Network Attached Storage Market by Design (1-8 Bays, 8-12 Bays, 12-20 Bays, more than 20 Bays), Product (Enterprise, Midmarket), Storage Solution (Scale-up NAS, Scale-out NAS), Deployment Type, End-user Industry & Region – Global Forecast to 2028

Updated on : October 22, 2024

The Network Attached Storage (NAS) market is experiencing robust growth, fueled by the increasing demand for efficient data management and storage solutions among businesses and individual consumers. As organizations continue to generate vast amounts of data, the need for reliable and scalable storage options has become paramount. Key trends driving this market include the rise of cloud-based services, which complement traditional NAS systems by offering enhanced accessibility and flexibility

Network Attached Storage Market Size & Share

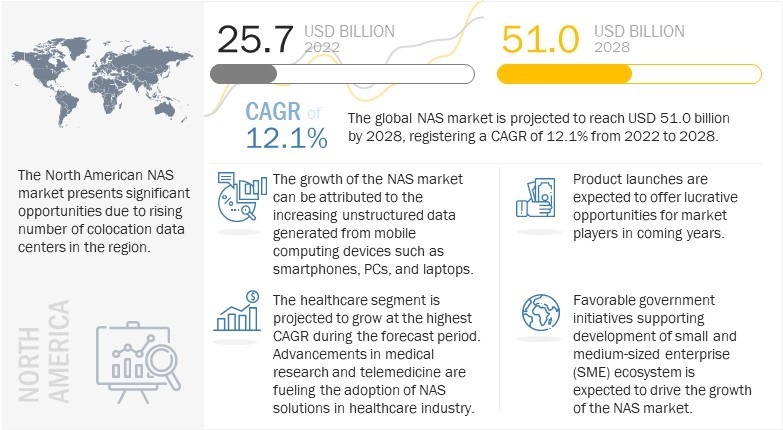

The Network Attached Storage market size is projected to grow from USD 25.7 billion in 2022 to reach USD 51.0 billion by 2028; growing at a Compound Annual Growth Rate (CAGR) of 12.1% from 2022 to 2028.

Rising data generation with surge in use of mobile computing devices, surging adoption of Internet of Things (IoT) technologies and connected devices, and growing use of 5G technology are the factors driving the growth of the NAS market.

Network Attached Storage (NAS) Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

NAS Market Dynamics

Driver: Rising data generation with surge in use of mobile computing devices

Personal computers (PCs) or enterprise desktops were earlier the major data generation sources. With rapid globalization and changing lifestyles and working patterns, smartphones, laptops, and tablets have become essential to life. The use of these devices has rapidly increased worldwide, indicating that the popularity of digital devices is at its peak. Likewise, with technological advancements, many new gadgets, such as Alexa (voice assistance device), consumer wearables, smart gadgets, 3D smart glasses, and augmented and virtual reality (AR/VR) products, have been launched in the market. These devices generate high volumes of data through various applications, financial transactions, online shopping, etc. Most people spend almost 5–6 hours on mobile apps daily. This increases data volumes and internet usage, leading to the exponential growth of big data and consequently fueling the demand for NAS solutions.

Restraint: Performance-related issues associated with network-attached storage (NAS) systems

The major factors restraining the adoption of NAS solutions are low performance and issues while scaling the system capacity compared to Storage Area Network (SAN) and Direct Attached Storage (DAS). The NAS is limited in resources; if the number of NAS users accessing the NAS system increases, it becomes slow, resulting in performance-related issues. These systems cannot scale up or out rapidly due to the requirement for dedicated NAS protocols such as Server Message Block (SMB) and Network File System (NFS). These protocols are not fast enough for high-performance applications due to the problems of high latency and lower throughputs. Additionally, the NAS is network-dependent, and the files are shared over a Local Area Network (LAN). This LAN network transfers data from one location to other through the data pockets by dividing them into several parts and sending them to any terminals. However, if any data packet gets delayed or sent out of order, the file may not open correctly.

Opportunity: Increasing adoption of hybrid cloud storage

The growing amount of unstructured data sets is the output of increased internet usage. This unstructured data is in the form of audio files, videos, or images. However, storing this data safely and securely has become a tough task. Cloud storage has become vital with the rapid growth in data generation. Hybrid NAS solutions are a combination of traditional NAS devices and cloud storage. They enable the creation of a virtual database where information can be stored in a single volume and accessed from anywhere. This, in turn, improves replication, remote mirroring, and data security. It also allows for data compressing to minimize space. With the help of hybrid NAS, companies can efficiently share and manage their critical data. With the increase in data volumes, the interest of customers and organizations is shifting toward adopting hybrid NAS.

Challenge: Lack of proper infrastructure to secure data

At present, the world is moving toward digitization; hence, data has emerged as a new, valuable asset. Increased data quantity has pressurized enterprises to get adequate infrastructure to secure and leverage the data generated. In the case of inappropriate or insufficient infrastructure, there is a threat of data loss or theft. Sometimes, implementing an apt infrastructure is costlier for enterprises. However, the growing demand for data security is forcing organizations to plan for proper infrastructure investments.

Moreover, instances such as work-from-home and hybrid work policies are creating challenges for the IT teams to set up the infrastructure that would offer seamless, smooth business operations from the users’ locations. Thus, the lack of proper infrastructure is a major challenge in the growth of the NAS market. Organizations need to make investments in improving their infrastructure to overcome this challenge.

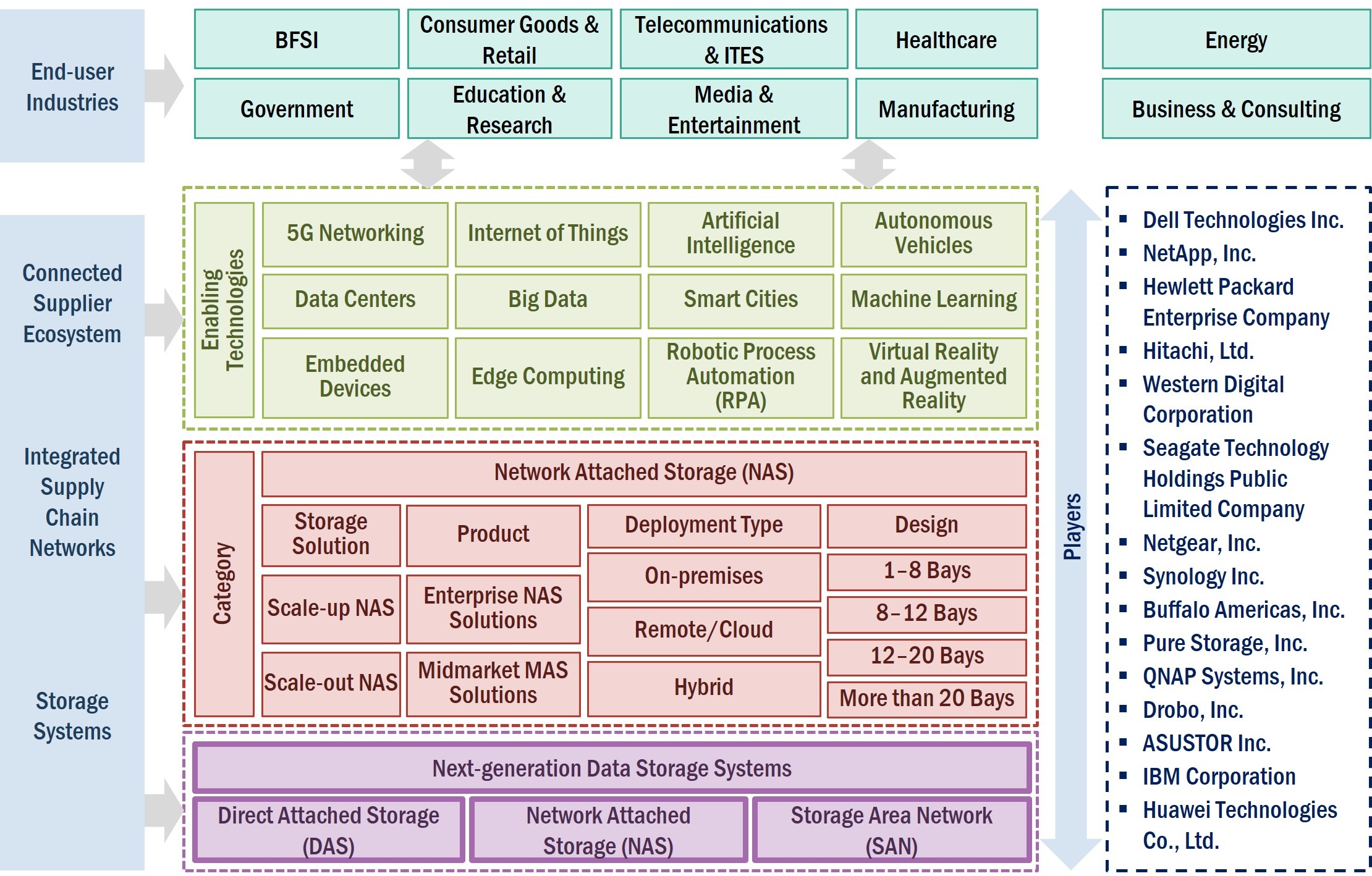

NAS Ecosystem

1–8 bays segment to dominate market during the forecast period.

The 1–8 bays segment is expected to lead the market during the forecast period. The segment’s growth can be attributed to the increasing adoption of these NAS solutions from small and medium-sized businesses, research centers, and media & entertainment professionals such as photographers and video editors. The NAS, with a capacity of 1–8 bays, provides several intuitive benefits such as space optimization, low product footprint, high-speed read/write, and low cost compared to high-end products. These benefits are fueling the adoption of NAS with a 1–8 bay design in the market.

The midmarket NAS solutions segment is expected to hold high market share from 2022 to 2028.

The midmarket NAS solutions segment is expected to hold high market share during the forecast period. Today’s generation is tech-savvy and uses advanced products such as smartphones, tablets, laptops, and other smart devices. The growing penetration of these electronic devices has led to an increase in the amount of digital content in the form of unstructured data. To manage these large data sets, consumers are adopting NAS solutions. Additionally, consumers prefer centralized NAS solutions to store data generated from video surveillance systems, media streaming devices, and backup systems. Although midmarket NAS systems find applications for personal uses, they are ideal and inexpensive solutions for small and mid-sized businesses. Their features and functionalities align more with business environments than residential applications thus fueling the segment growth over the forecast period.

The scale-out NAS segment to grow at high CAGR during the forecast period

The scale-out NAS is projected to be a fast-growing storage solution segment during the forecast period. Scale-out is an improved technique used in NAS devices, enabling capacity expansion based on the requirement of end-use applications. This is achieved with the help of clustered nodes, resulting in a reduction in upgrade costs. These are deployed in industries such as BFSI, healthcare, and government, wherein a large volume of data is generated, and data security is of utmost importance. However, these solutions are more costly compared to scale-up solutions. Thus, considering the importance of data security, the market for scale-out NAS is expected to grow significantly during the forecast period and eventually surpass the scale-up NAS solution market.

The on-premises segment is expected to hold high market share from 2022 to 2028

The on-premises segment is expected to hold high market share from 2022 to 2028. The dominance of this segment is due to the high adoption of this model by existing NAS users. The on-premises deployment of NAS devices is the most preferred option as it offers users complete control over data accessibility, ensuring high data security. Also, utilizing in-house hardware and software solutions ensures stored data’s safety, privacy, and security. Advancements in NAS hardware systems will further contribute to the growth of the on-premises segment. For instance, in September 2021, PAC Storage (US) launched a new U.2 NVMe all-flash network attached storage suitable for on-premises applications. The new NAS solution excels in high-performance-demanding requirements for high throughput and low latency workloads from high-performance computing, big data, and media and entertainment applications.

Market for telecommunications & information technology-enabled services (ITES) segment to hold the largest share throughout the forecast period

The telecommunications & ITES segment accounted for a high market share, in terms of value, in 2021. The segment’s growth is driven by increasing demand for NAS for data mobility, storage virtualization, backup, and recovery across the industry. The industry is witnessing high growth in digital media content, which includes consumer-generated audio files, images, documents, videos, and other digital content. This data is valuable for both the provider and the consumer, which increases the need for reliable and secure data storage solutions for telecom companies. With an increasing number of internet and advanced technology users, telecom service providers are experiencing challenges pertaining to data storage. Storage solutions having huge data storage capacity are required to address these challenges and store the customer records of telecommunications and related services. NAS devices provide a large storage capacity and high security required by the telecommunications & ITES industry.

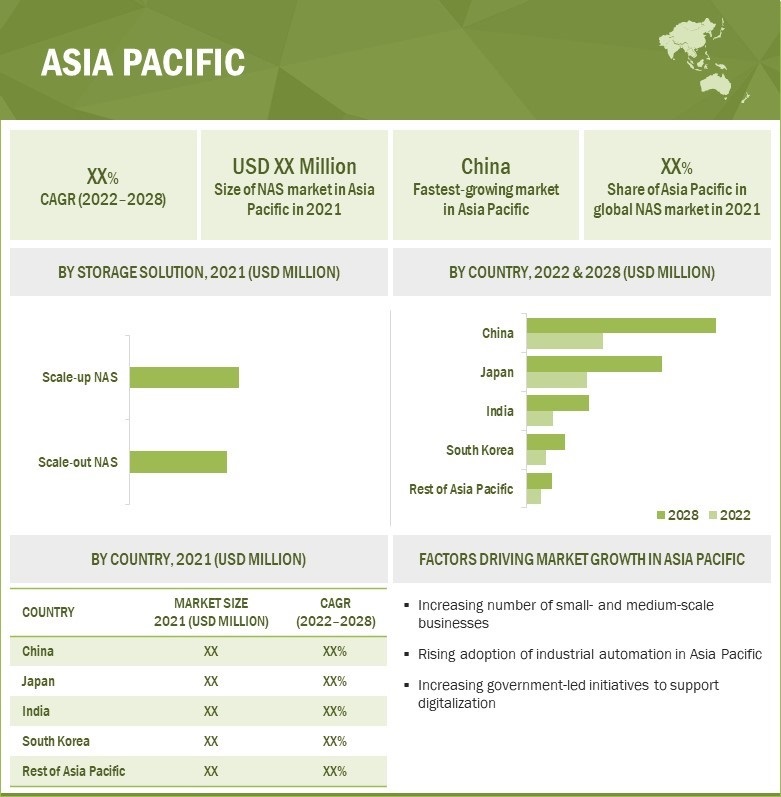

NAS market in Asia Pacific to grow at highest CAGR during the forecast period

The Asia Pacific NAS market is expected to grow at the highest CAGR during the forecast period. The market growth is driven by the increasing penetration of micro, small, and medium enterprises (MSMEs) across the region. According to the “Asia Small and Medium-Sized Enterprise Monitor 2021” report by Asian Development Bank (ADB), the total number of micro, small, and medium enterprises (MSMEs) with respect to the total number of enterprises across Asia accounted for around 99.6% in 2021. The presence of a large number of MSMEs across the region has led to an increase in the generation of unstructured data volumes, creating the need for modern-day data storage solutions to maintain secured backups across IT infrastructures. This, in turn, is expected to fuel the adoption of NAS solutions in MSMEs across Asia Pacific economies in the coming years.

Network Attached Storage (NAS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top NAS Companies

Key NAS Companies in the market are Dell Technologies Inc. (US), NetApp, Inc. (US), Hewlett Packard Enterprise Company (US), Hitachi, Ltd. (Japan), Western Digital Corporation (US), Seagate Technology Holdings Public Limited Company (US), NETGEAR, Inc. (US), Synology Inc. (Taiwan), Buffalo Americas, Inc. (US), Pure Storage, Inc. (US), and QNAP Systems, Inc. (Taiwan).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018—2028 |

|

Base year |

2021 |

|

Forecast period |

2022—2028 |

|

Segments covered |

Design, Product, Storage Solution, Deployment Type, End-user Industry, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

NAS Companies covered |

The major market players include Dell Technologies Inc. (US), NetApp, Inc. (US), Hewlett Packard Enterprise Company (US), Hitachi, Ltd. (Japan), Western Digital Corporation (US), Seagate Technology Holdings Public Limited Company (US), NETGEAR, Inc. (US), Synology Inc. (Taiwan), Buffalo Americas, Inc. (US), Pure Storage, Inc. (US), and QNAP Systems, Inc. (Taiwan), and Others- total 25 players have been covered |

This research report categorizes the NAS market based on design, product, storage solution, deployment type, end-user industry, and region.

|

Aspect |

Details |

|

NAS Market, By Design : |

|

|

NAS Market, By Product : |

|

|

NAS Market, By Storage Solution : |

|

|

NAS Market, By Deployment Type : |

|

|

NAS Market, By End-user Industry : |

|

|

NAS Market, By Region: |

|

Recent Developments

- In September 2022, QNAP Systems, Inc. (Taiwan) launched QTS 5.0.1 NAS operating system. The new operating system strengthens overall security with increased convenience and performance for data protection and day-to-day usage. The new operating system offers advanced features such as secure RAID disk replacement, support for Enterprise SED (Self-Encrypting Drives), and Windows Search Protocol support for NAS shared folders.

- In July 2022, Western Digital Corporation (US) launched 22TB HDDs targeting three key segments: WD Gold HDDs for IT/data center channel customers, WD Red Pro for network attached storage (NAS), and WD Purple Pro for smart video/surveillance.

- In June 2022, Synology Inc. (Taiwan) announced the launch of a new 5-bay Synology DiskStation DS1522+. It is the latest compact solution in its plus line of all-in-one storage devices that help users of all sizes protect data, IT infrastructure, and physical assets professionally and securely while supporting a host of business, IT administration, and productivity applications.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the NAS market during 2022-2028?

The global NAS market is expected to record the CAGR of 12.1% from 2022-2028.

Which regions are expected to pose significant demand for NAS from 2022-2028?

Asia Pacific is expected to pose significant demand from 2022 to 2028. Major economies such as China, India, Japan and South Korea are expected to have a high potential for the future growth of the market. The North America region is expected hold high market share during the forecast period.

What are the major driving factors and opportunities in the NAS market?

Surging adoption of Internet of Things (IoT) technologies and connected devices, and rising data generation with surge in use of mobile computing devices are the factors driving the growth of the NAS market. Growing requirement of real-time data, and increasing adoption of hybrid cloud storage are projected to create lucrative opportunities for the players operating in the NAS market during the forecast period.

Which are the significant players operating in NAS market?

Key players operating in the NAS market are Dell Technologies Inc. (US), NetApp, Inc. (US), Hewlett Packard Enterprise Company (US), Hitachi, Ltd. (Japan), Western Digital Corporation (US), Seagate Technology Holdings Public Limited Company (US), NETGEAR, Inc. (US), Synology Inc. (Taiwan), Buffalo Americas, Inc. (US), Pure Storage, Inc. (US), and QNAP Systems, Inc. (Taiwan).

Which are the major end-user industries of the NAS market?

Banking, financial services, and insurance (BFSI), consumer goods & retail, telecommunications & ITES, healthcare, energy, government, education & research, media & entertainment, manufacturing, business & consulting are the major end-user industries of the NAS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 NAS MARKET: SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 NAS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

2.2.2 DEMAND-SIDE ANALYSIS

FIGURE 4 ESTIMATION METHODOLOGY (DEMAND SIDE): DEMAND FOR NAS, BY PRODUCT

FIGURE 5 ESTIMATION METHODOLOGY (DEMAND SIDE): DEMAND FOR NAS FOR BFSI END-USER INDUSTRY VERTICAL

2.2.3 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.3.1 Approach to derive market size using bottom-up analysis (demand side)

2.2.4 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.4.1 Approach to derive market size using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 NAS MARKET: RISK ASSESSMENT

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 58)

3.1 GROWTH RATE ASSUMPTIONS/FORECAST

FIGURE 10 1–8 BAYS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 MIDMARKET NAS SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 SCALE-OUT NAS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 13 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 14 HEALTHCARE SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2022 TO 2028

FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF NAS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN NAS MARKET

FIGURE 16 INCREASING GENERATION OF UNSTRUCTURED DATA FROM MOBILE COMPUTING DEVICES

4.2 NAS MARKET, BY DESIGN

FIGURE 17 1–8 BAYS SEGMENT TO DOMINATE NAS MARKET DURING FORECAST PERIOD

4.3 NAS MARKET, BY PRODUCT

FIGURE 18 MIDMARKET NAS SOLUTIONS SEGMENT TO DOMINATE NAS MARKET DURING FORECAST PERIOD

4.4 NAS MARKET, BY STORAGE SOLUTION AND DEPLOYMENT TYPE

FIGURE 19 SCALE-UP NAS AND ON-PREMISES SEGMENTS TO HOLD LARGEST SHARES OF NAS MARKET IN 2022

4.5 NAS MARKET, BY END-USER INDUSTRY

FIGURE 20 TELECOMMUNICATIONS & ITES TO LEAD NAS MARKET DURING FORECAST PERIOD

4.6 NAS MARKET, BY REGION

FIGURE 21 NORTH AMERICA TO HOLD LARGEST SHARE OF NAS MARKET IN 2022

4.7 NAS MARKET, BY COUNTRY

FIGURE 22 CHINA NAS MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2028

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 NAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising data generation with surge in use of mobile computing devices

5.2.1.2 Surging adoption of Internet of Things (IoT) technologies and connected devices

5.2.1.3 Growing use of 5G technology

FIGURE 24 NAS MARKET: DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Performance-related issues associated with network-attached storage (NAS) systems

5.2.2.2 Data security concerns

FIGURE 25 NAS MARKET: RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of hybrid cloud storage

5.2.3.2 Growing requirement for real-time data

FIGURE 26 NAS MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of proper infrastructure to secure data

5.2.4.2 High-latency issues associated with connecting storage devices over internet

FIGURE 27 NAS MARKET: CHALLENGES AND THEIR IMPACT

5.3 TECHNOLOGY ANALYSIS

5.3.1 ADJACENT TECHNOLOGIES

5.3.1.1 Storage area network (SAN)

5.3.1.2 Direct-attached storage (DAS)

TABLE 2 COMPARISON BETWEEN DAS, NAS, AND SAN

5.3.2 DEVELOPMENTS IN LINUX AND WINDOWS-BASED NAS SOLUTIONS

5.4 VALUE CHAIN ANALYSIS

FIGURE 28 GLOBAL NAS MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM ANALYSIS

FIGURE 29 NAS MARKET: ECOSYSTEM ANALYSIS

TABLE 3 NAS COMPANIES AND THEIR ROLE IN NAS ECOSYSTEM

5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 30 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS IN NAS MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 NAS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 INTENSITY OF COMPETITIVE RIVALRY

5.7.2 BARGAINING POWER OF SUPPLIERS

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 THREAT OF SUBSTITUTES

5.7.5 THREAT OF NEW ENTRANTS

5.8 AVERAGE SELLING PRICE ANALYSIS

TABLE 5 PRICE RANGE OF NAS OFFERED BY KEY PLAYERS

5.8.1 AVERAGE SELLING PRICE OF NAS SYSTEMS OFFERED BY KEY MARKET PLAYERS TO TOP THREE END-USER INDUSTRIES

FIGURE 31 AVERAGE SELLING PRICE OF NAS SYSTEMS OFFERED BY KEY MARKET PLAYERS TO TOP THREE END-USER INDUSTRIES

TABLE 6 AVERAGE SELLING PRICE OF NAS OFFERED BY KEY MARKET PLAYERS TO TOP THREE END-USER INDUSTRIES (USD)

5.9 CASE STUDY ANALYSES

5.9.1 MAGHUB SELECTED BUURST TO EXPAND ITS CLOUD STORAGE CAPABILITIES AND ELIMINATE COSTLY REWRITE IN PUBLISHING APPLICATION

5.9.2 GREAT BARRIER REEF LEGACY DEPLOYS QNAP NAS ON RESEARCH VESSEL TO PROTECT MARINE RESEARCH DATA

5.9.3 KOREAN GOVERNMENT SELECTED INFORTREND FOR SURVEILLANCE PROJECTS TO REDUCE HARDWARE FOOTPRINT BY 75%

5.9.4 ITCE SYSTEMHAUS GMBH USES TERASTATION NAS OFFERED BY BUFFALO AMERICAS AS STORAGE TARGET FOR PRIVATE CLOUD BACKUP SERVICE

5.9.5 HUAWEI TECHNOLOGIES HELPED PUREGOLD ENHANCE STORAGE RELIABILITY AND PERFORMANCE

5.10 TRADE ANALYSIS

FIGURE 32 IMPORT DATA FOR HS CODE 847170, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 33 EXPORT DATA FOR HS CODE 847170, BY COUNTRY, 2017–2021

5.11 PATENT ANALYSIS

FIGURE 34 NUMBER OF PATENTS GRANTED, 2012–2021

FIGURE 35 TOP 10 NAS COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 7 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.11.1 NAS MARKET: LIST OF MAJOR PATENTS

TABLE 8 NAS MARKET: LIST OF MAJOR PATENTS

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 9 NAS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF ANALYSIS

TABLE 10 MFN TARIFF FOR HS CODE 847170 EXPORTED BY US

TABLE 11 MFN TARIFF FOR HS CODE 847170 EXPORTED BY CHINA

5.14 STANDARDS AND REGULATIONS

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 REGULATORY STANDARDS

5.14.2.1 NIST Special Publication 800-53

5.14.2.2 Critical Infrastructure Protection Standards

5.14.2.3 ISO/IEC 24775

5.14.2.4 ISO 14001:2015

5.14.3 GOVERNMENT REGULATIONS

5.14.3.1 US

5.14.3.2 Europe

5.14.3.3 China

5.14.3.4 Japan

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

5.15.2 BUYING CRITERIA

FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

6 NAS MARKET, BY DESIGN (Page No. - 100)

6.1 INTRODUCTION

FIGURE 38 MORE THAN 20 BAYS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 NAS MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 19 NAS MARKET, BY DESIGN, 2022–2028 (USD MILLION)

6.2 1–8 BAYS

6.2.1 GROWING ADOPTION OF 1–8-BAY NAS SOLUTIONS IN SMALL AND MEDIUM-SIZED ENTERPRISES

6.3 8–12 BAYS

6.3.1 RISING NUMBER OF ENTERPRISES USING 8–12-BAY NAS SOLUTIONS

6.4 12–20 BAYS

6.4.1 RISING DEMAND FOR 12–20-BAY NAS SOLUTIONS FROM LARGE ENTERPRISES

6.5 MORE THAN 20 BAYS

6.5.1 RISING DEMAND FOR NAS SOLUTIONS WITH MORE THAN 20 BAYS WITH GENERATION OF LARGE VOLUMES OF DATA BY LARGE-SCALE BUSINESSES

7 NAS MARKET, BY PRODUCT (Page No. - 105)

7.1 INTRODUCTION

FIGURE 39 MIDMARKET NAS SOLUTIONS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 20 NAS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 21 NAS MARKET, BY PRODUCT, 2022–2028 (USD MILLION)

TABLE 22 NAS MARKET, BY PRODUCT, 2018–2021 (THOUSAND UNITS)

TABLE 23 NAS MARKET, BY PRODUCT, 2022–2028 (THOUSAND UNITS)

7.2 ENTERPRISE NAS SOLUTIONS

7.2.1 INCREASED DIGITAL CONTENT WITH RISING USE OF INTERNET

7.3 MIDMARKET NAS SOLUTIONS

7.3.1 GROWING ADOPTION OF MIDMARKET NAS SOLUTIONS BY SMALL AND MEDIUM-SIZED BUSINESSES

8 NAS MARKET, BY STORAGE SOLUTION (Page No. - 110)

8.1 INTRODUCTION

FIGURE 40 SCALE-OUT NAS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 25 NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

8.2 SCALE-UP NAS

8.2.1 LOW-COST ARCHITECTURE OF SCALE-UP NAS SYSTEMS

TABLE 26 SCALE-UP NAS: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 27 SCALE-UP NAS: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 28 SCALE-UP NAS: NAS MARKET FOR ON-PREMISES DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 29 SCALE-UP NAS: NAS MARKET FOR ON-PREMISES DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 30 SCALE-UP NAS: NAS MARKET FOR REMOTE/CLOUD DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 31 SCALE-UP NAS: NAS MARKET FOR REMOTE/CLOUD DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 32 SCALE-UP NAS: NAS MARKET FOR HYBRID DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 33 SCALE-UP NAS: NAS MARKET FOR HYBRID DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 34 SCALE-UP NAS: NAS MARKET FOR BFSI, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 SCALE-UP NAS: NAS MARKET FOR BFSI, BY REGION, 2022–2028 (USD MILLION)

TABLE 36 SCALE-UP NAS: NAS MARKET FOR CONSUMER GOODS & RETAIL, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 SCALE-UP NAS: NAS MARKET FOR CONSUMER GOODS & RETAIL, BY REGION, 2022–2028 (USD MILLION)

TABLE 38 SCALE-UP NAS: NAS MARKET FOR TELECOMMUNICATIONS & ITES, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 SCALE-UP NAS: NAS MARKET FOR TELECOMMUNICATIONS & ITES, BY REGION, 2022–2028 (USD MILLION)

TABLE 40 SCALE-UP NAS: NAS MARKET FOR HEALTHCARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 SCALE-UP NAS: NAS MARKET FOR HEALTHCARE, BY REGION, 2022–2028 (USD MILLION)

TABLE 42 SCALE-UP NAS: NAS MARKET FOR ENERGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 SCALE-UP NAS: NAS MARKET FOR ENERGY, BY REGION, 2022–2028 (USD MILLION)

TABLE 44 SCALE-UP NAS: NAS MARKET FOR GOVERNMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 SCALE-UP NAS: NAS MARKET FOR GOVERNMENT, BY REGION, 2022–2028 (USD MILLION)

TABLE 46 SCALE-UP NAS: NAS MARKET FOR EDUCATION & RESEARCH, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 SCALE-UP NAS: NAS MARKET FOR EDUCATION & RESEARCH, BY REGION, 2022–2028 (USD MILLION)

TABLE 48 SCALE-UP NAS: NAS MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 SCALE-UP NAS: NAS MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2022–2028 (USD MILLION)

TABLE 50 SCALE-UP NAS: NAS MARKET FOR MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 SCALE-UP NAS: NAS MARKET FOR MANUFACTURING, BY REGION, 2022–2028 (USD MILLION)

TABLE 52 SCALE-UP NAS: NAS MARKET FOR BUSINESS & CONSULTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 SCALE-UP NAS: NAS MARKET FOR BUSINESS & CONSULTING, BY REGION, 2022–2028 (USD MILLION)

TABLE 54 SCALE-UP NAS: NAS MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 SCALE-UP NAS: NAS MARKET FOR OTHERS, BY REGION, 2022–2028 (USD MILLION)

TABLE 56 SCALE-UP NAS: NORTH AMERICA NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 SCALE-UP NAS: NORTH AMERICA NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 58 SCALE-UP NAS: EUROPE NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 SCALE-UP NAS: EUROPE NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 60 SCALE-UP NAS: ASIA PACIFIC NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 SCALE-UP NAS: ASIA PACIFIC NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 62 SCALE-UP NAS: ROW NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 SCALE-UP NAS: ROW NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

8.3 SCALE-OUT NAS

8.3.1 GROWING DEMAND FOR SEAMLESS AND SCALABLE STORAGE SPACE OVER ENTERPRISE NETWORKS

TABLE 64 SCALE-OUT NAS: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 65 SCALE-OUT NAS: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 66 SCALE-OUT NAS: NAS MARKET FOR ON-PREMISES DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 67 SCALE-OUT NAS: NAS MARKET FOR ON-PREMISES DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 68 SCALE-OUT NAS: NAS MARKET FOR REMOTE/CLOUD DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 69 SCALE-OUT NAS: NAS MARKET FOR REMOTE/CLOUD DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 70 SCALE-OUT NAS: NAS MARKET FOR HYBRID DEPLOYMENT, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 71 SCALE-OUT NAS: NAS MARKET FOR HYBRID DEPLOYMENT, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 72 SCALE-OUT NAS: NAS MARKET FOR BFSI, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 SCALE-OUT NAS: NAS MARKET FOR BFSI, BY REGION, 2022–2028 (USD MILLION)

TABLE 74 SCALE-OUT NAS: NAS MARKET FOR CONSUMER GOODS & RETAIL, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 SCALE-OUT NAS: NAS MARKET FOR CONSUMER GOODS & RETAIL, BY REGION, 2022–2028 (USD MILLION)

TABLE 76 SCALE-OUT NAS: NAS MARKET FOR TELECOMMUNICATIONS & ITES, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 SCALE-OUT NAS: NAS MARKET FOR TELECOMMUNICATIONS & ITES, BY REGION, 2022–2028 (USD MILLION)

TABLE 78 SCALE-OUT NAS: NAS MARKET FOR HEALTHCARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 SCALE-OUT NAS: NAS MARKET FOR HEALTHCARE, BY REGION, 2022–2028 (USD MILLION)

TABLE 80 SCALE-OUT NAS: NAS MARKET FOR ENERGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 SCALE-OUT NAS: NAS MARKET FOR ENERGY, BY REGION, 2022–2028 (USD MILLION)

TABLE 82 SCALE-OUT NAS: NAS MARKET FOR GOVERNMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 SCALE-OUT NAS: NAS MARKET FOR GOVERNMENT, BY REGION, 2022–2028 (USD MILLION)

TABLE 84 SCALE-OUT NAS: NAS MARKET FOR EDUCATION & RESEARCH, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 SCALE-OUT NAS: NAS MARKET FOR EDUCATION & RESEARCH, BY REGION, 2022–2028 (USD MILLION)

TABLE 86 SCALE-OUT NAS: NAS MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 SCALE-OUT NAS: NAS MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2022–2028 (USD MILLION)

TABLE 88 SCALE-OUT NAS: NAS MARKET FOR MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 SCALE-OUT NAS: NAS MARKET FOR MANUFACTURING, BY REGION, 2022–2028 (USD MILLION)

TABLE 90 SCALE-OUT NAS: NAS MARKET FOR BUSINESS & CONSULTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 SCALE-OUT NAS: NAS MARKET FOR BUSINESS & CONSULTING, BY REGION, 2022–2028 (USD MILLION)

TABLE 92 SCALE-OUT NAS: NAS MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 SCALE-OUT NAS: NAS MARKET FOR OTHERS, BY REGION, 2022–2028 (USD MILLION)

TABLE 94 SCALE-OUT NAS: NORTH AMERICA NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 SCALE-OUT NAS: NORTH AMERICA NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 96 SCALE-OUT NAS: EUROPE NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 SCALE-OUT NAS: EUROPE NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 98 SCALE-OUT NAS: ASIA PACIFIC NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 SCALE-OUT NAS: ASIA PACIFIC NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 100 SCALE-OUT NAS: ROW NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 SCALE-OUT NAS: ROW NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

9 NAS MARKET, BY DEPLOYMENT TYPE (Page No. - 140)

9.1 INTRODUCTION

FIGURE 41 HYBRID SEGMENT TO REGISTER HIGHEST CAGR IN NAS MARKET FROM 2022 TO 2028

TABLE 102 NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 103 NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

9.2 ON-PREMISES

9.2.1 REDUCTION IN INTERNET COSTS AND HIGH SECURITY

TABLE 104 ON-PREMISES: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 105 ON-PREMISES: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 106 ON-PREMISES: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 107 ON-PREMISES: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

9.3 REMOTE/CLOUD

9.3.1 LOW COST OF OWNERSHIP ASSOCIATED WITH REMOTE/CLOUD DEPLOYMENT TYPE

TABLE 108 REMOTE/CLOUD: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 109 REMOTE/CLOUD: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 110 REMOTE/CLOUD: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 111 REMOTE/CLOUD: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

9.4 HYBRID

9.4.1 HIGH AGILITY AND SCALABILITY FEATURES OF HYBRID DEPLOYMENT TYPE

TABLE 112 HYBRID: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 113 HYBRID: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 114 HYBRID: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 115 HYBRID: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

10 NAS MARKET, BY END-USER INDUSTRY (Page No. - 149)

10.1 INTRODUCTION

FIGURE 42 HEALTHCARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 116 NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 117 NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.2.1 INCREASING DEPLOYMENT OF NAS SYSTEMS IN BFSI SECTOR WITH RISE IN DATA BREACHES

TABLE 118 BFSI: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 119 BFSI: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 120 BFSI: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 121 BFSI: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 122 BFSI: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 123 BFSI: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.3 CONSUMER GOODS & RETAIL

10.3.1 RISING DEMAND FOR NAS SOLUTIONS IN EXPANDING RETAIL AND E-COMMERCE INDUSTRIES

TABLE 124 CONSUMER GOODS & RETAIL: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 125 CONSUMER GOODS & RETAIL: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 126 CONSUMER GOODS & RETAIL: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 127 CONSUMER GOODS & RETAIL: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 128 CONSUMER GOODS & RETAIL: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 129 CONSUMER GOODS & RETAIL: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.4 TELECOMMUNICATIONS & ITES

10.4.1 SURGING DEMAND FOR STORAGE SOLUTIONS HAVING HIGH DATA STORAGE CAPACITY

TABLE 130 TELECOMMUNICATIONS & ITES: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 131 TELECOMMUNICATIONS & ITES: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 132 TELECOMMUNICATIONS & ITES: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 133 TELECOMMUNICATIONS & ITES: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 134 TELECOMMUNICATIONS & ITES: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 135 TELECOMMUNICATIONS & ITES: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.5 HEALTHCARE

10.5.1 RISING DEMAND FOR NAS SOLUTIONS FOR EFFECTIVE DATA STORAGE AND MANAGEMENT

TABLE 136 HEALTHCARE: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 137 HEALTHCARE: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 138 HEALTHCARE: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 139 HEALTHCARE: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 140 HEALTHCARE: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 141 HEALTHCARE: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.6 ENERGY

10.6.1 INCREASED DEPLOYMENT OF NAS SOLUTIONS IN ENERGY INDUSTRY TO ENSURE HIGH-SPEED DATA TRANSFER

TABLE 142 ENERGY: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 143 ENERGY: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 144 ENERGY: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 145 ENERGY: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 146 ENERGY: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 147 ENERGY: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.7 GOVERNMENT

10.7.1 INCREASED DEMAND FOR NAS SYSTEMS WITH GROWING NEED FOR ROBUST, SECURE, AND LOW-COST STORAGE INFRASTRUCTURES

TABLE 148 GOVERNMENT: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 149 GOVERNMENT: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 150 GOVERNMENT: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 151 GOVERNMENT: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 152 GOVERNMENT: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 153 GOVERNMENT: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.8 EDUCATION & RESEARCH

10.8.1 RISING NEED FOR NAS SOLUTIONS TO ENSURE EASY AND SECURE ACCESS TO RESEARCH DOCUMENTS, PRESENTATIONS, AND PROJECT FILES FROM MULTIPLE LOCATIONS

TABLE 154 EDUCATION & RESEARCH: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 155 EDUCATION & RESEARCH: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 156 EDUCATION & RESEARCH: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 157 EDUCATION & RESEARCH: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 158 EDUCATION & RESEARCH: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 159 EDUCATION & RESEARCH: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.9 MEDIA & ENTERTAINMENT

10.9.1 INCREASED ADOPTION OF NAS SOLUTIONS FOR SMOOTH CONTENT DELIVERY ACROSS MEDIA & ENTERTAINMENT INDUSTRY

TABLE 160 MEDIA & ENTERTAINMENT: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 161 MEDIA & ENTERTAINMENT: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 162 MEDIA & ENTERTAINMENT: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 163 MEDIA & ENTERTAINMENT: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 164 MEDIA & ENTERTAINMENT: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 165 MEDIA & ENTERTAINMENT: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.10 MANUFACTURING

10.10.1 RISING DEMAND FOR ADVANCED NAS SOLUTIONS TO TRACK HISTORICAL DATA RELATED TO MANUFACTURING AND SUPPLY CHAIN MANAGEMENT

TABLE 166 MANUFACTURING: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 167 MANUFACTURING: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 168 MANUFACTURING: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 169 MANUFACTURING: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 170 MANUFACTURING: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 171 MANUFACTURING: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.11 BUSINESS & CONSULTING

10.11.1 RISE IN INSTALLATION OF NAS SYSTEMS TO PROTECT DATA FROM UNAUTHORIZED ENTITIES

TABLE 172 BUSINESS & CONSULTING: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 173 BUSINESS & CONSULTING: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 174 BUSINESS & CONSULTING: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 175 BUSINESS & CONSULTING: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 176 BUSINESS & CONSULTING: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 177 BUSINESS & CONSULTING: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

10.12 OTHERS

TABLE 178 OTHERS: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 179 OTHERS: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 180 OTHERS: NAS MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 181 OTHERS: NAS MARKET, BY DEPLOYMENT TYPE, 2022–2028 (USD MILLION)

TABLE 182 OTHERS: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 183 OTHERS: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

11 ESSENTIAL COMPONENTS OF NAS SOLUTIONS (Page No. - 178)

11.1 INTRODUCTION

FIGURE 43 ESSENTIAL COMPONENTS OF NAS SOLUTION

FIGURE 44 NAS ARCHITECTURE

11.2 HARDWARE

11.3 SOFTWARE

12 NAS MARKET, BY REGION (Page No. - 180)

12.1 INTRODUCTION

FIGURE 45 ASIA PACIFIC NAS MARKET TO REGISTER HIGHEST CAGR DURING REVIEW PERIOD

TABLE 184 NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 185 NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: SNAPSHOT OF NAS MARKET

TABLE 186 NORTH AMERICA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 187 NORTH AMERICA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 188 NORTH AMERICA: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 189 NORTH AMERICA: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

FIGURE 47 US TO RECORD HIGHEST CAGR IN NORTH AMERICAN NAS MARKET DURING FORECAST PERIOD

TABLE 190 NORTH AMERICA: NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 191 NORTH AMERICA: NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 192 US: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 193 US: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 194 CANADA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 195 CANADA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 196 MEXICO: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 197 MEXICO: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

12.2.1 US

12.2.1.1 Growing retail and telecommunications industries

12.2.2 CANADA

12.2.2.1 Increasing investments in data center infrastructure development

12.2.3 MEXICO

12.2.3.1 Favorable government policies to promote manufacturing activities

12.3 EUROPE

FIGURE 48 EUROPE: SNAPSHOT OF NAS MARKET

TABLE 198 EUROPE: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 199 EUROPE: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 200 EUROPE: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 201 EUROPE: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

FIGURE 49 GERMANY TO REGISTER HIGHEST CAGR IN EUROPEAN NAS MARKET DURING FORECAST PERIOD

TABLE 202 EUROPE: NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 203 EUROPE: NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 204 UK: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 205 UK: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 206 GERMANY: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 207 GERMANY: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 208 FRANCE: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 209 FRANCE: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 210 REST OF EUROPE: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 211 REST OF EUROPE: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

12.3.1 UK

12.3.1.1 High demand for hybrid storage solutions in BFSI sector and retail and telecommunications industries

12.3.2 GERMANY

12.3.2.1 Increasing unstructured data generation with technological advancements in automotive industry

12.3.3 FRANCE

12.3.3.1 Government-led support to develop IT infrastructure in healthcare sector

12.3.4 REST OF EUROPE

12.4 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC: SNAPSHOT OF NAS MARKET

TABLE 212 ASIA PACIFIC: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 213 ASIA PACIFIC: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 214 ASIA PACIFIC: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 215 ASIA PACIFIC: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

FIGURE 51 CHINA TO REGISTER HIGHEST CAGR IN ASIA PACIFIC NAS MARKET DURING FORECAST PERIOD

TABLE 216 ASIA PACIFIC: NAS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 217 ASIA PACIFIC: NAS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 218 CHINA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 219 CHINA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 220 JAPAN: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 221 JAPAN: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 222 INDIA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 223 INDIA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 224 SOUTH KOREA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 225 SOUTH KOREA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 226 REST OF ASIA PACIFIC: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increasing investments by Chinese telecom operators in commercialization of 5G technology

12.4.2 JAPAN

12.4.2.1 Favorable government initiatives to increase adoption of next-generation data storage solutions

12.4.3 INDIA

12.4.3.1 Rise in number of SMEs

12.4.4 SOUTH KOREA

12.4.4.1 Rising implementation of IoT technologies and big data analytics

12.4.5 REST OF ASIA PACIFIC

12.5 ROW

TABLE 228 ROW: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 229 ROW: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 230 ROW: NAS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 231 ROW: NAS MARKET, BY END-USER INDUSTRY, 2022–2028 (USD MILLION)

TABLE 232 ROW: NAS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 233 ROW: NAS MARKET, BY REGION, 2022–2028 (USD MILLION)

TABLE 234 MIDDLE EAST & AFRICA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

TABLE 236 SOUTH AMERICA: NAS MARKET, BY STORAGE SOLUTION, 2018–2021 (USD MILLION)

TABLE 237 SOUTH AMERICA: NAS MARKET, BY STORAGE SOLUTION, 2022–2028 (USD MILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Increasing investments by governments in development of healthcare infrastructure

12.5.2 SOUTH AMERICA

12.5.2.1 Rising number of data centers

13 COMPETITIVE LANDSCAPE (Page No. - 214)

13.1 OVERVIEW

13.1.1 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR MARKET PLAYERS

TABLE 238 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR MARKET PLAYERS

13.2 REVENUE ANALYSIS

FIGURE 52 REVENUE ANALYSIS OF TOP 5 NETWORK ATTACHED STORAGE COMPANIES IN LAST 3 YEARS

13.3 MARKET SHARE ANALYSIS (2021)

TABLE 239 NAS MARKET: DEGREE OF COMPETITION

13.4 COMPANY EVALUATION MATRIX

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 53 NAS MARKET, COMPANY EVALUATION MATRIX, 2021

13.5 STARTUP/SME EVALUATION MATRIX

TABLE 240 STARTUPS IN NAS MARKET

13.5.1 PROGRESSIVE NAS COMPANIES

13.5.2 RESPONSIVE NAS COMPANIES

13.5.3 DYNAMIC NAS COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 54 STARTUP/SME EVALUATION MATRIX, 2021

TABLE 241 STARTUP/SME MATRIX: DETAILED LIST OF KEY STARTUPS

13.6 COMPETITIVE BENCHMARKING

TABLE 242 NAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME BY END-USER INDUSTRY

TABLE 243 NAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME BY REGION

13.7 NAS MARKET: COMPANY FOOTPRINT

TABLE 244 COMPANY FOOTPRINT

TABLE 245 COMPANY DESIGN FOOTPRINT

TABLE 246 COMPANY PRODUCT FOOTPRINT

TABLE 247 COMPANY STORAGE SOLUTION FOOTPRINT

TABLE 248 COMPANY DEPLOYMENT TYPE FOOTPRINT

TABLE 249 COMPANY END-USER INDUSTRY FOOTPRINT

TABLE 250 COMPANY REGIONAL FOOTPRINT

13.8 COMPETITIVE SCENARIO AND TRENDS

13.8.1 PRODUCT LAUNCHES

TABLE 251 PRODUCT LAUNCHES, 2018–2021

13.8.2 DEALS

TABLE 252 DEALS, 2018–2021

14 COMPANY PROFILES (Page No. - 254)

14.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

14.1.1 DELL TECHNOLOGIES INC.

TABLE 253 DELL TECHNOLOGIES INC.: COMPANY OVERVIEW

FIGURE 55 DELL TECHNOLOGIES INC.: COMPANY SNAPSHOT

TABLE 254 DELL TECHNOLOGIES INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 255 DELL TECHNOLOGIES INC.: DEALS

TABLE 256 DELL TECHNOLOGIES INC.: PRODUCT LAUNCHES

14.1.2 NETAPP, INC.

TABLE 257 NETAPP, INC.: COMPANY OVERVIEW

FIGURE 56 NETAPP, INC.: COMPANY SNAPSHOT

TABLE 258 NETAPP, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 259 NETAPP, INC: DEALS

TABLE 260 NETAPP, INC.: PRODUCT LAUNCHES

14.1.3 HEWLETT PACKARD ENTERPRISE COMPANY

TABLE 261 HEWLETT PACKARD ENTERPRISE COMPANY (HPE): COMPANY OVERVIEW

FIGURE 57 HEWLETT PACKARD ENTERPRISE COMPANY: COMPANY SNAPSHOT

TABLE 262 HEWLETT PACKARD ENTERPRISE COMPANY: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 263 HEWLETT PACKARD ENTERPRISE COMPANY: DEALS

TABLE 264 HEWLETT PACKARD ENTERPRISE COMPANY: PRODUCT LAUNCHES

14.1.4 HITACHI, LTD.

TABLE 265 HITACHI, LTD.: COMPANY OVERVIEW

FIGURE 58 HITACHI, LTD.: COMPANY SNAPSHOT

TABLE 266 HITACHI, LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 267 HITACHI, LTD.: DEALS

TABLE 268 HITACHI, LTD.: PRODUCT LAUNCHES

14.1.5 WESTERN DIGITAL CORPORATION

TABLE 269 WESTERN DIGITAL CORPORATION: COMPANY OVERVIEW

FIGURE 59 WESTERN DIGITAL CORPORATION: COMPANY SNAPSHOT

TABLE 270 WESTERN DIGITAL CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 271 WESTERN DIGITAL CORPORATION: DEALS

TABLE 272 WESTERN DIGITAL CORPORATION: PRODUCT LAUNCHES

14.1.6 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY

TABLE 273 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY: COMPANY OVERVIEW

FIGURE 60 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY: COMPANY SNAPSHOT

TABLE 274 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY: PRODUCT/SOLUTION/ SERVICE OFFERINGS

TABLE 275 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY: DEALS

TABLE 276 SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY: PRODUCT LAUNCHES

14.1.7 NETGEAR, INC.

TABLE 277 NETGEAR, INC.: COMPANY OVERVIEW

FIGURE 61 NETGEAR, INC.: COMPANY SNAPSHOT

TABLE 278 NETGEAR, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 279 NETGEAR, INC.: PRODUCT LAUNCHES

TABLE 280 NETGEAR, INC.: DEALS

14.1.8 SYNOLOGY INC.

TABLE 281 SYNOLOGY INC.: COMPANY OVERVIEW

TABLE 282 SYNOLOGY INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 283 SYNOLOGY INC.: DEALS

TABLE 284 SYNOLOGY INC.: PRODUCT LAUNCHES

TABLE 285 SYNOLOGY INC.: OTHERS

14.1.9 BUFFALO AMERICAS, INC.

TABLE 286 BUFFALO AMERICAS, INC.: COMPANY OVERVIEW

TABLE 287 BUFFALO AMERICAS, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 288 BUFFALO AMERICAS, INC.: PRODUCT LAUNCHES

14.1.10 PURE STORAGE, INC.

TABLE 289 PURE STORAGE, INC.: COMPANY OVERVIEW

FIGURE 62 PURE STORAGE, INC.: COMPANY SNAPSHOT

TABLE 290 PURE STORAGE, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 291 PURE STORAGE, INC.: DEALS

TABLE 292 PURE STORAGE, INC.: PRODUCT LAUNCHES

14.1.11 QNAP SYSTEMS, INC.

TABLE 293 QNAP SYSTEMS, INC.: COMPANY OVERVIEW

TABLE 294 QNAP SYSTEMS, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 295 QNAP SYSTEMS INC.: DEALS

TABLE 296 QNAP SYSTEMS, INC.: PRODUCT LAUNCHES

14.1.12 DROBO, INC.

TABLE 297 DROBO, INC.: COMPANY OVERVIEW

TABLE 298 DROBO, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 299 DROBO, INC.: DEALS

14.1.13 ASUATOR INC.

TABLE 300 ASUSTOR INC.: COMPANY OVERVIEW

TABLE 301 ASUSTOR INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 302 ASUSTOR INC.: DEALS

TABLE 303 ASUSTOR INC.: PRODUCT LAUNCHES

14.1.14 IBM CORPORATION

TABLE 304 IBM CORPORATION: COMPANY OVERVIEW

FIGURE 63 IBM CORPORATION: COMPANY SNAPSHOT

TABLE 305 IBM CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 306 IBM CORPORATION: DEALS

TABLE 307 IBM CORPORATION: PRODUCT LAUNCHES

14.1.15 HUAWEI TECHNOLOGIES CO., LTD.

TABLE 308 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

FIGURE 64 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

TABLE 309 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 310 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 MICROSOFT CORPORATION

14.2.2 D-LINK CORPORATION

14.2.3 THECUS TECHNOLOGY CORP.

14.2.4 INFORTREND TECHNOLOGY INC.

14.2.5 PANASAS

14.2.6 BUURST INC.

14.2.7 NASUNI CORPORATION

14.2.8 PROMISE TECHNOLOGY INC.

14.2.9 SPECTRA LOGIC CORPORATION

14.2.10 IXSYSTEMS, INC.

15 APPENDIX (Page No. - 353)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

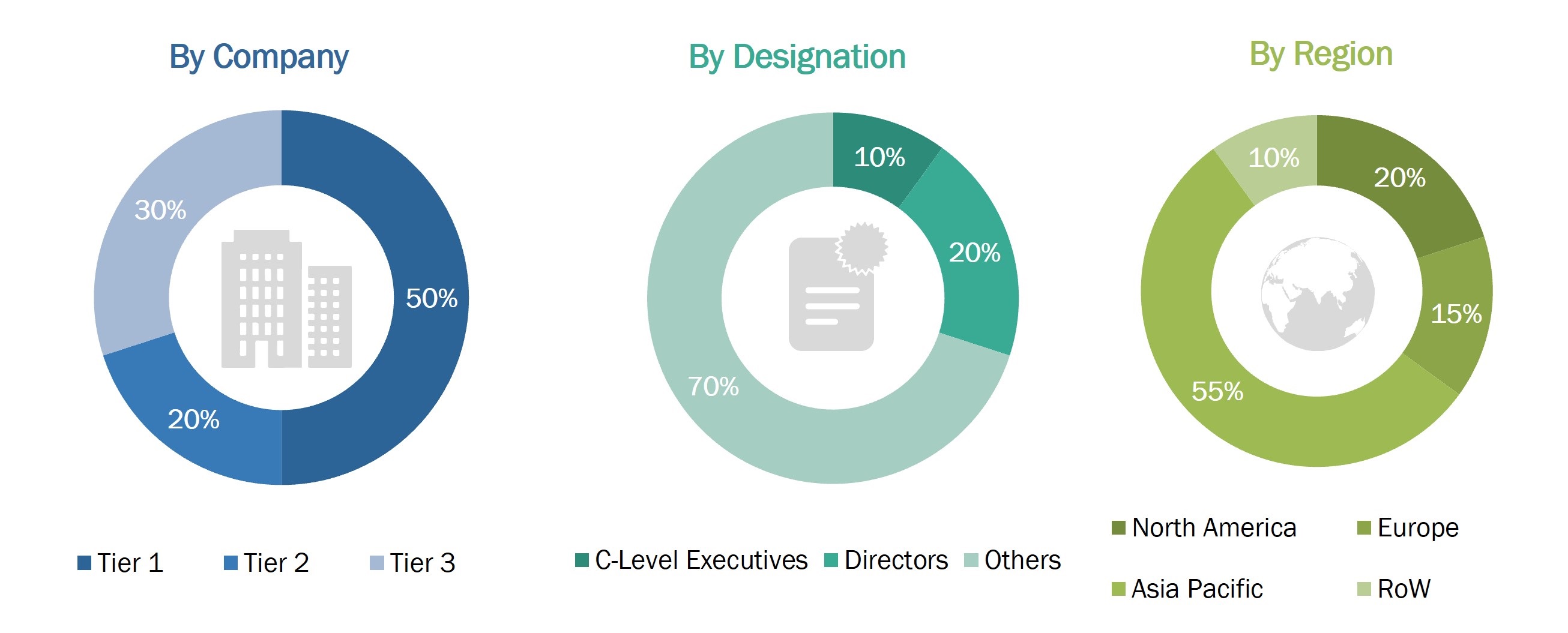

The study involved four major activities in estimating the size for Network Attached Storage (NAS) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of NAS companies, white papers, and articles by recognized authors were referred to. Secondary research was done to obtain key information about the market’s supply chain, value chain, the pool of key market players, and market segmentation according to industry trends, regions, and developments from both market and technology perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the NAS market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, we have implemented both top-down and bottom-up approaches to estimate and validate the size of the NAS market and various other dependent submarkets. The key players in the NAS market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players and interviews with experts (such as CEOs, COOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

NAS Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the network-attached storage (NAS) market in terms of value based on design, product, storage solution, deployment type, end-user industry, and region

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To define, describe, segment, and forecast the size of the NAS market in terms of volume based on product

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the NAS market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the NAS ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the NAS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of NAS companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Attached Storage Market