Orthopedic Braces & Supports Market: Growth, Size, Share, and Trends

Orthopedic Braces & Supports Market by Product (Knee, Ankle, Hip, Spine, Shoulder, Neck, Elbow, Hand, Wrist), Category (Soft, Rigid, Hinged), Application (Ligament (ACL, LCL), Preventive, OA), Distribution (Pharmacies) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global orthopedic braces and supports market is expected to experience significant growth, with projections indicating it will reach USD 5.92 billion by 2030, up from USD 4.32 billion in 2025, representing a CAGR of 6.5%. The global orthopedic braces and supports market is witnessing sustained growth, driven by the rising incidence of musculoskeletal disorders, sports injuries, and post-surgical rehabilitation needs. The market is transitioning from conventional immobilization products to dynamic, lightweight, and patient-centric bracing systems that are integrated with smart sensors and performance monitoring capabilities. Increasing adoption among geriatric populations, a growing focus on early mobilization, and the expanding use of preventive orthopedics across sports and wellness settings are further catalyzing demand.

KEY TAKEAWAYS

- The North America orthopedic braces and supports market captured a 47.6% revenue share in 2024.

- By product, the knee braces and supports segment is projected to record the highest CAGR of 7.8% during the forecast period 2025-2030.

- By type, the soft and elastic braces and supports segment captured a 51.7% revenue share in 2024.

- By application, the lateral colleteral ligament injury segment is projected to lead the market, registering the highest CAGR of 9.0% during the forecast period from 2025 to 2030

- By distribution channel, the pharmacies and retailers segment is projected to lead the market, registering the highest CAGR of 7.0% during the forecast period from 2025 to 2030

- 3M Company, DJO LLC (Enovis), and Essity Health & Medical were identified as leading players in the global orthopedic braces and supports market due to their substantial market share and extensive product footprint.

- Foundation Wellness, McDavid Inc., and Mueller Sports Medicine Inc., among others, have set themselves apart among startups and SMEs by establishing strong positions in specialized niche segments, highlighting their potential as emerging market leaders.

A major trend shaping this market is the convergence of orthopedics and digital health technologies. The emergence of smart braces equipped with biofeedback sensors and connected platforms for mobility tracking is redefining rehabilitation outcomes. Additionally, lightweight composite materials and hybrid textile designs are enhancing comfort and compliance for patients. Value-based care models are influencing purchasing decisions, driving hospitals and clinics to prefer modular, reusable, and cost-effective brace systems. The shift toward home-based rehabilitation and tele-orthopedic monitoring is expanding product usage beyond clinical settings. Players are also focusing on sustainability by introducing recyclable materials and patient-specific design platforms.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare providers are increasingly emphasizing patient comfort, functional recovery, and affordability—a shift that requires brace manufacturers to innovate around flexibility, ease of use, and outcomes measurement. Disruptions stem from the rise of digital orthopedics, 3D scanning for customized fitting, and the integration of AI-driven motion analysis for therapy optimization. Direct-to-patient sales channels are transforming the traditional distribution landscape, compelling manufacturers to adapt to omnichannel supply strategies. In parallel, the expansion of insurance coverage for non-surgical interventions and the growth of sports medicine are influencing hospital procurement patterns and product differentiation strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in incidence of musculoskeletal and joint-related conditions

-

Growth in incidence of athletic and accident-induced musculoskeletal injuries

Level

-

Low public awareness regarding available orthopedic treatment options

-

Reimbursement challenges in emerging and developed markets

Level

-

Expansion in pediatric and geriatric orthopedics

-

Shift toward at-home rehabilitation and remote patient monitoring

Level

-

Shortage of trained orthotists and technicians

-

Poor fitness and bulkiness of braces affect wearability and long-term usage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in incidence of musculoskeletal and joint-related conditions

Key drivers include the rising prevalence of osteoarthritis, osteoporosis, and ligament injuries, increasing awareness about preventive orthopedics, and technological advancements in materials science. The expansion of outpatient rehabilitation centers and the growing geriatric population in North America and Europe are significantly boosting market demand. Additionally, the increasing adoption of e-commerce platforms for orthopedic products and the rising number of sports injuries due to active lifestyles contribute to sustained growth momentum.

Restraint: Low public awareness regarding available orthopedic treatment options

Market expansion is hindered by limited reimbursement coverage in several emerging economies, product commoditization in the low-cost segment, and poor patient compliance due to discomfort and rigidity associated with traditional designs. The lack of clinical evidence supporting long-term effectiveness for some brace categories and price sensitivity in developing regions further hinders penetration.

Opportunity: Expansion in pediatric and geriatric orthopedics

The integration of digital sensors and IoT for performance tracking, coupled with the use of additive manufacturing for customization, presents significant growth opportunities. Companies can leverage predictive analytics to personalize therapy and improve adherence. Moreover, expansion in home rehabilitation, especially among post-operative and elderly populations, creates lucrative opportunities for remote monitoring-enabled braces. Emerging economies in the Asia-Pacific region, with improving healthcare access and increasing investments in sports infrastructure, offer untapped potential for global OEMs.

Challenge: Shortage of trained orthotists and technicians

Key challenges include ensuring product differentiation in a highly fragmented market, managing supply chain efficiency for both institutional and retail channels, and navigating complex regulatory pathways for Class I and II devices. Sustaining affordability while enhancing comfort, mobility, and durability remains a continuous challenge in innovation. The transition toward direct-to-consumer models also requires significant investment in marketing, logistics, and patient education.

Orthopedic braces & supports Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Real-time tracking of vital signs to improve patient safety and reduce response time | Centralized digital patient data to enhance care coordination and reduce errors | Continuously track patient vitals to improve safety and enable faster intervention to reduces complications and emergency response time. Maintain centralized patient data for seamless access by healthcare providers to enhances care coordination and reduces errors |

|

Maintain all patient orthopedic history in a digital format | Speeds up consultations and reduces errors |

|

Capture precise images for bone and joint assessment | Improves diagnostic accuracy and treatment planning |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The orthopedic braces and supports ecosystem involves a multi-tier network of manufacturers, distributors, rehabilitation centers, orthopedic clinics, hospitals, sports medicine specialists, and retail pharmacies. Manufacturers are increasingly collaborating with material science innovators, 3D printing companies, and tele-rehabilitation providers to enhance product functionality and clinical integration. Digital health firms are entering the ecosystem by offering connected mobility platforms, while e-commerce and specialty retailers are reshaping customer access and price transparency. End-user decision-making is now influenced by comfort, ease of use, and functional recovery outcomes, making the ecosystem more consumer-driven than ever.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Orthopedic Braces and Supports Market, By Product

Knee braces represent the largest product segment, driven by the high prevalence of osteoarthritis, sports-related ACL injuries, and post-surgical recovery requirements. The development of adjustable and unloader knee braces made from lightweight materials and improved biomechanical efficiency have further accelerated adoption. Ankle and spinal braces are also experiencing steady growth due to increasing rehabilitation applications.

Orthopedic Braces and Supports Market, Type

Soft and elastic braces dominate the market owing to their high comfort, affordability, and flexibility. These braces cater to patients with mild-to-moderate conditions and are preferred for preventive support and daily use. Meanwhile, rigid and hinged braces continue to play a critical role in acute injuries and post-operative recovery, with innovation focused on adjustable fit and hybrid materials.

Orthopedic Braces and Supports Market, Distribution Channel

Pharmacies and retail are prominent distribution channels due to their broad accessibility and convenience for consumers seeking immediate relief solutions. However, e-commerce platforms are growing at the fastest pace as consumers increasingly prefer online purchasing for comfort and price comparison. Institutional sales through hospitals and orthopedic clinics continue to account for a significant portion of value, driven by complex cases and rehabilitation support.

REGION

Asia-Pacific to be fastest growing region in global orthopedic braces & supports market during forecast period

The Asia Pacific is the fastest-growing region, driven by the rising burden of musculoskeletal disorders, increasing healthcare investments, and expanding participation in sports and fitness. Rapid urbanization, greater awareness of non-surgical orthopedic care, and growing middle-class purchasing power in countries such a China, India, Japan, and South Korea are accelerating market penetration. Furthermore, the proliferation of local manufacturers and affordable product lines in the region is fostering competitive growth momentum.

Orthopedic braces & supports Market: COMPANY EVALUATION MATRIX

The competitive landscape is moderately consolidated, with key players such as DJO Global (Enovis), Össur, Bauerfeind, 3M, Breg, Ottobock, and Thuasne leading through innovation in design and patient comfort. Players are differentiating themselves through lightweight materials, ergonomic design, and the integration of digital monitoring tools. Partnerships with rehabilitation clinics, investment in DTC channels, and geographic expansion into Asia-Pacific markets are common strategic priorities. Emerging companies are leveraging 3D printing and smart fabrics to penetrate niche segments in sports medicine and custom bracing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.08 Billion |

| Market Forecast in 2030 (Value) | USD 5.92 Billion |

| Growth Rate | 6.5% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Orthopedic braces & supports Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Device OEM |

|

|

| Hospital Healthcare Provider |

|

|

RECENT DEVELOPMENTS

- January 2023 : Zimmer Biomet acquired Secure Embody, Inc., a private medical device company specializing in soft tissue healing, for a total of USD 155 million initially, with the potential for an additional USD 120 million contingent upon attaining future regulatory and commercial milestones within a three-year timeframe.

- March 2023 : HealthMe and Breg, Inc. launched a direct-pay eCommerce engine to enable orthopedic providers to capture patient payments for the company’s line of cold therapy devices. Breg selected HealthMe, the market leader in orthopedic direct-pay solutions.

- January 2023 : Breg, Inc. announced a partnership with medical device supplier Coreal International to bring its broad portfolio of bracing and cold therapy products to Chinese physicians and their patients.

- May 2022 : Enovis Corporation’s affiliate, DJO, LLC, acquired the assets of Outcome-Based Technologies, LLC. This strategic step enhanced DJO’s (now under the Enovis umbrella) developments in bracing, with a particular focus on the rapidly expanding hip-bracing sector

Table of Contents

Methodology

This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global orthopedic braces & supports market. Additionally, in-depth interviews were conducted with key respondents, including major industry players, subject-matter experts (SMEs), C-level executives, and industry consultants. These interviews helped gather and verify important qualitative and quantitative data while evaluating growth prospects. The global market size, initially estimated through secondary research, was then refined and confirmed through triangulation with insights from primary research.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the orthopedic braces and support market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to gather both qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations in the orthopedic braces and support market. The primary sources from the demand side include OEMs, private and contract testing organizations, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on major industry trends and market dynamics.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

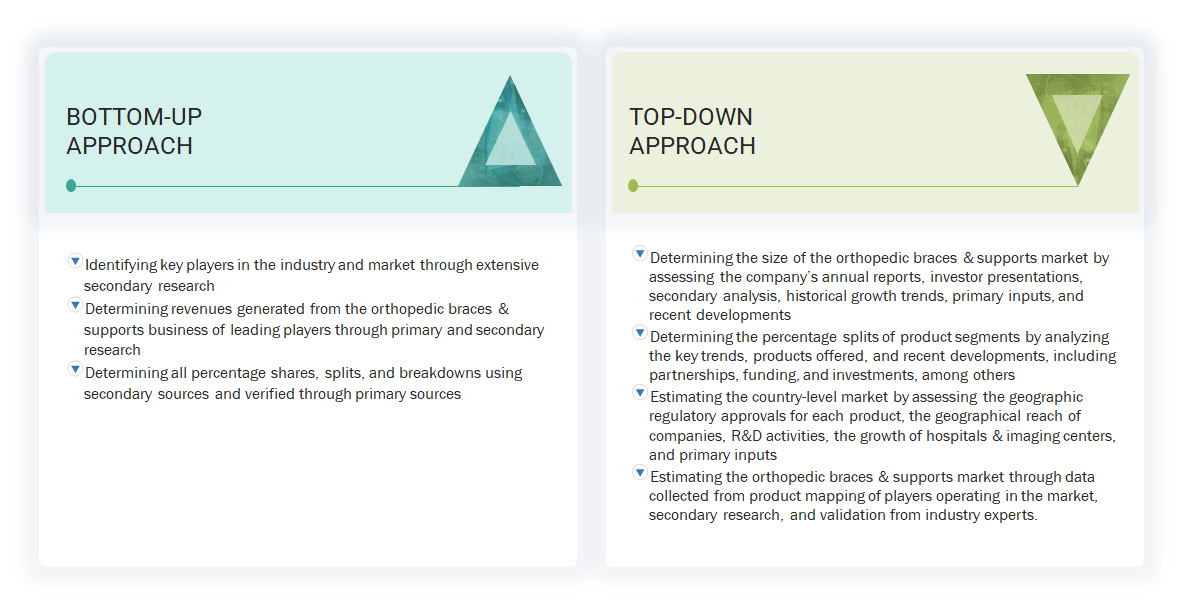

The bottom-up approach was used to estimate and validate the total size of the orthopedic braces & supports market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the orthopedic braces & supports market was generated.

- Mapping annual revenues generated by major global players from the orthopedic braces & supports segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global market as of 2024

- Extrapolating the global value of the orthopedic braces & supports market

Global Orthopedic Braces & Supports Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Orthopedic braces and supports are specialized medical devices designed to provide external support, stability, and protection to the musculoskeletal system. Usually worn on specific body parts such as the knees, ankles, wrists, elbows, or back, these devices help maintain proper joint and bone alignment, reduce pain caused by musculoskeletal conditions, support recovery after injuries or surgeries, and are also used preventively during physical activities to avoid injuries. The market includes a wide range of braces and supports used for both medical and non-medical purposes, addressing needs from post-injury rehabilitation to long-term management of chronic conditions like arthritis. It involves a diverse network of manufacturers, distributors, and retailers who supply these products to healthcare providers, physical therapy clinics, pharmacies, and directly to consumers.

Stakeholders

- Manufacturers of orthopedic braces and supports

- Product distributors and channel partners

- Hospitals and surgical centers

- Orthopedic clinics

- Emergency care units and trauma centers

- Ambulatory care centers, physician-operated labs, and skilled nursing facilities

- Sports institutes and organizations

- Contract manufacturers and third-party suppliers

- Research laboratories and academic institutes

- Clinical research organizations (CROs)

- Government and non-governmental regulatory authorities

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the orthopedic braces & supports market based on product, type, application, distribution channel, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global orthopedic braces & supports market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global orthopedic braces & supports market

- To analyze key growth opportunities in the global orthopedic braces & supports market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions: North America (US and Canada), Europe (Germany, UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

- To profile the key players in the orthopedic braces & supports market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global orthopedic braces & supports market , such as agreements, expansions, and & acquisitions

Frequently Asked Questions (FAQ)

What will be the addressable market value of the global orthopedic braces & supports market within five years?

The global orthopedic braces & supports market is projected to reach USD 5.92 billion by 2030 from USD 4.32 billion in 2025, at a CAGR of 6.5%.

Which product segments have the highest potential for growth in the orthopedic braces & supports market?

Knee braces and supports are expected to exhibit the highest growth rates.

Who are the top 3 players in the market, and what is the market landscape?

The leading players are Zimmer Biomet (US), 3M Company (US), and Essity (US). The market is moderately consolidated, with the top players holding 25–30% of the market share.

What are the major strategies adopted by leading players to enter emerging regions?

Distribution agreements, partnerships, product launches, and product approvals represent the major growth strategies adopted by leading market players.

Which application segment will likely show the highest growth in the orthopedic braces & supports market?

Preventive care applications are expected to grow at the highest rate in the orthopedic braces & supports market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Orthopedic Braces & Supports Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Orthopedic Braces & Supports Market