Contact Center Analytics Market by Component (Software and Services), Deployment Mode, Organization Size, Application (Automatic Call Distributor, Risk and Compliance Management, and Workforce Optimization), Vertical and Region - Global Forecast to 2027

Contact Center Analytics Market Size

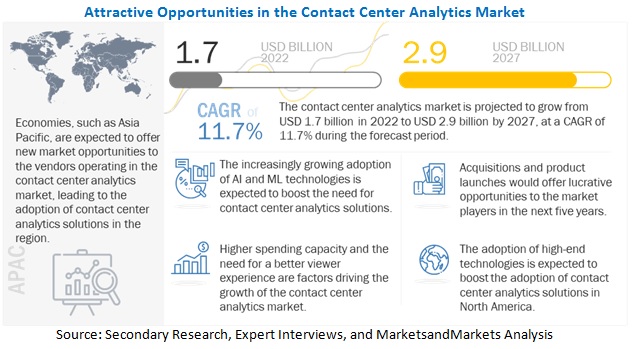

The contact center analytics market size is anticipated to rise in size from USD 1.7 billion in 2022 to USD 2.9 billion by 2027. At a CAGR of 11.7% over the forecast period. Various factors such as rising adoption of advanced contact center technologies, demand for better customer experience management solutions, and increasing adoption of cloud-based contact center solutions during and after COVID-19 are expected to drive the adoption of contact center analytics technologies and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global contact center analytics market

The COVID-19 pandemic has impacted all the elements of the technology sector. The hardware business remains the most affected in the IT industry. Due to the slowdown of the hardware supply and the reduced manufacturing capacity, IT infrastructure growth has slowed down. The software and service businesses are also expected to slow down for a short period. However, the adoption of collaborative applications, location-based applications, security solutions, big data, and AI is set to witness an increase in the remaining part of the year.

The pandemic has affected the contact center analytics market. However, companies are still leveraging contact center analytics solutions for customer experience management, real-time monitoring and reporting, risk and compliance management, automatic call distributor, workforce optimization, and smart quarantining. Governments, as well as private companies across verticals, are adopting contact center analytics solutions to provide fast and better services to their customers and employees. According to the 2020 ContactBabel survey in the UK, 84% of respondents moved to home-based work post-COVID-19 lockdowns, whereas in 2019, only 26% of operations had some homeworking capability and only 3.8% of agents were home-based.

Contact Center Analytics Market Dynamics

Driver: Demand for better customer experience management solutions

Customer expectations for superior customer service before and after any purchase have increased tremendously in the past few years. Several parameters are supposed to influence customer experience and directly affect the sale opportunities for a company. These are Fast Issue Resolution (FIR), First Call Resolution (FCR), knowledgeable and customer-friendly agents, and self-service information access. These parameters are among the key indicators of a contact center’s performance and require an in-depth analysis of data, being generated by the inbound and outbound operations in a contact center. For example, fast issue resolution requires a strong focus on First Call Resolution (FCR), a strong knowledge base, and should facilitate self-service methods. FCR analytics is one of the many capabilities provided by a contact center analytics solution, which enables the contact center managers to have a 360? view of the customer’s journey by integrating customer interactions across several channels and helps them identify crucial performance gaps and opportunities to enhance the overall customer experience. Apart from FCR, Automatic Call Distributor (ACD) and customer engagement analytics are some of the other solutions that impact the overall customer experience. All these solutions are essential for a contact center’s success, which, in turn, increases the company’s opportunities for sales cross-sell, up-sell, and improved customer satisfaction.

Restraint: Regulations and legal issues

Companies in the financial, insurance, public, and debt collection sectors have to comply with various regulations, failing which would lead to potentially expensive penalties, including heavy fines and criminal prosecution. Contact centers have tried to reduce their risks through scripting, call monitoring, and call recording, but these do not offer any guarantee or proof of compliance. Standards such as Payment Card Industry Data Security Standard (PCI-DSS) are developed to ensure the safe handling of information and protect customers against identity theft. Contact centers, complying with this standard, cannot store certain portions of sensitive cardholder information even through the most secured possible method. Further, the practice of offshoring has raised the concern among consumers, as companies have increasingly turned to outsourcing customer phone contact and back-office processing to overseas companies to cut costs and boost efficiency.

Opportunity: Rising demand for speech and text analytics

Contact centers have observed an increased demand for analytics solutions to analyze customer interactions across various channels. Speech and text analytics has been the most adopted tools by contact centers for sentiment analysis and for measuring customer satisfaction. The speech analytics software focuses on the voice of the customer and provides companies with insights into customer sentiments and satisfaction levels. It can prove to be a crucial tool to improve the FCR, reduce wait times, and measure agent performance. Text mining is used by contact centers, thus enabling them to understand the customer experience by analyzing customer interactions across platforms, such as social media, forums, chats, SMS, and email. The figure below highlights the adoption of both speech and text analytics. The speech and video analytics technology helps contact centers analyze audio and video conversations in real-time by automating a range of operational processes, including call and video recording, speech recognition and transcription, emotion detection, and analysis, search by keywords, and extraction of actionable insights, conversation quality management, behavioral analysis, and other forms of data analysis.

Challenge: Lack of a clear and holistic analytics approach in contact centers

A major challenge most contact centers are subjected to face is the lack of a clear and holistic analytics approach. For instance, most contact centers can measure their agent’s performance and have capability scorecards, but only 60.1% can translate these dashboards into business performance information reports due to a lack of a complete 360? view of the contact center’s operations. The majority of the contact centers lack appropriate analytics tools despite the fact that analytics has been a high-growth trend and is widely adopted across several industries in the past few years. Data in contact centers remain in silos, as various technologies and tools used in the contact centers are not integrated, and the processes are not aligned and connected.

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the contact center analytics market. The adoption of contact center solutions, especially during and post-COVID-19, to cater to the upsurge in call volumes, is expected to drive the market growth in 2022. The US government and public sector call centers, including Hudson Valley Region 211, Harris County, Marion County, Integral Care, LA County 211, and 211 San Diego, have adopted contact center solutions from renowned vendors to ensure citizen safety and convenience. The rising adoption has added to the growth of the contact center analytics market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Contact Center Analytics Market Players

The contact center analytics players have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the contact center analytics market include Cisco (US), Genpact (US), SAP (Germany), Oracle (US), Avaya (US), NICE (US), 8x8 (US), Five9 (US), Talkdesk (US), CallMiner (US), Servion Global Solutions (US), Genesys (US), VirtualPBX (US), ChaseData (US), and Broadvoice (US).

Contact Center Analytics Market Report Scope

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 2.9 billion |

|

Market value in 2022 |

USD 1.7 Billion |

|

Market Growth Rate |

11.7% CAGR |

|

Largest Market |

North America |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments covered |

Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Cisco (US), Genpact (US), SAP (Germany), Oracle (US), Avaya (US), NICE (US), 8x8 (US), Five9 (US), Talkdesk (US), CallMiner (US), Servion Global Solutions (US), Genesys (US), VirtualPBX (US), ChaseData (US), Broadvoice (US), SingleComm (US), LiveAgent (Slovakia), CloudTalk (US), Aircall (US), Bright Pattern (US), Dixa (Denmark), CallHippo (US), Strategic Contact (US), 3CLogic (US), and Metrocall (Uruguay). |

This research report categorizes the contact center analytics market based on component, deployment mode, organization size, application, industry vertical, and region.

By Component:

- Software

- Speech Analytics

- Text Analytics

- Desktop Analytics

- Predictive Analytics

- Cross-channel Analytics

- Performance Analytics

- Services

- Professional Services

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- SMEs

- Large Enterprises

By Application:

- Automatic Call Distributor (ACD)

- Log Management

- Risk and Compliance Management

- Real-Time Monitoring and Analysis

- Workforce Optimization

- Customer Experience Management (CEM)

- Other Applications

By Verticals:

- BFSI

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Energy and Utilities

- Telecom and IT

- Travel and Hospitality

- Government and Defense

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2022, Avaya entered into a strategic partnership with Alcatel-Lucent to extend the availability of Avaya’s OneCloud CCaaS (Contact Center as a Service) composable solutions to ALE’s global base of customers while also making ALE’s digital networking solutions available on a global basis to Avaya customers.

- In February 2022, Etisalat Digital chose to collaborate with NICE following a comprehensive review of Contact Center as a Service (CCaaS) providers that revealed CXone as the leading CX platform with a proven ability to drive digital transformation well into the future.

- In October 2021, Cisco acquired Kubernetes specialist, Replex, to boost AppDynamics’ observability skills and cloud-native spend visibility.

- In January 2021, NICE announced the expansion of support for information and service centers across the COVID-19 vaccine supply chain with its CXone cloud platform.

- In August 2020, Genpact and Deloitte formed a strategic alliance to accelerate business transformation, build enterprise resilience, and deliver several tangible benefits to clients that can be leveraged quickly to help them accelerate their digital transformation journeys.

Frequently Asked Questions (FAQ):

What is a contact center analytics?

Contact center analytics are the solutions that provide contact center managers a better way to get actionable insights and recommendations out of customer interactions with the agents. These tools provide the features of capturing, structuring, and analyzing the data to get a pattern or predict future outcomes.

Which countries are considered in the European region?

The report includes an analysis of the UK, France, and Germany in the European region.

Which are the key deployment modes adopting contact center analytics solutions and services?

The key deployment modes adopting contact center analytics solutions and services are cloud and on-premises.

Which are the key drivers supporting the growth of the contact center analytics market?

The key drivers supporting the growth of the contact center analytics market include rising adoption of advanced contact center technologies, demand for better customer experience management solutions, and increasing adoption of cloud-based contact center solutions during and after COVID-19.

Who are the key vendors in the contact center analytics market?

The key players in the contact center analytics market include Cisco (US), Genpact (US), SAP (Germany), Oracle (US), Avaya (US), NICE (US), 8x8 (US), Five9 (US), Talkdesk (US), CallMiner (US), Servion Global Solutions (US), Genesys (US), VirtualPBX (US), ChaseData (US), and Broadvoice (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL CONTACT CENTER ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

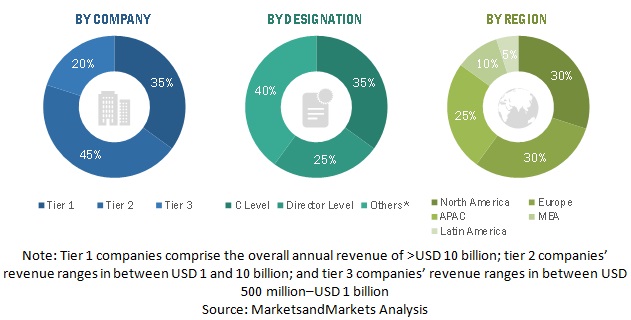

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE CONTACT CENTER ANALYTICS MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF CONTACT CENTER ANALYTICS THROUGH OVERALL CONTACT CENTER ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 4 GLOBAL CONTACT CENTER ANALYTICS MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 8 SOFTWARE SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE IN 2022

FIGURE 9 PROFESSIONAL SERVICES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE IN 2022

FIGURE 10 SPEECH ANALYTICS SOFTWARE SEGMENT EXPECTED TO DOMINATE THE MARKET IN 2022

FIGURE 11 CLOUD SEGMENT EXPECTED TO LEAD THE MARKET IN 2022

FIGURE 12 CUSTOMER EXPERIENCE MANAGEMENT SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2022

FIGURE 13 NORTH AMERICA EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CONTACT CENTER ANALYTICS MARKET

FIGURE 14 INCREASING ADOPTION OF AI AND ML TECHNOLOGIES TO BOOST THE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 15 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT EXPECTED TO LEAD THE MARKET BY 2027

4.3 MARKET, BY REGION

FIGURE 16 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.4 MARKET, BY APPLICATION AND SOFTWARE

FIGURE 17 CUSTOMER EXPERIENCE MANAGEMENT AND SPEECH ANALYTICS SEGMENTS ESTIMATED TO ACCOUNT FOR A SIGNIFICANT MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTACT CENTER ANALYTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising adoption of advanced contact center technologies

5.2.1.2 Demand for better customer experience management solutions

5.2.1.3 Increasing adoption of cloud-based contact center solutions during and after COVID-19

5.2.2 RESTRAINTS

5.2.2.1 High cost of investment

5.2.2.2 Regulations and legal issues

5.2.2.3 Impact of IVR frauds and cyber-attacks on business operations

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for speech and text analytics

5.2.3.2 Dynamic customer demand for robust self-service interactions

5.2.4 CHALLENGES

5.2.4.1 Data privacy and security concerns

5.2.4.2 Lack of a clear and holistic analytics approach in contact centers

5.3 CONTACT CENTER ANALYTICS MARKET: COVID-19 IMPACT

5.4 CONTACT CENTER ANALYTICS: EVOLUTION

FIGURE 19 EVOLUTION OF CONTACT CENTER ANALYTICS

5.5 CASE STUDY ANALYSIS

5.5.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.5.1.1 Case study: Maximize marketing campaign effectiveness during the pandemic

5.5.2 HEALTHCARE AND LIFE SCIENCES

5.5.2.1 Case study: Leveraging agent assist to improve efficiency and call quality

5.5.3 MANUFACTURING

5.5.3.1 Case study: Improving disaster preparedness and call center services

5.5.4 RETAIL AND CONSUMER GOODS

5.5.4.1 Case study: Enhancing personalized experiences with high-speed innovation

5.5.5 TRAVEL AND HOSPITALITY

5.5.5.1 Case study 1: Enabling omnichannel communication and omnichannel quality management for better customer service and agent empowerment

5.5.6 GOVERNMENT AND PUBLIC SECTOR

5.5.6.1 Case study 2: Improving efficiency during the busiest season

5.5.7 ENERGY AND UTILITIES

5.5.7.1 Case study 3: Increasing client base, tracking calls, and improving bonding with employees

5.5.8 TELECOM AND IT

5.5.8.1 Case study 4: Increasing customer service by reducing the number of dropped calls, time lags, and eliminating line disturbances

5.5.9 ECOSYSTEM

FIGURE 20 CONTACT CENTER MARKET: ECOSYSTEM

5.6 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 21 SUPPLY/VALUE CHAIN ANALYSIS

TABLE 6 CONTACT CENTER ANALYTICSMARKET: VALUE/SUPPLY CHAIN

5.6.1 PATENT ANALYSIS

5.6.1.1 Methodology

5.6.1.2 Document type

TABLE 7 PATENTS FILED, 2018-2021

5.6.1.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.6.1.4 Top applicants

FIGURE 23 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.6.2 PRICING MODEL ANALYSIS, 2021

TABLE 8 CONTACT CENTER ANALYTICS MARKET: PRICING MODEL ANALYSIS, 2021

5.7 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 CONTACT CENTER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 TECHNOLOGY ANALYSIS

5.9.1 AI AND CONTACT CENTER ANALYTICS

5.9.2 ML AND CONTACT CENTER ANALYTICS

5.9.3 NLP AND CONTACT CENTER ANALYTICS

5.9.4 CLOUD COMPUTING AND CONTACT CENTER ANALYTICS

5.9.5 ADVANCED ANALYTICS

5.9.5.1 Speech analytics

5.9.5.2 Social media analytics

5.9.5.3 Predictive analytics

5.9.5.4 Sentiment analytics

5.9.5.5 Real-time monitoring and analytics

5.10 REGULATORY IMPLICATIONS

5.10.1 INTRODUCTION

5.10.2 SARBANES-OXLEY ACT OF 2002

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 CALIFORNIA CONSUMER PRIVACY ACT

5.10.5 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.10.6 PERSONAL DATA PROTECTION ACT

5.10.7 OPEN GEOSPATIAL CONSORTIUM

5.10.8 WORLD WIDE WEB CONSORTIUM

6 CONTACT CENTER ANALYTICS MARKET, BY COMPONENT (Page No. - 87)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 25 SERVICES SEGMENT EXPECTED TO GROW AT A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOFTWARE

6.2.1 DIGITIZATION AND TECHNOLOGICAL ADVANCEMENTS IN CONTACT CENTER ANALYTICS SOFTWARE

FIGURE 26 SPEECH ANALYTICS SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

TABLE 13 MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 14 MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

6.2.1.1 Speech analytics

TABLE 15 SPEECH ANALYTICS: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 16 SPEECH ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.2 Cross-channel analytics

TABLE 17 CROSS-CHANNEL ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 CROSS-CHANNEL ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.3 Predictive analytics

TABLE 19 PREDICTIVE ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 PREDICTIVE ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.4 Performance analytics

TABLE 21 PERFORMANCE ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 PERFORMANCE ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.5 Text analytics

TABLE 23 TEXT ANALYTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 TEXT ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1.6 Desktop analytics

TABLE 25 DESKTOP ANALYTICS: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 DESKTOPS ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES IDENTIFY THE TYPE OF INTEGRATION REQUIRED BY ORGANIZATIONS TO MEET THEIR CONTACT CENTER DEMANDS

FIGURE 27 PROFESSIONAL SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

TABLE 27 MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 28 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

6.3.1.1 Professional services

TABLE 29 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Managed services

TABLE 31 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CONTACT CENTER ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 101)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 28 CLOUD SEGMENT EXPECTED TO LEAD THE MARKET IN 2022

TABLE 33 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 34 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISES DEPLOYMENT MODE ENABLES ADHERENCE TO EXTERNAL COMPLIANCE REQUIREMENTS

TABLE 35 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CLOUD

7.3.1 LOW COST AND EASE OF IMPLEMENTATION HAVE MADE THE CLOUD PLATFORM A HIGHLY DESIRABLE DELIVERY MODE AMONG ORGANIZATIONS

TABLE 37 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CONTACT CENTER ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 107)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 29 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE IN 2022

TABLE 39 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 40 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMES TO ADOPT MORE CLOUD-BASED CONTACT CENTER ANALYTICS SOLUTIONS TO ELIMINATE DATA MANAGEMENT HASSLES AND MAINTENANCE ISSUES

TABLE 41 SMES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 HIGHER ADOPTION OF CONTACT CENTER ANALYTICS SOLUTIONS IN LARGE ENTERPRISES

TABLE 43 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CONTACT CENTER ANALYTICS MARKET, BY APPLICATION (Page No. - 112)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: MARKET DRIVERS

9.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 30 CUSTOMER EXPERIENCE MANAGEMENT SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

TABLE 45 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 46 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 CUSTOMER EXPERIENCE MANAGEMENT

9.2.1 CUSTOMER EXPERIENCE ANALYTICS AGGREGATES CUSTOMER INTERACTIONS, TRANSACTIONS, AND FEEDBACK AND AGENT DATA

TABLE 47 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LOG MANAGEMENT

9.3.1 LOG MANAGEMENT ENABLES MANAGERS TO FORECAST COSTS AND TRACK PRODUCTIVITY

TABLE 49 LOG MANAGEMENT: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 LOG MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 RISK AND COMPLIANCE MANAGEMENT

9.4.1 CONTACT CENTERS TO MAXIMIZE PAYMENTS WHILE BEING COMPLIANT TO RULES AND REGULATIONS

TABLE 51 RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 REAL-TIME MONITORING AND REPORTING

9.5.1 MONITORING AND ANALYZING CALLS IN REAL-TIME HELP IN TRACKING AGENT PERFORMANCE AND EFFECTIVENESS OF CONTACT CENTER OPERATIONS

TABLE 53 REAL-TIME MONITORING AND REPORTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 REAL-TIME MONITORING AND REPORTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 WORKFORCE OPTIMIZATION

9.6.1 WFO IS ESSENTIAL FOR PROVIDING AGENTS WITH THE RIGHT TRAINING AND KNOWLEDGE

TABLE 55 WORKFORCE OPTIMIZATION: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 WORKFORCE OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 AUTOMATIC CALL DISTRIBUTOR

9.7.1 ACD ACQUIRES USAGE DATA, SUCH AS THE TOTAL NUMBER OF CALLS, TIME SPENT ON EACH CALL, AND WAITING TIME

TABLE 57 AUTOMATIC CALL DISTRIBUTOR: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 AUTOMATIC CALL DISTRIBUTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHER APPLICATIONS

TABLE 59 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CONTACT CENTER ANALYTICS MARKET, BY VERTICAL (Page No. - 123)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 31 ENERGY AND UTILITIES VERTICAL EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 61 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 62 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 CONTACT CENTER SOLUTIONS ENABLE BFSI COMPANIES TO MONITOR, MANAGE, AND ASSIST REMOTE AGENTS’ SELLING AND EARNING INCENTIVES

TABLE 63 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 HEALTHCARE AND LIFE SCIENCES

10.3.1 HEALTHCARE CONTACT CENTERS TO COMPLY WITH REGULATORY AND LEGAL REQUIREMENTS BY MEASURING CONTACT CENTER OPERATIONS AND PERFORMANCE

TABLE 65 HEALTHCARE AND LIFE SCIENCES: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 MANUFACTURING

10.4.1 CONTACT CENTER ANALYTICS HELPS MANUFACTURING COMPANIES TO ANALYZE CALLS FROM SUPPLIERS AND CHANNEL PARTNERS IN REAL-TIME

TABLE 67 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 RETAIL AND CONSUMER GOODS

10.5.1 COMPANIES CAN PROACTIVELY CONNECT WITH CUSTOMERS USING CONTACT CENTER ANALYTICS SOLUTIONS

TABLE 69 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 ENERGY AND UTILITIES

10.6.1 CONTACT CENTER SOLUTIONS USED BY PETROLEUM COMPANIES TO COACH AND TRAIN THEIR EMPLOYEES

TABLE 71 ENERGY AND UTILITIES: CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 TELECOM AND IT

10.7.1 DEPLOYING CONTACT CENTER ANALYTICS SOLUTIONS HAS INCREASED THE NUMBER OF PARTNERSHIPS OF TELECOM COMPANIES WITH OTT PLATFORM PROVIDERS

TABLE 73 TELECOM AND IT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 TELECOM AND IT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 TRAVEL AND HOSPITALITY

10.8.1 TRAVEL AND HOSPITALITY COMPANIES CAPTURING CUSTOMER DATA USING SPEECH AND TEXT ANALYTICS

TABLE 75 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 GOVERNMENT AND PUBLIC SECTOR

10.9.1 CONTACT CENTER SOLUTIONS ENABLE GOVERNMENT AGENCIES TO MINIMIZE LOSSES AND OPTIMIZE GOVERNMENT’S EFFICIENCY

TABLE 77 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.1 OTHER VERTICALS

TABLE 79 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 CONTACT CENTER ANALYTICS MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

11.1.1 REGION: COVID-19 IMPACT

FIGURE 32 INDIA EXPECTED TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 33 ASIA PACIFIC EXPECTED TO ACCOUNT FOR THE HIGHEST CAGR THE DURING FORECAST PERIOD

TABLE 81 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 82 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

TABLE 83 NORTH AMERICA: PROMINENT PLAYERS

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 84 NORTH AMERICA: CONTACT CENTER ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 UNITED STATES

11.2.2.1 Companies spend more on AI, ML, and NLP-enabled cloud contact center solutions

11.2.3 CANADA

11.2.3.1 Presence of knowledgeable and skilled workforce persuading the US companies to set up their contact centers in Canada

11.3 EUROPE

11.3.1 EUROPE: CONTACT CENTER ANALYTICS MARKET DRIVERS

TABLE 100 EUROPE: PROMINENT PLAYERS

TABLE 101 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UNITED KINGDOM

11.3.2.1 Companies in the UK constantly adopting contact center solutions to increase customers’ lifetime value and customer satisfaction

11.3.3 GERMANY

11.3.3.1 German manufacturing and telecom companies adopting contact center solutions to improve contact center processes

11.3.4 FRANCE

11.3.4.1 French Government to invest more in cloud-based advanced technologies

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: CONTACT CENTER ANALYTICS MARKET DRIVERS

TABLE 117 ASIA PACIFIC: PROMINENT PLAYERS

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: CONTACT CENTER ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Chinese citizens are moving from traditional communication to the usage of chat and social media for interacting with their vendors

11.4.3 JAPAN

11.4.3.1 Strong technology infrastructure and the presence of tech-savvy workforce

11.4.4 INDIA

11.4.4.1 Enterprise spending on business process outsourcing (BPO) services

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: CONTACT CENTER ANALYTICS MARKET DRIVERS

TABLE 134 MIDDLE EAST & AFRICA: PROMINENT PLAYERS

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 UNITED ARAB EMIRATES

11.5.2.1 Increasing demand for omnichannel communication and workforce management

11.5.3 SAUDI ARABIA

11.5.3.1 Adoption of contact center solutions helping businesses expand their enterprise service portfolios and enhance user experiences

11.5.4 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CONTACT CENTER ANALYTICS MARKET DRIVERS

TABLE 151 LATIN AMERICA: PROMINENT PLAYERS

TABLE 152 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 US-based contact center organizations are increasing their presence in the country to cater to the rising demand for contact center solutions

11.6.3 MEXICO

11.6.3.1 Businesses using contact center solutions to connect with customers

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 179)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 168 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE CONTACT CENTER ANALYTICS MARKET

12.3 REVENUE ANALYSIS

FIGURE 36 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

12.4 MARKET SHARE ANALYSIS

FIGURE 37 MARKET: MARKET SHARE ANALYSIS, 2022

TABLE 169 MARKET: DEGREE OF COMPETITION

12.5 COMPETITIVE BENCHMARKING

TABLE 170 COMPANY TOP 3 APPLICATION FOOTPRINTS

TABLE 171 COMPANY REGIONAL FOOTPRINT

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 38 KEY MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 39 STARTUP/SME CONTACT CENTER ANALYTICS MARKET EVALUATION MATRIX, 2021

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 172 PRODUCT LAUNCHES, 2021–2022

12.8.2 DEALS

TABLE 173 DEALS, 2021–2022

13 COMPANY PROFILES (Page No. - 192)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business and financial overview, Solutions offered, Recent Developments, MNM view)*

*Details on Business and financial overview, Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2.1 CISCO

TABLE 174 CISCO: BUSINESS OVERVIEW

FIGURE 40 CISCO: FINANCIAL OVERVIEW

TABLE 175 CISCO: SOLUTIONS OFFERED

TABLE 176 CISCO: DEALS

13.2.2 GENPACT

TABLE 177 GENPACT: BUSINESS OVERVIEW

FIGURE 41 GENPACT: COMPANY SNAPSHOT

TABLE 178 GENPACT: SOLUTIONS OFFERED

TABLE 179 GENPACT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 180 GENPACT: DEALS

13.2.3 SAP

TABLE 181 SAP: BUSINESS OVERVIEW

FIGURE 42 SAP: COMPANY SNAPSHOT

TABLE 182 SAP: SOLUTIONS OFFERED

TABLE 183 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 184 SAP: DEALS

13.2.4 ORACLE

TABLE 185 ORACLE: BUSINESS OVERVIEW

FIGURE 43 ORACLE: COMPANY SNAPSHOT

TABLE 186 ORACLE: SOLUTIONS OFFERED

TABLE 187 ORACLE: DEALS

13.2.5 AVAYA

TABLE 188 AVAYA: BUSINESS OVERVIEW

FIGURE 44 AVAYA: COMPANY SNAPSHOT

TABLE 189 AVAYA: SOLUTIONS OFFERED

TABLE 190 AVAYA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 AVAYA: DEALS

13.2.6 NICE

TABLE 192 NICE: BUSINESS OVERVIEW

FIGURE 45 NICE: COMPANY SNAPSHOT

TABLE 193 NICE: SOLUTIONS OFFERED

TABLE 194 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 195 NICE: DEALS

13.2.7 8X8

TABLE 196 8X8: BUSINESS OVERVIEW

FIGURE 46 8X8: COMPANY SNAPSHOT

TABLE 197 8X8: SOLUTIONS OFFERED

TABLE 198 8X8: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 199 8X8: DEALS

13.2.8 FIVE9

TABLE 200 FIVE9: BUSINESS OVERVIEW

FIGURE 47 FIVE9: COMPANY SNAPSHOT

TABLE 201 FIVE9: SOLUTIONS OFFERED

TABLE 202 FIVE9: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 203 FIVE9: DEALS

13.2.9 TALKDESK

TABLE 204 TALKDESK: BUSINESS OVERVIEW

TABLE 205 TALKDESK: SOLUTIONS OFFERED

TABLE 206 TALKDESK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 207 TALKDESK: DEALS

13.2.10 CALLMINER

TABLE 208 CALLMINER: BUSINESS OVERVIEW

TABLE 209 CALLMINER: SOLUTIONS OFFERED

TABLE 210 CALLMINER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 211 CALLMINER: DEALS

13.2.11 SERVION GLOBAL SOLUTIONS

TABLE 212 SERVION GLOBAL SOLUTIONS: BUSINESS OVERVIEW

TABLE 213 SERVION GLOBAL SOLUTIONS: SOLUTIONS OFFERED

TABLE 214 SERVION GLOBAL SOLUTIONS: DEALS

13.2.12 GENESYS

TABLE 215 GENESYS: BUSINESS OVERVIEW

TABLE 216 GENESYS: SOLUTIONS OFFERED

TABLE 217 GENESYS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 218 GENESYS: DEALS

13.2.13 VIRTUALPBX

TABLE 219 VIRTUALPBX: BUSINESS OVERVIEW

TABLE 220 VIRTUALPBX: SOLUTIONS OFFERED

TABLE 221 VIRTUALPBX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 222 VIRTUALPBX: DEALS

13.2.14 CHASEDATA

TABLE 223 CHASEDATA: BUSINESS OVERVIEW

TABLE 224 CHASEDATA: SOLUTIONS OFFERED

TABLE 225 CHASEDATA: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.15 BROADVOICE

TABLE 226 BROADVOICE: BUSINESS OVERVIEW

TABLE 227 BROADVOICE: SOLUTIONS OFFERED

TABLE 228 BROADVOICE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 229 BROADVOICE: DEALS

13.2.16 SINGLECOMM

13.2.17 LIVEAGENT

13.2.18 CLOUDTALK

13.2.19 AIRCALL

13.2.20 BRIGHT PATTERN

13.2.21 DIXA

13.2.22 CALLHIPPO

13.2.23 STRATEGIC CONTACT

13.2.24 3CLOGIC

13.2.25 METROCALL

14 APPENDIX (Page No. - 256)

14.1 ADJACENT AND RELATED MARKETS

14.1.1 INTRODUCTION

14.1.2 CONTACT CENTER SOFTWARE MARKET

14.1.2.1 Market definition

14.1.2.2 Market overview

14.1.2.3 Contact center software market, by component

TABLE 230 CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 231 CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

14.1.2.4 Contact center software market, by organization size

TABLE 232 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 233 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

14.1.2.5 Contact center software market, by deployment mode

TABLE 234 CONTACT CENTER SOFTWARE MARKET, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 235 CONTACT CENTER SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

14.1.2.6 Contact center software market, by industry

TABLE 236 CONTACT CENTER SOFTWARE MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 237 CONTACT CENTER SOFTWARE MARKET, BY INDUSTRY, 2020–2026 (USD MILLION)

14.1.2.7 Contact center software market, by region

TABLE 238 CONTACT CENTER SOFTWARE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 239 CONTACT CENTER SOFTWARE MARKET, BY REGION, 2020–2026 (USD MILLION)

14.1.3 CALL CENTER AI MARKET

14.1.3.1 Market definition

14.1.3.2 Market overview

14.1.3.3 Call center AI market, by component

TABLE 240 CALL CENTER AI MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

14.1.3.4 Call center AI market, by deployment type

TABLE 241 CALL CENTER AI MARKET, BY DEPLOYMENT TYPE, 2017–2024 (USD MILLION)

14.1.3.5 Call center AI market, by vertical

TABLE 242 CALL CENTER AI MARKET, BY VERTICAL, 2017–2024 (USD MILLION)

14.1.3.6 Call center AI market, by region

TABLE 243 CALL CENTER AI MARKET, BY REGION, 2017–2024 (USD MILLION)

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The research study for the contact center analytics market report involved the use of extensive secondary sources, directories, as well as several journals and magazines to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering contact center analyticsping solutions and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as, assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from contact center analyticsping solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global contact center analytics market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players not limited to Cisco, Avaya, NICE, 8x8, and Five9 in the market were identified through extensive secondary research, and their revenue contribution in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on contact center analyticsping solutions based on some of the key use cases. These factors for the contact center analyticsping industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the contact center analytics market by component (solution and services), mapping type, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of the COVID-19 pandemic on the contact center analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American contact center analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Contact Center Analytics Market