Recycled PET Market by Type (Flakes, Chips), Grade (Grade A, Grade B), Source (Bottles & Containers, Films & sheets), Application ( Bottles, fiber, Sheets, Strapping), Color (Clear, Colored), & Region (APAC, NA, Europe, MEA, SA) - Global Forecast to 2028

Updated on : August 22, 2025

Recycled PET Market

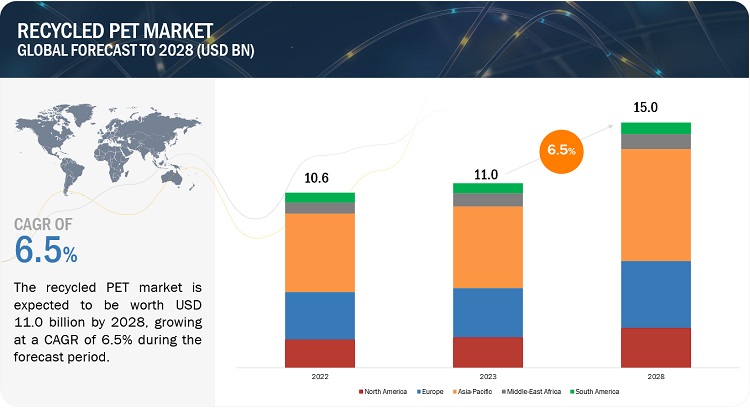

The global recycled PET market was valued at USD 11.0 billion in 2023 and is projected to reach USD 15.0 billion by 2028, growing at 6.5% cagr from 2023 to 2028. The global market is primarily driven by two significant factors. Firstly, there is an increasing global demand for sustainable and environmentally friendly packaging solutions. Consumers are becoming more conscious of the environmental impact of plastic waste and are actively seeking alternatives that are recyclable and made from recycled materials. This heightened consumer awareness and preference for sustainable packaging options have propelled the growth of the rPET market.

Secondly, government regulations and initiatives promoting recycling and circular economy practices have played a crucial role in driving the global rPET market. Many countries have implemented policies that encourage the use of recycled materials in packaging and set targets for the minimum content of recycled materials in products. These regulations create a favorable environment for businesses to adopt rPET and incorporate it into their packaging and manufacturing processes..

Recycled PET Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Recycled PET Market

Recycled PET Market Dynamics

Driver: Improving demand for RPET from the food & beverage industry

One of the significant drivers for the global recycled PET (rPET) market is the increasing demand from the food and beverage industry. This industry relies heavily on packaging materials, including PET bottles, for various products such as beverages, food items, sauces, condiments, and more.

The food and beverage industry is witnessing a shift in consumer preferences towards sustainable and environmentally friendly packaging. Consumers are becoming more conscious of the environmental impact of plastic waste and are actively seeking packaging solutions that use recycled materials like rPET. This demand is driven by a desire for packaging that aligns with their values and contributes to reducing plastic waste.

Furthermore, many brands and manufacturers in the food and beverage industry have recognized the importance of sustainable packaging and are making commitments to incorporate rPET into their packaging. They understand that utilizing rPET not only addresses consumer demands but also helps in achieving their own sustainability goals. This has led to a significant increase in the demand for rPET in the industry.

Restraint: Absence of the required framework for plastic waste collection and segregation

One of the significant restraints to the global recycled PET (rPET) market is the absence of the required framework for plastic collection and segregation. The efficient collection and segregation of plastic waste are essential for the recycling process to obtain high-quality rPET.

Many regions and countries lack well-established infrastructure and systems for the effective collection and segregation of plastic waste. This absence of a robust framework poses challenges in obtaining a consistent and reliable supply of post-consumer PET bottles, which are the primary source for rPET production. Inadequate collection and segregation systems can result in contamination and lower quality of the collected plastic, impacting the feasibility and cost-effectiveness of rPET production.

Furthermore, the absence of a standardized and comprehensive approach to plastic collection and segregation hinders the scaling up of recycling efforts. Without proper mechanisms in place, it becomes challenging to efficiently separate different types of plastics, including PET, from the overall waste stream. This can limit the availability of high-quality PET feedstock for rPET production.

Opportunity: Encouraging demand for environmental packaging solutions

The global recycled PET (rPET) market presents significant opportunities, one of which is the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for products that are packaged in eco-friendly materials like rPET.

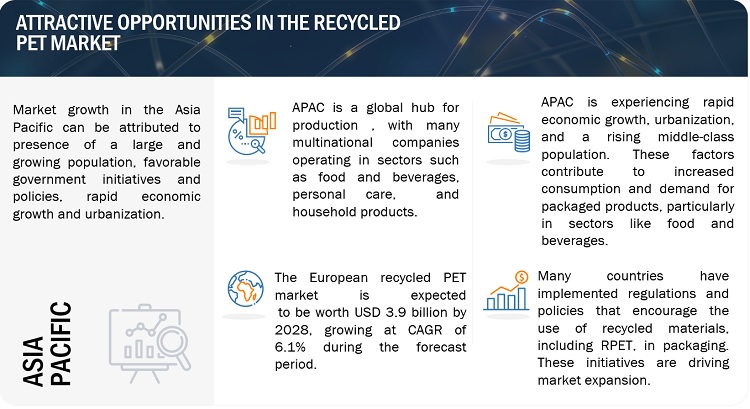

The demand for sustainable packaging extends across various industries, including food and beverages, personal care, household products, and more. Brands and manufacturers are recognizing the importance of aligning their packaging choices with consumer preferences and sustainability goals. By incorporating rPET into their packaging, they can meet the increasing demand for sustainable options and enhance their brand image as environmentally responsible companies.

Additionally, government regulations and initiatives that encourage the use of recycled materials in packaging further contribute to the opportunity for the rPET market. Many countries have implemented policies that incentivize or mandate the use of recycled content in packaging. This provides a favorable regulatory environment for businesses to adopt rPET and promotes the expansion of the market.

Challenges: High costs of recycled plastics

The high cost of recycled plastics, including recycled PET (rPET), poses a challenge to the market. The production of rPET involves various processes, such as collection, sorting, cleaning, and processing, which incur costs. Additionally, the quality requirements and regulations for food-grade packaging further increase the production expenses.

Compared to virgin plastics, the cost of recycled plastics can be higher due to factors such as limited availability of high-quality feedstock, additional processing steps required to remove impurities, and investments in recycling infrastructure. This cost disparity can deter some businesses from adopting rPET and choosing virgin plastics instead.

The price difference between rPET and virgin plastics creates a competitive disadvantage for recycled materials in the market. Companies may opt for cheaper virgin plastics, especially when faced with tight profit margins or cost-conscious consumers.

Addressing the challenge of the high cost of recycled plastics requires a multi-faceted approach. Increasing the scale of recycling operations can help reduce production costs by improving economies of scale. Investments in advanced recycling technologies and infrastructure can also drive efficiency and reduce expenses.

Government support, such as financial incentives or tax breaks, can encourage businesses to invest in recycling infrastructure and offset the cost difference between virgin and recycled materials. Collaboration among stakeholders, including recycling industries, packaging manufacturers, and brands, can lead to innovative solutions and cost-sharing mechanisms to make recycled plastics more economically viable.

Recycled PET Market Ecosystem

Source: Secondary research, primary research, and MarketsandMarkets Analysis

“The Recycled PET market is projected to register a CAGR of 6.5% during the forecast period, in terms of value.”

The global Recycled PET market is estimated to be USD 11.0 billion in 2023 and is projected to reach USD 15.0 billion by 2028, at a CAGR of 6.5% from 2023 to 2028.. Regulatory measures and initiatives aimed at reducing plastic waste have played a crucial role in the growth of the rPET market. Many countries have implemented regulations and policies that incentivize or mandate the use of recycled materials in packaging. These regulations create a favorable environment for the adoption of rPET by businesses, leading to increased market demand.

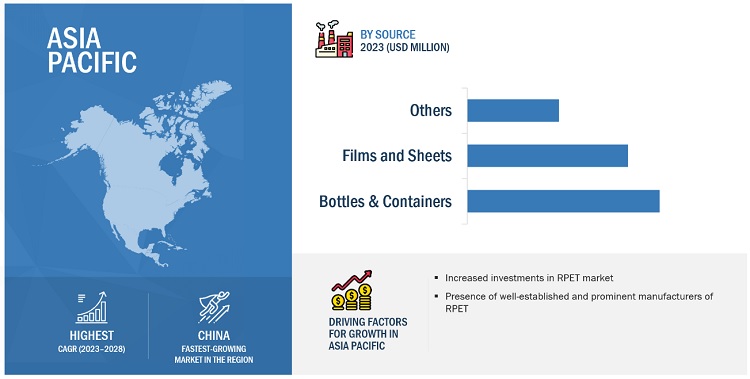

“Asia Pacific is the largest market for Recycled PET .”

APAC accounted for the largest share of the Recycled PET market in 2023. APAC has a substantial and rapidly growing population, which translates to increased consumption of products packaged in materials like PET. As consumer awareness and demand for sustainable packaging solutions rise, the APAC market is witnessing a shift towards rPET as a preferred choice for packaging. The sheer size of the consumer base in APAC contributes to the region's position as the largest market for rPET.

To know about the assumptions considered for the study, download the pdf brochure

Recycled PET Market Players

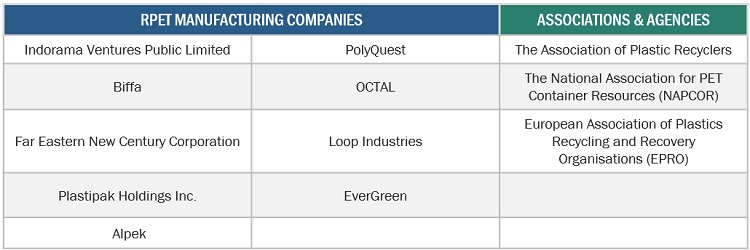

Recycled PET is a diversified and fragmented market with a large number of global players and some regional and local players. Indorama Ventures Public Limited (Thailand), Biffa (UK), Far Eastern New Century Corporation (Taiwan), Plastipak Holdings Inc (US), Alpek (Mexico), are some of the key players in the market.

Read More: Recycled PET Companies

Recycled PET Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018-2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD million/billion) and Volume (KiloTon) |

|

Segments Covered |

Type, Grade, Application, Source, Color, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, and South America |

|

Companies Covered |

Some of the leading players operating in the recycled PET market include Indorama Venturers Public Limited ( Thailand), Biffa (UK), Far Eastern New Century Corporation (Taiwan), Plastipak Holding Inc. (US), Alpek (Mexico), PolyQuest (US), OCTAL (Oman), Loop Industries (Canada), Evergreen (US), PLACON (US). |

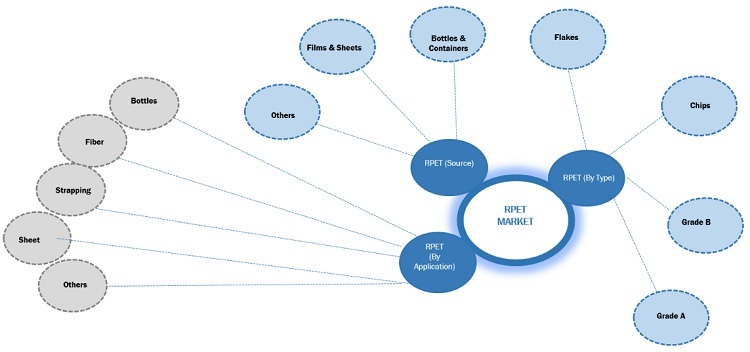

This research report categorizes the recycled PET market based on type, grade, application, source, and region.

Recycled PET Market, By Type

- RPET Flakes

- RPET Chips

Recycled PET Market, By Grade

- Grade A

- Grade

Recycled PET Market, By Application

- Bottles

- Fiber

- Sheets

- Strapping

- Others

Recycled PET Market, By Source

- Bottles & Containers

- Films & Sheets

- Others

Recycled PET Market, By Color

- Clear

- Colored

Recycled PET Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In September 2021, Biffa acquired the Collections business and certain recycling assets from Viridor Waste Management Limited. The acquisition is expected to expand Biffa's I&C collections business and recycling capabilities, broadening the Group's customer base, and strengthening its leading position in sustainable waste management in the UK.

- In June 2021, Indorama Ventures acquired the CarbonLite Holdings’ facility in Texas as part of the company’s commitment to increasing PET recycling capacity.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

- Germany

- The U.K.

- Italy

- Russia

- France

- Rest of Europe

What is the impact of recession on the Recycled PET market?

Industry experts believe that recession would have a impact on Recycled PET market.

Which market segments are published in the report?

Segments by application, source, type, color, recycling technique, and region are mentioned.

What is the total CAGR expected to be recorded for the recycled PET market during 2023-2028?

The CAGR is expected to record a CAGR of 6.5% from 2023-2028 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for recycled PET from food & beverage industry- Laws & regulations enforced by governmentsRESTRAINTS- Absence of required framework for plastic waste collection and segregation- Few treatment plants and lack of expertise in recycling PET wasteOPPORTUNITIES- Increasing demand for sustainable packaging solutionsCHALLENGES- High cost of recycled plastics

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT & NEW REVENUE POCKETS FOR RECYCLED PET MANUFACTURERSREVENUE SHIFT FOR RECYCLED PET PLAYERS

-

5.6 TARIFF AND REGULATORY LANDSCAPE ANALYSISRESOURCE CONSERVATION AND RECOVERY ACT (RCRA)ISO 15270GUIDANCE FOR INDUSTRY USE OF RECYCLED PLASTICS IN FOOD PACKAGINGEUROPEAN STANDARDSINDIAN STANDARDS

-

5.7 REGULATORY BODIES AND GOVERNMENT AGENCIESREGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS- The Plastics Industry Association (PLASTICS) (US)- The National Association for PET Container Resources (NAPCOR) (US)

-

5.8 SUPPLY CHAIN ANALYSISCOLLECTION & TRANSPORTATIONSORTINGPROCESSINGEND-USE APPLICATION

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 ECOSYSTEM MAPPING

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.13 TRADE ANALYSIS

-

5.14 PATENT ANALYSISDOCUMENT ANALYSISJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.15 CASE STUDYHOLLAND COLOURS: STEADY SUPPLY OF HIGH-QUALITY RECYCLED PET- Challenge- SolutionTHE BODY SHOP AND PLASTICS FOR CHANGE- Challenge- Solution

-

5.16 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

-

5.17 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY KEY PLAYERAVERAGE SELLING PRICE, BY SUBSEGMENT

- 5.18 RECESSION IMPACT: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- 6.1 INTRODUCTION

-

6.2 FLAKESRISING DEMAND FOR FOOD-GRADE PACKAGING TO BOOST MARKET

-

6.3 CHIPSINCREASING DEMAND FROM FIBER SEGMENT TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 BOTTLES & CONTAINERSINCREASING BOTTLE-TO-BOTTLE RECYCLING TO DRIVE MARKET

-

7.3 FILMS & SHEETSNON-FOOD APPLICATIONS TO PROPEL DEMAND

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 BOTTLESSEGMENT TO LEAD RECYCLED PET MARKET

-

8.3 FIBERSIGNIFICANT ALTERNATIVE TO CONCRETE TO ENABLE COST REDUCTION

-

8.4 SHEETSSUSTAINABLE SOLUTION FOR AUTOMOTIVE SECTOR TO DRIVE MARKET

-

8.5 STRAPPINGINCREASING EASE OF TRANSPORTATION OF PRODUCTS TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 MECHANICAL RECYCLINGCOST-EFFECTIVENESS OF MECHANICAL RECYCLING TO CONTRIBUTE TO ITS WIDER ADOPTION AND MARKET GROWTH

-

9.3 FEEDSTOCK RECYCLINGFEEDSTOCK RECYCLING HAS POTENTIAL TO PRODUCE HIGH-QUALITY RECYCLED PET MATERIALS

-

9.4 CHEMICAL RECYCLINGCHEMICAL RECYCLING TO CONTRIBUTE TO ENVIRONMENTAL IMPACT REDUCTION BY REDUCING FOSSIL FUEL CONSUMPTION

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- Large-scale industrialization and urbanization to increase scope for recyclingJAPAN- Sustainable waste management practices to boost marketINDIA- Increasing recycling activities to drive marketSOUTH KOREA- Rising preference for recycled plastic to boost marketVIETNAM- Increasing trade flow of plastic to offer opportunitiesREST OF ASIA PACIFIC

-

10.3 EUROPEGERMANY- Highest plastic recycling rates in region to boost marketFRANCE- Expansion and new technological developments to boost marketITALY- Increasing investments for recycling PET to drive marketUK- Presence of established recycled PET manufacturers to drive marketRUSSIA- Advancements in recycling technologies to boost marketREST OF EUROPE

-

10.4 NORTH AMERICAUS- Largest generator of consumer plastic waste in North AmericaCANADA- Various organizations working toward sustainable plastic waste solutionsMEXICO- High consumption of beverages to lead to market growth

-

10.5 SOUTH AMERICABRAZIL- Increase in consumer waste to boost demand for recycling servicesARGENTINA- Increasing awareness and development of recycling infrastructure to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICASAUDI ARABIA- Sustainable waste management practices to boost growthSOUTH AFRICA- Increase in PET recycling rates to propel growthEGYPT- Ban on single-use plastics to increase need for recyclingREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 MARKET RANKING

- 11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE BENCHMARKINGSTRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

-

11.7 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIO AND TRENDSEXPANSIONS & INVESTMENTSMERGERS & ACQUISITIONS

-

12.1 KEY COMPANIESINDORAMA VENTURES PUBLIC CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIFFA PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFAR EASTERN NEW CENTURY CORPORATION- Business overview- Recent developments- MnM viewPLASTIPAK HOLDINGS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALPEK S.A.B. DE C.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPOLYQUEST, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOOP INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVERGREEN RECYCLING LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLACON CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewEXTRUPET (PTY) LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER COMPANIESCLEAR PATH RECYCLING, LLCPENINSULA PLASTICS RECYCLING, INC.LAVERGNE, INC.VERDECO RECYCLING, INC.RELIANCE INDUSTRIES LIMITED (RIL)LOTTE CHEMICAL CORPORATIONPETCOMARGLEN INDUSTRIESREPRO-PETLIBOLONAL MEHTAB INDUSTRIESGREEN RECYCLED & MODIFIED POLYMER CO. LTD. (GRM)JP RECYCLING LTD.ALOXE HOLDING B.V.SEIU JAPAN CO., LTD.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 RECYCLED PLASTICS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 13.4 RECYCLED PLASTICS MARKET, BY TYPE

- 13.5 RECYCLED PLASTICS MARKET, BY SOURCE

- 13.6 RECYCLED PLASTICS MARKET, BY PLASTIC TYPE

- 13.7 RECYCLED PLASTICS MARKET, BY END-USE INDUSTRY

- 13.8 RECYCLED PLASTICS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 RECYCLED PET MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 RECYCLED PET MARKET: SUPPLY CHAIN

- TABLE 3 ECOSYSTEM OF RECYCLED PET MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 6 RECYCLED PET MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 WASTE, PARINGS, AND SCRAP OF PLASTICS EXPORT DATA, HS CODE: 3915, 2022 (USD MILLION)

- TABLE 8 WASTE, PARINGS, AND SCRAP OF PLASTICS IMPORT DATA, HS CODE: 3915, 2022 (USD MILLION)

- TABLE 9 LIST OF PATENTS BY MOHAWK INDUSTRIES, INC.

- TABLE 10 LIST OF PATENTS BY ALADDIN MFG. CORP.

- TABLE 11 LIST OF PATENTS BY RESINATE MATERIALS GROUP INC.

- TABLE 12 LIST OF PATENTS BY COLUMBIA INSURANCE CO.

- TABLE 13 LIST OF PATENTS BY ALLNEX BELGIUM SA

- TABLE 14 US: TOP TEN PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 15 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 16 RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 17 RECYCLED PET MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 18 RECYCLED PET MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 19 RECYCLED PET MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 20 RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 21 RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 22 RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 23 RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 24 RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 25 RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 26 RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 27 RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 28 RECYCLED PET MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 29 RECYCLED PET MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 30 RECYCLED PET MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 31 RECYCLED PET MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 32 BOTTLES & CONTAINERS: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 33 BOTTLES & CONTAINERS: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 34 BOTTLES & CONTAINERS: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 BOTTLES & CONTAINERS: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 36 FILMS & SHEETS: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 37 FILMS & SHEETS: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 38 FILMS & SHEETS: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 39 FILMS & SHEETS: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 40 OTHER SOURCES: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 41 OTHER SOURCES: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 42 OTHER SOURCES: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 43 OTHER SOURCES: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 44 RECYCLED PET MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 45 RECYCLED PET MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 46 RECYCLED PET MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 47 RECYCLED PET MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 48 BOTTLES: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 49 BOTTLES: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 50 BOTTLES: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 51 BOTTLES: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 52 FIBER: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 53 FIBER: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 54 FIBER: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 55 FIBER: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 56 SHEETS: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 57 SHEETS: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 58 SHEETS: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 59 SHEETS: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 60 STRAPPING: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 61 STRAPPING: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 62 STRAPPING: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 63 STRAPPING: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 64 OTHER APPLICATIONS: RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 66 OTHER APPLICATIONS: RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 68 RECYCLED PET MARKET, BY RECYCLING TECHNIQUE, 2018–2021 (USD MILLION)

- TABLE 69 RECYCLED PET MARKET, BY RECYCLING TECHNIQUE, 2018–2021 (KILOTON)

- TABLE 70 RECYCLED PET MARKET, BY RECYCLING TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 71 RECYCLED PET MARKET, BY RECYCLING TECHNIQUE, 2022–2028 (KILOTON)

- TABLE 72 RECYCLED PET MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 73 RECYCLED PET MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 74 RECYCLED PET MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 75 RECYCLED PET MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 76 ASIA PACIFIC: RECYCLED PET MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 78 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 80 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 82 ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 84 ASIA PACIFIC: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 85 ASIA PACIFIC: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 86 ASIA PACIFIC: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 88 ASIA PACIFIC: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 89 ASIA PACIFIC: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 90 ASIA PACIFIC: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 92 ASIA PACIFIC: RECYCLED PET MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 94 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 96 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 98 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 100 CHINA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 101 CHINA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 102 CHINA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 104 CHINA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 106 CHINA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 108 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 109 CHINA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 110 CHINA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 111 CHINA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 112 JAPAN: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 113 JAPAN: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 114 JAPAN: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 115 JAPAN: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 116 JAPAN: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 117 JAPAN: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 118 JAPAN: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 119 JAPAN: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 120 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 121 JAPAN: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 122 JAPAN: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 124 INDIA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 126 INDIA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 127 INDIA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 128 INDIA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 129 INDIA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 130 INDIA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 131 INDIA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 132 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 133 INDIA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 134 INDIA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 135 INDIA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 136 SOUTH KOREA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 137 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 138 SOUTH KOREA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 139 SOUTH KOREA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 140 SOUTH KOREA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 141 SOUTH KOREA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 142 SOUTH KOREA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 144 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 145 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 146 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 148 VIETNAM: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 149 VIETNAM: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 150 VIETNAM: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 151 VIETNAM: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 152 VIETNAM: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 153 VIETNAM: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 154 VIETNAM: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 155 VIETNAM: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 156 VIETNAM: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 157 VIETNAM: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 158 VIETNAM: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 159 VIETNAM: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 160 REST OF ASIA PACIFIC: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 164 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 166 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 168 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 170 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 172 EUROPE: RECYCLED PET MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 173 EUROPE: MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 174 EUROPE: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 175 EUROPE: MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 176 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 177 EUROPE: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 178 EUROPE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 179 EUROPE: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 180 EUROPE: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 181 EUROPE: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 182 EUROPE: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 183 EUROPE: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 184 EUROPE: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 185 EUROPE: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 186 EUROPE: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 187 EUROPE RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 188 EUROPE: RECYCLED PET MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 189 EUROPE: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 190 EUROPE: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 191 EUROPE: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 192 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 193 EUROPE: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 194 EUROPE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 195 EUROPE: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 196 GERMANY: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 197 GERMANY: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 198 GERMANY: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 199 GERMANY: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 200 GERMANY: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 201 GERMANY: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 202 GERMANY: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 203 GERMANY: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 204 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 205 GERMANY: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 206 GERMANY: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 207 GERMANY: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 208 FRANCE: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 209 FRANCE: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 210 FRANCE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 211 FRANCE: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 212 FRANCE: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 213 FRANCE: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 214 FRANCE: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 215 FRANCE: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 216 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 217 FRANCE: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 218 FRANCE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 219 FRANCE: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 220 ITALY: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 221 ITALY: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 222 ITALY: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 223 ITALY: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 224 ITALY: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 225 ITALY: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 226 ITALY: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 227 ITALY: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 228 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 229 ITALY: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 230 ITALY: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 231 ITALY: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 232 UK: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 233 UK: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 234 UK: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 235 UK: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 236 UK: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 237 UK: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 238 UK: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 239 UK: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 240 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 241 UK: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 242 UK: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 243 UK: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 244 RUSSIA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 245 RUSSIA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 246 RUSSIA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 247 RUSSIA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 248 RUSSIA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 249 RUSSIA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 250 RUSSIA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 251 RUSSIA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 252 RUSSIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 253 RUSSIA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 254 RUSSIA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 255 RUSSIA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 256 REST OF EUROPE: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 257 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 258 REST OF EUROPE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 259 REST OF EUROPE: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 260 REST OF EUROPE: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 261 REST OF EUROPE: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 262 REST OF EUROPE: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 263 REST OF EUROPE: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 264 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 265 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 266 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 267 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 268 NORTH AMERICA: RECYCLED PET MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 269 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 270 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 271 NORTH AMERICA: MARKET, BY COUNTRY 2022–2028 (KILOTON)

- TABLE 272 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 273 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 274 NORTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 275 NORTH AMERICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 276 NORTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 277 NORTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 278 NORTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 279 NORTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 280 NORTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 281 NORTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 282 NORTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 283 NORTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 284 NORTH AMERICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 285 NORTH AMERICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 286 NORTH AMERICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 287 NORTH AMERICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 288 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 289 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 290 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 291 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 292 US: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 293 US: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 294 US: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 295 US: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 296 US: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 297 US: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 298 US: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 299 US: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 300 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 301 US: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 302 US: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 303 US: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 304 CANADA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 305 CANADA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 306 CANADA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 307 CANADA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 308 CANADA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 309 CANADA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 310 CANADA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 311 CANADA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 312 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 313 CANADA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 314 CANADA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 315 CANADA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 316 MEXICO: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 317 MEXICO: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 318 MEXICO: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 319 MEXICO: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 320 MEXICO: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 321 MEXICO: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 322 MEXICO: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 323 MEXICO: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 324 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 325 MEXICO: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 326 MEXICO: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 327 MEXICO: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 328 SOUTH AMERICA: RECYCLED PET MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 329 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 330 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 331 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 332 SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 333 SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 334 SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 335 SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 336 SOUTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 337 SOUTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 338 SOUTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 339 SOUTH AMERICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 340 SOUTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 341 SOUTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 342 SOUTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 343 SOUTH AMERICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 344 SOUTH AMERICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 345 SOUTH AMERICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 346 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 347 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 348 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 349 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 350 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 351 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 352 BRAZIL: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 353 BRAZIL: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 354 BRAZIL: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 355 BRAZIL: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 356 BRAZIL: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 357 BRAZIL: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 358 BRAZIL: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 359 BRAZIL: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 360 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 361 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 362 BRAZIL: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 363 BRAZIL: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 364 ARGENTINA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 365 ARGENTINA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 366 ARGENTINA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 367 ARGENTINA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 368 ARGENTINA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 369 ARGENTINA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 370 ARGENTINA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 371 ARGENTINA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 372 ARGENTINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 373 ARGENTINA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 374 ARGENTINA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 375 ARGENTINA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 376 REST OF SOUTH AMERICA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 377 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 378 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 379 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 380 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 381 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 382 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 383 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 384 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 385 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 386 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 387 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 388 MIDDLE EAST & AFRICA: RECYCLED PET MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 389 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 390 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 391 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 392 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 393 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 394 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 395 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 396 MIDDLE EAST & AFRICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 398 MIDDLE EAST & AFRICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 399 MIDDLE EAST & AFRICA: RECYCLED PET FLAKES MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 400 MIDDLE EAST & AFRICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (USD MILLION)

- TABLE 401 MIDDLE EAST & AFRICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2018–2021 (KILOTON)

- TABLE 402 MIDDLE EAST & AFRICA: RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (USD MILLION)

- TABLE 403 MIDDLE EAST & AFRICA RECYCLED PET CHIPS MARKET, BY GRADE, 2022–2028 (KILOTON)

- TABLE 404 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 405 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 406 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 407 MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 408 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 409 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 410 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 411 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 412 SAUDI ARABIA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 413 SAUDI ARABIA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 414 SAUDI ARABIA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 415 SAUDI ARABIA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 416 SAUDI ARABIA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 417 SAUDI ARABIA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 418 SAUDI ARABIA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 419 SAUDI ARABIA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 420 SAUDI ARABIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 421 SAUDI ARABIA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 422 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 423 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 424 SOUTH AFRICA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 425 SOUTH AFRICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 426 SOUTH AFRICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 427 SOUTH AFRICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 428 SOUTH AFRICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 429 SOUTH AFRICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 430 SOUTH AFRICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 431 SOUTH AFRICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 432 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 433 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 434 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 435 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 436 EGYPT: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 437 EGYPT: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 438 EGYPT: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 439 EGYPT: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 440 EGYPT: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 441 EGYPT: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 442 EGYPT: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 443 EGYPT: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 444 EGYPT: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 445 EGYPT: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 446 EGYPT: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 447 EGYPT: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 448 REST OF MIDDLE EAST & AFRICA: RECYCLED PET MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 449 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 450 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 451 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 452 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 453 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2018–2021 (KILOTON)

- TABLE 454 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2022–2028 (USD MILLION)

- TABLE 455 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOURCE, 2022–2028 (KILOTON)

- TABLE 456 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 457 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 458 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 459 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 460 RECYCLED PET MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 461 COMPANY TYPE FOOTPRINT

- TABLE 462 COMPANY REGION FOOTPRINT

- TABLE 463 COMPANY APPLICATION FOOTPRINT

- TABLE 464 RECYCLED PET MARKET: EXPANSIONS & INVESTMENTS, 2019–2023

- TABLE 465 RECYCLED PET MARKET: MERGERS & ACQUISITIONS, 2019–2023

- TABLE 466 INDORAMA VENTURES PUBLIC CO. LTD.: COMPANY OVERVIEW

- TABLE 467 INDORAMA VENTURES PUBLIC CO. LTD.: PRODUCTS OFFERED

- TABLE 468 INDORAMA VENTURES PUBLIC CO. LTD.: DEALS

- TABLE 469 BIFFA PLC: COMPANY OVERVIEW

- TABLE 470 BIFFA PLC: PRODUCTS OFFERED

- TABLE 471 BIFFA PLC: DEALS

- TABLE 472 FAR EASTERN NEW CENTURY CORPORATION: COMPANY OVERVIEW

- TABLE 473 FAR EASTERN NEW CENTURY CORPORATION: PRODUCTS OFFERED

- TABLE 474 FAR EASTERN NEW CENTURY CORPORATION: DEALS

- TABLE 475 FAR EASTERN NEW CENTURY CORPORATION: OTHERS

- TABLE 476 PLASTIPAK HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 477 PLASTIPAK HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 478 PLASTIPAK HOLDINGS, INC.: DEALS

- TABLE 479 PLASTIPAK HOLDINGS, INC.: OTHERS

- TABLE 480 ALPEK S.A.B. DE C.V.: COMPANY OVERVIEW

- TABLE 481 ALPEK S.A.B. DE C.V.: PRODUCTS OFFERED

- TABLE 482 ALPEK S.A.B. DE C.V.: DEALS

- TABLE 483 POLYQUEST, INC.: COMPANY OVERVIEW

- TABLE 484 POLYQUEST, INC.: PRODUCTS OFFERED

- TABLE 485 POLYQUEST, INC.: DEALS

- TABLE 486 POLYQUEST, INC.: OTHERS

- TABLE 487 LOOP INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 488 LOOP INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 489 LOOP INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 490 LOOP INDUSTRIES, INC.: DEALS

- TABLE 491 LOOP INDUSTRIES, INC.: OTHERS

- TABLE 492 EVERGREEN RECYCLING LLC: COMPANY OVERVIEW

- TABLE 493 EVERGREEN RECYCLING LLC: PRODUCTS OFFERED

- TABLE 494 EVERGREEN RECYCLING LLC: DEALS

- TABLE 495 EVERGREEN RECYCLING LLC.: OTHERS

- TABLE 496 PLACON CORPORATION: COMPANY OVERVIEW

- TABLE 497 PLACON CORPORATION: PRODUCTS OFFERED

- TABLE 498 EXTRUPET (PTY) LTD: COMPANY OVERVIEW

- TABLE 499 EXTRUPET (PTY) LTD: PRODUCTS OFFERED

- TABLE 500 EXTRUPET (PTY) LTD.: OTHERS

- TABLE 501 CLEAR PATH RECYCLING, LLC: COMPANY OVERVIEW

- TABLE 502 PENINSULA PLASTICS RECYCLING, INC.: COMPANY OVERVIEW

- TABLE 503 LAVERGNE, INC.: COMPANY OVERVIEW

- TABLE 504 VERDECO RECYCLING, INC.: COMPANY OVERVIEW

- TABLE 505 RELIANCE INDUSTRIES LIMITED (RIL): COMPANY OVERVIEW

- TABLE 506 LOTTE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 507 PETCO: COMPANY OVERVIEW

- TABLE 508 MARGLEN INDUSTRIES: COMPANY OVERVIEW

- TABLE 509 REPRO-PET: COMPANY OVERVIEW

- TABLE 510 LIBOLON: COMPANY OVERVIEW

- TABLE 511 AL MEHTAB INDUSTRIES: COMPANY OVERVIEW

- TABLE 512 GREEN RECYCLED & MODIFIED POLYMER CO. LTD. (GRM): COMPANY OVERVIEW

- TABLE 513 JP RECYCLING LTD.: COMPANY OVERVIEW

- TABLE 514 ALOXE HOLDING B.V.: COMPANY OVERVIEW

- TABLE 515 SEIU JAPAN CO., LTD.: COMPANY OVERVIEW

- TABLE 516 RECYCLED PLASTICS MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 517 RECYCLED PLASTICS MARKET SIZE, BY TYPE, 2023–2030 (KILOTON)

- TABLE 518 RECYCLED PLASTICS MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 519 RECYCLED PLASTICS MARKET SIZE, BY SOURCE, 2023–2030 (USD MILLION)

- TABLE 520 RECYCLED PLASTICS MARKET SIZE, BY PLASTIC TYPE, 2018–2022 (USD MILLION)

- TABLE 521 RECYCLED PLASTICS MARKET SIZE, BY PLASTIC TYPE, 2023–2030 (USD MILLION)

- TABLE 522 RECYCLED PLASTICS MARKET SIZE, BY PLASTIC TYPE, 2018–2022 (KILOTON)

- TABLE 523 RECYCLED PLASTICS MARKET SIZE, BY PLASTIC TYPE, 2023–2030 (KILOTON)

- TABLE 524 RECYCLED PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 525 RECYCLED PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2023–2030 (USD MILLION)

- TABLE 526 RECYCLED PLASTICS MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 527 RECYCLED PLASTICS MARKET SIZE, BY REGION, 2023–2030 (USD MILLION)

- TABLE 528 RECYCLED PLASTICS MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 529 RECYCLED PLASTICS MARKET SIZE, BY REGION, 2023–2030 (KILOTON)

- FIGURE 1 RECYCLED PET MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 RECYCLED PET MARKET: DATA TRIANGULATION

- FIGURE 6 FLAKES SEGMENT DOMINATED RECYCLED PET MARKET

- FIGURE 7 BOTTLES & CONTAINERS SEGMENT DOMINATED RECYCLED PET MARKET

- FIGURE 8 BOTTLES APPLICATION LED MARKET

- FIGURE 9 ASIA PACIFIC LED RECYCLED PET MARKET

- FIGURE 10 INCREASING DEMAND FOR RECYCLED PET IN END-USE APPLICATIONS TO DRIVE MARKET

- FIGURE 11 BOTTLES TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 12 BOTTLES & CONTAINERS TO BE LARGEST SOURCE DURING FORECAST PERIOD

- FIGURE 13 CHINA AND FLAKES SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RECYCLED PET MARKET

- FIGURE 16 RECYCLED PET MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF RECYCLED PET

- FIGURE 18 REVENUE SHIFT FOR RECYCLED PET MANUFACTURERS

- FIGURE 19 SUPPLY CHAIN OF RECYCLED PET INDUSTRY

- FIGURE 20 RECYCLED PET MARKET ECOSYSTEM

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 23 OVERALL PATENTS REGISTERED BETWEEN 2013 AND 2022

- FIGURE 24 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 25 TOTAL NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 26 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 27 FLAKES TYPE TO CAPTURE LARGER SHARE OF RECYCLED PET MARKET

- FIGURE 28 BOTTLES & CONTAINERS SOURCE SEGMENT TO CAPTURE LARGEST SHARE OF RECYCLED PET MARKET

- FIGURE 29 BOTTLES APPLICATION SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 30 MECHANICAL RECYCLING TECHNIQUE SEGMENT TO CAPTURE LARGEST SHARE OF RECYCLED PET MARKET

- FIGURE 31 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: RECYCLED PET MARKET SNAPSHOT

- FIGURE 33 EUROPE: RECYCLED PET MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: RECYCLED PET MARKET SNAPSHOT

- FIGURE 35 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- FIGURE 36 SHARE OF KEY PLAYERS IN RECYCLED PET MARKET

- FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN RECYCLED PET MARKET

- FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: RECYCLED PET MARKET, 2022

- FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN RECYCLED PET MARKET

- FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN RECYCLED PET MARKET

- FIGURE 42 SME MATRIX: RECYCLED PET MARKET, 2022

- FIGURE 43 INDORAMA VENTURES PUBLIC CO. LTD.: COMPANY SNAPSHOT

- FIGURE 44 BIFFA PLC: COMPANY SNAPSHOT

- FIGURE 45 FAR EASTERN NEW CENTURY CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 ALPEK S.A.B. DE C.V.: COMPANY SNAPSHOT

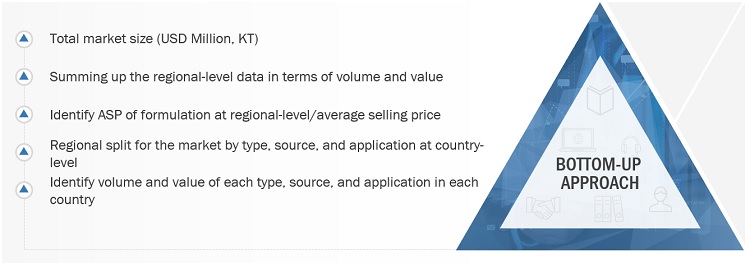

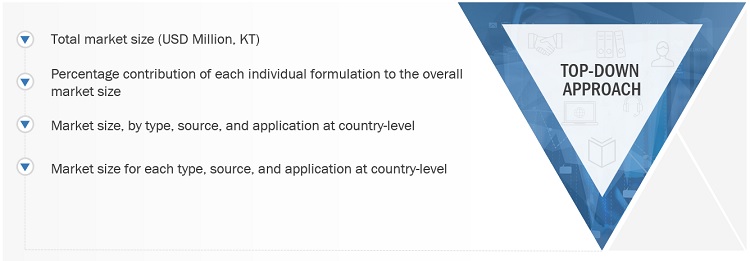

The study involved four major activities in estimating the size of the recycled PET Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

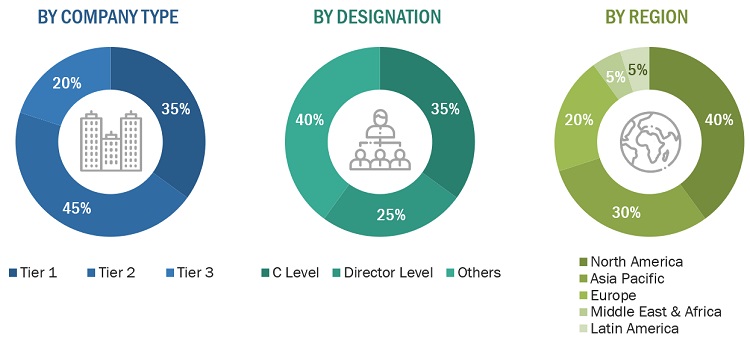

The recycled PET market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the recycled PET market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the recycled PET market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

To know about the assumptions considered for the study, Request for Free Sample Report

key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Recycled PET: Bottom-Up Approach

Recycled PET: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above— the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was

triangulated by studying various factors and trends from both the demand and supply sides in the recycled PET market.

Market Definition:

Recycled polyethylene terephthalate is known as RPET and is the most widely used recycled plastic in the world. Recycled PET is made from PET, short for polyethylene terephthalate, which is a highly recyclable plastic resin and a form of polyester. PET is a clear, strong, and lightweight plastic that is widely used for packaging foods and beverages, especially convenience-sized soft drinks, juices, and water. In the recycling process, PET bottles and containers are sorted, washed and then ground into RPET Flakes and Chips. These flakes and chips are further used in various applications including bottles, sheets, fibers, strapping among others. Recycled PET products are functional and cost-effective. The recycling code number for PET is #1.

Key Stakeholders

- RPET Manufacturers

- .Plastic & Special Plastic Material and Chemical Companies

- RPET Recyclers

- Environmental Service Providers

- Government and Regulatory Bodies

- Commercial R&D Institutions

- Associations and Industry Bodies

- Municipalities, Local, and Regional Authorities

Report Objectives

- To define, describe, and forecast the recycled PET market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on type, grade, applications, color, and source.

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as new product launches, expansion, mergers & acquisitions, and partnership & collaboration in the recycled PET market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Recycled PET Market