Compound Feed Market by Ingredients (Cereals, Cakes & Meals, By-Products, and Supplements), Form (Mash, Pellets, Crumbles), Livestock (Ruminants, Poultry, Swine, and Aquaculture), Source (Plant-Based and Animal-Based), and Region - Global Forecast to 2028

Compound Feed Market Size, Share, and Outlook (2023-2028)

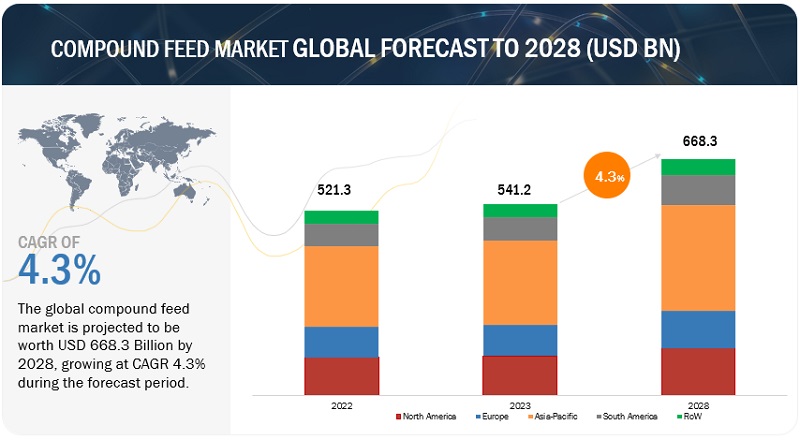

The global compound feed market size was valued at USD 541.2 billion in 2023 and is poised to reach USD 668.3 billion by 2028, growing at a CAGR of 4.3% from 2023–2028.

The increasing consumer concern for animal health and welfare throughout the food production chain has created a strong demand for products that prioritize humane and healthy practices. Consumers are actively seeking assurances that animals used in meat, dairy, and egg production are raised in a responsible manner. This shift in consumer preferences presents an opportunity for compound feed manufacturers to capitalize on by developing and promoting feed formulations that contribute to the overall well-being of animals. One of the key considerations in addressing animal health and welfare is recognizing that different animal species have unique nutritional requirements. Manufacturers can take advantage of this focus on animal welfare by developing specialized compound feed formulations tailored to meet the specific needs of different species. This process may involve adjusting the nutrient composition to support optimal growth and development, incorporating functional additives that promote health and disease prevention, and exploring alternative protein sources that align with specific dietary needs. By offering customized compound feed solutions, manufacturers can address the specific health and welfare concerns of various animal species, catering to the diverse needs of farmers and livestock producers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Compound Feed Market Dynamics

Drivers: Surge in demand for appropriate livestock nutrition

Livestock continues to make an important contribution to the global food chain. It is seen that energy fluctuation and imbalance in the metabolic process can induce various diseases and hamper livestock performance. The major reasons include inappropriate nutrition, overeating, and lack of physical activity. Compound feed is a careful mix of ingredients that provide a proper blend of carbohydrates from cereals, fat and protein from oilseeds, and fiber, which is highly valuable in animal nutrition. Feeding good-quality feed to animals, which includes grains like corn and barley, changes the color of carcass fat from yellow to white, which increases the chance of obtaining higher-quality meat for commercial purposes. Additionally, the use of compound feed helps in obtaining high-quality milk, eggs, and dairy products and further helps in a good feed conversion ratio.

Livestock breeders often look for compound feed as a convenient and efficient way to provide a balanced diet to their animals. Compound feed, also known as complete feed or mixed feed, is a mixture of various ingredients that are formulated to meet the nutritional requirements of specific types of livestock. Compound feed is produced through standardized processes, ensuring consistent quality and nutritional composition. This consistency is crucial for maintaining the health and productivity of livestock. It eliminates the variations that can occur when using multiple feed ingredients from different sources. And also, Compound feed production involves economies of scale, making it a cost-effective option for livestock breeders. Purchasing ingredients in bulk and using specialized equipment for formulation and production can help reduce costs compared to buying individual ingredients separately.

Restraints: Volatile raw material prices for manufacturing of compound feed

The prices of raw materials like seeds and plant leaves have been experiencing fluctuations, while the extraction methods have become more costly for producers. Interestingly, the main raw material itself has become cheaper. On the other hand, the prices of cereals such as corn, barley, and oats have been steadily increasing. This upward trend can be attributed to the impact of the COVID-19 pandemic, which has caused a sudden surge in prices. The availability of feed has become a critical issue for the industry, particularly due to the growing global population and the resulting increased demand for food. As a result, the industry is facing significant challenges in procuring essential raw feed like corn, wheat, and barley. The ongoing Ukraine-Russia war has further exacerbated this problem, leading to disruptions in the supply chain and contributing to the volatility of raw material prices. Consequently, the production of compound feed for livestock is expected to be adversely affected by this situation.

Opportunities: Growing importance of livestock feeding practice in developing economies

Intensive livestock production is booming in emerging countries; however, there are still vast areas where extensive livestock production, especially ruminants, is largely supported by grazed pastures. The only approach to minimize grassland degradation while maintaining the health of the animal is by reducing animal density. The low productivity of ruminants in developing countries is reflected by high mortality, the poor growth rate of young ones, delay in the onset of puberty, and long intervals between successive parturition, all of which are largely attributed to poor feed resources, feeding, and management. However, high mortality and inadequate milk production by nursing mothers affect the growth rate of those who survive. Therefore, economics strategists and government policies encourage livestock farmers to transform the extensive system of production into semi-intensive systems with additional imported feed inputs. The low productivity in ruminants in developing countries is reflected by high mortality, the poor growth rate of young ones, delay in the onset of puberty, and long intervals between successive parturition, all of which are largely attributed to poor feed resources, feeding, and management. Therefore, it is important to improve the productivity of ruminant livestock through the promotion of early weaning of young ones. Compound feed provides a mix of optimum nutrition to livestock, and it is available in different forms and can be fed to different livestock from an early age. To increase productivity and performance, many farmers are adopting nutrition specifically designed for livestock, which will impact the demand for compound feed in developing nations.

Challenges: Stringent regulatory framework

Animal health is a vital component in the food chain, and the prevention and management of infectious diseases like zoonotic disease are also essential. In 2011, the US FDA and the Association of American Feed Control Officials partnered to develop the Animal Feed Regulatory Program Standards. The feed standards establish a uniform foundation for the design and management of states' programs responsible for the regulation of feed. In the European Union, there are standards for feed materials, compound feed, and others like feed additives. The Commission and the EU countries discuss animal nutrition issues in the Standing Committee on Plants, Animals, Food, and Animal Nutrition. Manufacturers must abide by the regulations and provide proper details of the ingredients used in the manufacturing of compound feed. Manufacturers need to fulfill the requirement regarding the health and safety of the product they manufacture for livestock and its adverse effect on the environment. They are also required to submit the documents for approval from the respective regulatory body, and altogether, it adds up to the overall production cost. These factors contribute to the challenges faced by compound feed manufacturers.

Compound Feed Market: Value Chain Analysis

Based on ingredients, cereals are estimated to account for the largest market share of the compound feed market.

Cereal crops, such as corn and wheat, have several characteristics that contribute to their dominance in the compound feed market. They are abundantly grown and easily accessible in many regions, resulting in large quantities being available for use in compound feed formulations. This abundance makes cereals a cost-effective option for feed manufacturers. Additionally, cereals offer versatility in formulating compound feeds for different animal species. They can be processed and combined with other feed ingredients to meet specific nutritional requirements. Whether used as the main ingredient or as part of a blend, cereals provide a flexible base for creating feeds suitable for various animals. Taking into account their abundance, accessibility, versatility, and feed conversion efficiency, cereals possess key attributes that contribute to their dominance in the compound feed market.

Based on livestock, poultry-related compound feed is anticipated to dominate the market.

Poultry, especially chicken, is one of the most widely consumed meats globally. The demand for poultry products, such as meat and eggs, is consistently high due to factors like affordability, versatility, and nutritional value. Nutritional value is a significant driver of the demand for poultry products. The nutritional value of poultry meat, such as chicken, is a major factor driving the demand for these products. Poultry is recognized for being a rich source of high-quality protein, essential amino acids, vitamins, and minerals. With lower fat content compared to red meats, particularly when consumed without the skin, poultry products are often perceived as healthier options. Consumers who prioritize nutritious and balanced diets consider poultry as an important component, leading to the sustained demand for poultry products. Additionally, the global acceptance of poultry products plays a significant role in their high demand. Poultry, especially chicken, has become a staple in many cuisines and dietary traditions worldwide. Its versatility and adaptability to various cooking styles have led to its integration into diverse cultural dishes. This global acceptance of poultry products across different regions and cultures bolsters their consistent demand.

Based on form, the mash form of compound feed is projected to witness the largest market share during the forecast period.

Mash feed offers the advantage of providing a consistent distribution of ingredients throughout the mixture, which helps prevent selective feeding by animals. By eliminating the ability to pick and choose specific ingredients, mash feed ensures that animals receive a balanced diet with all the necessary nutrients. Additionally, the production of mash feed is cost-effective as it requires less equipment and processing compared to more complex forms like pelleted or extruded feed. This streamlined production process can lead to cost savings for feed manufacturers, which can potentially be passed on to customers, making mash feed an economical choice in the compound feed market.

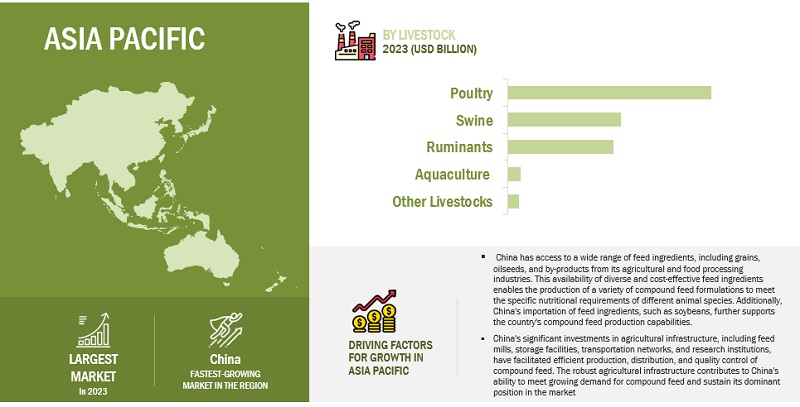

The Asia Pacific market is projected to contribute the largest share in the compound feed market.

The livestock and poultry industry in the Asia Pacific region has witnessed significant growth, driven by multiple factors. As incomes rise and dietary preferences change, there is an increased consumption of animal protein, leading to a surge in demand for livestock and poultry products. To meet this demand, there has been an expansion of livestock and poultry production, which in turn creates a substantial need for compound feed. Furthermore, the rapid urbanization occurring across many countries in the region has contributed to the expansion of the livestock industry. As people migrate to urban areas, there is a notable shift in dietary patterns, with an inclination towards higher meat and dairy consumption. This urbanization trend has further fueled the demand for compound feed, as intensive animal production systems require adequate nutrition for optimal productivity.

Key Market Players

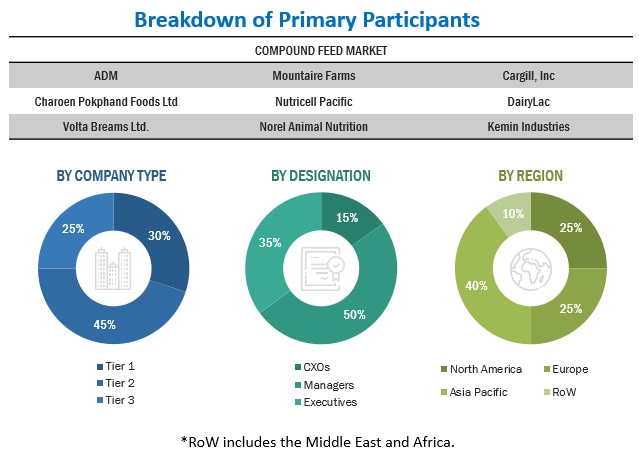

Cargill, Inc. (US), ADM (US), Charoen Pokphand Foods (Thailand), New Hope Group (China), and Land O’Lakes (US) are among the key players in the global compound feed market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the compound feed market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market Size in 2022 |

USD 521.3 billion |

|

Market Size in 2023 |

USD 541.2 billion |

|

Revenue Forecast in 2028 |

USD 668.3 billion |

|

Growth Rate |

CAGR of 4.3% |

|

Forecast Period |

2023-2028 |

|

Segments Covered |

By Ingredient, By Form, By Livestock, By Source, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Largest Market |

Asia Pacific |

|

Companies studied |

|

Compound Feed Market:

By Ingredient

- Cereals

- Cakes & Meals

- By-Products

- Supplements

By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Other livestock

By Form

- Mash

- Pellets

- Crumbles

- Other forms

By Source

- Plant-Based

- Animal-Based

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)*

*RoW includes the Middle East and Africa.

Recent Developments

- In April 2022, Cargill and Intelia entered into a strategic partnership to enhance broiler performance through a new precision management tool. The data from this digital platform would help maximize bird health and well-being, operational performance, and efficiency.

- In May 2022, ADM acquired a feed mill in the Philippines, which will support the company’s growth in the region through a wide range of products like pet food, complete feed, aquaculture, and premix solutions. Additionally, the acquisition will strengthen the company’s portfolio.

- In June 2021, Charoen Pokphand Foods (Thailand) acquired C.P. Aquaculture (India), a food and beverage manufacturer, to increase its shareholding to 75%. CPA is involved in the manufacturing and distribution of shrimp feed. This acquisition will help Charoen Pokphand Foods to expand its shrimp feed business.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the compound feed market?

The Asia Pacific region accounted for the largest share, in terms of value, of USD 227.2 billion, of the global compound feed market in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period. The growing population and rising demand for meat & livestock products are expected to drive the growth of the compound feed market in emerging counties such as China, India, and Thailand, to name a few.

What is the current size of the global compound feed market?

The global market for compound feed was valued at USD 541.2 Billion in 2023 and is projected to reach USD 668.3 Billion by 2028, at a CAGR of 4.3% during the forecast period.

Which are the key players in the market?

The key players in this market include Cargill, Inc. (US), ADM (US), Charoen Pokphand Foods (Thailand), New Hope Group (China), Land O’Lakes (US), Nutreco N.V. (Netherlands), Alltech, Inc. (US), Guangdong Haid Group Co., Ltd (China), Weston Milling Group (Australia), and Feed One Co. (Japan).

What are the factors driving the compound feed market?

- Increasing demand for meat, dairy, and eggs drives the need for compound feed.

- Growing population and changing dietary preferences fuel the rise in livestock production.

- Industrialization of animal farming necessitates efficient and cost-effective feeding solutions.

- Focus on animal health and nutrition enhancing the demand for specialized feed products.

What are the chellenges of the compound feed market?

- Raw material availability and price volatility.

- Regulatory compliance and standards.

- Disease outbreaks and biosecurity risks.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

-

5.3 MARKET DYNAMICSDRIVERS- Surge in demand for appropriate livestock nutrition- Growing demand for animal products for commercial use- Rising adoption of modern techniques for livestock rearing- Growth of organized livestock farming in developing countriesRESTRAINTS- Volatile raw material prices for manufacturing compound feed- Lack of awareness about modern feeding methods in developing countriesOPPORTUNITIES- Growing importance of livestock feeding practice in developing economies- Expanding market reach through international tradeCHALLENGES- Stringent regulatory framework- Quality control of genetic feed products manufactured by Asian companies

- 6.1 INTRODUCTION

-

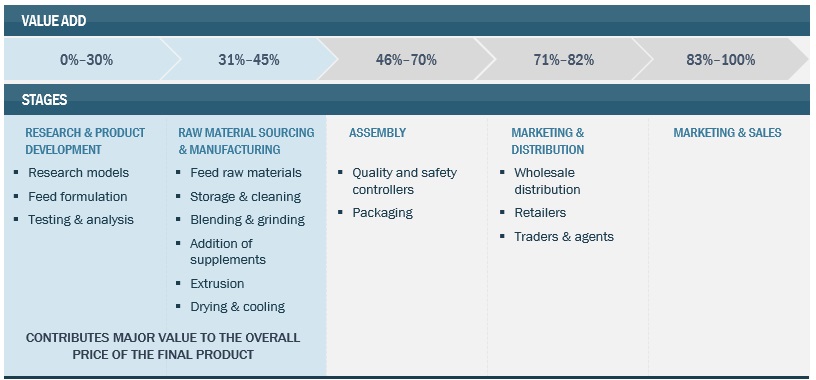

6.2 VALUE CHAINRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCING AND MANUFACTURINGASSEMBLYDISTRIBUTIONMARKETING & SALES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 PRICING ANALYSIS: COMPOUND FEED MARKET

-

6.6 MARKET MAPPING AND ECOSYSTEM OF COMPOUND FEEDDEMAND SIDESUPPLY SIDE

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.8 COMPOUND FEED MARKET: PATENT ANALYSIS

- 6.9 TRADE DATA: COMPOUND FEED MARKET

-

6.10 CASE STUDIESCARGILL DEVELOPED HIGH-PERFORMANCE FOR HORSE FEED MANUFACTURERSCARGILL DEVELOPED AQUAFEED FOR CLIENT

- 6.11 KEY CONFERENCES & EVENTS IN 2022–2023

-

6.12 TARIFF & REGULATORY LANDSCAPENORTH AMERICA- United States (US)- CanadaEUROPEAN UNION (EU)ASIA PACIFIC- Japan- ChinaINTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)

-

6.13 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 CEREALSABUNDANCE OF CEREAL CROPS TO FUEL COMPOUND FEED MARKET GROWTH

-

7.3 CAKES & MEALSRISING DEMAND FOR PROTEIN AND MICRONUTRIENTS IN FEED TO BOOST DEMAND FOR CAKES & MEALS

-

7.4 BY-PRODUCTSBY-PRODUCTS TO PROVIDE OPTIMUM NUTRITION TO CATTLE AND AQUACULTURE

-

7.5 SUPPLEMENTSNEED FOR MICRONUTRIENTS FOR OVERALL WELL-BEING OF LIVESTOCK TO INCREASE REQUIREMENT OF SUPPLEMENTS

- 8.1 INTRODUCTION

-

8.2 PLANT-BASEDEASY AVAILABILITY AND SUSTAINABILITY OF PLANT-BASED PRODUCTS TO INFLUENCE THEIR APPLICATION IN COMPOUND FEED

-

8.3 ANIMAL-BASEDINCREASED AWARENESS ABOUT ANIMAL-BASED FEED TO INCREASE REQUIREMENT OF COMPOUND FEED

- 9.1 INTRODUCTION

-

9.2 MASHFLEXIBILITY IN MASH FORM TO ENABLE CUSTOMIZATION OF NUTRIENT CONTENT FOR SPECIFIC ANIMAL SPECIES AND PRODUCTION STAGES

-

9.3 PELLETSPELLETS TO ACCOUNT FOR LARGEST SHARE IN GLOBAL COMPOUND FEED MARKET

-

9.4 CRUMBLESGROWING IMPORTANCE OF CRUMBLES IN POULTRY TO FUEL DEMAND

- 9.5 OTHER FORMS

- 10.1 INTRODUCTION

-

10.2 RUMINANTSINCREASING DEMAND FOR HIGH-QUALITY PROTEIN AND MILK TO FUEL MARKET GROWTHDAIRYBEEFCALFOTHER RUMINANTS

-

10.3 POULTRYGROWING DEMAND FOR EGGS IN DEVELOPING COUNTRIES TO FUEL DEMAND FOR COMPOUND FEED IN POULTRY SECTORBROILERSLAYERSBREEDERS

-

10.4 SWINEINCREASING PORK CONSUMPTION TO DRIVE COMPOUND FEED MARKETSTARTERSOWGROWER

-

10.5 AQUACULTUREGROWING FISH CONSUMPTION TO FUEL COMPOUND FEED MARKET

- 10.6 OTHER LIVESTOCK

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing animal rearing for export to drive demand for compound feedCANADA- Rising poultry sector to lead to surge in demand for compound feed in CanadaMEXICO- Growth in poultry and cattle rearing practices to fuel demand for compound feed

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISSPAIN- Increasing demand for better animal nutrition for livestock production to drive compound feed market in SpainRUSSIA- Upward trend in livestock production and consumption to drive Russian marketGERMANY- Improved livestock sector to fuel demand for compound feed in GermanyFRANCE- Growing concerns regarding livestock diseases to fuel demand for compound feed amongst meat manufacturersITALY- Growing meat production in Italy to lead to increased demand for compound feedREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Advancements in livestock sector to fuel demand for compound feedJAPAN- Growth opportunity in domestic livestock industry to drive compound feed marketINDIA- Increased awareness of commercial livestock feed to boost demand for compound feedTHAILAND- Rising exports of meat products and improvements in meat quality to fuel demand for compound feedREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Developed animal husbandry sector to present opportunities for compound feed manufacturersARGENTINA- Rapid growth in livestock sector to drive demand for compound feedREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISMIDDLE EAST- Increasing awareness about meat quality to fuel demand for compound feedAFRICA- Growing importance of animal rearing and agriculture to drive compound feed market

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPOUND FEED MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

-

12.7 COMPOUND FEED MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY COMPANIESCARGILL, INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewADM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCHAROEN POKPHAND FOODS PCL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNEW HOPE GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLAND O’LAKES, INC.- Business Overview- Products/Services/Solutions offered- Recent developments- MnM viewNUTRECO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewALLTECH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGUANGDONG HAID GROUP CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFEED ONE CO., LTD- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKENT NUTRITION GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewELANCO ANIMAL HEALTH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDE HEUS ANIMAL NUTRITION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFORFARMERS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGODREJ AGROVET LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKERALA FEEDS LTD- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSHUEBER FEED, LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNOR-FEED- Business overview- Products/Services/Solutions offered- MnM viewARASCO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBHARAT FEEDS & EXTRACTIONS LTD- Business Overview- Products/Services/Solutions offered- Recent developments- MnM viewUNIVERSAL INDUSTRIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewANFONTAL NUTRITIONS PRIVATE LIMITEDTHE CB GROUPNWF AGRICULTUREJAPFAARIVAN AGROVET PRODUCTS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 FEED ADDITIVES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 AQUAFEED MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 COMPOUND FEED MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 GLOBAL COMPOUND FEED AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONNES)

- TABLE 4 PATENTS PERTAINING TO COMPOUND FEED, 2020–2022

- TABLE 5 TOP 10 IMPORTERS AND EXPORTERS OF COMPOUND FEED, 2020 (KG)

- TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF COMPOUND FEED, 2021 (KG)

- TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF COMPOUND FEED, 2022 (KG)

- TABLE 8 KEY CONFERENCES & EVENTS IN COMPOUND FEED MARKET

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 COMPOUND FEED MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 16 COMPOUND FEED MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 17 COMPOUND FEED MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 18 CEREALS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 19 CEREALS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 20 CAKES & MEALS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 21 CAKES & MEALS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 22 BY-PRODUCTS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 23 BY-PRODUCTS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 24 SUPPLEMENTS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 25 SUPPLEMENTS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 26 COMPOUND FEED MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 27 MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 28 PLANT-BASED: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 29 PLANT-BASED: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 30 ANIMAL-BASED: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 31 ANIMAL-BASED: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 32 COMPOUND FEED MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 33 MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 34 MASH: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 35 MASH: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 36 PELLETS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 37 PELLETS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 38 CRUMBLES: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 39 CRUMBLES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 40 OTHER FORMS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 41 OTHER FORMS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 42 COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 43 MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 44 MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 45 MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 46 RUMINANTS: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 47 RUMINANTS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 48 RUMINANTS: MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 49 RUMINANTS: MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 50 COMPOUND FEED MARKET, BY RUMINANT TYPE, 2018–2022 (USD BILLION)

- TABLE 51 COMPOUND FEED MARKET, BY RUMINANT TYPE, 2023–2028 (USD BILLION)

- TABLE 52 POULTRY: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 53 POULTRY: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 54 POULTRY: MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 55 POULTRY: MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 56 COMPOUND FEED MARKET, BY POULTRY TYPE, 2018–2022 (USD BILLION)

- TABLE 57 COMPOUND FEED MARKET, BY POULTRY TYPE, 2023–2028 (USD BILLION)

- TABLE 58 SWINE: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 59 SWINE: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 60 SWINE: MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 61 SWINE: MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 62 COMPOUND FEED MARKET, BY SWINE TYPE, 2018–2022 (USD BILLION)

- TABLE 63 COMPOUND FEED MARKET, BY SWINE TYPE, 2023–2028 (USD BILLION)

- TABLE 64 AQUACULTURE: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 65 AQUACULTURE: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 66 AQUACULTURE: MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 67 AQUACULTURE: MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 68 OTHER LIVESTOCK: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 69 OTHER LIVESTOCK: COMPOUND FEED MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 70 OTHER LIVESTOCK: COMPOUND FEED MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 71 OTHER LIVESTOCK: COMPOUND FEED MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 72 COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 73 COMPOUND FEED MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 74 NORTH AMERICA: COMPOUND FEED MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (MMT)

- TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (MMT)

- TABLE 78 NORTH AMERICA: MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 83 NORTH AMERICA: MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 84 NORTH AMERICA: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 88 US: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 89 US: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 90 CANADA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 91 CANADA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 92 MEXICO: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 93 MEXICO: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 94 EUROPE: COMPOUND FEED MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 95 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 96 EUROPE: MARKET, BY COUNTRY, 2018–2022 (MMT)

- TABLE 97 EUROPE: MARKET, BY COUNTRY, 2023–2028 (MMT)

- TABLE 98 EUROPE: MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 99 EUROPE: MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 100 EUROPE: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 101 EUROPE: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 102 EUROPE: MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 103 EUROPE: MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 104 EUROPE: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 105 EUROPE: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 106 EUROPE: MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 107 EUROPE: MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 108 SPAIN: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 109 SPAIN: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 110 RUSSIA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 111 RUSSIA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 112 GERMANY: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 113 GERMANY: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 114 FRANCE: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 115 FRANCE: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 116 ITALY: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 117 ITALY: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 118 REST OF EUROPE: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 119 REST OF EUROPE: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 120 ASIA PACIFIC: COMPOUND FEED MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (MMT)

- TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (MMT)

- TABLE 124 ASIA PACIFIC: MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 129 ASIA PACIFIC: MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 130 ASIA PACIFIC: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 134 CHINA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 135 CHINA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 136 JAPAN: MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 137 JAPAN: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 138 INDIA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 139 INDIA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 140 THAILAND: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 141 THAILAND: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 142 REST OF ASIA PACIFIC: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 143 REST OF ASIA PACIFIC: COMPOUND FEED MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 144 SOUTH AMERICA: COMPOUND FEED MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 145 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 146 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (MMT)

- TABLE 147 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (MMT)

- TABLE 148 SOUTH AMERICA: MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 149 SOUTH AMERICA: MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 150 SOUTH AMERICA: MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 151 SOUTH AMERICA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 152 SOUTH AMERICA: MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 153 SOUTH AMERICA: MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 154 SOUTH AMERICA: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 155 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 156 SOUTH AMERICA: MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 157 SOUTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 158 BRAZIL: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 159 BRAZIL: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 160 ARGENTINA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 161 ARGENTINA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 162 REST OF SOUTH AMERICA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 163 REST OF SOUTH AMERICA: COMPOUND FEED MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 164 REST OF THE WORLD: COMPOUND FEED MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 165 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 166 REST OF THE WORLD: MARKET, BY REGION, 2018–2022 (MMT)

- TABLE 167 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (MMT)

- TABLE 168 REST OF THE WORLD: MARKET, BY INGREDIENT, 2018–2022 (USD BILLION)

- TABLE 169 REST OF THE WORLD: MARKET, BY INGREDIENT, 2023–2028 (USD BILLION)

- TABLE 170 REST OF THE WORLD: MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 171 REST OF THE WORLD: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 172 REST OF THE WORLD: MARKET, BY LIVESTOCK, 2018–2022 (MMT)

- TABLE 173 REST OF THE WORLD: MARKET, BY LIVESTOCK, 2023–2028 (MMT)

- TABLE 174 REST OF THE WORLD: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 175 REST OF THE WORLD: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 176 REST OF THE WORLD: MARKET, BY SOURCE, 2018–2022 (USD BILLION)

- TABLE 177 REST OF THE WORLD: MARKET, BY SOURCE, 2023–2028 (USD BILLION)

- TABLE 178 MIDDLE EAST: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 179 MIDDLE EAST: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 180 AFRICA: COMPOUND FEED MARKET, BY LIVESTOCK, 2018–2022 (USD BILLION)

- TABLE 181 AFRICA: MARKET, BY LIVESTOCK, 2023–2028 (USD BILLION)

- TABLE 182 GLOBAL COMPOUND FEED MARKET: DEGREE OF COMPETITION, 2022

- TABLE 183 STRATEGIES ADOPTED BY KEY PLAYERS IN COMPOUND FEED MARKET

- TABLE 184 COMPANY FOOTPRINT, BY LIVESTOCK

- TABLE 185 COMPANY FOOTPRINT, BY SOURCE

- TABLE 186 COMPANY FOOTPRINT, BY REGION

- TABLE 187 OVERALL COMPANY FOOTPRINT

- TABLE 188 GLOBAL COMPOUND FEED MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 189 GLOBAL COMPOUND FEED MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 COMPOUND FEED MARKET: DEALS, 2019–2023

- TABLE 191 COMPOUND FEED MARKET: OTHERS, 2019–2023

- TABLE 192 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 193 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 CARGILL, INCORPORATED: DEALS

- TABLE 195 CARGILL, INCORPORATED: OTHERS

- TABLE 196 ADM: BUSINESS OVERVIEW

- TABLE 197 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 ADM: DEALS

- TABLE 199 CHAROEN POKPHAND FOODS PCL: BUSINESS OVERVIEW

- TABLE 200 CHAROEN POKPHAND FOODS PCL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 CHAROEN POKPHAND FOODS PCL: DEALS

- TABLE 202 NEW HOPE GROUP: BUSINESS OVERVIEW

- TABLE 203 NEW HOPE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LAND O’LAKES, INC.: BUSINESS OVERVIEW

- TABLE 205 LAND O’LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 NUTRECO: BUSINESS OVERVIEW

- TABLE 207 NUTRECO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 NUTRECO: DEALS

- TABLE 209 ALLTECH: BUSINESS OVERVIEW

- TABLE 210 ALLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ALLTECH: OTHERS

- TABLE 212 GUANGDONG HAID GROUP CO., LTD.: BUSINESS OVERVIEW

- TABLE 213 GUANGDONG HAID GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FEED ONE CO., LTD.: BUSINESS OVERVIEW

- TABLE 215 FEED ONE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 KENT NUTRITION GROUP: BUSINESS OVERVIEW

- TABLE 217 KENT NUTRITION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 ELANCO ANIMAL HEALTH: BUSINESS OVERVIEW

- TABLE 219 ELANCO ANIMAL HEALTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 DE HEUS ANIMAL NUTRITION: BUSINESS OVERVIEW

- TABLE 221 DE HEUS ANIMAL NUTRITION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 DE HEUS ANIMAL NUTRITION: DEALS

- TABLE 223 FORFARMERS: BUSINESS OVERVIEW

- TABLE 224 FORFARMERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 GODREJ AGROVET LIMITED: BUSINESS OVERVIEW

- TABLE 226 GODREJ AGROVET LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 KERALA FEEDS LTD: BUSINESS OVERVIEW

- TABLE 228 KERALA FEEDS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HUEBER FEED, LLC: BUSINESS OVERVIEW

- TABLE 230 HUEBER FEED, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 NOR-FEED: BUSINESS OVERVIEW

- TABLE 232 NOR-FEED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ARASCO: BUSINESS OVERVIEW

- TABLE 234 ARASCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 BHARAT FEEDS & EXTRACTIONS LTD: BUSINESS OVERVIEW

- TABLE 236 BHARAT FEEDS & EXTRACTIONS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 UNIVERSAL INDUSTRIES: BUSINESS OVERVIEW

- TABLE 238 UNIVERSAL INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ANFONTAL NUTRITIONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 240 THE CB GROUP: COMPANY OVERVIEW

- TABLE 241 NWF AGRICULTURE: COMPANY OVERVIEW

- TABLE 242 JAPFA: COMPANY OVERVIEW

- TABLE 243 ARIVAN AGROVET PRODUCTS: COMPANY OVERVIEW

- TABLE 244 ADJACENT MARKETS TO COMPOUND FEED MARKET

- TABLE 245 FEED ADDITIVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 246 AQUAFEED MARKET, BY INGREDIENT, 2020–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 COMPOUND FEED MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 INDICATORS OF RECESSION

- FIGURE 5 WORLD INFLATION RATE: 2011–2021

- FIGURE 6 GLOBAL GDP: 2011–2021 (USD TRILLION)

- FIGURE 7 RECESSION INDICATORS AND THEIR IMPACT ON COMPOUND FEED MARKET

- FIGURE 8 COMPOUND FEED MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 9 COMPOUND FEED MARKET, BY INGREDIENT, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 MARKET, BY LIVESTOCK, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 MARKET, BY FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 COMPOUND FEED MARKET, BY SOURCE, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 COMPOUND FEED MARKET (VALUE), BY REGION

- FIGURE 14 RISING DEMAND FOR PROCESSED MEAT AND ANIMAL PRODUCTS TO FUEL DEMAND FOR COMPOUND FEED

- FIGURE 15 CHINA AND CEREALS ACCOUNTED FOR LARGEST SHARES IN 2022

- FIGURE 16 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC AND PELLETS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 GLOBAL POPULATION, 2010–2021

- FIGURE 19 COMPOUND FEED: MARKET DYNAMICS

- FIGURE 20 GLOBAL MEAT PRODUCTION (KILO TONNES)

- FIGURE 21 GLOBAL RAW MATERIAL PRICES

- FIGURE 22 LEADING EXPORTERS OF ANIMAL FOOD, 2021

- FIGURE 23 LEADING IMPORTERS OF ANIMAL FOOD, 2021

- FIGURE 24 VALUE CHAIN ANALYSIS OF COMPOUND FEED MARKET

- FIGURE 25 COMPOUND FEED MARKET: SUPPLY CHAIN

- FIGURE 26 COMPOUND FEED MARKET MAP

- FIGURE 27 COMPOUND FEED ECOSYSTEM MAPPING

- FIGURE 28 REVENUE SHIFT FOR COMPOUND FEED MARKET

- FIGURE 29 NUMBER OF PATENTS GRANTED FOR COMPOUND FEED, 2012–2022

- FIGURE 30 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 31 COMPOUND FEED MARKET, BY INGREDIENT, 2023 VS. 2028 (USD BILLION)

- FIGURE 32 COMPOUND FEED MARKET, BY SOURCE, 2023 VS. 2028 (USD BILLION)

- FIGURE 33 COMPOUND FEED MARKET, BY FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 34 COMPOUND FEED MARKET, BY LIVESTOCK, 2023 VS. 2028 (USD BILLION)

- FIGURE 35 GEOGRAPHIC SNAPSHOT (2023–2028): RAPIDLY GROWING MARKETS TO EMERGE AS NEW HOT SPOTS

- FIGURE 36 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 37 NORTH AMERICAN COMPOUND FEED MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: COMPOUND FEED MARKET SNAPSHOT

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 40 EUROPEAN COMPOUND FEED MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 42 ASIA PACIFIC COMPOUND FEED MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: COMPOUND FEED MARKET SNAPSHOT

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 45 SOUTH AMERICAN COMPOUND FEED MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 REST OF THE WORLD: INFLATION RATE, BY REGION, 2018–2021

- FIGURE 47 REST OF THE WORLD COMPOUND FEED MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 49 GLOBAL COMPOUND FEED MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 50 GLOBAL COMPOUND FEED MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 51 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 52 ADM: COMPANY SNAPSHOT

- FIGURE 53 CHAROEN POKPHAND FOODS PCL: COMPANY SNAPSHOT

- FIGURE 54 LAND O’LAKES, INC.: COMPANY SNAPSHOT

- FIGURE 55 FEED ONE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 ELANCO ANIMAL HEALTH: COMPANY SNAPSHOT

- FIGURE 57 FORFARMERS: COMPANY SNAPSHOT

- FIGURE 58 GODREJ AGROVET LIMITED: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the compound feed market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), European Association of Specialty Feed Ingredients and their Mixtures (FEFANA), International Feed Industry Federation (IFIF), Animal Feed Manufacturers Association (AFMA), National Grain and Feed Association (NGFA), The Compound Feed Manufacturers Association (CLFMA), Alltech Feed Survey, and academic references pertaining to compound feed were referred to identify and collect information for this study. The secondary sources also include livestock feed journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation, according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include feed manufacturers, dairy, poultry growers, and other livestock growers, feed importers and exporters, and intermediary suppliers such as traders and distributors of compound feed. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include compound feed manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end-use sectors.

To know about the assumptions considered for the study, download the pdf brochure

Compound Feed Market Size Estimation

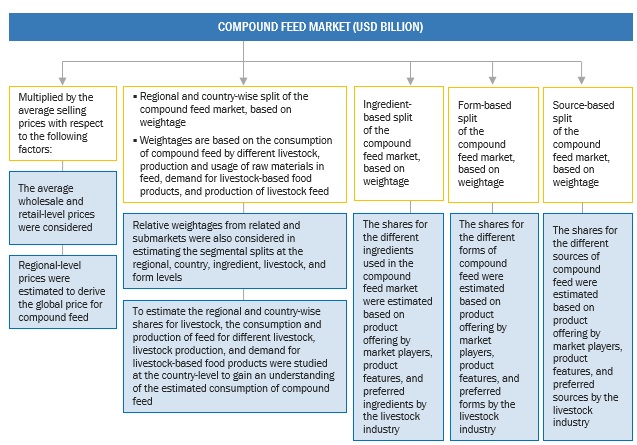

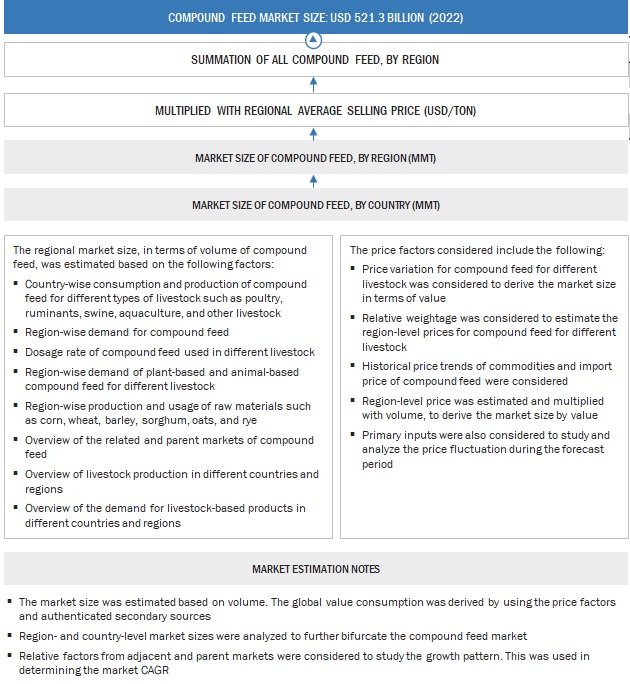

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up Approach:

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall compound feed market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

According to the Food and Agriculture Organization (FAO), compound feed is defined as “A mixture of products of vegetable or animal origin in their natural state, fresh or preserved, or products derived from the industrial processing thereof, or organic or inorganic substances, whether or not containing additives, for oral feeding in the form of a complete feed

The compound feed market refers to the industry involved in the manufacturing of formulated feed products for animals. Compound feed, also known as complete feed or mixed feed, is a nutritionally balanced combination of various ingredients such as cereals, cakes & meals, by-products, and supplements. The feeds can be processed into different forms, including mash, pellets, and crumbles, to suit the specific needs and preferences of the animals. The market serves ruminants, poultry, swine, and aquaculture species. It also takes into account the source of the ingredients, which can be plant-based or animal-based and is influenced by regional factors.

Stakeholders

- Feed and feed ingredient manufacturers and feed integrators

- Traders & distributors

- Livestock farmer associations and large animal husbandry companies

- Agricultural research organization

- Associations, regulatory bodies, and other industry-related bodies:

Food and Agriculture Organization (FAO)

- EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- International Feed Industry Federation (IFIF)

- European Feed Manufacturers Federation (FEFAC)

- The Association of American Feed Control Officials (AAFCO)

- American Feed Industry Association (AFIA)

Report Objectives

Market Intelligence

- Determining and projecting the size of the compound feed market with respect to ingredient, livestock, form, source, and regional markets

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the compound feed market

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the compound feed market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global compound feed market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Compound feed into Poland, Netherlands, Denmark, Belgium, and other EU and non-EU countries.

- Further breakdown of the Rest of the South America market for Compound feed into Colombia, Peru, Paraguay, Chile, and Venezuela

- Further breakdown of the Rest of Asia Pacific for Compound feed into Malaysia, Singapore, Philippines, Vietnam, South Korea, and other ASEAN countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Compound Feed Market