The study involved four major activities in estimating the current market size for the Ultralight and Light Aircraft market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Dow Jones Factiva and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases. Secondary sources referred for this research study included General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

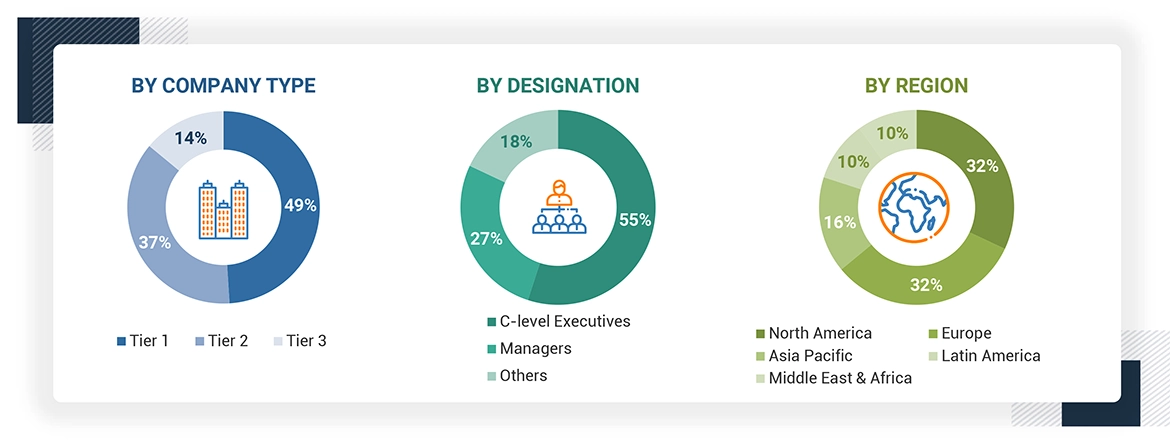

The Ultralight and Light Aircraft Market comprises several stakeholders, such as raw material providers, Ultralight and Light Aircraft manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in sensors and wireless connected systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Notes: C-Level includes CEO, COO, and CTO, among others.

Others include sales managers, marketing managers, and product managers.

The tier of the companies has been defined based on their total revenue as of 2019: Tier 1 = > USD 1 billion,

Tier 2 = From USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

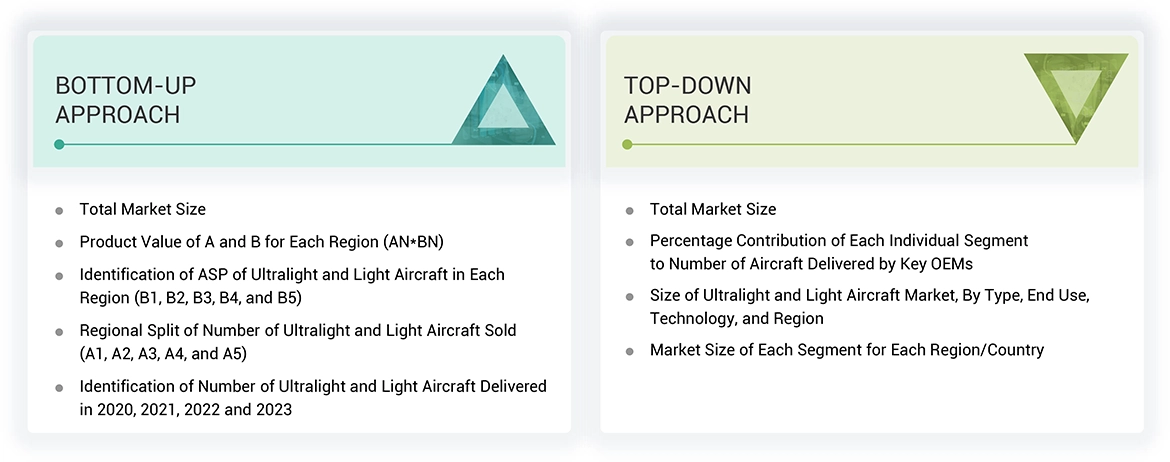

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Ultralight and Light Aircraft market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

-

Key players in the industry and markets were identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the ultralight and light aircraft market. All types of new aircraft delivered were considered to calculate the size of the ultralight and light aircraft market. This data was segmented based on aircraft type, propulsion, technology, and flight operation. The number of each type of aircraft delivered was then multiplied by its respective Average Selling Price (ASP). ASPs of aircraft were identified based on the model and type of aircraft.

Market size estimation methodology: Top-down approach

In the top-down approach, the size of the ultralight and light aircraft market was used to estimate the sizes of individual segments through percentage splits obtained from primary and secondary research. For the calculation of the size of specific market segments, the size of the immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenues obtained for various other segments.

The ultralight and light aircraft market was considered a part of the global aviation market due to its significant share in the market. The market size of each segment was cross-checked and validated to arrive at a common value. Similar methodologies were adopted to determine the sizes of different subsegments of the ultralight and light aircraft market. For instance, in the aircraft type, parameters such as aircraft cost, MTOW, seating capacity, and aircraft range were considered to arrive at the market split for various aircraft models and aircraft types.

Market shares were estimated for each company to verify revenue shares used in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the size of the parent market and each individual segment was determined and confirmed. Moreover, the total volumes of the Exports and Imports (EXIM) were also considered for the validation ofto validate the total size of the ultralight and light aircraft market.

Ultralight & Light Aircraft Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the ultralight and light aircraft market from the market size estimation process explained above, the total market size was split into several segments and subsegments. Market breakdown and data triangulation procedures were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for different market segments and subsegments. The data was triangulated by studying various factors from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches.

In the top-down approach, the size of the ultralight and light aircraft market was derived by calculating the country-level data. Moreover, in the bottom-up approach, the market size was derived by estimating the revenues of key companies operating in the market and validating the data acquired through primary research.

The following figure indicates the market breakdown and data triangulation procedures implemented in the market engineering process used to develop this report on the ultralight and light aircraft market.

Market Definition

Ultralight Ultralight and light aircraft are twoentirely different categories of small aviation vehicles that mainly differ in weight and intent. Ultralight aircraft typically weigh less than 600 kg, and these are small, light planes that are mostly utilized for recreational flying, training, and sport aviation. They usually are often designed for single or dual occupancy with the purpose of developing a relatively easy hands-on flying experience. Ultralights are generally restricted as far as speed, altitude, and operational range and, in some countries, have fewer regulatory restrictions, making more room for enthusiasts to fly much more easily.

Light aircraft weigh between 600 to 5700 Kg Light and are used for a variety of jobs such as personal transportation, training, aerial photography, agriculture, and small business operations. Light aircraft generally can carry more passengers, such as up to 10 or more, with advanced avionics more features for safety, and longer ranges. They are generally required to have a private pilot's license to fly in most countries because they adhere to stricter aviation standards. Each of them has positive features with ultralights being very accessible for recreational users and light aircraft for practical and commercial purposes.

Stakeholders

-

Ultralight and Light Aircraft Manufacturers

-

Ultralight and Light Aircraft Material Providers

-

Ultralight and Light Aircraft Propulsion Manufacturers

-

Regulatory Bodies for Light and Ultralight Aircraft

-

Research Institutes and Consultancy Companies

-

Distribution Channels for Ultralight and Light Aircraft Services

Report Objectives

-

To define, describe, and forecast the ultralight and light aircraft market based on point of sale, flight operation, system, technology, propulsion, end use, material, and region.

-

To forecast sizes of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa along with key countries in each of these regions.

-

To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the ultralight and light aircraft market.

-

To identify industry trends, market trends, and technology trends currently prevailing in the ultralight and light aircraft market

-

To provide an overview of the regulatory landscape with respect to ultralight and light aircraft regulations across regions.

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders by identifying key market trends

-

To profile key market players and comprehensively analyze their market shares and core competencies

-

To analyze the degree of competition in the ultralight and light aircraft market by analyzing recent developments such as contracts, agreements, expansions, and new product launches adopted by leading market players

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market

-

To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

1. Micromarkets are defined as further segments and subsegments of the ultralight and light aircraft market included in the report.

2. Core competencies of the companies have been captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakdown of the market segments at country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Ultralight & Light Aircraft Market