Smart Robots Market Size, Share & Trends, 2025 To 2030

Smart Robots Market by Component (Sensors, Actuators, Power Sources, Control Systems, Software), Type (Industrial, Service), Operating Environment (Ground, Underwater), Mobility (Stationary, Mobile), Application and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

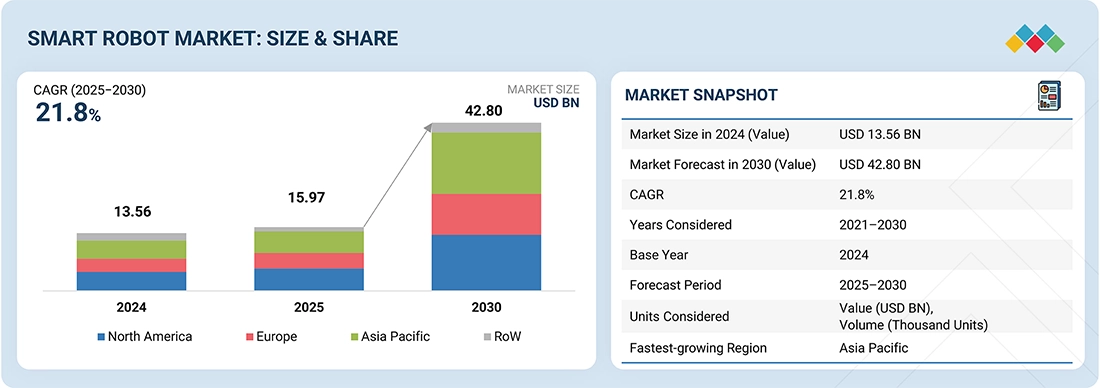

The global smart robot market is expected to grow from USD 15.97 billion in 2025 to USD 42.80 billion by 2030, at a CAGR of 21.8% from 2025 to 2030. The increasing adoption of artificial intelligence and smart sensor technologies significantly contributes to the rising demand for robots in industries. AI enables robots to perform sophisticated tasks independently, learn from experience, and adapt to changing environments. On the other hand, advanced sensors improve their sense, enabling precise detection, navigation, and interaction with the environment. These advancements are expanding the application of smart robots into new fields, including healthcare, agriculture, logistics, and personal and domestic use. As companies strive for greater efficiency, safety, and accuracy, the combination of AI and sensors is making smart robots an increasingly valuable resource, propelling their widespread adoption and market expansion.

KEY TAKEAWAYS

-

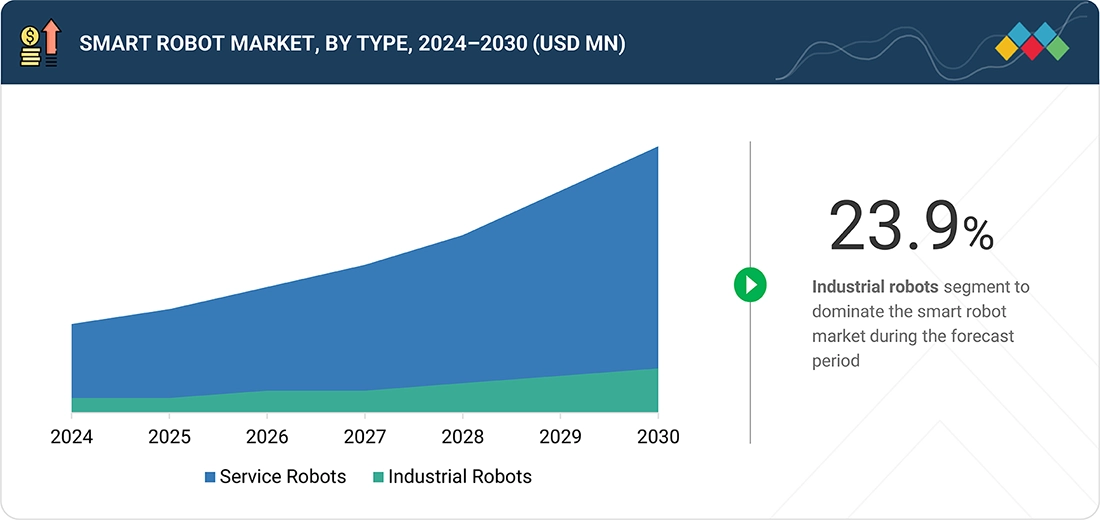

BY TYPEBy type, the industrial robot segment is projected to grow at the highest CAGR of 26.7% in terms of value during the forecast period.

-

BY COMPONENTBy component, the hardware segment is expected to hold a larger share of 58.8% of the smart robot market in 2025.

-

BY MOBILITYBy mobility, the mobile segment accounted for the largest market size in 2024.

-

BY OPERATING ENVIRONMENTBy operating environment, the ground segment is projected to grow at the highest CAGR of 22.0% in terms of value during the forecast period.

-

BY APPLICATIONBy application, the professional segment accounted for a share of 63.7% in terms of value in 2024.

-

BY REGIONBy region, North America is estimated to dominate the smart robot market with a share of 35.5% in 2025.

-

COMPETITIVE LANDSCAPEiRobot Corporation, SoftBank Robotics Group, ABB, and Kuka AG were identified as Star players in the smart robot market, given their broad industry coverage and strong operational & financial strength.

The smart robot market is projected to grow from USD 15.97 billion in 2025 to USD 42.80 billion by 2030, at a CAGR of 21.8% during this period. One of the primary drivers behind the rising popularity of smart robots is the growing emphasis on manufacturing automation. As industries face increasing pressure to improve productivity, reduce costs, and maintain high-quality output, automation has become essential. AI-driven robots equipped with sensors can perform complex and repetitive tasks with high precision and consistency. In light of these benefits, companies in the market are adopting strategies such as technological innovation, product customization, and strategic partnerships. Leading organizations are focusing on integrating machine learning, edge computing, and vision systems to develop smarter and more responsive robots.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

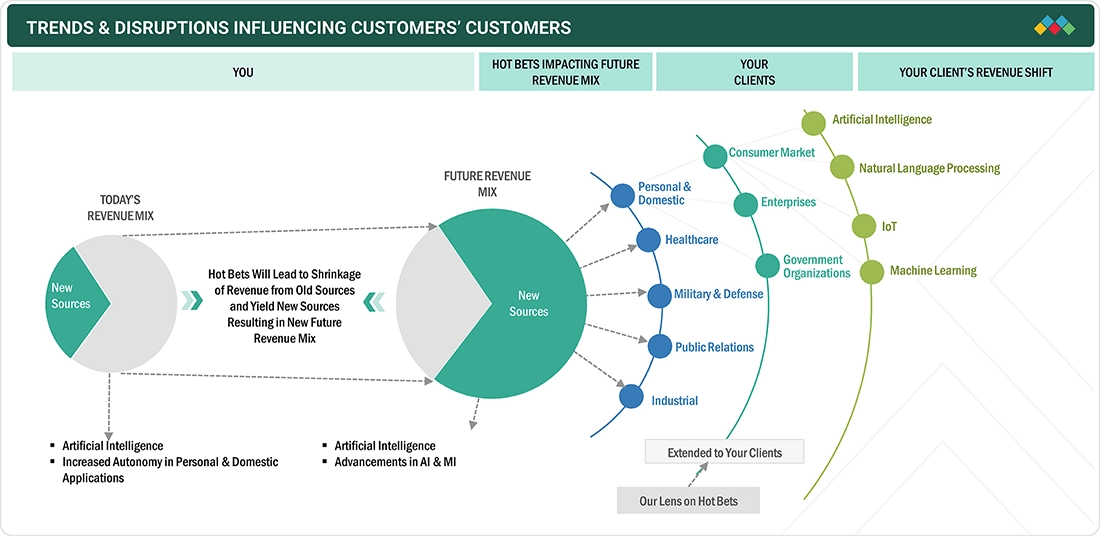

The smart robots market is undergoing significant transformation, driven by advancements in artificial intelligence (AI), machine learning (ML), and automation. Businesses are shifting away from traditional revenue sources toward AI-powered autonomy, particularly in personal, domestic, and industrial applications. The growing adoption of AI is creating new revenue streams in key sectors, such as healthcare, military & defense, public relations, and industrial automation. Additionally, enterprises and government organizations are witnessing a shift in their revenue models, influenced by emerging technologies such as natural language processing (NLP), the Internet of Things (IoT), and machine learning. These innovations are reshaping business models and creating new market opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of AI- and advanced sensor technology-enabled robots in newer applications

-

Rising deployment of IoT-integrated robots to ensure cost-efficient predictive maintenance

Level

-

Data privacy and cybersecurity concerns and lack of standardized regulatory framework

-

Workforce resistance due to job displacement concerns

Level

-

Advancements in swarm intelligence enabling robots to execute complex tasks with ease

-

Growing adoption of smart robots for elderly care, disability assistance, and companionship

Level

-

Technical and environmental barriers restricting deployment in critical applications

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of AI- and advanced sensor technology-enabled robots in newer applications

The smart robot market is witnessing a surge in demand as robots are increasingly being adopted in newer and innovative applications across various sectors. Beyond traditional industrial uses, robots are now deployed in diverse fields, such as healthcare, agriculture, education, and even entertainment. For instance, in healthcare, robots assist in surgeries with precision and consistency that surpass human capabilities, as well as in patient care and rehabilitation applications. The integration of smart robots into healthcare is a transformative trend reshaping medical procedures and patient care.

Restraint: Data privacy and cybersecurity concerns and lack of standardized regulatory framework

The increasing deployment of smart robots in various sectors, including healthcare, manufacturing, and retail, raises significant concerns regarding data privacy and security issues. These robots are often equipped with advanced sensors, cameras, and connectivity solutions that collect and process vast volumes of data. Although this enables them to function intelligently, it exposes sensitive data to potential breaches and misuse. Concerns regarding the ethical handling of data, ownership of data, and the risk of cyberattacks pose significant restraints to the widespread adoption of smart robots, particularly in industries where confidentiality is crucial.

Opportunity: Advancements in swarm intelligence enabling robots to execute complex tasks with ease

Swarm intelligence technology is emerging as a transformative force in the smart robots market, enabling multiple robots to collaborate seamlessly in executing complex tasks. Inspired by the collective behavior of biological systems such as ant colonies and bee swarms, this approach leverages decentralized control, robust communication networks, and advanced algorithms to enhance efficiency and flexibility in task execution. It is particularly beneficial in environments where individual robots would struggle to operate effectively independently.

Challenge: Technical and environmental barriers restricting deployment in critical applications

Robots are used in various critical applications, such as medical surgeries, bomb disposal, and the security and assistance of senior citizens. However, since robots cannot be programmed for every possible scenario, their deployment in critical applications, such as complex medical procedures, remains limited. Technical issues, such as software viruses and connectivity issues, can hinder performance during critical operations. To address these challenges, more precise programming, along with reliable internet connectivity and power backup, is essential for more accurate performance by robots.

Smart Robots Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used for personal & domestic applications such as cleaning, bin emptying, pad washing, and self-cleaning cycles. | Compatible with all operating systems, such as Android, Chrome OS, Windows, iOS, and macOS, it also learns cleaning rules, asks for and responds to feedback, and remembers how to react |

|

Used for personal & domestic, and professional applications, such as vacuuming, sweeping, scrubbing, and mopping. Also offers various smart delivery robots for high-end hospitality in hotels, restaurants, and other applications, as well as humanoids for educational institutions, research facilities, and new communication and entertainment applications | Act as an intelligent commercial robot that consolidates sweeping, mopping, vacuuming, and drying into one unit. Humanoids are equipped with voice interaction through a tablet on its chest, facial recognition, and emotion recognition |

|

Articulated, Collaborative, Delta, Scara, and Paint Robot used for various professional applications such as material handling, machine tending, cutting, assembling, testing, inspecting, dispensing, grinding, and polishing | Automate high-volume and repetitive tasks with consistent speed and reliability, resulting in substantial gains in output for industries like automotive, electronics, and logistics. |

|

Articulated and collaborative technologies are used in various professional applications, including material handling, assembly, welding, and polishing. They cater to a wide array of industries, from automotive manufacturing to logistics | Flexible in installation for small parts assembly, material handling, or testing and handle more demanding tasks while still maintaining flexibility and safety in a collaborative setting |

|

Industrial, automotive, manufacturing, and others enhancing automation, productivity, and precision | These robots excel in high-volume production by operating 24/7 with minimal downtime, increasing throughput and speeding up production cycles |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

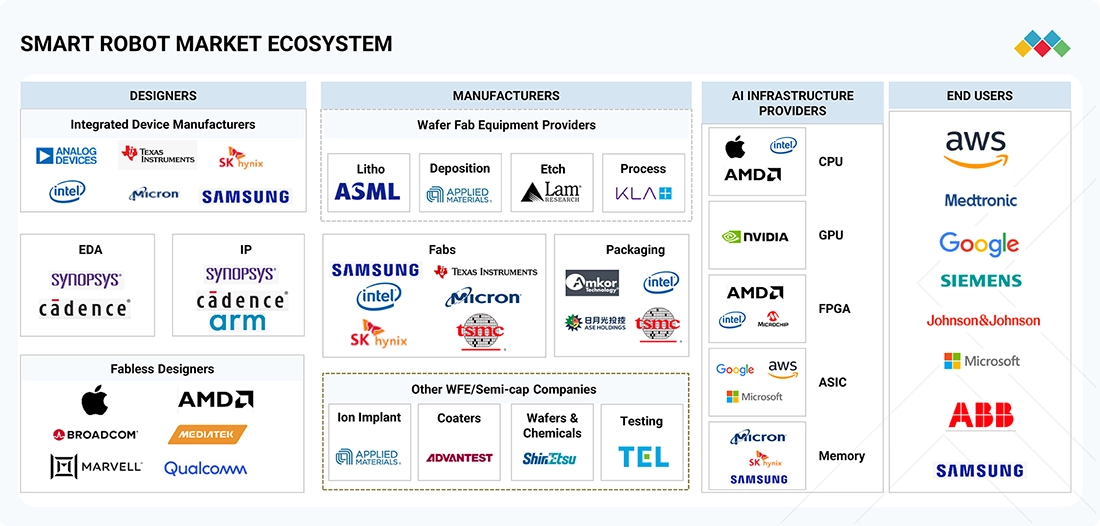

MARKET ECOSYSTEM

The smart robot market is a rapidly evolving space, driven by advancements in artificial intelligence, machine learning, and robotics technologies. These robots are equipped with cutting-edge capabilities, including autonomous decision-making, real-time data processing, and human-machine interaction, enabling them to perform complex tasks with precision and adaptability. As the adoption of smart robots expands across industries, including manufacturing, healthcare, logistics, retail, and defense, a dynamic and interconnected ecosystem has emerged to support their development, deployment, and operation. This ecosystem comprises a diverse range of participants, including technology providers, component suppliers, robot developers and manufacturers, system integrators, and end users. Each participant plays a critical role in ensuring the successful design, functionality, and integration of smart robots into real-world applications. By combining their expertise, resources, and innovations, these stakeholders drive market growth, address industry-specific challenges, and facilitate the seamless implementation of robotic solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Robot Market, by Type

The industrial robots segment is likely to exhibit the highest CAGR in the smart robots market during the forecast period, driven by rising automation in manufacturing. Industries such as automotive, electronics, and food & beverage adopt smart robots to enhance efficiency, accuracy, and reduce costs. Unlike traditional robots, smart industrial robots use AI, ML, and computer vision to perform complex tasks, adapt to changing environments, and work alongside humans. The shift toward Industry 4.0, labor shortages, and demand for 24/7 operations further fuel this growth.

Smart Robot Market, by Application

The professional application is spurred by the growing adoption in different commercial and industrial sectors. Smart robots are increasingly utilized in professional settings, including healthcare, logistics, manufacturing, defense, and agriculture, as they can execute complex tasks with precision, efficiency, and minimal human intervention. In the healthcare industry, these robots are utilized in patient care, rehabilitation, surgical support, and hospital logistics. The increasing demand for advanced medical care and the growing adoption of healthcare automation drive the deployment of these technologies. In logistics and warehousing, processes are automated by managing inventory control, sorting, packaging, and delivery.

Smart Robot Market, by Operating Environment

The ground segment is expected to capture a larger market share during the forecast period, primarily due to the widespread deployment of smart robots in various terrestrial applications across industries, including manufacturing, healthcare, logistics, agriculture, and retail. Ground robots are employed for tasks such as material handling, cleaning, monitoring, assembly, customer engagement, and elderly care on a large scale. Their ability to function accurately in controlled indoor and outdoor environments makes them highly versatile and suitable for a wide range of applications. The increasing use of service robots in homes, hospitals, and offices, such as vacuum cleaners, delivery robots, and robotic assistants, also boosts segmental growth. Additionally, the use of industrial smart robots in manufacturing factories for welding, assembly, and packaging also contributes to the dominance of the segment.

REGION

Asia Pacific to be fastest-growing region in global smart robot market during forecast period

The Asia Pacific region is experiencing significant technological advancements, driven by growing government support and increasing industrial automation. Nations such as China, Japan, South Korea, and India are spearheading robotics development and implementation, particularly in manufacturing, healthcare, logistics, and consumer services. For example, China is greatly funding AI and robotics under its “Made in China 2025” initiative, which aims to shift its focus to high-tech industries. Underneath these robotic superpowers, Japan and South Korea, known for their strong robotics infrastructure, are expanding the use of smart robots in elderly care, healthcare, and service industries, addressing demographic challenges, such as aging populations and labor shortages. Moreover, the emerging middle class and the increased consumer spending in Southeast Asian countries and India are driving the use of smart home and service robots in these countries. The market growth is also supported by the presence of leading robotics manufacturers, increased investments in R&D, and favorable government policies. As a result, it is emerging as a key hub for both production and consumption of smart robots.

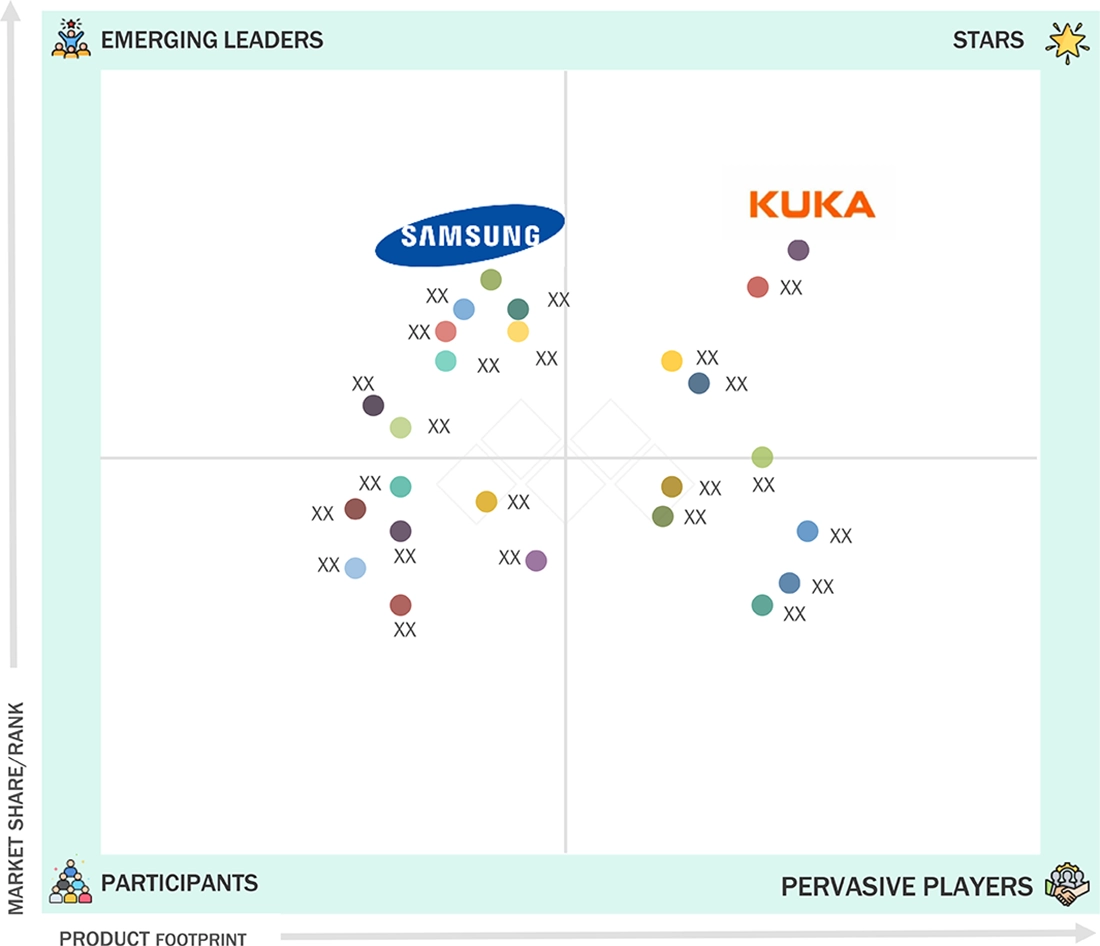

Smart Robots Market: COMPANY EVALUATION MATRIX

In the smart robot market, Kuka AG is positioned as a star player due to its advanced and high-precision robots backed by a strong global presence and technological innovation. In contrast, SAMSUNG is classified as an emerging player as it continues to expand its capabilities in the smart robot market and strengthen its market reach through partnerships and product diversification.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.56 Billion |

| Market Forecast in 2030 (Value) | USD 42.80 Billion |

| Growth Rate | CAGR of 21.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, and RoW |

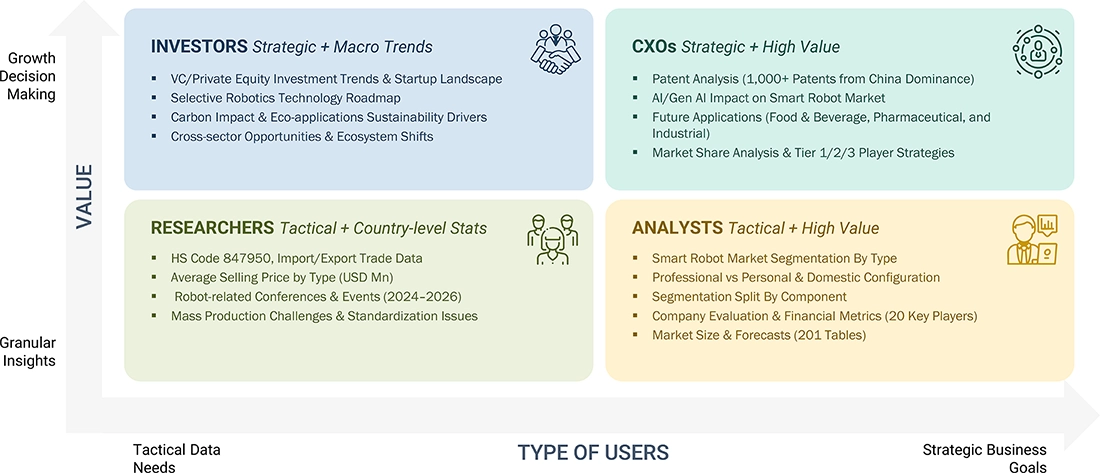

WHAT IS IN IT FOR YOU: Smart Robots Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific Smart Robot Adoption |

|

|

RECENT DEVELOPMENTS

- January 2025 : SoftBank Robotics Group has entered a strategic partnership with McLaren International Pty Ltd., a leading hospitality cloud technology provider and system integrator in the Asia Pacific, to transform facility management in the Australian hospitality sector through robotics and AI-driven automation technologies. This partnership underscores a shared commitment to innovation, operational excellence, and guest satisfaction, harnessing technological advancements to elevate industry standards.

- May 2024 : ABB has expanded its modular large robot portfolio with the introduction of the new IRB 7710 and IRB 7720. These new robots, combined with the recently launched IRB 5710-IRB 5720 and IRB 6710-IRB 6740, offer 46 different variants capable of handling payloads ranging from 70 to 620 kg, providing customers with a new level of flexibility, greater choice, and enhanced performance in their operations.

- April 2024 : iRobot Corporation launched the Roomba Combo Essential Robot, which features adjustable suction and liquid settings, a special V-shaped multi-surface brush, an edge-sweeping brush, and a pump-fed microfiber mop pad that work together to vacuum and mop hard floors in a single pass. The company also announced it has surpassed the milestone of selling over 50 million robots worldwide.

- May 2023 : KUKA AG launched the KR CYBERTECH series edition robot, designed to be cost-effective and simplify automation in various industries, such as manufacturing and automotive. This flexible robot excels in handling, quality checks, and grinding tasks, offering adaptability and high performance. Its fast and compact design makes it ideal for basic machining and handling processes. The edition robot provides lower costs without compromising quality, making it an excellent option for entry-level automation.

- May 2023 : FANUC CORPORATION introduced two new high-payload capacity collaborative robots at Automate 2023. The event showcased the expanded payload capacities of the CRX and CR cobot lines, offering variations capable of handling products from 4 to 50 kg. Demonstrations featured the CRX-25iA cobot, with a 30 kg payload capacity, and the CR-35iB cobot, with a 50 kg payload capacity, highlighting their capabilities in handling heavy products. The company emphasized the reliability, flexibility, and maintenance-free operation of CRX cobots, as well as the industry-leading strength and compact footprint of the CR-35iB cobot.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the blockchain market. Exhaustive secondary research was done to collect information on the blockchain industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the blockchain market.

Secondary Research

The secondary research for this study involved gathering information from a wide range of credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortiums, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources such as the International Trade Centre (ITC) and the International Monetary Fund (IMF) were consulted to support and validate the market analysis.

Primary Research

Extensive primary research was accomplished after understanding and analyzing the smart robots market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 20% of the primary interviews were conducted with the demand side and 80% with the supply side. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

To know about the assumptions considered for the study, download the pdf brochure

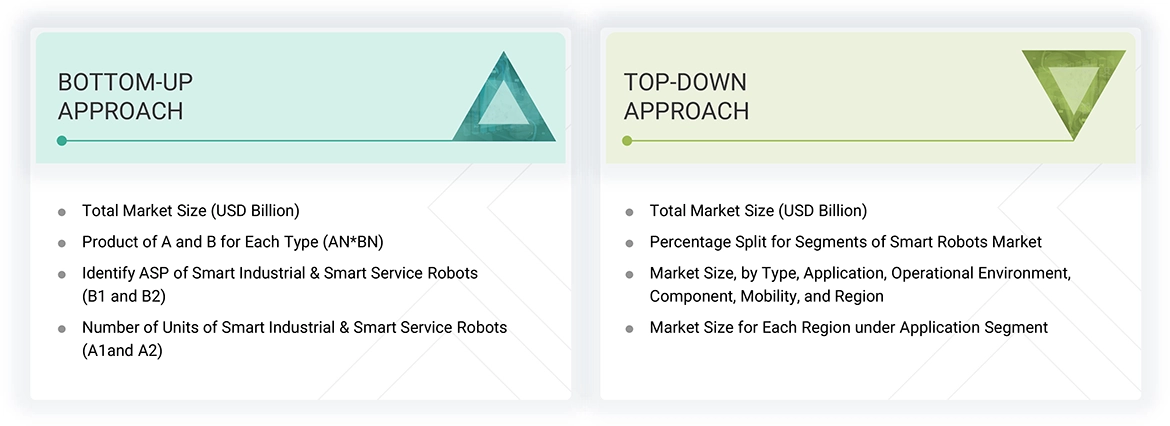

Market Size Estimation

The smart robots market size and submarkets have been estimated and validated using top-down and bottom-up approaches. Secondary research identified key market players and their regional market shares, which were confirmed via primary and secondary sources. The methodology involved analyzing annual reports and conducting expert interviews (with CEOs, VPs, and directors) for quantitative and qualitative insights. All market shares, splits, and influencing factors were thoroughly examined, verified, and analyzed. The final data was consolidated and enriched with expert insights and analysis from MarketsandMarkets, ensuring a comprehensive and accurate representation of the report.

Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the smart robots market from the calculations based on the revenues of key players and their shares in the market. For instance, key players, such as iRobot Corporation (US), SoftBank Robotics Group (Japan), ABB (Switzerland), and KUKA AG (Germany), have been studied, and market estimations have been done considering the shipment and average selling prices (ASPs) of smart robots.

Top-Down Approach

In the top-down approach, the overall market size is segmented using percentage splits derived from primary and secondary research. Conversely, the bottom-up approach aggregates data from individual segments to validate the total market size. Primary respondents across different regions further confirmed these findings. Additionally, the bottom-up approach was used to cross-check data obtained from secondary sources and verify company market shares by estimating their revenue contributions. To ensure accuracy and consistency, data triangulation was used—integrating findings from the industrial and markets with segment-specific data. The triangulation and validation methods applied in this study help strengthen the reliability of the overall market estimation.

Smart Robots Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the smart robots market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

Smart robots are automated devices that can think, sense, move, and manipulate materials, parts, tools, or specialized devices through a variable programmed motion to perform various tasks. The functioning of a smart robot is executed by the control system in AI, whereas sensing and manipulation are body functions based on physics, mechanical and electrical engineering, and software.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Technology solution providers

- Research institutes

- Market research and consulting firms

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users and prospective end users

Report Objectives

- To describe, segment, and forecast the smart robots market based on operating environment, mobility, type, component, application, and geography, in terms of value

- To forecast the global smart robots market, by operating environment and type, in terms of volume

- To describe, segment, and forecast the market for four key regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding the market dynamics (drivers, restraints, opportunities, and challenges) influencing the growth of the smart robots market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze competitive developments, such as product launches & developments, expansions, partnerships, and acquisitions, in the smart robots market

- To strategically profile the key players in the smart robots market and comprehensively analyze their market ranking and core competencies2

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Robots Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Smart Robots Market

Veronica

Feb, 2018

Conversational Artificial Intelligence, Voice User Interface Design, AI Robotics, Virtual Reality, Augmented Reality, and Mixed Reality. Also Deep Learning, Artificial Intelligence, and Machine Learning. .

Hiroshi

Sep, 2018

Send me the sample brochure of this report and then we will decide to purchase this report..

Hideshi

Aug, 2016

I checked table contents of this report and I have many question. Q1:The company profile,Honda,Google and Northrop, it have been published, we want the data of the other robot vendors such as Universal Robot and Kawasaki Heavy Industries etc. If possible to add other vendors ? Q2:Regard to Section 8.2 of the Collaborative Robots, how much of the amount of description, we are very interested in this field. .

Sascha

Jan, 2016

Is there a segmentation of robotics software market size in chapter 7 (e.g. embedded software, open source software, robotic analytics software, etc.) is there just 1 number of the overall software market for smart robots?.