Molded Plastics Market by Type (PE, PP, PVC, PET, PS, PU), Application (Packaging, Automotive & Transportation, Construction & Infrastructure, Electronics & Electrical, Pharmaceutical, Agriculture), and Region - Global Forecast to 2027

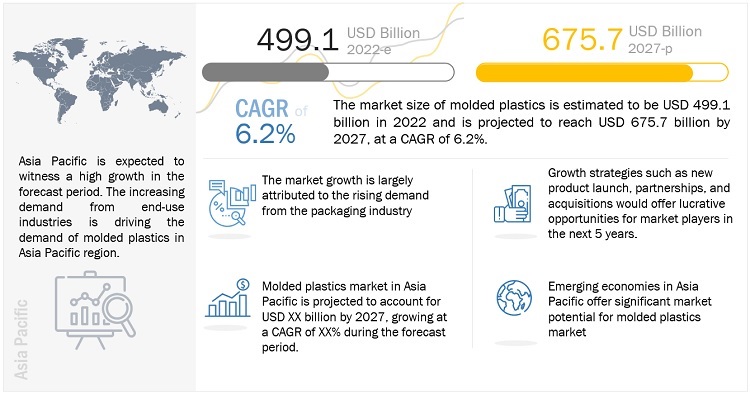

The Molded Plastics Market is projected to reach USD 675.7 billion by 2027 from USD 499.1 billion in 2022, at a cagr 6.2% during the forecast period. The overall increase in demand for molded plastics in emerging regions such as Asia Pacific and Middle East & Africa is driving the molded plastics market. Rising demand from end-use industries including, packaging, automotive, construction, and agriculture is driving the global molded plastics market.

Global Molded Plastics Market Trends

Note: e-estimated, p-projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Molded Plastics Market Dynamics

Driver: Rising demand from packaging industry

Molded plastics are largely utilized in the packaging and automotive industries. The packaging industry is a major consumer of molded plastics. The commonly used molded plastics in packaging application include PE, PP, and PET. These plastic products, which can be rigid or flexible depending on the end-use requirements, are used in various packaging applications, including food & beverage, pharmaceutical, and cosmetics. The different molding technologies, including blow molding, injection molding, and extrusion molding, offer various advantages, such as durability, medical safety & effectiveness, and food preservation. Owing to these benefits over other materials (such as metals, glass, and paper), plastic packaging has found universal use. Products manufactured through blow molding technology are replacing traditional materials. Cold-filled beverage containers, drinking water bottles, alcohol beverage containers, soft drink containers, and dairy containers are being preferred in the food & beverage industry, thus driving the demand for molded plastics.

Restrain: Stringent Regulations

Plastic waste harms the ecosystem as it takes decades to decompose. Governments worldwide are addressing this issue by imposing strict laws that the plastics industry is subjected to adhering to. Governments in Europe have undertaken various measures to deal with packaging waste and recycling issues. In developing nations, governments have become more cautious about protecting the environment, wherein steps are being taken to promote sustainable packaging. As these laws prohibit companies from sourcing raw materials, which fail to comply with environmental legislation, the cost of raw materials is higher, thereby increasing the operational costs. This affects the overall plastic packaging revenues, which hinders the growth of the plastic injection molding industry.

Opportunity: Rising adoption of 3D printing plastic composities

The growing adoption of 3D printing technology in commercial applications is supporting the growth of 3D printing plastic composites globally. These grades offer optimum performance in extreme conditions such as corrosive and high temperature/pressure environments. The composite grades of plastics after some value additions, such as carbon fibers, offer improved performance. Commonly used molded plastics in 3D printing plastic composites include PA, ABS, and PC. Some of the popular grades of 3D printing plastic composites include PC-ABS, stainless steel-PLA, and carbon fiber-PLA. Major manufacturers of molded plastics, such as SABIC, have started manufacturing 3D printing plastics by carrying out forward integration in the last few years. The growth in the demand for 3D printing plastic composites will provide growth opportunities for the molded plastics market.

Challenge: High cost of recycling

The percentage of plastic recycling is growing at a slower rate. According to the World Economic, the widely circulated statistic states that only 5 to 6% of plastic waste is recycled instead of 9% as estimated. In 2020, the US witnessed a decrease by 5.7% in recycled plastic waste as compared to 2019. The major reason for the slow growth of plastic recycling is the high costs associated with recycling of plastic, as compared to other materials such as paper and glass. According to Eurostat, the average prices of recycling secondary materials were: 55 EUR/tonne for glass, 104 EUR/tonne for paper and cardboard and 245 EUR/tonne for plastic in 2020. Furthermore, glass, metal, and plastic cannot be repeatedly recycled without degrading in quality. However, plastic recycling is one of the major challenges in the overall plastics industry, which can affect the growth of the molded plastics market.

Polyethylene segment accounted for the largest share amongst type in the molded plastics market

Polyethylene based molded plastics are among the most dominant plastics owing to their superior properties such as high impact strength, insulation, good heat resistance, flame retardancy, environmental stress cracking resistance (ESCR), high load melt strength, and excellent rigidity. BASF and DuPont are the two leading suppliers of PE for engineering applications.

Injection molded plastics market segment is projected to grow the fastest amongst technologies in the overall molded plastics market

Injection molding is the most dominated and popular technology for the molded plastics. This technology is widely used in multiple end use industries such as packaging, automotive, construction, agriculture, and electronics for mass production. Additionally, it’s automated process minimize the waste produced during the manufacturing process thereby, reducing the manufacturing cost. These factors are driving the growth of the injection molded plastics market.

Packaging application accounted for the largest market share amongst all the applications in the molded plastics market

Packaging accounted for the largest market share in applications in the molded plastics market. The dominant market position is attributed to the exponential growth in demand for molded plastics in the packaging applications. With the increasing trade globally, changing in lifestyle and buying pattern, the demand for effective, efficient, and sustainable packaging increased. These factors are expected to drive the molded plastics market during the forecast period.

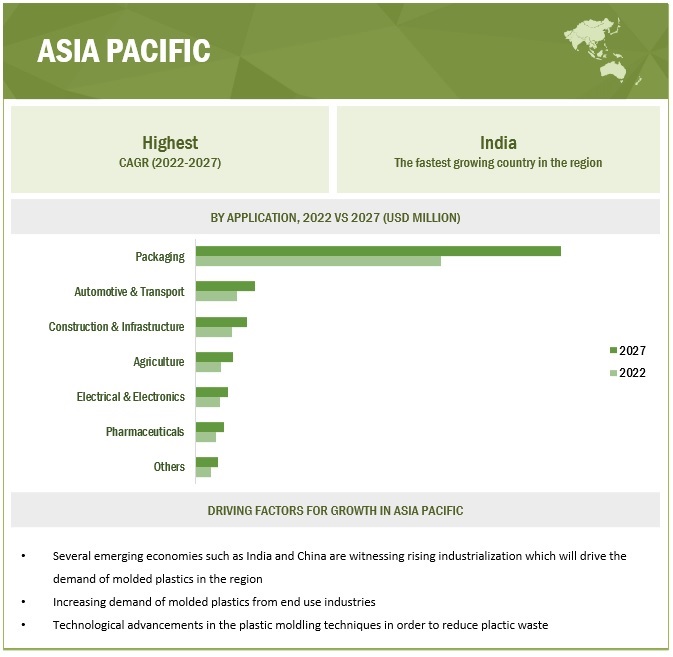

Asia Pacific is estimated to grow at the fastest growth rate in the global molded plastics market

The Asia Pacific region accounted for the largest market share in 2021 and is also expected to grow at the highest CAGR, during the forecast period. The increase in demand in the region for molded plastics can be largely attributed to the growing population, urbanization & industrialization. Besides, there are less stringent norms and standards for the use of raw materials for the manufacturing of molded plastics, along with the easy availability of cheap labor, which is attracting the major players to expand their operations in the region. Furthermore, the increase in demand for plastics from the emerging economies of Asia Pacific is expected to boost the market for molded plastics as well.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the molded plastics market LyondellBasell (Netherlands), SABIC (Saudi Arabia), INEOS (Switzerland), DuPont (US), ExxonMobil (US), Sinopec (China), Dow Inc (US), BASF SE (Germany), Eastman Chemical Company (US), Chevron Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay (Belgium), China Plastics Extrusion Ltd. (China), Lanxess AG (Germany), Versalis(Italy), LG Chem(South Korea) and Reliance Industries (India). These players have established a strong foothold in the market by adopting strategies, such as new product launches, strategic partnerships, investment & expansions, and acquisitions between 2019 and 2022.

Molded Plastics Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/USD Billion) and Volume (KT/Tons) |

|

Segments |

Type, Technology, Application, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies |

LyondellBasell (Netherlands), SABIC (Saudi Arabia), INEOS (Switzerland), DuPont (US), ExxonMobil (US), Sinopec (China), Dow Inc (US), BASF SE (Germany), Eastman Chemical Company (US), Chevron Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay (Belgium), China Plastics Extrusion Ltd. (China), Lanxess AG (Germany), Versalis (Italy), LG Chem (South Korea) and Reliance Industries (India) |

This research report categorizes the molded plastics market based on type, technology, application, and region.

By Type:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polystyrene

- Polyurethane

- Others

By Technology:

- Injection Molding

- Blow Molding

- Extrusion Molding

- Thermoforming

- Rotational Molding

- Others

By Application:

- Packaging

- Automotive & Transportation

- Construction & Infrastructure

- Agriculture

- Pharmaceuticals

- Electrical & Electronics

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

- The molded plastics market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In June 2021, LyondellBasell announced the successful startup of Ulsan PP Co., Ltd.’s polypropylene production facility, with a capacity of 400 kilotons per annum (KTA), in South Korea. Ulsan PP Co., Ltd. is a joint venture between PolyMirae Company Ltd. (a 50:50 partnership between LyondellBasell and DL Chemical) and SK Advanced. This move complements LyondellBasell’s reach into the polypropylene production market and provides the company with a strong foundation for growth in adjacent sectors.

- In July 2022, INEOS signed three petrochemical deals (aggregate value of USD 7 billion) with Sinopec to strengthen its presence in China.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the molded plastics market?

The growth of the molded plastics market can be attributed to the increasing demand of molded plastics from end use industries.

What are the key applications of driving the molded plastics market?

Packaging is the largest application of molded plastics. Molded plastics are also used in end-use industries such as electronics, automotive, agriculture, pharmaceuticals, and construction.

Who are the major manufacturers of the molded plastics?

Major manufacturers of molded plastics include LyondellBasell (Netherlands), SABIC (Saudi Arabia), INEOS (Switzerland), DuPont (US), ExxonMobil (US), Sinopec (China), Dow Inc (US), BASF SE (Germany), and LG Chem Ltd. (South Korea).

What are the restraints for molded plastics?

The biggest restraint for this market can be the stringent government regulations regarding plastic waste disposal coupled with volatility in raw material prices.

What will be the growth prospects of the molded plastics market?

Increasing demand for electric vehicles and rising adoption of 3D printing plastic composites are expected to provide the growth opportunities to molded plastics manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size for molded plastics market. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, extensive use of secondary sources, directories, and databases, such as World Bank, Statista, Organization for Economic Cooperation and Development (OECD), Bloomberg, International Monetary Fund (IMF), Trademap, Zauba, Environmental Protection Agency (EPA), European Environment Agency, and other government & private websites, associations related to the molded plastics industry. The study also involves analyzing regulations and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial molded plastics market study.

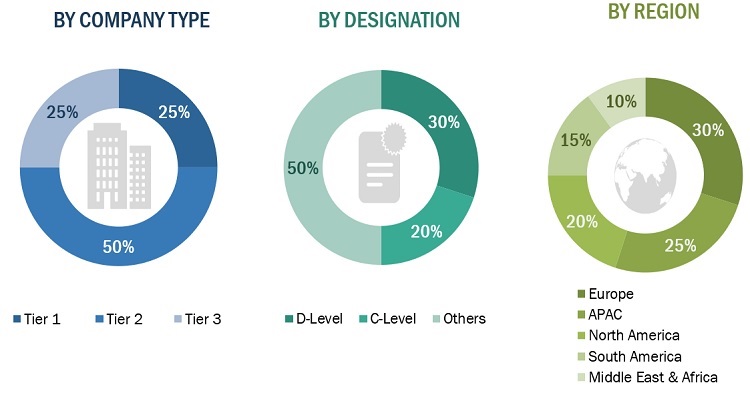

Primary Research

The molded plastics market comprises several stakeholders such as raw material suppliers, distributors, manufacturers, end-users, and regulatory organizations in the supply chain. Primary sources include experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the molded plastics market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, type, technology, and applications in various industries and markets were identified through extensive secondary research.

- The industry’s value chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size - using the market size estimation process explained above - the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of molded plastics and their applications.

Objectives of the Study:

- To analyze and forecast the molded plastics market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by type, technology, and application

- To forecast the size of the market with respect to five regions, namely, Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa, along with the key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, agreement & collaboration, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- Notes: 1. Micro markets are defined as sub segments of the molded plastics market included in the report.

- 2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the molded plastics market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molded Plastics Market