Electronic Sensors Market For Consumer Industry by Type (Image, Motion, Pressure, Temperature, Fingerprint, Proximity, & Others), Application (Communication & IT, Entertainment, Home Appliances, & Wearable Devices), and Geography - Global Forecast to 2022

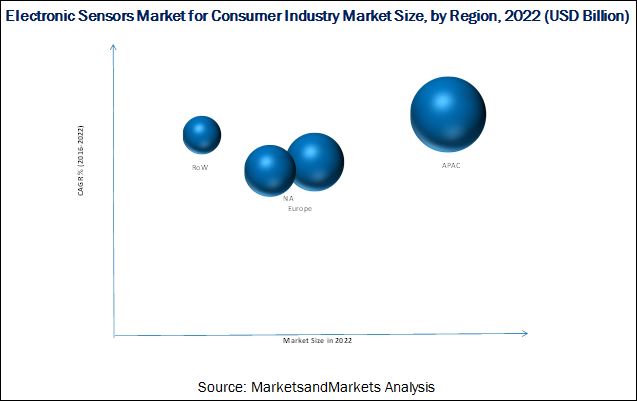

[172 Pages Report] The electronic sensors market for the consumer industry was valued at USD 11.94 Billion in 2015 and is expected to grow at a CAGR of 12.26% during the forecast period. The base year considered for the study is 2015 and the forecast period is between 2016 and 2022. The objective of the report is to provide a detailed analysis of the electronic sensor market for the consumer industry based on, type, application, and geography. The report provides detailed information regarding the major factors influencing the growth of the market for consumer industry. It also offers a detailed overview of the value chain in this market for the consumer industry. Sensor is a device which detects and responds to changes in its surroundings. It is used to measure various parameters such as motion, temperature, and pressure among others. They are widely adopted in consumer electronics across numerous devices such as smartphones, gaming consoles, PCs, home appliances, and kitchen appliances among others. The demand from the smartphones and wearable devices is expected to drive the growth of the electronic sensors market in consumer industry. Image sensors and motion sensors are the most widely used across various consumer electronics devices.

The electronic sensors market for consumer industry is expected to reach USD 26.76 Billion by 2022, at a CAGR of 12.26% between 2016 and 2022. The growing demand for smartphones, smartwatch, emergence of fitness and activity trackers, and growing adoption of augmented reality (AR) based and virtual reality (VR) based headsets are the key factors driving the growth of the electronic sensors market for consumer industry.

Image sensors held the largest share of the electronic sensors market for consumer industry owing to their huge demand in smartphones and digital cameras. However, the market for fingerprint sensors is expected to grow at the highest CAGR between 2016 and 2022 because of their growing adoption in a large number of electronic devices such as smartphones and laptops. These sensors are used to add another layer of security authentication for safe access of these devices. The rising mobile application ecosystem enables adoption of smartphones for ecommerce and financial transaction further makes fingerprint sensor as an essential requirement. Fingerprint sensors are also likely to be commercialized in computer peripherals such as mouse and keypad in the near future.

The communication & IT application of the electronic sensors market for consumer industry which comprise smartphones, tablets, laptops, and desktop PCs is expected to foster the growth of the market in the near future. The availability of smartphone-friendly content demands the integration of numerous innovative features to facilitate the enhanced user experience and firm rivalry among smartphones suppliers would further propel the growth of communication & IT segment in the electronic sensors market for consumer industry. Wearable devices created altogether a new opportunity in front of the sensor suppliers begins with the introduction of smartwatches. The advent in technology has improved the wearable devices and it has propelled the adoption of motion sensors. Moreover, the enhanced processing capabilities of the wearable devices is further expected to fuel the demand of certain environment sensors, such as temperature sensors and pressure sensors.

The electronic sensors market for consumer industry market for APAC held the largest market share in 2015 and also has the presence of key players such as include Sony Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Murata Manufacturing Co., Ltd. (Japan). Rapid urbanization and increasing disposable income is driving the demand for consumer electronics in Asia Pacific. This phenomenon fostering the growth of electronic sensors in consumer electronics in Asia Pacific.

The key driver for the electronic sensors market for consumer industry is the demand for the smartphones across the globe with emphasis on feature enhancement to deliver the better user experience. Market restraints are primarily the lack of a standardized fabrication process for MEMS-based sensors. Opportunities are the global demand and increasing adoption of wearable devices such as smartwatch, activity tracker, and VR headsets. Image sensors, motion sensors, proximity sensors, and fingerprint sensors are largely used in smartphones, while temperature sensors, pressure sensors, and level sensors are deployed in home appliances.

Market players involved in the manufacturing of electronic sensors market include Sony Corporation (Japan), Samsung Electronics Co., Ltd.(South Korea), STMicroelectronics N.V.(Switzerland), NXP Semiconductors N.V.,(acquired by Qualcomm), TE Connectivity Ltd. (Switzerland), Murata Manufacturing Co., Ltd.(Japan), Robert Bosch GmbH (Germany), Infineon Technologies AG (Germany), Synaptics Incorporated (US) Cypress Semiconductor Corporation (US) and Omron Corporation (Japan) are focusing on product launches, research and development, acquisitions, and collaborations to enhance their product offerings and business expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Research Methodology (Page No. - 34)

4.1 Attractive Market Opportunities in the Electronic Sensors Market for Consumer Industry

4.2 Electronic Sensors Market for Consumer Industry, By Geography and Sensor Type

4.3 Electronic Sensors Market for Consumer Industry, By Geography, 2015

4.4 Electronic Sensors Market for Consumer Industry, By Application (2022)

4.5 Electronic Sensors Market for Consumer Industry, Asia-Pacific vs Europe

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 Pressure Sensor Market for Consumer Industry,By Type

5.3.3 Temperature Sensor Market for Consumer Industry, By Type

5.3.4 Motion Sensor Market for Consumer Industry, By Type

5.3.5 Image Sensor Market for Consumer Industry, By Type

5.3.6 Image Sensor Market for Consumer Industry, By Operating Spectrum

5.3.7 CMOS Image Sensor Market for Consumer Industry, By Image Processing

5.3.8 Proximity Sensor Market for Consumer Industry, By Sensing Range

5.3.9 Proximity Sensor Market for Consumer Industry, By Technology

5.3.10 Fingerprint Sensor Market for Consumer Industry, By Type

5.3.11 Other Sensors Market for Consumer Industry, By Type

5.3.12 By Application

5.3.13 By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand for Smartphones Across the Globe With the Emphasis on Features Enhancement

5.4.2 Restraints

5.4.2.1 Lack of Standardized Fabrication Process for MEMS Sensors

5.4.3 Opportunities

5.4.3.1 Increasing Demand and Adoption of Wearable Devices

5.4.4 Challenges

5.4.4.1 Trade-Off Between Increasing Pricing Pressure and Size of the Sensors

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Value Chain Analysis for Electronic Sensors Market for Consumer Industry

6.3 Porter’s Five Forces Analysis

6.3.1 Degree of Competition

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Electronic Sensors Market for Consumer Industry, By Type (Page No. - 64)

7.1 Introduction

7.2 Pressure Sensor

7.2.1 Introduction

7.2.2 Piezoresistive

7.2.3 Capacitive

7.2.4 Electromagnetic

7.2.5 Optical

7.2.6 Resonant Solid State

7.2.7 Microelectromechanical System (MEMS)

7.2.8 Others

7.3 Temperature Sensor

7.3.1 Introduction

7.3.2 Bimetallic

7.3.3 Thermistor

7.3.4 Resistance Temperature Detector (RTD)

7.3.5 Temperature Sensor IC

7.3.6 Thermocouple

7.3.7 Infrared

7.3.8 Fiber Optic

7.3.9 Others

7.4 Motion Sensor

7.4.1 Introduction

7.4.2 MEMS Accelerometer

7.4.3 MEMS Gyroscope

7.4.4 MEMS Magnetometer

7.4.5 Sensor Combos

7.5 Image Sensor

7.5.1 Introduction

7.5.2 CMOS Image Sensor

7.5.2.1 CMOS Image Sensor, By Processing Type

7.5.2.1.1 2d Image Sensors

7.5.2.1.2 3d Image Sensors

7.5.3 Ccd Image Sensor

7.5.4 Other Image Sensors

7.5.4.1 Nmos Linear Image Sensor

7.5.4.2 Ingaas Linear Image Sensor

7.5.4.3 Flat Panel X-Ray Image Sensor

7.5.4.4 Scmos

7.5.5 Image Sensor, By Operating Spectrum

7.5.5.1 Visible Spectrum

7.5.5.2 Invisible Spectrum

7.5.5.2.1 Infrared Spectrum

7.5.5.2.2 X-Ray Spectrum

7.6 Proximity Sensor

7.6.1 Introduction

7.6.2 Capacitive Proximity Sensor

7.6.3 Others

7.6.3.1 Photoelectric Proximity Sensor

7.6.3.2 Ultrasonic Proximity Sensor

7.7 Fingerprint Sensor

7.7.1 Introduction

7.8 Other Sensors

7.8.1 Introduction

7.8.2 Level Sensor

7.8.3 Biosensor

8 Electronic Sensors Market for Consumer Industry, By Application (Page No. - 102)

8.1 Introduction

8.2 Entertainment

8.3 Communication and IT

8.4 Home Appliances

8.5 Wearable Devices

9 Electronic Sensors Market for Consumer Industry, By Geography (Page No. - 109)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of APAC

9.5 Rest of the World

9.5.1 Middle East & Africa

9.5.2 South America

10 Competitive Landscape (Page No. - 124)

10.1 Overview

10.2 Electronic Sensors Market for Consumer Industry Market Rank Analysis

10.3 Competitive Situations and Trends

10.4 New Product Launches

10.5 Expansions

10.6 Mergers & Acquisitions

10.7 Agreements and Partnerships

11 Company Profiles (Page No. - 131)

11.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

11.2 Sony Corporation

11.3 Samsung Electronics Co., Ltd.

11.4 Stmicroelectronics N.V.

11.5 NXP Semiconductors N.V.

11.6 TE Connectivity Ltd.

11.7 Murata Manufacturing Co., Ltd.

11.8 Robert Bosch GmbH

11.9 Infineon Technologies AG

11.10 Synaptics Incorporated

11.11 Cypress Semiconductor Corporation

11.12 Omron Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 165)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (82 Tables)

Table 1 Impact Analysis of Drivers

Table 2 Impact Analysis of Restraints

Table 3 Impact Analysis of Opportunities

Table 4 Impact Analysis of Challenges

Table 5 Prominent Companies in the Electronic Sensors Market for Consumer Industry

Table 6 Electronic Sensors Market for Consumer Industry, By Type, 2013–2022 (USD Million)

Table 7 Electronic Sensors Market for Consumer Industry, By Type, 2013–2022 (Million Units)

Table 8 Pressure Sensor Market in Consumer Industry, By Type, 2013–2022 (USD Million)

Table 9 Pressure Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 10 North American Pressure Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 11 European Pressure Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 12 Asia-Pacific Pressure Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 13 RoW Pressure Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 14 Temperature Sensor Market in Consumer Industry, By Type, 2013–2022 (USD Million)

Table 15 Temperature Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 16 North American Temperature Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 17 European Temperature Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 18 Asia-Pacific Temperature Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 19 RoW Temperature Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 20 Motion Sensor Market in Consumer Industry, By Type, 2013–2022 (USD Million)

Table 21 Motion Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 22 North American Motion Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 23 European Motion Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 24 Asia-Pacific Motion Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 25 RoW Motion Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 26 Difference Between CMOS and Ccd Sensor

Table 27 Image Sensor Market in Consumer Industry, By Type, 2013–2022 (USD Million)

Table 28 Image Sensor Market in Consumer Industry, By Spectrum Type, 2013–2022 (USD Million)

Table 29 CMOS Image Sensor Market in Consumer Industry, By Image Processing, 2013–2022 (USD Million)

Table 30 Image Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 31 North American Image Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 32 European Image Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 33 Asia-Pacific Image Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 34 RoW Image Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 35 Proximity Sensor Market in Consumer Industry, By Technology, 2013–2022 (USD Million)

Table 36 Proximity Sensor Market in Consumer Industry, By Sensing Range, 2013–2022 (USD Million)

Table 37 Proximity Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 38 North American Proximity Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 39 European Proximity Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 40 Asia-Pacific Proximity Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 41 RoW Proximity Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 42 Fingerprint Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 43 Other Electronic Sensors Market for Consumer Industry, By Type, 2013–2022 (USD Million)

Table 44 Other Electronics Sensors Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 45 North American Other Electronic Sensors Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 46 European Other Electronic Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 47 Asia-Pacific Other Electronic Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 48 RoW Other Electronic Sensor Market in Consumer Industry, By Application, 2013–2022 (USD Million)

Table 49 Electronic Sensors Market for Consumer Industry, By Application, 2013–2022 (USD Million)

Table 50 North American Electronic Sensors Market in Consumer Electronics, By Application, 2013–2022 (USD Million)

Table 51 European Electronic Sensors Market in Consumer Electronics, By Application, 2013–2022 (USD Million)

Table 52 Asia-Pacific Electronic Sensors Market in Consumer Electronics, By Application, 2013–2022 (USD Million)

Table 53 RoW Electronic Sensors Market in Consumer Electronics, By Application, 2013–2022 (USD Million)

Table 54 Electronic Sensors Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 55 North American Electronic Sensors Market in Consumer Industry, By Country, 2013–2022 (USD Million)

Table 56 European Electronic Sensors Market in Consumer Industry, By Country, 2013–2022 (USD Million)

Table 57 APAC Electronic Sensors Market in Consumer Industry, By Country, 2013–2022 (USD Million)

Table 58 RoW Electronic Sensors Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 59 Temperature Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 60 Pressure Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 61 Image Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 62 Motion Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 63 Proximity Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 64 Fingerprint Sensor Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 65 Other Electronic Sensors Market in Consumer Industry, By Region, 2013–2022 (USD Million)

Table 66 Level Sensor Market for Consumer Industry, By Region, 2013–2022 (USD Million)

Table 67 Electronic Sensors Market for Consumer Industry Market Rank Analysis, 2015

Table 68 New Product Launches, 2014–2016

Table 69 Expansions, 2014–2016

Table 70 Acquisitions, 2014–2016

Table 71 Agreements and Partnerships, 2014–2016

Table 72 Sony Corporation: Products Offered

Table 73 Samsung Electronics Co., Ltd. : Productsoffered

Table 74 Stmicroelectronics N.V. : Products Offered

Table 75 NXP Semiconductors N.V. : Products Offered

Table 76 TE Connectivity Ltd.: Products Offered

Table 77 Murata Manufacturing Co., Ltd.: Products Offered

Table 78 Robert Bosch GmbH: Products Offered

Table 79 Infineon Technologies: Products Offered

Table 80 Synaptics Incorporated: Products Offered

Table 81 Cypress Semiconductor Corporation: Products Offered

Table 82 Omron Corporation: Products Offered

List of Figures (79 Figures)

Figure 1 Markets Covered

Figure 2 Electronic Sensors Market for Consumer Industry, By Geography

Figure 3 Electronic Sensors Market for Consumer Industry: Research Design

Figure 4 Electronic Sensors Market for Consumer Industry —Size Estimation Methodology: Bottom-Up Approach

Figure 5 Electronic Sensors Market for Consumer Industry —Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 Snapshot of Electronic Sensors Market for Consumer Industry (USD Million)

Figure 10 Snapshot of Electronic Sensors Market for Consumer Industry, 2015 vs 2022 (USD Million): Market for Fingerprint Sensors Expected to Grow at the Highest Rate

Figure 11 CMOS Technology Held the Largest Size of the Global Image Sensor Market in Consumer Industry in 2015

Figure 12 Electronic Sensors Market for Consumer Industry, By Application, 2015

Figure 13 Asia-Pacific Electronic Sensors Market for Consumer Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 Electronic Sensors Market for Consumer Industry Expected to Grow at A Double Digit Rate Between 2016 and 2022

Figure 15 Asia-Pacific Held the Largest Share of the Electronic Sensors Market for Consumer Industry in 2015

Figure 16 The U.S. Held the Largest Share of the Electronic Sensors Market for Consumer Industry in 2015

Figure 17 Communication & It Expected to Hold the Largest Share of the Market in Asia-Pacific By 2022

Figure 18 Asian Markets to Grow Faster Than Their Counterparts in Europe During the Forecast Period

Figure 19 Evolution of Electronic Sensors Market for Consumer Industry

Figure 20 Electronic Sensors Market for Consumer Industry, By Type

Figure 21 Pressure Sensor, By Type

Figure 22 Temperature Sensor, By Type

Figure 23 Motion Sensor, By Type

Figure 24 Image Sensor, By Type

Figure 25 Image Sensor, By Operating Spectrum

Figure 26 CMOS Image Sensor, By Image Processing

Figure 27 Proximity Sensor, By Sensing Range

Figure 28 Proximity Sensor, By Technology

Figure 29 Fingerprint Sensor, By Type

Figure 30 Other Sensors, By Type

Figure 31 Electronic Sensors Market for Consumer Industry, By Application

Figure 32 Electronic Sensors Market for Consumer Industry, By Geography

Figure 33 Drivers, Restraints, Opportunities, and Challenges in the Electronic Sensors Market for Consumer Industry

Figure 34 Global Smartphones Shipment Snapshot for Key Suppliers

Figure 35 Design Techniques Adopted By the Key Players in the MEMS Industry

Figure 36 Global Wearable Electronics Growth Story: the Fitbit, Inc. Prospective

Figure 37 Electronic Sensors Market for Consumer Industry : Value Chain Analysis

Figure 38 Porter’s Five Forces Analysis

Figure 39 Porter’s Five Forces Analysis for Electronic Sensors Market for Consumer Industry

Figure 40 Electronic Sensors Market for Consumer Industry : Degree of Competition

Figure 41 Electronic Sensors Market for Consumer Industry : Threat of Substitutes

Figure 42 Electronic Sensors Market for Consumer Industry : Bargaining Power of Buyers

Figure 43 Electronic Sensors Market for Consumer Industry : Bargaining Power of Suppliers

Figure 44 Electronic Sensors Market for Consumer Industry : Threat of New Entrants

Figure 45 Pressure Sensor, By Type

Figure 46 Temperature Sensor, By Type

Figure 47 Motion Sensor, By Type

Figure 48 Image Sensor, By Type

Figure 49 Proximity Sensor Market, By Sensing Range

Figure 50 Proximity Sensor Market, By Technology

Figure 51 Other Sensor, By Type

Figure 52 Electronic Sensors Market for Consumer Industry, By Entertainment Application

Figure 53 Electronic Sensors Market for Consumer Industry, By Communication & It

Figure 54 Electronic Sensors Market for Consumer Industry, By Home Appliance

Figure 55 Electronic Sensors Market for Consumer Industry, By Wearable

Figure 56 Electronic Sensors Market for Consumer Industry : Geographic Snapshot (2013–2022)

Figure 57 Snapshot of the North American Electronic Sensors Market for Consumer Industry

Figure 58 Snapshot of the European Sensors Market for Consumer Industry

Figure 59 Snapshot of Asia-Pacific Sensors Market for Consumer Industry

Figure 60 Snapshot of the RoW Electronic Sensors Market for Consumer Industry

Figure 61 Companies Majorly Adopted New Product Launches as the Key Growth Strategy Over the Last Three Years (2014–2016)

Figure 62 Product Mapping for the Key Suppliers of the Electronic Sensors Market for Consumer Industry

Figure 63 Market Evolution Framework: New Product Lauches Fueled Growth and Innovation in the Electronic Sensors Market for Consumer Industry (2014–2016)

Figure 64 Battle for Market Share: New Product Lauches Were the Key Strategies (2014–2016)

Figure 65 Geographic Revenue Mix of Top 5 Market Players

Figure 66 Sony Corporation: Company Snapshot

Figure 67 Sony Corporation: SWOT Analysis

Figure 68 Samsung Electronics Co., Ltd. : Company Snapshot

Figure 69 Samsung Electronics Co., Ltd. : SWOT Analysis

Figure 70 Stmicroelectronics N.V. : Company Snapshot

Figure 71 Stmicroelectronics N.V. : SWOT Analysis

Figure 72 NXP Semiconductors N.V. : Company Snapshot

Figure 73 TE Connectivity Ltd.: Company Snapshot

Figure 74 Murata Manufacturing Co., Ltd.: Company Snapshot

Figure 75 Robert Bosch GmbH: Company Snapshot

Figure 76 Infineon Technologies AG: Company Snapshot

Figure 77 Synaptics Incorporated: Company Snapshot

Figure 78 Cypress Semiconductor Corporation: Company Snapshot

Figure 79 Omron Corporation: Company Snapshot

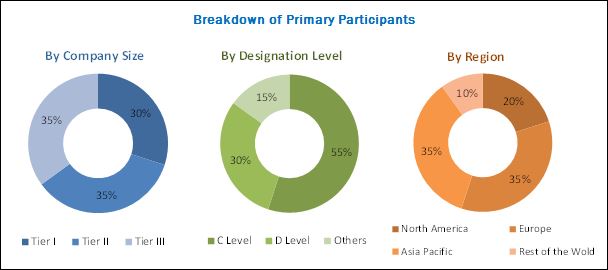

The research methodology used to estimate and forecast the electronic sensors market begins with obtaining data on key vendor revenues through secondary research, such as Consumer Technology Association, IEEE Journals & Magazines and newsletters as well as whitepapers. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the market by estimating the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure given below.

In-depth interviews of various primary respondents have been conducted which include key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants among other experts to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

The electronic sensors market for consumer industry ecosystem comprises sensor manufacturers and suppliers, OEMs, system integrators, sensors component providers, distributors, MEMS technology providers, CMOS technology providers, smartphone manufacturers, and wearable device suppliers. Companies involved in the manufacturing of electronic sensors include Sony Corporation (Japan), Samsung Electronics Co., Ltd.,(South Korea), STMicroelectronics N.V.(Switzerland) NXP Semiconductors N.V.(Acquired by Qualcomm), TE Connectivity Ltd., (Switzerland), Murata Manufacturing Co., Ltd.( Japan), Robert Bosch GmbH (Germany), Infineon Technologies AG (Germany), Synaptics Incorporated (US), Cypress Semiconductor Corporation (US), and Omron Corporation (Japan).

Target Audience:

- Sensor suppliers

- Sensor component suppliers

- OEM and ODM in consumer electronics industry

- MEMS and CMOS technology companies

- System integrators and service providers in the consumer electronics market

- Banks, financial institutions, investors, and venture capitalists

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

Scope of the Report:

Electronic Sensors Market for Consumer Industry scope:

By Type:

- Pressure Sensor

- Temperature Sensor

- Motion Sensor

- Image Sensor

- Proximity Sensor

- Fingerprint Sensor

- Others

By Application:

- Entertainment

- Communication & IT

- Home Appliances

- Wearable Devices

By Geography:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the electronic sensors market for consumer industry by region into the respective countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Electronic Sensors Market

I am a masters student currently specializing in strategy and innovation management. I am specifically interested to learn about niche strategies and commercialization techniques for the sensors' industry and analyze market trends, technology patterns etc. for the same. I request you to give me access to the report for research purposes.

I am looking for information specifically for the US electronic sensor market.

I am interested in the following - New Trends in Consumer Electronics & Mobile Hand set., New Trends in Sales, New Technology in Telecom & IT.