Organic Feed Market

Organic Feed Market by Ingredient Source (Cereals & Grains, Oilseed Meals & Pulses, Fibers & Forage, Additives), Form (Pellets, Crumbles, Mashes), Livestock, Nutrient Source, Farm Size, Manufacturing Technology, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

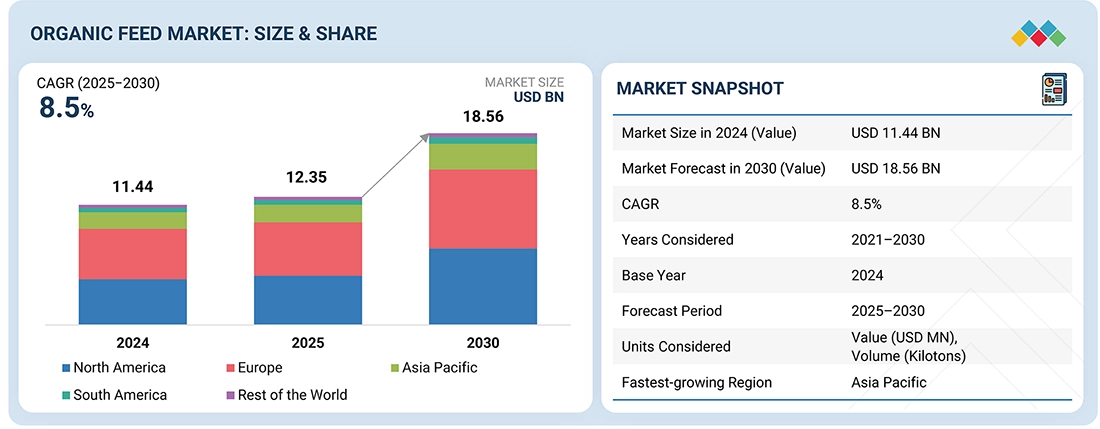

The organic feed market is projected to reach USD 18.56 billion by 2030 from USD 12.35 billion in 2025, at a CAGR of 8.5% from 2025 to 2030. The growth of the organic feed market is driven by the rising demand for high-quality dairy products, which has encouraged governments worldwide to support organic livestock grazing practices in their respective countries.

KEY TAKEAWAYS

-

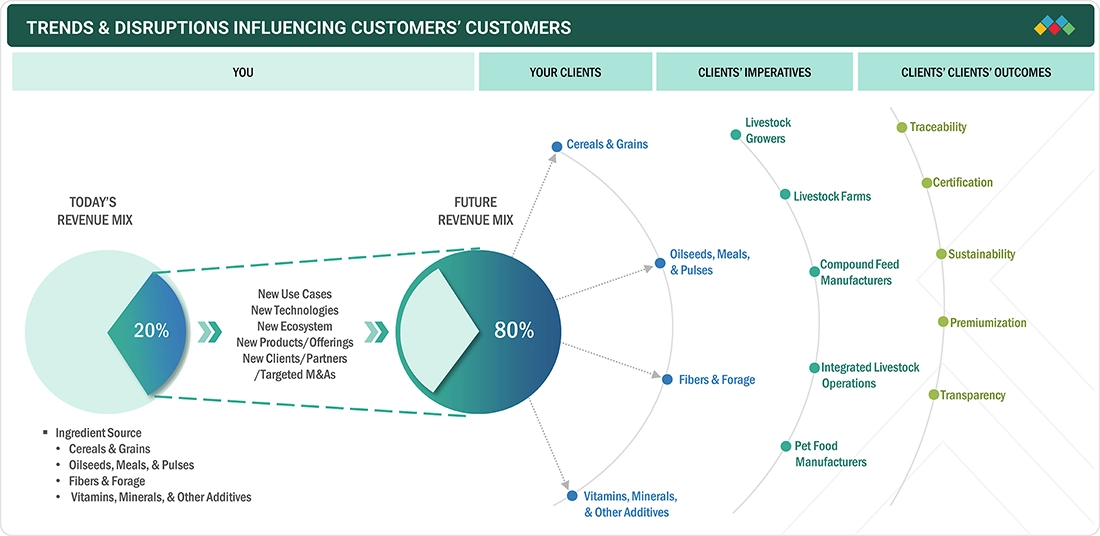

BY INGREDIENT SOURCEThe ingredient source segment includes cereals & grains, oilseeds, meals & pulses, fibers & forage, additives, and other ingredient sources. The cereals & grains segment is expected to hold a major share as they serve as the primary energy source in animal diets, supplying essential carbohydrates, starch, and moderate protein content for growth and maintenance.

-

BY FORMKey forms include pellets, crumbles, mashes, and other forms. Pellets are expected to gain significant market share as they contain a higher level of binders than the other forms of organic feed.

-

BY NUTRIENT SOURCEKey nutrient sources are energy, protein, fiber, minerals & vitamins, and performance additives. The use of energy and protein sources has grown significantly in the poultry and swine sectors, as it provide the essential fuel for maintenance, growth, and production, while protein sources supply the amino acids needed for tissue development, repair, and overall animal performance.

-

BY LIVESTOCKPoultry is widely consumed for its meat and eggs, making it a universal food source. As a result, the poultry industry has become the largest and quickest growing sector in animal production.

-

BY FARM SIZELarge-scale commercial farms hold a significant market share as they focus on cost-efficiency and consistency.

-

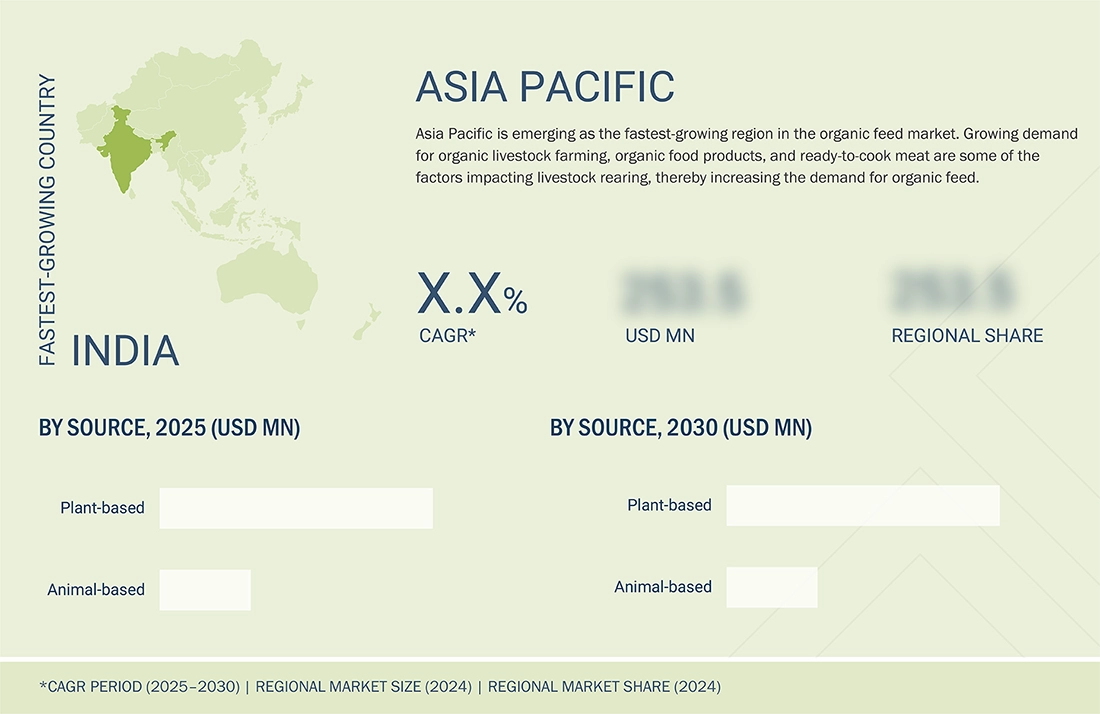

BY REGIONThe organic feed market covers North America, Europe, Asia Pacific, South America, and Rest of the World. The Asia Pacific region is projected to grow at a significant rate due to the increase in poultry livestock production, which has led to a rising demand for organic poultry meat and organic eggs.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including deals, new product launches, and expansions. For instance, Aller Aqua A/S (Denmark), ForFarmers Group (Netherlands), Bern Aqua NV (ADM) (Belgium), and others have entered into numerous agreements and partnerships to cater to the growing demand for organic feed across innovative applications.

The organic feed market is expected to grow at a faster rate due to the increasing demand for organic products, expanding organic livestock farming, and rising investments by major market players.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are new emerging ingredient sources of organic feed, and target end users are clients of organic feed manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users, thus affecting the revenue of hotbets and further the revenues of organic feed manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in organic livestock farming

-

Expansion of organic farmlands

Level

-

High cost of organic feed

-

Storage and shelf-life issues

Level

-

Sustainability and environmental concerns

-

Rising importance of livestock feeding practices in emerging economies

Level

-

Maintaining certification and compliance standards

-

Supply chain complexity and traceability requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in organic livestock farming

There is a current need to increase global livestock production, as global meat production and consumption continue to rise. Nevertheless, environmental concerns demanding sustainable approaches and the rising interest of consumers in safe meat products have enabled livestock producers to shift to organic farming. To respond to the growing demand for animal meat while maintaining sustainability, organic livestock farming is increasing rapidly, generating demand for organic feed. Additionally, consumers worldwide are increasingly demanding organic animal products due to the growing number of contamination cases involving meat, milk, and egg products.

Restraint: High cost of organic feed

The organic feed market faces significant financial barriers due to elevated production costs throughout the value chain. Organic ingredients command premium prices compared to their conventional counterparts, often costing 30-50% more due to lower yields, labor-intensive farming practices, and restricted use of synthetic inputs. Additionally, farmers and feed manufacturers must bear the burden of expensive certification processes, regular audits, and maintaining separate handling facilities to prevent contamination.

Opportunity: Sustainability and environmental concerns

The global imperative to address climate change and environmental degradation positions organic feed as a solution aligned with sustainability goals. Organic farming practices associated with organic feed production, including the prohibition of synthetic pesticides and fertilizers, emphasis on soil health, crop rotation, and biodiversity, contribute to reduced environmental impact.

Challenge: Maintaining certification and compliance standards

Organic feed producers must comply with complex and evolving regulatory frameworks across countries and certification bodies such as USDA Organic, EU Organic, or equivalent local standards. Each requires stringent documentation, traceability, and audit processes from ingredient sourcing to final production. Managing these certifications increases operational complexity, administrative overhead, and potential delays in product launches if standards are updated or differ across markets.

Organic Feed Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Expanded capacity to produce organic feed with the recent acquisition of a compound feed plant in West Germany by its subsidiary, Reudink | Increased supply and improved logistics for European organic farmers, promoting high-welfare, sustainable livestock production |

|

Maintains current certification for producing fish and shrimp feed suitable for organic aquaculture under EU Organic Farming regulations | Regulatory compliance and assurance of sustainable, low environmental impact feed for certified organic fish farms, ensuring premium market access |

|

Continuously produces and supplies EU-certified organic fish feeds for multiple species, covering the life cycle from hatch to harvest | Provides a complete, non-GMO, and traceable organic diet to support optimal growth and health in certified organic aquaculture operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The organic feed ecosystem is categorized into manufacturers, regulatory bodies, and animal husbandry companies. The organic feed market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. Established companies and agile startups are central to this market, and they develop organic feed products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

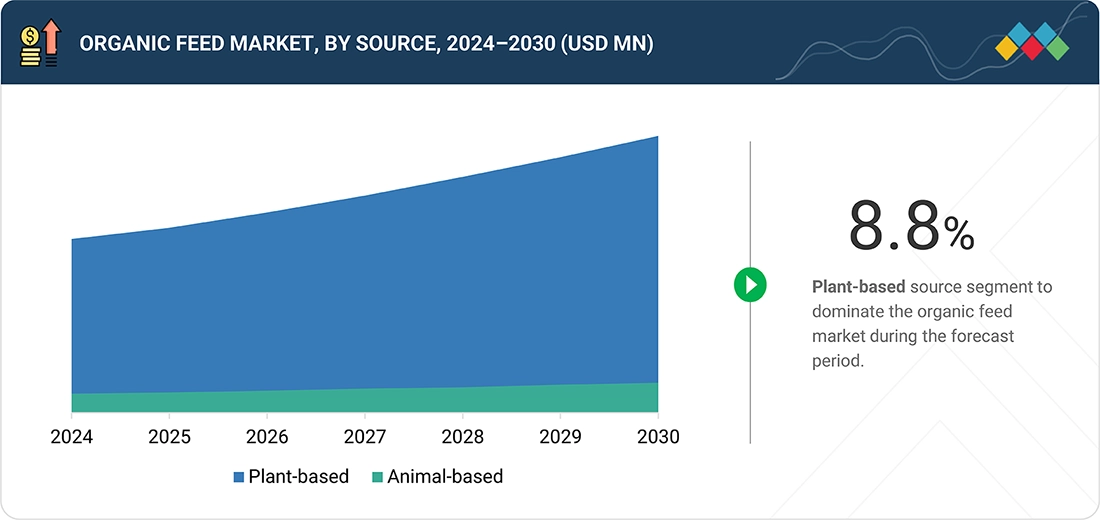

Organic Feed Market, By Ingredient Source

Cereals contain high energy and/or protein content, which is why they are widely used in organic feed. This drives the cereals segment in the organic feed market. Cereal grains are a concentrated source of energy, with most of that energy stored as starch. They also provide varying levels of oils, proteins, vitamins, minerals, and fibers. Due to the increasing importance of the market, key players invest substantial amounts in R&D activities to develop new and effective active ingredients for organic feed formulations.

Organic Feed Market, By Livestock

Poultry is widely consumed for its meat and eggs, making it a universal food source. As a result, the poultry industry has become the largest and quickest-growing sector in animal production. Developing economies, such as China and Brazil, are projected to have the highest poultry production rates due to increased living standards, cost benefits in production, organized structures, and strong export and domestic demand.

Organic Feed Market, By Form

Pellets can be easily automated for feeding systems, allowing for precise and consistent portion control. Additionally, pellets are durable and less prone to breakage during handling, transportation, and storage, which also reduces feed dust and improves air quality. As a result, pellets hold a significant market share.

REGION

Asia Pacific to be fastest-growing region in global organic feed market during the forecast period

The Asia Pacific organic feed market is expected to register the highest CAGR during the forecast period, driven by the rapid expansion of organic livestock and poultry farming, increasing consumer awareness of clean-label and chemical-free animal products, and supportive government initiatives promoting organic agriculture.

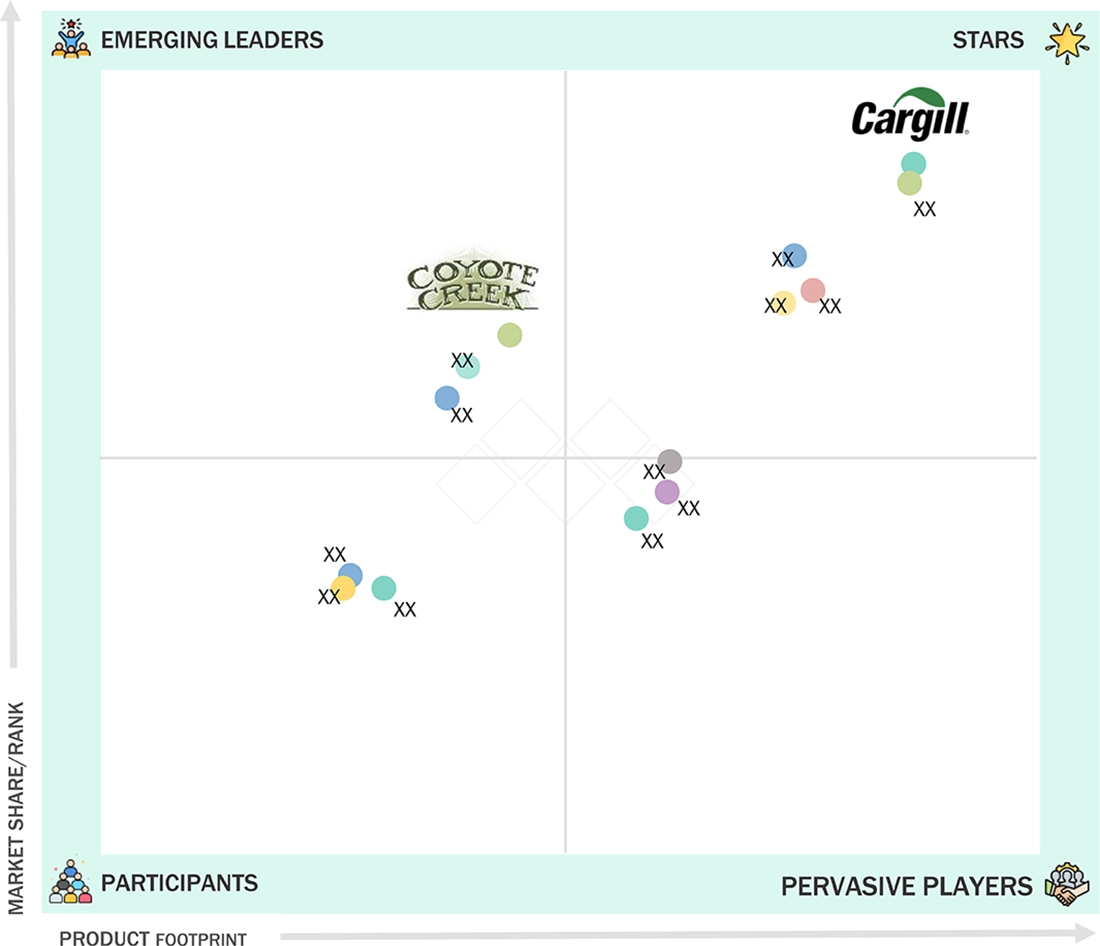

Organic Feed Market: COMPANY EVALUATION MATRIX

In the organic feed market matrix, Cargill, Incorporated and Purina Animal Nutrition LLC (Star) lead with a strong market share and extensive product footprint for poultry and other livestock, driven by its strong geographical presence, significant formulation and distribution capabilities, and strong ties with livestock growers and farmers. Coyote Creek Farm (Emerging Leader) is gaining visibility with its specialized organic feed offerings for poultry and ruminants, strengthening its position through strong product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.44 Billion |

| Market Forecast in 2030 (Value) | USD 18.56 Billion |

| Growth Rate | CAGR of 8.5% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kilotons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

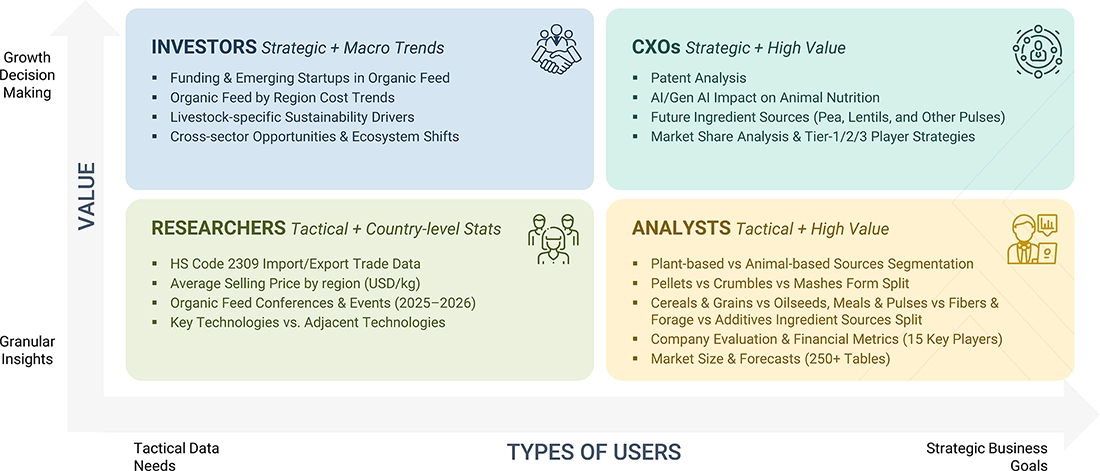

WHAT IS IN IT FOR YOU: Organic Feed Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based Organic Feed Manufacturers |

|

|

| Poultry Feed Segment Assessment |

|

|

RECENT DEVELOPMENTS

- January 2025 : Reudink, part of ForFarmers N.V., expanded its production of organic animal feed by purchasing a compound feed factory in Fürstenau (Lower Saxony, Germany), currently owned by A.Ricke Agrar GmbH & Co. KG. This will allow Reudink to better serve its customers in that region.

- September 2024 : Cargill, Incorporated acquired two feed mills from Compana Pet Brands, one in Denver, Colorado, and the other in Kansas City, Kansas. This enables the company to expand its production and distribution capabilities of its Animal Nutrition and Health business in the US.

- June 2024 : ForFarmers entered into an agreement to acquire Van Triest Veevoeders (Van Triest), which specializes in trading residual flows and co-products. This acquisition enables the company to further its mission for the Future of Farming and create a more sustainable future by producing dairy, meat, and eggs in a manner that keeps food both affordable and environmentally friendly.

Table of Contents

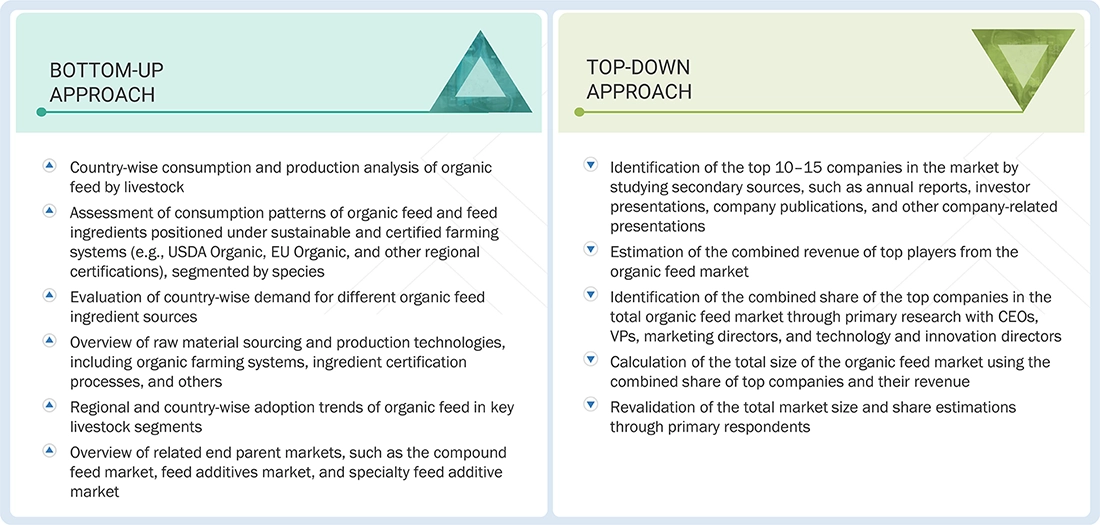

Methodology

This study employed two primary approaches to estimate the current size of the organic feed market. Exhaustive secondary research was done to collect information on the ingredient source, form, nutrient source, livestock, farm size, and manufacturing technology (qualitative) segments of the market. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study used extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, feed journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the organic feed market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to understand the various trends related to ingredient source, form, livestock, farm size (qualitatively), and region. Stakeholders from the demand side, including distributors, importers, exporters, and end-use sectors such as livestock growers, feed integrators, and livestock farms, were interviewed to understand the buyers’ perspective on suppliers, products, and the outlook for their business, which will impact the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, based on the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = revenue = USD 1 billion; Tier 3: Revenue

< USD 100 million. RoW includes Africa and the Middle East.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Cargill, Incorporated (US) |

Product Development Manager |

|

Unique Organics Ltd. (India) |

Sales Manager |

|

Purina Animal Nutrition LLC (US) |

Marketing Head |

|

Aller Aqua A/S (Denmark) |

Sales Head |

|

Country Heritage Feeds (Australia) |

Senior Sales Manager |

|

GPF Feed Supplements (India) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the organic feed market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Organic Feed Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall organic feed market and obtain precise statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

According to USDA, “Organic is a labeling term that indicates that the food or other agricultural product has been produced through approved methods. The organic standards describe the specific requirements that must be verified by a USDA-accredited certifying agent before products can be labeled USDA organic.”

Organic feed is the product of a farming system that prevents the use of man-made fertilizers, pesticides, growth regulators, chemicals, and feed additives. Irradiation and the use of genetically modified organisms (GMOs) or products produced from GMOs are generally prohibited based on the legislation introduced for organic crop cultivation.

Stakeholders

- Organic feed manufacturers

- Organic raw material providers

- Dairy farms, poultry farms, and other livestock farms

- Feed integrators, feed ingredients manufacturers, compound feed manufacturers

- Livestock growers

- Intermediate stakeholders, including distributors, retailers, associations, regulatory bodies, and others

- Regulatory bodies

- Government organizations, institutes, and research organizations

-

Associations and industry bodies:

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- International Organization for Standardization (ISO)

- International Federation of Organic Agriculture Movements (IFOAM)

- USDA – National Organic Program (NOP)

- Canadian Organic Standards (COS)

- Organic Farmers Association

- EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- International Feed Industry Federation (IFIF)

- Organisation for Economic Co-operation and Development (OECD)

- The compound Livestock Feed Manufacturers Association (CLFMA)

- The National Grain and Feed Association (NGFA)

Report Objectives

- To determine and project the size of the organic feed market based on ingredient source, form, nutrient source, livestock, farm size, manufacturing technology (qualitative), and region, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe organic feed market into key countries

- Further breakdown of the Rest of Asia Pacific organic feed market into key countries

- Further breakdown of the Rest of South America organic feed market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Organic Feed Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Organic Feed Market

Peter

Dec, 2020

Does the report cover regulations for export of organic feed products?.