Flooring Market by Material (Resilient, Non-Resilient (Ceramic tiles, Wood, Laminate, Stone), Soft-floor covering), End-use Industry (Residential, Non-residential), & Region (North America, Europe , APAC, MEA, South America) - Global Forecast to 2028

Updated on : November 27, 2025

Flooring Market

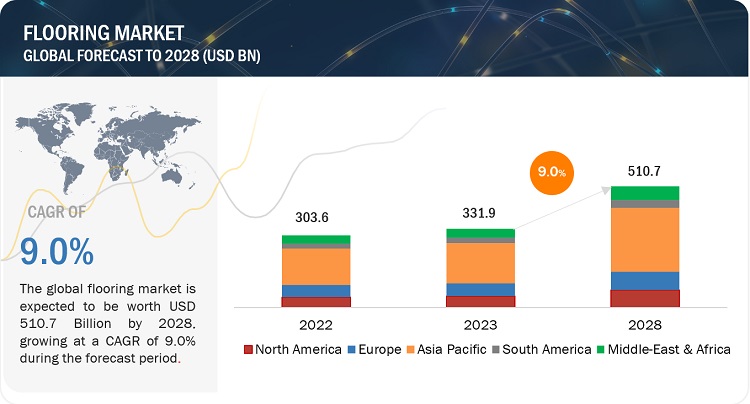

The global flooring market size was valued at USD 331.9 billion in 2023 and is projected to reach USD 510.7 billion by 2028, growing at 9.0% cagr from 2023 to 2028. The market growth is driven by construction and infrastructure development. The demand for flooring materials is closely tied to construction activities and infrastructure development. As new residential, commercial, and industrial buildings are constructed or renovated, there is a need for flooring solutions. Infrastructure projects such as transportation systems, airports, and public spaces also contribute to the demand for flooring materials.

Flooring Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Flooring Market

Flooring Market Dynamics

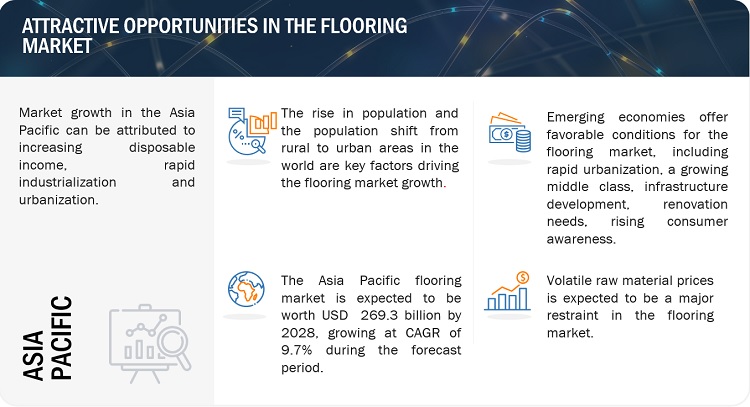

Driver: Rise in population & rapid urbanization and increase in investment in the construction industry are the major drivers of the flooring market.

As the population grows, the demand for housing also rises. This creates a need for flooring materials in residential construction projects. Whether it's new housing developments or renovations, the flooring market benefits from the increased demand for various types of flooring products. Urbanization leads to the construction of roads, bridges, airports, railway stations, and public spaces, all of which require flooring materials. The flooring market benefits from this increased construction activity in urban areas.

Restraint: Volatile raw material prices

Raw material price fluctuations can be a considerable restraint for the flooring industry, affecting the profitability and competitiveness of flooring companies. Fluctuations in raw material prices directly impact the cost of producing flooring products. If the prices of key raw materials, such as wood, vinyl, carpet fibers, ceramics, or resins, increase, manufacturers may face higher production costs. This can lead to increased prices for finished flooring products, affecting consumer demand and market competitiveness.

Opportunities: Rise in demand from emerging economies

Emerging economies present significant opportunities for the flooring industry due to rapid urbanization, a growing middle class, infrastructure development, renovation and modernization needs, rising consumer awareness, and the growing tourism and hospitality industry. These factors drive the demand for flooring materials and offer a favourable market environment for manufacturers and suppliers. By leveraging these opportunities, flooring businesses can establish a strong presence and drive growth in emerging markets.

Challenges: Disposal of waste

The flooring industry generates a significant volume of waste during installation, renovation, and demolition processes. This waste includes old flooring materials, scraps, packaging, adhesives, and other related items. Disposing of such large volumes of waste can be costly and time-consuming. Some flooring materials, such as certain adhesives, coatings, or underlays, may contain hazardous substances. Disposing of these materials requires adherence to specific regulations and guidelines to ensure proper handling, containment, and disposal to avoid environmental and health risks.

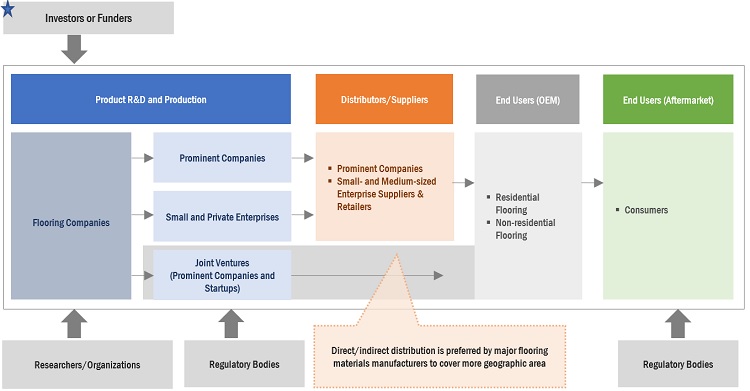

Flooring Market Ecosystem

By Material, Resilient flooring material accounted for the highest CAGR during the forecast period

Resilient flooring materials, such as vinyl, linoleum, and rubber, are known for their durability and long lifespan. They can withstand high foot traffic, resist scratches, stains, and dents, and maintain their appearance over time. This durability appeals to consumers looking for flooring options that offer longevity and require minimal maintenance or replacement, making resilient materials a popular choice.

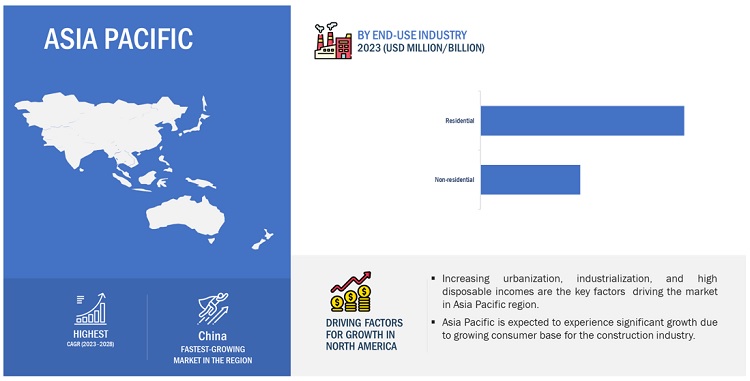

By End Use Industry, Non-residential accounted for the highest CAGR during the forecast period

The growth of non-residential flooring market is driven by rapid urbanization and industrialization. Construction of commercial buildings and infrastructure projects, such as offices, hotels, hospitals, airports, and public spaces, create a higher demand for durable and visually appealing flooring solutions. Government and private investments in infrastructure development further contribute to the expansion of the non-residential flooring market.

Asia Pacific is projected to account for the highest CAGR in the flooring market during the forecast period

The Asia Pacific region is undergoing rapid urbanization, with a significant rural-to-urban population shift. This has resulted in a surge in construction projects, encompassing residential, commercial, and industrial sectors. Therefore, there is a rising need for flooring solutions to accommodate the expanding urban areas. Countries like China, India, and Southeast Asian nations are experiencing robust economic growth, leading to increased consumer purchasing power and investments in infrastructure ventures. This economic progress has created a greater demand for high-quality flooring products and materials, driven by improved living standards and disposable income.

To know about the assumptions considered for the study, download the pdf brochure

Flooring Market Players

Flooring market comprises key manufacturers such as Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the flooring market. Major focus was given to the new product development due to the changing requirements of consumers across the world.

Read More: Flooring Companies

Flooring Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 331.9 billion |

|

Revenue Forecast in 2028 |

USD 510.7 billion |

|

CAGR |

9.0% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion), and Volume (Million Square Meters) |

|

Segments |

Material, End-use industry, and Region |

|

Regions |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

The major players are Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and others are covered in the flooring market. |

This research report categorizes the global flooring market on the basis of Material, End-use industry, and Region.

Flooring Market by Material

-

Resilient Flooring

- Vinyl

- Others

-

Non-Resilient Flooring

- Ceramic tiles

- Wood

- Laminate

- Stone

- Others

- Soft floor covering/ Carpets & Rugs

Flooring Market by End-use industry

- Non-residential

- Residential

Flooring Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2023, Tarkett has collaborated with Dutch design research firm Studio RENS, to launch DESSO X RENS, a range of carpet tiles that can be recycled into a new raw material.

- In November 2022, Mohawk Industries, Inc. acquired Elizabeth Coatings (Brazil). With this acquisition, the company became the largest producer of ceramic tiles by revenue in Brazil.

- In November 2022, Tarkett has launched the carpet tile collection with the lowest circular carbon footprint.

- In July 2022, Mohawk Industries, Inc. acquired the Foss Manufacturing Company, LLC, a Georgia-based manufacturer known for its expertise in non-woven, needle-punch technology used in products ranging from peel-and-stick carpet tile to artificial turf.

- In June 2022, Forbo has launched a brand-new adhesive-free, Health, and Safety Executive (HSE) compliant safety flooring range: Surestep Fast Fit.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the flooring market?

The flooring market is expected to witness significant growth in the future due to rise in population & rapid urbanization, increase in investment in the construction industry, and rise in the number of renovation & remodelling activities.

What is the major challenge in the flooring market?

The major challenge in the flooring market is the disposal of waste.

What are the restraining factors in the flooring market?

The major restraining factor faced by the flooring market volatile raw material prices and rise in health and environmental concerns.

What is the key opportunity in the flooring market?

Growth of the organized retail sector is the key opportunity in the flooring market.

What are the end-use industries where flooring materials are used?

The flooring materials are majorly used in residential and non-residential floor construction. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Investments in infrastructure industry- Rise in population & rapid urbanization- Rise in renovation & remodeling activities- Growing industrialization- Increasing demand for high-end residential units and multi-story buildingsRESTRAINTS- Volatile raw material prices- Environmental concerns associated with flooring materialsOPPORTUNITIES- Rapidly growing organized retail sector- Rise in demand from emerging economiesCHALLENGES- Environmental concerns associated with product waste management- Extremely competitive market

- 6.1 INTRODUCTION

-

6.2 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.3 MACROECONOMIC OVERVIEWINTRODUCTIONGLOBAL GDP OUTLOOKGDP TRENDS AND FORECASTS

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 SUPPLY CHAIN ANALYSIS

- 6.6 RECESSION IMPACT: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

-

6.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERSREVENUE SHIFT AND NEW REVENUE POCKETS FOR FLOORING PRODUCT MANUFACTURERS

-

6.8 MARKET MAPPING/ECOSYSTEM MAP

-

6.9 CASE STUDY ANALYSISPROJECT TO IDENTIFY AND SHOWCASE GOOD PRACTICES AND INNOVATIVE FLOORING METHODS

-

6.10 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSTOP APPLICANTS

-

6.11 TECHNOLOGY ANALYSISSMART CARPETSDIGITAL PRINTINGANTI-SLIP TECHNOLOGYUNDERFLOOR HEATING TECHNOLOGYHYBRID VINYL FLOORINGSHAPES AND SIZES

- 6.12 REGULATORY ANALYSIS

- 6.13 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 KEY MARKETS FOR IMPORTS AND EXPORTS (TRADE ANALYSIS)

-

6.15 PRICING ANALYSISCHANGES IN PRICING OF FLOORING PRODUCTS IN 2022PRICING ANALYSIS BY FLOORING MATERIALPRICING ANALYSIS, BY REGION

- 6.16 KEY CONFERENCES

-

6.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 RESILIENT FLOORINGVINYLOTHER RESILIENT FLOORING (CORK, LINOLEUM, RUBBER, AND RESIN) TYPES

-

7.3 NON-RESILIENT FLOORINGCERAMIC TILESWOODLAMINATESTONEOTHER NON-RESILIENT FLOORING (BAMBOO, TERRAZZO) TYPES

- 7.4 SOFT FLOOR COVERING/CARPETS & RUGS

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALCERAMIC TILES ARE DURABLE AND EASY TO MAINTAIN

-

8.3 NON-RESIDENTIALINCREASING SPENDING ON OFFICE SPACE AND OTHER COMMERCIAL & INSTITUTIONAL CONSTRUCTION

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTCHINA- Fastest-growing market for flooring in Asia PacificINDIA- Developing economy and rising urbanization to boost marketJAPAN- Government initiatives to propel marketAUSTRALIA- Growing non-residential sector to support marketSOUTH KOREA- Increasing demand for residential houses to propel marketREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACTGERMANY- Growing construction industry to drive flooring marketUK- New construction projects to drive marketFRANCE- Rise in construction industry to drive demandRUSSIA- Growth potential of construction sector lucrative for market growthSPAIN- Government investment in construction projects to boost marketNETHERLANDS- Increasing housing demand to propel marketREST OF EUROPE

-

9.4 MIDDLE EAST & AFRICAUAE- Investments in construction sector to fuel market growthSAUDI ARABIA- Commencement of new construction projects to boost demandSOUTH AFRICA- Rapid recovery of construction sector to drive marketTURKEY- Growing construction industry to boost demand for flooring productsREST OF MIDDLE EAST & AFRICA

-

9.5 NORTH AMERICARECESSION IMPACTUS- Largest market for flooring products in North AmericaCANADA- Rise in residential and non-residential construction activities to drive marketMEXICO- Increase in infrastructure investment to drive growth

-

9.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Government efforts for fiscal sustainability to boost marketARGENTINA- Growing tourism to boost marketREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 COMPANIES ADOPTED PRODUCT LAUNCHES AS A KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

- 10.3 MARKET RANKING ANALYSIS

-

10.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE COMPANIES

- 10.5 COMPETITIVE BENCHMARKING

-

10.6 SME MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.7 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHES

-

11.1 KEY PLAYERSMOHAWK INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTARKETT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORBO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHAW INDUSTRIES GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERFACE, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOLI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBEAULIEU INTERNATIONAL GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMILLIKEN & COMPANY- Business overview- Products/Solutions/Services offered- MnM viewGERFLOR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKAJARIA CERAMICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSCONGOLEUM CORPORATIONFLOWCRETEJAMES HALSTEAD PLCTHE DIXIE GROUP, INC.VICTORIA PLCMANNINGTON MILLS INC.SWISS KRONO GROUPLX HAUSYS, LTD.PARADOR GMBHINVISTAORIENTAL WEAVERS GROUPMIRAGEEGGERWELSPUN FLOORING LIMITEDJ&J FLOORING LLC

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 FLOORING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 REGIONAL URBANIZATION PROSPECTS

- TABLE 3 INDUSTRIAL PRODUCTION GROWTH RATE (%), 2021

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 BRICKS, BLOCKS, TILES, AND OTHER CERAMIC GOODS IMPORT DATA, 2022 (USD MILLION)

- TABLE 8 BRICKS, BLOCKS, TILES, AND OTHER CERAMIC GOODS EXPORT DATA, 2022 (USD MILLION)

- TABLE 9 CARPETS AND OTHER TEXTILE FLOOR COVERINGS, TUFTED, NEEDLE PUNCHED, WHETHER OR NOT MADE UP OF WOOL OR FINE ANIMAL HAIR, IMPORT DATA 2022 (USD MILLION)

- TABLE 10 CARPETS AND OTHER TEXTILE FLOOR COVERINGS, TUFTED, NEEDLE PUNCHED, WHETHER OR NOT MADE UP OF WOOL OR FINE ANIMAL HAIR, EXPORT DATA 2022 (USD MILLION)

- TABLE 11 FLOORING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF FLOORING PRODUCTS

- TABLE 13 KEY BUYING CRITERIA FOR FLOORING MARKET

- TABLE 14 FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 15 FLOORING MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 16 FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 17 FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 18 FLOORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 FLOORING MARKET, BY REGION 2021–2028 (MILLION SQUARE METER)

- TABLE 20 ASIA PACIFIC: FLOORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 22 ASIA PACIFIC: MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 23 ASIA PACIFIC: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 24 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 26 CHINA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 27 CHINA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 28 CHINA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 29 CHINA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 30 INDIA: MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 31 INDIA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 32 INDIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 33 INDIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 34 JAPAN: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 35 JAPAN: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 36 JAPAN: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 37 JAPAN: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 38 AUSTRALIA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 39 AUSTRALIA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 40 AUSTRALIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 41 AUSTRALIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 42 SOUTH KOREA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 43 SOUTH KOREA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 44 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 45 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 46 REST OF ASIA PACIFIC: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 47 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 48 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 50 EUROPE: FLOORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 52 EUROPE: FLOORING TYPE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 54 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 56 GERMANY: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 57 GERMANY: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 58 GERMANY: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 59 GERMANY: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 60 UK: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 61 UK: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 62 UK: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 63 UK: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 64 FRANCE: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 65 FRANCE: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 66 FRANCE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 68 RUSSIA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 69 RUSSIA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 70 RUSSIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 71 RUSSIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 72 SPAIN: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 73 SPAIN: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 74 SPAIN: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 75 SPAIN: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 76 NETHERLANDS: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 77 NETHERLANDS: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 78 NETHERLANDS: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 79 NETHERLANDS: MARKET, BY END-USE INDUSTRY, 2021–2023 (MILLION SQUARE METER)

- TABLE 80 REST OF EUROPE: FLOORING MARKET, MATERIAL, 2021–2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 82 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 84 MIDDLE EAST & AFRICA: FLOORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 86 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 88 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 90 UAE: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 91 UAE: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 92 UAE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 93 UAE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 94 SAUDI ARABIA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 95 SAUDI ARABIA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 96 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 97 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 98 SOUTH AFRICA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 99 SOUTH AFRICA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 100 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 101 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 102 TURKEY: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 103 TURKEY: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 104 TURKEY: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 105 TURKEY: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 106 REST OF MIDDLE EAST & AFRICA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 107 REST OF MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 108 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 109 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 110 NORTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 112 NORTH AMERICA: MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 114 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 116 US: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 117 US: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 118 US: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 119 US: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 120 CANADA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 121 CANADA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 122 CANADA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 123 CANADA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 124 MEXICO: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 125 MEXICO: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 126 MEXICO: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 127 MEXICO: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 128 SOUTH AMERICA: FLOORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 130 SOUTH AMERICA: MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 132 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 134 BRAZIL: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 135 BRAZIL: MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 136 BRAZIL: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 137 BRAZIL: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 138 ARGENTINA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 139 ARGENTINA: FLOORING MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 140 ARGENTINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 141 ARGENTINA: FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 142 REST OF SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 143 REST OF SOUTH AMERICA: FLOORING MARKET, BY MATERIAL, 2021–2028 (MILLION SQUARE METER)

- TABLE 144 REST OF SOUTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 145 REST OF SOUTH AMERICA: FLOORING MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 146 FLOORING MARKET: DETAILED LIST OF PLAYERS

- TABLE 147 FLOORING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 148 DEALS, 2019–2023

- TABLE 149 PRODUCT LAUNCHES, 2019–2023

- TABLE 150 MOHAWK INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 151 MOHAWK INDUSTRIES, INC.: DEALS

- TABLE 152 MOHAWK INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 153 TARKETT: COMPANY OVERVIEW

- TABLE 154 TARKETT: DEALS

- TABLE 155 TARKETT: PRODUCT LAUNCHES

- TABLE 156 FORBO: COMPANY OVERVIEW

- TABLE 157 FORBO: DEALS

- TABLE 158 FORBO: PRODUCT LAUNCHES

- TABLE 159 FORBO: OTHER DEVELOPMENTS

- TABLE 160 SHAW INDUSTRIES GROUP INC.: COMPANY OVERVIEW

- TABLE 161 SHAW INDUSTRIES GROUP INC.: DEALS

- TABLE 162 SHAW INDUSTRIES GROUP INC.: OTHER DEVELOPMENTS

- TABLE 163 INTERFACE, INC.: COMPANY OVERVIEW

- TABLE 164 INTERFACE, INC.: PRODUCT LAUNCHES

- TABLE 165 TOLI CORPORATION: COMPANY OVERVIEW

- TABLE 166 TOLI CORPORATION: DEALS

- TABLE 167 TOLI CORPORATION: PRODUCT LAUNCHES

- TABLE 168 TOLI CORPORATION: OTHER DEVELOPMENTS

- TABLE 169 BEAULIEU INTERNATIONAL GROUP: COMPANY OVERVIEW

- TABLE 170 BEAULIEU INTERNATIONAL GROUP: DEALS

- TABLE 171 BEAULIEU INTERNATIONAL GROUP: PRODUCT LAUNCHES

- TABLE 172 BEAULIEU INTERNATIONAL GROUP: OTHER DEVELOPMENTS

- TABLE 173 MILLIKEN & COMPANY: COMPANY OVERVIEW

- TABLE 174 GERFLOR: COMPANY OVERVIEW

- TABLE 175 GERFLOR: DEALS

- TABLE 176 GERFLOR: PRODUCT LAUNCHES

- TABLE 177 KAJARIA CERAMICS: COMPANY OVERVIEW

- TABLE 178 KAJARIA CERAMICS: PRODUCT LAUNCHES

- TABLE 179 KAJARIA CERAMICS: OTHER DEVELOPMENTS

- TABLE 180 CONGOLEUM CORPORATION: COMPANY OVERVIEW

- TABLE 181 FLOWCRETE: COMPANY OVERVIEW

- TABLE 182 JAMES HALSTEAD PLC: COMPANY OVERVIEW

- TABLE 183 THE DIXIE GROUP, INC.: COMPANY OVERVIEW

- TABLE 184 VICTORIA PLC: COMPANY OVERVIEW

- TABLE 185 MANNINGTON MILLS INC.: COMPANY OVERVIEW

- TABLE 186 SWISS KRONO GROUP: COMPANY OVERVIEW

- TABLE 187 LX HAUSYS, LTD.: COMPANY OVERVIEW

- TABLE 188 PARADOR GMBH: COMPANY OVERVIEW

- TABLE 189 INVISTA: COMPANY OVERVIEW

- TABLE 190 ORIENTAL WEAVERS GROUP: COMPANY OVERVIEW

- TABLE 191 MIRAGE: COMPANY OVERVIEW

- TABLE 192 EGGER: COMPANY OVERVIEW

- TABLE 193 WELSPUN FLOORING LIMITED: COMPANY OVERVIEW

- TABLE 194 J&J FLOORING LLC: COMPANY OVERVIEW

- FIGURE 1 FLOORING MARKET SEGMENTATION

- FIGURE 2 FLOORING MARKET, BY REGION

- FIGURE 3 FLOORING MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 FLOORING MARKET: DATA TRIANGULATION

- FIGURE 7 CERAMIC TILES SEGMENT TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 8 RESIDENTIAL SECTOR TO LEAD FLOORING MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF FLOORING MARKET IN 2022

- FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 11 CHINA AND NON-RESILIENT FLOORING LED THEIR RESPECTIVE SEGMENTS IN FLOORING MARKET IN 2022

- FIGURE 12 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLOORING MARKET

- FIGURE 14 ANNUAL GROWTH RATE FOR INDUSTRY (INCLUDING CONSTRUCTION)

- FIGURE 15 INCREASING POPULATION TREND IN DIFFERENT REGIONS

- FIGURE 16 URBAN POPULATION VS. RURAL POPULATION FOR DIFFERENT REGIONS

- FIGURE 17 BUILDINGS 200 METERS OR TALLER COMPLETED IN 2022, BY REGION

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF FLOORING PRODUCTS

- FIGURE 20 SUPPLY CHAIN OF FLOORING INDUSTRY

- FIGURE 21 REVENUE SHIFT FOR FLOORING PRODUCT MANUFACTURERS

- FIGURE 22 ECOSYSTEM MAP

- FIGURE 23 PATENT COUNT, 2019–2023

- FIGURE 24 PUBLICATION TRENDS, 2019–2023

- FIGURE 25 JURISDICTION ANALYSIS, 2019–2023

- FIGURE 26 TOP APPLICANTS, BY NUMBER OF PATENTS

- FIGURE 27 AVERAGE PRICING ANALYSIS, BY REGION

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA OF FLOORING MARKET

- FIGURE 30 CERAMIC TILES SEGMENT TO CAPTURE LARGEST SHARE OF FLOORING MARKET BETWEEN 2023 AND 2028

- FIGURE 31 RESIDENTIAL SEGMENT TO CAPTURE LARGER SHARE OF FLOORING MARKET BETWEEN 2023 AND 2028

- FIGURE 32 FLOORING MARKET GROWTH RATE, BY COUNTRY, 2023–2028

- FIGURE 33 ASIA PACIFIC: FLOORING MARKET SNAPSHOT

- FIGURE 34 EUROPE: FLOORING MARKET SNAPSHOT

- FIGURE 35 NEW PRIVATELY OWNED HOUSING UNITS COMPLETED IN US IN 2020, 2021, AND 2022

- FIGURE 36 FLOORING MARKET: MARKET RANKING ANALYSIS

- FIGURE 37 COMPANY EVALUATION MATRIX: FLOORING MARKET, 2022

- FIGURE 38 SME MATRIX: FLOORING MARKET, 2022

- FIGURE 39 MOHAWK INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 40 TARKETT: COMPANY SNAPSHOT

- FIGURE 41 FORBO: COMPANY SNAPSHOT

- FIGURE 42 INTERFACE, INC.: COMPANY SNAPSHOT

- FIGURE 43 TOLI CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 KAJARIA CERAMICS: COMPANY SNAPSHOT

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the flooring market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The flooring market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the flooring market. Primary sources from the supply side include associations and institutions involved in the flooring industry, key opinion leaders, and processing players.

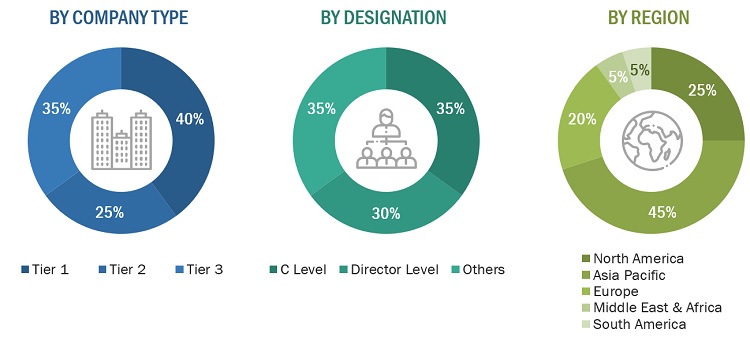

Following is the breakdown of primary respondents—

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global flooring industry. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The Flooring industry refers to the industry that produces and supplies flooring materials and products. Flooring is the process of supplying structural support, covering the floor with any finishing materials, and establishing a livable area. Common resilient flooring materials include vinyl and rubber. The non-resilient flooring materials include wood, ceramic, and stone. Additionally, carpet and rugs are also a good flooring option.

Key Stakeholders

- Raw material suppliers

- Flooring material manufacturers

- Flooring associations

- Builders & contractors

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, describe, and forecast the global flooring market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on material, region, and end-use industry.

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the Asia Pacific flooring market

- Further breakdown of the Rest of Europe's flooring market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Flooring Market