Polymer Binders Market by Type (Acrylic, Vinyl Acetate, and Latex), Form (Liquid, Powder, and High Solids), Application (Architectural Coatings, Adhesives & Sealants, Textile & Carpets, Paper & Board, and Construction Additives), and Region - Global Forecast to 2023

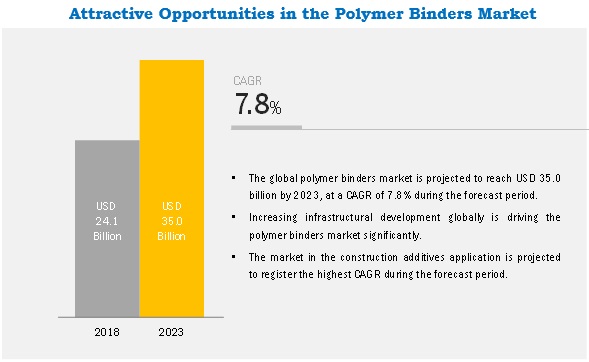

[123 Pages Report] The polymer binders market size is estimated at USD 24.1 billion in 2018 and is projected to reach USD 35.0 billion by 2023, at a CAGR of 7.8%. The study involves four major activities in estimating the current market size for polymer binders. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

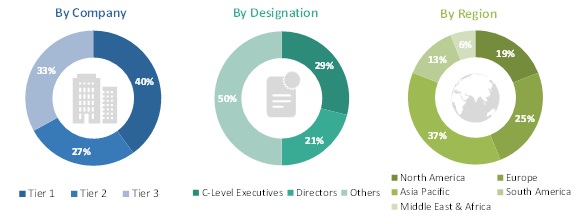

The polymer binders market comprises several stakeholders such as raw material suppliers, distributors of polymer binders, paint associations, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers and suppliers of paints & coatings, adhesives & sealants, paper & board, and textile & carpets. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the polymer binders market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the market size estimation process explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the paints & coatings, adhesives & sealants, and paper & board industries.

Objectives of the Study:

- To define, describe, and forecast the polymer binders market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, form, and application

- To forecast the size of the market with respect to five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch, & expansion, and acquisition, undertaken in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Notes: Micromarkets1 are the subsegments of the polymer binders market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value(USD) and Volume(Kiloton) |

|

Segments covered |

Type, Form, Application, and Region |

|

Regions covered |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies covered |

BASF (Germany), Wacker (Germany), DowDuPont (US), Celanese (US), and Arkema (France) |

Scope of the report

This research report categorizes the polymer binders market based on type, form, application, and region.

Polymer Binders Market, by Type:

- Acrylic

- Vinyl Acetate

- Latex

- Others (alkyd, epoxy, acrylonitrile copolymers, polyvinyl chloride, polyurethane, and chlorinated polymer binders)

Polymer Binders Market, by Form:

- Liquid

- Powder

- High Solids

Polymer Binders Market, by Application

- Architectural Coatings

- Adhesives & Sealants

- Textile & Carpets

- Paper & Board

- Construction Additives

- Others (printing inks, wax & polishes, industrial coatings, nonwovens, sports surfaces, and footwear)

Polymer Binders Market, by Region

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The polymer binders market has been further analyzed based on key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the polymer binders market

Company Information:

- Detailed analysis and profiling of additional market players

The polymer binders market size is estimated at USD 24.1 billion in 2018 and is projected to reach USD 35.0 billion by 2023, at a CAGR of 7.8%. Growth in the global construction industry is the major driver for the polymer binders market. In addition, growing per capita paint consumption is also driving the demand for polymer binders significantly.

By type, the acrylic segment is expected to be the largest contributor, in terms of volume, in the polymer binders market during the forecast period.

The acrylic segment is estimated to account for the largest share of the polymer binders market during the forecast period. The high market share is due to acrylic polymer binders good performance and low cost as compared to vinyl acetate ethylene and latex. It has excellent alkali resistance, water resistance, abrasion resistance, and good pigment binding capacity, make acrylic polymer binders an ideal for the low-cost architectural coatings and other applications.

By application, construction additives is expected to be the fastest-growing segment, in terms of volume, in the polymer binders market during the forecast period.

Construction additives is projected to be the fastest-growing application during the forecast period. The growth of this segment can be attributed to polymer binders increasing use for the tiling & flooring, mortar modification, plastering, and insulation system applications. Polymer binders used in these applications improves the performance of mortars by increasing durability, tensile strength, compressive strength, and flexural strength.

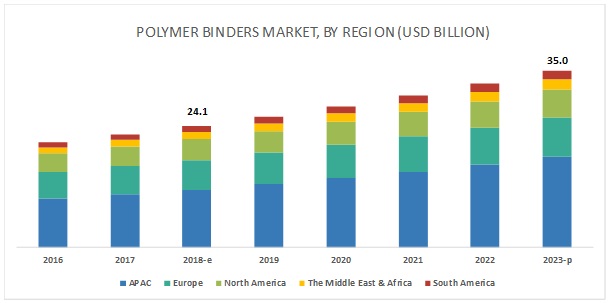

APAC is projected to be the largest market, in terms of value, during the forecast period

APAC has the largest populous countries such as China and India. These countries are rapidly going through infrastructural development to meet public and private infrastructural needs, owing to which the demand for polymer binders in these countries is high. The presence of rapidly growing economies along with growing per capita paint consumption across the region is driving the polymer binders market. In addition, the presence of largest textile producing countries, such as India, China, and South Korea, is also favourable for the growth of the polymer binders market. China is the worlds largest consumer of adhesives & sealants, making China a favourable polymer binders market.

BASF (Germany), DowDuPont (US), Celanese Corporation (US), Arkema (France), and Wacker (Germany) are the key players operating in the polymer binders market.

These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2018 to strengthen their position in the market. New product launch and expansion was among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for polymer binders from emerging economies.

Recent Developments

- In March 2018, BASF (Germany) extended the production of its JONCRYL brand of emulsions from the Netherlands production site to cater to the increasing demand from the inks and paper & board applications in Europe.

- In April 2017, DowDuPont launched fluorocarbon-free binders for the paper & board application. The product is marketed under the brand RHOBARR. It can be used to strengthen the oil & grease resistance barrier coatings for the paper- packaging. This development will strengthen the companys polymer binders product portfolio.

- In November 2017, Wacker expanded its VAE dispersion production capacity at its Ulsans plant in South Korea. This expansion is the result of the increasing demand for polymer binders in the region. The total annual capacity of the plant will increase by 80 kilotons. This will allow the company to cater the growing demand for polymer binders across the region.

- In October 2018, Arkema (France) expanded its production capacity of SYNAQUA emulsions at its Michigan facility in the US. This expansion is in response to the growing demand for polymer binders in North America.

Critical questions the report answers:

- What are the upcoming hot bets for polymer binders market?

- How is the market dynamics changing for different types of polymer binders?

- How is the market dynamics changing for different applications of polymer binders?

- Who are the major manufacturers of polymer binders?

- How is the market dynamics changing for different regions of polymer binders?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Polymer Binders Market

4.2 Polymer Binders Market, By Type

4.3 Polymer Binders Market, By Form

4.4 Polymer Binders Market, By Application

4.5 APAC Polymer Binders Market, By Application and Country

4.6 Polymer Binders Market, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in the Global Construction Industry

5.2.1.2 Increasing Demand From Technical Textile

5.2.1.3 Rising Per Capita Paint Consumption

5.2.2 Restraints

5.2.2.1 Diminishing Demand for Paper Products and Carpets

5.2.2.2 Risks Associated With Spray Drying in the Production of Powdered Polymer Binder

5.2.3 Opportunities

5.2.3.1 Increased Demand for Water-Based Polymer Binders in Emerging Markets

5.2.4 Challenges

5.2.4.1 Manufacturing Low-Voc Polymer Binders

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Polymer Binders Market, By Form (Page No. - 38)

6.1 Introduction

6.2 Liquid

6.2.1 Liquid Polymer Binders, Used in All Major Applications, is Expected to Dominate the Market During the Forecast Period

6.3 Powder

6.3.1 High Adhesive Strength, Flexibility, and High Sag Resistance of Powdered Polymer Binders are Increasing Their Demand in the Construction Additives Application

6.4 High Solids

6.4.1 The High Solids Segment to Register the Highest CAGR in the Polymer Binders Market During the Forecast Period

7 Polymer Binders Market, By Type (Page No. - 42)

7.1 Introduction

7.2 Acrylic

7.2.1 Pure Acrylic

7.2.1.1 Cost-Effective Pure Acrylic has High Demand in the Architectural Coatings Application

7.2.2 Styrene Acrylic

7.2.2.1 Styrene Acrylic has Low Voc Content, and Hence has High Demand in Various Applications

7.2.3 Vinyl Acrylic

7.2.3.1 Vinyl Acrylic is Extensively Used in Wide Application Areas, as It Improves Performance Without Adding Plasticizers

7.3 Vinyl Acetate

7.3.1 Polyvinyl Acetate

7.3.1.1 Polyvinyl Acetate Exhibits High Electrolyte Tolerance Which Makes It Suitable for the Adhesives & Sealants Application

7.3.2 Vinyl Acetate Ethylene

7.3.2.1 Higher Efficiency and Performance of Vinyl Acetate Ethylene Increases Its Demand

7.3.3 Ethylene Vinyl Acetate

7.3.3.1 Ethylene Vinyl Acetate Have High Demand in the Architectural Coatings Application Due to Its Excellent Water & Oil Resistance Property

7.4 Latex

7.4.1 Styrene Butadiene Copolymer

7.4.1.1 High Elasticity and Adhesive Strength of Latex to Drive Its Demand in the Carpet, Textile, and Paints Applications

7.4.2 Styrene Butadiene Rubber

7.4.2.1 High Aging Resistance to Fuel the Demand for Styrene Butadiene Rubber in the Sports Surface Coating Application

7.5 Others

8 Polymer Binders Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Architectural Coatings

8.2.1 Architectural Coatings is the Largest Application of Polymer Binders Market in 2017

8.3 Adhesives & Sealants

8.3.1 Fast Curing Time and Excellent Oxidation Resistance of Polymer Binders Make Them Suitable for Use in Adhesives & Sealants

8.4 Textile & Carpets

8.4.1 Textile Coating

8.4.1.1 Polymer Binders Excellent Abrasion and Oil Resistance Properties to Boost Their Demand in the Textile Coating Application

8.4.2 Carpet Backing

8.4.2.1 Polymer Binders Have Excellent Adhesion to Fabric and is Water Resistant, Making It Suitable for Carpet Backing Application

8.5 Construction Additives

8.5.1 Tiling & Flooring

8.5.1.1 Polymer Binders Have Excellent Adhesion Strength for Use in the Tiling & Flooring Application

8.5.2 Mortar Mix

8.5.2.1 Mortar Modification is Expected to Generate Huge Demand for Polymer Binders

8.5.3 Plastering

8.5.3.1 Increased Adoption of Polymer Binders in Plastering Owing to Its Excellent Bonding Property

8.5.4 Insulation Systems

8.5.4.1 Polymer Binders High Flexibility, Bonding Strength, and Durability to Boost Their Demand in Insulation Systems

8.6 Paper & Board

8.6.1 Excellent Pigment Binding Property of Polymer Binders to Drive Their Demand for Coating in the Paper & Board Application

8.7 Others

9 Polymer Binders Market, By Region (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US Accounts for the Largest Market Share Owing to the Presence of the Regions Largest Construction Industry

9.2.2 Canada

9.2.2.1 Increased Consumption of Architectural Coatings Owing to the Growing Number of Construction Projects to Drive the Demand for Polymer Binders

9.2.3 Mexico

9.2.3.1 Mexico is Expected to Witness the Highest Growth Rate During the Forecast Period Owing to Its Rapidly Growing Economy

9.3 APAC

9.3.1 China

9.3.1.1 China Accounted for the Largest Market Share in APAC Owing to the Presence of the Biggest Textile, Adhesive & Sealants, and Architectural Coatings Markets

9.3.2 India

9.3.2.1 India to Witness the Highest Growth Rate in the Polymer Binders Market During the Forecast Period Owing to the Rapidly Growing Construction and Textile Industries

9.3.3 Japan

9.3.3.1 Increased Adoption of Polymer Binders as Construction Additives in Mortar Modification Drive the Market

9.3.4 South Korea

9.3.4.1 The Architectural Coatings Application to Lead the Polymer Binders Market Owing to High Demand in the Paints & Coating Formulations

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.1.1 Germany to Lead the Polymer Binders Market in Europe With the Largest Share

9.4.2 UK

9.4.2.1 Moderate Recovery in the Construction Sector to Drive the Polymer Binders Market During the Forecast Period

9.4.3 France

9.4.3.1 Growth in the Number of Construction Projects Along With Growing Adhesives & Sealants Consumption is Fueling the Market Growth

9.4.4 Italy

9.4.4.1 The Architectural Coatings Application to Dominate the Polymer Binders Market During the Forecast Period

9.4.5 Spain

9.4.5.1 Spain to Witness the Highest Growth in the Polymer Binders Market During the Forecast Period in Europe Owing to the Growing Textile Production and Increasing Demand for Decorative Paints

9.4.6 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Saudi Arabia Dominates the Polymer Binders Market in the Middle East & Africa

9.5.2 South Africa

9.5.2.1 Increased Adoption of Polymer Binders as Construction Additives to Boost the Demand for Polymer Binders

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 The Presence of the Largest Construction Industry in the Region to Positively Influence the Growth of the Polymer Binders Market

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 87)

10.1 Overview

10.2 Market Ranking of Key Players

10.2.1 BASF SE

10.2.2 Dowdupont

10.2.3 Wacker Chemie Ag

10.2.4 Celanese Corporation

10.2.5 Arkema

10.3 Competitive Scenario

10.3.1 New Product Launch

10.3.2 Expansion

10.3.3 Acquisition

11 Company Profiles (Page No. - 93)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 BASF SE

11.2 Dowdupont

11.3 Wacker Chemie

11.4 Celanese Corporation

11.5 Arkema

11.6 Trinseo

11.7 Omnova Solutions

11.8 Dairen Chemical Corporation

11.9 Toagosei Co., Ltd.

11.10 Synthomer PLC

11.11 Other Key Companies

11.11.1 Chemrez Technologies

11.11.2 Shandong Hearst Building Material

11.11.3 Zydex

11.11.4 Visen Industries

11.11.5 Jesons

11.11.6 Acquos

11.11.7 Organik Kimya

11.11.8 Puyang Yintai Industrial Trading

11.11.9 Bosson Union Tech(Beijing)

11.11.10 Adpl Group

11.11.11 Sakshi Chem Sciences

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 115)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Related Reports

12.6 Author Details

List of Tables (69 Tables)

Table 1 Polymer Binders Market Size, By Form, 20162023 (Kiloton)

Table 2 Polymer Binders Market Size, By Form, 20162023 (USD Million)

Table 3 Polymer Binders Market Size, By Type, 20162023 (USD Million)

Table 4 Polymer Binders Market Size, By Type, 20162023 (Kiloton)

Table 5 Polymer Binders Market Size, By Application, 20162023 (Kiloton)

Table 6 Polymer Binders Market Size, By Application, 20162023 (USD Million)

Table 7 Polymer Binders Market Size, By Region, 20162023 (Kiloton)

Table 8 Polymer Binders Market Size, By Region, 20162023 (USD Million)

Table 9 North America: By Market Size, By Country, 20162023 (Kiloton)

Table 10 North America: By Market Size, By Country, 20162023 (USD Million)

Table 11 North America: By Market Size, By Application, 20162023 (Kiloton)

Table 12 North America: By Market Size, By Application, 20162023 (USD Million)

Table 13 US: By Market Size, By Application, 20162023 (Kiloton)

Table 14 US: By Market Size, By Application, 20162023 (USD Million)

Table 15 Canada: By Market Size, By Application, 20162023 (Kiloton)

Table 16 Canada: By Market Size, By Application, 20162023 (USD Million)

Table 17 Mexico: By Market Size, By Application, 20162023 (Kiloton)

Table 18 Mexico: By Market Size, By Application, 20162023 (USD Million)

Table 19 APAC: By Market Size, By Country, 20162023 (Kiloton)

Table 20 APAC: By Market Size, By Country, 20162023 (USD Million)

Table 21 APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 22 APAC: By Market Size, By Application, 20162023 (USD Million)

Table 23 China: By Market Size, By Application, 20162023 (Kiloton)

Table 24 China: By Market Size, By Application, 20162023 (USD Million)

Table 25 India: By Market Size, By Application, 20162023 (Kiloton)

Table 26 India: By Market Size, By Application, 20162023 (USD Million)

Table 27 Japan: By Market Size, By Application, 20162023 (Kiloton)

Table 28 Japan: By Market Size, By Application, 20162023 (USD Million)

Table 29 South Korea: By Market Size, By Application, 20162023 (Kiloton)

Table 30 South Korea: By Market Size, By Application, 20162023 (USD Million)

Table 31 Rest of APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 32 Rest of APAC: By Market Size, By Application, 20162023 (USD Million)

Table 33 Europe: By Market Size, By Country, 20162023 (Kiloton)

Table 34 Europe: By Market Size, By Country, 20162023 (USD Million)

Table 35 Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 36 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 37 Germany: By Market Size, By Application, 20162023 (Kiloton)

Table 38 Germany: By Market Size, By Application, 20162023 (USD Million)

Table 39 UK: By Market Size, By Application, 20162023 (Kiloton)

Table 40 UK: By Market Size, By Application, 20162023 (USD Million)

Table 41 France: By Market Size, By Application, 20162023 (Kiloton)

Table 42 France: By Market Size, By Application, 20162023 (USD Million)

Table 43 Italy: By Market Size, By Application, 20162023 (Kiloton)

Table 44 Italy: By Market Size, By Application, 20162023 (USD Million)

Table 45 Spain: By Market Size, By Application, 20162023 (Kiloton)

Table 46 Spain: By Market Size, By Application, 20162023 (USD Million)

Table 47 Rest of Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 48 Rest of Europe: By Market Size, By Application, 20162023 (USD Million)

Table 49 Middle East & Africa: By Market Size, By Country, 20162023 (Kiloton)

Table 50 Middle East & Africa: By Market Size, By Country, 20162023 (USD Million)

Table 51 Middle East & Africa: By Market Size, By Application, 20162023 (USD Million)

Table 52 Middle East & Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 53 Saudi Arabia: By Market Size, By Application, 20162023 (Kiloton)

Table 54 Saudi Arabia: By Market Size, By Application, 20162023 (USD Million)

Table 55 South Africa: By Market Size, By Application, 20162023 (USD Million)

Table 56 South Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 57 Rest of Middle East & Africa: By Market Size, By Application, 20162023 (USD Million)

Table 58 Rest of Middle East & Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 59 South America: By Market Size, By Country, 20162023 (USD Million)

Table 60 South America: By Market Size, By Country, 20162023 (USD Kiloton)

Table 61 South America: By Market Size, By Application, 20162023 (USD Million)

Table 62 South America: By Market Size, By Application, 20162023 (Kiloton)

Table 63 Brazil: By Market Size, By Application, 20162023 (USD Million)

Table 64 Brazil: By Market Size, By Application, 20162023 (Kiloton)

Table 65 Rest of South America: By Market Size, By Application, 20162023 (USD Million)

Table 66 Rest of South America: By Market Size, By Application, 20162023 (Kiloton)

Table 67 New Product Launch, 20152018

Table 68 Expansion, 20152018

Table 69 Acquisition, 20152018

List of Figures (41 Figures)

Figure 1 Polymer Binders Market Segmentation

Figure 2 Polymer Binders Market: Research Design

Figure 3 Polymer Binders Market: Data Triangulation

Figure 4 Liquid Form to Dominate the Polymer Binders Market

Figure 5 Acrylic to Be the Largest Type of Polymer Binders

Figure 6 Construction Additives Segment to Register the Highest CAGR in the Market

Figure 7 APAC to Be the Largest and the Fastest-Growing Polymer Binders Market

Figure 8 Growth in the Construction Industry to Drive the Demand for Polymer Binders

Figure 9 Acrylic Segment to Account for the Largest Share of the Polymer Binders Market

Figure 10 Liquid Form to Capture the Highest Share of the Market

Figure 11 Architectural Coatings to Be the Largest Application of Polymer Binders

Figure 12 Architectural Coatings Segment Accounted for the Largest Share of the APAC Market in 2017

Figure 13 APAC to Register the Highest CAGR in the Market

Figure 14 Overview of Factors Governing the Polymer Binders Market

Figure 15 Porters Five Forces Analysis: Polymer Binders Market

Figure 16 Liquid Form to Be the Largest Segment of the Polymer Binders Market

Figure 17 Acrylic Segment to Lead the Polymer Binders Market

Figure 18 Architectural Coatings Application to Lead the Polymer Binders Market

Figure 19 India to Register the Highest CAGR in the Polymer Binders Market

Figure 20 North America: Polymer Binders Market Snapshot

Figure 21 APAC: Polymer Binders Market Snapshot

Figure 22 Europe: Polymer Binders Market Snapshot

Figure 23 Middle East & Africa: Polymer Binders Market Snapshot

Figure 24 South America: Polymer Binders Market Snapshot

Figure 25 Companies Adopted Expansion as the Key Growth Strategy Between 2015 and 2018

Figure 26 Ranking of Key Polymer Binder Manufacturers in 2017

Figure 27 BASF SE: Company Snapshot

Figure 28 BASF SE: SWOT Analysis

Figure 29 Dowdupont: Company Snapshot

Figure 30 Dowdupont: SWOT Analysis

Figure 31 Wacker Chemie: Company Snapshot

Figure 32 Wacker Chemie: SWOT Analysis

Figure 33 Celanese Corporation: Company Snapshot

Figure 34 Celanese Corporation: SWOT Analysis

Figure 35 Arkema: Company Snapshot

Figure 36 Arkema: SWOT Analysis

Figure 37 Trinseo: Company Snapshot

Figure 38 Trinseo: SWOT Analysis

Figure 39 Omnova Solutions: Company Snapshot

Figure 40 Toagosei Co., Ltd.: Company Snapshot

Figure 41 Synthomer PLC: Company Snapshot

Growth opportunities and latent adjacency in Polymer Binders Market