 45 IMA GROUP: COMPANY SNAPSHOT

TABLE 192 IMA GROUP: PRODUCTS OFFERED

TABLE 193 IMA GROUP: DEALS, 2018-2019

12.8 MULTIVAC

TABLE 194 MULTIVAC: BUSINESS OVERVIEW

TABLE 195 MULTIVAC: PRODUCTS OFFERED

TABLE 196 MULTIVAC: DEALS

TABLE 197 MULTIVAC: PRODUCT LAUNCHES

TABLE 198 MULTIVAC: OTHERS

12.9 KRONES GROUP

TABLE 199 KRONES GROUP: BUSINESS OVERVIEW

FIGURE 46 KRONES GROUP: COMPANY SNAPSHOT

TABLE 200 KRONES GROUP: PRODUCTS OFFERED

TABLE 201 KRONES GROUP: DEALS, 2018-2020

12.10 TETRA LAVAL

TABLE 202 TETRA LAVAL: BUSINESS OVERVIEW

FIGURE 47 TETRA LAVAL: COMPANY SNAPSHOT

TABLE 203 TETRA LAVAL: PRODUCTS OFFERED

TABLE 204 TETRA LAVAL: DEALS, 2020

TABLE 205 TETRA LAVAL: PRODUCT LAUNCHES, 2020

TABLE 206 TETRA LAVAL: OTHERS, 2021

12.11 MIDDLEBY CORPORATION

TABLE 207 THE MIDDLEBY CORPORATION: BUSINESS OVERVIEW

FIGURE 48 MIDDLEBY CORPORATION: COMPANY SNAPSHOT

TABLE 208 THE MIDDLEBY CORPORATION: PRODUCTS OFFERED

TABLE 209 THE MIDDLEBY CORPORATION: DEALS, 2020-2021

12.12 DOVER CORPORATION

TABLE 210 DOVER CORPORATION: BUSINESS OVERVIEW

FIGURE 49 DOVER CORPORATION: COMPANY SNAPSHOT

TABLE 211 DOVER CORPORATION: PRODUCTS OFFERED

TABLE 212 DOVER CORPORATION: DEALS, 2021

TABLE 213 DOVER CORPORATION: PRODUCT LAUNCHES, 2018-2019

12.13 ALI GROUP S.R.L.

TABLE 214 ALI GROUP S.R.L.: BUSINESS OVERVIEW

TABLE 215 ALI GROUP S.R.L: PRODUCTS OFFERED

TABLE 216 ALI GROUP S.R.L: PRODUCT LAUNCHES, 2018-2019

12.14 ELECTROLUX

TABLE 217 ELECTROLUX: BUSINESS OVERVIEW

FIGURE 50 ELECTROLUX: COMPANY SNAPSHOT

TABLE 218 ELECTROLUX: PRODUCTS OFFERED

TABLE 219 ELECTROLUX: DEALS, 2018-2019

12.15 HOSHIZAKI

TABLE 220 HOSHIZAKI: BUSINESS OVERVIEW

TABLE 221 HOSHIZAKI: PRODUCTS OFFERED

TABLE 222 HOSHIZAKI: PRODUCT LAUNCHES, 2018-2021

TABLE 223 HOSHIZAKI: OTHERS, 2019

12.16 GLOBAL BAKERY SOLUTIONS

TABLE 224 GLOBAL BAKERY SOLUTIONS: BUSINESS OVERVIEW

TABLE 225 GLOBAL BAKERY SOLUTIONS: PRODUCTS OFFERED

12.17 SEALTECH ENGINEERS

TABLE 226 SEALTECH ENGINEERS: BUSINESS OVERVIEW

TABLE 227 SEALTECH ENGINEERS: PRODUCTS OFFERED

12.18 DAIRY TECH INDIA

12.19 SPHERETECH PACKAGING INDIA PVT. LTD.

12.20 ALIGN INDUSTRY

12.21 WOOTZANO LTD.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 275)

13.1 INTRODUCTION

TABLE 228 ADJACENT MARKETS TO THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

13.2 LIMITATIONS

13.3 DAIRY PROCESSING EQUIPMENT MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 229 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 230 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 231 FOOD & BEVERAGE PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2023 (USD BILLION)

TABLE 232 FOOD & BEVERAGE PRIMARY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2023 (USD BILLION)

13.5 BAKERY PROCESSING EQUIPMENT MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

TABLE 233 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 234 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2020–2025 (USD MILLION)

13.6 BEVERAGE PROCESSING EQUIPMENT MARKET

13.6.1 MARKET DEFINITION

13.6.2 MARKET OVERVIEW

13.6.3 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE

TABLE 235 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 236 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

13.6.4 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

TABLE 237 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 238 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 283)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

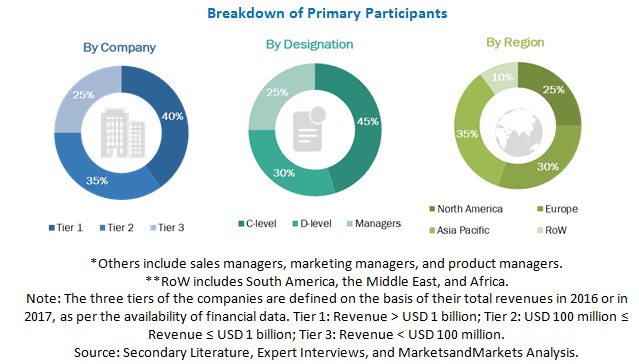

This research study involved the use of extensive secondary sources (such as directories and databases)—Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet (which acquired Avention)—to identify and collect information useful for this study of the food processing and handling & handling equipment market. The primary sources mainly included several industry experts from the core and related industries and suppliers, manufacturers, distributors, alliances, and organizations related to all segments of this industry’s supply chain. In-depth interviews were conducted with various primary respondents—including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the market research methodology used in drafting this report on the food processing and handling & handling equipment market.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain, the total pool of key customers, market classification, and segmentation according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Food Processing and Handling Equipment Market Primary Research

The market includes several stakeholders in the supply chain—suppliers, R&D institutes, and end-product manufacturers. The demand side of the market is characterized by the presence of food & beverage manufacturers and the foodservice sector. The supply side is characterized by the presence of key providers of raw materials. Various primary sources from the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Food Processing and Handling Equipment Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key customers in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market customers, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Food Processing and Handling Equipment Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe food processing and handling equipment market

- Further breakdown of the Rest of Asia Pacific food processing and handling equipment market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Processing & Handling Equipment Market