Audio Communication Monitoring Market by Component (Solutions and Services), Type (Wireless Communication and Wired Communication) , Application, Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2025

Audio Communication Monitoring Market Share, Forecast - Growth 2025

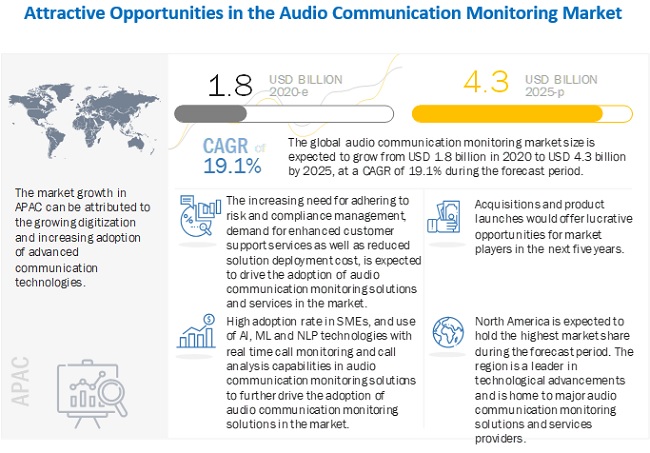

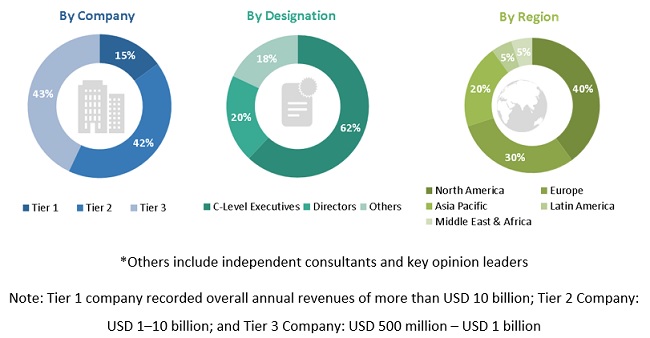

[369 Pages Report] The global Audio Communication Monitoring Market size was surpassed $1.8 billion in 2020 and is anticipated to reach over $4.3 billion by the end of 2025, projecting a effective CAGR of 19.1% during the forecast period (2020-2025). The base year for estimation is 2019 and the market size available for the years 2020 to 2025.

Increasing tele fraudulent activities and cybercrimes, need for analyzing audio conversations in real time, and growing demand for risk and compliance management, are the major factors adding value to the audio communication monitoring offerings, which is expected to provide opportunities for enterprises operating in various verticals in the audio communication monitoring market. Data and information security concerns is one of the major challenges in the audio communication market. Moreover, the lack of awareness of audio communication monitoring solutions acts as a key restraining factor in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

In a short time, the COVID-19 outbreak has affected markets and customers' behavior and has a substantial impact on economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period; major sports and events being postponed; and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them through these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in more advanced analytics such as AI and ML have been called for their expertise to help executives make business decisions on how to respond to the new business challenges caused by the COVID-19 outbreak.

The pandemic has broken down barriers to innovation that blocked progress in the contact center industry for decades. Agents across countries are comfortably performing their jobs in the same secure, compliant way as they would have in a physical office. Where there may have been a lack of trust around home working, the capabilities of cloud contact center technology, such as real-time screen reporting and quality management for supervisors, has enabled contact center managers to maintain the complete visibility over their remote agents’ wellbeing and workload. Never has the call to innovate in the contact center been more clearly heard than now. This pandemic will change several things. For the contact center, it will fundamentally alter the landscape forever, marking the start of a more caring, efficient, agile, and environmentally responsible industry.

Audio Communication Monitoring Market Growth Dynamics

Driver: Increasing tele fraudulent activities and cyber crimes

Innovative businesses in every industry are successfully using automation, intelligence, and multichannel communications to improve collaboration, advance customer satisfaction, and drive sales. At the same time, these businesses are experiencing an unprecedented amount of chaos in the form of unsecured networks, identity frauds, communications overload, and digital distractions that reduce productivity and leave them less secure. Oracle’s ‘Enterprise Networks in Transition: Quieting the Chaos’ survey found that 66% of the respondents identified security as a key network challenge, and at least 83% acknowledged network and telecom fraud as a serious concern. The digital revolution changed the way businesses operate and how consumers make purchases. Consumers expect seamless digital exchanges tailored to their interests and to be able to instantly and securely transact and have any issues and problems resolved immediately. However, when communications are compromised through fraud and data breaches, businesses not only experience loss in revenue and market share but also credibility and trust. Securely and effectively engaging with customers is crucial to success in the 21st century. According to the Communications Fraud Control Association, there was an estimated USD 30 billion revenue loss to businesses worldwide due to telecom frauds in 2017. Fraud incidents can be identified and alerted within a matter of minutes with the help of self-learning and scalable audio communication monitoring solutions that help enterprises and Managed Service Providers (MSPs) detect phone frauds and prevent them before the damage is done.

Restraint: Lack of awareness about audio communication monitoring solutions

The adoption of audio communication monitoring solutions is increasing across verticals. However, consumers have limited knowledge about how these solutions can benefit and compliment their business goals. Similar to all other emerging technologies, audio communication monitoring also faces the challenge of lack of awareness about the technology and potential RoI it can give to the business. This is one of the major restraints that the audio communication monitoring market faces.

Knowing how to ensure security and compliance with the communication strategy is essential to protect businesses from serious disruptions. At the same time, the right communication management strategy helps companies think about how they are going to deploy or provision tools, manage the quality of service, and fight back against risks like toll frauds. Owing to this, businesses need to think of the protection strategies for voice streams, recording any crucial information, and protecting collected data. The extensive encryption strategies combined with effective security and access controls are usually a good starting point when it comes to making communications as compliant as possible. Several audio communication monitoring solution providers ignore the significance of this technology in small- to mid-sized companies where the scope for further growth is available. Targeting companies from developing countries will also assist the audio communication monitoring providers to enhance their scope in the market. In the next five to six years, as the market will gain traction across the globe, an increased level of awareness is expected to be witnessed even in developing regions, which would boost the adoption of audio communication monitoring solutions.

Opportunity: Implementation of AI, analytics, and NLP capabilities to add value to existing audio communication monitoring offerings

The growing use of AI and NLP technologies has enabled companies to build robust communication strategies and add services as well as perform tasks integrated with other multiple platforms. In the audio communication monitoring space, Artificial Intelligence (AI) is being used to enhance user experience and make the human workflow easier. Some collaboration platforms can dynamically add a person to a coworking environment because he/she was mentioned on a call while other platforms enable real-time translations and accurate transcriptions. Audio communication monitoring solutions offer plenty of areas where predictive learning can enhance productivity and help people overcome the little bumps in their workflow. At Microsoft Ignite 2019—Microsoft’s annual gathering for IT professionals and technologists end of 2019—a couple of use cases were revealed that are relevant to AI’s entry into unified communications and how it might affect IT professionals, including a demonstration that used AI to improve web conference or Voice over Internet Protocol (VoIP) conversations. Low-quality network paths can make having a voice conversation untenable, causing voices to drop out and create conversational gaps. Their demo showed how AI could use its learned knowledge (the result of listening to and analyzing real speakers) to see the ‘holes’ and guess how it can fill in any gaps by subbing in voice bits in real time. AI, in other words, can make up for a bad connection, low bandwidth, or a constantly interrupted connection, keeping a voice conversation going, and ensuring a more seamless experience. As technology improves and as humans become more comfortable working with ‘machines’ that help them make smarter decisions, we can expect AI applications in the audio communication monitoring space to skyrocket. The potential is almost limitless. The key vendors in this market are already working in this direction to enhance their product offerings. For instance, in February 2018, Google announced support for seven new languages for actions on the Google Assistant. With this update, the company now provides support for 16 languages, and developers can develop new actions using Dialogflow and its NLP capabilities.

Challenge: Data and information security concerns

Voice communication is the de facto communications channel for businesses. It is also subject to security loopholes. Hence, it is vital to use advanced encryption methods to secure communications channels. More technologies in the same place also mean that business leaders need to have the right management strategies in place. Knowing how to ensure security and compliance with the communication strategy is essential to protecting businesses from serious disruptions. Security, redundancy, geo-diversity, and failover planning are critical components of a highly available network. Data privacy is the major barrier for audio communication monitoring solution providers and end users. Audio communication monitoring can make customers feel uncomfortable, as their personal details are being shared among companies. Unstructured planning, with little coordination among various business administration agencies, is one of the major concerns for data analysis in business applications that creates privacy issues. Governments provide guidelines in support of opt-in-permission before allowing an application to access the communication-based data. These privacy guidelines can vary from carrier to carrier, device to device, and platform to platform. Privacy concerns related to communication-based analytics include certain factors, such as the fact that customers should receive an appropriate notice that an application would collect and use their respective data. Employees working all over the world need a strategy in place to ensure they do not fall into dangerous habits when sharing and managing information. Encryption and safety tools need to be in place to keep data protected both at rest and in transit. Some companies may need to even think about the compliance strategies that they can use to avoid problems with things, such as recordings of meetings and collaboration sessions. The future might be in collaboration, but like any transformation, making the most of this evolution requires the right strategy.

By component, the solutions segment is expected to account for the higher market share during the forecast period

By solution, the solutions segment is expected to account for a higher market share during the forecast period. The high market share of solutions is attributed to the high adoption of audio communication monitoring solutions across verticals to aid in resolving customer queries through surveillance. These solutions are further capable of creating a detailed analysis of the voice communication through the integration of various technologies. Audio communication monitoring solutions comprise reporting and analytics; call recording software and quality analysis; and audio loudness, metering, and monitoring. These solutions help businesses to not only maintain audit and compliance needs but also in getting the right insights to the right people at the right time. Most of these solutions offered are claimed to be easy to deploy and are feature-rich to address rigors and requirements of communication centers. This helps in capturing all forms of audio— VoIP, analog, and digital telephony—a critical necessity for contact centers, with support for a wide range of Private Branch Exchange (PBX) platforms, extensions, and IP switches. These solutions are further capable of creating a detailed analysis of the voice communication through the integration of various technologies that range from analytics, NLP, and AI, to deliver actionable insights to businesses. Most of the enterprises leverage the audio communication monitoring solutions to understand the conversational data generated and leverage the same to achieve operational efficiencies. The audio communication monitoring solution providers offer end-to-end solutions to cater to the industry-specific requirements of verticals, such as BFSI, media and entertainment, retail and eCommerce, telecom and IT, government, and healthcare and life sciences.

By deployment mode, the cloud deployment segment to record the higher CAGR during the forecast period

The deployment mode in the audio communication monitoring market includes on-premises and cloud. Deployment refers to the setting-up of an IT infrastructure with hardware, operating systems, and applications that are required to manage the IT ecosystem. Audio communication monitoring solutions can be deployed on any one deployment mode based on security, availability, and scalability. The majority of audio communication monitoring solutions are getting deployed on the cloud as it offers advantages, such as reduced operational costs, simple deployments, and higher scalability. This deployment mode is expected to show high growth in the near future.

By application, the law enforcement agencies application segment to record the higher CAGR during the forecast period

In the audio communication monitoring market by application, the intelligent law enforcement agencies segment is expected to record the higher CAGR during the forecast period. The growth is attributed to the need of government and law enforcement agencies to identify and track criminal activities, such as human trafficking, narco-trafficking, terrorism, cybercrime, child pornography, frauds, and other threats related to personal safety and national security. The solutions have enabled enterprises to capture every call based on telephony and VoIP recording. These solutions have provided the Public Safety Answering Point (PSAP), transportation industries, and other government agencies clear with visibility of all types of threats and incidents. Audio communication monitoring has made criminal investigations easier as the police officers can use the internet and control their PCs through their voice, which results in content getting commands much faster through voice over the internet, further increasing the efficiency of the police officers in case of emergency.

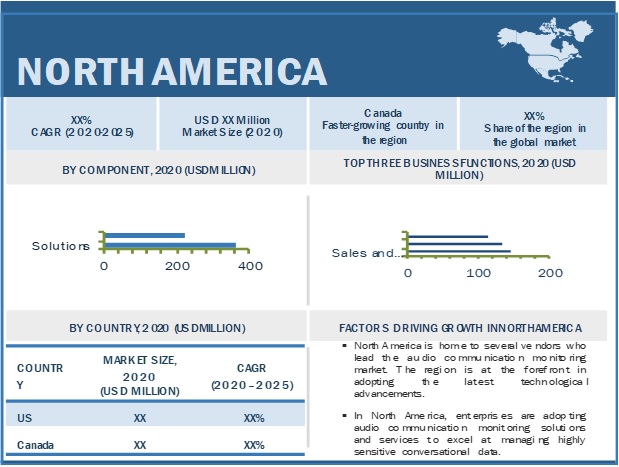

North America to account for the largest market size during the forecast period

North America is expected to hold the largest market size in the global audio communication monitoring market during the forecast period. The US has emerged as the largest market, due to the increasing investments and a growing presence of vendors who are exploring the use of AI and NLP technologies for various applications. The US market widely adopts AI and NLP technologies in its business establishments and other verticals, catering to customers in a better way and continually improving business efficiencies. The country has advanced infrastructure, innovations, and initiatives necessary to evolve audio communication monitoring into robust solutions with innovative benefits.

To know about the assumptions considered for the study, download the pdf brochure

Audio Communication Monitoring Companies

The major audio communication monitoring companies in this market areNICE (Germany), Cisco (US), IBM (US), Enghouse Interactive (US), Google (US), AudioCodes (Israel), Integrated Research (Australia), Martello Technologies (Canada), Nuance Communication (US), Avaya (US), Veritone (US), Relativity (US), PathSolutions (US), Empirix (US), Genesys (US), Nectar (US), Behavox (US), Vyopta (US), Intelligent Voice (UK), Ameyo (India), Elastix (Spain), Dashbase (US), Ribbon Communications (US), Deepgram (US), Haloocom (India), Toku (Singapore), Servetel (India), CloudTalk (India), Dialer360 (UK), and JustCall (UK).

Cisco (US) caters to a broad customer base in the regions of the Americas, EMEA, and APAC. The company deals in IT-related software and hardware products, which cater to a wide range of verticals, such as energy, government, education, financial services, retail, sports and entertainment, manufacturing, healthcare, transportation, and hospitality. In the audio communication monitoring market, Cisco offers cognitive Contact Center and Unified Communications (UC) solutions that provide integration of tools, such as IP telephony for voice calling, web and video conferencing, and voice mail, with user experiences that help people work together more effectively.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Solutions and Services), Type (Wireless Communication and Wired Communication) , Application, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Audio Communication Monitoring |

NICE (Germany), Cisco (US), IBM (US), Enghouse Interactive (US), Google (US), AudioCodes (Israel), Integrated Research (Australia), Martello Technologies (Canada), Nuance Communication (US), Avaya (US), Veritone (US), Relativity (US), PathSolutions (US), Empirix (US), Genesys (US), Nectar (US), Behavox (US), Vyopta (US), Intelligent Voice (UK), Ameyo (India), Elastix (Spain), Dashbase (US), Ribbon Communications (US), Deepgram (US), Haloocom (India), Toku (Singapore), Servetel (India), CloudTalk (India), Dialer360 (UK), and JustCall (UK) |

The research report categorizes the audio communication monitoring market to forecast the revenues and analyze trends in each of the following subsegments:

Audio Communication Monitoring Market By Component

- Solutions

-

Services

- Professional Services

- Managed Services

Audio Communication Monitoring Market By Type

- Wireless Communication

- Wired Communication

Audio Communication Monitoring Market By Application

- On-Premises

- Cloud

Audio Communication Monitoring Market By Technology

- Law Enforcement Agencies

- Sales and Internal Communication Monitoring

- Commercial Areas

- Broadcast Monitoring

- Others (Sensitive Areas and Employee/Agent Performance Monitoring)

Audio Communication Monitoring Market By Deployment Mode

- On-premises

- Cloud.

Audio Communication Monitoring Market By Organization Size

- SMEs

- Large Enterprises

Audio Communication Monitoring Market By Vertical

- BFSI

- Media and Entertainment

- Retail and eCommerce

- Telecom and IT

- Government

- Healthcare and Life Sciences

- Others (Travel and Hospitality, Education, and Transportation and Logistics)

Audio Communication Monitoring Market By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments in Audio Communication Monitoring Market

- In May 2020, NICE introduced NEVA@home helping organizations to provide with ease continued service excellence to their employees even when working remotely, driving an immediate impact on service excellence for the work at home employees. NICE has made available the NEVA Starter Kit to help organizations get up and running with NEVA on every employee desktop and realize value within days.

- In May 2020, NICE inConnect, a NICE business, partnered with Zendesk to support contact centers responding to the changing customer demands. Companies can now use NICE inContact CXone@home with the Zendesk Support Suite and the complimentary Zendesk Remote Support Bundle to help remote contact center and help desk teams keep up with increased interactions due to COVID-19. Both NICE inContact CXone@home and Zendesk Remote Support Bundle enable a fully virtual contact center for business continuity, productivity, and service reliability. The partnership ensures agents have a full view of the customer in an easy-to-use workspace.

- In May 2020, Relativity announced the opening of two new datacentres in Europe in Q3 2020, as it invests in expanding RelativityOne and Relativity Trace in EMEA. The new datacentres in Germany and Switzerland bring Relativity up to a total of 10 datacentres across nine countries.

- In May 2020, Enghouse Interactive signed a partnership agreement with converse360 as a member of its EMEA partner program integrating their service automation and AI technology with Enghouse’s flagship Communications Center (CC) solution. As part of the new alliance, converse360 will market, sell, and deliver Enghouse’s advanced customer experience solutions.

- In April 2020, NICE inContact, a NICE business announced that its CXone@home offering has been expanded to include the complete suite of Workforce Engagement and Optimization (WFO) capabilities to ensure agents are productive while working from home. The fully integrated, enterprise-grade cloud platform provides contact centers flexibility, speed, and the ability to manage costs with a superior alternative to on-premises systems not built for remote work.

- In April 2020, Nuance Communications announced the Voice-to-Agent solution. This solution will eliminate the process of putting customers on hold. It has enabled companies to add Nuance Voice-to-Agent Messaging to their IVR system so that customers can leave voice message containing their requests of any length instead of waiting on hold. It is an addition to Nuance IVR-to-Digital solution suite.

- In April 2020, Martello acquired GSX as a part of its strategic investment to strengthen its Digital Experience Monitoring (DEM) capabilities. GSX is a Microsoft Gold Partner in both Messaging and Cloud Productivity. This acquisition will extend the DEM capabilities of Martello Technologies. Owing to the global shift toward remote work and cloud-based communication tools, market opportunities for Martello has increased.

- In April 2020, NICE inContact, a NICE business, partnered with Zoom Video Communications to provide an integrated solution to quickly and productively enable remote employee collaboration and distributed virtual contact centers. The partnership helps address rapidly changing customer needs and business continuity demands.

- In April 2020, NICE inContact, a NICE business, partnered with RingCentral to enable organizations in rapidly transitioning their entire workforce, including contact center agents, to work from home. The offer includes NICE inContact CXone@home, a special edition of the enterprise-grade NICE inContact CXone cloud contact center platform, which can be fully operational in 48 hours and is free for 45 days for new customers. The partnership provides organizations with solutions that include cloud PBX, video meetings, and team messaging capabilities running on a carrier-grade infrastructure with a 99.99% uptime SLA.

- In April 2020, AudioCodes announced a collaboration with Google Dialogflow virtual agents to bring telephony voice services to Google Dialogflow. Through the collaboration, AudioCodes solution enables the rapid purchase and integration of phone numbers, with virtual agents developed on Google Dialogflow.

- In March 2020, NICE Launched WEM@home to help organizations maintain service levels and agent engagement while working from home. The solution provides advanced remote management capabilities to maintain productivity and helps supervisors managing hundreds or thousands of employees, each working remotely, to maintain team engagement and KPIs in less than 48 hours.

- In March 2020, NICE launched CXone@home, a cloud native offering designed to enable contact centers that are not using CXone to respond to COVID-19 and transition their workforce to work from home in 48 hours or less. The solution is offered with no commitment, no contract, and free for 45 days to aid the necessity of fast transition to the cloud.

- In March 2020, NICE inContact is providing a free work from home module for users of the NICE inContact CXone cloud customer experience platform to maintain service continuity while employees need to work from home. To support the potential increase in call volume that 211 and 311 organizations may receive, NICE inContact is providing free voice call ports to these organizations for the next six months. NICE inContact is also offering a free business continuity planning review to verify that work from home and geographic flexibility can be performed without interruption to the business.

- In March 2020, AudioCodes launched work-at-home solutions to support business continuity, along with free SBC and OVOC licenses for 90 days. The work-at-home solutions provided by AudioCodes focus on Microsoft Teams users, remote contact center agents, and secure VPN-less voice connectivity.

- In February 2020, Enghouse Interactive partnered with MJ Flood Technology, providing MJ Flood Technology with the accreditation to sell, implement, and support the Enghouse Interactive Communications Centre (CC) and Quality Management Suite (QMS) to customers across vertical sectors. This strategic partnership will compliment MJ Flood Technology’s acclaimed Microsoft offering in strengthening their proposition with the Microsoft Teams collaboration enterprise voice environment.

- In January 2020, Cisco announced three developments to its Contact Center portfolio that include new integrations with Voicea and Google Cloud’s Contact Center AI (CCAI) and a new customer experience solution, Webex Experience Management. The update empowers contact center staff with real-time visibility into how customers are feeling to radically change the customer experience.

- In January 2020, Enghouse Systems acquired Dialogic Group strengthening Enghouse Systems’ position in the enterprise video and unified communications market segment by adding rich multi-media processing applications and capabilities. The acquisition adds Dialogic’s network infrastructure solutions that facilitate virtualization, the evolution to 5G networks and the transition of networks from hardware to software-defined network connectivity for Enghouse Systems’ product portfolio.

- In December 2019, AudioCodes expanded collaboration with AWS and Amazon Chime. The expansion will allow customers to benefit from advanced phone call analytics, such as transcription and sentiment analysis from AWS. As a part of the extended collaboration, AudioCodes’ Mediant Session Border Controllers (SBCs) have also been successfully tested with the Amazon Chime Voice Connector SIP-based Media Recording (SIPREC) streaming capability.

- In October 2019, With the update, Nexidia Analytics now includes AutoDiscovery capabilities, which leverage AI-based unsupervised ML, providing organizations with cross-channel insights on service anomalies and surfaces areas that are customer pain points. As a result, organizations can swiftly remedy issues as they grow, improving customer experiences and loyalty.

- In October 2019, Enghouse Systems acquired Eptica S.A., helping expand Enghouse Contact Centre presence in France. The acquisition provides Enghouse with an important entry point into the French market for organic and acquisitive expansion combining the Eptica product suite with the complementary Enghouse contact center product into an effective solution for the market.

- In October 2019, Cisco partnered with Samsung to enable an intelligent and unified experience of Webex solutions across Samsung mobile devices. This alliance was founded with the goal to make it easier for personal and business users to collaborate with each other.

- In October 2019, Martello Technologies partnered with SecureServ. This partnership will help Martello to resell its products and solutions in Australian market as SecureServ is an Australian cybersecurity solutions and network performance reseller. This partnership will drive and support digital transformation in Australia.

Frequently Asked Questions (FAQ):

What is the Audio Communication Monitoring Market Size?

The Audio Communication Monitoring Market size was valued $1.8 billion in 2020 and is anticipated to increase up to $4.3 billion by the end of 2025.

What is the Audio Communication Monitoring Market Growth?

The global Audio Communication Monitoring Market is expected to grow at a CAGR of 19.1% from 2020 to 2025.

Which are the leading Audio Communication Monitoring Companies?

The companies covered in audio communication monitoring market are NICE (Germany), Cisco (US), IBM (US), Enghouse Interactive (US), Google (US), AudioCodes (Israel), Integrated Research (Australia), Martello Technologies (Canada), Nuance Communication (US), Avaya (US), Veritone (US), Relativity (US), PathSolutions (US), Empirix (US), Genesys (US), Nectar (US), Behavox (US), Vyopta (US), Intelligent Voice (UK), Ameyo (India), Elastix (Spain), Dashbase (US), Ribbon Communications (US), Deepgram (US), Haloocom (India), Toku (Singapore), Servetel (India), CloudTalk (India), Dialer360 (UK), and JustCall (UK).

What are the top industries adopting Audio Communication Monitoring Market?

The following are major industries adoptingaudio communication monitoring market are BFSIMedia and EntertainmentRetail and eCommerceTelecom and ITGovernmentHealthcare and Life SciencesOthers (Travel and Hospitality, Education, and Transportation and Logistics).

What are various Challenges and Opportunity inAuto Communication monitoring market?

The various challenges and opportunity in Auto Communication monitoring market are

Challenges:Data and information security concerns

Opportunities:Implementation of AI, analytics, and NLP capabilities to add value to existing audio communication monitoring offerings.

What are the top applications covered in audio communication monitoring market?

The top applications include law enforcement agencies, sales and internal communication monitoring, commercial areas, broadcast monitoringand others (sensitive areas and employee/agent performance monitoring) in audio communication monitoring market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 48)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 58)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL AUDIO COMMUNICATION MONITORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF AUDIO COMMUNICATION MONITORING THROUGH OVERALL AUDIO COMMUNICATION MONITORING SPENDING

FIGURE 10 AUDIO COMMUNICATION MONITORING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

TABLE 4 IMPACT OF COVID-19

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 11 COMPETITIVE LEADERSHIP MAPPING MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 12 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 71)

TABLE 5 GLOBAL AUDIO COMMUNICATION MONITORING MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

FIGURE 13 MARKET SNAPSHOT, BY COMPONENT

FIGURE 14 MARKET SNAPSHOT, BY TYPE

FIGURE 15 MARKET SNAPSHOT, BY SERVICE

FIGURE 16 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 17 MARKET SNAPSHOT, BY APPLICATION

FIGURE 18 MARKET SNAPSHOT, BY VERTICAL

FIGURE 19 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 77)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN AUDIO COMMUNICATION MONITORING MARKET

FIGURE 20 INCREASING DEMAND TO MOVE FROM TRADITIONAL PRIVATE BRANCH EXCHANGE TO COLLABORATIVE PLATFORMS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 21 COMMERCIAL AREAS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 22 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE IN 2020

4.4 MARKET IN NORTH AMERICA, BY SOLUTION AND VERTICAL

FIGURE 23 CALL RECORDING SOFTWARE AND QUALITY ANALYSIS SOLUTIONS, AND TELECOM AND IT VERTICAL IN NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARES IN MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 80)

5.1 INTRODUCTION

5.2 MARKET EVOLUTION

5.3 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AUDIO COMMUNICATION MONITORING MARKET

5.3.1 DRIVERS

5.3.1.1 Increasing tele fraudulent activities and cyber crimes

5.3.1.2 Need for analyzing audio conversations in real time

5.3.1.3 Growing demand for risk and compliance management

5.3.1.4 Rising demand for remote contact centers during COVID-19 pandemic

5.3.2 RESTRAINTS

5.3.2.1 Lack of awareness about audio communication monitoring solutions

5.3.2.2 Legacy system architecture

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging need for audio communication monitoring solutions among SMEs

5.3.3.2 Implementation of AI, analytics, and NLP capabilities to add value to existing audio communication monitoring offerings

5.3.4 CHALLENGES

5.3.4.1 Data and information security concerns

5.3.4.2 Maintaining business continuity during COVID-19 pandemic

5.4 CUMULATIVE GROWTH ANALYSIS

5.5 ADJACENT/RELATED MARKETS SNAPSHOT

TABLE 6 AUDIO COMMUNICATION MONITORING MARKET: ADJACENT/RELATED MARKETS

5.6 AVERAGE SELLING PRICE TREND

5.6.1 INTRODUCTION

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.8 ECOSYSTEM

FIGURE 26 MARKET: ECOSYSTEM

5.9 TECHNOLOGY ANALYSIS

5.9.1 NATURAL LANGUAGE PROCESSING

5.9.2 PHONETIC SEARCH TECHNIQUE

5.9.3 ARTIFICIAL INTELLIGENCE

5.1 CASE STUDY ANALYSIS

5.10.1 INTRODUCTION

5.10.1.1 Use case: Scenario 1

5.10.1.2 Use case: Scenario 2

5.10.1.3 Use case: Scenario 3

5.10.1.4 Use case: Scenario 4

5.10.1.5 Use case: Scenario 5

6 AUDIO COMMUNICATION MONITORING MARKET: COVID-19 IMPACT (Page No. - 96)

FIGURE 27 MARKET TO WITNESS A MINOR DECLINE BETWEEN 2020 AND 2021

7 AUDIO COMMUNICATION MONITORING MARKET, BY COMPONENT (Page No. - 98)

7.1 INTRODUCTION

7.1.1 COMPONENTS: COVID-19 IMPACT ON MARKET

7.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 SOLUTIONS

FIGURE 29 REPORTING AND ANALYTICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 9 MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 SOLUTIONS: AUDIO COMMUNICATION MONITORING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.1 REPORTING AND ANALYTICS

7.2.2 CALL RECORDING SOFTWARE AND QUALITY ANALYSIS

7.2.3 AUDIO LOUDNESS, METERING, AND MONITORING

7.2.3.1 LTE/VoLTE monitoring

7.2.3.2 Audio communication surveillance monitoring

7.2.3.3 Media monitoring

7.3 SERVICES

FIGURE 30 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 13 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 AUDIO COMMUNICATION MONITORING MARKET, BY TYPE (Page No. - 108)

8.1 INTRODUCTION

8.1.1 TYPES: COVID-19 IMPACT ON MARKET

8.1.2 TYPES: MARKET DRIVERS

FIGURE 31 WIRELESS COMMUNICATION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 18 MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

8.2 WIRELESS COMMUNICATION

TABLE 19 WIRELESS COMMUNICATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 WIRELESS COMMUNICATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 WIRED COMMUNICATION

TABLE 21 WIRED COMMUNICATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 WIRED COMMUNICATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 AUDIO COMMUNICATION MONITORING MARKET, BY APPLICATION (Page No. - 113)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: COVID-19 IMPACT ON MARKET

9.1.2 APPLICATIONS: MARKET DRIVERS

FIGURE 32 LAW ENFORCEMENT AGENCIES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 24 MARKET SIZE, BY APPLICATION , 2019–2025 (USD MILLION)

9.2 LAW ENFORCEMENT AGENCIES

9.3 SALES AND INTERNAL COMMUNICATION MONITORING

9.4 COMMERCIAL AREAS

9.5 BROADCAST MONITORING

9.6 OTHERS

10 AUDIO COMMUNICATION MONITORING MARKET, BY DEPLOYMENT MODE (Page No. - 118)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODE: COVID-19 IMPACT ON MARKET

10.1.2 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 33 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 25 MARKET SIZE, BY DEPLOYMENT MODE , 2016–2019 (USD MILLION)

TABLE 26 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

10.2 CLOUD

TABLE 27 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 ON-PREMISES

TABLE 29 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 AUDIO COMMUNICATION MONITORING MARKET, BY ORGANIZATION SIZE (Page No. - 123)

11.1 INTRODUCTION

11.1.1 ORGANIZATION SIZE: COVID-19 IMPACT ON MARKET

11.1.2 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 32 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 SMALL AND MEDIUM-SIZED ENTERPRISES : MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 LARGE ENTERPRISES

TABLE 35 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 AUDIO COMMUNICATION MONITORING MARKET, BY VERTICAL (Page No. - 128)

12.1 INTRODUCTION

12.1.1 VERTICALS: COVID-19 IMPACT ON MARKET

12.1.2 VERTICALS: MARKET DRIVERS

FIGURE 35 RETAIL AND ECOMMERCE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 38 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

12.3 MEDIA AND ENTERTAINMENT

12.4 RETAIL AND ECOMMERCE

12.5 TELECOM AND IT

12.6 GOVERNMENT

12.7 HEALTHCARE AND LIFE SCIENCES

12.8 OTHERS VERTICAL

13 AUDIO COMMUNICATION MONITORING MARKET, BY REGION (Page No. - 135)

13.1 INTRODUCTION

FIGURE 36 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: COVID-19 IMPACT

13.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

13.2.4 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

13.2.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

13.2.6 CALIFORNIA CONSUMER PRIVACY ACT

13.2.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: AUDIO COMMUNICATION MONITORING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.2.8 UNITED STATES

13.2.9 CANADA

13.3 EUROPE

13.3.1 EUROPE: AUDIO COMMUNICATION MONITORING MARKET DRIVERS

13.3.2 EUROPE: COVID-19 IMPACT ON MARKET

13.3.3 EUROPE: REGULATORY IMPLICATIONS

13.3.4 GENERAL DATA PROTECTION REGULATION

TABLE 59 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.3.5 UNITED KINGDOM

13.3.6 GERMANY

13.3.7 FRANCE

13.3.8 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: AUDIO COMMUNICATION MONITORING MARKET DRIVERS

13.4.2 ASIA PACIFIC: COVID-19 IMPACT

13.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

13.4.4 PERSONAL DATA PROTECTION ACT

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.4.5 CHINA

13.4.6 JAPAN

13.4.7 INDIA

13.4.8 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: AUDIO COMMUNICATION MONITORING MARKET DRIVERS

13.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

13.5.3 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

13.5.4 PERSONAL DATA PROTECTION LAW

TABLE 95 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.5.5 MIDDLE EAST

13.5.6 SOUTH AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: AUDIO COMMUNICATION MONITORING MARKET DRIVERS

13.6.2 LATIN AMERICA: COVID-19

13.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

13.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

TABLE 113 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.6.5 BRAZIL

13.6.6 MEXICO

13.6.7 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 183)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK

14.3 MARKET SHARE OF KEY PLAYERS IN AUDIO COMMUNICATION MONITORING MARKET, 2019

FIGURE 41 MARKET SHARE OF KEY PLAYERS, 2019

14.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

14.4.1 INTRODUCTION

FIGURE 42 HISTORIC FIVE-YEAR REVENUE ANALYSIS OF KEY MARKET PLAYERS

14.5 KEY MARKET DEVELOPMENTS

14.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 131 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2020

14.5.2 BUSINESS EXPANSIONS

TABLE 132 BUSINESS EXPANSIONS, 2019–2020

14.5.3 MERGERS AND ACQUISITIONS

TABLE 133 MERGERS AND ACQUISITIONS, 2018–2019

14.5.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 134 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2019–2020

15 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 194)

15.1 OVERVIEW

15.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

15.2.1 RANKING OF KEY PLAYERS IN AUDIO COMMUNICATION MONITORING MARKET, 2020

FIGURE 43 RANKING OF KEY PLAYERS, 2020

15.3 COMPANY EVALUATION MATRIX, 2020

15.3.1 STAR

15.3.2 EMERGING LEADERS

15.3.3 PERVASIVE

FIGURE 44 AUDIO COMMUNICATION MONITORING MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

15.4 STARTUP/SME EVALUATION MATRIX, 2020

15.4.1 PROGRESSIVE COMPANIES

15.4.2 RESPONSIVE COMPANIES

15.4.3 STARTING BLOCKS

FIGURE 45 AUDIO COMMUNICATION MONITORING MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

15.5 COMPANY PROFILES

(Business overview, Solutions and Services offered, Covid-19 development, SWOT analysis, Recent developments, and MNM view)*

15.5.1 NICE

FIGURE 46 NICE: COMPANY SNAPSHOT

FIGURE 47 NICE: SWOT ANALYSIS

15.5.2 CISCO

FIGURE 48 CISCO: COMPANY SNAPSHOT

FIGURE 49 CISCO: SWOT ANALYSIS

15.5.3 IBM

FIGURE 50 IBM: COMPANY SNAPSHOT

FIGURE 51 IBM: SWOT ANALYSIS

15.5.4 ENGHOUSE INTERACTIVE

FIGURE 52 ENGHOUSE INTERACTIVE: COMPANY SNAPSHOT

FIGURE 53 ENGHOUSE INTERACTIVE: SWOT ANALYSIS

15.5.5 GOOGLE

FIGURE 54 GOOGLE: COMPANY SNAPSHOT

FIGURE 55 GOOGLE: SWOT ANALYSIS

15.5.6 AUDIOCODES

FIGURE 56 AUDIOCODES: COMPANY SNAPSHOT

15.5.7 INTEGRATED RESEARCH

FIGURE 57 INTEGRATED RESEARCH: COMPANY SNAPSHOT

15.5.8 MARTELLO TECHNOLOGIES

FIGURE 58 MARTELLO TECHNOLOGIES: COMPANY SNAPSHOT

15.5.9 NUANCE COMMUNICATIONS

FIGURE 59 NUANCE COMMUNICATIONS: COMPANY SNAPSHOT

15.5.10 AVAYA

FIGURE 60 AVAYA: COMPANY SNAPSHOT

15.5.11 VERITONE

FIGURE 61 VERITONE: COMPANY SNAPSHOT

15.5.12 RELATIVITY

15.5.13 PATHSOLUTIONS

15.5.14 EMPIRIX

15.5.15 GENESYS

15.5.16 NECTAR

15.5.17 BEHAVOX

15.5.18 VYOPTA

15.5.19 INTELLIGENT VOICE

15.5.20 AMEYO

15.5.21 ELASTIX

15.5.22 DASHBASE

15.5.23 RIBBON COMMUNICATIONS

15.5.24 DEEPGRAM

15.5.25 HALOOCOM

15.5.26 TOKU

15.5.27 SERVETEL

15.5.28 CLOUDTALK

15.5.29 DIALER360

15.5.30 JUSTCALL

*Details on Business overview, Solutions and Services offered, Covid-19 development, SWOT analysis, Recent developments, and MNM view might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 264)

16.1 ADJACENT/RELATED MARKETS

16.1.1 CLOUD-BASED CONTACT CENTER MARKET

TABLE 135 CHATBOT MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 136 PROFESSIONAL SERVICES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 137 MANAGED SERVICES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 138 CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 139 CALL ROUTING AND QUEUING: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 140 DATA INTEGRATION AND RECORDING: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 141 CHAT QUALITY AND MONITORING: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 142 REAL-TIME DECISION MAKING: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 143 WORKFORCE OPTIMIZATION: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 144 CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

TABLE 145 PUBLIC CLOUD: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 146 PRIVATE CLOUD: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 147 HYBRID CLOUD: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 148 CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 149 LARGE ENTERPRISES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 150 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 151 CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 152 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 153 CONSUMER GOODS AND RETAIL: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 154 GOVERNMENT AND PUBLIC SECTOR: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 155 HEALTHCARE AND LIFE SCIENCES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 156 MANUFACTURING: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 157 MEDIA AND ENTERTAINMENT: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 158 TELECOMMUNICATION AND ITES: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 159 OTHERS: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 160 CLOUD-BASED CONTACT CENTER MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 161 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 162 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 163 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL 2015–2022 (USD MILLION)

TABLE 164 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 165 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 166 EUROPE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 167 EUROPE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 168 EUROPE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

TABLE 169 EUROPE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 170 EUROPE: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 171 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 172 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 173 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

TABLE 174 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 175 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 181 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 182 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 183 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

TABLE 184 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 185 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

16.1.2 WEB REAL-TIME COMMUNICATION MARKET

TABLE 186 WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 187 WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 188 SOLUTION: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 189 VOICE CALLING AND CONFERENCING: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 190 MESSAGING AND FILE SHARING: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 191 VIDEO CALLING AND CONFERENCING: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 192 OTHERS: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 193 WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 194 SERVICE: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 195 IMPLEMENTATION AND INTEGRATION SERVICES: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 196 CONSULTING SERVICES: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 197 OTHER SERVICES: WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 198 WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 199 IT AND TELECOM: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 200 MEDIA AND ENTERTAINMENT: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 201 BANKING, FINANCIAL SERVICES, AND INSURANCE: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 202 RETAIL AND CONSUMER GOODS: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 203 PUBLIC SECTOR AND EDUCATION: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 204 HEALTHCARE: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 205 TRANSPORTATION AND LOGISTICS: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 206 OTHERS: WEBRTC MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 207 WEBRTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 208 NORTH AMERICA: WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 209 NORTH AMERICA: WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 210 NORTH AMERICA: WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 211 NORTH AMERICA: WEBRTC VIDEO CALLING AND CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 212 NORTH AMERICA: WEBRTC VOICE CALLING AND CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 213 NORTH AMERICA: WEBRTC MESSAGING AND FILE SHARING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 214 NORTH AMERICA: OTHER WEBRTC SOLUTIONS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 215 NORTH AMERICA: WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 216 NORTH AMERICA: WEBRTC IMPLEMENTATION AND INTEGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 217 NORTH AMERICA: WEBRTC CONSULTING SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 218 NORTH AMERICA: OTHER WEBRTC SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 219 EUROPE: WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 220 EUROPE: WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 221 EUROPE: WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 222 EUROPE: WEBRTC MESSAGING AND FILE SHARING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 223 EUROPE: WEBRTC VOICE CALLING AND CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 224 EUROPE: WEBRTC VIDEO CALLING AND CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 225 EUROPE: OTHER WEBRTC SOLUTIONS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 226 EUROPE: WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 227 EUROPE: WEBRTC IMPLEMENTATION AND INTEGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 228 EUROPE: WEBRTC CONSULTING SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 229 EUROPE: WEBRTC OTHER SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 230 ASIA PACIFIC: WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 231 ASIA PACIFIC: WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 232 ASIA PACIFIC: WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 233 ASIA PACIFIC: WEBRTC MESSAGING & FILE SHARING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 234 ASIA PACIFIC: WEBRTC VOICE CALLING & CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 235 ASIA PACIFIC: WEBRTC VIDEO CALLING & CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 236 ASIA PACIFIC: OTHER WEBRTC SOLUTIONS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 237 ASIA PACIFIC: WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 238 ASIA PACIFIC: WEBRTC IMPLEMENTATION & INTEGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 239 ASIA PACIFIC: WEBRTC CONSULTING SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 240 ASIA PACIFIC: OTHER WEBRTC SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 241 LATIN AMERICA: WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 242 LATIN AMERICA: WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 243 LATIN AMERICA: WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 244 LATIN AMERICA: WEBRTC MESSAGING & FILE SHARING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 245 LATIN AMERICA: WEBRTC VOICE CALLING & CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 246 LATIN AMERICA: WEBRTC VIDEO CALLING & CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 247 LATIN AMERICA: OTHER WEBRTC SOLUTIONS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 248 LATIN AMERICA: WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 249 LATIN AMERICA: WEBRTC IMPLEMENTATION & INTEGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 250 LATIN AMERICA: WEBRTC CONSULTING SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 251 LATIN AMERICA: OTHER WEBRTC SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA: WEBRTC MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA: WEBRTC MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA: WEBRTC MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA: WEBRTC MESSAGING & FILE SHARING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA: WEBRTC VOICE CALLING & CONFERENCING SOLUTION MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA: WEBRTC VIDEO CALLING & CONFERENCING MARKET SIZE, BY VERTICAL,2015–2022 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA: OTHER WEBRTC SOLUTIONS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA: WEBRTC MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 260 MIDDLE EAST AND AFRICA: WEBRTC IMPLEMENTATION & INTEGRATION SERVICES MARKET SIZE, BY VERTICAL,2015–2022 (USD MILLION)

TABLE 261 MIDDLE EAST AND AFRICA: WEBRTC CONSULTING SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 262 MIDDLE EAST AND AFRICA: OTHER WEBRTC SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

16.1.3 UNIFIED COMMUNICATIONS AS A SERVICE MARKET

TABLE 263 UNIFIED COMMUNICATIONS AS A SERVICE MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 264 TELEPHONY: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 265 NORTH AMERICA: TELEPHONY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 266 EUROPE: TELEPHONY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 267 ASIA PACIFIC: TELEPHONY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 268 UNIFIED MESSAGING: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 269 NORTH AMERICA: UNIFIED MESSAGING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 270 EUROPE: UNIFIED MESSAGING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 271 ASIA PACIFIC: UNIFIED MESSAGING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 272 CONFERENCING: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 273 NORTH AMERICA: CONFERENCING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 274 EUROPE: CONFERENCING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 275 ASIA PACIFIC: CONFERENCING MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 276 COLLABORATION PLATFORMS AND APPLICATIONS: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 277 NORTH AMERICA: COLLABORATION PLATFORMS AND APPLICATIONS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 278 EUROPE: COLLABORATION PLATFORMS AND APPLICATIONS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 279 ASIA PACIFIC: COLLABORATION PLATFORMS AND APPLICATIONS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 280 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 281 LARGE ENTERPRISES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 282 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 283 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 284 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 285 SMALL AND MEDIUM-SIZED ENTERPRISES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 286 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 287 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 288 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 289 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 290 BANKING, FINANCIAL SERVICES, AND INSURANCE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 291 NORTH AMERICA: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 292 EUROPE: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 293 ASIA PACIFIC: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 294 TELECOM AND IT: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 295 NORTH AMERICA: TELECOM AND IT MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 296 EUROPE: TELECOM AND IT MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 297 ASIA PACIFIC: TELECOM AND IT MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 298 CONSUMER GOODS AND RETAIL: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 299 NORTH AMERICA: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 300 EUROPE: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 301 ASIA PACIFIC: CONSUMER GOODS AND RETAIL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 302 HEALTHCARE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 303 NORTH AMERICA: HEALTHCARE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 304 EUROPE: HEALTHCARE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 305 ASIA PACIFIC: HEALTHCARE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 306 PUBLIC SECTOR AND UTILITIES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 307 NORTH AMERICA: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 308 EUROPE: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 309 ASIA PACIFIC: PUBLIC SECTOR AND UTILITIES MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 310 LOGISTICS AND TRANSPORTATION: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 311 NORTH AMERICA: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 312 EUROPE: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 313 ASIA PACIFIC: LOGISTICS AND TRANSPORTATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 314 TRAVEL AND HOSPITALITY: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 315 NORTH AMERICA: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 316 EUROPE: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 317 ASIA PACIFIC: TRAVEL AND HOSPITALITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 318 OTHERS: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 319 NORTH AMERICA: OTHERS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 320 EUROPE: OTHERS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 321 ASIA PACIFIC: OTHERS MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 322 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017-2024 (USD MILLION)

TABLE 323 NORTH AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 324 NORTH AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 325 NORTH AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 326 NORTH AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 327 UNITED STATES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 328 UNITED STATES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 329 UNITED STATES: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 330 CANADA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 331 CANADA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 332 CANADA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 333 EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 334 EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 335 EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 336 EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 337 UNITED KINGDOM: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 338 UNITED KINGDOM: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 339 UNITED KINGDOM: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 340 REST OF EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 341 REST OF EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 342 REST OF EUROPE: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 343 ASIA-PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 344 ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 345 ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 346 ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 347 CHINA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 348 CHINA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 349 CHINA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 350 REST OF ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 351 REST OF ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 352 REST OF ASIA PACIFIC: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 353 MIDDLE EAST AND AFRICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 354 MIDDLE EAST AND AFRICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 355 MIDDLE EAST AND AFRICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 356 LATIN AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 357 LATIN AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 358 LATIN AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 359 LATIN AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 360 MEXICO: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 361 MEXICO: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 362 MEXICO: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 363 REST OF LATIN AMERICA: UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)