Airport Information System Market Size, Share and Trends, 2025 To 2030

Airport Information System Market by Application (Passenger Processing, Flight Operation, Cargo and Baggage Management, Resource Management, Airside Operations), Type, Implementation and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Airport Information Systems market is projected to reach USD 5.36 billion by 2030, at a CAGR of 4.0% from 2025 to 2030. The growth of the Airport Information Systems Market is driven by AI-driven decision support, predictive maintenance, and dynamic flight-scheduling capabilities are increasing demand for Airport Information Systems by improving operational efficiency and reducing downtime, while the adoption of digital-twin–based planning tools enables airports to optimize infrastructure use, streamline passenger movement, and strengthen overall operational management.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific Airport Information Systems Market market accounted for a 38.1% revenue share in 2024.

-

By ApplcationBy application, the Cargo and Baggage Management market segment is expected to register the highest CAGR of 4.8%.

-

By TypeBy type, the Airport Operational Support market segment is projected to grow at the fastest rate from 2024 to 2030.

-

By Implementation TypeBy implementation type, the New Installation market segment is expected to dominate the market. This segment is growing fastest as new and expanding airports adopt advanced AIS platforms to handle rising traffic, replace legacy systems, and meet modern operational standards. Strong investment in greenfield projects across emerging markets further accelerates demand.

-

By End-use ApplicationBy end-use application, the Airport Information Systems market segment will grow the fastest during the forecast period.

-

By Distribution ChannelBy distribution channel, the Airport Information Systems market segment is expected to dominate the market, growing at the highest CAGR of X.X%.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompany SITA, Amadeus IT Group SA, and Vanderlande Industries B.V were identified as some of the star players in the Airport Information Systems market market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - START UPSCompanies AeroCloud Systems Ltd, Veovo, and Trebide, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The Airport Information Systems market is witnessing steady growth, driven by demand for Airport Information Systems is rising due to AI-based operational optimization, predictive maintenance, dynamic scheduling, and the adoption of digital-twin tools that improve infrastructure use and overall airport management. Future demand will be shaped by wider adoption of AI automation, predictive analytics, and digital-twin–driven planning as airports modernize operations and expand capacity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the Airport Information Systems market stems from shifting passenger expectations and industry disruptions. Airports, airlines, logistics firms, and related service providers increasingly rely on AIS solutions, with operational efficiency and passenger management as key focus areas. Disruptive technologies, regulatory amendments, and advancements in baggage and cargo handling directly influence how these stakeholders operate and generate revenue. These developments, in turn, drive demand for integrated, data-driven AIS platforms, shaping the market’s future growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in IT spending by airports

-

Increased use of smartphones

Level

-

Data and privacy concerns

-

High operating costs

Level

-

Increased investments for airport expansion in emerging economies

-

Emergence of smart airports

Level

-

Management of large datasets

-

Complexity in integrating new technologies into legacy systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in IT spending by airports

Growing passenger volumes and the need for smoother airport operations are pushing airports worldwide to invest heavily in advanced IT systems. Upgrades focus on automating check-in, baggage handling, and boarding to reduce congestion and improve throughput. Regions such as Asia Pacific are leading investments as airports expand infrastructure and adopt biometric and data-driven systems to enhance operational efficiency and passenger experience.

Restraint: Data and privacy concerns

Data privacy and security concerns remain a key barrier to AIS adoption due to the handling of large volumes of sensitive biometric and travel information. Compliance with regulations such as GDPR and CCPA increases operational complexity, while interconnected systems heighten exposure to cyberattacks. Breaches can lead to financial losses and reputational damage, forcing airports to delay or rethink technology upgrades.

Opportunity:Increased investments for airport expansion in emerging economies

Rapid airport expansion in emerging markets, especially in Asia Pacific, is creating substantial opportunities for AIS deployment. Governments are prioritizing modern, digital-first infrastructure and allowing greater investment to meet rising passenger demand. Large-scale programs in China and India, including hundreds of new or upgraded airports, are driving sustained demand for integrated, future-ready information systems.

Challenge: Management of large datasets

Managing rapidly expanding operational datasets is becoming increasingly difficult as airports record more passenger, cargo, and aircraft movement data. Generating predictive insights requires advanced analytics capabilities, along with robust storage, processing, and visualization tools. Airports must continuously update AIS platforms to handle growing data volumes, creating ongoing operational and technical strain.

AIRPORT INFORMATION SYSTEM MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed biometrics to replace manual ID checks at key touchpoints. | Reduced processing time, improved passenger flow, enhanced security. |

|

Implemented self-service kiosks, facial recognition, and RFID for passenger and baggage handling. | Lower congestion, faster check-in, improved staff productivity. |

|

Adopted AI-powered analytics to manage peak-hour congestion and resource allocation. | Reduced wait times, optimized operations, maintained service quality. |

|

Executed a digital transformation integrating big data, AI, and IoT to modernize operations. | Improved efficiency, better resource management, reduced mishandling and costs. |

|

Migrated GIS and operational data systems to AWS cloud. | Increased scalability, reduced costs, improved uptime, enhanced operational efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Airport Information Systems market ecosystem comprises two core groups: solution manufacturers and system integrators. Manufacturers such as Siemens, Thales, SITA, Amadeus, RESA, and RTX develop the hardware and software platforms that support airport operations, passenger processing, and data management. System integrators like CGI, ADB Safegate, and TAV Technologies bring these solutions together, customizing and deploying them across complex airport environments. This collaboration enables airports to implement unified, scalable, and operationally efficient information systems.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Airport Information Systems Market, By Implementation

New installation is the largest segment because expanding airports and greenfield projects require full-scale deployment of modern AIS platforms. Emerging markets, infrastructure upgrades, and the replacement of legacy systems accelerate demand for new, integrated installations over retrofits.

Airport Information Systems Market, By Type

Passenger-centric systems lead the market as airports focus on enhancing traveler experience, reducing touchpoints, and offering personalized, real-time services. Growing expectations for seamless, contactless, and digitally supported travel drive the dominance of this segment.

Airport Information Systems Market, By Application

Passenger processing dominates because airports prioritize systems that reduce queues, automate identity verification, and streamline check-in, bag drop, and boarding. Rising passenger volumes and the shift toward biometric and self-service journeys make this the most critical operational area for investment.

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

The North American Airport Information Systems market is the fastest-growing region due to sustained investment in airport modernization and the need to manage high passenger volumes with advanced digital systems. Airports are prioritizing upgrades in passenger processing, security, and operational management, driving strong demand for AIS technologies. Major government-led programs, such as TSA’s deployment of next-generation authentication systems, reinforce this momentum. The region’s focus on efficiency, security, and technology integration continues to accelerate market expansion.

AIRPORT INFORMATION SYSTEM MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMPANY EVALUATION MATRIX

In the airport infromation systems market matrix, SITA (Star) leads with a strong market share and extensive product footprint, driven by its advanced passenger processing and airport operations solutions widely adopted across global aviation. AeroCloud Systems Ltd (Emerging Leader) is strengthening its position with cloud-native airport management solutions that offer scalable, data-driven operational support. As airports increasingly adopt flexible, real-time platforms, the company is well positioned to move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SITA (Switzerland)

- Amadeus IT Group SA (Spain)

- Vanderlande Industries B.V. (Netherlands)

- Indra (Spain)

- RTX (US)

- Siemens AG (Germany)

- Thales (France)

- ADB SAFEGATE (Belgium)

- RESA (France)

- TAV Technologies (Turkey)

- Damarel Systems International Ltd (UK)

- CGI Inc. (Canada)

- Airport Information Systems (England)

- NEC Corporation (Japan)

- Honeywell International Inc. (US)

- Deutsche Telekom AG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 4.1 Billion |

| Market Forecast in 2030 (Value) | USD 5.3 Billion |

| Growth Rate | CAGR of 4.0% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Rest of the World |

WHAT IS IN IT FOR YOU: AIRPORT INFORMATION SYSTEM MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- November 2024 : SITA partnered with Taoyuan International Airport (TPE) to revolutionize its passenger processing solutions. TPE will install SITA’s game changing check-in kiosk solutions, allowing passengers to fly through the airport and on to their destination faster than ever before.

- February 2024 : NAV CANADA and Indra signed an agreement to contribute to the evolution of Canada’s air traffic management systems. The agreement would support the deployment of a state-of-the-art flight data processing system (FDPS) and an air traffic flow management system (iACM) for complex airspaces within NAV CANADA’s network centre.

- June 2024 : RESA collaborated with Air Djibouti for its billing operations. The Invoice Handling Services software solution is designed for ground agents in charge of services related to a specific flight.

- April 2024 : ADB SAFEGATE entered a new contract for the new Terminal One at JFK Airport. OneControl systems will be added to the new Terminal One at John F. Kennedy International Airport (JFK) will provide the most efficient and safest ramp operation in US.

- November 2024 : Indra was awarded with a contract by VATM (Vietnam Air Traffic Management Corporation) (Vietnam) to overhaul a large part of the country's air traffic management systems. Indra's system will bring together all the air traffic management (ATM) processes occurring during a flight in a single centralized suite and will be equipped with en-route services, approach and control tower management systems.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the Aircraft Information System market. Primary sources included industry experts from the core and related industries, as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for market growth during the forecast period.

Secondary Research

The share of companies in the Airport information Systems market was determined using secondary data made available through paid and unpaid sources and analyzing product portfolios of major companies in the Airport Information Systems market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study on the Airport information Systems market included financial statements of companies offering and developing Airport information Systems and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to determine the total size of the Airport Informations Systems market, which primary respondents further validated.

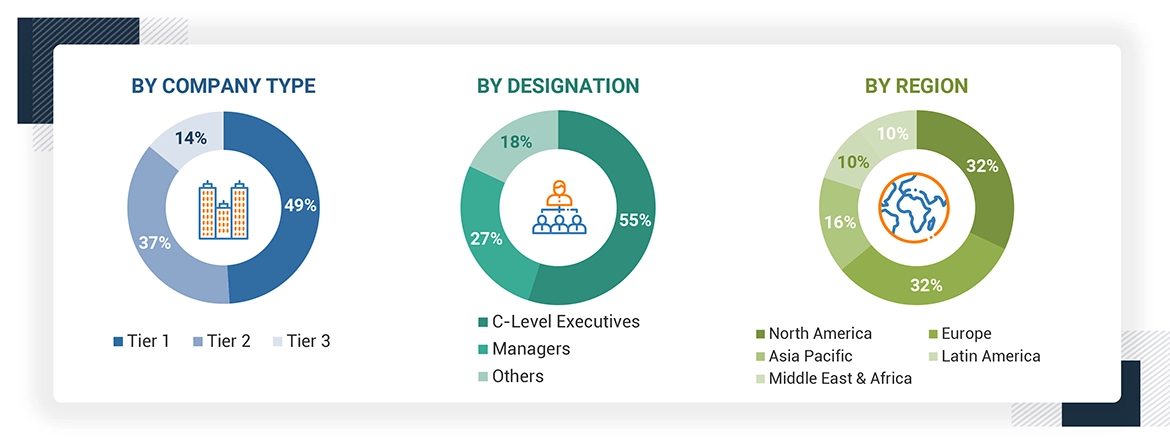

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Airport information Systems market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and Afrca. This primary data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, varied primary sources from the supply and demand sides were interviewed to get qualitative and quantitative information on the market. Primary sources from the supply side include different industry experts like vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary research has been done through interviews to get information that includes market statistics, revenue collection data from the products and services, and market breakups, size estimations, market forecasting, and data triangulation. Through primary research, the trends of technology, application, platform, and region were also understood. Demand-side stakeholders, such as CXOs, production managers, engineers, and installation teams of end users of Airport information Systems, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the Airport information Systems market.

Note: C-level Executives include the CEO, COO, and CTO, among others.

*Others include Sales Managers, Marketing Managers, and Product Managers. The tiers of the companies have been defined based on their total revenue as of 2022. Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

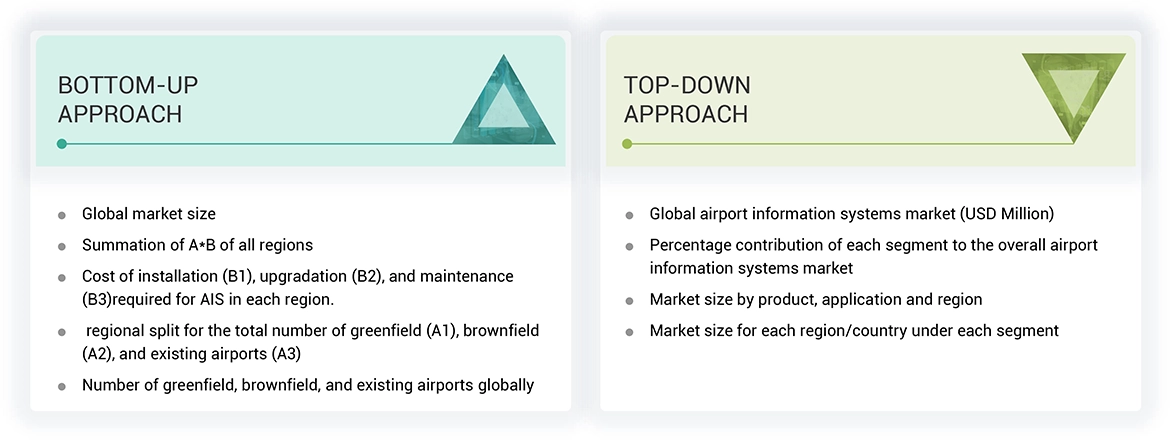

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Airport Information Systems market. The research methodology used to estimate the market size includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Airport Information System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Airport information Systems market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and sub-segments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The Airport Information Systems (AIS) market focuses on technologies that streamline and optimize airport operations, integrating software, hardware, and real-time data for efficient passenger processing, flight management, resource allocation, and security. Key components like Departure Control Systems (DCS), Airport Operational Databases (AODB), and Flight Information Display Systems (FIDS) enhance decision-making, operational efficiency, and passenger experiences. AIS supports applications in baggage handling, airside management, and dynamic revenue optimization while fostering collaboration among airlines, air traffic control, airport authorities, and ground handlers. AIS solutions are vital for smarter, more connected airport ecosystems by addressing congestion, improving security, and enabling sustainable practices.

Key Stakeholders

Various stakeholders of the market are listed below:

- Systems Manufacturers

- Software Developers of Airport Information Systems

- Service providers

- Airport Authorities

- Airport Staff

- Regulatory Bodies

Report Objectives

- To define, describe, and forecast the airport information systems market based on technology, application, type, implementation, and region.

- To forecast sizes of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East and Rest of the World along with key countries in each of these regions.

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the airport information systems market.

- To identify industry trends, market trends, and technology trends currently prevailing in the airport information systems market

- To provide an overview of the regulatory landscape with respect to airport information systems regulations across regions.

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the airport information systems market by analyzing recent developments such as contracts, agreements, expansions, and new product launches adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Share at:ChatGPT Perplexity Grok Google AI

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Airport Information System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Airport Information System Market