Aircraft De-Icing Market by Application (Commercial & Military), by Equipment (De-Icing Trucks, Sweepers, & Others), by Fluid Type (Type I, Type II, Type III, & Type IV), by Geography (North America, Europe & APAC) - Global Forecasts & Analysis to 2024-2032

Market Overview

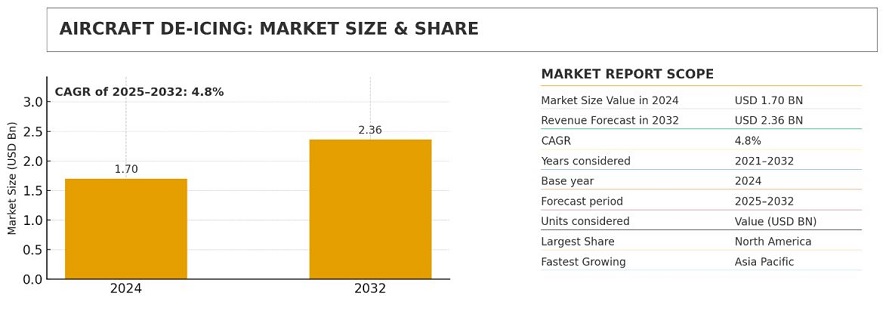

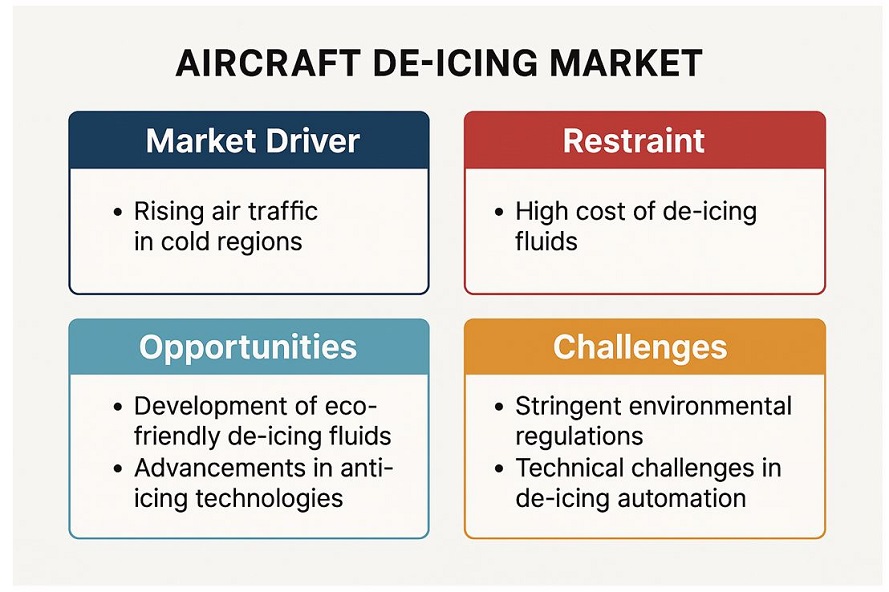

In recent years, the aircraft de-icing market has gained renewed momentum as airports modernize ground-handling systems to meet higher safety standards and environmental expectations. The market was valued at approximately USD 1.7 billion in 2024 and, based on current estimates, is expected to reach around USD 2.36 billion by 2032, indicating a compound annual growth rate (CAGR) of 4.8%. This expansion is linked to the rebound in passenger and cargo movements, the growing frequency of winter flight disruptions, and tighter regulations on glycol usage and effluent management across major aviation economies.

Conventional apron-based spraying using glycol mixtures is gradually being phased out. Operators are adopting electric and hybrid de-icing trucks, remote pad facilities, and automated fluid metering systems that help lower chemical consumption and turnaround times. Several major hubs in North America and Europe have begun implementing standardized pad designs to streamline winter operations. Manufacturers such as Vestergaard Company and Textron GSE are now delivering electrically powered boom vehicles equipped with onboard diagnostics that track fluid performance parameters throughout each application.

Segmentation Analysis

From a structural standpoint, the market is analysed by fluid type, equipment, and application. Fluid classifications adhere to SAE AMS 1424 / 1428 standards, comprising Type I, II, III, and IV formulations. Key de-icing methods include spray, chemical, infrared, and electro-thermal techniques. Equipment encompasses mobile trucks, fixed-base or remote systems, and glycol-recovery units. End users fall into commercial, military, and general aviation, each shaped by distinct procurement cycles. Commercial airlines emphasize automated pads to sustain on-time performance, whereas defense organizations prioritize electro-thermal configurations to maintain readiness in severe conditions.

Market By Fluid Type

Type I Fluids

Type I fluids dominate the market due to their fast-acting, glycol-based formulation, which removes snow, ice, and frost from aircraft surfaces before takeoff. Their low viscosity and quick heat-transfer capability make them ideal for short-term protection, particularly in regions with frequent turnaround operations.

Type II Fluids

Used primarily for larger aircraft and longer holdover times, Type II fluids offer enhanced performance in moderate precipitation. Airlines operating out of major hubs, such as Chicago, Frankfurt, and Toronto, prefer these for their balance of efficiency and endurance.

Type III Fluids

Developed for turboprops and regional jets, Type III fluids offer mid-range viscosity and moderate protection, addressing the needs of regional airports that face intermittent icing conditions.

Type IV Fluids

The fastest-growing segment, Type IV fluids, provides extended anti-icing protection for heavy snowfall conditions. Growing environmental concerns are driving R&D toward bio-based Type IV fluids with lower toxicity and glycol content.

Market By Application

Commercial Aircraft

The commercial segment holds the largest share, driven by the expansion of airline fleets and increased passenger traffic in North America and Europe. Frequent winter operations at major hubs amplify the need for rapid, automated de-icing solutions.

Military Aircraft

Defense aviation relies on robust de-icing systems to maintain mission readiness. Procurement programs for next-generation aircraft de-icing trucks and runway treatment systems are enhancing operational reliability at military bases in cold climates.

General Aviation

Private jet operators and charter service providers are adopting compact de-icing systems and portable fluid tanks to maintain on-demand flight operations. This niche segment is expected to grow steadily due to increasing winter travel and business aviation activity.

Market By Equipment

De-Icing Trucks

De-icing trucks represent the backbone of airport operations, providing mobility and flexibility for treating multiple aircraft stands. Leading manufacturers, such as Vestergaard Company, Textron GSE, and Global Ground Support, are developing automated, sensor-assisted systems that optimize fluid usage and reduce turnaround times.

De-Icing Boots

Installed on aircraft leading edges, pneumatic de-icing boots mechanically remove ice accumulation mid-flight. This technology remains critical for smaller aircraft and turboprops, ensuring continuous flight safety under icing conditions.

Heating Systems

Integrated heating systems, including electrical and bleed-air systems, are increasingly used in next-generation aircraft designs. These systems eliminate external fluid dependency and support long-haul operational efficiency.

Others (Sprayers, Nozzles, Storage Tanks)

Ground support accessories—such as nozzles, sprayers, and fluid storage systems—complement the de-icing ecosystem, ensuring precise fluid delivery and environmental containment.

Regional Outlook

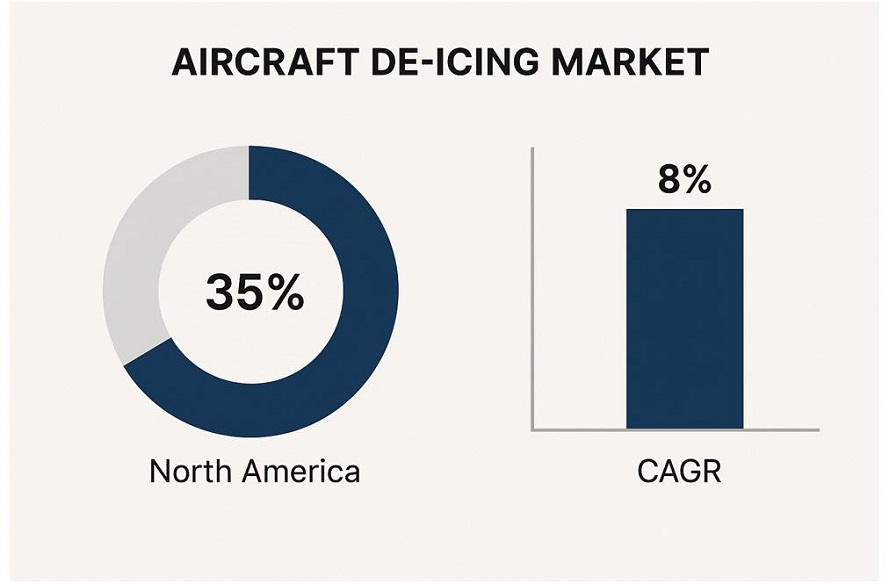

North America continues to hold the largest regional share, supported by its long-standing infrastructure and a well-defined regulatory regime. The Federal Aviation Administration’s Holdover Time (HOT) program, in conjunction with Transport Canada TP 14052 and the ICAO Manual of Ground De/anti-Icing Operations, provides the framework for certification and best practices. Europe, guided by EASA directives, is extending its leadership in sustainability through closed-loop recycling facilities that recover more than 80 percent of used fluids. Growth in the Asia Pacific is being driven by the expansion of airport capacity in Japan, South Korea, and northern China, where operators are integrating de-icing management software with live meteorological and traffic control feeds to improve decision accuracy.

Competitive Landscape

Competitive activity across the aircraft de-icing systems domain remains strong. Major participants, including Collins Aerospace (RTX), Clariant, Dow Inc., Cryotech (General Atomics), BASF, Kilfrost, Vestergaard Company, JBT Corporation, Oshkosh Aerotech, Tronair, and Contego Aviation Solutions, continue to expand their technology portfolios. Their current priorities include developing bio-based or low-toxicity propylene-glycol fluids, connected control modules, and integrated equipment and fluid solutions for airport sustainability programs. Collaboration between chemical suppliers and ground-support equipment manufacturers is increasing as airports seek unified solutions that address both operational reliability and environmental compliance simultaneously.

Sustainability & ESG

Sustainability objectives are now embedded within procurement planning. Airports are investing in glycol-capture and recycling infrastructure to satisfy emission and water-quality targets. Electrified and hybrid vehicles have demonstrated fuel savings of up to 80 percent compared to diesel alternatives. At the same time, new fluid chemistries provide faster biodegradation without compromising freeze-point protection. These advancements align with Airport Carbon Accreditation (ACA) milestones and broader ESG reporting frameworks, underscoring the role of de-icing as a quantifiable component in airport sustainability performance.

Technology Trends

Digital transformation continues to enhance operational control and efficiency. Airlines and service providers are deploying AI-enabled scheduling systems that align weather forecasts with resource allocation and gate planning. Predictive analytics help identify frost formation hours in advance, enabling precise deployment of crews and de-icing resources. This analytical approach supports higher safety compliance while reducing delays and fluid waste.

Why This Report

Overall, the aircraft de-icing market continues to demonstrate steady technological advancement and a stronger orientation toward environmental stewardship. The combined effects of regulation, electrification, and digital optimization are expected to strengthen resilience across airport ground-handling networks. Over the forecast period, aircraft de-icing systems will remain central to safe winter flight operations and will continue to be an essential indicator of airport efficiency worldwide.

FAQs

Q1. What are Type I–IV aircraft de-icing fluids?

Type I is thin and used primarily for de-icing; Types II, III, and IV are thicker anti-icing formulations that extend holdover time under specific conditions, as per SAE AMS 1424/1428.

Q2. How do centralized (remote) de-icing pads improve operations?

They consolidate equipment and crews away from gates, enabling parallel processing, shorter taxi-out times, and better fluid capture for recycling.

Q3. What is the FAA Holdover Time (HOT) program?

HOT tables define the safe exposure interval after treatment, based on fluid type, concentration, and precipitation, used to determine when a re-treatment or pre-take-off check is required.

Q4. Which regions are growing fastest?

North America retains the largest share; Asia Pacific shows faster growth as airports add capacity and digital de-icing control linked to weather and ATC systems.

Q5. What sustainability measures are airports adopting?

Electric/hybrid de-icing vehicles, closed-loop glycol recovery, and faster-biodegrading fluids aligned to Airport Carbon Accreditation (ACA) and ESG targets.

Q6. Where is digitalization changing outcomes?

AI-based scheduling/resource tools combine forecasts, gate plans, and crew availability to anticipate frost formation and optimize manpower and fluid use.

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Key Data From Secondary Sources

2.2 Factor Analysis

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities in Market

4.2 Market Analysis: Developed V/S Developing Nations

4.3 Aircraft De-Icing: Product Growth Matrix

4.4 Us: Hot Revenue Pocket for the Aircraft Deicing Market

4.5 Rotor Blade Ice Protection System: Expert Opinion

4.6 Heatcoat Anti-Icing Technology for Uavs

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Fluid Type

5.2.2 By Application

5.2.3 By Ground Equipment

5.2.4 By Geography

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Modernization & Expansion of Existing Airports

5.4.1.2 Increasing Need for Passenger Comfort

5.4.1.3 Safe Take-Off & Landing Operations During Wintry Weather Conditions

5.4.1.4 Technological Advancements

5.4.1.5 Flight Delays During Snow

5.4.2 Restraints

5.4.2.1 High Initial Investments

5.4.2.2 Regulatory Issues

5.4.3 Challenges

5.4.3.1 Storage & Handling Challenges of De-Icing Materials

5.4.3.2 Treating Glycol Runoff From Airport De-Icing Operations

5.4.4 Opportunities

5.4.4.1 Airport Ground Handling Equipment

5.4.5 Burning Issues

5.4.5.1 Optimizing the Use of Aircraft De-Icing and Anti-Icing Fluids

5.4.5.2 Development of Environment Friendly De-Icing Fluids

5.4.6 Winning Imperative

5.4.6.1 Development Cost-Effective Aircraft De-Icing Systems

5.5 Technology Trends

5.5.1 Infared Aircraft De-Icing Technology

5.5.2 Hot Water Aircraft De-Icing

5.5.3 Pre-Deicing and Other De-Icing Procedures

5.5.4 Tempered Steam Technology

5.5.5 Forced Air Deicing System

5.5.6 Electro-Expulsive Separation System

5.5.7 Electro-Mechanical Expulsion Deicing System

5.5.8 Ultra Sound Technology

5.5.9 Shape Memory Alloys

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Environmental Threat Opportunity Profile

6.5 Strategic Benchmarking

7 Aircraft De-Icing Market, By Fluid Type

7.1 Introduction

7.2 Fluid Type

7.2.1 Type I

7.2.2 Type II

7.2.3 Type III

7.2.4 Type IV

7.3 Fluid Uses

7.4 Fluid Application

7.5 Variables That Affect Fluid Use

7.6 Dry Weather Deicing

7.7 Non-Chemical De-Icing Methods

8 Aircraft De-Icing Market, By Application

8.1 Military

8.2 Commercial

8.2.1 Dual-Channel Deicing System for A Rotary Wing Aircraft

8.2.2 Energy-Efficient Systems Eliminate Icing Danger for Uavs

9 Aircraft De-Icing Market, By Equipment

9.1 Introduction

9.2 De-Icing Trucks

9.3 Sweepers

9.4 Others

10 Best Industry Practices (Qualitative Only )

10.1 Introduction

10.2 Aircraft Deicing Fluid Minimization Methods

10.2.1 Preventive Anti-Icing

10.2.2 Forced-Air Aircraft Deicing Systems

10.2.3 Computer-Controlled Fixed-Gantry

10.2.4 Varying Glycol Content to Ambient Air Temperature

10.2.5 Hangar Storage

10.2.6 Ice-Detection Systems

10.2.7 Glycol Minimization Methods Currently Under Development

10.3 Aircraft Deicer/Anti-Icer Collection and Containment Methods

10.3.1 ADF Collection Systems

10.3.2 Temporary Aircraft Deicing Pads

10.3.3 Storm Drain Inserts

10.3.4 Glycol Vacuum Vehicles

10.3.5 Mobile Pumping Station With Fluid Concentration Sensor

10.4 Glycol Recycling

10.4.1 Glycol Recyclers

10.4.2 Current Uses for Recovered Glycol

10.4.3 Operational and Economic Issues

10.5 Airfield Pavement Deicing/ Anti-Icing Minimization Practices

10.5.1 Good Winter Maintenance Practices

10.5.2 Preventive Anti-Icing

10.5.3 Runway Surface Condition Monitoring Systems

11 Geographic Analysis

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.1.1 Market Size, By Fluid Type

11.2.1.2 Market Size, By Application

11.2.1.3 Market Size, By Equipment

11.2.2 Canada

11.2.2.1 Market Size, By Fluid Type

11.2.2.2 Market Size, By Application

11.2.2.3 Market Size, By Equipment

11.2.3 Alaska

11.2.3.1 Market Size, By Fluid Type

11.2.3.2 Market Size, By Application

11.2.3.3 Market Size, By Equipment

11.3 Europe

11.3.1 U.K.

11.3.1.1 Market Size, By Fluid Type

11.3.1.2 Market Size, By Application

11.3.1.3 Market Size, By Equipment

10.3.2 Germany

11.3.2.1 Market Size, By Fluid Type

11.3.2.2 Market Size, By Application

11.3.2.3 Market Size, By Equipment

11.3.3 France

11.3.3.1 Market Size, By Fluid Type

11.3.3.2 Market Size, By Application

11.3.3.3 Market Size, By Equipment

11.3.4 Russia

11.3.4.1 Market Size, By Fluid Type

11.3.4.2 Market Size, By Application

11.3.4.3 Market Size, By Equipment

11.3.5 Switzerland

11.3.5.1 Market Size, By Fluid Type

11.3.5.2 Market Size, By Application

11.3.5.3 Market Size, By Equipment

11.3.6 Norway

11.3.6.1 Market Size, By Fluid Type

11.3.6.2 Market Size, By Application

11.3.6.3 Market Size, By Equipment

11.3.7 Turkey

11.3.7.1 Market Size, By Fluid Type

11.3.7.2 Market Size, By Application

11.3.7.3 Market Size, By Equipment

11.3.8 Austria

11.3.8.1 Market Size, By Fluid Type

11.3.8.2 Market Size, By Application

11.3.8.3 Market Size, By Equipment

11.3.9 Finland

11.3.9.1 Market Size, By Fluid Type

11.3.9.2 Market Size, By Application

11.3.9.3 Market Size, By Equipment

11.4 Asia-Pacific

11.4.1 China

11.4.1.1 Market Size, By Fluid Type

11.4.1.2 Market Size, By Application

11.4.1.3 Market Size, By Equipment

11.4.2 Japan

11.4.2.1 Market Size, By Fluid Type

11.4.2.2 Market Size, By Application

11.4.2.3 Market Size, By Equipment

11.4.3 South Korea

11.4.3.1 Market Size, By Fluid Type

11.4.3.2 Market Size, By Application

11.4.3.3 Market Size, By Equipment

12 Competitive Landscape

12.1 Overview

12.2 Market Share Analysis, By Company

12.3 Market Share Analysis, By Region

12.4 Opportunity Analysis

12.5 Competitive Situation and Trends

13 Company Profiles

13.1 B/E Aerospace, Inc.

13.2 UTC Aerospace Systems

13.3 JBT Corporation

13.4 Clariant AG

13.5 The Dow Chemical Company.

13.6 Cryotech.

13.7 Global Ground Support LLC

13.8 Weihai Guangtai Airport Equipment Co Ltd.

13.9 Vestergaard Company A/S

13.1 Safeaero I Trelleborg AB

13.11 Contego

13.12 Kilfrost Corporation.

13.13 BASF Corporation

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT:Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (86 Tables)

Table 1 Periodization

Table 2 Cod Discharge for Various Airports in the U.S.

Table 3 ADF Collection and Containment Methods and Percentage of Us Airports Using Them in 2010

Table 4 Important Airport Projects (2013–2014)

Table 5 Ranking of Technologies & Procedures By Capital Cost

Table 6 Etop Analysis: Technological Impact to Remain High (2014-2020)

Table 7 Market Size, By Application, 2012-2020 ($Million)

Table 8 Commercial Aviation Aircraft De-Icing Market Size, 2012-2020 ($Million)

Table 9 Market Size: By Fluid Type, 2012-2020 ($Million)

Table 10 Global Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 11 Type 1 Fluid Market Size, By Region, 2012-2020 ($Million)

Table 12 Type 2 Fluid Market Size, By Region, 2012-2020 ($ Million)

Table 13 Type 3 Fluid Market Size: By Region, 2012-2020 ($ Million)

Table 14 Type 4 Fluid Market Size, By Region, 2012-2020 ($Million)

Table 15 Market Size, By Region, 2012-2020 ($Million)

Table 16 North America: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 17 North America: Market Size, By Application, 2012-2020 ($Million)

Table 18 North America: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 19 U.S.: Market Landscape (2013)

Table 20 U.S.: Market Size, By Fluid Type , 2012-2020 ($Million)

Table 21 U.S.: Market Size, By Application, 2012-2020 ($Million)

Table 22 U.S.: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 23 Canada: Market Landscape (2013)

Table 24 Canada: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 25 Canada: Market Size, By Application, 2012-2020 ($Million)

Table 26 Canada: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 27 Alaska: Market Landscape (2013)

Table 28 Alaska: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 29 Alaska: Market Size, By Application, 2012-2020 ($Million)

Table 30 Alaska: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 31 Europe: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 32 Europe: Market Size, By Application, 2012-2020 ($Million)

Table 33 Europe: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 34 U.K.: Market Landscape (2013)

Table 35 U.K.: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 36 U.K.: Market Size, By Application, 2012-2020 ($Million)

Table 37 U.K.: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 38 Germany: Market Landscape (2013)

Table 39 Germany: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 40 Germany: Market Size, By Application, 2012-2020 ($Million)

Table 41 Germany: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 42 France: Market Landscape (2013)

Table 43 France: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 44 France: Market Size, By Application, 2012-2020 ($Million)

Table 45 France: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 46 Russia: Market Landscape (2013)

Table 47 Russia: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 48 Russia: Market Size, By Application, 2012-2020 ($Million)

Table 49 Russia: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 50 Switzerland: Market Landscape (2013)

Table 51 Switzerland: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 52 Switzerland: Market Size, By Application, 2012-2020 ($Million)

Table 53 Switzerland: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 54 Norway: Market Landscape (2013)

Table 55 Norway: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 56 Norway: Market Size, By Application, 2012-2020 ($Million)

Table 57 Norway: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 58 Turkey: Market Landscape (2013)

Table 59 Turkey: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 60 Turkey: Market Size, By Application, 2012-2020 ($Million)

Table 61 Turkey: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 62 Austria: Market Landscape (2013)

Table 63 Austria: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 64 Austria: Market Size, By Application, 2012-2020 ($Million)

Table 65 Austria: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 66 Finland: Market Landscape (2013)

Table 67 Finland: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 68 Finland: Market Size, By Application, 2012-2020 ($Million)

Table 69 Finland: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 70 Asia-Pacific: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 71 Asia-Pacific: Market Size, By Application, 2012-2020 ($Million)

Table 72 Asia-Pacific: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 73 China: Market Landscape (2013)

Table 74 China: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 75 China: Market Size, By Application, 2012-2020 ($Million)

Table 76 China: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 77 Japan: Market Landscape (2013)

Table 78 Japan: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 79 Japan: Market Size, By Application, 2012-2020 ($Million)

Table 80 Japan: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 81 South Korea: Market Landscape (2013)

Table 82 South Korea: Aircraft De-Icing Market Size, By Fluid Type , 2012-2020 ($Million)

Table 83 South Korea: Market Size, By Application, 2012-2020 ($Million)

Table 84 South Korea: Market Size, By Ground Equipment, 2012-2020 ($Million)

Table 85 South Africa: Aircraft De-Icing Market Size, By Application, 2012-2020 ($Million)

Table 86 South Africa: Market Size, By Ground Equipment, 2012-2020 ($Million)

List of Figures (73 Figures)

Figure 1 Market Scope: Aircraft De-Icing

Figure 2 Geographic Scope: Market

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 5 South Asia Leads the Annual GDP Growth

Figure 6 New Opportunities in Commercial Aviation

Figure 7 New Airport Construction Projects Share, By Region, 2013

Figure 8 Propylene Glycol Prices, By Region, 2012-2020 ($/T)

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 Data Triangulation Methodology

Figure 12 Assumptions of the Research Study

Figure 13 Evolution of the Aircraft Deicing Market

Figure 14 North America Leads the Aircraft Deicing Market, 2012–2020

Figure 15 APAC to Witness Remarkable Growth During the Review Period

Figure 16 Aircraft Deicing Market, Revenue Pockets, 2020

Figure 17 New Product Launches Will Be the Key Growth Strategy

Figure 18 Attractive Market Opportunities

Figure 19 APAC to Witness High Growth During the Projected Period

Figure 20 Type I & Type Iv Fluids to Witness Healthy Growth

Figure 21 U.S. to Lead the APAC Market

Figure 22 Rotor Blade Ice Protection System

Figure 23 Embeds Technology Compared to Traditional Pneumatic Boots

Figure 24 Market, By Fluid

Figure 25 Market, By Application

Figure 26 Market, By Ground Equipment

Figure 27 Market, By Region

Figure 28 Evolution

Figure 29 Need to Replace Old Equipment is Increasing the Market

Figure 30 Supply Chain Analysis

Figure 31 Value Chain Analysis

Figure 32 Trends in Deicing/Anti-Icing Equipment and Operations

Figure 33 ETOP Analysis

Figure 34 ETOP Analysis of Emerging & Mature Markets

Figure 35 Technological Integration & Product Enhancement

Figure 36 Growth in the Type I Fluid Market

Figure 37 U.S. to Dominate the Type 1 Market By 2020

Figure 38 Europe to Lead the Type 2 Fluid Market Till 2020

Figure 39 Projected Commercial Aircraft Deliveries, (2013-2020)

Figure 40 Market Overview: Commercial Aviation, By Region

Figure 41 Market for Fixed Wing Aircraft Will Witness Rapid Growth By 2020

Figure 42 Commercial Market Size, By Region, 2015-2020 ($Million)

Figure 43 Military Aircraft De-Icing Market Size, By Region, 2015-2020 ($Million)

Figure 44 De-Icing Trucks Market, By Region

Figure 45 Sweepers Market, By Region

Figure 46 Others (Mechanical Methods) Market, By Region

Figure 47 Geographic Snapshot (2015) – Rapid Growth Markets Are Emerging as Hotspots

Figure 48 Russia and U.K.: Attractive Markets for Aircraft De-Icing

Figure 49 North America: Market Snapshot (2015)

Figure 50 Europe: Market Snapshot (2015)

Figure 51 Asia-Pacific: Market Snapshot (2015)

Figure 52 Organic and Inorganic Growth Strategies Followed By Key Players in the Market, 2012-2014

Figure 53 Market Share Analysis, 2013

Figure 54 Market, By Region (2014)

Figure 55 Market Evolution Framework, 2012-2014

Figure 56 Company Landscape, 2013

Figure 57 The Dow Chemical Company.: Company Snapshot

Figure 58 SWOT Analysis: the Dow Chemical Company

Figure 59 JBT Corporation: Company Snapshot

Figure 60 SWOT Analysis: JBT Corporation

Figure 61 Clariant Corporation.: Company Snapshot

Figure 62 SWOT Analysis: Clariant Corporation

Figure 63 Vestergaard: Company Snapshot

Figure 64 SWOT Analysis: Vestergaard

Figure 65 Cryotech Deicing Technology.: Company Snapshot

Figure 66 Kilfrost: Company Snapshot

Figure 67 Contego Systems: Company Snapshot

Figure 68 BASF Corporation: Company Snapshot

Figure 69 B/E Aerospace: Company Snapshot

Figure 70 UTC Aerospace Systems: Company Snapshot

Figure 71 Global Ground Support LLC: Company Snapshot

Figure 72 Safeaero I Trelleborg AB: Company Snapshot

Figure 73 Weihai Guangtai Airport Equipment Co. Ltd: Company Snapshot

Growth opportunities and latent adjacency in Aircraft De-Icing Market