The study involved four major activities in estimating the current size of the smart sensors market —exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include high-speed data converter technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

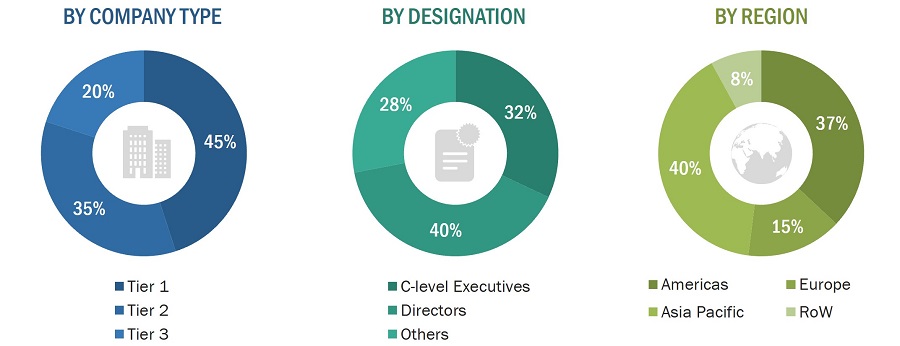

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the smart sensors market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

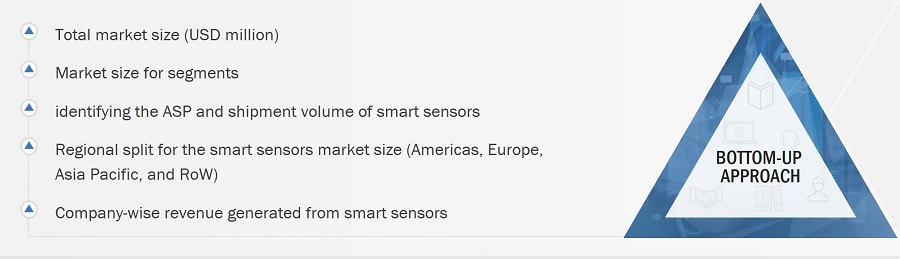

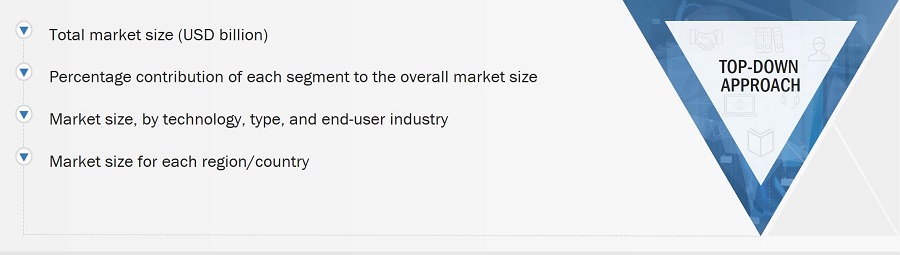

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the smart sensors market and other dependent submarkets listed in this report.

-

Extensive secondary research has identified key players in the industry and market.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Smart Sensors Market: Bottom-Up Approach

Smart Sensors Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

A sensor detects, measures, and controls physical properties such as light, humidity, motion, moisture, temperature, and pressure. It converts data such as light and sound into a practical format for the user. On the other hand, a smart sensor has built-in circuitry for a designer. For instance, the motion sensor has an operational amplifier (op-amp) and digital circuitry built into the sensor module, making it ready to use once plugged in. A smart sensor can produce an electrical output when combined with a sensing element, an analog interface circuit, an Analog-to-Digital Converter (ADC), and a bus interface under one housing. It is a combination of sensing elements with a microprocessor or microcontroller providing processing capabilities. A smart sensor is capable of multi-sensing, multi-tasking, and communication. The smart sensors market is expected to grow significantly during the forecast period, with consumer electronics and industrial automation being the major end-user industries. The growing popularity of IoT devices and the increasing need for energy conservation are among the major factors contributing to the market's growth. Since the circuitry of digital sensors is similar to that of smart sensors, all digital sensors are considered smart sensors for this study.

Key Stakeholders

-

Raw material suppliers

-

Component manufacturers and providers

-

Sensor manufacturers and providers

-

Original Equipment Manufacturers (OEMs)

-

Technology solution providers

-

Application providers

-

System integrators

-

Middleware providers

-

Assembly, testing, and packaging vendors

-

Market research and consulting firms

-

Associations, organizations, forums, and alliances related to the smart sensor industry

-

Technology investors

-

Governments, regulatory bodies, and financial institutions

-

Venture capitalists, private equity firms, and start-ups

-

End users

Report Objectives

The following are the primary objectives of the study.

-

To forecast the size of the smart sensors market, in terms of value, based on type, technology, component, end-user industry, and region

-

To define, describe, and forecast the smart sensors market size, in terms of volume, based on type

-

To describe and forecast the market, in terms of value, for various segments across four main regions: Americas, Asia Pacific, Europe, and Rest of the World (RoW)

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To study the complete value chain and related industry segments and conduct a value chain analysis of the smart sensors market landscape

-

To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s Five Forces, import and export scenarios for products covered under HS code 902690 trade landscape, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

-

To analyze opportunities for stakeholders by identifying high-growth segments in the market

-

To strategically profile the key players and provide a detailed competitive landscape of the smart sensors market

-

To analyze strategic approaches adopted by the leading players in the smart sensors market, including product launches/developments and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Nathaniel

Nov, 2018

I am a business student - Indianapolis creating a presentation about smart sensors and I am wanting to know if I could get a sample report to use in my research..

Nikita

Oct, 2018

I am doing a research on advancement and use of sensors in the field of agriculture so to accomplish my goal I need the report. .

John

Jun, 2016

I am potentially interested in purchasing a report encompassing all potential applications for short range radars in 'X' and 'K' Band including motion, occupancy, perimeter protection, automotive, traffic monitoring etc. I am not interested in any other kinds of sensors. What could you offer me?.

coleman

Jan, 2019

Positioning my sales team with data so that they can proactively engage with OEM customers that are in need of Smart Sensors..

THOMAS

May, 2015

Before purchasing this report, I need to understand a little more about the methodology used to calculate and forecast the market of each sensor and industry. In particular, I'm looking for information on units of each, in addition to total market size in sales. Is that something that is available? Please let me know if you would like to discuss. I'm on a tight deadline for a project, and need to make a decision before this weekend on whether or not to buy the report..

Boris

Mar, 2019

Looking for Market Share information within the smart sensor market. Particularly optical sensors, CMOS..

Ryan

Jan, 2017

How is smart sensor defined? What percent of the total sensor market are smart sensors? what types of non-smart sensors are being excluded?.

SRINIVAS

Oct, 2018

Annual India market survey report for field instruments, Industrial IOT solutions, Water system management..

Hugo

Oct, 2019

I would like to know more about the impact of smart sensors in the next five years in both first and second world countries..

Lata

May, 2016

I just want to know about smart sensors for water level, water velocity, water temperature, pressure and hydrodynamic force measurement in physical hydraulic models..