Current Sensor Market Size, Share & Trends Report 2030

Current Sensor Market by Measurement (Less than 10A, 10-100A, Above 100A), Offering (Isolated, Non-isolated), Technology (Hall-effect, AMR, GMR, TMR, Flux Gate, Current Sensing Amplifier, Opto-isolated and Shunt Isolated OP Amp) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The current sensor market is projected to reach USD 5.41 billion by 2030, up from USD 3.24 billion in 2025 at a CAGR of 10.8% from 2025 to 2030. The market growth is driven by increasing demand for efficient power management solutions across various sectors, including automotive, consumer electronics, and renewable energy. Rising demand for EVs and HEVs has boosted the need for precise current sensing in battery management systems, inverters, and motor control applications.

KEY TAKEAWAYS

- The current sensors market in the Asia Pacific region is estimated to dominate, with a share of 37.1% in 2025.

- By current sensing method, contact-based sensing is expected to hold the largest share in 2025.

- By loop type, the closed-loop segment is projected to grow at the highest rate from 2025 to 2030.

- By offering, isolated current sensors are estimated to hold a significant share throughout the forecast period.

- By technology, magnetic current sensors are expected to exhibit the highest CAGR of 12.1% from 2025 to 2030.

- By mounting type, PCB-mounted current sensors are estimated to hold the largest share in 2025.

- By measurement range, the medium (10A to 100A) segment is likely to be the fastest-growing in the current sensor market.

- By output type, the analog segment is expected to dominate the market over the forecast period.

- By industry, the automotive segment is projected to grow at a significant rate of 10.6% over the forecast period.

- Allegro MicroSystems, Inc., LEM International SA, and Asahi Kasei Corporation were identified as Star players in the current sensor market, as they have adopted organic growth strategies, including product launches and technology upgrades.

- Magnesensor Technology, Sinomags Technologies Co., Ltd., and YUANXING ELECTRONICS CO., LTD., have distinguished themselves among startups and SMEs due to their strong product portfolio and diverse applications.

The current sensors market is expected to grow rapidly over the next decade, driven by technological advancements in sensors such as Hall-effect, fluxgate, and AMR sensors, which have improved accuracy and reliability. This has led to widespread applications in various industries, including automotive, consumer electronics, and manufacturing. The increasing use of current sensors in devices like smartphones, laptops, and smart appliances will create even more growth opportunities. With greater investments in power infrastructure, electric mobility, and automation, the market is forecasted to expand significantly during this period.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The current sensors market is witnessing major shifts driven by the surge in electric vehicle adoption, rapid industrial automation, and the expansion of smart grids. Disruptions include the integration of IoT-enabled solutions and the miniaturization of high-accuracy sensor technologies, as well as supply chain volatility for advanced components. Increasing demand from automotive and renewable energy sectors is reshaping industry hotbeds, while pressure for energy efficiency and precise measurement propels innovations in Hall-effect and shunt-based sensors. End-user revenue dynamics now depend heavily on these trends, making product development and regional expansion critical for current sensor providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing use of battery-powered systems and increasing focus on renewable energy

-

Increasing demand from consumer electronics industry

Level

-

Intense pricing pressure resulting in fluctuations in average selling price

-

Accuracy and sensitivity trade-offs with high electromagnetic interference

Level

-

Miniaturization of current sensors

-

Increase in manufacturing of hybrid and electric cars

Level

-

Need for product differentiation and development of innovative solutions

-

Fluctuations in accuracy of current sensors over varying temperature ranges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing use of battery-powered systems and increasing focus on renewable energy

The increasing use of battery-powered systems in electric vehicles, portable electronics, and industrial equipment is significantly boosting demand for current sensors. These sensors are essential for monitoring current flow, ensuring energy efficiency, and protecting circuits in battery management systems. At the same time, the global shift toward renewable energy sources like solar and wind power has created a need for precise current measurement to improve system performance and grid stability. As energy storage and distributed generation grow, the need for advanced current sensing solutions continues to increase rapidly.

Restraint: Intense pricing pressure resulting in fluctuations in average selling price

The current sensor market faces significant pricing pressure due to intense competition among established and new players. Manufacturers are continually driven to lower product costs while maintaining quality and accuracy, causing fluctuations in average selling prices. Additionally, the commodification of certain sensor types has further increased price sensitivity, especially in high-volume markets like consumer electronics and automotive. This ongoing pressure on profit margins limits companies' ability to invest heavily in R&D, which could slow innovation over the long term.

Opportunity: Miniaturization of current sensors

Miniaturization offers a major opportunity for current sensor manufacturers as industries increasingly seek compact, lightweight, and high-performance components. The move toward smaller and smarter electronic devices like wearables, IoT systems, and electric mobility solutions requires sensors that take up minimal space but deliver high precision and reliability. Advances in semiconductor materials and manufacturing technologies enable the creation of highly integrated, energy-efficient miniature sensors. This transition expands application opportunities and opens new growth paths in emerging markets.

Challenge: Need for product differentiation and development of innovative solutions

The growing competition and rapid technological evolution in the current sensor market have made product differentiation a major challenge. Many sensors offer similar specifications, making it difficult for manufacturers to stand out based on performance alone. To gain a competitive edge, companies must focus on developing innovative features such as enhanced accuracy, temperature stability, and digital connectivity. Integrating intelligence through AI and IoT compatibility can also add significant value, helping manufacturers cater to evolving customer needs and sustain market relevance.

Current Sensor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of ACS37030 coreless Hall-effect current sensor ICs in electric vehicle inverters for high-bandwidth current monitoring | 5 MHz bandwidth for precise control, 20% smaller footprint than traditional cored sensors, and improved efficiency with low power loss in SiC/GaN systems. |

|

Deployment of CAB series closed-loop Hall-effect current sensors in EV high-voltage battery management systems for charge/discharge monitoring | Accuracy better than 0.5% up to 1500 A, ISO 26262 ASIL compliance for safety, and extended battery life through precise State-of-Charge estimation |

|

Integration of CZ39 series coreless current sensors in EV on-board chargers for fast AC-DC current detection | 100 ns response time enabling 30% size reduction in chargers, low heat generation reducing cooling needs, and high noise immunity for reliable operation |

|

Application of TLE4971 XENSIV coreless current sensors in automotive on-board chargers and auxiliary drives for bi-directional current measurement | AEC-Q100 qualified with 210 kHz bandwidth, up to 120 A range with 1% accuracy, and enhanced thermal performance for high-current reliability |

|

Utilization of CUR 423x TMR-based closed-loop current sensors in high-voltage battery monitoring systems of hybrid and electric vehicles | Galvanic isolation for safety, measurements up to 1200 A without magnetic core, and reduced module size/weight by 25% compared to conventional designs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The current sensor ecosystem encompasses multiple interconnected stakeholders dedicated to fostering efficient innovation, manufacturing, and deployment across various industries. Suppliers of raw materials, including semiconductors, magnetic materials, and advanced electronic components, provide essential inputs that establish the technological foundation for sensor performance and dependability. Manufacturers utilize these materials to design and produce an extensive range of current sensing devices, emphasizing high accuracy, miniaturization, power efficiency, and integration with advanced electronics and digital platforms. Distributors and suppliers are instrumental in maintaining robust supply chain logistics, ensuring timely access to global markets and efficient delivery to OEMs and system integrators. End users are situated across sectors such as automotive, industrial automation, renewable energy, telecommunications, aerospace, data centers, and consumer electronics, promoting adoption through applications that necessitate precise, reliable, and energy-efficient current measurement and monitoring.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Current Sensor Market, By Current Sensing Method

Contact-based current sensors maintain the largest market share owing to their high accuracy, reliability, and cost-effectiveness, thereby rendering them suitable for a diverse range of industrial, automotive, and consumer applications. These sensors are extensively employed in power management systems, battery monitoring, and motor control, where precise current measurement is essential. Their robust performance across various operating conditions and ease of integration into existing systems continue to drive their dominance in the market.

Current Sensor Market, By Loop Type

The closed-loop segment dominates the market because of its higher accuracy, quicker response, and ability to handle larger currents with minimal losses. These sensors constantly monitor output current and adjust feedback to keep system stability, making them perfect for electric vehicles, renewable energy setups, and industrial automation. The increasing need for precise current control in critical applications has driven widespread use of closed-loop current sensors.

Current Sensor Market, By Offering

Isolated current sensors hold a larger share because they provide galvanic isolation between the measurement circuit and the load, ensuring safety and protecting sensitive electronics from high-voltage spikes. These sensors are essential in industrial equipment, power electronics, and renewable energy systems, where isolation improves reliability and prevents damage to control systems. The increasing focus on safety and regulatory compliance further promotes the adoption of isolated current sensors.

Current Sensor Market, By Technology

Magnetic current sensors dominate the market because of their high precision, wide measurement range, and suitability for AC and DC applications. These sensors are widely employed in automotive, industrial, and energy applications for current monitoring, motor control, and battery management. Advances in Hall-effect, AMR, and other magnetic technologies have enhanced their performance, making them a preferred choice for modern sensing solutions.

Current Sensor Market, By Mounting Type

PCB-mounted current sensors dominate the market due to their compact design, easy integration, and cost-effectiveness in electronic devices and industrial circuits. They are widely used in automotive electronics, consumer products, and industrial control systems where space efficiency is vital. Their increasing adoption reflects the trend of miniaturization and high-density PCB layouts.

Current Sensor Market, By Measurement Range

The medium current range segment leads because it serves various applications, such as automotive power systems, industrial machinery, and renewable energy equipment. This range offers a good balance of performance and safety while satisfying most commercial and industrial device requirements. The flexibility and broad usability of medium-range sensors have strengthened their strong market position.

Current Sensor Market, By Output Type

Analog current sensors hold the largest market share because they provide simplicity, real-time monitoring, and compatibility with existing control systems. These sensors are widely used in industrial automation, automotive electronics, and power management applications where continuous current measurement is essential. Their reliability and easy integration make them the preferred choice over digital alternatives in many applications.

Current Sensor Market, By Industry

The automotive sector predominantly influences the current sensor market, owing to the escalating adoption of electric vehicles, hybrid systems, and sophisticated driver-assistance systems (ADAS). Current sensors play an essential role in battery management, motor control, and monitoring vehicle energy efficiency. The rising regulatory mandates for vehicle electrification and the transition towards intelligent, connected vehicles persist in fostering substantial demand within this industry.

REGION

Asia Pacific to be fastest-growing region in global current sensor market during forecast period

Asia Pacific is the fastest-growing region in the current sensor market due to its rapidly expanding industrial base, large-scale adoption of electric vehicles, and increasing investments in renewable energy projects. Countries like China, Japan, South Korea, and India are leading the transition toward electrification and smart energy systems, driving strong demand for accurate and efficient current sensing solutions. The presence of major semiconductor and electronics manufacturers in the region also fosters innovation and cost-effective production. Additionally, government initiatives promoting clean energy and industrial automation further boost the adoption of current sensors across diverse applications.

Current Sensor Market: COMPANY EVALUATION MATRIX

LEM (Star) maintains a leading position in the current sensor market with a broad and diverse product portfolio. It enables widespread adoption across various sectors, including automotive, consumer electronics, telecommunications, networking, and healthcare, while continuously innovating to strengthen its market dominance. Texas Instruments Incorporated (Emerging Leader) is rapidly gaining ground by offering advanced sensor ICs that deliver high accuracy, seamless integration, and low power consumption, catering to various industrial and automotive applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.99 Billion |

| Market Forecast in 2030 (Value) | USD 5.41 Billion |

| Growth Rate | CAGR of 10.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: Current Sensor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Industrial Automation Provider |

|

|

| Renewable Energy System Integrator |

|

|

| Consumer Electronics Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2025 : Allegro MicroSystems introduced two new current sensor ICs, the ACS37030MY and ACS37220MZ, designed for precise current sensing in compact, durable packages. These sensors offer a 40% smaller footprint than 16-pin packages, providing higher isolation and lower resistance to reduce power dissipation.

- January 2025 : Infineon Technologies AG launched the Sensor Units & Radio Frequency (SURF) business unit, merging its existing Sensor and Radio Frequency (RF) operations. This strategic move aims to enhance competitiveness and capitalize on the growing demand for sensors and RF solutions across the automotive, consumer, and industrial sectors. This move aligns with the growing demand for precise, high-performance current sensors in energy-efficient and electrification-driven markets.

- February 2024 : Asahi Kasei Microdevices (AKM) launched a CZ39 series of coreless current sensors for electric vehicle (EV) applications. These sensors facilitate smaller, lighter, and more precise on-board charging systems in EVs.

- October 2023 : TDK Corporation and LEM International SA announced a collaboration to develop next-generation integrated current sensors (ICS) utilizing Tunnel Magnetoresistance (TMR) technology.

- May 2023 : Infineon Technologies AG (Germany) acquired Swedish startup Imagimob (Sweden) to boost its microcontrollers and sensors' TinyML edge AI capabilities. Imagimob’s platform enables many use cases in embedded designs, from audio event detection, voice control, predictive maintenance, gesture recognition, and signal classification to material detection.

Table of Contents

Methodology

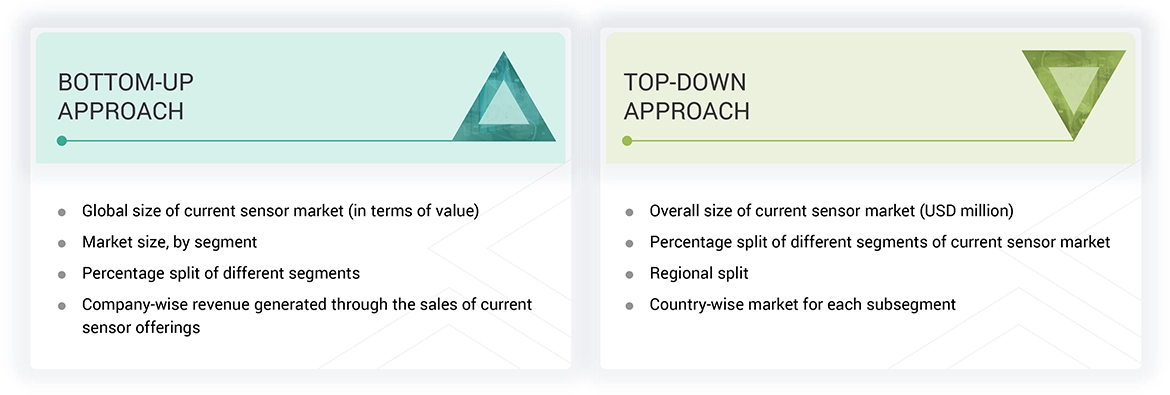

The study utilized four major activities to estimate the current sensor market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the current sensor market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

Source |

Web Link |

|

International Society of Automation |

|

|

International Federation of Robotics |

|

|

International Electrotechnical Commission |

|

|

Organisation Internationale des Constructeurs d'Automobiles |

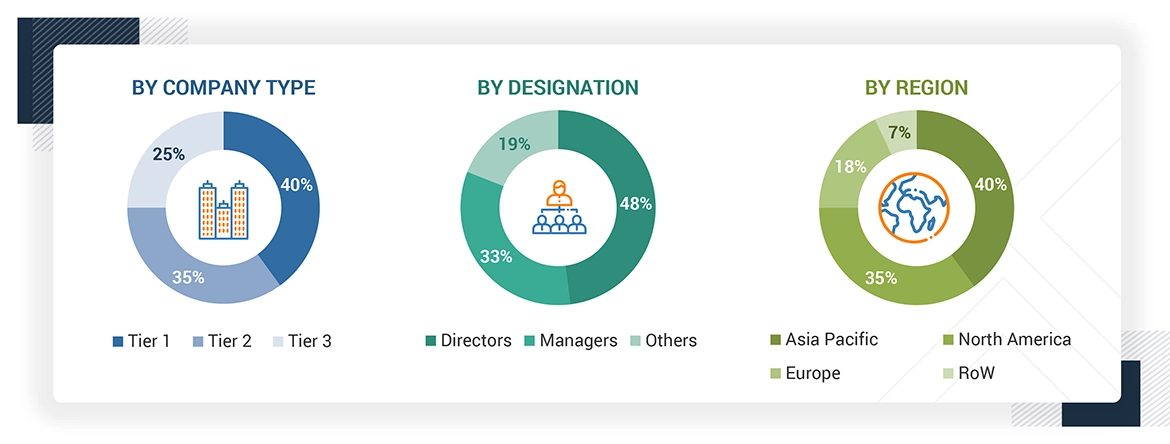

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, type, end-use, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using current sensor offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of current sensor, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Current Sensor Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the current sensor market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

A current sensor is a device which measures and transforms an electrical current to an output voltage that can be measured and directly proportional to the current passing through the monitored circuit. The measurement of the current is very vital in power management and measurement systems where current sensors offer indications in the form of an analog voltage, current, or digital output. These signals may be indicated on ammeters or logged for later analysis in data acquisition systems (DAS). Originally applied mainly for circuit protection and control, current sensing has progressed with advances in technology to become a critical function in monitoring and optimizing the operation of motors, fans, pumps, and other electrical loads. This provides efficient operation in a wide range of end-user markets, such as automotive, industrial automation, energy, and consumer electronics.

The report study covers a comprehensive analysis of the current sensor market based on current sensing methods, loop types, technologies, mounting types, measurement ranges, output types, industries, and regions. A few key manufaturers of current sensors are Asahi Kasei Corporation (Japan), Infineon Technologies AG (Germany), Allegro MicroSystems, Inc. (US), LEM International SA (Switzerland), and TDK Corporation (Japan).

Key Stakeholders

- Raw material suppliers

- Component manufacturers and providers

- Sensor manufacturers and providers

- Original equipment manufacturers (OEMs)

- ODM and OEM technology solution providers

- Automobile manufacturers

- Current sensor and device suppliers and distributors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the current sensor industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and start-ups

- End users

Report Objectives

- To describe and forecast the current sensor market size by current sensing method, loop type, offering, technology, mounting type, measurement range, output type, industry, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value.

- To describe and forecast the market for current sensor technology, loop type, industry, and region, in terms of volume

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the markets.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth.

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the current sensor value chain

- To strategically analyze key technologies, average selling price trend, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the current sensor market and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the current sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the current sensor market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the current sensor market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Current Sensor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Current Sensor Market