The study involved four major activities in estimating the size for next-generation data storage market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors were referred to. Secondary research was done to obtain key information about the market’s supply chain, the market's value chain, the pool of key market players, and market segmentation according to industry trends, region, and developments from both market and technology perspectives.

Primary Research

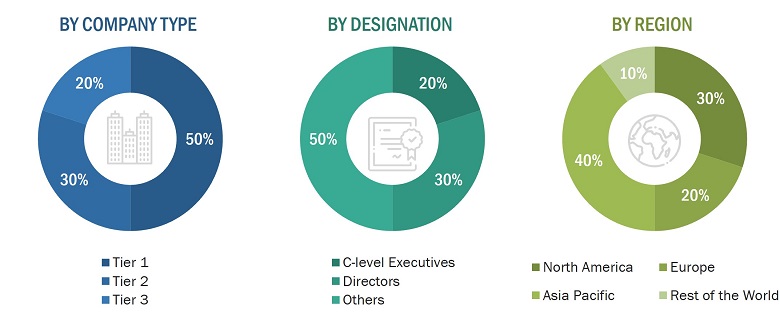

Extensive primary research has been conducted after acquiring knowledge about the next-generation data storage market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply sides across four major geographies: North America, Europe, Asia Pacific, and RoW (the Middle East, Africa, and South America). Approximately 60% and 40% of primary interviews were conducted with both the supply and demand sides. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report.

The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top players as well as extensive interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the next-generation data storage market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

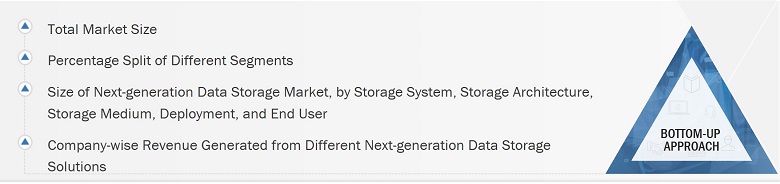

Next-generation Data Storage Market: Bottom-Up Approach

The bottom-up procedure has been employed to arrive at the overall size of the next-generation data storage market. From the revenues of the key players (companies), the size of the next-generation data storage market has been estimated at the first stage. The market has been further narrowed down to obtain splits for various storage systems, storage architecture, storage mediums, deployment types, end users, and regions. These splits have been validated through primary interviews with industry stakeholders and subject-matter experts.

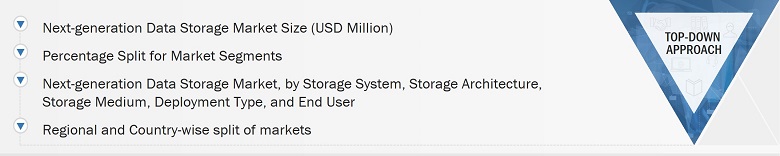

Next-generation Data Storage Market: Top-Down Approach

In the top-down approach, the overall size of the next-generation data storage market has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. Moreover, the bottom-up approach has also been implemented for the data extracted from the secondary research to validate the size of various segments and subsegments of the next-generation data storage market.

Each company's market share has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the individual market size has been determined and confirmed in this study. The data triangulation procedure used for this study has been explained in the next section.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Next-generation data storage refers to advanced technologies and solutions aimed at meeting the growing needs for storing, managing, and accessing vast amounts of data more efficiently and on a larger scale. These technologies go beyond traditional storage methods, providing improved performance, capacity, reliability, and flexibility. It deals with the security and management of data and harnessing the information to meet the application and software networking needs of end users. Next-generation data storage comprises various computer-controlled systems, equipment, and software used to store and retrieve data more accurately for reuse.

Key Stakeholders

-

Next-generation data storage solution providers

-

Technology consultants and system integrators

-

System distributors and suppliers

-

Data storage experts

-

Suppliers of accessories related to next-generation data storage systems

-

Research organizations and consulting companies

-

Government bodies such as regulating authorities and policymakers

-

Venture capitalists and private equity firms

-

Associations, organizations, and alliances related to the next-generation data storage ecosystem

-

Analysts and strategic business planners

-

Technology investors

Report Objectives

-

To define, describe, segment, and forecast the size of the next-generation data storage market, in terms of value, based on storage system, storage architecture, storage medium, end user, deployment, and region

-

To forecast the market size, in terms of value, for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To define, describe, segment, and forecast the size of the next-generation data storage market, in terms of volume, based on the storage capacity of storage medium

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the next-generation data storage market

-

To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market

-

To provide a detailed overview of the value chain analysis of the next-generation data storage ecosystem

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the market

-

To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive landscape of the market.

-

To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the next-generation data storage market

-

To study and analyze the impact of the recession on next-generation data storage market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Next-Generation Data Storage Market