Redispersible Polymer Powder Market

Redispersible Polymer Powder Market by Type (VAE, VeoVA, Acrylic, Styrene Butadiene), Application (Tiling & Flooring, Mortars, Plastering, Insulation Systems), End Use (Residential, Commercial, Industrial), and Region - Global Forecast to 2029

Updated on : December 11, 2025

REDISPERSIBLE POLYMER POWDER MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global redispersible polymer powder market was valued at USD 1.61 billion in 2024 and is projected to reach USD 2.35 billion by 2029, growing at 7.8% cagr from 2025 to 2029. The market has grown significantly due to the rising demand in the construction industry and increasing spending on repair & maintenance activities.

KEY TAKEAWAYS

-

BY TYPEThe Types include Vinyl Acetate Ethylene (VAE), Vinyl Ester of Versatic Acid (VeoVa), Acrylic, and Styrene Butadiene (SB)

-

BY APPLICATIONThe Application includes Tiling & Flooring, Mortars, Plastering, Insulation Systems, and Others

-

BY END USEThe End Use includes Residential, Commercial, and Industrial

-

BY REGIONThe Redispersible Polymer Powder Market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

-

COMPETITIVE LANDSCAPEWacker Chemie AG (Germany), DOW (US), Celanese Corporation (US), BASF (Germany), and DCC (Taiwan) are the top players that have distribution network coverage across the Asia Pacific, North America, the Middle East & Africa, South America, and Europe. These companies are prominent in their domestic regions and explore geographic diversification alternatives to grow their businesses. They focus on increasing their market shares through agreements, expansions, acquisitions, and enhancing their portfolios.

Major factors contributing to the growth of the redispersible polymer powder market includes demand for energy-efficient and sustainable building materials, and the rising preference for high-performance building products that offer enhanced durability, flexibility, and water resistance. Additionally, the increasing focus on improving indoor air quality and reducing volatile organic compound (VOC) emissions is driving the demand for eco-friendly building materials, such as those containing redispersible polymer powders.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The construction industry significantly drives the growth of the redispersible polymer powder market. RDP enhances the properties of cement-based materials by improving adhesion, flexibility, and water resistance. This increases demand for RDP in applications such as tiling & flooring, mortars, plastering, and insulation systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

REDISPERSIBLE POLYMER POWDER MARKET DYNAMICS

Level

-

Rising demand in construction industry.

-

Expanding residential construction sector.

Level

-

High risks associated with spray-drying production process

Level

-

Rising demand for green buildings

Level

-

Stringent environmental regulations related to VOC emissions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand in construction industry

The use of redispersible polymer powder (RDP) in the construction industry is driven by its superior functionality in cement and gypsum-based applications. Redispersible polymer powder is widely used in tile adhesives, self-leveling compounds, mortars, and plasters to improve adhesion, flexibility, durability, and water resistance. The necessity is significantly rising with rapid urbanization and infrastructure development especially in emerging contexts looking for materials from efficiency to performance. The growing trend in green building and sustainable practices also brings the RDP combinations under demand as reduced material wastage and enhanced energy efficiency add weight on their side. More reasons are the rising momentum in renovation and remodeling activities in developed markets. In modern construction technology, the polymer powder's interesting property of enhancing workability, impact resistance, and mechanical strength of building material makes its utilization imperative. Moreover, increasing the use of RDP in dry-mix formulations for lightweight construction and prefabricated structures enhances consistency and application ease. Progress in polymer chemistry technology has, to date, resulted in even more efficient and user-friendly RDP types.

Restraint: High risk associated with spray drying production process

Spray-drying technology for redispersible polymer powders involves certain critical conditions leading to the safety of the process, as well as its efficiency and product quality. The main risk involved is the highly sensitive flammability of polymer powders, enabling dust to combine with aeration excitingly, thereby turning out into explosions subject to precise conditions. Overall, a risk is declared against dust explosion or fire upon lack of proper ventilation systems and reading mechanisms. The spray drying process also involves employing high temperatures for the liquid to evaporate, contributing to the thermal destruction of the polymer, and, consequently, the final product quality suffers. Failures of equipment such as nozzle malfunctions or plate heat exchanger choking may lead inefficiencies in production time and expenditure loss to the manufacturers. Moreover, inhalation risks remain with any fine polymer particles becoming aerial, which may be inhaled by the workers unless proper dust collection, or personal protection equipment, and preventive measures are taken. Environmental issues raise their heads as well, almost given volatile organic compounds (VOCs) and fine particulate emissions that must be filtered and adhered down for environmental regulations.

Opportunity: Rising demand for green buildings

The demand for green buildings offers ample opportunity for redispersible polymer powders (RDP) since sustainability is on the rise and snowballing in the building industry. Green buildings are no longer confined to construction only with energy efficiency, durability, and environmentally favorable inputs. Redispersible polymer powders are the right answer to building technology questions of the present, making construction-materials-like tiling adhesives, mortars, and stuccos do a better performance in flexibility, hydrophobicity, and mechanical strength. This leads to construction materials that are durable, environmentally friendly, requiring the least maintenance, thereby ensuring low lifecycle costs. Further, dry-mix materials are eco-friendly, less water intensive, and encourage less waste than conventional wet-mortar applications. Use of redispersible polymer powder in lightweight and high-performance materials for green buildings leads to the use of RDP in self-leveling compounds, insulation systems, and prefabricated building elements. The effort towards the adoption of low VOC and nontoxic building materials tallies with the extra mile so development of RDP technology for green improvements, curving towards respecting stringent environmental guidelines.

Challenges: Stringent environmental regulations related to VOC emissions

The redispersible powders (RDP) industry is faced with particularly stringent environmental regulations related to volatile organic compounds (VOCs). As global air pollution and health risks have become a growing concern, governments and regulatory bodies all over the world are toughening their limits on VOC emissions. In line with those, RDP manufacturers have to adapt their production processes and formulations to such changing limits. Conventional polymer binders contain solvents comprises of residual volatiles that participate in VOCs off-gassing either during manufacturing or during actual application processes. The main goal is to produce RDPs that are low VOC or VOC-free altogether and still maintain their performance capability in all possible given applications. The reconstruction of polymers for minimal emissions while upholding some inherent properties (such as adhesion, flexibility, and durability) is technically cumbersome and expensive. While maintaining profitability, these VOC control practices add extra costs such as efficient filtration, thermal oxidation systems, and the need for source materials selected from a sustainable perspective. Compliance with various environmental regulations, thus, destabilizes production and distribution strategies, as companies must tailor formulations for the diversity among endpoints.

Redispersible Polymer Powder Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Wacker produces redispersible polymer powders primarily used in construction, including concrete modification, tile adhesives, flexible mortars, renders, and crack fillers. | Enhances adhesion, flexibility, and cohesion in cementitious materials, improves crack resistance. |

|

Dow manufactures redispersible polymer powders used in thermal insulation systems, particularly for adhesive and reinforcement layers, gypsum plasters, and floor leveling applications. | Provides superior bonding strength and thermal insulation, improving durability and energy efficiency in construction systems. |

|

Celanese, redispersible polymer powder used in cement and lime-based renders, floor levelling compounds & screeds, gypsum joint fillers, gypsum plasters, polymer binder applications, repairs, tile grouts, tile adhesives, waterproofing membranes, and ETICS/EIFS | Improves workability and flexibility of mortars, enhances adhesion and impact resistance, and delivers water resistance and surface smoothness, ensuring long-term durability in construction materials. |

|

BASF produces redispersible polymer powders for cementitious applications such as self-leveling compounds, mineral plasters, and sealants. The company leverages strong R&D and global supply capabilities to provide customized formulations for high-performance building materials. | Primarily used to formulate highly flexible, one-component cementitious sealing slurries designed for waterproofing applications indoors and outdoors under tiles. |

|

DCC manufactures high–glass transition temperature (Tg) redispersible polymer powders used in tile adhesives, repair mortars, self-leveling compounds, and gypsum-based components. | VAE redispersible powder is a white, free-flowing copolymer powder derived from ethyl and vinyl acetate through spray drying. It serves as an effective binder in building materials and adhesives, enhancing performance and versatility across construction applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The redispersible polymer powder market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of redispersible polymer powder. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks. Prominent companies in this market include Wacker Chemie AG (Germany), DOW (US), Celanese Corporation (US), BASF (Germany), DCC (Taiwan) and among others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Redispersible Polymer Powder Market, By Type

Vinyl Acetate Ethylene (VAE) is expected to grow significantly to the greater extent during the forecasted period mainly as a redispersible polymer powder (RDP). The growing demand for applied construction items, like tile adhesives, self-leveling compounds, and cementitious repair mortars, is stimulating the growth of VAE-based RDP. For these powders, their absence intrinsically makes modern construction practice very favorable; these redispersible polymer powder gives exceptional bonding strength, flexibility, and rapid setting. VAE also provides high water resistance and durability needed in infrastructure. The rise in demand for sustainable and environment-friendly building materials is further conducive to VAE expansion. VAE has lower volatile organic compound (VOC) emissions compared with more common polymer powders and, thus, aligns with stringent global environmental regulations. Besides local availability, its compatibility with numerous cementitious, and gypsum-based formulations has made it a preferred option by manufacturers and consumers alike. Another significant factor propelling the demand for VAE-based RDP is the thriving set of construction industries, mainly in the emerging regions still at their development stages. The result of rapid urban sprawl, infrastructure creation, and renovation activity has skyrocketed the consumption of the latest polymer powders. In addition, the growing strength of the polymerization process has improved the performance under extreme meteorological conditions for VAE. VAE-based redispersible polymer powder is projected to have robust growth over the years with increasing demand for high-performance, sustainable, and cost-effective construction materials.

Redispersible Polymer Powder Market, By End Use

The residential segment is expected to experience significant growth during the forecast period, led by increasing use of redispersible polymer powder (RDP) in renovation and construction activities. With increasing urbanization and housing demand, particularly in developing economies, high-performance building products have gained high relevance. RDP has widespread use in residential construction on account of its ability to enhance the durability, adhesion, and flexibility of cementitious products, thus being used for tile adhesives, self-leveling compounds, skim coats, and external insulation finishing systems (EIFS). Among the key drivers of RDP growth in the residential market is the emerging tide of sustainable and energy-efficient homes. Homeowners and builders are seeking more building materials that improve thermal insulation, conserve maintenance costs, and assure enduring durability. RDP formulations provide higher water resistance, crack resistance, and overall structural stability, which makes them highly compatible with existing housing programs. Furthermore, the renovation and remodeling sector is developing rapidly, especially in developed nations, where ancient infrastructure requires advanced repair techniques. The flexibility of RDP allows it to be an ideal candidate for application in restoration activities, improving the durability and quality of residential facility buildings. Furthermore, policy compliance with eco-friendly and low-VOC materials has accelerated the application of RDP in residential construction. With growing emphasis on affordability in housing, sustainability, and high-performance building materials, the residential market will experience substantial growth, and RDP will become a critical component of residential projects in the future.

REGION

Asia Pacific is to be fastest-growing region in global redispersible polymer powder market during forecast period

The redispersible polymer powder (RDP) market in Asia Pacific is poised to witness exemplary growth during the forecast period by very rapid urbanization, infrastructure, and building activities wherein countries as China, India, and the nations of Southeast Asia have zipped forth in residential, commercial, and industrial activities, asking for high-performance building materials. RDP is versatilely used across applications in tile adhesives, self-leveling compounds, EIFS (external insulation and finish systems), and repair mortar, thereby becoming a requisite in modern construction. One of the natural drivers for the Asia-Pacific market growth is the increasing support provided by government in affordable housing and smart city projects. The governments across the region are heavily investing in infrastructure, roads, and urban development, thus translating into advanced cementitious and gypsum bond compatible formulation combining RDP for additional durability and improved workability. Along with above line, sustainable construction is allowing the claims of more biodegradable, eco-friendly, and low-VOC polymer powders, adding to the increased demand for greater sales expansion.

Redispersible Polymer Powder Market: COMPANY EVALUATION MATRIX

In the redispersible polymer powder market matrix, Wacker Chemie AG (Star) maintains a solid position in the market. The company provides diverse redispersible polymer powder products. It has a significant global presence and is highly focused on R&D to provide innovative products. Synthomer PLC (Emerging Leader) has a significant presence across the globe, positioning it well to capture a larger market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.61 BN |

| Market Forecast in 2029 (value) | USD 2.35 BN |

| Growth Rate | CAGR 7.8% from 2024-2029 |

| Years Considered | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD MN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, South America, and Middle East & Africa. |

WHAT IS IN IT FOR YOU: Redispersible Polymer Powder Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Construction Chemicals Manufacturer | Formulation optimization of RDP grades for tile adhesives, self-leveling compounds, and repair mortars. | Enhances bonding strength, flexibility, and crack resistance; improves long-term durability of cementitious products. |

| Insulation System Supplier (EIFS/ETICS) | Customization of RDP for external insulation systems to improve adhesion and weather resistance. | Provides superior adhesion on diverse substrates, enhances energy efficiency, and increases weather durability. |

| Gypsum Product Producer | Evaluation of RDP compatibility in gypsum-based plasters and joint fillers. | Improves workability, reduces shrinkage, and ensures smooth finish with high mechanical strength. |

| Ready-Mix Mortar Company | Benchmarking RDP performance in pre-mixed dry mortars for water retention and setting control. | Ensures consistency, reduces water demand, and enhances application efficiency at construction sites. |

| Adhesive & Sealant Manufacturer | Development of polymer blends combining RDP with other binders for improved adhesion and flexibility. | Enhances elasticity and surface bonding, extends service life, and provides eco-friendly low-VOC formulations. |

RECENT DEVELOPMENTS

- May 2020 : Celanese Corporation signed a long-term agreement with Anhui Wanwei Group Co., Ltd. to supply ethylene-based vinyl acetate monomer (VAM) to meet approximately 50% of Wanwei’s product needs for chemicals, fibers, and new materials in Anhui Province, China.

- April 2020 : Celanese Corporation acquired Nouryon’s redispersible polymer powders business, marketed under the Elotex brand. The acquisition includes Nouryon’s global production facilities in Frankfurt (Germany), Geleen (Netherlands), Moosleerau (Switzerland), and Shanghai (China), along with all related products, customer agreements, technology, and commercial assets. Celanese will integrate the Elotex portfolio and facilities into its global vinyl acetate ethylene (VAE) emulsions business to strengthen its capacity and better address global market demand.

- September 2019 : Wacker Chemie AG opened a new production factory for dispersible polymer powders in Ulsan, South Korea. The new plant in Ulsan is part of an ongoing site expansion to increase manufacturing capacity for dispersible polymer powders in Asia Pacific.

Table of Contents

Methodology

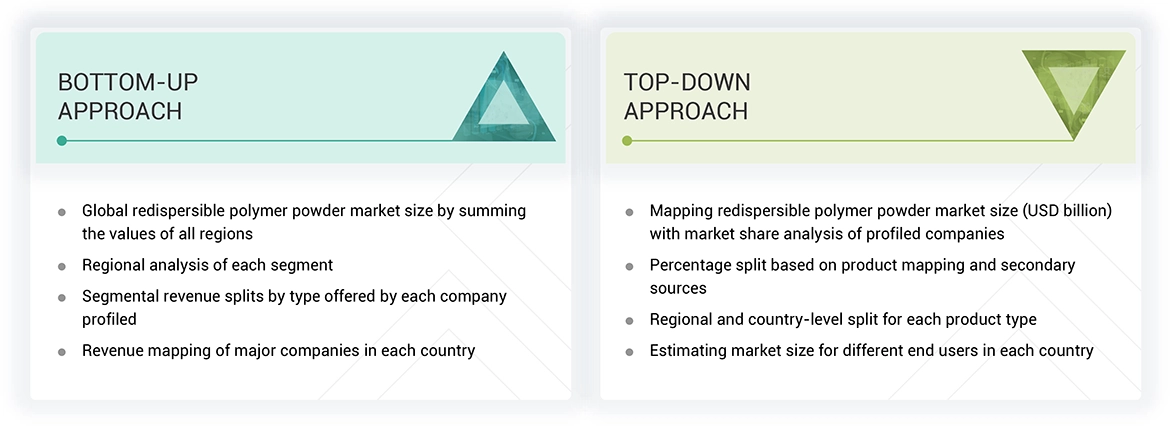

The study involved four major activities in estimating the current size of the redispersible polymer powder market—exhaustive secondary research collected information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the redispersible polymer powder value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; redispersible polymer powder manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain critical information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

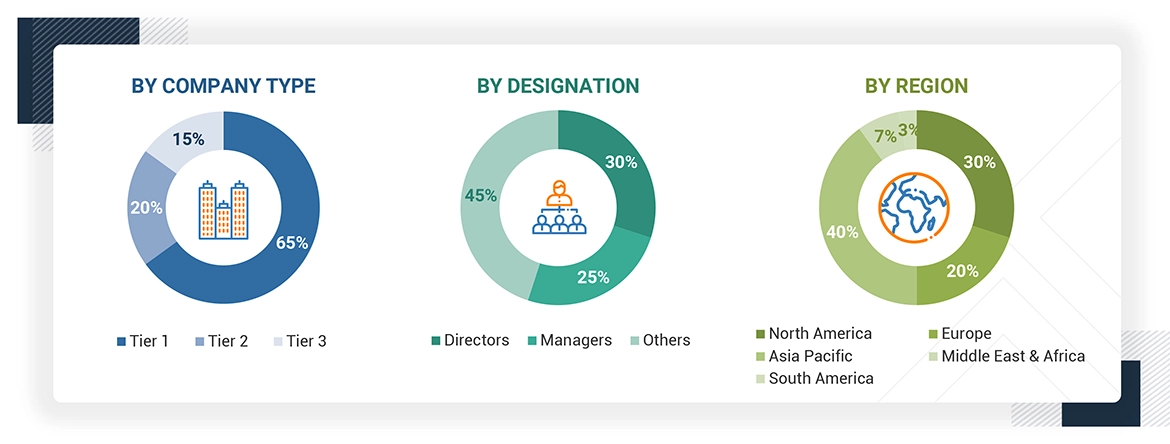

The redispersible polymer powder market comprises several stakeholders, such as raw material manufacturers and suppliers, manufacturers, traders, distributors, suppliers, contract manufacturing organizations, institutions, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the redispersible polymer powder market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various companies and organizations operating in the redispersible polymer powder market. Primary sources from the demand side included directors, marketing heads, and purchase managers from multiple end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the redispersible polymer powder market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

- The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the redispersible polymer powder market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Transfection is the process of deliberately introducing naked or purified nucleic acids (including DNA, RNA, or proteins) into eukaryotic cells. Transfection is a powerful tool that helps in the study of gene functions and can be achieved using biochemical, physical, and viral vector methods. Transfection technologies have been used in life science research and have been exploited for therapeutic delivery like gene therapy. This gene transfer technology enables the study of gene function and protein expression in a cellular environment.

The scope of the report includes FDA-approved transfection technologies products that are used for the transfection of nucleic acids into eukaryotic cells with the help of innovative method where the transfection technologies are intended to deliver DNA, RNA, or proteins for biomedical research, therapeutic delivery, and protein production.

Report Objectives

- To define, describe, and forecast the redispersible polymer powder market size based on type, end use, applications, and region.

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth.

- To forecast the size of the various segments of the redispersible polymer powder market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each region.

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders.

- To analyze recent developments, such as expansions, agreements, new product developments, and acquisitions in the redispersible polymer powder market.

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Redispersible Polymer Powder Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Redispersible Polymer Powder Market