Foot and Ankle Devices Market by Product (Implants, Plates, Screw, Wires, Internal Fixators, Braces, Prosthesis (SACH, Single/Multi-Axial)), Application (Rheumatoid Arthritis, Osteoporosis, Hammertoe), End-User (Hospital, ASCs) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global foot and ankle devices market growth forecasted to transform from $3.9 billion in 2020 to $5.3 billion by 2025, driven by a CAGR of 6.4%. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The market growth is driven by greater disease burden for key risk groups, emergence of user-centric foot and ankle devices, and rising demand for minimally invasive surgical procedures. However, the risk associated with surgical site infection is expected to limit market growth in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Foot and ankle devices Market Dynamics

Driver: Continuous product commercialization

Foot and ankle devices offer several benefits such as better affordability, higher efficacy, greater patient comfort, and are easy-to-use as compared to conventional products. Moreover, key players are increasingly focusing on the development of specialized products for the treatment of various foot and ankle disorders and deformaties as well as to address the unmet market needs. The availability of advanced products and treatment modalities is generating significant interest among end users owing to the better treatment outcomes promised by them.

Listed below are regulatory approval and launches in recent years:

- In October 2020, WishBone Medical, Inc (US) received FDA approval Smart Correction External Fixation System for pediatric patients. It consists of hexapod external fixator hardware and proprietary planning software.

- In June 2019, Metalogix received FDA 510(k) clearance for the Revolution External Plating System, open ring fixation. Its is all-in-one system intended to be used for treatment of Charcot, foot and ankle, in adult and pediatric subgroups (except newborns).

- In June 2019, Metalogix received FDA 510(k) clearance for the Revolution External Plating System, open ring fixation. Its is all-in-one system intended to be used for treatment of Charcot, foot and ankle, in adult and pediatric subgroups (except newborns).

Restraint: Metal Sensitivity in patients with foot and ankle implants

There are several risks associated with using orthopedic impants and devices, such as the discomfort associated with the insertion of implants and devices. Surgical site infections are some other major risks. Foot and ankle devices are mostly made of metal or metal alloys (nickel, cobalt, chromium, and/or titanium). Products containing or made of these metals may cause allergies and infections once implanted, such as eczematous dermatitis, urticaria, and vasculitis. Metal sensitivity also causes osteolysis, pain, and the aseptic loosening of implanted metal hardware. Therefore, the above-mentioned risks limit usage of foot and ankle implants and devices

Opportunity: Marketing, promotion and branding initiatives undertaken by major product manufacturers

Major product manufacturers are undertaking strategic initiatives to increase their brand visibility and product awareness among key end users (such as medical professionals, patients, and physiotherapists) across major healthcare markets worldwide. Company operating in market are opting for hybrid distribution strategy as per which distribution takes place both by distribution channel and through partnership with global orthopedic companies. Foot and ankle devices company has also adopted consignment model, accoding to which company first places the systems with its customers and sales are made according to the implementation of implants. Such initiatives undertaken by major product manufacturers are expected to increase their brand awareness among target end-users as well as sensitize them about their role in preventive care.

Challenge: Higher adoption of alternative therapies for the treatment of foot and ankle disorders & injuries Increasing pricing pressure on market players

Regenerative medicine plays a major role in the management of foot and ankle injuries. Regenerative medicine treatments are typically used to repair or replace damaged cartilage, tendon, and ligament tissues. This area of medicine involves the use of orthobiologics, which are substances used to improve the healing of broken bones & injured muscles, tendons, and ligaments. Orthobiologics, such as allografts, polymer-based bone substitutes, and viscosupplements, are extensively used to treat foot and ankle injuries or conditions resulting from trauma. The other treatment methodologies in regenerative medicine include stem cell treatments, PRP, and prolotherapy. The adoption of pain medications for such applications is high owing to the low awareness about the benefits of orthopedic braces as well as the unfavorable reimbursement scenario for these products. The ease of administration and greater affordability of pain medications are the other major factors supporting this trend. This is considered a major challenge for the growth of the market during the study period.

By product, the orthopedic implants and devices products segment dominated the global foot and ankle devices industry

Based on the product, the foot and ankle devices market is segmented into orthopedic implants and devices, bracing and support devices, and prostheses. Orthopedic implants and devices products include joint implants, fixation devices, and soft tissue orthopedic devices. The orthopedic implants and devices segment dominated the market in 2019. Rising incidences of diabetes, new product launches, coupled with the rising adoption of branded orthopedic devices and implants because of better quality and lower risk associated with surgical site infection in emerging countries, is expected to drive the segment growth.

By application, the trauma & hair line fractures products segment dominated the global foot and ankle devices industry

Based on the application, the foot and ankle devices market is segmented into trauma & hair line fractures, rheumatoid arthritis & osteoarthritis, diabetic foot diseases, ligament injuries, neurological disorders, hammertoe and others. The trauma and hair line fracture segment accounted for a larger share of in the market in 2019. The increasing prevalence of sport injuries and road accidents, growing number of foot and ankle reconstruction procedures related to fractures, rapid growth in the aging population across the globe, and the development of advanced foot and ankle products are factors expected to drive the growth of this market segment in the coming years.

By end user, the hospital segment accounted for the largest share of the foot and ankle devices industry in 2019

Based on application, the foot and ankle devices market has been segmented into the hospitals, ambulatory surgery centers, orthopaedic clinics andrehabilitation centers. Among these, the hospitals segment accounted for the largest share of the market in 2019. The large share of this segment is attributed to the large target patient population base (especially in emerging countries) preferring hospitals, the growing procedural volume in hospital settings, rising emphasis on effective and early disease diagnosis in hospital, and the high budget of hospitals for introducing various technologically advanced foot and ankle devices products.

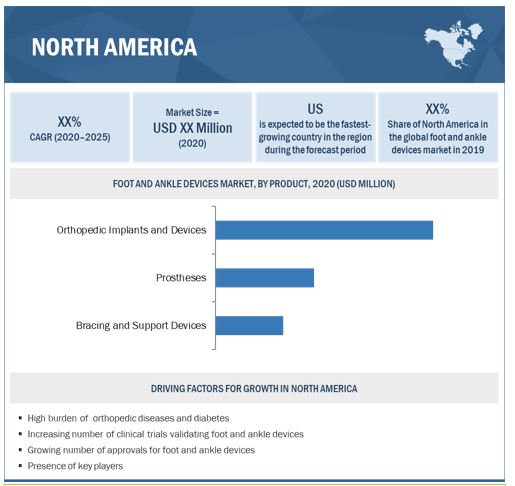

North America is expected to command the largest share of the foot and ankle devices industry in 2019

The report covers the foot and ankle devices market across five major geographies, namely, Europe, North America, Asia Pacific, Latin America, and MEA. North America commanded the largest share of the market in 2019. The increasing R&D to develop patient specific foot and ankle devices, rising prevalence of orthopaedic diseases, technological advancements in foot and ankle devices products and procedures are the key factors supporting market growth in North America.

The major players in the foot and ankle devices market are DePuy Synthes Companies (US), Stryker Corporation (US), Zimmer Biomet Holdings, Inc (US), Smith & Nephew plc (UK), Arthrex Inc (US), Integra LifeSciences Holdings Corporation (US), DJO Finance, LLC (US), CONMED Corporation (US), Össur HF (Iceland), Orthofix Medical Inc. (US), Medartis AG (Switzerland), Acumed LLC (US), Extremity Medical (US), aap Implantate AG (Germany), Ottobock SE & Co. KGaA (Germany), Ortho Solutions UK Ltd. (UK), Vilex in Tennessee, Inc. (US), Advanced Orthopaedic Solutions (US), Fillauer LLC (US), and Groupe FH Ortho (France), among others.

DePuy Synthes Companies (A subsidiary of Johnson & Johnson Services, Inc) (US) has a wide range of product offerings in the market, including internal fixation devices, external fixation devices, joint implants and musculoskeletal reinforcement d evices products. The company sustains its key position in the global market owing to its multiple product launches. DePuy Synthes has a strong product portfolio, supporting around one million orthopedic and neuro procedures worldwide.The company is focused on innovations and improving the quality of its products with increasing investment in its R&D department. DePuy Synthes global footprint allows it to cater to a customer base across 60+ countries such as Germany, the UK, South Korea, France, Australia, and the US.

Scope of the Foot and Ankle Devices Industry:

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Product, Application, End User, and Region |

|

Geographies covered |

Europe, North America, the Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

DePuy Synthes Companies (US), Stryker Corporation (US), Zimmer Biomet Holdings, Inc (US), Smith & Nephew plc (UK), Arthrex Inc (US), Integra LifeSciences Holdings Corporation (US), DJO Finance, LLC (US), CONMED Corporation (US), Össur HF (Iceland), Orthofix Medical Inc. (US), Medartis AG (Switzerland), Acumed LLC (US), Extremity Medical (US), aap Implantate AG (Germany), Ottobock SE & Co. KGaA (Germany), Ortho Solutions UK Ltd. (UK), Vilex in Tennessee, Inc. (US), Advanced Orthopaedic Solutions (US), Fillauer LLC (US), and Groupe FH Ortho (France) |

This report has segmented the global foot and ankle devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Orthopedic Implants and Devices

-

Joint Implants

- Ankle Implants (Ankle Replacement Devices)

- Subtalar Joint Implants/Subtalar Joint Reconstruction Devices

- Phalangeal Implants

-

Fixation Devices

-

Internal Fixation Devices

- Screws

- Plates

- Fusion Nails

- Wires & Pins

-

External Fixation Devices

- Ring Ankle Fixators

- Unilateral Fixators

- Hybrid Fixators

-

Internal Fixation Devices

-

Soft Tissue Orthopedic Devices

- Musculoskeletal Reinforcement Devices

- Artificial Tendons & Ligaments

-

Joint Implants

-

Bracing and Support Devices

- Soft Bracing & Support Devices

- Hinged Braces & Suppot Devices

- Hard Braces & Support Devices

-

Prostheses

- Solid Ankle Cushion Heel (SACH) Prostheses

- Single-Axial Prostheses

- Multiaxial Prostheses

- Dynamic Response/Energy-Storing Prostheses

- Microprocessor-Controlled (Mpc) Prostheses

By Application

- Trauma & Hair line Fractures

- Rheumatoid Arthritis & Osteoarthritis

- Diabetic Foot Diseases

- Ligament Injuries

- Neurological Disorders

- Hammertoe

- Others

By End User

- Hospitals

- Ambulatory Surgery Centers

- Orthopedic Clinics

- Rehabilitation Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments of Foot and Ankle Devices Industry

- In September 2020, Stryker Corporation (US) launched the AxSOS 3 Ankle Fusion System, which is an ankle fusion titanium plate system used for the fusion of the tibio-talar joint.

- In March 2020, DePuy Synthes (US) launched the FIBULINK Syndesmosis Repair System in the US for the treatment of traumatic injuries to the syndesmosis.

- In June 2020, DePuy Synthes renewed its agreement with AO Foundation (Switzerland) to continue with the advancement of surgical education.

Frequently Asked Questions (FAQ):

What is the projected market value of the global foot and ankle devices market?

The global market of foot and ankle devices is projected to reach USD 5.3 billion.

What is the estimated growth rate (CAGR) of the global foot and ankle devices market for the next five years?

The global foot and ankle devices market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% from 2020 to 2025.

What are the major revenue pockets in the foot and ankle devices market currently?

The report covers the market across five major geographies, namely, Europe, North America, Asia Pacific, Latin America, and MEA. North America commanded the largest share of the foot and ankle devices market in 2019. The increasing R&D to develop patient specific foot and ankle devices, rising prevalence of orthopaedic diseases, technological advancements in foot and ankle devices products and procedures are the key factors supporting market growth in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 MAJOR MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

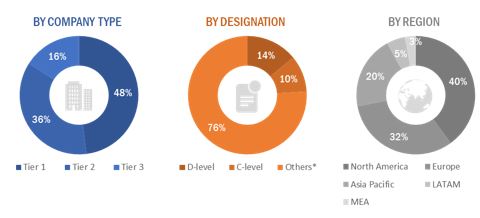

FIGURE 2 BREAKDOWN OF PRIMARIES: FOOT AND ANKLE DEVICES MARKET

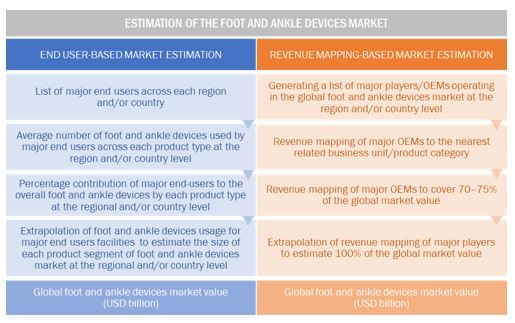

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 END USER-BASED MARKET ESTIMATION

2.2.2 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: MARKET

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 6 FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 7 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 FOOT AND ANKLE DEVICES MARKET OVERVIEW

FIGURE 10 INCREASING PREVALENCE OF TARGET DISEASES TO DRIVE MARKET GROWTH

4.2 MARKET, BY PRODUCT

FIGURE 11 ORTHOPEDIC IMPLANTS AND DEVICES TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET DURING THE FORECAST PERIOD

4.3 MARKET SHARE, BY END USER

FIGURE 12 HOSPITALS TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 APAC MARKET, BY COUNTRY AND APPLICATION

FIGURE 13 JAPAN IS THE LARGEST MARKET FOR FOOT AND ANKLE DEVICES IN APAC

4.5 GEOGRAPHICAL SNAPSHOT OF THE MARKET

FIGURE 14 MARKET IN CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 FOOT AND ANKLE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of orthopedic diseases and foot and ankle disorders

FIGURE 16 OBESE POPULATION (AS A PERCENTAGE OF THE TOTAL POPULATION) IN OECD COUNTRIES (2017)

5.2.1.2 Continuous product commercialization

5.2.1.3 Greater product affordability and market availability

5.2.1.4 Rising number of sports and accident-related foot and ankle injuries

FIGURE 17 INJURIES CAUSED BY VARIOUS SPORTS ACTIVITIES IN THE US (2017)

FIGURE 18 GERMANY REPORTED THE HIGHEST NUMBER OF ROAD ACCIDENTS GLOBALLY (2016)

5.2.1.5 Growing public-private educational and awareness initiatives related to preventive & post-operative care

5.2.2 RESTRAINTS

5.2.2.1 High cost of foot and ankle devices

5.2.2.2 Metal sensitivity in patients with foot and ankle implants

5.2.3 OPPORTUNITIES

5.2.3.1 Marketing, promotion, and branding initiatives undertaken by major product manufacturers

5.2.3.2 Emergence of bioresorbable and 3D-printed implants

5.2.4 CHALLENGES

5.2.4.1 Higher adoption of alternative therapies for the treatment of foot and ankle disorders & injuries

5.2.4.2 Increasing pricing pressure on market players

5.2.4.3 Dearth of skilled professionals

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS—MAXIMUM VALUE ADDED DURING THE MANUFACTURING PHASE

5.4 ECOSYSTEM LANDSCAPE

5.4.1 PARENT MARKET: ORTHOPEDIC IMPLANTS, SURGICAL DEVICES, AND SUPPORT PRODUCTS

5.4.2 TARGET MARKET: IMPLANTS, SURGICAL DEVICES, AND SUPPORT PRODUCTS FOR FOOT AND ANKLE PROCEDURES

5.5 PRICING ANALYSIS

TABLE 1 PRICING ANALYSIS: FOOT AND ANKLE DEVICES, 2019 (ASP IN USD)

5.6 REGULATORY ANALYSIS

5.6.1 NORTH AMERICA

5.6.1.1 US

TABLE 2 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 3 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.6.1.2 Canada

TABLE 4 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 20 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.6.2 EUROPE

FIGURE 21 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.6.3 ASIA PACIFIC

5.6.3.1 Japan

TABLE 5 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.6.3.2 China

TABLE 6 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.6.3.3 India

5.7 REIMBURSEMENT SCENARIO

TABLE 7 REIMBURSEMENT CODES FOR VARIOUS PROCEDURES AS OF 2018

5.8 COVID-19 IMPACT

6 FOOT AND ANKLE DEVICES MARKET, BY PRODUCT (Page No. - 91)

6.1 INTRODUCTION

TABLE 8 MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 ORTHOPEDIC IMPLANTS AND DEVICES

6.2.1 INTRODUCTION

TABLE 9 ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 12 ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

6.2.2 FIXATION DEVICES

TABLE 13 FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 14 FIXATION DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.1 Internal fixation devices

TABLE 15 INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 16 INTERNAL FIXATION DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.1.1 Screws

6.2.2.1.1.1 Growing preference for headless and bioresorbable screws in foot and ankle procedures to fuel market growth

TABLE 17 SCREWS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.1.2 Plates

6.2.2.1.2.1 Extensive use of variable ankle locking plates technology to drive market growth

TABLE 18 PLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.1.3 Fusion nails

6.2.2.1.3.1 Increasing applications of intramedullary nailing systems to drive market growth

TABLE 19 FUSION NAILS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.1.4 Wires & pins

6.2.2.1.4.1 Shift toward bioresorbable pins to drive market growth

TABLE 20 WIRES & PINS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.2 External fixation devices

TABLE 21 EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 22 EXTERNAL FIXATION DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.2.1 Ring ankle fixators

6.2.2.2.1.1 Introduction of computer-assisted ring ankle fixators to drive market growth

TABLE 23 RING ANKLE FIXATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.2.2 Unilateral fixators

6.2.2.2.2.1 Lower cost of these devices to drive their adoption

TABLE 24 UNILATERAL FIXATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2.2.3 Hybrid fixators

6.2.2.2.3.1 Rising geriatric population to support the growth of this market segment

TABLE 25 HYBRID FIXATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.3 JOINT IMPLANTS

TABLE 26 JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 27 JOINT IMPLANTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.3.1 Ankle Implants (Ankle Replacement Devices)

6.2.3.1.1 Growing number of ankle replacement procedures to fuel market growth

TABLE 28 ANKLE IMPLANTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.3.2 Subtalar Joint Implants (Subtalar Joint Reconstruction Devices)

6.2.3.2.1 Evolving reimbursement scenario for subtalar joint implants to fuel market growth

TABLE 29 SUBTALAR JOINT IMPLANTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.3.3 Phalangeal implants

6.2.3.3.1 Emergence of structural encoding technology likely to fuel market growth

TABLE 30 PHALANGEAL IMPLANTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.4 SOFT-TISSUE ORTHOPEDIC DEVICES

TABLE 31 SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.4.1 Musculoskeletal reinforcement devices

6.2.4.1.1 Rising prevalence of musculoskeletal disorders to drive market growth

TABLE 33 MUSCULOSKELETAL REINFORCEMENT DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.4.2 Artificial tendons & ligaments

6.2.4.2.1 Advances in tendon and ligament tissue engineering to fuel market growth

TABLE 34 ARTIFICIAL TENDONS & LIGAMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 PROSTHESES

TABLE 35 K-LEVELS FOR AMPUTEES

TABLE 36 PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 37 PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 PROSTHESES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 39 PROSTHESES MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3.1 SOLID ANKLE CUSHION HEEL PROSTHESES

6.3.1.1 SACH is relatively inexpensive, durable, and virtually maintenance-free

TABLE 40 SOLID ANKLE CUSHION HEEL PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.2 SINGLE-AXIAL PROSTHESES

6.3.2.1 Requirement for periodic servicing to limit the growth of this market to a certain extend

TABLE 41 SINGLE-AXIAL PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.3 MULTIAXIAL PROSTHESES

6.3.3.1 Availability of prostheses with advanced technologies to hinder market growth

TABLE 42 MULTIAXIAL PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.4 DYNAMIC RESPONSE/ENERGY-STORING PROSTHESES

6.3.4.1 Increasing number of mergers and acquisitions to drive market growth

TABLE 43 DYNAMIC RESPONSE/ENERGY-STORING PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.5 MICROPROCESSOR-CONTROLLED PROSTHESES

6.3.5.1 MPC prostheses offer more stability and motion to amputees

TABLE 44 MICROPROCESSOR-CONTROLLED PROSTHESES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 BRACING AND SUPPORT DEVICES

TABLE 45 BRACING AND SUPPORT DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 46 BRACING AND SUPPORT DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 47 BRACING AND SUPPORT DEVICES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 BRACING AND SUPPORT DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

6.4.1 SOFT BRACES AND SUPPORT DEVICES

6.4.1.1 Advantages of soft and elastic braces & supports have driven their demand

TABLE 49 SOFT BRACES AND SUPPORT DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4.2 HARD BRACES AND SUPPORT DEVICES

6.4.2.1 Supportive reimbursement scenario and rising prevalence of target diseases to drive market growth

TABLE 50 HARD BRACES AND SUPPORT DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4.3 HINGED BRACES AND SUPPORT DEVICES

6.4.3.1 Increasing public participation in sports and increasing number of ankle injuries to drive market growth

TABLE 51 HINGED BRACES AND SUPPORT DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

7 FOOT AND ANKLE DEVICES MARKET, BY APPLICATION (Page No. - 125)

7.1 INTRODUCTION

TABLE 52 MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 TRAUMA AND HAIRLINE FRACTURES

7.2.1 INCREASING PUBLIC PARTICIPATION IN SPORTS-RELATED ACTIVITIES TO SUPPORT MARKET GROWTH

TABLE 53 TYPES OF FOOT AND ANKLE INJURIES IN VARIOUS SPORTS

TABLE 54 MARKET FOR TRAUMA AND HAIRLINE FRACTURES, BY REGION, 2018–2025 (USD MILLION)

7.3 RHEUMATOID ARTHRITIS & OSTEOARTHRITIS

7.3.1 INCREASING NUMBER OF ORTHOPEDIC RECONSTRUCTIVE SURGERIES TO SUPPORT MARKET GROWTH

TABLE 55 MARKET FOR RHEUMATOID ARTHRITIS & OSTEOARTHRITIS, BY REGION, 2018–2025 (USD MILLION)

7.4 DIABETIC FOOT DISEASES

7.4.1 GROWING PREVALENCE OF DIABETES-ASSOCIATED FOOT ULCERATIONS TO SUPPORT MARKET GROWTH

TABLE 56 GLOBAL DIABETIC POPULATION AND DIABETES-RELATED HEALTHCARE EXPENDITURE

TABLE 57 MARKET FOR DIABETIC FOOT DISEASES, BY REGION, 2018–2025 (USD MILLION)

7.5 LIGAMENT INJURIES

7.5.1 GROWING REIMBURSEMENT COVERAGE FOR LIGAMENT INJURIES-RELATED SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

TABLE 58 MARKET FOR LIGAMENT INJURIES, BY REGION, 2018–2025 (USD MILLION)

7.6 NEUROLOGICAL DISORDERS

7.6.1 HIGH PREVALENCE OF NEUROPATHY IN THE GERIATRIC POPULATION TO SUPPORT MARKET GROWTH

TABLE 59 MARKET FOR NEUROLOGICAL DISORDERS, BY REGION, 2018–2025 (USD MILLION)

7.7 HAMMERTOE

7.7.1 RISING PREVALENCE OF HAMMERTOE TO SUPPORT MARKET GROWTH

TABLE 60 MARKET FOR HAMMERTOE, BY REGION, 2018–2025 (USD MILLION)

7.8 OTHER APPLICATIONS

TABLE 61 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8 FOOT AND ANKLE DEVICES MARKET, BY END USER (Page No. - 136)

8.1 INTRODUCTION

TABLE 62 MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 HOSPITALS

8.2.1 INCREASING NUMBER OF ORTHOPEDIC SURGERIES AND POST-OPERATIVE PATIENT REHABILITATION PROCEDURES TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 63 MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

8.3 AMBULATORY SURGERY CENTERS

8.3.1 PATIENTS ARE INCREASINGLY OPTING FOR AMBULATORY SURGERY CENTERS COMPARED TO HOSPITAL-BASED OUTPATIENT PROCEDURES

TABLE 64 MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2018–2025 (USD MILLION)

8.4 ORTHOPEDIC CLINICS

8.4.1 PREFERENCE FOR ORTHOPEDIC CLINICS IS GROWING OWING TO THEIR GREATER VERSATILITY

TABLE 65 MARKET FOR ORTHOPEDIC CLINICS, BY REGION, 2018–2025 (USD MILLION)

8.5 REHABILITATION CENTERS

8.5.1 REHABILITATION CENTERS ARE FAST EMERGING AS MAJOR END USERS FOR VARIOUS ORTHOPEDIC BRACING AND SUPPORT PRODUCTS

TABLE 66 MARKET FOR REHABILITATION CENTERS, BY REGION, 2018–2025 (USD MILLION)

9 FOOT AND ANKLE DEVICES MARKET, BY REGION (Page No. - 142)

9.1 INTRODUCTION

TABLE 67 FOOT AND ANKLE DEVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: FOOT AND ANKLE DEVICES MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: ANKLE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: ANKLE DEVICES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: FOOT AND ANKLE DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Strong presence of market players has driven market growth in the US

TABLE 80 US: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 81 US: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 US: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 US: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 US: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 US: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 US: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 US: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 US: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Market growth is driven by the rising incidence of bone-related degenerative diseases

TABLE 89 CANADA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 90 CANADA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 CANADA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 CANADA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 CANADA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 CANADA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 CANADA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 CANADA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 CANADA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 98 EUROPE: FOOT AND ANKLE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 99 EUROPE: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 100 EUROPE: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 EUROPE: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 EUROPE: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 EUROPE: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 EUROPE: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 EUROPE: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 EUROPE: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 EUROPE: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 EUROPE: ANKLE DEVICES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 EUROPE: FOOT AND ANKLE DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany accounted for the largest share of the European market

TABLE 110 FUNDING INITIATIVES IN GERMANY

TABLE 111 GERMANY: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 112 GERMANY: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 GERMANY: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 GERMANY: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 115 GERMANY: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 116 GERMANY: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 GERMANY: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 GERMANY: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 GERMANY: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Market growth in the UK is mainly driven by the increasing funding by public and private organizations

TABLE 120 UK: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 121 UK: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 UK: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 UK: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 UK: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 UK: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 UK: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 UK: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 UK: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Strategic acquisitions to support market growth in France

TABLE 129 FRANCE: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 130 FRANCE: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 FRANCE: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 FRANCE: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 FRANCE: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 FRANCE: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 FRANCE: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 FRANCE: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 FRANCE: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing market availability of high-end foot and ankle devices to drive market growth

TABLE 138 ITALY: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 139 ITALY: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 ITALY: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 ITALY: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 ITALY: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 ITALY: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 ITALY: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 ITALY: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 ITALY: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing prevalence of target conditions to drive market growth

TABLE 147 SPAIN: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 148 SPAIN: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 SPAIN: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 SPAIN: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 SPAIN: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 SPAIN: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 SPAIN: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 SPAIN: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 SPAIN: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 156 ROE: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 157 ROE: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 158 ROE: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 159 ROE: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 160 ROE: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 161 ROE: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 ROE: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 ROE: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 ROE: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: FOOT AND ANKLE DEVICES MARKET SNAPSHOT

TABLE 165 ASIA PACIFIC: ANKLE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 166 ASIA PACIFIC: ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 167 ASIA PACIFIC: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 168 ASIA PACIFIC: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 169 ASIA PACIFIC: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 170 ASIA PACIFIC: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 171 ASIA PACIFIC: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 ASIA PACIFIC: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 ASIA PACIFIC: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 ASIA PACIFIC: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 175 ASIA PACIFIC: ANKLE DEVICES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 176 ASIA PACIFIC: ANKLE DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan dominates the Asia Pacific foot and ankle devices market

TABLE 177 JAPAN: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 178 JAPAN: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 179 JAPAN: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 JAPAN: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 JAPAN: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 182 JAPAN: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 183 JAPAN: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 184 JAPAN: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 JAPAN: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Expansion in target patient population and modernization of healthcare facilities to drive market growth

TABLE 186 CHINA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 187 CHINA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 188 CHINA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 189 CHINA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 190 CHINA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 191 CHINA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 192 CHINA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 193 CHINA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 194 CHINA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE,2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing number of foot and ankle surgeries to support market growth

TABLE 195 INDIA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 196 INDIA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 197 INDIA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 INDIA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 INDIA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 200 INDIA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 201 INDIA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 202 INDIA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 203 INDIA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Research and Development Tax Incentive Program to support market growth

TABLE 204 AUSTRALIA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 205 AUSTRALIA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 206 AUSTRALIA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 207 AUSTRALIA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 208 AUSTRALIA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 209 AUSTRALIA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 210 AUSTRALIA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 211 AUSTRALIA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 212 AUSTRALIA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Supportive government initiatives expected to positively impact market growth

TABLE 213 SOUTH KOREA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 214 SOUTH KOREA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 215 SOUTH KOREA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 216 SOUTH KOREA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 SOUTH KOREA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 218 SOUTH KOREA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 219 SOUTH KOREA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 220 SOUTH KOREA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 221 SOUTH KOREA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 222 ROAPAC: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 223 ROAPAC: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 224 ROAPAC: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 225 ROAPAC: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 226 ROAPAC: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 227 ROAPAC: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 228 ROAPAC: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 229 ROAPAC: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 ROAPAC: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 231 LATIN AMERICA: FOOT AND ANKLE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 233 LATIN AMERICA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 234 LATIN AMERICA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 235 LATIN AMERICA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 236 LATIN AMERICA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 237 LATIN AMERICA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 238 LATIN AMERICA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 239 LATIN AMERICA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 240 LATIN AMERICA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 241 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Modernization of healthcare facilities will drive market growth

TABLE 243 BRAZIL: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 244 BRAZIL: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 BRAZIL: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 BRAZIL: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 247 BRAZIL: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 248 BRAZIL: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 249 BRAZIL: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 250 BRAZIL: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 251 BRAZIL: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Favorable investment scenario for medical device manufacturers to drive market growth

TABLE 252 MEXICO: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 253 MEXICO: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 254 MEXICO: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 255 MEXICO: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 256 MEXICO: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 257 MEXICO: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 258 MEXICO: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 259 MEXICO: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 260 MEXICO: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 261 ROLATAM: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 262 ROLATAM: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 263 ROLATAM: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 264 ROLATAM: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 265 ROLATAM: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 266 ROLATAM: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 267 ROLATAM: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 268 ROLATAM: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 269 ROLATAM: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 AWARENESS INITIATIVES TO DRIVE THE ADOPTION OF FOOT AND ANKLE DEVICES IN THE REGION

TABLE 270 MIDDLE EAST & AFRICA: FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 271 MIDDLE EAST & AFRICA: ORTHOPEDIC IMPLANTS AND DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 272 MIDDLE EAST & AFRICA: FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 273 MIDDLE EAST & AFRICA: INTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 274 MIDDLE EAST & AFRICA: EXTERNAL FIXATION DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: JOINT IMPLANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 276 MIDDLE EAST & AFRICA: SOFT-TISSUE ORTHOPEDIC DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA: PROSTHESES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: BRACING AND SUPPORT DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 280 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 239)

10.1 OVERVIEW

FIGURE 24 KEY DEVELOPMENTS IN THE FOOT AND ANKLE DEVICES MARKET(2017–2020)

10.2 GLOBAL MARKET SHARE ANALYSIS (2019)

FIGURE 25 DEPUY SYNTHES COMPANIES HELD THE LEADING POSITION IN THE MARKET IN 2019

10.3 COMPETITIVE SCENARIO (2017–2020)

10.3.1 KEY PRODUCT LAUNCHES AND PRODUCT APPROVALS (2018–2020)

10.3.2 KEY EXPANSIONS (2017–2020)

10.3.3 KEY MERGERS AND ACQUISITIONS (2017–2020)

10.3.4 KEY AGREEMENTS, CONTRACTS, AND PARTNERSHIPS (2017–2020)

10.4 COMPETITIVE LEADERSHIP MAPPING

10.5 VENDOR INCLUSION CRITERIA

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 26 MARKET: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019

10.6 COMPETITIVE LEADERSHIP MAPPING: EMERGING COMPANIES/SMES/START-UPS (2019)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 27 MARKET: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019 (SME/START-UPS)

11 COMPANY PROFILES (Page No. - 249)

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

11.1 DEPUY SYNTHES COMPANIES (A PART OF JOHNSON & JOHNSON)

FIGURE 28 DEPUY SYNTHES: COMPANY SNAPSHOT (2019)

11.2 STRYKER CORPORATION

FIGURE 29 STRYKER CORPORATION: COMPANY SNAPSHOT (2019)

11.3 ZIMMER BIOMET HOLDINGS, INC.

FIGURE 30 ZIMMER BIOMET HOLDINGS, INC: COMPANY SNAPSHOT (2019)

11.4 SMITH & NEPHEW PLC

FIGURE 31 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2019)

11.5 ARTHREX INC.

11.6 ÖSSUR HF

FIGURE 32 ÖSSUR HF: COMPANY SNAPSHOT (2019)

11.7 DJO FINANCE, LLC (A SUBSIDIARY OF COLFAX CORPORATION)

FIGURE 33 DJO FINANCE, LLC: COMPANY SNAPSHOT (2018)

11.8 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

FIGURE 34 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2019)

11.9 CONMED CORPORATION

FIGURE 35 CONMED CORPORATION: COMPANY SNAPSHOT (2019)

11.10 ORTHOFIX MEDICAL INC.

FIGURE 36 ORTHOFIX MEDICAL INC.: COMPANY SNAPSHOT (2019)

11.11 AAP IMPLANTATE AG

FIGURE 37 AAP IMPLANTATE AG: COMPANY SNAPSHOT (2019)

11.12 MEDARTIS AG

FIGURE 38 MEDARTIS AG: COMPANY SNAPSHOT (2019)

11.13 EXTREMITY MEDICAL

11.14 ACUMED LLC

11.15 OTTOBOCK SE & CO. KGAA (A PART OF OTTOBOCK GROUP SCANDINAVIA)

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

11.16 OTHER COMPANIES

11.16.1 VILEX IN TENNESSEE, INC.

11.16.2 ORTHO SOLUTIONS UK LTD.

11.16.3 ADVANCED ORTHOPAEDIC SOLUTIONS

11.16.4 GROUPE FH ORTHO (A SUBSIDIARY OF OLYMPUS CORPORATION)

11.16.5 FILLAUER LLC

12 APPENDIX (Page No. - 300)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the foot and ankle devices market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global foot and ankle devices market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, ambulatory surgery centers, outpatient facilities, clinics, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Foot and Ankle Devices Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global market and other dependent submarkets.

- The key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After deriving the overall foot and ankle devices market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives

- To define, describe, and forecast the foot and ankle devices market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the global market

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global market, such as product launches; agreements, partnerships, and collaborations; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global foot and ankle devices market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Foot and Ankle Devices Market