Compression Therapy Market: Growth, Size, Share, and Trends

Compression Therapy Market by Technique (Static, Dynamic), Product (Bandage, Wraps, Stockings, Tapes, Braces, Pneumatic), Application (Varicose Vein, DVT, Lymphedema, Ulcers), Distribution Channel (Clinics, Pharmacy, E-Commerce) - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global compression therapy market is expected to see substantial growth, with projections indicating it will reach USD 5.9 billion by 2030 from USD 4.5 billion in 2025. The global Compression Therapy Market is witnessing robust growth, driven by the rising prevalence of venous disorders, lymphedema, deep vein thrombosis (DVT), and sports-related injuries. The market encompasses a wide range of products such as compression garments, bandages, stockings, and pneumatic compression devices designed to improve blood flow, reduce swelling, and prevent venous stasis. The increasing incidence of chronic venous insufficiency among aging populations, combined with the growing adoption of minimally invasive therapies and homecare solutions, is shaping the future of this market. Advancements in fabric technologies, patient-friendly wearables, and connected compression systems are enabling greater compliance and efficacy, positioning compression therapy as a critical component in preventive and therapeutic care across vascular, orthopedic, and post-surgical domains.

KEY TAKEAWAYS

-

By RegionThe US holds the largest share of the North American compression therapy market, largely due to its high healthcare spending, which supports the widespread use of compression products. Asia Pacific is expected to register the highest CAGR of 7.0%

-

By Product TypeBy product type, the compression bandages segment dominated the market with a share of 27.0% in 2024. The large share of this segment is primarily driven by the growing use of compression bandages in a wide range of indications, such as varicose veins, edema, DVT, and lymphedema, as well as in the management of several chronic conditions

-

By TechniqueBy technique, the dynamic compression therapy segment is estimated to grow at the highest CAGR of 5.7% during the forecast period. The increasing prevalence of diseases like lymphedema, DVT, and varicose veins, along with favorable clinical evidence supporting the use of IPC devices in various treatments, are the key factors driving the growth of the dynamic compression therapy market

-

By ApplicationBy Application, the varicose vein treatment segment accounted for the largest share of 26.9% of the compression therapy market. The rising prevalence of varicose veins, along with the strong preference among healthcare providers for compression therapy as the first-line treatment, are significant factors contributing to the substantial share of the varicose vein treatment segment.

-

By Distribution ChannelBy distribution channel, pharmacies & retailers segment accounted for a share of 20.0% of the compression therapy market. This significant share can be attributed to several factors, including the increasing number of orthopedic surgical procedures that necessitate post-operative care, the broad availability of compression therapy products at pharmacies and retailers, and the growing adoption of off-the-shelf products for sprains and ligament injuries.

The market is transitioning from conventional elastic bandages toward smart compression systems that incorporate sensor technology and digital feedback mechanisms. Pneumatic compression devices are seeing expanded applications beyond venous ulcers to include lymphedema and post-operative recovery. The integration of lightweight, breathable, and antimicrobial materials in garments has significantly enhanced patient comfort and adherence. Moreover, the increasing use of compression therapy in sports medicine and rehabilitation reflects the broadening application landscape. Vendors are also focusing on AI-enabled pressure monitoring and custom-fit garment designs using 3D scanning technologies, which are redefining the personalization of therapy.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers—ranging from hospitals to homecare providers—are navigating a disruptive landscape marked by the convergence of digital health monitoring, tele-rehabilitation platforms, and data-driven compliance tracking. Reimbursement reforms across major healthcare markets are influencing procurement models, while direct-to-consumer (D2C) distribution channels and e-commerce-led retail expansion are reshaping traditional supply chains. Additionally, the integration of compression therapy within comprehensive vascular care programs and post-orthopedic protocols is fostering a more holistic approach to patient management. Startups are driving disruption through wearable IoT-based compression sleeves that offer real-time data on pressure uniformity and limb circumference changes, improving clinical outcomes and patient engagement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Large target patient population

-

Growing incidence of sports injuries and accidents

Level

-

Lack of universally accepted standards for compression products

-

Low patient compliance with compression garments

Level

-

Growth potential offered by emerging markets

-

Growing patient awareness regarding benefits of compression therapy

Level

-

Significant adoption of alternative therapies for specific target indications

-

Increasing pricing pressure on market players

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing number of orthopedic procedures

In the last decade, the orthopedic industry has witnessed significant technological advancements that have enabled surgeons to carry out advanced orthopedic procedures, such as arthroscopic surgery (a minimally invasive surgery), total hip reconstruction procedures, minimally invasive disc surgery, and spinal fusion procedures for degenerative disorders. These advancements have played a major role in improving the quality of life for patients with painful and disabling conditions affecting the musculoskeletal system. Some other statistics related to orthopedic procedures include: Over 600,000 knee replacements are performed each year in the US (Source: Agency for Healthcare Research and Quality). By 2030, the total number of knee replacement surgeries in the US will grow by 673% to reach 3.5 million procedures per year (Source: American Academy of Orthopaedic Surgeons). Around 300,000 spinal fusion surgeries are performed annually in the US (Source: Imaging of the Post-operative Spine, an issue of Neuroimaging Clinics). The demand for various orthopedic procedures is expected to increase in the coming years, owing to the rising geriatric population. Since a majority of compression therapy products are used for the rehabilitation and faster recovery of patients after orthopedic surgeries, these trends are expected to support the growth of the compression therapy market during the forecast period.

Restraint: Lack of universally accepted standards for compression products

DThe lack of uniform international pressure standards for compression therapy garments can create confusion when selecting the appropriate garment for treating various medical conditions. Different countries have established their own standards, such as the German RAL, the French ASQUL, and British standards, each with varying pressure specifications. For example, according to the British, French, and German standards, Class I compression hosiery should apply pressures of 14–17 mmHg, 15 mmHg, and 18–21 mmHg, respectively. Additionally, the US FDA does not have established standards for compression garments. Currently, the pressure exerted by stockings is determined by manufacturers on the basis of their laboratory measurements due to the lack of uniform standards for graduated compression stockings worldwide. In addition, factors such as the elasticity and stiffness of stocking material and the size and shape of a patient’s legs can affect the overall pressure exerted by the garment. Considering the lack of uniform standards in the market, a wide range of products are offered at different price points with varying levels of medical efficacy. The varying efficacy of these products can potentially hamper customer trust in compression therapy, thereby restraining the growth of this market.

Opportunity: Growth potential offered by emerging markets

Emerging economies such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities for players operating in the compression therapy market during the forecast period. Factors such as the presence of a large patient population, rising healthcare expenditure, increasing disposable income levels, and growing awareness among physicians, surgeons, and patients about the latest treatment options available for various orthopedic and vascular disorders are expected to drive the demand for compression therapy products in these countries. Asia is home to a large and rapidly growing patient population for target diseases, such as diabetes and cancer. Moreover, the geriatric population in Asia is expected to increase significantly in the coming years, which will further increase the prevalence of target diseases in the region. For instance, between 2015 and 2040, the diabetic population in Southeast Asia is estimated to increase from 78.3 million to 140.2 million; this figure is expected to increase from 153.2 million to 241.8 million across Western Pacific countries during the same period (Source: IDF). Considering the potential growth opportunities in these regions, prominent and emerging product manufacturers in the orthopedic and medical device industries are increasingly focusing on expanding their business across emerging Asian and LATAM countries to increase their profitability and strengthen their presence in the global compression therapy market

Challenge: Significant adoption of alternative therapies for specific target indications

Several treatment options, including surgeries, ablation procedures, sclerotherapy, and ligation, are available for chronic venous diseases such as chronic venous insufficiency, varicose veins & spider veins, leg swelling and pain, and leg ulcers. Although compression therapy is considered the first-line treatment for these diseases, several alternative therapies offer benefits (over compression therapy) such as few or no complications, minimal pain during and after treatment, and reduced hospital stay. Also, unlike compression therapy, these alternative therapies cure the disease and not just the symptoms. For instance, varicose veins are mainly treated with ablation procedures, such as laser and radiofrequency ablation. These ablation procedures are performed with local anesthetics and typically require no sedation. Likewise, DVT is commonly treated with anticoagulants such as heparin and warfarin. Considering the potential benefits of these alternative therapies, their preference has increased among patients as well as healthcare providers over the years. This is considered a major challenge for the growth of the compression therapy market.

Compression Therapy Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of graduated compression stockings to manage chronic venous insufficiency (CVI) in elderly patients | Enhances venous circulation, alleviates leg swelling, improves mobility, and elevates overall quality of life. |

|

Implementation of compression therapy for lymphedema management in post-cancer care patients. | Decreased limb volume, prevention of infection, pain reduction, and improved lymph drainage |

|

Utilization of compression garments for the prevention of deep vein thrombosis (DVT) in post-operative patients | Reduced incidence of DVT, enhanced blood flow, shortened recovery time |

|

Application of multi-layer compression bandaging in the treatment of venous leg ulcers. Application of multi-layer compression bandaging in the treatment of venous leg ulcers. | Accelerated wound healing, reduced edema, and improved patient compliance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The compression therapy ecosystem includes raw material suppliers, OEMs, distributors, retail pharmacies, home healthcare providers, and end users. Leading players such as 3M Health Care, BSN Medical (Essity), SIGVARIS Group, medi GmbH, and Tactile Medical dominate through strong portfolios and advanced R&D capabilities. The ecosystem is witnessing increased cross-industry collaboration with textile innovators and digital health startups to develop intelligent fabrics and sensor-embedded devices. Hospital procurement chains, insurance networks, and telemedicine platforms are integral to shaping market access and user adoption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Compression Therapy Market, By Product

Compression garments (stockings, sleeves, and wraps) hold the largest market share due to their widespread clinical acceptance, cost-effectiveness, and ease of use. Continuous innovation in materials—such as microfibers, elastic weaves, and moisture-wicking fabrics—has enhanced comfort and compliance, sustaining their dominance. Pneumatic compression devices, however, are the fastest-growing segment, driven by increasing utilization in chronic lymphedema and post-surgical care where precise, programmable pressure gradients are critical.

Compression Therapy Market, By Distribution Channel

Hospitals & clinics are the primary distribution channels in the compression therapy market, especially for specialty products such as pneumatic compression devices and advanced therapeutic stockings. These medical facilities play a crucial role in treating conditions like chronic venous insufficiency, lymphedema, and post-surgical recovery. The prescriptions and recommendations made by physicians in clinical settings are vital for driving demand for compression therapy products. The growing clinical acceptance and well-established benefits of compression therapy contribute to its widespread use in these environments. Consequently, hospitals & clinics stand out as the leading distribution channels.

Compression Therapy Market, By Application

The varicose vein and deep vein thrombosis (DVT) segment dominates the application landscape, reflecting the high global burden of venous insufficiency and related complications. The lymphedema management segment follows closely, driven by increasing post-cancer surgery cases and broader reimbursement inclusion. Meanwhile, wound management and orthopedic rehabilitation represent emerging high-growth applications as clinicians increasingly integrate compression for edema control and faster healing.

Compression Therapy Market, By Technique

The static compression technique accounts for the largest share, primarily due to its affordability and wide usage in the management of chronic venous disorders and sports injuries. However, dynamic compression techniques—delivered via intermittent pneumatic compression (IPC) systems—are rapidly gaining traction owing to superior therapeutic outcomes, automation, and integration with remote monitoring systems that enable clinician oversight.

REGION

North America holds the largest share in global compression therapy market during forecast period

North America holds the largest market share owing to the high prevalence of chronic venous disorders, robust reimbursement framework, and the strong presence of leading manufacturers. The region’s advanced healthcare infrastructure and emphasis on patient comfort have accelerated the adoption of premium compression systems. Asia-Pacific (APAC), on the other hand, is the fastest-growing region, driven by rising awareness, increasing healthcare investments, and expanding access to preventive care in countries such as China, India, and Japan. Growing geriatric populations and lifestyle-related vascular diseases are key accelerators of demand across the region.

Compression Therapy Market: COMPANY EVALUATION MATRIX

The competitive landscape is characterized by a blend of multinational players and regional innovators focusing on ergonomic design and digital integration. 3M Health Care, Essity (BSN Medical), SIGVARIS Group, medi GmbH, Tactile Medical, DJO Global, and Cardinal Health lead through diversified portfolios, strategic mergers, and investments in smart compression systems. Emerging players are leveraging e-commerce channels and direct-to-consumer models to penetrate niche segments such as sports recovery and travel compression wear. Competition is intensifying as differentiation shifts from traditional product performance to digital compliance monitoring, patient comfort, and sustainability of materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.3 Billion |

| Market Forecast in 2030 (Value) | USD 5.9 Billion |

| Growth Rate | CAGR of 5.5 % from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Compression Therapy Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hospitals & Multispecialty Clinics |

|

|

| Home Healthcare Providers |

|

|

| Sports & Wellness Centers |

|

|

| Retail & E-commerce Platforms |

|

|

| Medical Device Manufacturers |

|

|

RECENT DEVELOPMENTS

- September 2024 : Solventum introduced a comprehensive, extended-wear wound dressing for V.A.C. Therapy. The New V.A.C. Peel and Place Dressing enhances accessibility and reduces pain in negative-pressure wound therapy.

- Friday, November 01, 2024 : Cardinal Health launched the Kendall SCD SmartFlow Compression System, the next generation of the Kendall Compression Series, which provides an improved experience for both clinicians and patients.

- January 2024 : Materion Beryllium & Composites (a subsidiary of Materion Corporation) partnered with Liquidmetal Technologies Inc. and other Certified Liquidmetal Partners to use their alloy production technologies to provide high-quality products and support services to their customers.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

The size of the compression therapy market was based on four primary studies to ensure accuracy. Initial data for the compression therapy market and related sectors was gathered from 3 to 5 secondary sources. This information was then validated through primary research to confirm the assumptions and overall market sizing. Both top-down and bottom-up approaches were employed to determine the total market size, which was subsequently refined into segment and subsegment sizes. Finally, data triangulation was conducted to verify the accuracy of the findings.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Business, annual reports, SEC filings, business filings, and investor presentations. These sources offered valuable insights into market leaders, sector divisions, and technological differences within various segments of the compression therapy industry.

Primary Research

Primary research consisted of both quantitative and qualitative insights gathered through interviews with key stakeholders. On the demand side, participants included physicians, researchers, department heads, and staff from diagnostic centers, hospitals, and research institutes. On the supply side, interviews were conducted with CEOs, area sales managers, territory and regional sales managers, and other top executives from relevant companies. These direct conversations helped validate the findings from secondary research and provided an opportunity to directly question and confirm assumptions.

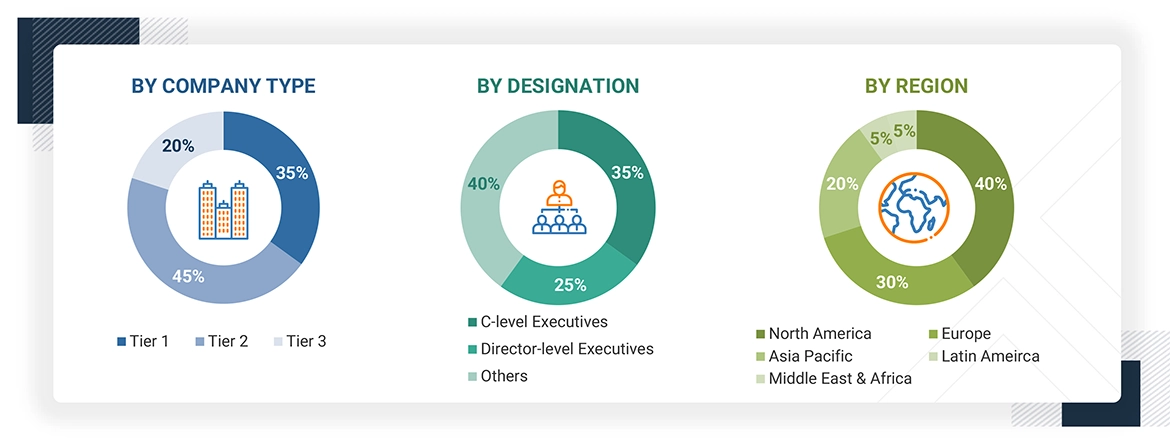

A breakdown of the primary respondents is provided below.

Note q: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report utilized the revenue share analysis of major companies to evaluate the size of the global compression therapy market. This analysis involved identifying key market participants and calculating their revenue from compression therapy using a variety of data collected during both primary and secondary research phases. One aspect of the secondary research included reviewing the annual and financial reports of leading market players. Conversely, primary research consisted of detailed interviews with influential thought leaders, including directors, CEOs, and key marketing executives.

To determine the overall market value, the segmental revenue was calculated by mapping the revenue of the leading solution and service providers. The process involved several steps.

- Making a list of leading international companies in the compression therapy industry

- Charting annual profits made by leading companies in the compression therapy sector (or the closest stated business unit/product category)

- 2024 revenue mapping of leading companies to cover a significant portion of the global market

- Calculating the global value of the compression therapy industry

Global Compression Therapy Market: Bottom-up and Top-down Approach

Data Triangulation

To ensure accurate data, the compression therapy market was divided into various segments and subsegments. A data triangulation process that used both top-down and bottom-up approaches was applied. This involved analyzing factors and trends from both the demand and supply sides to validate the findings for each segment. The combination of this segmentation with the triangulation process helps ensure that the market data is both accurate and reliable.

Market Definition

Compression therapy is the process of applying controlled pressure to the lower extremities to increase and improve blood flow to the heart. This mode of treatment utilizes the elastic properties of compression garments or the pneumatic force of compression devices to address specific clinical requirements as part of disease management. The compression therapy market is primarily used for managing venous disorders, lymphedema, wound care, post-surgical recovery, and sports injuries. It enhances blood circulation, reduces swelling, and promotes healing, commonly through compression garments, bandages, and devices like pneumatic pumps. Key settings include hospitals, clinics, and home care.

Stakeholders

- Manufacturers of compression garments, bandages, and devices

- Healthcare providers such as hospitals, clinics, and rehabilitation centers

- Patients using compression therapy for various conditions

- Healthcare professionals, including physicians, surgeons, and physiotherapists

- Insurance companies involved in reimbursement and coverage

- Regulatory bodies overseeing product standards and safety

- Suppliers and distributors of compression therapy products

- Research & development firms focusing on innovation and technology in compression therapy

Report Objectives

- To define, describe, and forecast the compression therapy market based on product, application, technique, distribution channel, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze competitive developments such as product launches, agreements, expansions, collaborations, and acquisitions in the compression therapy market

Frequently Asked Questions(FAQ)

What will be the addressable market value of the global compression therapy market within five years?

The global compression therapy market is projected to reach USD 5.9 billion by 2030 from USD 4.5 billion in 2025, at a CAGR of 5.5%.

Which product type segments have the highest potential for growth in the compression therapy market?

Compression bandages are expected to exhibit the highest growth rate.

Who are the top three players in the market, and what is the current market landscape?

The leading companies are DJO Global, Tactile Medical, and BSN Medical. The market is moderately consolidated, with the top players holding 50–55% of the market share.

What are the major strategies adopted by leading players to enter emerging regions?

Distribution agreements, partnerships, product launches, and product approvals are the key strategies adopted by major players.

What are the emerging trends in the global compression therapy market?

Trends include smart technology integration for real-time monitoring and personalized treatment, wearable compression garments for comfort, use of sustainable materials, customization through 3D printing, and expansion into sports and wellness applications.

What are the major factors likely to hamper the growth of the compression therapy market?

High costs, limited awareness, strict regulatory requirements, patient discomfort, lack of compliance, and the availability of alternative treatments may hinder market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Compression Therapy Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Compression Therapy Market

Fiona

May, 2022

Global Compression Therapy Market Size, Forecast 2026. Its data on Market Projection By Technology, Major key players, Growth, Revenue, CAGR, Regional Analysis, Industry Forecast.

Edward

Jun, 2022

Can you share more about how key players are able to retain their position in the global Compression Therapy Market?.