Polymer Modified Cementitious Coatings Market by Flexibility, Composition, Polymer Type (Acrylic Polymers, SBR Latex), Application (Non-Residential Buildings, Residential Buildings, Public Infrastructure) and Region - Global Forecast to 2025

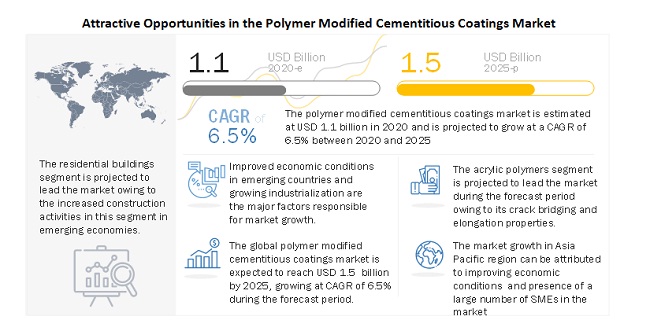

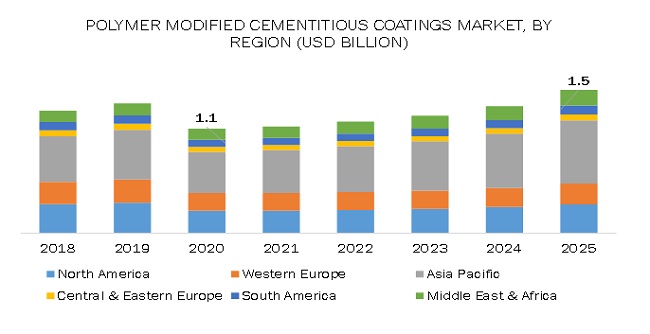

[161 Pages Report] In 2020, the polymer modified cementitious coatings market is estimated at USD 1.1 billion and is projected to reach USD 1.5 billion by 2025, at a CAGR of 6.5% from 2020 to 2025. Growing demand for polymer modified cementitious coatings from the residential buildings segment is expected to drive the polymer modified cementitious coatings market. Increasing urbanization in the emerging economies is expected to drive the growth of the market. Rising government initiatives to support infrastructure development and construction activities in emerging countries of the Asia Pacific region offer lucrative growth opportunities to manufacturers of polymer modified cementitious coatings. However, the limited shelf-life of these coatings acts as a key restraint to the growth of the market

Based on Composition, the two-component segment is projected to lead the market, during the forecast period

The two-component segment is estimated to lead the polymer modified cementitious coatings market in 2020, owing to the Increasing demand for higher durability and flexible waterproofing solution. . The two-component coating material possesses high flexibility, abrasion resistance, impact resistance, and water resistance properties. Further, the consumption of two-component coatings is expected to lead the market owing to the durability of the coating, increasing disposable incomes, and increasing industrialization in emerging economies.

Based on flexibility, the flexible segment is projected to be largest market, during the forecast period

Flexible cementitious coatings are applied to objects which are subject to shrinkage, vibration, movement, stress, and crack formation and to substrates which are difficult to stick to, such as wood, steel, aerated lightweight blocks, and gypsum. Due to the high polymer content in flexible cementitious coating material, they have a low coefficient of diffusion and are resistant to chemicals such as chloride ions, sulfate ions, carbon dioxide, and other chemicals. Superior waterproofing performance, excellent durability compared to non-flexible coatings is projected to fuel the market

Based on polymer type, the acrylics segment is projected to grow at the highest CAGR , during the forecast period

The polymer modified cementitious coatings market has been segmented on the basis of polymer type, application, and region. Based on polymer type, the acrylic polymer segment led the polymer modified cementitious coatings market in 2019, owing to the use of its varied derivatives across various applications. Based on application, the residential buildings segment led the polymer modified cementitious coatings market, owing to increase in construction activities across all regions. Further, increasing demand for low cost and fast setting cementitous coatings from the residential segment is expected to drive the market

Based on application, residential segment is projected to lead the polymer modified cementitious coatings market, from 2020-2025

Residential buildings segment is the largest application segment in the polymer modified cementitious coatings market, and it is estimated to lead the market during the forecast period as well. Low cost of polymer modified cementitious coatings is driving the growth of these coatings in the residential buildings segment. The growing urbanization and migration of people from rural areas to urban cities are important factors driving the housing sector. Polymer modified cementitious coatings are also applied on the exteriors of brick, block, or concrete walls to waterproof structures. Exterior walls are subject to harsh climatic conditions and may also require timely maintenance. This coating finds applications in decorative as well as protective exterior waterproof coatings.

Asia Pacific is expected to witness the highest growth in the polymer modified cementitious coatings market during the forecast period

The polymer modified cementitious coatings market in the Asia Pacific region is projected to grow at the highest CAGR between 2020 and 2025. The Asia Pacific region led the polymer modified cementitious coatings market in 2016, and is expected to grow at a high rate during the forecast period. The Asia Pacific region is an emerging and lucrative market for polymer modified cementitious coatings, owing to industrial development and improving economic conditions. This region constitutes approximately 60% of the world’s population, and thus leads to the wide-scale use of polymer modified cementitious coatings for waterproofing applications in residential and non-residential buildings, and public infrastructure.

Key Market Players

Major companies such as Arkema S.A. (France), Sika AG (Switzerland), Akzo Nobel N.V. (Netherlands), MAPEI S.p.A. (Italy), Compagnie de Saint-Gobain S.A. (France), and Fosroc International Limited (UAE) , Dow, Inc. (US) and H.B. Fuller Company (US) The Lubrizol Corporation (US), Organik Kimya Sanayi Ve Ticaret A.S. (Turkey), Pidilite Industries Limited (India), GCP Applied Technologies Inc. (US), Berger Paints India Limited (India), W. R. Meadows, Inc. (US), Evercrete Corporation (US), Indulor Chemie GmbH (Germany), The Euclid Chemical Company (US), among others, are the major players in the polymer modified cementitious coatings market. These players have been focusing on strategies such as expansions, acquisitions, partnerships, and new product developments, which have helped them expand their businesses in untapped and potential markets. They have also been adopting various organic and inorganic growth strategies, such as contracts, agreements, new product developments, acquisitions, and expansions, to enhance their current position in the polymer modified cementitious coatings market.

Scope of the report:

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Kilotons) |

|

Segments covered |

Flexibility, Composition, Polymer Type, Application, and Region |

|

Regions covered |

North America, Western Europe, Central & Eastern Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

On the basis of flexibility, the polymer modified cementitious coatings market is segmented as follows:

- Flexible

- Non-flexible

On the basis of composition, the polymer modified cementitious coatings market is segmented as follows:

- One-component

- Two-component

On the basis of polymer type, the polymer modified cementitious coatings market is segmented as follows:

- Acrylic Polymer

- SBR Latex

On the basis of application, the polymer modified cementitious coatings market is segmented as follows:

- Non-residential Buildings

- Residential Buildings

- Public Infrastructure

On the basis of Region, the polymer modified cementitious coatings market is segmented as follows:

- North America

- Asia Pacific

- Western Europe

- Central & Eastern Europe

- Middle East & Africa

- South America

Recent Developments

- In March 2020, W. R. Meadows, Inc. introduced a new one-component polymer modified coating, namely, MEADOW-PATCH SMOOTH-GRADE. It is used to fill cracks, smooth rough surfaces, and other small surface defects in newly placed or existing concrete surfaces. This has helped the company to expand its product portfolio and cater to new markets.

- In February 2020, Fosroc International Ltd, and Berger Paints Bangladesh Ltd, market leader in the Bangladesh paint industry, entered into a joint venture to establish a new legal entity, Berger Fosroc Limited. This new entity serves the construction chemicals market in Bangladesh. This joint venture has helped the company in working with contractors onsite and provide solutions to protect concrete with grouts, waterproofing, coatings, sealants, and flooring products. This is also expected to help the company serve the construction sector in Bangladesh which is expected to witness significant growth over the next few decades

- In December 2019, Arkema S.A. acquired LIP Bygningsartikler AS (LIP), the Danish leader in tile adhesives, waterproofing systems, and floor preparation solutions through its subsidiary, Bostik. With this acquisition, the company is able to meet customer demand in the Nordic countries

- In May 2019, Saint-Gobain Weber signed a memorandum of understanding with SCG Cement-Building Materials in Thailand for the development of a modular bathroom solution that incorporates Saint-Gobain Weber tiling and waterproofing solutions. With this partnership, the company is expected to expand their presence in Thailand and cater its waterproofing materials for several applications.

- In May 2018, GCP Applied Technologies Inc. acquired UK-based R.I.W. Limited (R.I.W.), a supplier of waterproofing products, for approximately USD 30 million. This acquisition has helped the company to establish its presence in the UK and increase its customer base.

Key questions addressed by the report

- What are the future revenue pockets in the polymer modified cementitious coatings market?

- Which key developments are expected to have a long-term impact on the polymer modified cementitious coatings market?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the polymer modified cementitious coatings market?

- What are the prime strategies of leaders in the polymer modified cementitious coatings market?

Frequently Asked Questions (FAQ):

What is polymer modified cementitious coatings?

Polymer modified cementitious coating refers to a one-component or two-component, thixotropic coating that provides high adhesion to both, concrete and steel. It forms a highly elastic, hard alkaline coating on the substrate. This coating is composed of cement-based materials that easily blend with liquids, such as water or polymer emulsion.

What is the major application of polymer modified cementitious coatings?

Residential buildings is the major application of polymer modified cemnetitous coatings. Polymer modified cementitious coatings are widely used in kitchens, bathrooms (wet rooms), and balconies for roofing, wall coatings, and floorings, among others. These coatings are majorly preferred in residential buildings owing to the low cost in comparison to the substitutes available. Floor waterproofing is also essential during the construction of residential buildings. It provides mechanical resistance and protection against corrosive substances.

How does flexibility of polymer modified cementitious coatings affects the waterproofing properties?

Flexibility plays an important role in deciding the performance of the coating during adverse temperatures. Flexibility is a property of cementitious coatings that essentially serves as a bridge during surface cracks on substrates on which the coating is applied. The polymer content in the products decides the final flexibility and crack bridging property of the hardened membrane.

What is major polymer type used in the production of polymer modifie cementitious coatings?

The acrylic polymers are largely preferred for such coatings. Increasing demand for low-cost waterproofing solutions for residential buildings is expected to drive the acrylic polymers segment. This type of coating enhances characteristics such as adhesion, toughness, flexural strength, and resistance to chemicals.

Who are the leading polymer modified cementitious coatings provider in the world?

Major companies such as Arkema S.A. (France), Sika AG (Switzerland), Akzo Nobel N.V. (Netherlands), MAPEI S.p.A. (Italy), Compagnie de Saint-Gobain S.A. (France), and H.B. Fuller Company (US) among others are the major players in the polymer modified cementitious coatings market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 MARKET DEFINITION AND SCOPE

2.1.1 POLYMER MODIFIED CEMENTITOUS COATINGS MARKET: INCLUSIONS AND EXCLUSIONS

2.2 BASE NUMBER CALCULATION

FIGURE 1 BASE NUMBER CALCULATION - APPROACH 1

FIGURE 2 BASE NUMBER CALCULATION - APPROACH 2

2.3 ORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RESEARCH DATA

2.7.1 SECONDARY DATA

2.7.1.1 Key data from secondary sources

2.7.2 PRIMARY DATA

2.7.2.1 Key data from primary sources

2.7.2.2 Breakdown of primary interviews

2.7.2.3 Key industry insights

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 5 ASIA PACIFIC TO DOMINATE THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

FIGURE 6 RESIDENTIAL BUILDINGS TO BE THE LARGEST APPLICATION OF POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

FIGURE 7 ACRYLIC POLYMERS TO LEAD THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

FIGURE 8 INCREASING DEMAND FROM RESIDENTIAL BUILDINGS SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY PRODUCT TYPE

FIGURE 9 ACRYLIC POLYMERS MODIFIED CEMENTITIOUS COATINGS TO BE THE FASTEST-GROWING SEGMENT

4.3 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COMPOSITION

FIGURE 10 TWO-COMPONENT POLYMER MODIFIED CEMENTITIOUS COATINGS TO BE THE FASTEST-GROWING SEGMENT

4.4 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION AND REGION

FIGURE 11 RESIDENTIAL BUILDINGS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in urbanization

TABLE 1 URBAN POPULATION, BY COUNTRY, 2014-2018

5.2.2 RESTRAINTS

5.2.2.1 Limited shelf-life of polymer modified cementitious coatings

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing construction activities in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in the availability and prices of raw materials

FIGURE 13 CRUDE OIL PRICES, (2016-2019)

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.5 INDUSTRY TRENDS

5.6 IMPACT OF COVID-19 ON THE CONSTRUCTION INDUSTRY

TABLE 2 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021

6 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COMPOSITION (Page No. - 52)

6.1 INTRODUCTION

FIGURE 15 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COMPOSITION, 2020 & 2025 (USD MILLION)

TABLE 3 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COMPOSITION, 2018-2025 (USD MILLION)

TABLE 4 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COMPOSITION, 2018-2025 (TONS)

6.2 ONE-COMPONENT

6.2.1 EASE OF APPLICATION, MIXING, AND LOW COST COMPARED TO

TWO-COMPONENT ARE EXPECTED TO DRIVE THE MARKET 54

6.3 TWO-COMPONENT

6.3.1 INCREASING DEMAND FOR HIGHER DURABILITY AND FLEXIBILITY IS EXPECTED TO DRIVE THE MARKET FOR TWO-COMPONENT POLYMER MODIFIED CEMENTITIOUS COATINGS

7 POLYMER MODIFIED CEMENTIITOUS COATINGS MARKET, BY FLEXIBILITY (Page No. - 55)

7.1 INTRODUCTION

FIGURE 16 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY FLEXIBILITY, 2020 & 2025 (USD MILLION)

TABLE 5 POLYMER MODIFIED CEMENTIITOUS COATINGS MARKET, BY FLEXIBILITY, 2018-2025 (USD MILLION)

TABLE 6 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY FLEXIBILITY, 2018-2025 (KILOTONS)

7.2 NON-FLEXIBLE

7.2.1 IMPROVED COHESIVE STRENGTH, ABRASION RESISTANCE, AND TOUGHNESS ALONG WITH ECONOMICAL COST ARE EXPECTED TO DRIVE THE MARKET

7.3 FLEXIBLE

7.3.1 SUPERIOR WATERPROOFING PERFORMANCE, EXCELLENT DURABILITY COMPARED TO NON-FLEXIBLE COATINGS IS PROJECTED TO FUEL THE MARKET

8 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE (Page No. - 58)

8.1 INTRODUCTION

FIGURE 17 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2020 & 2025 (USD MILLION)

TABLE 7 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 8 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (KILOTONS)

8.2 ACRYLIC POLYMERS

8.2.1 INCREASING DEMAND FOR LOW COST AND FAST SETTING CEMENTITOUS COATINGS FROM THE RESIDENTIAL SEGMENT IS EXPECTED TO DRIVE THE MARKET

TABLE 9 ACRYLIC POLYMERS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 10 ACRYLIC POLYMERS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

8.3 SBR LATEX

8.3.1 HIGHER ELONGATION AND LONGER SERVICE LIFE IS PROJECTED TO FUEL THE MARKET FOR SBR LATEX

TABLE 11 SBR LATEX: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 SBR LATEX: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

9 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION (Page No. - 62)

9.1 INTRODUCTION

FIGURE 18 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2020 & 2025 (USD MILLION)

TABLE 13 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 14 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

9.2 NON-RESIDENTIAL BUILDINGS

9.2.1 INCREASE IN INDUSTRIALIZATION IS EXPECTED TO DRIVE THE NON-RESIDENTIAL BUILDINGS SEGMENT

9.2.2 INDUSTRIAL

9.2.3 COMMERCIAL

TABLE 15 NON-RESIDENTIAL BUILDINGS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 16 NON-RESIDENTIAL BUILDINGS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

9.3 RESIDENTIAL BUILDINGS

9.3.1 INCREASING URBANIZATION AND LOW COST OF POLYMER MODIFIED CEMENTITIOUS COATINGS ARE PROJECTED TO FUEL THE MARKET

9.3.2 EXTERIOR WALLS

9.3.3 FLOORINGS

TABLE 17 RESIDENTIAL BUILDINGS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 18 RESIDENTIAL BUILDINGS: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

9.4 PUBLIC INFRASTRUCTURE

9.4.1 INCREASING GOVERNMENT INTERVENTIONS FOR INFRASTRUCTURE DEVELOPMENT ARE EXPECTED TO FUEL THE PUBLIC INFRASTRUCTURE SEGMENT

9.4.2 ROADS & BRIDGES

9.4.3 PARKING STRUCTURES & STADIUMS

9.4.4 PIPE COATINGS

TABLE 19 PUBLIC INFRASTRUCTURE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 20 PUBLIC INFRASTRUCTURE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

10 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET BY REGION (Page No. - 69)

10.1 INTRODUCTION

FIGURE 19 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY REGION (USD MILLION)

TABLE 21 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 22 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY REGION, 2018-2025 (KILOTONS)

10.2 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 23 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 24 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 25 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 26 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 27 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 28 ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.2.1 CHINA

10.2.1.1 China is expected to lead the Asia Pacific polymer modified cementitious coatings market

TABLE 29 CHINA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 30 CHINA POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.2.2 JAPAN

10.2.2.1 Increasing new and redevelopment construction projects are expected to lead the market in Japan

TABLE 31 JAPAN: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 32 JAPAN: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.2.3 INDIA

10.2.3.1 Increase in the demand for commercial buildings is expected to fuel the polymer modified cementitious coatings market in India

TABLE 33 INDIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 34 INDIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.2.4 SOUTH KOREA

10.2.4.1 Rapid industrialization and urbanization is projected to drive the market in South Korea

TABLE 35 SOUTH KOREA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 36 SOUTH KOREA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.2.5 REST OF ASIA PACIFIC

10.2.5.1 The demand for infrastructural development in the non-residential buildings segment are projected to propel the market in the Rest of Asia Pacific

TABLE 37 REST OF ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 38 REST OF ASIA PACIFIC: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.3 NORTH AMERICA

FIGURE 21 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 40 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 41 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 42 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 43 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 44 NORTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.3.1 US

10.3.1.1 US is projected to lead polymer modified cementitious coatings market in North America

TABLE 45 US: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 46 US: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.3.2 CANADA

10.3.2.1 Increasing demand for infrastructure development in construction sector expected to fuel market in Canada

TABLE 47 CANADA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 48 CANADA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.3.3 MEXICO

10.3.3.1 Increasing investment in construction expected to lead to the growth of the polymer modified cementitious coatings market in Mexico

TABLE 49 MEXICO: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 50 MEXICO: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.4 WESTERN EUROPE

FIGURE 22 WESTERN EUROPE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 51 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 52 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 53 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 54 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 55 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 56 WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.1 GERMANY

10.4.1.1 Germany is expected to lead the market in Western Europe

TABLE 57 GERMANY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 58 GERMANY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.2 UK

10.4.2.1 Growth of commercial sector to drive demand in polymer modified cementitious coatings market in the UK

TABLE 59 UK: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 60 UK: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.3 FRANCE

10.4.3.1 Increase in new construction projects expected to trigger market in France

TABLE 61 FRANCE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 62 FRANCE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.4 ITALY

10.4.4.1 Increase in industrial construction activities is expected lead to the growth of the market in Italy

TABLE 63 ITALY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 64 ITALY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.5 SPAIN

10.4.5.1 Construction of residential buildings expected to drive the market in Spain

TABLE 65 SPAIN: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 66 SPAIN: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.6 REST OF WESTERN EUROPE

10.4.6.1 Rising demand for building materials for the construction of residential and commercial infrastructure is projected to

trigger the market in Rest of Western Europe 92

TABLE 67 REST OF WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 68 REST OF WESTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.5 CENTRAL & EASTERN EUROPE

FIGURE 23 EASTERN & CENTRAL EUROPE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 69 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 70 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 71 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 72 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 73 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 74 CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.5.1 RUSSIA

10.5.1.1 Development of affordable housing projects is expected to drive the market in Russia

TABLE 75 RUSSIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 76 RUSSIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.5.2 TURKEY

10.5.2.1 Increasing construction of commercial buildings projected to drive the market in Turkey

TABLE 77 TURKEY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 78 TURKEY: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.5.3 REST OF CENTRAL & EASTERN EUROPE

10.5.3.1 The rise in economic conditions and spending power of the population are expected to drive the market

TABLE 79 REST OF CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 80 REST OF CENTRAL & EASTERN EUROPE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.6 MIDDLE EAST & AFRICA

FIGURE 24 MIDDLE EAST & AFRICA POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 81 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 83 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 85 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.6.1 SAUDI ARABIA

10.6.1.1 Increase in construction activities is expected to propel the market in Saudi Arabia

TABLE 87 SAUDI ARABIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 88 SAUDI ARABIA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.6.2 UAE

10.6.2.1 Increasing demand for non-residential buildings is projected to drive the market in the UAE

TABLE 89 UAE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 UAE: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.6.3 REST OF MIDDLE EAST & AFRICA

10.6.3.1 Rise in the construction of commercial buildings and public infrastructure is projected to lead to the growth of the market in Rest of Middle East & Africa 103

TABLE 91 REST OF MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 92 REST OF MIDDLE EAST & AFRICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BYAPPLICATION, 2018-2025 (KILOTONS)

10.7 SOUTH AMERICA

FIGURE 25 SOUTH AMERICA POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SNAPSHOT

TABLE 93 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 94 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY COUNTRY, 2018-2025 (KILOTONS)

TABLE 95 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (USD MILLION)

TABLE 96 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE, 2018-2025 (KILOTONS)

TABLE 97 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.7.1 BRAZIL

10.7.1.1 Brazil is expected to lead the polymer modified cementitious coatings market in South America

TABLE 99 BRAZIL: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 BRAZIL: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.7.2 ARGENTINA

10.7.2.1 Economic growth and government investments in infrastructural development of roads and residential buildings projected to drive the market in Argentina

TABLE 101 ARGENTINA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 102 ARGENTINA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

10.7.3 REST OF SOUTH AMERICA

10.7.3.1 Increasing investments for infrastructural developments expected to drive market in Rest of South America

TABLE 103 REST OF SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 104 REST OF SOUTH AMERICA: POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY APPLICATION, 2018-2025 (KILOTONS)

11 COMPETITIVE LANDSCAPE (Page No. - 110)

11.1 INTRODUCTION

11.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.2.1 MARKET SHARE ANALYSIS

FIGURE 26 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

11.3 PRODUCT FOOTPRINT

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

11.3.1 STAR

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.4 COMPANY EVALUATION MATRIX

FIGURE 28 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET: COMPANY EVALUATION MATRIX, 2019

11.5 SME EVALUATION MATRIX, 2019

FIGURE 29 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET: SME COMPANY EVALUATION MATRIX, 2019

12 COMPANY PROFILES (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, Current Focus and Strategies, Threat from Competition, Right to Win)*

12.1 ARKEMA S.A.

FIGURE 30 ARKEMA S.A.: COMPANY SNAPSHOT

FIGURE 31 ARKEMA S.A.: SWOT ANALYSIS

12.2 SIKA AG

FIGURE 32 SIKA AG: COMPANY SNAPSHOT

FIGURE 33 SIKA AG: SWOT ANALYSIS

12.3 AKZO NOBEL N.V.

FIGURE 34 AKZO NOBEL N.V.: COMPANY SNAPSHOT

FIGURE 35 AKZO NOBEL N.V.: SWOT ANALYSIS

12.4 MAPEI S.P.A.

FIGURE 36 MAPEI S.P.A.: COMPANY SNAPSHOT

FIGURE 37 MAPEI S.P.A.: SWOT ANALYSIS

12.5 COMPAGNIE DE SAINT-GOBAIN S.A.

FIGURE 38 COMPAGNIE DE SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

FIGURE 39 COMPAGNIE DE SAINT-GOBAIN S.A.: SWOT ANALYSIS

12.6 H.B. FULLER COMPANY

FIGURE 40 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 41 H.B. FULLER COMPANY: SWOT ANALYSIS

12.7 FOSROC INTERNATIONAL LIMITED

FIGURE 42 FOSROC INTERNATIONAL LIMITED: SWOT ANALYSIS

12.8 DOW INC.

FIGURE 43 DOW INC.: COMPANY SNAPSHOT

FIGURE 44 DOW INC.: SWOT ANALYSIS

12.9 THE LUBRIZOL CORPORATION

FIGURE 45 THE LUBRIZOL CORPORATION: SWOT ANALYSIS

12.1 ORGANIK KIMYA SANAYI VE TICARET A.S.

12.11 PIDILITE INDUSTRIES LIMITED

FIGURE 46 PIDILITE INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 47 PIDILITE INDUSTRIES LIMITED: SWOT ANALYSIS

12.12 GCP APPLIED TECHNOLOGIES INC.

FIGURE 48 GCP APPLIED TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 49 GCP APPLIED TECHNOLOGIES INC.: SWOT ANALYSIS

12.13 BERGER PAINTS INDIA LIMITED

FIGURE 50 BERGER PAINTS INDIA LIMITED: COMPANY SNAPSHOT

12.14 W. R. MEADOWS, INC.

12.15 EVERCRETE CORPORATION

12.16 INDULOR CHEMIE GMBH

12.17 THE EUCLID CHEMICAL COMPANY

12.18 QINGDAO HIGHONOUR CHEMICAL TECH CO., LTD.

12.19 OTHER KEY PLAYERS

12.19.1 AQUAFIN INC.

12.19.2 DUROCK ALFACING INTERNATIONAL LIMITED

12.19.3 HENKEL POLYBIT INDUSTRIES LTD.

12.19.4 PERMA CONSTRUCTION AIDS PVT. LTD.

12.19.5 OZEKI CHEMICAL INDUSTRY CO., LTD.

12.19.6 ARMSTRONG CHEMICALS PVT. LTD.

12.19.7 A.B.E. CONSTRUCTION CHEMICALS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, Current Focus and Strategies, Threat from Competition, Right to Win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 154)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for polymer modified cementitious coatings. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources, directories, and databases, such as Forbes, Bloomberg, Businessweek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the polymer modified cementitious coatings market. Other secondary sources included annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

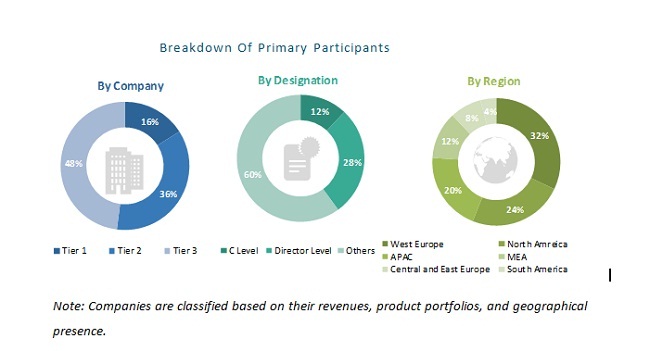

Primary Research

The polymer modified cementitious coatings market comprises stakeholders such as producers, suppliers, and distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in applications such as residential buildings, non-residential buildings and public infrastructure. The supply side is characterized by market consolidation activities undertaken by polymer modified cementitious coatings. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the polymer modified cementitious coatings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size - using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the market size for polymer modified cementitious coatings, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To estimate and forecast the polymer modified cementitious coatings market size based on flexibility, composition, polymer type, and application.

- To analyze and forecast the polymer modified cementitious coatings market based on

region – Asia Pacific, Western Europe, Central & Eastern Europe, North America, Middle East & Africa, and South America - To analyze the opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Polymer Type Analysis

- A further breakdown of the polymer type segment of the polymer modified cementitious coatings market with respect to a particular application

Application Analysis

- A further breakdown of the application segment of the polymer modified cementitious coatings market with respect to a particular country

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Polymer Modified Cementitious Coatings Market