Top 10 Medical Device Technologies Market Size, Share & Trends by Type (In Vitro Diagnostics, Diagnostics Imaging, Orthopedic, Ophthalmology, Cardiology, Endoscopy, Diabetes Care, Respiratory Care & Anesthesia, Kidney/Dialysis Devices) and Region - Global Forecast to 2027

Updated on : Aug 28, 2024

Top 10 Medical Device Technologies Market Size, Share & Trends

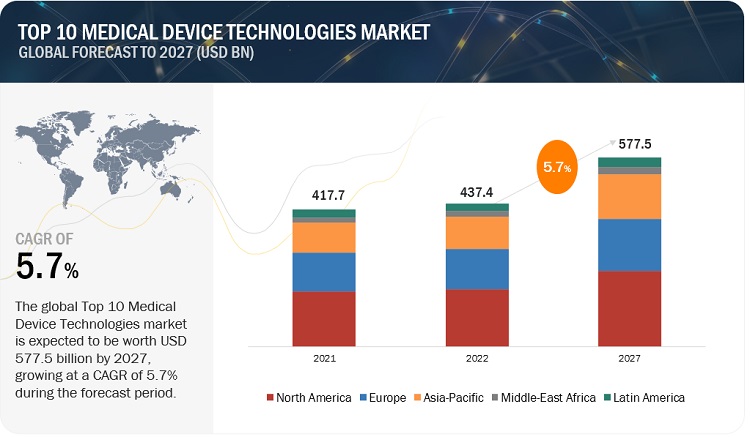

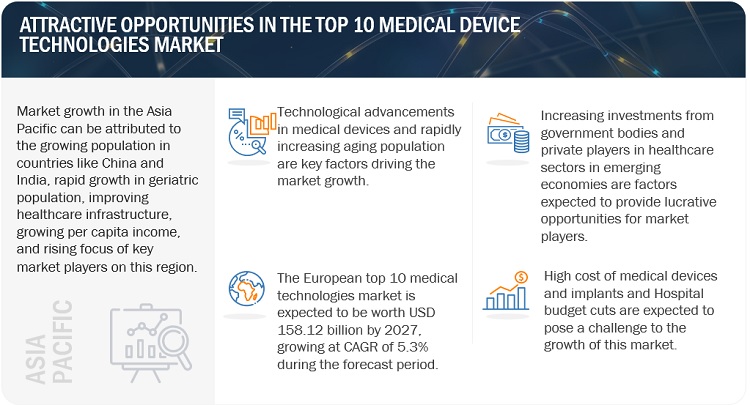

The global Top 10 Medical Device Technologies market, valued at US$417.7 billion in 2021, stood at US$437.4 billion in 2022 and is projected to advance at a resilient CAGR of 5.7% from 2022 to 2027, culminating in a forecasted valuation of US$577.5 billion by the end of the period. This growth is driven by trends such as the shift from centralized to point-of-care testing, increasing chronic disease prevalence due to urbanization and lifestyle changes, and growing healthcare needs in emerging economies like India, China, and Brazil. Key market players include Abbott Laboratories, Roche Diagnostics, Philips, Siemens Healthineers, and Medtronic. However, challenges such as uncertainty in reimbursement, high costs of advanced technologies, and hospital budget cuts pose significant constraints. Opportunities exist in expanding markets and advancing technologies, though the market is also expected to face limitations due to regulatory hurdles and reimbursement issues. The Asia Pacific region is anticipated to experience the highest growth rate due to its rising geriatric population and increasing demand for advanced medical devices.

Top 10 Medical Device Technologies Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Top 10 Medical Device Technologies Market Dynamics

Driver: Gradual shift from centralized testing to point-of-care testing

The dominant model of laboratory testing throughout the world remains the centralized laboratory that uses automated analytical testing methods to detect target analytes. This trend is well established in clinical chemistry and hematology disciplines and extends to other areas, including immunoassays and molecular diagnostics.

Point-of-care devices offer advantages over conventional diagnostic procedures in affordability and ease of use and yield rapid results required for initiating decision-making. The increased adoption of POCT devices is greatly influenced by the need to make healthcare more patient-centered by organizing healthcare services around the patient than the provider. Centralized testing does not represent a convenient process for many patients because the testing process is often disconnected from the consultation. This happens particularly to those patients with a chronic disease such as diabetes who require regular monitoring, including frequent blood tests. The growth in self-monitoring of blood glucose, the largest portion of POC testing, is partly a testament to this need for more convenient and effective care.

The volume of testing performed outside the conventional laboratory is likely to increase in the coming years, driven by the need to deliver care closer to the patient. The menu of tests performed using POC testing devices has expanded considerably in the last two decades. This development was majorly driven by well-established technologies such as lateral flow strips, immunosensors, and the continual miniaturization of electronics & increased computing power of devices.

However, while estimates of the growth potential for POC testing are positive, POC devices may be vulnerable to budgetary pressures. The burden is on the manufacturer to provide evidence of improved outcomes, but these outcomes can only be achieved through an improved care pathway. Despite having robust device design, inflexibility in the patient care pathway or poor understanding by diagnostics manufacturers may limit the adoption of POC devices.

Restraint: Uncertainty in reimbursement

The unfavorable reimbursement scenario in most countries across the globe is a major factor restraining the growth of the medical devices market.

Healthcare providers—particularly in developing countries such as India, Brazil, and Mexico—have low financial resources to invest in costly, sophisticated technologies. Moreover, the staff should be trained in the efficient handling and maintenance of medical devices and accessories. Maintaining medical equipment is of vital importance as improperly reprocessed devices can lead to cross-contamination and potentially expose patients to infections. This can incur additional costs. All these factors add to the cost of diagnostic or surgical procedures. Owing to the high capital, training, and maintenance costs, diagnostic or surgical procedures are generally expensive. Also, in most Asian countries, there is limited or no reimbursement for diagnostic or surgical procedures from governments.

Currently, the healthcare system in developing countries faces many challenges due to rising healthcare costs, increasing incidence of chronic diseases, and the growing geriatric population (coupled with the growth in age-related disorders). To counter these challenges, governments in a number of countries are focusing on redesigning their healthcare reimbursement systems. In Asian countries, there is very limited or no reimbursement available (except in Japan). Thus, limited or decreasing reimbursement rates in developed countries and undefined reimbursement policies in emerging countries restrict the adoption of diagnostic or surgical procedures globally.

Opportunity: Growth potential of emerging economies

India, China, and Brazil are relatively untapped markets for interventional cardiology. The high incidence of diabetes and the large geriatric population in these and other emerging countries offer significant growth opportunities for the interventional cardiology devices market.

According to the IDF, ~77.0 million people suffered from diabetes in India alone in 2019; this is projected to reach 101.0 million by 2030. Similarly, in China, the population suffering from diabetes is projected to reach 140.5 million by 2030, from 116.4 million in 2019. In addition, increasing health awareness in the aforementioned countries is expected to increase the demand for advanced treatment methods, including interventional cardiology.

Challenge: Hospital budget cuts

In response to increasing government pressure for reducing Several healthcare providers have allied themselves with group purchasing organisations (GPOs), integrated health networks (IHNs), and integrated delivery networks (IDNs) in response to growing government pressure to lower healthcare costs. In order to negotiate a fair price with the suppliers and manufacturers of medical devices, these organisations pool the purchasing power of their members. For large purchases of diagnostic imagingequipment, GPOs, IHNs, and IDNs are highly negotiable.

Hospital budgets have been drastically reduced as a result of rising prescription drug prices and a sharp decrease in the US's proposed budgetary allotment for health and human services as of 2022. According to an American Hospital Association study, federal payment reductions to hospitals will total USD 218 billion by 2028, forcing them to set aside smaller budgets every year.

In 2020, Nigeria decided to cut its healthcare spending by 40%. Owing to these budget cuts, most hospitals cannot afford costly imaging devices and prefer lower-priced alternatives, such as refurbished devices or upgrading existing devices. To address this challenge, market players adopt suitable strategies to meet the needs of these hospitals.

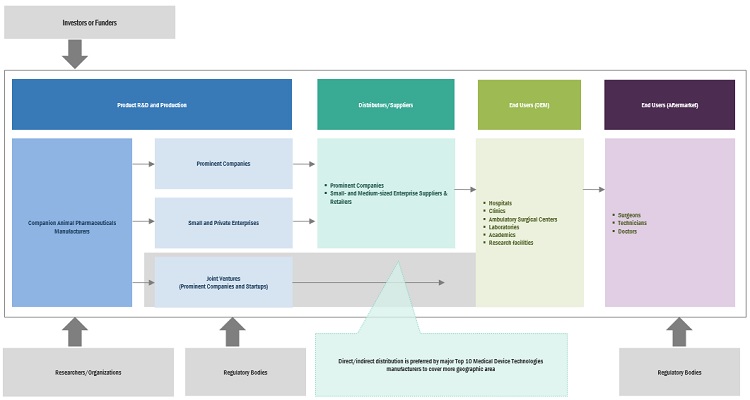

Top 10 Medical Device Technologies MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of Top 10 Medical Device Technologies. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Abbott Laboratories, Inc. (US), Roche Diagnostics (Switzerland), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), Stryker Corporation (US), Boston Scientific Corporation (US), Johnson & Johnson (US), Medtronic PLC (Ireland), Smith & Nephew PLC (UK), GE Healthcare (US).

The IVD Market segment is expected to account for the largest share of the Top 10 Medical Device Technologies market

Growth in the in vitro diagnostics (IVD) market is driven by the Gradual shift from centralized testing to point-of-care testing, Growing awareness of early disease diagnosis in emerging economies, and Emergence of rapid PoC technologies and rising adoption of automated analyzers. However, an unfavorable reimbursement scenario is expected to restrain the growth of this market during the forecast period.

The global respiratory care & anesthesia devices market segment is expected to grow at highest CAGR in the Top 10 Medical Device Technologies market during the forecast period

The increasing need for advanced and innovative machines and equipment and high incidence of chronic obstructive pulmonary diseases (COPD) and obtrusive sleep apnea (OSA) are key factors driving the growth of this market. The changing preference of patients towards home care devices is expected to propel the growth of anesthesia and respiratory care devices market.

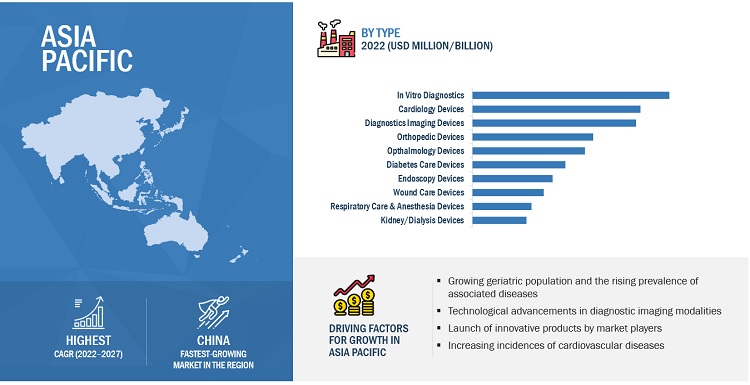

Asia Pacific will grow by highest CAGR in the top 10 Medical Device Technologies market, by region.

Asia Pacific will grow by highest CAGR in the the top 10 Medical Device Technologies market, by region, followed by Latin America, Europe, Middle East & Africa and North America. The highest CAGR of Asia Pacific can be attributed to the rising geriatric population, growing incidences of lifestyle diseases, and the rising demand for technologically advanced devices. However, stringent regulatory policies and a lack of reimbursement are expected to restrain the growth of this market.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global Top 10 Medical Device Technologies market are Stryker Corporation (US), Boston Scientific Corporation (US), Johnson & Johnson (US), Smith & Nephew PLC (UK), GE Healthcare (US).

Top 10 Medical Device Technologies Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

437.4 billion |

|

Projected Revenue by 2027 |

577.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.7% |

|

Market Driver |

Gradual shift from centralized testing to point-of-care testing |

|

Market Opportunity |

Growth potential of emerging economies |

The study categorizes the Top 10 Medical Device Technologies market to forecast revenue and analyze trends in each of the following submarkets:

- By In Vitro Diagnostics (IVD) Market

- By Cardiology Devices Market

- By Diagnostics Imaging Devices Market

- By Orthopedic Devices Market

- By Ophthalmology Devices Market

- By Endoscopy Devices Market

- By Diabetes Care Devices Market

- By Wound Car Devices Market

- By Kidney/Dialysis Devices Market

- By Respiratory Care & Anesthesia Devices Market

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments:

- In March 2023, The company Abbott launched received U.S FDA has approval for Epic Max stented tissue valve to treat people with aortic regurgitation or stenosis.

- In March 2023, The company Abbott launched received U.S FDA has approved FreeStyle Libre 2 and FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system sensors for integration with automated insulin delivery (AID) systems.

- In November 2022, Roche diagnostics Received US FDA approval of the VENTANA FOLR1 (FOLR1-2.1) RxDx Assay, the first immunohistochemistry (IHC) companion diagnostic test to aid in identifying epithelial ovarian cancer (EOC) patients who are eligible for targeted treatment with ELAHERE (mirvetuximab soravtansine-gynx).

- In November 2022, Siemens Healthineers launched Viato.Mobile with 1.5 Tesla for high-quality MR imaging.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the top 10 medical device technologies market?

The top 10 medical device technologies market boasts a total revenue value of $577.5 billion in 2027.

What is the estimated growth rate (CAGR) of the top 10 medical device technologies market?

The global market for top 10 medical device technologies has an estimated compound annual growth rate (CAGR) of 5.7% and a revenue size in the region of $437.4 billion by 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising prevalence of chronic diseases and related increase in disability-adjusted life years- Technological advancements in medical devices- Rapidly increasing geriatric populationRESTRAINTS- Uncertainty in reimbursement- Excise tax on medical devices in USOPPORTUNITIES- Increasing investments from government bodies and private players in healthcare sectors in emerging economies- Increasing focus of key players on medical devices market in emerging countriesCHALLENGES- High cost of medical devices and implants- Hospital budget cuts- Increasing adoption of refurbished medical devices

- 6.1 INTRODUCTION

-

6.2 MARKET DYNAMICSDRIVERS- Gradual shift from centralized testing to point-of-care testing- Growing awareness of early disease diagnosis in emerging economies- Emergence of rapid PoC diagnostics and rising adoption of automated analyzersRESTRAINTS- Unfavorable reimbursement scenarioOPPORTUNITIES- Introduction of disease-specific biomarkers and tests- Growing significance of companion diagnosticsCHALLENGES- Stringent regulatory and legal guidelines

-

6.3 IMMUNOASSAY/IMMUNOCHEMISTRYRISING TREND OF AUTOMATION TO DRIVE MARKET

-

6.4 CLINICAL CHEMISTRYINCREASING INCIDENCE OF LIFESTYLE DISEASES TO PROPEL MARKET

-

6.5 MOLECULAR DIAGNOSTICSRISING PREVALENCE OF INFECTIOUS DISEASES TO SUPPORT MARKET GROWTH

-

6.6 HEMATOLOGYINCREASING ADOPTION OF AUTOMATED HEMATOLOGY ANALYZERS TO DRIVE MARKET

-

6.7 MICROBIOLOGYRISING PREVALENCE OF MICROBIAL INFECTIONS TO DRIVE MARKET

-

6.8 COAGULATION AND HEMOSTASISGROWING USE OF ANTICOAGULATION THERAPY IN SURGICAL PROCEDURES TO DRIVE MARKET

-

6.9 URINALYSISRISING PREVALENCE OF KIDNEY DISORDERS AND UTIS TO SUPPORT MARKET GROWTH

- 6.10 OTHER IVD TECHNOLOGIES

- 7.1 INTRODUCTION

-

7.2 MARKET DYNAMICSDRIVERS- Increasing incidence of cardiovascular diseases- Launch of innovative products by market playersRESTRAINTS- Low affordability and inaccessibility of cardiac surgeries in developing countriesOPPORTUNITIES- Growth potential of emerging economiesCHALLENGES- Stringent regulatory requirements delaying approval of cardiac devices

-

7.3 CARDIOVASCULAR MONITORING DEVICESINCREASING ACCEPTANCE OF REMOTE MONITORING DEVICES TO PROPEL MARKET GROWTH

-

7.4 CARDIAC RHYTHM MANAGEMENT DEVICESTECHNOLOGICAL IMPROVEMENTS IN PACEMAKERS TO SUPPORT MARKET GROWTH

-

7.5 INTERVENTIONAL CARDIOLOGY DEVICESUSED FOR DIAGNOSIS AND TREATMENT OF ARTERIAL BLOCKAGES

-

7.6 PERIPHERAL VASCULAR DEVICESEMERGENCE OF ADVANCED FLOW ALTERATION DEVICES TO SUPPORT MARKET GROWTH

-

7.7 PROSTHETIC DEVICESSTRINGENT APPROVAL PROCESS TO RESTRAIN MARKET GROWTH

-

7.8 ELECTROPHYSIOLOGY DEVICESLACK OF SKILLED AND EXPERIENCED ELECTROPHYSIOLOGISTS TO RESTRAIN MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 MARKET DYNAMICSDRIVERS- Growing geriatric population and rising prevalence of associated diseases- Technological advancements in diagnostic imaging modalitiesRESTRAINTS- High cost of diagnostic imaging systemsOPPORTUNITIES- Adoption of AI and analytics in diagnostic imagingCHALLENGES- Hospital budget cuts

-

8.3 ULTRASOUND SYSTEMSTECHNOLOGICAL AND SOFTWARE MODIFICATIONS IN ULTRASOUND TECHNOLOGY TO DRIVE MARKET

-

8.4 X-RAY SYSTEMSEASY ACCESSIBILITY AND ADEQUACY OF X-RAY DEVICES TO PROPEL MARKET

-

8.5 NUCLEAR IMAGING EQUIPMENTHIGH COST OF NUCLEAR IMAGING EQUIPMENT TO RESTRAIN MARKET GROWTH

-

8.6 MAGNETIC RESONANCE IMAGING (MRI) SYSTEMSSAFETY ISSUES ASSOCIATED TO HAMPER MARKET GROWTH

-

8.7 COMPUTED TOMOGRAPHY (CT) SCANNERSGROWING APPLICATIONS OF CT SCANNERS TO DRIVE MARKET

-

8.8 MAMMOGRAPHY SYSTEMSMAMMOGRAPHY SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR

- 9.1 INTRODUCTION

-

9.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of orthopedic diseases and disorders- Rising number of sports and accident-related orthopedic injuriesRESTRAINTS- High cost associated with orthopedic treatmentsOPPORTUNITIES- Increasing use of robotics and 3D printing in orthopedicsCHALLENGES- Dearth of orthopedic surgeons

-

9.3 ORTHOBIOLOGICSRISING INCIDENCE OF DEFORMITIES AND TRAUMA IN SMALL EXTREMITIES TO DRIVE MARKET

-

9.4 JOINT RECONSTRUCTION DEVICESINCREASING PARTICIPATION IN SPORTS TO BOOST ADOPTION

-

9.5 SPINAL SURGERY DEVICESINCREASING INCIDENCE OF SPINAL DEFORMITIES TO DRIVE ADOPTION

-

9.6 TRAUMA FIXATION PRODUCTSINCREASING INCIDENCE OF OSTEOPOROSIS TO DRIVE MARKET

-

9.7 ARTHROSCOPIC DEVICESGROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES TO SUPPORT MARKET GROWTH

-

9.8 ORTHOPEDIC ACCESSORIESINCREASING PREVALENCE OF RHEUMATOID DISEASES AND OSTEOARTHRITIS TO PROPEL MARKET

-

9.9 ORTHOPEDIC BRACES AND SUPPORTSRISING PREVALENCE OF ORTHOPEDIC INJURIES AND DISORDERS TO PROPEL MARKET

- 10.1 INTRODUCTION

-

10.2 MARKET DYNAMICSDRIVERS- Rising prevalence of eye disorders- Technological advancements in ophthalmic devicesRESTRAINTS- High cost and risk associated with eye surgeriesOPPORTUNITIES- Low adoption of phacoemulsification devices and premium IOLs in emerging regionsCHALLENGES- Low accessibility to eye care in low-income countries

-

10.3 OPHTHALMIC DIAGNOSTIC AND MONITORING DEVICESINCREASING INCIDENCE AND PREVALENCE OF OPHTHALMIC DISORDERS TO DRIVE MARKET

-

10.4 REFRACTIVE SURGERY DEVICESRISING PREVALENCE OF UNCORRECTED REFRACTIVE ERRORS TO SUPPORT MARKET GROWTH

-

10.5 GLAUCOMA SURGERY DEVICESRISING GERIATRIC POPULATION TO PROPEL ADOPTION

-

10.6 CATARACT SURGERY DEVICESFAVORABLE REIMBURSEMENT POLICIES IN DEVELOPED COUNTRIES TO SUPPORT MARKET GROWTH

-

10.7 VITREORETINAL SURGERY DEVICESINCREASING PREVALENCE OF DIABETIC RETINOPATHY AND AMD SURGERY DEVICES TO SUPPORT MARKET GROWTH

-

10.8 VISION CARE DEVICESTECHNOLOGICAL ADVANCEMENTS IN LENS MATERIALS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 MARKET DYNAMICSDRIVERS- Surging requirement for endoscopy to diagnose and treat target diseases- Adoption of single-use endoscopy instruments to prevent infectious diseasesRESTRAINTS- High overhead cost of endoscopy procedures with limited reimbursement in developing countriesOPPORTUNITIES- Booming healthcare sector in developing economiesCHALLENGES- Infections caused by some endoscopy products offered by giant companies

-

11.3 ENDOSCOPESRIGID ENDOSCOPES- Growing demand for minimally invasive surgical procedures to propel market growthFLEXIBLE ENDOSCOPES- Rising prevalence of colorectal cancer to support market growthROBOT-ASSISTED ENDOSCOPES- Technological advancements to support market growthDISPOSABLE ENDOSCOPES- Strong focus on preventing hospital-acquired infections to increase demandCAPSULE ENDOSCOPES- Favorable reimbursement policies to support market growth

-

11.4 VISUALIZATION EQUIPMENTWIRELESS DISPLAYS AND MONITORS- Use of wireless displays and monitors reduces cost of routing cables through ceilings in hospitalsENDOSCOPIC LIGHT SOURCES- Light sources are critical components of endoscopy visualization systemsVIDEO CONVERTERS- Need for high-resolution images and videos to propel marketVIDEO RECORDERS- Necessity to document patient data to drive marketVIDEO PROCESSORS- Sort electric signals transmitted by camera head according to pixel location and intensityCAMERA HEADS- Technological advancements in camera technology to propel marketTRANSMITTERS AND RECEIVERS- Wireless transmitters and receivers ensure operating room safety and efficiencyCARTS- Surge in demand for endoscopy systems to fuel demandOTHER VISUALIZATION EQUIPMENT

-

11.5 ENDOSCOPIC ACCESSORIESGROWING NUMBER OF ENDOSCOPIC PROCEDURES TO PROPEL ADOPTION

-

11.6 OTHER ENDOSCOPY EQUIPMENTELECTRONIC ENDOSCOPY EQUIPMENT- Enable surgeons to perform procedures with easeMECHANICAL ENDOSCOPY EQUIPMENT- Increasing number of endoscopy procedures to drive market

- 12.1 INTRODUCTION

-

12.2 MARKET DYNAMICSDRIVERS- Global rise in diabetic population- Technological advancements in diabetes care devicesRESTRAINTS- High cost of devices and lack of reimbursement in developing countriesOPPORTUNITIES- Increasing diabetes-related health expenditureCHALLENGES- Pricing pressure

-

12.3 BLOOD GLUCOSE MONITORING SYSTEMSINCREASING INCIDENCE OF DIABETES TO PROPEL MARKET

-

12.4 INSULIN DELIVERY DEVICESRISING AWARENESS OF DIABETES AND IMPROVING HEALTHCARE FACILITIES IN DEVELOPING COUNTRIES TO DRIVE MARKET

-

12.5 DIABETES MANAGEMENT MOBILE APPLICATIONSGROWING ADOPTION OF BLOOD GLUCOSE TRACKING APPS TO SUPPORT MARKET GROWTH

- 13.1 INTRODUCTION

-

13.2 MARKET DYNAMICSDRIVERS- Growing prevalence of diseases and health conditions that affect wound healing capabilities- Technological advancements in wound care productsRESTRAINTS- Risks associated with use of advanced wound care productsOPPORTUNITIES- Growth potential of emerging countriesCHALLENGES- High cost of advanced wound care products

-

13.3 ADVANCED WOUND CARE DEVICESINCREASING INCIDENCE OF DIABETIC ULCERS TO PROPEL MARKET

-

13.4 SURGICAL WOUND CARE DEVICESGROWING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

-

13.5 TRADITIONAL WOUND CARE DEVICESRISING INCIDENCE OF CHRONIC DISEASES TO SUPPORT MARKET GROWTH

- 14.1 INTRODUCTION

-

14.2 MARKET DYNAMICSDRIVERS- Increasing number of ESRD patients- Growing prevalence of diabetes and hypertensionRESTRAINTS- Risks and complications of dialysisOPPORTUNITIES- Increasing number of dialysis centersCHALLENGES- Benefits of renal transplantation

-

14.3 HEMODIALYSIS PRODUCTSHEMODIALYSIS MACHINES- Presence of large ESRD patient population to drive marketHEMODIALYSIS CONSUMABLES/SUPPLIES- Increasing number of ESRD patients to support market growth

-

14.4 PERITONEAL DIALYSIS PRODUCTSPERITONEAL DIALYSIS CONCENTRATES/DIALYSATES- High demand for PD concentrates prompted players to focus on improving their manufacturing capabilitiesPERITONEAL DIALYSIS MACHINES- Rising prevalence of chronic diseases in emerging countries to boost adoption of home peritoneal dialysisPERITONEAL DIALYSIS CATHETERS- Favorable changes in reimbursement policies for PD catheters to support market growthPERITONEAL DIALYSIS TRANSFER SETS- Shift toward home dialysis to increase adoption of PD transfer setsOTHER PERITONEAL DIALYSIS PRODUCTS

- 15.1 INTRODUCTION

-

15.2 MARKET DYNAMICSDRIVERS- Rising prevalence of respiratory diseases- Increasing incidence of preterm birthsRESTRAINTS- Unfavorable reimbursement scenarioOPPORTUNITIES- High growth in developing countries across Asia Pacific and Latin AmericaCHALLENGES- Harmful effects of certain devices on neonates

-

15.3 ANESTHESIA DEVICESANESTHESIA MACHINES- Demand for technologically advanced machines to propel marketANESTHESIA DISPOSABLES- Increasing number of surgical procedures to support market growth

-

15.4 RESPIRATORY CARE DEVICESRESPIRATORY DEVICES- Humidifiers- Nebulizers- Oxygen concentrators- PAP devices- Reusable resuscitators- Ventilators- InhalersRESPIRATORY DISPOSABLES- Disposable oxygen masks- Resuscitators- Tracheostomy tubes- Oxygen cannulasRESPIRATORY MEASUREMENT DEVICES- Pulse oximetry systems- Capnographs- Spirometers- Peak flow meters

- 16.1 INTRODUCTION

-

16.2 NORTH AMERICAIMPACT OF RECESSION ON TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN NORTH AMERICAUS- High healthcare expenditure to favor market growthCANADA- Growing awareness about early disease diagnosis to drive market

-

16.3 EUROPEIMPACT OF RECESSION ON TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN EUROPEGERMANY- Higher healthcare spending to favor market growthFRANCE- Modernization of healthcare infrastructure to fuel market growthUK- Rising geriatric population to drive marketITALY- Improved reimbursement scenario to support market growthSPAIN- Developing healthcare facilities and infrastructure to support market growthREST OF EUROPE

-

16.4 ASIA PACIFICIMPACT OF RECESSION ON TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN ASIA PACIFICCHINA- Increasing patient pool to drive marketJAPAN- Rising geriatric population to propel market growthINDIA- High burden of target diseases and availability of affordable devices to support market growthREST OF ASIA PACIFIC

-

16.5 LATIN AMERICAIMPACT OF RECESSION ON TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN LATIN AMERICABRAZIL- Universal healthcare system to drive marketMEXICO- Modernization of healthcare infrastructure to support market growthREST OF LATIN AMERICA

-

16.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN MIDDLE EAST & AFRICA

- 17.1 INTRODUCTION

-

17.2 MARKET SHARE ANALYSISIN VITRO DIAGNOSTICS MARKETCARDIOLOGY DEVICES MARKETDIAGNOSTIC IMAGING DEVICES MARKETORTHOPEDIC DEVICES MARKETOPHTHALMOLOGY DEVICES MARKETENDOSCOPY DEVICES MARKETDIABETES CARE DEVICES MARKETWOUND CARE DEVICES MARKETKIDNEY/DIALYSIS DEVICES MARKETRESPIRATORY CARE AND ANESTHESIA DEVICES MARKET

-

17.3 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 17.4 R&D ASSESSMENT OF KEY PLAYERS

- 17.5 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

-

18.1 ABBOTT LABORATORIESBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.2 ROCHE DIAGNOSTICSBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.3 KONINKLIJKE PHILIPS N.V.BUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.4 SIEMENS HEALTHINEERSBUSINESS OVERVIEWPRODUCTS & SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.5 STRYKER CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.6 BOSTON SCIENTIFIC CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.7 JOHNSON & JOHNSONBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.8 MEDTRONIC PLCCOMPANY OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.9 SMITH & NEPHEW PLCBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

18.10 GE HEALTHCAREBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET

- TABLE 3 PROJECTED DISABILITY-ADJUSTED LIFE YEARS ACROSS VARIOUS REGIONS, BY CAUSE, 2015 VS. 2030 (MILLION YEARS)

- TABLE 4 GLOBAL CANCER INCIDENCE FOR GERIATRIC POPULATION (65 YEARS AND OVER), 2020 VS. 2040

- TABLE 5 IN VITRO DIAGNOSTICS MARKET: PRODUCT LAUNCHES (2020−2022)

- TABLE 6 APPLICATION OF CANCER BIOMARKERS IN CLINICAL PRACTICE

- TABLE 7 IVD MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 8 IVD MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 9 KEY IMMUNOASSAY/IMMUNOCHEMISTRY ANALYZERS AVAILABLE IN IVD MARKET

- TABLE 10 IMMUNOASSAY/IMMUNOCHEMISTRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 11 CLINICAL CHEMISTRY ANALYZERS FOR HIGH AND MID-VOLUME LABORATORIES

- TABLE 12 CLINICAL CHEMISTRY ANALYZERS FOR LOW-VOLUME LABORATORIES

- TABLE 13 CLINICAL CHEMISTRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 14 KEY AUTOMATED MOLECULAR DIAGNOSTIC PLATFORMS AVAILABLE IN IVD MARKET

- TABLE 15 MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 16 KEY HEMATOLOGY ANALYZERS AVAILABLE IN IVD MARKET

- TABLE 17 HEMATOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 KEY MICROBIOLOGY INSTRUMENTS AVAILABLE IN IVD MARKET

- TABLE 19 MICROBIOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 KEY COAGULATION ANALYZERS AVAILABLE IN IVD MARKET

- TABLE 21 KEY POINT-OF-CARE/SELF-MONITORING COAGULATION ANALYZERS AVAILABLE IN IVD MARKET

- TABLE 22 COAGULATION AND HEMOSTASIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 KEY URINALYSIS INSTRUMENTS AVAILABLE IN IVD MARKET

- TABLE 24 URINALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 KEY BLOOD GLUCOSE TESTING SYSTEMS AVAILABLE IN IVD MARKET

- TABLE 26 TISSUE PROCESSORS, EMBEDDERS, MICROTOMES, AND STAINERS AVAILABLE IN IVD MARKET

- TABLE 27 OTHER IVD TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 29 CARDIOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 CARDIOVASCULAR MONITORING DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 CARDIAC RHYTHM MANAGEMENT DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 INTERVENTIONAL CARDIOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 PROSTHETIC DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 ELECTROPHYSIOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 AGE-RELATED DISEASES AND ASSOCIATED DIAGNOSTIC MODALITIES

- TABLE 37 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTIC IMAGING SYSTEMS

- TABLE 38 DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 39 DIAGNOSTIC IMAGING DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 42 NUCLEAR IMAGING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 MAGNETIC RESONANCE IMAGING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 COMPUTED TOMOGRAPHY SCANNERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 45 MAMMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 46 ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 47 ORTHOPEDIC DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 ORTHOBIOLOGICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 49 JOINT RECONSTRUCTION DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 SPINAL SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 51 TRAUMA FIXATION DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 52 ARTHROSCOPIC DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 ORTHOPEDIC ACCESSORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 54 ORTHOPEDIC BRACES AND SUPPORTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 PREVALENCE OF EYE DISORDERS, BY TYPE, 2021 (IN MILLION)

- TABLE 56 NUMBER OF CATARACT SURGERIES, BY COUNTRY, 2020 VS. 2021

- TABLE 57 NUMBER OF GLAUCOMA PATIENTS, BY REGION AND TYPE, 2020 VS 2040 (IN MILLION)

- TABLE 58 NUMBER OF PEOPLE WITH DIABETES, BY REGION, 2030 VS. 2045 (MILLION)

- TABLE 59 NUMBER OF PEOPLE WITH AGE-RELATED MACULAR DEGENERATION, BY REGION, 2020 VS. 2050 (MILLION)

- TABLE 60 RECENT PRODUCT LAUNCHES IN OPHTHALMOLOGY DEVICES MARKET (2020–2021)

- TABLE 61 OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 62 OPHTHALMOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 63 OPHTHALMIC DIAGNOSTIC AND MONITORING DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 65 GLAUCOMA SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 66 CATARACT SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 67 VITREORETINAL SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 68 VISION CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 69 ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 70 ENDOSCOPY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 71 ENDOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 RIGID ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 74 FLEXIBLE ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 75 ROBOT-ASSISTED ENDOSCOPE PRODUCTS

- TABLE 76 ROBOT-ASSISTED ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 77 INDICATIVE LIST OF DISPOSABLE ENDOSCOPE MANUFACTURERS

- TABLE 78 DISPOSABLE ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 79 INDICATIVE LIST OF CAPSULE ENDOSCOPE MANUFACTURERS

- TABLE 80 CAPSULE ENDOSCOPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 81 VISUALIZATION EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 VISUALIZATION EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 83 WIRELESS DISPLAYS AND MONITORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 84 ENDOSCOPIC LIGHT SOURCES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 85 VIDEO CONVERTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 86 VIDEO RECORDERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 87 VIDEO PROCESSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 88 CAMERA HEADS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 89 TRANSMITTERS AND RECEIVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 90 CARTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 91 OTHER VISUALIZATION EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 92 ENDOSCOPY ACCESSORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 93 OTHER ENDOSCOPY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 94 OTHER ENDOSCOPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 95 ELECTRONIC ENDOSCOPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 96 MECHANICAL ENDOSCOPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 97 DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 98 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 99 BLOOD GLUCOSE MONITORING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 100 INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 101 DIABETES MANAGEMENT MOBILE APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 102 RISKS ASSOCIATED WITH ADVANCED WOUND CARE PRODUCTS

- TABLE 103 STRATEGIC DEVELOPMENTS IN ASIA PACIFIC REGION

- TABLE 104 AVERAGE COST OF TREATMENT FOR DIABETIC FOOT ULCERS

- TABLE 105 WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 WOUND CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 107 ADVANCED WOUND CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 108 SURGICAL WOUND CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 109 TRADITIONAL WOUND CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 110 NUMBER OF PEOPLE AGED 65 YEARS OR OVER, BY REGION, 2019 VS. 2050

- TABLE 111 KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 112 KIDNEY/DIALYSIS DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 113 HEMODIALYSIS PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 HEMODIALYSIS PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 115 HEMODIALYSIS MACHINES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 116 HEMODIALYSIS CONSUMABLES/SUPPLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 117 PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 118 PERITONEAL DIALYSIS PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 119 PERITONEAL DIALYSIS CONCENTRATES/DIALYSATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 120 PERITONEAL DIALYSIS MACHINES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 121 PERITONEAL DIALYSIS CATHETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 122 PERITONEAL DIALYSIS TRANSFER SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 123 OTHER PERITONEAL DIALYSIS PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 124 ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 125 ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 126 ANESTHESIA DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 127 ANESTHESIA DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 128 ANESTHESIA MACHINES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 129 ANESTHESIA DISPOSABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 130 RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 131 RESPIRATORY CARE DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 132 RESPIRATORY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 133 RESPIRATORY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 134 HUMIDIFIERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 135 NEBULIZERS AVAILABLE IN MARKET

- TABLE 136 NEBULIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 137 OXYGEN CONCENTRATORS AVAILABLE IN MARKET

- TABLE 138 OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 139 PAP DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 140 REUSABLE RESUSCITATORS OFFERED BY MAJOR PLAYERS

- TABLE 141 REUSABLE RESUSCITATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 142 VENTILATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 143 INHALERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 144 RESPIRATORY DISPOSABLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 145 RESPIRATORY DISPOSABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 146 DISPOSABLE OXYGEN MASKS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 147 RESUSCITATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 148 TRACHEOSTOMY TUBES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 149 OXYGEN CANNULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 150 RESPIRATORY MEASUREMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 151 RESPIRATORY MEASUREMENT DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 152 PULSE OXIMETER SYSTEMS OFFERED BY MAJOR PLAYERS

- TABLE 153 PULSE OXIMETER SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 154 CAPNOGRAPHS OFFERED BY MAJOR PLAYERS

- TABLE 155 CAPNOGRAPHS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 156 SPIROMETERS OFFERED BY MAJOR PLAYERS

- TABLE 157 SPIROMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 158 PEAK FLOW METERS OFFERED BY VARIOUS PLAYERS

- TABLE 159 PEAK FLOW METERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 160 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 161 NORTH AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 162 NORTH AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 163 NORTH AMERICA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 164 NORTH AMERICA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 165 NORTH AMERICA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 166 NORTH AMERICA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 167 NORTH AMERICA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 168 NORTH AMERICA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 169 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 170 NORTH AMERICA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 171 NORTH AMERICA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 172 NORTH AMERICA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 173 US: KEY MACROINDICATORS

- TABLE 174 US: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 175 US: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 176 US: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 177 US: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 178 US: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 179 US: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 180 US: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 181 US: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 182 US: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 183 US: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 184 US: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 185 CANADA: KEY MACROINDICATORS

- TABLE 186 CANADA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 187 CANADA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 188 CANADA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 189 CANADA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 190 CANADA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 191 CANADA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 192 CANADA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 193 CANADA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 194 CANADA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 195 CANADA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 196 CANADA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 197 EUROPE: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 198 EUROPE: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 199 EUROPE: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 200 EUROPE: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 201 EUROPE: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 202 EUROPE: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 203 EUROPE: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 204 EUROPE: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 205 EUROPE: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 206 EUROPE: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 207 EUROPE: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 208 EUROPE: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 209 GERMANY: KEY MACROINDICATORS

- TABLE 210 GERMANY: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 211 GERMANY: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 212 GERMANY: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 213 GERMANY: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 214 GERMANY: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 215 GERMANY: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 216 GERMANY: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 217 GERMANY: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 218 GERMANY: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 219 GERMANY: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 220 GERMANY: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 221 FRANCE: KEY MACROINDICATORS

- TABLE 222 FRANCE: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 223 FRANCE: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 224 FRANCE: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 225 FRANCE: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 226 FRANCE: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 227 FRANCE: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 228 FRANCE: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 229 FRANCE: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 230 FRANCE: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 231 FRANCE: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 232 FRANCE: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 233 UK: KEY MACROINDICATORS

- TABLE 234 UK: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 235 UK: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 236 UK: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 237 UK: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 238 UK: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 239 UK: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 240 UK: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 241 UK: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 242 UK: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 243 UK: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 244 UK: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 245 ITALY: KEY MACROINDICATORS

- TABLE 246 ITALY: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 247 ITALY: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 248 ITALY: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 249 ITALY: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 250 ITALY: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 251 ITALY: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 252 ITALY: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 253 ITALY: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 254 ITALY: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 255 ITALY: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 256 ITALY: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 257 SPAIN: KEY MACROINDICATORS

- TABLE 258 SPAIN: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 259 SPAIN: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 260 SPAIN: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 261 SPAIN: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 262 SPAIN: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 263 SPAIN: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 264 SPAIN: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 265 SPAIN: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 266 SPAIN: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 267 SPAIN: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 268 SPAIN: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 269 REST OF EUROPE: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 270 REST OF EUROPE: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 271 REST OF EUROPE: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 272 REST OF EUROPE: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 273 REST OF EUROPE: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 274 REST OF EUROPE: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 275 REST OF EUROPE: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 276 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 277 REST OF EUROPE: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 278 REST OF EUROPE: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 279 REST OF EUROPE: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 280 ASIA PACIFIC: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 281 ASIA PACIFIC: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 282 ASIA PACIFIC: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 283 ASIA PACIFIC: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 284 ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 285 ASIA PACIFIC: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 286 ASIA PACIFIC: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 287 ASIA PACIFIC: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 288 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 289 ASIA PACIFIC: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 290 ASIA PACIFIC: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 291 ASIA PACIFIC: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 292 CHINA: KEY MACROINDICATORS

- TABLE 293 CHINA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 294 CHINA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 295 CHINA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 296 CHINA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 297 CHINA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 298 CHINA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 299 CHINA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 300 CHINA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 301 CHINA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 302 CHINA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 303 CHINA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 304 JAPAN: KEY MACROINDICATORS

- TABLE 305 JAPAN: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 306 JAPAN: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 307 JAPAN: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 308 JAPAN: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 309 JAPAN: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 310 JAPAN: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 311 JAPAN: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 312 JAPAN: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 313 JAPAN: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 314 JAPAN: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 315 JAPAN: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 316 INDIA: KEY MACROINDICATORS

- TABLE 317 INDIA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 318 INDIA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 319 INDIA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 320 INDIA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 321 INDIA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 322 INDIA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 323 INDIA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 324 INDIA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 325 INDIA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 326 INDIA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 327 INDIA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 328 REST OF ASIA PACIFIC: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 329 REST OF ASIA PACIFIC: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 330 REST OF ASIA PACIFIC: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 331 REST OF ASIA PACIFIC: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 332 REST OF ASIA PACIFIC: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 333 REST OF ASIA PACIFIC: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 334 REST OF ASIA PACIFIC: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 335 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 336 REST OF ASIA PACIFIC: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 337 REST OF ASIA PACIFIC: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 338 REST OF ASIA PACIFIC: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 339 LATIN AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 340 LATIN AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 341 LATIN AMERICA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 342 LATIN AMERICA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 343 LATIN AMERICA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 344 LATIN AMERICA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 345 LATIN AMERICA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 346 LATIN AMERICA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 347 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 348 LATIN AMERICA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 349 LATIN AMERICA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 350 LATIN AMERICA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 351 BRAZIL: KEY MACROINDICATORS

- TABLE 352 BRAZIL: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 353 BRAZIL: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 354 BRAZIL: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 355 BRAZIL: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 356 BRAZIL: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 357 BRAZIL: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 358 BRAZIL: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 359 BRAZIL: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 360 BRAZIL: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 361 BRAZIL: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 362 BRAZIL: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 363 MEXICO: KEY MACROINDICATORS

- TABLE 364 MEXICO: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 365 MEXICO: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 366 MEXICO: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 367 MEXICO: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 368 MEXICO: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 369 MEXICO: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 370 MEXICO: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 371 MEXICO: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 372 MEXICO: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 373 MEXICO: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 374 MEXICO: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 375 REST OF LATIN AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 376 REST OF LATIN AMERICA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 377 REST OF LATIN AMERICA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 378 REST OF LATIN AMERICA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 379 REST OF LATIN AMERICA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 380 REST OF LATIN AMERICA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 381 REST OF LATIN AMERICA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 382 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 383 REST OF LATIN AMERICA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 384 REST OF LATIN AMERICA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 385 REST OF LATIN AMERICA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 386 MIDDLE EAST AND AFRICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 387 MIDDLE EAST AND AFRICA: IVD DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 388 MIDDLE EAST AND AFRICA: CARDIOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 389 MIDDLE EAST AND AFRICA: DIAGNOSTIC IMAGING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 390 MIDDLE EAST AND AFRICA: ORTHOPEDIC DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 391 MIDDLE EAST AND AFRICA: OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 392 MIDDLE EAST AND AFRICA: ENDOSCOPY DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 393 MIDDLE EAST AND AFRICA: DIABETES CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 394 MIDDLE EAST AND AFRICA: WOUND CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 395 MIDDLE EAST AND AFRICA: KIDNEY/DIALYSIS DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 396 MIDDLE EAST AND AFRICA: ANESTHESIA AND RESPIRATORY CARE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 397 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET: PRODUCT LAUNCHES (JANUARY 2020–APRIL 2023)

- TABLE 398 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET: DEALS (JANUARY 2020–APRIL 2023)

- TABLE 399 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET: OTHER DEVELOPMENTS (JANUARY 2020–APRIL 2023)

- TABLE 400 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 401 ROCHE DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 402 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 403 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- TABLE 404 STRYKER CORPORATION: BUSINESS OVERVIEW

- TABLE 405 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 406 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 407 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 408 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

- TABLE 409 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

- FIGURE 1 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

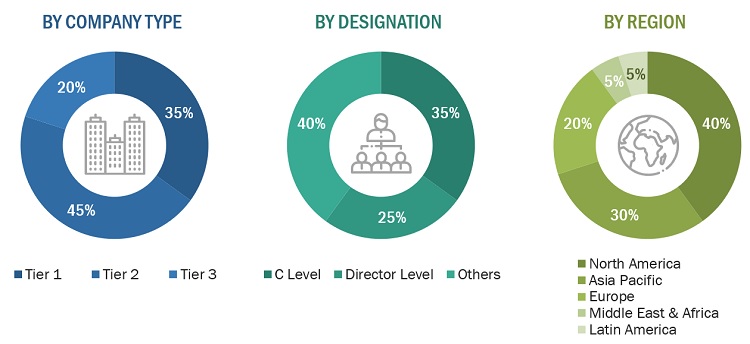

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET, BY TYPE, 2022–2027

- FIGURE 11 RESPIRATORY CARE AND ANESTHESIA DEVICES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 IN VITRO DIAGNOSTICS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 CARDIOLOGY DEVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 OPHTHALMOLOGY DEVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 ENDOSCOPY DEVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 GEOGRAPHIC SNAPSHOT OF TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET

- FIGURE 17 INCREASING INCIDENCE OF CHRONIC DISEASES TO DRIVE MARKET

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA WILL CONTINUE TO DOMINATE TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET IN 2027

- FIGURE 20 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 21 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 SHARE OF GERIATRIC POPULATION, BY REGION, 2015 VS. 2030

- FIGURE 23 IN VITRO DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 IVDR: KEY AREAS OF IMPACT

- FIGURE 25 CARDIOLOGY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 DIAGNOSTIC IMAGING DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 ORTHOPEDIC DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 OPHTHALMOLOGY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 ENDOSCOPY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 UK: NUMBER OF ANNUAL PLANNED ENDOSCOPY SESSIONS PER INDIVIDUAL

- FIGURE 31 DIABETES CARE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 32 WOUND CARE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 33 KIDNEY/DIALYSIS DEVICES MARKET: DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- FIGURE 34 RESPIRATORY CARE AND ANESTHESIA DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 35 TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 36 NORTH AMERICA: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET SNAPSHOT

- FIGURE 38 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 39 IN VITRO DIAGNOSTICS MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 40 CARDIOLOGY DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 41 DIAGNOSTIC IMAGING DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 42 ORTHOPEDIC DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 43 OPHTHALMOLOGY DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 44 ENDOSCOPY DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 45 DIABETES CARE DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 46 WOUND CARE DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 47 KIDNEY/DIALYSIS DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 48 RESPIRATORY CARE AND ANESTHESIA DEVICES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 49 R&D EXPENDITURE OF KEY PLAYERS IN TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET (2021 VS. 2022)

- FIGURE 50 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS IN TOP 10 MEDICAL DEVICE TECHNOLOGIES MARKET (2021)

- FIGURE 51 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 52 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT (2022)

- FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 54 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2022)

- FIGURE 55 STRYKER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 56 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 57 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2022)

- FIGURE 58 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- FIGURE 59 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2022)

- FIGURE 60 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

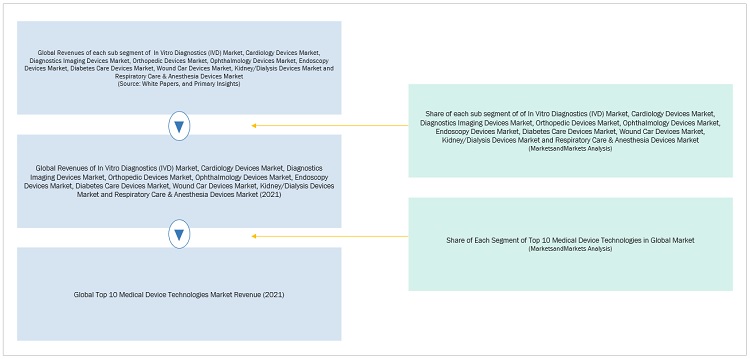

The study involved four major activities in estimating the current size of the Top 10 Medical Device Technologies market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Top 10 Medical Device Technologies and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Top 10 Medical Device Technologies market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Top 10 Medical Device Technologies market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Top 10 Medical Device Technologies manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, customer/end users who are using Top 10 Medical Device Technologies were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of Top 10 Medical Device Technologies and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Top 10 Medical Device Technologies market includes the following details.

The market sizing of the market was undertaken from the global side.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Top 10 Medical Device Technologies Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A medical device is any instrument, apparatus, implant, or in vitro reagent used for the prevention, diagnosis, treatment, and monitoring of illnesses or diseases. These products have applications in detecting, measuring, restoring, correcting, or modifying the structure or function of the body for health purposes.

Key Stakeholders

- Senior Management

- End Users

- Doctors/Surgeons

- Finance/Procurement Department

Report Objectives

- To define, describe, and forecast the Top 10 Medical Device Technologies Market on the basis of products.

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, challenges, and industry trends)

- To strategically analyze various segments and subsegments covered in the study with respect to individual growth trends, future prospects, and contributions to the overall market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically profile key players in this market and comprehensively analyze their market shares and core competencies2.

- To forecast the market size of the Top 10 Medical Device Technologies Market with respect to five main regions (along with countries), namely, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, agreements and partnerships, and expansions in the Top 10 Medical Device Technologies Market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Top 10 Medical Device Technologies market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Top 10 Medical Device Technologies Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Top 10 Medical Device Technologies Market

TahatAksi is also a manufacturer and supplier of medical equipment. Is the company profiled in your study?