Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market

Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market by PET Type, PET Application (Bottles, Films, Food Packaging), PBT Application (Electrical & Electronics, Automotive, Consumer Appliance), Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

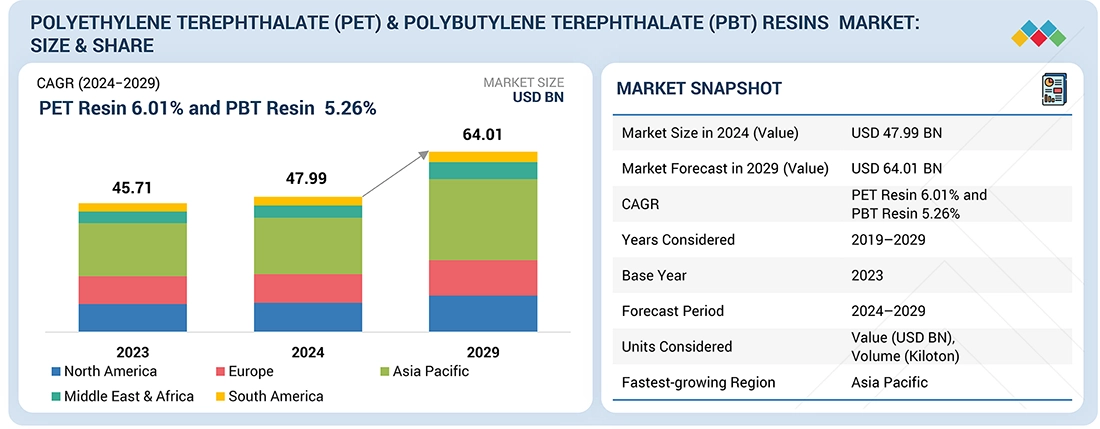

The combined global PET & PBT resin market size was USD 47.99 billion in 2024, and it is anticipated to be worth USD 64.01 billion by 2029, at a CAGR of 6.01 for PET and 5.26% for PBT Resin between 2024 to 2029.Polyethylene terephthalate (PET) is a condensation polymer composed of ethylene glycol and terephthalic acid. It's lightweight, translucent, and comes in several colors. As a member of the ester family, it's also known as polyester. This recyclable thermoplastic polymer has excellent strength, ductility, stiffness, and hardness. It may be treated by vacuum forming, injection molding, compression molding, and blow molding. PET is largely used for food packaging, including fruit and drink containers. It's also utilized to make microwavable trays, food packaging, and cosmetic and pharmaceutical containers. PBT, a semi-crystalline engineering thermoplastic, shares comparable qualities and composition with PET. PBT is part of the polyester family of polymers. The polymer has good mechanical and electrical characteristics. PBT has garnered commercial attention for its many uses, including automotive, electrical and electronics, and consumer products.

KEY TAKEAWAYS

-

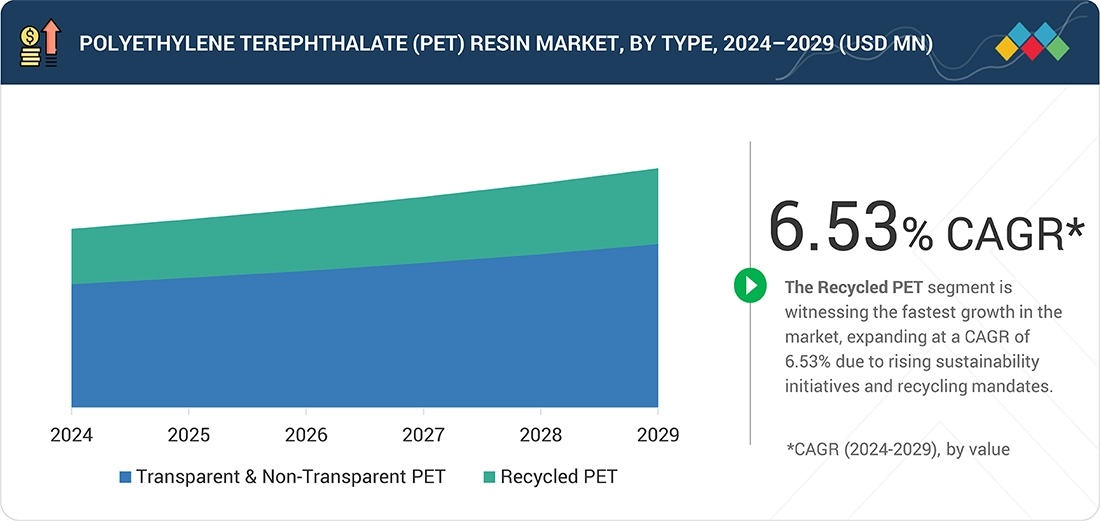

BY TYPEThe transparent & non-transparent PET segment accounted for the largest share of the global PET market. This significant share is driven by their widespread use in bottles, films, and food packaging. Transparent PET is preferred in the food & beverage industry for its clarity, lightweight nature, and recyclability, making it ideal for bottles and food containers. Non-transparent PET is commonly used in films and rigid food packaging due to its durability and barrier properties. The market for these PET types is projected to grow steadly, during the forecast period, supported by the increasing demand for sustainable packaging solutions, rising beverage consumption, and advancements in PET recycling technologies.

-

BY PET Resin ApplicationThe bottles segment is projected to lead the global PET market, driven by its extensive use in the food & beverage, consumer goods, and packaging industries. PET bottles offer advantages such as lightweight, durability, cost-effectiveness, and recyclability, making them ideal for beverages and food packaging. Rising packaged beverage consumption, urbanization, and retail sector expansion, especially in emerging economies, are boosting demand. Additionally, the shift toward sustainable packaging and increasing investments in recycled PET (rPET) production are further supporting market growth. Technological advancements, such as lightweight and improved barrier coatings, are enhancing PET bottle efficiency while reducing the environmental impact.

-

BY PBT Resin ApplicationOne of the fastest-growing application areas for PBT resin is in the electrical and electronics segment due to its characteristics of electrical insulation and high-temperature resistance, as well as dimensional stability. Applications where PBT is being used increasingly include connectors, switches, and circuit boards and housings for consumer and automotive electronics and communication devices. The demand for smaller, highly reliable, and durable electronic components is therefore propelling the growth of PBT in this sector owing to its versatility and performance in applications that are constantly under effort. The drive toward energy-efficient technologies is also serving as a catalyst for the adoption of PBT in electronics.

-

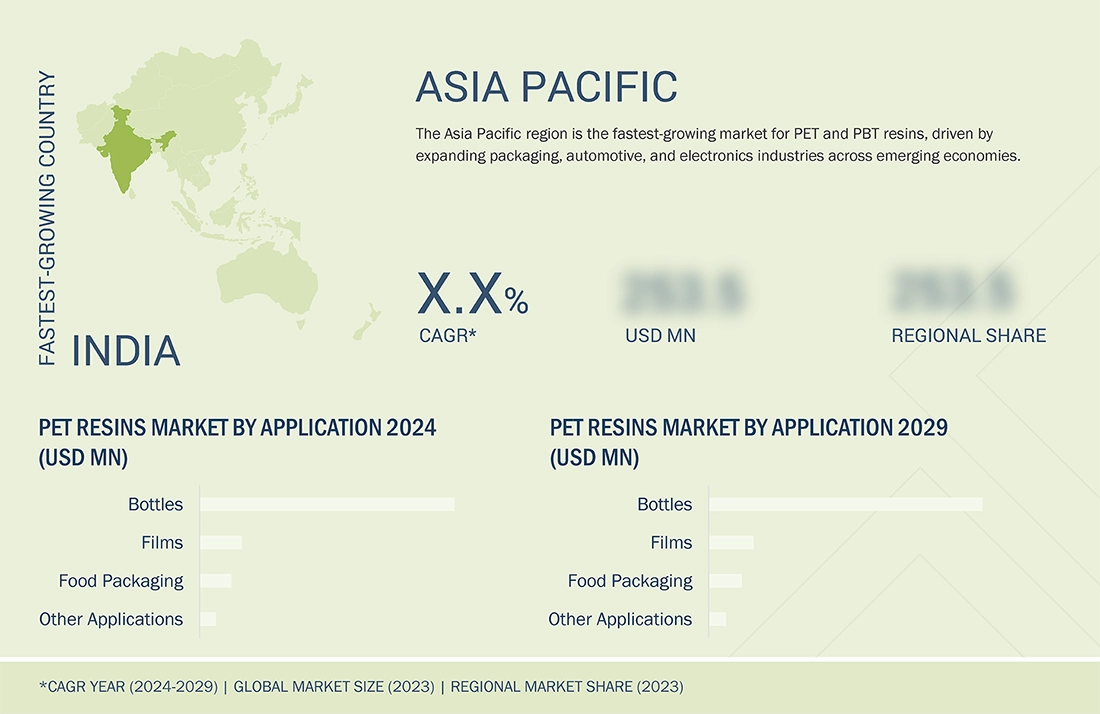

BY REGIONAsia Pacific will be the fastest-growing region for PET & PBT resin markets during the forecast period due to rapid industrialization, expanding manufacturing capabilities, and increasing demand in packaging, automotive, and electronics applications. Demand for consumer goods, especially beverages and electronics, is boosted in this region by its large population and growing middle-class population, thus increasing the consumption of PET & PBT resins. Furthermore, government initiatives, infrastructure, and cost-effective production in countries such as India and China are driving growth for the regional market.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Indorama Ventures Public Company Limited, through its subsidiary IVL Dhunseri Petrochem Industries Limited, has formed a joint venture with Varun Beverages Limited to establish several state-of-the-art PET recycling facilities in India. This initiative aims to meet the growing demand for recycled PET (rPET) content, aligning with sustainability goals and regulatory requirements.

PET (Polyethylene Terephthalate) and PBT (Polybutylene Terephthalate) are thermoplastic resins that are further categorized as composite materials, which are versatile polymers exhibiting exceptional properties. PET material is considered excellent for packaging, textiles, and bottles due to its wide applications, strength, clarity, and recyclability. Other features, such as lightweight, strong, and moisture-resistant properties, further allow for the adoption of PET in consumer goods. PBT, on the other hand, provides excellent mechanical property advantages, with high temperature resistance and electrical insulation capabilities targeted to the automotive, electronics, and electrical engineering industries. These two polycondensation resins find their utility in different industries due to their reliability and sustainability.

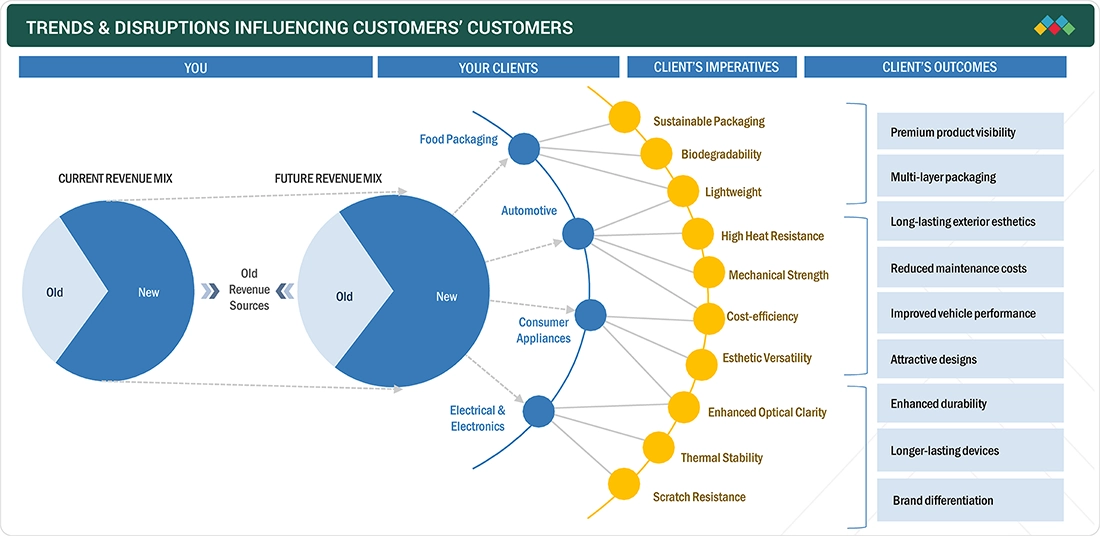

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends which include material transformation and renewables, will impact the company's revenue stream in future. For instance, the use of advanced PET and PBT resins in various applications is a new trend that is expected to drive the PET and PBT resin market in the future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements in PET packaging sector

-

Laws and regulations enforced by governments

Level

-

Fluctuations in raw material prices

-

Absence of required framework for plastic waste collection and segregation

Level

-

Increasing demand for sustainable packaging solutions

-

Expansion to emerging markets

Level

-

High costs of recycled plastics

-

Existence of alternate products with identical properties

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for lightweight vehicles

The automobile sector is one of the primary consumers of PBT resin. PBT is replacing traditional automotive materials including stainless steel, bronze, cast iron, and ceramics due to its higher strength-to-weight ratio, heat resistance, and chemical stability. Lightweight plastics provide reasonable cost, stylish design, dependability, excellent performance, strength, and safety. Plastic components are over 50% lighter than comparable components built from other materials. This improves fuel economy by 25%-35%, making it crucial for the automobile and transportation industries. PBT is employed in both indoor and outdoor applications, particularly in electric systems in the automobile sector. Typical uses include handles, fans, connectors, mirror housings, fuse boxes, windshield wiper covers, cowl vents, fuel system components, sensor housings, switches, motor components, actuator cases, power relays, and ignition system components.

Restraint: Absence of required framework for plastic waste collection and segregation

Environmental concerns are linked to the production of synthetic leather using PVC and PU. Proper waste collection and segregation are crucial for the effective recycling of PET. The segregation of different types of waste at the source helps recover a significant amount of recyclable waste and reduces the required total effort and time. Inappropriate waste disposal poses threats to municipalities and other concerned bodies involved in waste management. Developed countries such as the US, Australia, Japan, and Germany have implemented waste management frameworks to administer effective waste management and ensure productive recycling results. Egypt, Turkey, South Africa, Nigeria, and Brazil are yet to standardize and organize their waste management frameworks, leading to the mishandling of waste materials. According to the Canadian government, 87% of plastic waste ends up in landfills or the environment. According to the UN Environment Programme, the world produces approximately 330 million tons of plastic waste each year globally. Only 9% of the plastic waste generated has been recycled, and only 14% is collected for recycling presently.

Opportunity: Expansion to emerging markets

The PET & PBT resins market offers significant potential prospects because to rising industrialization and urbanization in emerging areas like Asia-Pacific and Latin America. Increased population density, disposable income, and middle-class growth in these regions drive demand for consumer goods, drinks, and packaged foods. PET resins are in high demand due to their application in lightweight, recyclable, and durable beverage and food packaging. The rise of retail and e-commerce in these regions drives demand for sustainable and cost-effective packaging solutions, strengthening the market for PET resins. PBT resins are widely used in automotive and electronics due to their superior thermal, mechanical, and electrical insulation qualities. Asian-Pacific nations, such as China, India, and Southeast Asia, are seeing increased automotive manufacturing and electric vehicle adoption, necessitating the use of lightweight and high-performance materials such as PBT for various parts. Global tech firms' investment in these locations has led to increasing demand for PBT resins in electronics production, including connections and switches. These regions are ideal for PET & PBT resin producers seeking to increase their market reach due to government industrialization programs, cheap manufacturing costs, and a competent workforce.

Challenge: High costs of recycled plastics

The main reason for the high cost of recycled plastics in the PET & PBT resins market is the requirement for advanced processing technologies to achieve the material quality needed for industrial applications. Unlike virgin plastics, recycled PET & PBT contain impurities or degraded polymer chains, necessitating additional steps such as depolymerization, re-polymerization, and thorough purification. These processes are energy-demanding and, therefore increase production costs, especially for those applications requiring high strength and performance, such as in the automotive or electronics industries. Additionally, inconsistencies in the systems of collecting and sorting waste add to the problem as inconsistent feedstock quality causes inefficiencies and higher operational expenses to the recyclers. The situation is even more pronounced in the underdeveloped regions, especially those lacking appropriate recycling infrastructures, which are dependent on imported recyclable materials, adding to the inflation of costs. As a result, the price gap between recycled and virgin PET & PBT discourages their adoption, even in industries actively pursuing sustainability goals, creating a persistent barrier to market growth.

Polyethylene Terephthalate PET & Polybutylene Terephthalate PBT Resins Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Electrical connectors, sensor housings | Offers heat resistance, dimensional stability, and electrical insulation. |

|

Automotive housings, lamp sockets | Ensures durability, chemical resistance, and lightweight performance. |

|

Electronic casings, appliance parts | Provides insulation, impact strength, and high aesthetic finish. |

|

Films, adhesive tapes | Ensures tensile strength, moisture resistance, and dimensional stability. |

|

Packaging for detergents and cosmetics | Delivers clarity, recyclability, and strong barrier properties. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The supply chain analysis of the PET & PBT resin market involves a comprehensive evaluation of the key stages in producing and distributing PET & PBT resins. Starting from sourcing raw materials and the manufacturing process, it encompasses the formulation of different types of PET & PBT resins that address specific plastic industry challenges. These PET & PBT resins are developed to optimize functionality, such as durability, insulation, and recyclability, while also improving esthetics, with glossy finishes, vibrant colors, and high clarity. These advanced properties make these resins ideal for diverse industries such as beverages & food packaging, consumer appliances, automotive, electrical & electronics, and others. The efficient distribution of PET & PBT resins ensures their availability to end users across these industries, supporting their processes in improving product quality and reducing operational costs. By analyzing the complete supply chain, PET & PBT resin manufacturers can streamline their operations to meet the demands of different industries while maintaining a reliable supply of high-quality products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PET Resins Market, By Type

In the PET resin market, recycled PET (rPET) has emerged as a critical segment, accounting for the second-largest market share. Its rapid adoption is driven by increasing environmental regulations, corporate sustainability initiatives, and growing consumer preference for eco-friendly packaging. Manufacturers are integrating rPET into beverages, textiles, and packaging applications, balancing performance with cost efficiency. The segment’s fastest growth rate reflects the shift toward circular economy practices, highlighting the strategic importance of recycled materials in meeting both regulatory compliance and market demand.

PET Resin Market, By Application

The films segment is projected to account for the second-largest share, of the PET resin market for the forecast period due to its huge demand for packaging and related applications. PET films are characterized by their excellent clarity, strength, and barrier properties, making them suitable for packaging of foods, drinks, and pharmaceuticals. The lightweight, durable, and recyclable nature of PET films also support the growing sustainability trends. The increasing demand for flexible packaging solutions is also a strong trend in favor of the food and retail sectors, leading to the further growth of the market for PET films

PBT Resin Market, By Application

The automotive application is projected to be the second-largest share in the PBT resin market during the forecast period. PBT offers superior mechanical strength, heat resistance, and dimensional stability over other materials for automotive manufacturing. This results in the production of lightweight and durable plastic parts such as connectors, switches, and under-the-hood components, all of which contribute toward improved fuel economy and performance. The PBT segment is expected to grow significantly because the automotive industry is leaning more toward utilizing lightweight materials and advanced technology.

REGION

In the Asia Pacific, India is projected to be the fastest-growing PET resin market during the forecast period

India will emerge as the fastest-growing PET resin market in the Asia Pacific region during the forecast period. Rapid industrialization, urbanization, and increasing demand for packaged food and beverages, and consumer goods are instrumental to the growth of the market. The booming middle class and disposable income are being translated into the increased consumption of PET bottles and packaging materials. Further, the additional support in sustainability initiatives and recycling programs with respect to PET packaging is fostering the demand for rPET and, thereby, leading to the growth of the PET resin market. Investments in the manufacturing and infrastructure sectors are the other contributors to the expansion of the market.

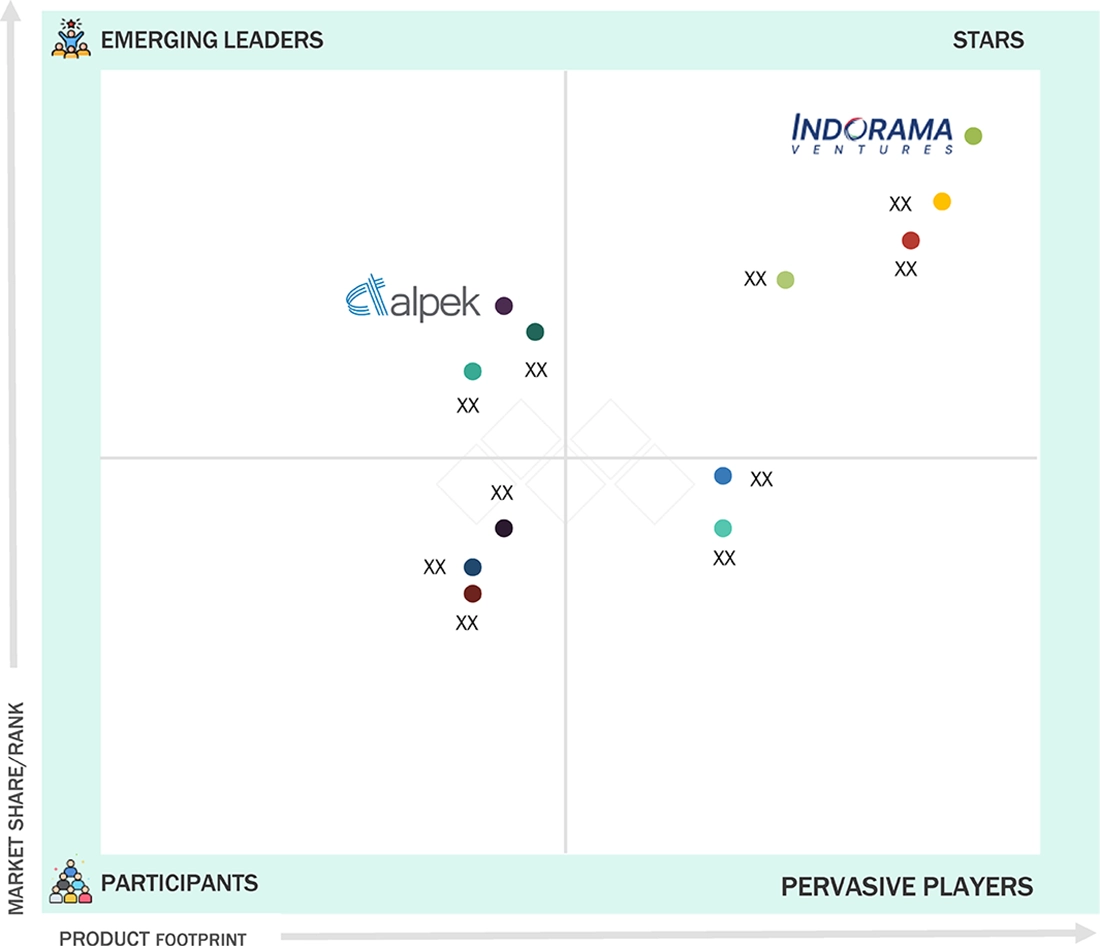

Polyethylene Terephthalate PET & Polybutylene Terephthalate PBT Resins Market: COMPANY EVALUATION MATRIX

In the PET and PBT Resin market matrix, Indorama Ventures Public Company Limited (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. Alpek S.A.B. de C.V. (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While Indorama Ventures Public Company Limited dominates with scale, Alpek S.A.B. de C.V. shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 47.99 BN |

| Revenue Forecast in 2029 | USD 64.01 BN |

| Growth Rate | CAGR for PET Resin 6.01% and PBT Resin 5.26% from 2024-2029 |

| Actual data | 2019−2029 |

| Base year | 2023 |

| Forecast period | 2024−2029 |

| Units considered | Value (USD Billion) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

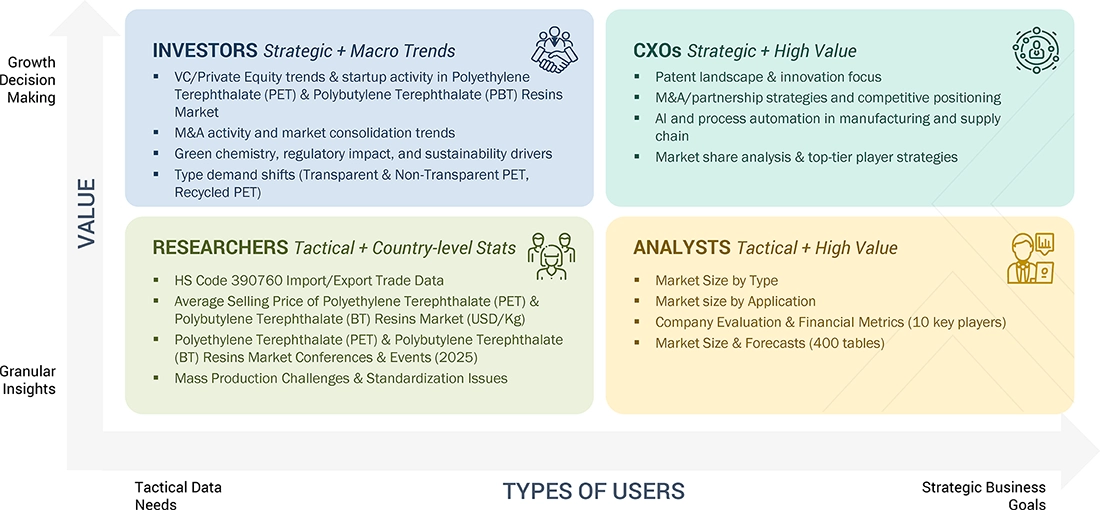

WHAT IS IN IT FOR YOU: Polyethylene Terephthalate PET & Polybutylene Terephthalate PBT Resins Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based PET and PBT Resins Manufacturer |

|

|

| Asia Pacific-based PET & PBT Resins Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2024 : Indorama Ventures Public Company Limited, through its subsidiary IVL Dhunseri Petrochem Industries Limited, has formed a joint venture with Varun Beverages Limited to establish several state-of-the-art PET recycling facilities in India. This initiative aims to meet the growing demand for recycled PET (rPET) content, aligning with sustainability goals and regulatory requirements.

- June 2023 : Indorama Ventures Public Company Limited and Carbios SA have signed a non-binding Memorandum of Understanding (MOU) to establish the world’s first PET biorecycling plant in France. Indorama Ventures plans to invest approximately USD 119.06 million (€110 million) in equity and non-convertible loan financing for the joint venture.

- February 2022 : Alpek, S.A.B. de C.V. has agreed to acquire Octal Holding SAOC for USD 620 million, gaining over one million tons of PET sheet, resin, thermoform packaging, and recycling capacity. This acquisition integrates Alpek into the high-value PET sheet business, advancing its environmental, social, and governance (ESG) goals and strengthening its ability to meet increasing customer demand for PET resin.

Table of Contents

Methodology

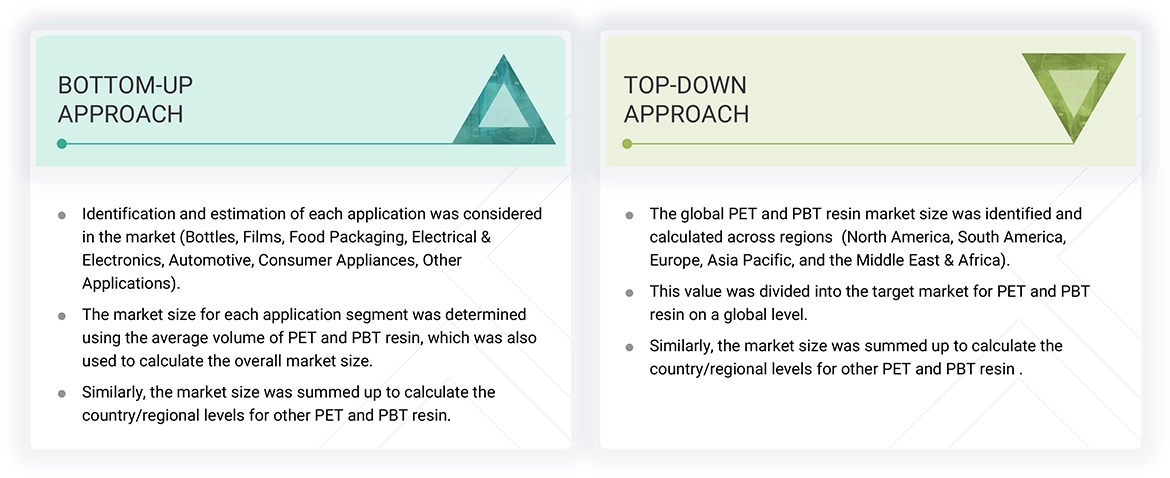

The study involved four major activities in order to estimating the current size of the PET & PBT resin market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including PETRA (the PET Resin Association), CPMA (Chemicals & Petrochemicals Manufacturers’ Association), NAPCOR (National Association for PET Container Resources).

Primary Research

Extensive primary research was carried out after gathering information about PET & PBT resin market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the PET & PBT resin market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, application, and region.

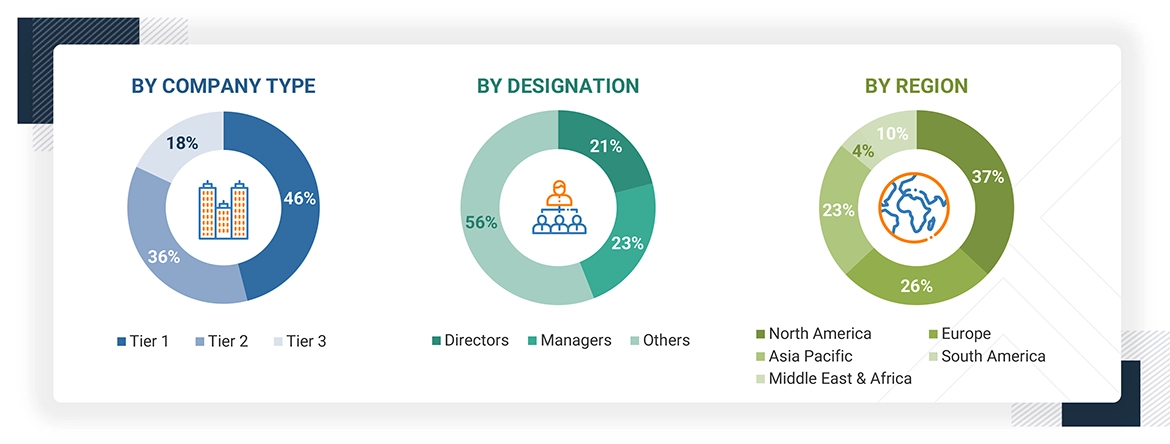

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

| PET & PBT RESIN MANUFACTURERS | ||

|---|---|---|

| Indorama Ventures Public Company Limited | Alpek, S.A.B. de C.V. | |

| SABIC | Lotte Chemical Corporation | |

| BASF SE | Mitsubishi Chemical Group Corporation | |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the PET & PBT resin market. The market sizing of the PET & PBT resin market was undertaken from the demand side. The market size was estimated based on market size for PET & PBT resin in various type.

Global PET & PBT Resin Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Polyethylene terephthalate (PET) is a condensation polymer composed of ethylene glycol and terephthalic acid. It's lightweight, translucent, and comes in several colors. As a member of the ester family, it's also known as polyester. This recyclable thermoplastic polymer has excellent strength, ductility, stiffness, and hardness. It may be treated by vacuum forming, injection molding, compression molding, and blow molding. PET is largely used for food packaging, including fruit and drink containers. It's also utilized to make microwavable trays, food packaging, and cosmetic and pharmaceutical containers.

PBT, a semi-crystalline engineering thermoplastic, shares comparable qualities and composition with PET. PBT is part of the polyester family of polymers. The polymer has good mechanical and electrical characteristics. PBT has garnered commercial attention for its many uses, including automotive, electrical and electronics, and consumer products.

Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the PET & PBT resin market based on type, application, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the PET & PBT resin market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market