Phytogenic Feed Additives Market by Type (Essential Oils, Flavonoids, Saponins, and Oleoresins), Livestock (Poultry, Swine, Ruminants, and Aquatic Animals), Source, Form, Function, Packaging and Region - Global Forecast to 2027

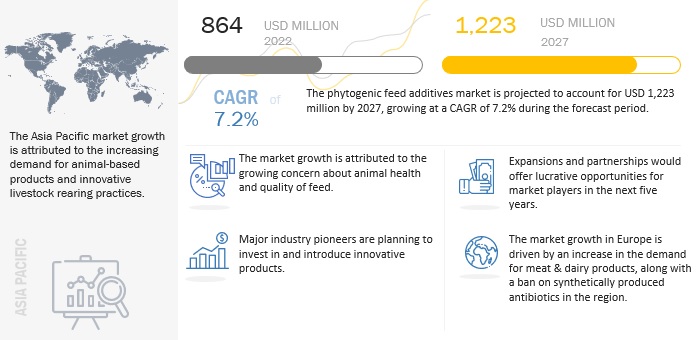

The global phytogenic feed additives market was valued at USD 864 million in 2022 and is projected to surpass USD 1,223 million by 2027, growing at a CAGR of 7.2% during the forecast period. These figures demonstrate the increasing demand for natural and sustainable feed additives in the animal feed industry, as well as the growing awareness of the benefits of using phytogenic additives in livestock nutrition. Phytogenic feed additives are natural growth promoters or non-antibiotic growth promoters that are derived from plant sources such as herbs & spices, fruits & vegetables or flowers and are used as feed additives to support livestock performance and health. They cater to a range of livestocks across feed industries and are also gaining significant traction in the industry with the usage of natural additives gaining increased customer acceptance all over the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Phytogenic Feed Additives Market Dynamics

Drivers: Rise in demand for natural additives after the ban on AGP to enhance livestock performance

Diseases in livestock lead to a loss of production & profit, disruption in the economy & international trade, and risk to human health. With changing lifestyles, improved health awareness, and food safety concerns increasing worldwide, demand for quality meat products has increased. Human health is threatened by livestock diseases in two forms—zoonotic and foodborne diseases. To reduce the outbreak of diseases and increase the overall health of the livestock, livestock farmers are opting for natural additives in animal feed, such as phytogenic feed additives. After the EU banned antibiotics in 2006, there was a surge in demand for natural growth promoters and additives that help in nutrient sparing, improved final product, and ease of use in animal feed. Most of the natural additives currently being used in feed, such as organic acids, prebiotics, and probiotics, help in the overall development of the livestock. Organic acids such as fumaric acid, propionic acid, lactic acid, and sorbic acid, reduce the colonization of pathogenic bacteria and toxic metabolites through acidification of diet. Prebiotics and probiotics primarily help in the growth of indigenous gastrointestinal bacteria with a different mode of action. These additives also increase animal feed intake, help with immunity development, and are sustainable and environmentally friendly.

Restraints: Elevated prices of end products resulting in low profit margins

In the animal nutrition industry, getting a combination of high profit and high margin is difficult. In the past two decades, high-margin products have been sold at a lesser volume. The profit margin for a livestock owner depends on the price of final products such as milk and beef on a cattle farm. The feed phytogenic additives are a very new and niche market. The demand for phytogenic feed additives increased drastically after the ban on antibiotics as growth promoters for sustainable livestock rearing. Since the market is new and still developing, awareness is low, leading to low demand. Usually, low demand products cost more as it impacts the production cycle. Slowly, once the demand is generated, it leads to an increase in production, thus impacting the prices of the end product. The price fluctuation is a short-term restraining factor in the phytogenic feed additives market, and it is expected to grow at a steady rate in the next 5–6 years.

Opportunities: Rise in demand for phytogenic feed additives in poultry, swine and pet feeds

Additives play a very important role in enhancing the feed quality for different livestock. Poultry and swine are types of meat whose demand is growing drastically in the market. These meats have their application in the processed meat and food industry. Further, it is also observed that poultry and swine are prone to animal diseases, due to which their consumption may fluctuate. On the other hand, the trend of keeping pets is also gaining pace. Pet owners remain very sensitive and concerned about the quality, safety, and source of the ingredients involved in manufacturing their pet’s food. Considering these trends, livestock farmers are opting for natural additives like phytogenic feed additives to enhance the nutritional value of the feed and overall livestock development. Even companies are developing innovative feed products from naturally sourced ingredients, such as plants and microbes. On the other hand, pet food contains phytogenic additives, which are safe and positively affect the overall health of the pet animal. The increase in the pet population, along with concerns of pet owners for pet health and nutrition, would persuade many feeds additive players to launch phytogenic feed additives in the pet food segment. Silvateam SPA (Italy) offers phytogenic feed additives for pet food.

Challenges: Prevalence of adulteration and side effects of essential oils

Adulterated essential oils are extremely hazardous. They may have numerous side effects and may cause permanent damage to the livestock. The high prices of essential oils are the main reason for the prevalence of such adulterated and synthetic products. The concern of adulteration in essential oils has become a major challenge for this market. Essential oils are highly concentrated and volatile compounds. Side effects of essential oils mainly occur when consumers are unaware of the proper procedure of application to be followed. Lack of transparency in patent protection laws and regulatory compliance in various countries has led to the duplication of products. Low-quality products are also introduced into the market by regional or local manufacturers to reap the benefits of the growing demand for phytogenic feed additives. Pets should not be introduced to essential oils, as it would lead to skin rashes and nausea. Essential oils are highly beneficial for holistic development only if administered wisely.

By type, oleoresins is projected to witness significant growth rate during the forecast period.

Based on type, oleoresins account for the second-fastest growing segment in the phytogenic feed additives market. The consumption of oleoresins as a phytogenic feed additive is increasing all over the globe, due to their desirable characteristics of being able to impart color, flavor and aroma to the livestock feed which enhances the palatability of the feed. The oleoresins are likely to witness significant growth over the forecasted period as their consumption and acceptance continues to rise over the forecasted period.

By livestock, swine segment accounts for the second-largest market share in the phytogenic feed additives market

Based on livestock, swine accounts for the second-largest segment in the phytogenic feed additives market. The consumption of swine meat or pork has increased significantly in recent years which has contributed to the growth and application of feed phytogenic products in swine. Phytogenic feed intakes are used in swine for a variety of reasons such as increasing their feed intake, improving their gut function and increasing their resistance to various diseases which have contributed significantly to their market growth in recent years.

By source, the fruits & vegetables segment account for significant market share in the phytogenic feed additives market

By source, the fruits & vegetables account for the second-largest segment in the phytogenic feed additives market. Fruit & vegetables waste are particularly used in phytogenic feed additives for sustainability and it also addresses the issues of waste recycling and waste reduction. Furthermore, fruits & vegetables such as berries, citrus fruits and onions are used as sources to extract essential oils, flavonoids and saponins and their oils are considered an excellent phytogenic additive which propels their demand and market growth in the industry.

By form, dry segment is projected to witness higher growth rate during the forecast period.

Based on form, dry phytogenic feed additives account for the fastest growing segment in the phytogenic feed additives market. The dry segment is considered easier to use and handle which contributes to their increasing consumer acceptance and usage in the industry. The powdered form of dry segment is also more economical and results in increased nutrient digestibility and reduced feed wastage owing to which they are likely to witness significant demand and growth over the forecasted period.

By function, antimicrobial properties segment accounts for the second-largest market share in the phytogenic feed additives market

Based on function, antimicrobial properties account for the second-largest segment in the phytogenic feed additives market. The phytogenic feed additives are largely used in feed products for their antiviral and antimicrobial properties. The phytogenic feed additives primarily control potential pathogens and modulate intestinal microbia. They possess significant antimicrobial and antifungal properties due to which they are considered a suitable alternative to antibiotic growth promoters. These desirable properties of phytogenic feed additives are likely to contribute to their market growth and demand over the forecasted period.

To know about the assumptions considered for the study, download the pdf brochure

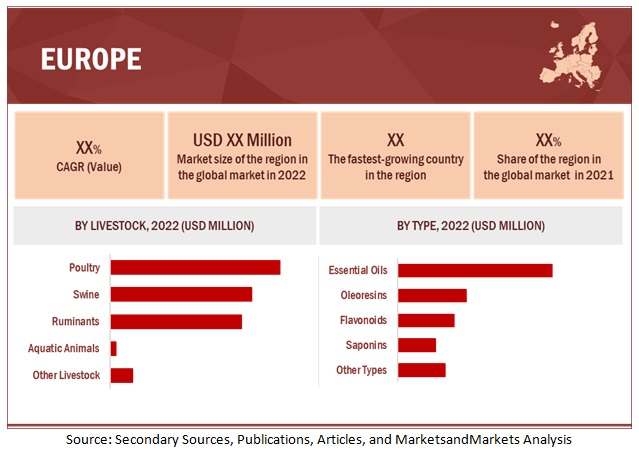

Europe accounted for the fastest growing region for the phytogenic feed additives market. The rise in awareness regarding health and wellness of livestock and ban on antibiotic growth promoters have propelled the market growth for phytogenic feed additives in the region. Furthermore, the European market is likely to witness significant growth due to several reasons such as an increase in livestock production such as cattle, poultry, and swine, easy availability of raw materials, and due to the presence of major feed manufacturing companies in the region which are likely to contribute towards the growth of phytogenic feed additives in the region over the forecasted period.

Key Market Players:

Key players in this market include Cargill (US), ADM (US), DuPont (US), DSM N.V. (Netherlands), Land O’ Lakes (US), Adisseo (France), Nutreco (Netherlands), Kemin Industries (US), Natural Remedies (India), and Nor Feed (France).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 864 million |

|

Revenue forecast in 2027 |

USD 1,223 million |

|

Growth rate |

CAGR of 7.2% |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Primary companies highlighted |

Cargill (US), ADM (US), DuPont (US), DSM N.V. (Netherlands), Land O’ Lakes (US), Adisseo (France), Nutreco (Netherlands), Kemin Industries (US), Natural Remedies (India), and Nor Feed (France). |

|

Major Drivers |

|

Target Audience:

- Feed additive manufacturers and traders

- Feed and feed ingredients manufacturers and feed integrators

- Essential oil manufacturers and distributors

- Chemical industries and biotechnology companies

- Traders & distributors

- Livestock farmer associations

- Agricultural research organizations

-

Associations. regulatory bodies, and other industry-related bodies:

- EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- Food and Agriculture Organization (FAO)

- International Feed Industry Federation (IFIF)

- European Food Safety Authority (EFSA)

- Association of Poultry Processors and Poultry Trade in the EU (AVEC)

- The Association of American Feed Control Officials (AAFCO)

- The US Environmental Protection Agency (US EPA)

Report Scope:

This research report categorizes the phytogenic feed additives market based on type, livestock, source, form, function, packaging (qualitative), and region

By Type

- Essential oils

- Flavonoids

- Saponins

- Oleoresins

- Other types (tannins, pungent substances, bitter substances, and mucilages)

By livestock

-

Poultry

- Broilers

- Layers

- Turkey

- Other poultry (ducks and game birds)

-

Swine

- Starters

- Sows

- Growers

-

Ruminants

- Dairy cattle

- Beef cattle

- Calves

- Other ruminants (sheep and goats)

-

Aquatic animals

- Carp

- Salmon

- Tilapia

- Other aquatic animals (miscellaneous fish species and diadromous fish)

- Other livestock (equine and companion animals)

By source

- Herbs & spices

- Fruits & vegetables

- Flowers

By form

- Liquid

- Dry

By function

- Performance enhancers

- Antimicrobial properties

- Palatability enhancers

- Other functions (anti-inflammatory properties and better feed conversion rate (FCR))

By packaging (Qualitative)

- Flexible

- Rigid

- Other packaging (poly bags, foil seals and chipboard packaging)

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

- Middle East

- Africa

Recent Developments

- In June 2022, after a successful partnership of five years, Cargill (US) announced that it acquired Delacon (Austria). The acquisition would bring deep feed additives expertise at a global level. Cargill’s animal health technology and Delacon’s phytogenic feed additives combined will result in increased animal productivity and sustainable production.

- In January 2021, Cargill (US) expanded its operation with a new facility in Ohio, US. The facility would focus on the production of different animal feed products, including feed premix and additives. The expansion would help Cargill produce more and better-quality livestock products and cater to the growing demand in the market.

- In October 2020, DSM N.V. (Netherlands) acquired Biomin Holding GMBH (Austria), further strengthening the former’s product portfolio, expertise, and nutrition solutions for farm productivity and sustainability. The acquisition strengthens DSM’s animal product portfolio and helps to expand its business segment with phytogenic feed additives products.

- In August 2020, DuPont (US) announced the opening of a new animal nutrition manufacturing facility in Wuxi, China. The new production plant would provide the local animal production industry with customized solutions.

Frequently Asked Questions (FAQ):

Which are the major phytogenic feed additives types considered in this study and which segments are projected to have promising growth rates in the future?

All the major phytogenic feed additives types such as essential oils, flavonoids, saponins, oleoresins and other types such as mucilage, tannins, bitter substances and pungent substances are considered in the scope of the study. Essential oils is currently accounting for a dominant share in the phytogenic feed additives market and is also projected to experience the highest growth rate in the next five years, due to its positive perception of being a natural ingredient and also because it offers various desirable charactertistics such as improving feed intake, maintenance of gut health and supporting healthy digestion which contributes to their demand and market growth.

I am interested in the Asia Pacific market for essential oils and oleoresins segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects including market size, forecast, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- Australia

- New Zealand

- South Korea

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the phytogenic feed additives market?

Global phytogenic feed additives market is characterized by the following drivers

Drivers: Increase in demand for animal meat and dairy products in developing countries

The major driving factor for the rising demand for phytogenic feed additives is the growing requirement for animal-based products such as dairy, eggs, and processed meat. Most key phytogenic feed additives markets have diversified businesses; they focus on new feed resources, improve the feed knowledge base, invest in quality & safety management systems, and stimulate innovation in more resource-efficient feeding systems, driving the European phytogenic feed additives market. Countries such as the US, Mexico, Canada, Brazil, China, Japan, the UK, France, and Germany are the main consumers of processed meat and pork. It is estimated by World Watch Institute (US) that the demand for livestock products will nearly double in the Sub-Saharan African and South Asian regions, from 200 kcal per person per day in 2000 to about 400 kcal by 2050. To meet this demand, manufacturing facilities are being developed for animal feed in emerging economies, such as India, Brazil, Argentina, and China.

Further, according to the Organisation for Economic Co-operation and Development (OECD), global meat production volume is projected to be 13% higher in 2026. According to the National Pork Producers Council (NPPC), the US, over the past ten years, on average, has been the leading exporter of pork across the globe, and it exports pork products to more than 100 countries. Mexico is estimated to have the largest volume and second-largest value market for the US pork exports industry.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are Cargill (US), ADM (US), DuPont (US), DSM N.V. (Netherlands), Land O’ Lakes (US), Adisseo (France), Nutreco (Netherlands), Kemin Industries (US), Natural Remedies (India), and Nor Feed (France). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 PHYTOGENIC FEED ADDITIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON TYPE, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 2 PHYTOGENIC FEED ADDITIVES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 4 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 5 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

FIGURE 6 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 8 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022 VS. 2027 (USD MILLION)

FIGURE 9 PHYTOGENIC FEED ADDITIVES MARKET (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BRIEF OVERVIEW OF PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 10 RISE IN CONCERNS REGARDING FEED QUALITY AND LIVESTOCK PRODUCTIVITY TO SUPPORT MARKET GROWTH

4.2 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE & COUNTRY

FIGURE 11 CHINA AND ESSENTIAL OILS TO ACCOUNT FOR LARGEST RESPECTIVE SHARES IN EUROPE IN 2022

4.3 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE

FIGURE 12 ESSENTIAL OILS TO DOMINATE DURING FORECAST PERIOD

4.4 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION

FIGURE 13 PERFORMANCE ENHANCERS TO BE LARGEST FUNCTION DURING FORECAST PERIOD

4.5 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE & REGION

FIGURE 14 ASIA PACIFIC AND HERBS & SPICES SEGMENT TO DOMINATE DURING FORECAST PERIOD

4.6 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM

FIGURE 15 DRY PHYTOGENIC FEED ADDITIVES TO BE LARGER DURING FORECAST PERIOD

4.7 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK

FIGURE 16 POULTRY FEED TO DOMINATE AMONG LIVESTOCK DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC FACTORS

FIGURE 17 FEED PRODUCTION, 2021 (MILLION TONNES)

5.2 MARKET DYNAMICS

FIGURE 18 PHYTOGENIC FEED ADDITIVES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for meat and dairy products in developing countries

FIGURE 19 MEAT CONSUMPTION IN DEVELOPING COUNTRIES, 2015 VS. 2030 (KG PER CAPITA, CARCASS WEIGHT EQUIVALENT)

5.2.1.2 Rise in demand for natural additives after banning AGP to enhance livestock performance

5.2.1.3 Encapsulated technology offers enhanced efficiency

5.2.2 RESTRAINTS

5.2.2.1 Elevated price of end products resulting in low-profit margins

5.2.2.2 Higher cost of active ingredients and raw materials used in phytogenic feed additives

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for additives in poultry and swine feed and pet food

5.2.3.2 Higher application of natural products in livestock diet

5.2.4 CHALLENGES

5.2.4.1 Prevalence of adulteration and side effects of essential oils

5.2.4.2 Lack of awareness about phytogenic feed additives in developing nations

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 20 VALUE CHAIN ANALYSIS OF THE PHYTOGENIC FEED ADDITIVES MARKET

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 PHYTOGENIC FEED ADDITIVES MARKET: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.5 PRICE ANALYSIS: PHYTOGENIC FEED ADDITIVES MARKET

6.5.1 AVERAGE SELLING PRICES, BY TYPE

FIGURE 22 GLOBAL AVERAGE SELLING PRICES, BY TYPE

TABLE 3 ESSENTIAL OILS AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

TABLE 4 OLEORESINS AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

TABLE 5 FLAVONOIDS AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

6.6 MARKET MAPPING AND ECOSYSTEM

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

FIGURE 23 PHYTOGENIC FEED ADDITIVES MARKET MAP

FIGURE 24 PHYTOGENIC FEED ADDITIVES ECOSYSTEM MAP

TABLE 6 PHYTOGENIC FEED ADDITIVES MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 25 REVENUE SHIFT IN PHYTOGENIC FEED ADDITIVES MARKET

6.8 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 27 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 28 TOP 9 APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 7 PATENTS PERTAINING TO FEED ADDITIVES, 2020–2022

6.9 TRADE DATA

6.9.1 PHYTOGENIC FEED ADDITIVES

TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF FEED ADDITIVES, 2021 (KG)

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF ESSENTIAL OILS, 2021 (KG)

6.10 CASE STUDIES

6.10.1 DELACON: PHYTOGENIC FEED ADDITIVES FOR AQUACULTURE

6.10.2 KEMIN INDUSTRIES: PHYT0GENIC FEED ADDITIVES FOR POULTRY

6.11 KEY CONFERENCES & EVENTS

TABLE 10 KEY CONFERENCES & EVENTS RELATED TO PHYTOGENIC FEED ADDITIVES MARKET, 2022–2023

6.12 TARIFF & REGULATORY LANDSCAPE

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.1 NORTH AMERICA

6.12.1.1 US

6.12.1.2 Association of American Feed Control Officials (AAFCO)

6.12.1.3 The Canadian Food Inspection Agency (CFIA)

6.12.2 EUROPEAN UNION

6.12.3 ASIA PACIFIC

6.12.3.1 China

6.12.3.2 Japan

6.12.4 SOUTH AMERICA

6.12.4.1 Brazil

6.12.4.2 Chile

6.12.4.3 Argentina

6.12.5 SOUTH AFRICA

6.12.6 THE INTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 PHYTOGENIC FEED ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT FROM SUBSTITUTES

6.13.5 THREAT FROM NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TYPES

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TYPES

6.14.2 BUYING CRITERIA

TABLE 18 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS, BY TYPE

FIGURE 30 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS, BY TYPE

7 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 31 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 19 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 20 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 21 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 22 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

7.2 ESSENTIAL OILS

7.2.1 INCREASE IN USE OF ESSENTIAL OILS IN FEED TO FUEL ITS DEMAND

TABLE 23 FEED ESSENTIAL OILS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 FEED ESSENTIAL OILS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 FEED ESSENTIAL OILS MARKET, BY REGION, 2018–2021 (TON)

TABLE 26 FEED ESSENTIAL OILS MARKET, BY REGION, 2022–2027 (TON)

7.3 FLAVONOIDS

7.3.1 BENEFITS OF FLAVONOIDS IN POULTRY AND RUMINANT FEED TO PROPEL ITS NEED IN MARKET

TABLE 27 FEED FLAVONOIDS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 FEED FLAVONOIDS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 FEED FLAVONOIDS MARKET, BY REGION, 2018–2021 (TON)

TABLE 30 FEED FLAVONOIDS MARKET, BY REGION, 2022–2027 (TON)

7.4 SAPONINS

7.4.1 SAPONINS CONTAINING FEED HELP IMPROVE FEED CONVERSION RATIO IN RUMINANTS

TABLE 31 FEED SAPONINS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 FEED SAPONINS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 FEED SAPONINS MARKET, BY REGION, 2018–2021 (TON)

TABLE 34 FEED SAPONINS MARKET, BY REGION, 2022–2027 (TON)

7.5 OLEORESINS

7.5.1 RISE IN USE OF OLEORESIN IN LIVESTOCK FEED DUE TO ITS AROMATIC AND FLAVOR-IMPARTING PROPERTIES

TABLE 35 FEED OLEORESINS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 FEED OLEORESINS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 FEED OLEORESINS MARKET, BY REGION, 2018–2021 (TON)

TABLE 38 FEED OLEORESINS MARKET, BY REGION, 2022–2027 (TON)

7.6 OTHER TYPES

TABLE 39 OTHER PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 OTHER PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 OTHER PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (TON)

TABLE 42 OTHER PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (TON)

8 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK (Page No. - 100)

8.1 INTRODUCTION

FIGURE 32 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022 VS. 2027 (USD MILLION)

TABLE 43 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 44 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

8.2 POULTRY

8.2.1 NEED FOR QUALITY CHICKEN AND EGGS TO DRIVE DEMAND FOR POULTRY

TABLE 45 PHYTOGENIC POULTRY FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 PHYTOGENIC POULTRY FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.1.1 Broilers

8.2.1.2 Layers

8.2.1.3 Turkey

8.2.1.4 Other poultry

TABLE 47 PHYTOGENIC POULTRY FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 48 PHYTOGENIC POULTRY FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

8.3 SWINE

8.3.1 INCREASED DEMAND FOR PORK MEAT TO DRIVE MARKET

TABLE 49 PHYTOGENIC SWINE FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 PHYTOGENIC SWINE FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3.1.1 Starters

8.3.1.2 Sows

8.3.1.3 Growers

TABLE 51 PHYTOGENIC SWINE FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 52 PHYTOGENIC SWINE FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

8.4 RUMINANTS

8.4.1 GROWTH IN APPLICATION OF DAIRY PRODUCTS IN COMMERCIAL USE TO PROPEL ITS DEMAND

TABLE 53 PHYTOGENIC RUMINANTS FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 PHYTOGENIC RUMINANT FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4.1.1 Dairy cattle

8.4.1.2 Beef cattle

8.4.1.3 Calves

8.4.1.4 Other ruminants

TABLE 55 PHYTOGENIC RUMINANTS FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 56 PHYTOGENIC RUMINANTS FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

8.5 AQUATIC ANIMALS

8.5.1 HIGH DEMAND FOR FISH IN FOOD TO DRIVE NEED FOR PHYTOGENICS IN AQUAFEED

TABLE 57 PHYTOGENIC AQUAFEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 PHYTOGENIC AQUAFEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5.1.1 Carp

8.5.1.2 Salmon

8.5.1.3 Tilapia

8.5.1.4 Other aquatic animals

TABLE 59 PHYTOGENIC AQUAFEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 60 PHYTOGENIC AQUAFEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

8.6 OTHER LIVESTOCK

TABLE 61 PHYTOGENIC OTHER LIVESTOCK FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 PHYTOGENIC OTHER LIVESTOCK FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE (Page No. - 112)

9.1 INTRODUCTION

FIGURE 33 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 63 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 64 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

9.2 HERBS & SPICES

9.2.1 INCREASE IN DEMAND FOR MEDICINAL PROPERTIES AND FLAVORS OF HERBS & SPICES TO FUEL MARKET

TABLE 65 MAJOR HERBS & SPICES USED IN PHYTOGENIC FEED ADDITIVES

TABLE 66 HERB- & SPICE-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 HERB- & SPICE-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 FRUITS & VEGETABLES

9.3.1 FRUITS & VEGETABLE WASTE PARTICULARLY USED IN PHYTOGENIC FEED ADDITIVES FOR SUSTAINABILITY

TABLE 68 FRUIT- & VEGETABLE-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 FRUIT- & VEGETABLE-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 FLOWERS

9.4.1 ENHANCED CHARACTERISTICS OF FLOWERS INCREASE THEIR DEMAND AS SOURCE OF FEED PHYTOGENICS

TABLE 70 FLOWER-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 FLOWER-SOURCED PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM (Page No. - 118)

10.1 INTRODUCTION

FIGURE 34 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 72 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 73 PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

10.2 LIQUID

10.2.1 BENEFITS OF APPLICATION OF LIQUID FORM TO PROPEL ITS DEMAND

TABLE 74 LIQUID PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 LIQUID PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 DRY

10.3.1 EASE OF USAGE AND HANDLING OF THIS FORM MAKES IT PREFERABLE

TABLE 76 DRY PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 DRY PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

11 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION (Page No. - 123)

11.1 INTRODUCTION

FIGURE 35 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

TABLE 78 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 79 PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

11.2 PERFORMANCE ENHANCERS

11.2.1 ADDITION OF PHYTOGENIC FEED ADDITIVES HELPS DEVELOP CARCASS MEAT FOR COMMERCIAL UTILIZATION

TABLE 80 PERFORMANCE ENHANCERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 PERFORMANCE ENHANCERS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 ANTIMICROBIAL PROPERTIES

11.3.1 ANTIMICROBIAL PROPERTIES OF PHYTOGENIC FEED ADDITIVES PROTECT LIVESTOCK FROM DISEASES

TABLE 82 ANTIMICROBIAL PROPERTIES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 ANTIMICROBIAL PROPERTIES MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 PALATABILITY ENHANCERS

11.4.1 BLENDS OF FLAVORS AND AROMAS TO INCREASE THE ADOPTION OF PALATABILITY ENHANCERS

TABLE 84 PALATABILITY ENHANCERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 PALATABILITY ENHANCERS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 OTHER FUNCTIONS

TABLE 86 OTHER FUNCTIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 OTHER FUNCTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

12 PHYTOGENIC FEED ADDITIVES MARKET, BY PACKAGING (Page No. - 130)

12.1 INTRODUCTION

12.2 FLEXIBLE

12.2.1 BENEFITS OF FLEXIBLE PACKAGING TO PROPEL ITS DEMAND

12.3 RIGID

12.3.1 TRADITIONAL PACKAGING METHOD TO PROVIDE STRUCTURE AND SUPPORT

12.4 OTHER PACKAGING

13 PHYTOGENIC FEED ADDITIVES MARKET, BY REGION (Page No. - 132)

13.1 INTRODUCTION

FIGURE 36 GEOGRAPHIC SNAPSHOT (2022–2027): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOT SPOTS

TABLE 88 PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (TON)

TABLE 91 PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (TON)

13.2 NORTH AMERICA

TABLE 92 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 99 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

TABLE 100 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Rise in awareness of precision nutrition in livestock feeding to impact demand for phytogenic additives in US

TABLE 106 US: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 107 US: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Favorable regulatory environment framework to propel market in Canada

TABLE 108 CANADA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 109 CANADA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Growth in livestock rearing and exports increases demand in Mexico

TABLE 110 MEXICO: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 111 MEXICO: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 37 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET SNAPSHOT

TABLE 112 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 115 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 117 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 119 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

TABLE 120 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 121 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 123 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 125 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

13.3.1 SPAIN

13.3.1.1 Increased requirement for good-quality meat products to impact market in Spain

TABLE 126 SPAIN: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 127 SPAIN: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.2 RUSSIA

13.3.2.1 Rise in feed exports increases demand for these additives in Russia

TABLE 128 RUSSIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 129 RUSSIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.3 GERMANY

13.3.3.1 Implementation of advanced methods in livestock industry to propel demand in Germany

TABLE 130 GERMANY: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 131 GERMANY: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 Rise in concerns about animal health to drive market in France

TABLE 132 FRANCE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 133 FRANCE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Growing livestock market within country to propel demand

TABLE 134 ITALY: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 135 ITALY: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.6 UK

13.3.6.1 Growth in regulatory concerns regarding animal health to increase demand in UK

TABLE 136 UK: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 137 UK: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 138 REST OF EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 139 REST OF EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET SNAPSHOT

TABLE 140 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 147 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

TABLE 148 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Livestock farmers opt for phytogenic feed additives to reduce risk of disease outbreaks

TABLE 154 CHINA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 155 CHINA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.2 INDIA

13.4.2.1 Great opportunities for feed manufacturers to impact need for phytogenic additives in India

TABLE 156 INDIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 157 INDIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Demand set to increase due to the rising imports and consumption within country

TABLE 158 JAPAN: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 159 JAPAN: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.4 THAILAND

13.4.4.1 Thriving poultry industry and increasing exports to propel market

TABLE 160 THAILAND: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 161 THAILAND: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.5 INDONESIA

13.4.5.1 Increase in feed production to generate demand in Indonesia

TABLE 162 INDONESIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 163 INDONESIA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.6 VIETNAM

13.4.6.1 Growth in imports and consumption of meat products to drive demand in Vietnam

TABLE 164 VIETNAM: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 165 VIETNAM: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 166 REST OF ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.5 SOUTH AMERICA

TABLE 168 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 169 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 170 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 171 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 172 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 173 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 174 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 175 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

TABLE 176 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 177 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 178 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 179 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 180 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 181 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Higher meat exports to Europe to increase demand in Brazil

TABLE 182 BRAZIL: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 183 BRAZIL: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.5.2 ARGENTINA

13.5.2.1 Increase in application in poultry feed to propel growth in Argentina

TABLE 184 ARGENTINA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 185 ARGENTINA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.5.3 REST OF SOUTH AMERICA

TABLE 186 REST OF SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.6 REST OF THE WORLD (ROW)

TABLE 188 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 189 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 191 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 192 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 193 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TON)

TABLE 195 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TON)

TABLE 196 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 197 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 198 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 199 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

TABLE 200 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 201 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2022–2027 (USD MILLION)

13.6.1 MIDDLE EAST

13.6.1.1 Increase in in-house manufacturing of livestock feed and investment in region to boost market

TABLE 202 MIDDLE EAST: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 203 MIDDLE EAST: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13.6.2 AFRICA

13.6.2.1 Government initiatives to develop livestock sector to drive demand in Africa

TABLE 204 AFRICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 205 AFRICA: PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 185)

14.1 OVERVIEW

14.2 KEY PLAYER STRATEGIES

TABLE 206 OVERVIEW OF KEY PLAYER STRATEGIES

14.3 MARKET SHARE ANALYSIS

TABLE 207 PHYTOGENIC FEED ADDITIVES MARKET SHARE ANALYSIS, 2021

14.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019–2021 (USD BILLION)

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STARS

14.5.2 PERVASIVE PLAYERS

14.5.3 EMERGING LEADERS

14.5.4 PARTICIPANTS

FIGURE 40 PHYTOGENIC FEED ADDITIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

14.5.5 PHYTOGENIC FEED ADDITIVES PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 208 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 209 COMPANY FOOTPRINT, BY LIVESTOCK (KEY PLAYERS)

TABLE 210 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

TABLE 211 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

TABLE 212 COMPANY FOOTPRINT, BY FUNCTION (KEY PLAYERS)

TABLE 213 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 214 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

14.6 COMPANY EVALUATION QUADRANT (OTHER PLAYERS)

14.6.1 PROGRESSIVE COMPANIES

14.6.2 STARTING BLOCKS

14.6.3 RESPONSIVE COMPANIES

14.6.4 DYNAMIC COMPANIES

FIGURE 41 PHYTOGENIC FEED ADDITIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 215 PHYTOGENIC FEED ADDITIVES: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

14.7 COMPETITIVE SCENARIO

14.7.1 NEW PRODUCT LAUNCHES

TABLE 216 PHYTOGENIC FEED ADDITIVES MARKET: NEW PRODUCT LAUNCHES, 2019–2022

14.7.2 DEALS

TABLE 217 PHYTOGENIC FEED ADDITIVES MARKET: DEALS, 2019–2022

TABLE 218 PHYTOGENIC FEED ADDITIVES MARKET: OTHERS, 2019–2022

15 COMPANY PROFILES (Page No. - 200)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

15.1 KEY PLAYERS

15.1.1 CARGILL

TABLE 219 CARGILL: BUSINESS OVERVIEW

FIGURE 42 CARGILL: COMPANY SNAPSHOT

TABLE 220 CARGILL: PRODUCTS OFFERED

TABLE 221 CARGILL: NEW PRODUCT LAUNCHES

TABLE 222 CARGILL: DEALS

TABLE 223 CARGILL: OTHERS

15.1.2 ADM

TABLE 224 ADM: BUSINESS OVERVIEW

FIGURE 43 ADM: COMPANY SNAPSHOT

TABLE 225 ADM: PRODUCTS OFFERED

TABLE 226 ADM: OTHERS

15.1.3 DUPONT

TABLE 227 DUPONT: BUSINESS OVERVIEW

FIGURE 44 DUPONT: COMPANY SNAPSHOT

TABLE 228 DUPONT: PRODUCTS OFFERED

TABLE 229 DUPONT: OTHERS

15.1.4 DSM N.V.

TABLE 230 DSM N.V.: BUSINESS OVERVIEW

FIGURE 45 DSM N.V.: COMPANY SNAPSHOT

TABLE 231 DSM N.V.: PRODUCTS OFFERED

TABLE 232 DSM N.V.: DEALS

15.1.5 LAND O’ LAKES

TABLE 233 LAND O’ LAKES: BUSINESS OVERVIEW

FIGURE 46 LAND O’ LAKES: COMPANY SNAPSHOT

TABLE 234 LAND O’ LAKES: PRODUCTS OFFERED

15.1.6 ADISSEO

TABLE 235 ADISSEO: BUSINESS OVERVIEW

TABLE 236 ADISSEO: PRODUCTS OFFERED

TABLE 237 ADISSEO: DEALS

15.1.7 NUTRECO

TABLE 238 NUTRECO: BUSINESS OVERVIEW

TABLE 239 NUTRECO: PRODUCTS OFFERED

15.1.8 KEMIN INDUSTRIES

TABLE 240 KEMIN INDUSTRIES: BUSINESS OVERVIEW

TABLE 241 KEMIN INDUSTRIES: PRODUCTS OFFERED

TABLE 242 KEMIN INDUSTRIES: DEALS

TABLE 243 KEMIN INDUSTRIES: OTHERS

15.1.9 NATURAL REMEDIES

TABLE 244 NATURAL REMEDIES: BUSINESS OVERVIEW

TABLE 245 NATURAL REMEDIES: PRODUCTS OFFERED

15.1.10 NOR FEED

TABLE 246 NOR FEED: BUSINESS OVERVIEW

TABLE 247 NOR FEED: PRODUCTS OFFERED

15.2 OTHER PLAYERS

15.2.1 TEGASA

TABLE 248 TEGASA: BUSINESS OVERVIEW

TABLE 249 TEGASA: PRODUCTS OFFERED

15.2.2 DOSTOFARMS GMBH

TABLE 250 DOSTOFARMS GMBH: BUSINESS OVERVIEW

TABLE 251 DOSTOFARMS GMBH: PRODUCTS OFFERED

15.2.3 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

TABLE 252 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH: BUSINESS OVERVIEW

TABLE 253 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH: PRODUCTS OFFERED

15.2.4 ALLTECH

TABLE 254 ALLTECH: BUSINESS OVERVIEW

TABLE 255 ALLTECH: PRODUCTS OFFERED

TABLE 256 ALLTECH: DEALS

15.2.5 SILVATEAM S.P.A

TABLE 257 SILVATEAM S.P.A: BUSINESS OVERVIEW

TABLE 258 SILVATEAM S.P.A: PRODUCTS OFFERED

15.2.6 SYNTHITE INDUSTRIES LTD.

15.2.7 AYURVET LIMITED

15.2.8 GROWELL INDIA

15.2.9 INDIAN HERBS

15.2.10 NUTREX

15.2.11 IGUSOL

15.2.12 HIMALAYA WELLNESS

15.2.13 NUTRICARE LIFE SCIENCES LTD.

15.2.14 NATURA FEED INGREDIENTS

15.2.15 NATURAL HERBS & FORMULATION

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 239)

16.1 INTRODUCTION

TABLE 259 ADJACENT MARKETS TO THE PHYTOGENIC FEED ADDITIVES MARKET

16.2 LIMITATIONS

16.3 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

TABLE 260 ANIMAL GROWTH PROMOTERS AND PERFORMANCE ENHANCERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

16.4 ESSENTIAL OILS MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

TABLE 261 ESSENTIAL OILS MARKET, BY TYPE, 2021–2026 (USD MILLION)

17 APPENDIX (Page No. - 243)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

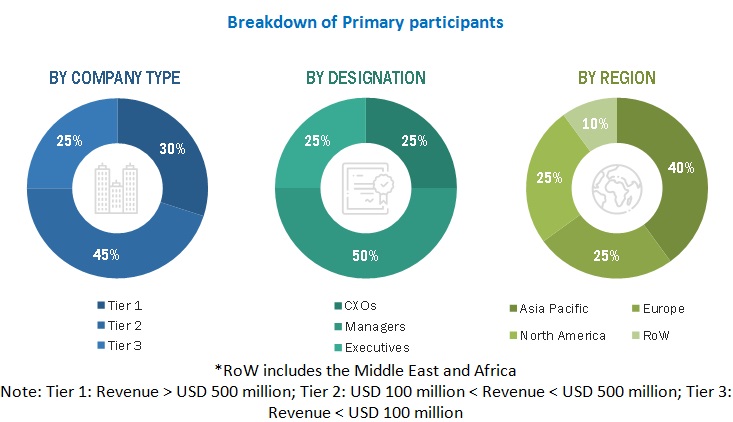

The study involved four major activities in estimating phytogenic feed additives market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to, to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the phytogenic feed additives market.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of phytogenic feed additives supplied by different market players, and key market dynamics such as drivers, restraints, opportunities, burning issues, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the phytogenic feed additives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the phytogenic feed additives market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall phytogenic feed additives market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the phytogenic feed additives market, in terms of type, livestock, source, form, function, and region.

- To describe and forecast the phytogenic feed additives market, in terms of value, by region– North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the phytogenic feed additives market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the phytogenic feed additives market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the phytogenic feed additives market.

Available Customizations

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European phytogenic feed additives market into the Netherlands, Poland and Denmark.

- Further breakdown of the Rest of Asia Pacific phytogenic feed additives market into Australia, the New Zealand and South Korea.

- Further breakdown of the Rest of the South American phytogenic feed additives market into Peru, Chile, and Venezuela

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Phytogenic Feed Additives Market

Your market study is very informative. I would like to know more about the products and additives for livestock and poultry feed that have been covered in this study.