The research study for the Speech analytics market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred speech analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering Speech analytics software and services was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing major companies' product portfolios and rating them based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, Speech analytics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to software by functionality, services, deployment modes, business functions, channel, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

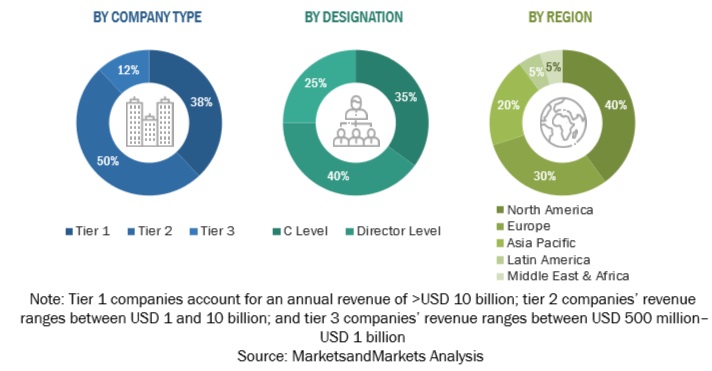

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Speech analytics expertise; related key executives from Speech analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using speech analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Speech analytics software and services, which would impact the overall Speech analytics market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, key Speech analytics and service vendors such as Qualtrics (US), Talkdesk (US), Alvaria (US), Castel Communications (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), 3CLogic (US), Sprinklr (US), Uniphore ( US), Enthu.ai (India), Deepgram (US), Gnani.ai (India), Observe.ai (US), Batvoice (France), Kwantics (India), Convin (India), Salesken (US), Tethr (US), Gong (US), and Clari (US) were identified. These vendors contribute nearly 50%–55% to the global Speech analytics market. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue pertaining to Business Units (BUs) that offer Speech analytics solutions was identified through similar sources. Then, through primaries, the revenue data generated from specific speech analytics software was collected. The collective revenue of key companies that offer speech analytics solutions comprises 40%–50% of the market, which was again confirmed through primary interviews with industry experts.

-

The pricing trend is assumed to vary over time.

-

All the forecasts are made with the standard assumption that the accepted currency is USD.

-

To convert various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

-

All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

-

Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

Demand/end-user analysis: End users operating in verticals across regions are analyzed regarding market spending on Speech analytics based on some of the key use cases. These factors for the Speech analytics industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the Speech analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major Speech analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Speech analytics market size and segments’ size were determined and confirmed using the study.

Report Objectives

-

To define, describe, and predict the speech analytics market by offering (software by functionality and deployment mode, and services), business function, channel, verticals, and region.

-

To provide detailed information on major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth.

-

To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

-

To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

-

To profile key players and comprehensively analyze their market rankings and core competencies.

-

To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

-

To analyze the impact of recession across all the regions across the speech analytics market

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the North American speech analytics market

-

Further breakup of the European market

-

Further breakup of the Asia Pacific market

-

Further breakup of the Middle East and Africa market

-

Further breakup of the Latin America market

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Speech Analytics Market