Ethylene Vinyl Acetate Market by Type (Very low-density, Low-density, Medium-density, and High-density EVA), End-use Industry (Photovoltaic Panels, Footwear & Foams, Packaging, Agriculture), Application, and Region - Global Forecast to 2026

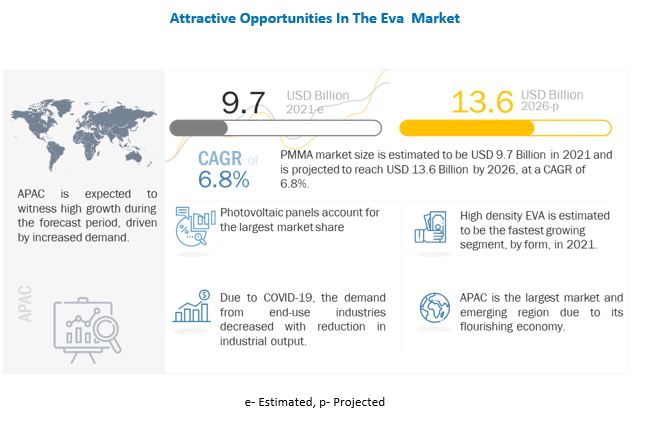

The global ethylene vinyl acetate market (EVA Market) was valued at USD 9.7 Billion in 2021 and is projected to reach USD 13.6 Billion by 2026, growing at a cagr 6.8% from 2021 to 2026. EVA is the copolymer of ethylene and vinyl acetate. It is an elastic material with the presence of about 10% – 40% of vinyl acetate content. It is also known as polyethylene vinyl acetate (PEVA), with high flexibility and softness. EVA also possesses good clarity and gloss, low-temperature toughness, stress crack resistance, high friction coefficient, hot-melt adhesive waterproof properties, and resistance to UV radiations. These copolymers are used in various end-use industries such as footwear & foams, packaging, agriculture, photovoltaic encapsulation, and others end-use industries.

EVA is a versatile, recyclable, sustainable, and durable material, owing to which it is gaining traction across several industrial applications. Due to its superior properties and the changing government policies such as European Green Deals, the global market for EVA is expected to grow

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 pandemic Impact on the Global EVA market

Due to COVID-19 pandemic, the suspension of manufacturing operation, disruption of supply chain, and declining demand for industrial goods had significant impact on the market. However, due to COVID-19 pandemic, the demand for pharmaceutical industry goods has risen, which, in turn, support for the growth of EVA market. At the same time, due to panic situation, people stock the hygiene products across the globe that drives the market. However, the end-use industries like footwear and foam were affected by the pandemic.

EVA market Dynamics

Driver: Significant growth in solar PV installation across the globe to boost the demand for EVA during over the forecast period

The global solar power industry is witnessing experiencing strong growth owing to massive government’s large investment by the governments of different developed and developing nations. to promote renewable energy. Solar power is one of the most reliable and clean sources of energy and is a sustainable alternative to fossil fuels that are largely responsible for polluting the environment and contributing to global warming. Ethylene vinyl acetate (EVA) is used in solar modules as an encapsulating agent to provide good radiation transmission and low degradability to sunlight. Also, it is used to forms a sealing and insulating films around the solar cells.

Restraint: Intervention of substitute materials will hamper the market growth

LDPE is considered as one of the substitutes for EVA copolymers soon due to its comparatively low-cost and approximately the same properties. Since EVA with lower vinyl acetate content has faced competition with metallocene LDPE, many producers are focusing on differentiated or value-added products with a high concentration of vinyl acetate by increasing the vinyl acetate content in EVA copolymers.

Opportunities: Introduction of bio-based ethylene vinyl acetate

The replacement of petroleum-based EVA copolymers with bio-based EVA copolymers can prove as a milestone in the polymer industry Bio-based EVA is made from sugarcane, which is a sustainable resource that helps to reduce greenhouse gas emissions by capturing CO2. Green EVA is suitable for usage in footwear, toys, general foams, and a variety of other applications for those looking to incorporate it into a new product concept.

Challenges: Potential problems with ethylene vinyl acetate photovoltaic encapsulation

There are also some drawbacks of EVA copolymers used in encapsulation. EVA copolymers start decomposing when exposed to atmospheric water or ultraviolet radiation and starts producing acetic acid at a slow rate, leading to the a lowered level of pH and increased surface corrosion

High density EVA accounted for the largest share in 2020

Extruded sheets are estimated to be the largest form of EVA. This is due to its advantages, which include clarity, good surface quality, range of colors, easy maintenance, surface hardness, lightweight, and easy fabrication.

Film application accounted for the largest share in 2020

Ethylene Vinyl Acetate (EVA) EVA with 6% – 10% vinyl acetate content is commercially used for film applications. Films manufactured using EVA copolymers became the most widespread due to their properties, such as lower melting point, higher transparency, high impact resistance, thermal stability, elasticity, and hygienic characteristics

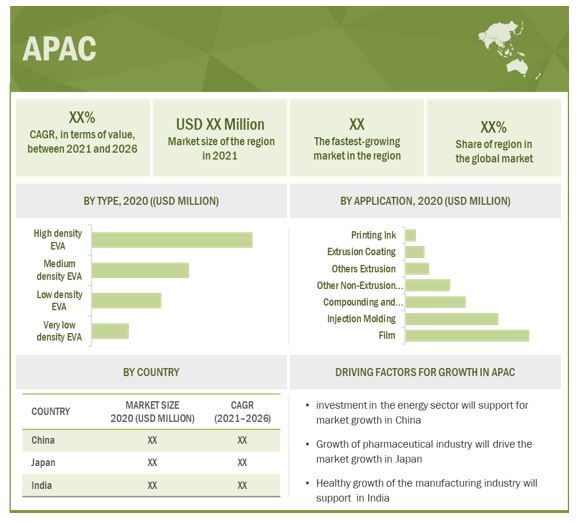

APAC is projected to account for the largest share of the EVA market during the forecast period

APAC is estimated to be the largest market for EVA and is projected to reach USD 8,740 Million by 2026. The market in the region is primarily driven by the rising demand for durable plastic products from the footwears, pharmaceuticals, and photovoltaic panels segments.

Key Market Players

The EVA market comprises major manufacturers such as ExxonMobil Corporation (US), Dow Inc. (US), SIPCHEM (Saudi Arabia), Formosa Plastics Corporation (Taiwan), and Hanwha Total Petrochemical are the key players operating in the EVA market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the EVA s market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Meter) |

|

Segments covered |

By Type, Application, End-use and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

ExxonMobil Corporation (US), Dow Inc. (US), SIPCHEM (Saudi Arabia), Formosa Plastics Corporation (Taiwan), and Hanwha Total Petrochemical |

This research report categorizes the EVA market based on resin type, backing material, a, and region.

EVA market, By Type

- Very low density ethylene vinyl acetate

- Low density ethylene vinyl acetate

- Medium density ethylene vinyl acetate

- High density ethylene vinyl acetate

EVA market, By Application

- Film

- Injection molding

- Comp0unding and wire & cable

- Others non-extrusion

- Others extrusion

- Extrusion coating

- Printing ink

EVA market, By End-Use Industry

- Footwear & foams

- Packaging

- Agriculture

- Photovoltaic panels

- Pharmaceuticals

- Others

EVA market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In 2020, Tosoh Corporation The company launched the full-scale operation of its new main research building located in Shuan city, China.

- In Feb 2020, Dow Inc. The company had announced the expansion of Canada based ethylene production facility by 130 kilotons.

- In 2020, Ineos Group acquired 100% shares in its joint venture "Gemini HDPE" with Sasol Chemicals. The company produces high high-density polyethylene in LA Porte, Texas.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the EVA market?

The major drivers influencing the growth of EVA are increasing demand from the photovoltaic panels and pharmaceutical industry.The major drivers influencing the growth of EVA are increasing demand from the photovoltaic panels and pharmaceutical industry.

What are the major challenges in the EVA market?

The major challenges in EVA market is problem faced in photovoltaic encapsulation.

What are the different applications of EVA?

EVA find their applications in various end-use industries such as footwear & foams, packaging, agriculture, photovoltaic encapsulation, and others. The applications of these have been constantly increasing owing to constant innovation.

What is the impact of COVID-19 pandemic on the EVA market?

Owing to the COVID-19 pandemic, there has been a mixed impact on the EVA market across the globe. The demand from the pharmaceutical industry has increased due to rising health concerns among the consumers, also there is an increase in the demand of films due to high packaging applications whereas in footwears, and in others, the demand for EVA was declined.

What are the industry trends in EVA market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for EVA and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE REPORT

1.3 MARKET SCOPE

FIGURE 1 ETHYLENE VINYL ACETATE MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 ETHYLENE VINYL ACETATE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 DEMAND-SIDE APPROACH: ASCERTAINING THE CONSUMPTION OF ETHYLENE VINYL ACETATE IN PHOTOVOLTAIC PANEL APPLICATION

FIGURE 3 DEMAND SIDE: FROM PHOTOVOLTAIC PANELS

2.2.2 BOTTOM-UP APPROACH: ESTIMATING THE MARKET SIZE OF CHINA AND ITS SHARE IN THE GLOBAL MARKET

FIGURE 4 BOTTOM-UP APPROACH: ASCERTAINING CHINA’S SHARE

2.3 DATA TRIANGULATION

FIGURE 5 ETHYLENE VINYL ACETATE MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 6 HIGH-DENSITY EVA TYPE HELD THE LARGEST SHARE IN 2020

FIGURE 7 FILM APPLICATION HELD THE LARGEST SHARE IN 2020

FIGURE 8 PHOTOVOLTAIC PANELS END-USE INDUSTRY HELD THE LARGEST SHARE IN 2020

FIGURE 9 APAC TO BE FASTEST-GROWING ETHYLENE VINYL ACETATE MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 SIGNIFICANT OPPORTUNITIES IN THE ETHYLENE VINYL ACETATE MARKET

FIGURE 10 GROWTH IN FILM APPLICATION TO DRIVE THE MARKET

4.2 APAC: ETHYLENE VINYL ACETATE MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 11 CHINA ACCOUNTED FOR THE LARGEST SHARE IN APAC

4.3 ETHYLENE VINYL ACETATE MARKET, BY TYPE

FIGURE 12 HIGH-DENSITY EVA TYPE TO LEAD THE OVERALL ETHYLENE VINYL ACETATE MARKET

4.4 ETHYLENE VINYL ACETATE MARKET, BY APPLICATION

FIGURE 13 FILM APPLICATION TO LEAD THE OVERALL ETHYLENE VINYL ACETATE MARKET

4.5 ETHYLENE VINYL ACETATE MARKET, BY END-USE INDUSTRY

FIGURE 14 PHOTOVOLTAIC PANELS END-USE INDUSTRY TO LEAD THE OVERALL ETHYLENE VINYL ACETATE MARKET

4.6 ETHYLENE VINYL ACETATE MARKET, BY COUNTRY

FIGURE 15 CHINA TO BE FASTEST-GROWING MARKET FOR ETHYLENE VINYL ACETATE

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.1.1 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ETHYLENE VINYL ACETATE MARKET

5.1.2 DRIVERS

5.1.2.1 Significant growth in solar PV installation across the globe to boost the demand for EVA during the forecast period

FIGURE 17 SOLAR ENERGY GENERATION (TERAWATT-HR), BY REGION

FIGURE 18 SOLAR PV INSTALLED CAPACITY SHARE (%), BY COUNTRY, 2020

5.1.2.2 Increasing usage of EVA in footwear will drive the market over the forecast period

FIGURE 19 SHARE (%) OF TOP 10 COUNTRIES IN TERMS OF FOOTWEAR DEMAND

5.1.2.3 Increasing demand from packaging industry will support the market growth

5.1.3 RESTRAINTS

5.1.3.1 Substitute materials to hamper the market growth

5.1.3.2 Economic slowdown and impact of COVID-19 on the manufacturing sector

5.1.4 OPPORTUNITIES

5.1.4.1 Introduction of bio-based ethylene vinyl acetate

5.1.5 CHALLENGES

5.1.5.1 Potential problems with ethylene vinyl acetate photovoltaic encapsulation

FIGURE 20 SOLAR ENERGY INSTALLED CAPACITY (MW), BY COUNTRY, 2020

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 ETHYLENE VINYL ACETATE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF RIVALRY

5.3 FORECAST FACTORS AND COVID-19 IMPACT

5.4 MACROECONOMIC OVERVIEW

5.4.1 GLOBAL GDP OUTLOOK

TABLE 2 WORLD GDP GROWTH PROJECTIONS

5.5 VALUE CHAIN ANALYSIS

5.5.1 IMPACT OF COVID-19

5.6 REGULATORY LANDSCAPE

5.7 TRADE ANALYSIS

5.7.1 MAJOR EXPORTERS

TABLE 3 MAJOR EXPORTERS OF ETHYLENE VINYL ACETATE, IN PRIMARY FORMS (2018–2020) (TON)

TABLE 4 MAJOR EXPORTERS OF ETHYLENE VINYL ACETATE, IN PRIMARY FORMS AND IMPACT OF COVID-19 ON TRADE (TON)

5.7.2 MAJOR IMPORTERS

TABLE 5 MAJOR IMPORTERS OF ETHYLENE VINYL ACETATE, IN PRIMARY FORMS (2018–2020) (TON)

TABLE 6 MAJOR IMPORTERS OF ETHYLENE VINYL ACETATE, IN PRIMARY FORMS AND IMPACT OF COVID-19 ON TRADE (TON)

6 ETHYLENE VINYL ACETATE MARKET, BY TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 22 HIGH-DENSITY EVA TO BE FASTER-GROWING SEGMENT

TABLE 7 EVA MARKET, BY GRADE, 2019–2026 (KILOTON)

TABLE 8 EVA MARKET, BY GRADE, 2019–2026 (USD MILLION)

6.2 VERY LOW-DENSITY ETHYLENE VINYL ACETATE

TABLE 9 VERY LOW-DENSITY EVA MARKET, BY GRADE, 2019–2026 (KILOTON)

TABLE 10 VERY LOW-DENSITY EVA MARKET, BY GRADE, 2019–2026 (USD MILLION)

6.3 LOW DENSITY ETHYLENE VINYL ACETATE

TABLE 11 LOW-DENSITY EVA MARKET, BY GRADE, 2019–2026 (KILOTON)

TABLE 12 LOW-DENSITY EVA MARKET, BY GRADE, 2019–2026 (USD MILLION)

6.4 MEDIUM DENSITY ETHYLENE VINYL ACETATE

TABLE 13 MEDIUM EVA MARKET, BY GRADE, 2019–2026 (KILOTON)

TABLE 14 MEDIUM EVA MARKET, BY GRADE, 2019–2026 (USD MILLION)

6.5 HIGH DENSITY ETHYLENE VINYL ACETATE

TABLE 15 HIGH DENSITY EVA MARKET, BY GRADE, 2019–2026 (KILOTON)

TABLE 16 HIGH DENSITY EVA MARKET, BY GRADE, 2019–2026 (USD MILLION)

7 ETHYLENE VINYL ACETATE MARKET, BY APPLICATION (Page No. - 75)

7.1 INTRODUCTION

FIGURE 23 FILM APPLICATION SEGMENT TO DOMINATE THE EVA MARKET DURING THE FORECAST PERIOD

TABLE 17 ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 18 ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 FILM

7.2.1 INCREASING DEMAND FOR FILMS IN SOLAR PANELS AND PACKAGING INDUSTRY WILL BOOST THE DEMAND FOR ETHYLENE VINYL ACETATE

TABLE 19 ETHYLENE VINYL ACETATE MARKET SIZE IN FILM, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 ETHYLENE VINYL ACETATE MARKET SIZE IN FILM, BY REGION, 2019–2026 (KILOTON)

7.3 INJECTION MOLDING

7.3.1 RISE IN GLOBAL FOOTWEAR PRODUCTION TO INCREASE THE DEMAND FOR INJECTION MOLDING IN THE EVA MARKET

TABLE 21 ETHYLENE VINYL ACETATE MARKET SIZE IN INJECTION MOLDING, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 ETHYLENE VINYL ACETATE MARKET SIZE IN INJECTION MOLDING, BY REGION, 2019–2026 (KILOTON)

7.4 COMPOUNDING AND WIRE & CABLE

7.4.1 HIGH GROWTH IN CONSTRUCTION AND AUTOMOTIVE INDUSTRIES WILL BOOST THE DEMAND

TABLE 23 ETHYLENE VINYL ACETATE MARKET SIZE IN COMPOUNDING AND WIRE & CABLE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 ETHYLENE VINYL ACETATE MARKET SIZE IN COMPOUNDING AND WIRE & CABLE, BY REGION, 2019–2026 (KILOTON)

7.5 OTHERS (NON-EXTRUSION)

7.5.1 RISE IN THE CONSUMPTION OF PACKED FOOD AND HEALTHCARE PRODUCTS WITH CHANGING LIFESTYLES WILL DRIVE THE DEMAND FOR EVA IN THIS SEGMENT

TABLE 25 ETHYLENE VINYL ACETATE MARKET SIZE IN OTHERS (NON-EXTRUSION), BY REGION, 2019–2026 (USD MILLION)

TABLE 26 ETHYLENE VINYL ACETATE MARKET SIZE IN OTHERS (NON-EXTRUSION), BY REGION, 2019–2026 (KILOTON)

7.6 OTHERS (EXTRUSION)

7.6.1 INCREASING INDUSTRIALIZATION AND AGRICULTURAL ACTIVITIES ARE BOOSTING THE DEMAND FOR OTHERS (EXTRUSION) APPLICATION

TABLE 27 ETHYLENE VINYL ACETATE MARKET SIZE IN OTHERS (EXTRUSION), BY REGION, 2019–2026 (USD MILLION)

TABLE 28 ETHYLENE VINYL ACETATE MARKET SIZE IN OTHERS (EXTRUSION), BY REGION, 2019–2026 (KILOTON)

7.7 EXTRUSION COATING

7.7.1 INCREASING GROWTH IN PACKAGING INDUSTRY AND OTHER APPLICATIONS BOOST THE DEMAND FOR OTHER EXTRUSION APPLICATIONS OF ETHYLENE VINYL ACETATE

TABLE 29 ETHYLENE VINYL ACETATE MARKET SIZE IN EXTRUSION COATING, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 ETHYLENE VINYL ACETATE MARKET SIZE IN EXTRUSION COATING, BY REGION, 2019–2026 (KILOTON)

7.8 PRINTING INK

7.8.1 INCREASING USE OF EVA PRINTING INKS IN DIVERSE INDUSTRIES WILL BOOST THE DEMAND FOR ETHYLENE VINYL ACETATE IN FORECAST PERIOD

TABLE 31 ETHYLENE VINYL ACETATE MARKET SIZE IN PRINTING INK, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 ETHYLENE VINYL ACETATE MARKET SIZE IN PRINTING INK, BY REGION, 2019–2026 (KILOTON)

8 ETHYLENE VINYL ACETATE MARKET, BY END-USE INDUSTRY (Page No. - 85)

8.1 INTRODUCTION

FIGURE 24 PHOTOVOLTAIC PANELS END-USE INDUSTRY ACCOUNTED FOR THE LARGEST SHARE OF THE OVERALL ETHYLENE VINYL ACETATE MARKET IN 2020

TABLE 33 ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 34 ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.1.1 PHOTOVOLTAIC PANELS

8.1.1.1 Growth in renewable energy to drive the demand for photovoltaic panels

FIGURE 25 SOLAR PHOTOVOLTAIC CAPACITY, BY REGION, 2011-2020

TABLE 35 ETHYLENE VINYL ACETATE MARKET SIZE FOR PHOTOVOLTAIC PANELS, BY REGION, 2019–2026 (KILOTON)

TABLE 36 ETHYLENE VINYL ACETATE MARKET SIZE FOR PHOTOVOLTAIC PANELS, BY REGION, 2019–2026 (USD MILLION)

8.1.2 FOOTWEAR & FOAMS

8.1.2.1 Increased use of foam in sports equipment

TABLE 37 ETHYLENE VINYL ACETATE MARKET SIZE FOR FOOTWEAR & FOAMS, BY REGION, 2019–2026 (KILOTON)

TABLE 38 ETHYLENE VINYL ACETATE MARKET SIZE FOR FOOTWEAR & FOAMS, BY REGION, 2019–2026 (USD MILLION)

8.1.3 PACKAGING

8.1.3.1 Growth in e-commerce to drive the demand

TABLE 39 ETHYLENE VINYL ACETATE MARKET SIZE FOR PACKAGING, BY REGION, 2019–2026 (KILOTON)

TABLE 40 ETHYLENE VINYL ACETATE MARKET SIZE FOR PACKAGING, BY REGION, 2019–2026 (USD MILLION)

8.1.4 AGRICULTURE

8.1.4.1 Increase in utilization of agriculture films to drive the demand for EVA

TABLE 41 ETHYLENE VINYL ACETATE MARKET SIZE FOR AGRICULTURE, BY REGION, 2019–2026 (KILOTON)

TABLE 42 ETHYLENE VINYL ACETATE MARKET SIZE FOR AGRICULTURE, BY REGION, 2019–2026 (USD MILLION)

8.1.5 PHARMACEUTICALS

8.1.5.1 COVID-19 will influence the demand for vaccines and other pharmaceutical products

TABLE 43 ETHYLENE VINYL ACETATE MARKET SIZE FOR PHARMACEUTICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 44 ETHYLENE VINYL ACETATE MARKET SIZE FOR PHARMACEUTICALS, BY REGION, 2019–2026 (USD MILLION)

8.1.6 OTHERS

TABLE 45 ETHYLENE VINYL ACETATE MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

TABLE 46 ETHYLENE VINYL ACETATE MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

9 ETHYLENE VINYL ACETATE MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 26 SAUDI ARABIA TO BE FASTEST-GROWING ETHYLENE VINYL ACETATE MARKET

TABLE 47 ETHYLENE VINYL ACETATE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 48 ETHYLENE VINYL ACETATE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 APAC

FIGURE 27 APAC: ETHYLENE VINYL ACETATE MARKET SNAPSHOT

TABLE 49 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 50 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 52 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 54 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 56 APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Growing investment in the energy sector and growth of manufacturing industry output will support market growth

TABLE 57 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 58 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 60 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 62 CHINA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Growth of the pharmaceutical industry and energy sector will drive the market

TABLE 63 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 64 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 66 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 68 JAPAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Robust growth of the manufacturing industry to bolster the EVA market

TABLE 69 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 70 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 72 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 74 INDIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Growing solar panel production and pharmaceutical industry to drive the market

TABLE 75 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 76 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 78 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 80 SOUTH KOREA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.5 MALAYSIA

9.2.5.1 High investment in renewable energy drives the demand for EVA in the region

TABLE 81 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 82 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 84 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 86 MALAYSIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.6 INDONESIA

9.2.6.1 Government policies for renewable resources to boost the demand for the EVA market

TABLE 87 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 88 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 90 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 92 INDONESIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.7 THAILAND

9.2.7.1 Increasing investment for solar energy capacity addition and growing manufacturing industry to drive the market

TABLE 93 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 94 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 96 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 98 THAILAND: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.8 TAIWAN

9.2.8.1 Investment for solar panel production and installation to lead the market growth

TABLE 99 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 100 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 102 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 103 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 104 TAIWAN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.9 REST OF APAC

TABLE 105 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 106 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 108 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 110 REST OF APAC: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SNAPSHOT

TABLE 111 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 112 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 114 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 116 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 118 NORTH AMERICA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Growing investment in photovoltaics and footwear industries to support market growth

TABLE 119 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 120 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 122 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 123 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 124 US: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Increasing demand for clean energy will boost the demand for EVA in the market

TABLE 125 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 126 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 128 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 129 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 130 CANADA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Liberalization in trade policy and growth in the solar power industry will drive the growth in the country

TABLE 131 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 132 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 134 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 135 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 136 MEXICO: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4 EUROPE

TABLE 137 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 138 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 139 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 140 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 142 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 143 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 144 EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Favorable economic environment for photovoltaic and manufacturing sectors to foster market growth

TABLE 145 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 146 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 148 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 149 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 150 GERMANY: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.2 ITALY

9.4.2.1 Steady recovery of footwear industry to drive the demand for EVA

TABLE 151 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 152 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 154 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 155 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 156 ITALY: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.3 SPAIN

9.4.3.1 Growth in the installation of solar panels will boost the demand for EVA

TABLE 157 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 158 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 160 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 161 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 162 SPAIN: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.4 UK

9.4.4.1 Rising demand for clear energy increases the demand for EVA in the solar power market

TABLE 163 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 164 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 166 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 167 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 168 UK: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.5 REST OF EUROPE

TABLE 169 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 170 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 172 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 173 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 174 REST OF EUROPE: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

TABLE 175 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 176 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 177 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 178 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 180 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 181 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 182 REST OF THE WORLD: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 High share of solar energy output drives the demand for EVA in the market

TABLE 183 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 184 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 186 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 187 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 188 SAUDI ARABIA: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.2 BRAZIL

9.5.2.1 Rising year-on-year photovoltaic installations drive the demand for EVA in the market

TABLE 189 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 190 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 192 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 193 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 194 BRAZIL: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.3 OTHERS

TABLE 195 OTHER COUNTRIES IN ROW: ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 196 OTHER: COUNTRIES IN ROW ETHYLENE VINYL ACETATE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 197 OTHER COUNTRIES IN ROW: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 198 OTHER COUNTRIES IN ROW: ETHYLENE VINYL ACETATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 199 OTHER COUNTRIES IN ROW: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 200 OTHER COUNTRIES IN ROW: ETHYLENE VINYL ACETATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 163)

10.1 INTRODUCTION

FIGURE 29 EXPANSION OF FACILITIES IS A KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

10.2 MARKET SHARE ANALYSIS

FIGURE 30 MARKET SHARE OF KEY PLAYERS, BY PRODUCTION CAPACITY, 2020

TABLE 201 DEGREE OF COMPETITION IN THE ETHYLENE VINYL ACETATE MARKET

FIGURE 31 GLOBAL EVA PRODUCTION CAPACITY SHARE (%), BY REGION, 2020

10.3 KEY MARKET DEVELOPMENTS

10.3.1 EXPANSIONS

10.3.2 ACQUISITIONS

10.3.3 NEW PRODUCT LAUNCHES

11 COMPANY PROFILES (Page No. - 170)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Divestment, Winning imperatives, MnM view, Key strengths/right to win, Strategic overview, Weaknesses and competitive threats)*

11.1.1 EXXON MOBIL CORPORATION

TABLE 202 EXXON MOBIL CORP.: BUSINESS OVERVIEW

FIGURE 32 EXXON MOBIL CORP: COMPANY SNAPSHOT

FIGURE 33 EXXONMOBIL'S CAPABILITY IN ETHYLENE VINYL ACETATE MARKET

11.1.2 HANWHA TOTAL PETROCHEMICAL

TABLE 203 HANWHA TOTAL PETROCHEMICAL: BUSINESS OVERVIEW

FIGURE 34 HANWHA TOTAL PETROCHEMICAL: COMPANY SNAPSHOT

FIGURE 35 HANWHA'S CAPABILITY IN EVA MARKET

11.1.3 SIPCHEM

TABLE 204 SIPCHEM: BUSINESS OVERVIEW

FIGURE 36 SIPCHEM: COMPANY SNAPSHOT

TABLE 205 SIPCHEM: PRODUCT OFFERINGS

FIGURE 37 SIPCHEM'S CAPABILITY IN ETHYLENE VINYL ACETATE MARKET

11.1.4 FORMOSA PLASTICS CHEMICALS

TABLE 206 FORMOSA PLASTIC CORPORATION: BUSINESS OVERVIEW

FIGURE 38 FORMOSA PLASTIC CORPORATION: COMPANY SNAPSHOT

FIGURE 39 FORMOSA'S CAPABILITY IN EVA MARKET

11.1.5 DOW INC.

TABLE 207 DOW INC.: BUSINESS OVERVIEW

FIGURE 40 DOW INC.: COMPANY SNAPSHOT

FIGURE 41 DOW INC.'S CAPABILITY IN EVA MARKET

11.1.6 LG CHEMICAL

TABLE 208 LG CHEMICAL: BUSINESS OVERVIEW

FIGURE 42 L.G. CHEMICAL: COMPANY SNAPSHOT

FIGURE 43 LG CHEMICAL'S CAPABILITY IN ETHYLENE VINYL ACETATE MARKET

11.1.7 SUMITOMO CHEMICALS CO., LTD

TABLE 209 SUMITOMO CHEMICALS CO., LTD: BUSINESS OVERVIEW

FIGURE 44 SUMITOMO CHEMICALS CO., LTD: COMPANY SNAPSHOT

TABLE 210 SUMITOMO CHEMICALS CO., LTD: PRODUCT OFFERINGS

TABLE 211 SUMITOMO CHEMICAL CO., LTD: OTHERS

FIGURE 45 SUMITOMO'S CAPABILITY IN EVA MARKET

11.1.8 BRASKEM SA

TABLE 212 BRASKEM SA: BUSINESS OVERVIEW

FIGURE 46 BRASKEM SA: COMPANY SNAPSHOT

FIGURE 47 BRASKEM SA CAPACITY IN EVA MARKET

11.1.9 CHINA NATIONAL PETROLEUM CORPORATION

FIGURE 48 CHINA NATIONAL PETROLEUM CORPORATION: COMPANY SNAPSHOT

TABLE 213 CHINA NATIONAL PETROLEUM CORPORATION.: BUSINESS OVERVIEW

11.1.10 CLARIANT AG

TABLE 214 CLARIANT AG: BUSINESS OVERVIEW

FIGURE 49 CLARIANT AG: COMPANY SNAPSHOT

11.1.11 LYONDELLBASELL INDUSTRIES N.V.

TABLE 215 LYONDELLBASELL INDUSTRIES N.V.: BUSINESS OVERVIEW

FIGURE 50 LYONDELLBASELL: COMPANY SNAPSHOT

11.1.12 CELANESE CORPORATION

TABLE 216 CELANESE CORPORATION.: BUSINESS OVERVIEW

FIGURE 51 CELANESE CORPORATION: COMPANY SNAPSHOT

11.1.13 BASF SE

TABLE 217 BASF SE: BUSINESS OVERVIEW

FIGURE 52 BASF SE: COMPANY SNAPSHOT

11.1.14 MITSUI CHEMICALS, INC.

TABLE 218 MITSUI CHEMICALS, INC: BUSINESS OVERVIEW

FIGURE 53 MITSUI CHEMICALS, INC: COMPANY SNAPSHOT

11.1.15 LANXESS AG

TABLE 219 LANXESS AG.: BUSINESS OVERVIEW

11.1.16 REPSOL S.A.

TABLE 220 REPSOL, SA: BUSINESS OVERVIEW

11.1.17 ASIA POLYMER CORPORATION

TABLE 221 ASIA POLYMER CORPORATION: BUSINESS OVERVIEW

11.1.18 INEOS GROUP HOLDINGS S.A.

TABLE 222 INEOS GROUP HOLDINGS S.A.: BUSINESS OVERVIEW

11.1.19 NOVA CHEMICALS CORPORATION

TABLE 223 NOVA CHEMICALS CORPORATION: BUSINESS OVERVIEW

11.1.20 SK GLOBAL CHEMICAL CO., LTD.

TABLE 224 SK GLOBAL CHEMICAL CO., LTD: BUSINESS OVERVIEW

11.1.21 USI CORPORATION

TABLE 225 USI CORPORATION: BUSINESS OVERVIEW

11.1.22 TOSOH CORPORATION

TABLE 226 TOSOH CORPORATION: BUSINESS OVERVIEW

11.1.23 VERSALIS S.P.A.

11.1.24 INNOSPEC INC

*Details on Business Overview, Products Offered, Recent Developments, Divestment, Winning imperatives, MnM view, Key strengths/right to win, Strategic overview, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 225)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

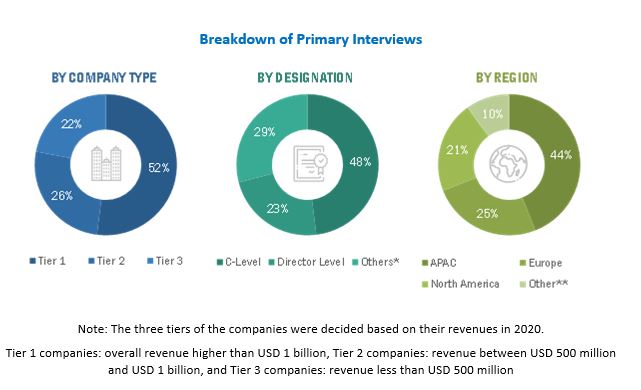

The study involved four major activities for estimating the current size of the global EVA market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand regarding end-use industries, application areas, and countries was comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of EVA market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the EVA market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect this study's EVA market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the EVA market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the EVA market industry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global EVA market size. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- In terms of value, the industry's supply chain and market size were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the EVA market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the EVA market in terms of value and volume based on type, application, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, and Rest of the World.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the EVA market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the EVA market report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further breakdown of the Rest of the APAC, EVA market into more nations not covered in the study

- Further breakdown of Rest of Europe, EVA market into more nations not covered in the study

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ethylene Vinyl Acetate Market

Report on Ethylene Vinyl Acetate should contain few information regarding market

EVA market for the wires & cables application

Global Ethylene-vinyl acetate (EVA) market and also intersted in Formic Acid Vinyl Acetate Monomer (VAM) market

Information on suppliers of EVA, 28% and 9%.