Fixed-wing VTOL UAV (Drone) Market Size, Share & Growth

Fixed-Wing VTOL UAV Market by Range (VLOS, EVLOS, BVLOS), MTOW (<25 Kg, 25-170 Kg, >170 Kg), Application (Military, Government & Law Enforcement, Commercial), Endurance, Mode of Operation, Propulsion, Point of Sale, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

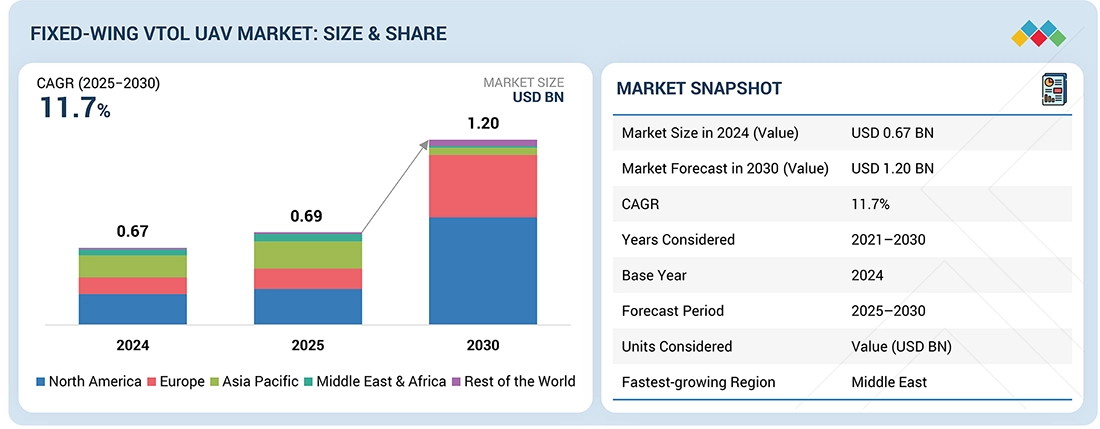

The global fixed-wing VTOL UAV market is estimated at USD 0.69 billion in 2025 and is projected to reach USD 1.20 billion by 2030, registering a CAGR of 11.7% during the forecast period (2025–2030). Market growth is primarily driven by the increasing adoption of hybrid-endurance UAVs across defense, intelligence, and commercial applications requiring extended range, vertical flexibility, and autonomous operation. The rising demand for ISR-capable platforms, border surveillance, and logistics support is accelerating procurement activities among defense agencies and law enforcement organizations. On the commercial side, fixed-wing VTOL UAVs are gaining traction for infrastructure monitoring, mapping, and disaster response. Technological advancements in hybrid-electric propulsion, lightweight composite materials, and autonomous navigation systems are enhancing endurance, payload capacity, and operational efficiency. Supported by ongoing defense modernization and growing commercial UAV integration, the global fixed-wing VTOL UAV market is poised for significant expansion over the next decade.

KEY TAKEAWAYS

-

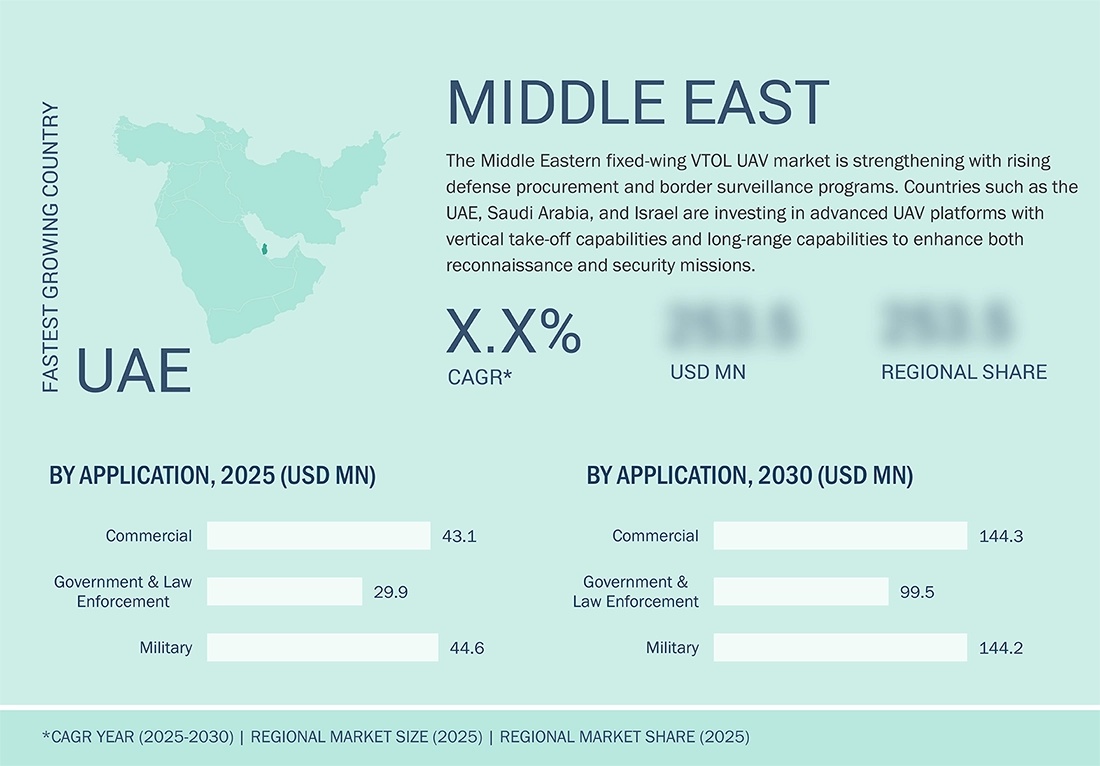

By RegionThe Middle East is projected to be the fastest-growing regional market for fixed-wing VTOL UAVs during the forecast period, driven by large-scale defense modernization programs, rapid adoption of unmanned ISR systems, and rising investments in indigenous UAV production across the UAE, Saudi Arabia, and Israel.

-

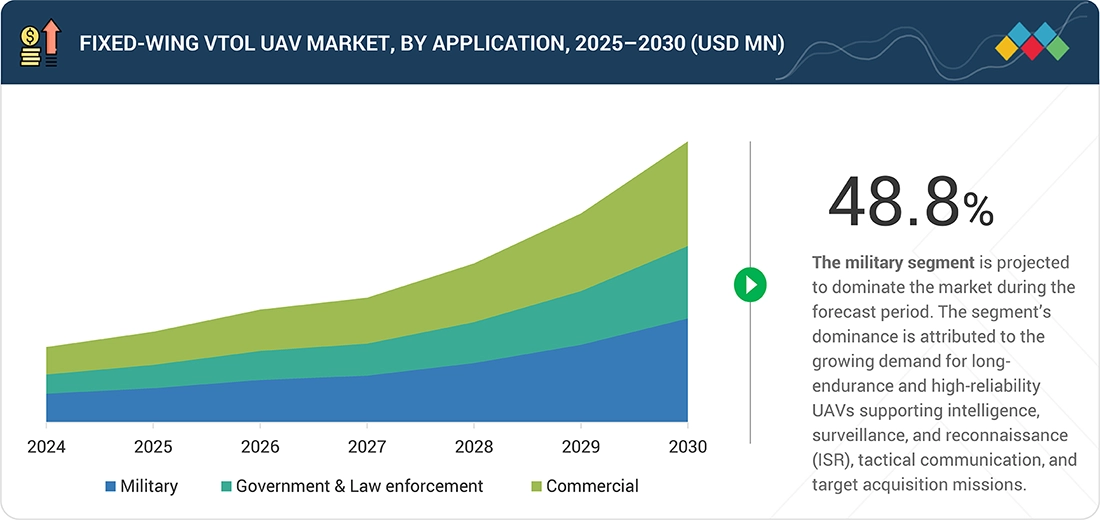

By ApplicationThe military segment accounted for the largest market share in 2024 and is expected to maintain its dominance through 2030, supported by the growing use of long-endurance and high-payload UAVs for intelligence, surveillance, reconnaissance (ISR), and tactical operations.

-

By RangeThe beyond visual line of sight (BVLOS) segment is projected to grow at the highest CAGR of 24.5 percent during the forecast period, driven by increasing operational deployment for extended reconnaissance, border patrol, and logistics missions requiring long-range autonomy.

-

By MTOWThe >170 kilograms segment is projected to be the fastest-growing MTOW segment, registering a CAGR of 25.7% from 2025 to 2030, as defense and security agencies adopt larger UAVs with enhanced payload capacity and endurance for long-duration missions.

-

By Mode of OperationThe fully autonomous segment is projected to register the highest growth of 21.5% during the forecast period, owing to advancements in onboard AI, sensor fusion, and autonomous mission management, enabling reduced operator dependency and improved mission precision.

-

By EnduranceUAVs with an endurance of more than 10 hours are projected to grow at the highest rate of 25.3% through 2030, driven by demand for persistent surveillance and extended ISR missions requiring sustained airborne operations.

-

By ProupulsionThe electric propulsion segment is expected to record the fastest growth at a CAGR of 25.0 percent during the forecast period, supported by increasing R&D in hybrid-electric systems, improved battery energy density, and global push for low-emission UAV technologies.

-

Competitive LandscapeA-Tech Syn, Elroy Air, Wingtra AG, and Avy BY have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The fixed-wing VTOL UAV market is expanding rapidly as manufacturers focus on enhancing endurance, payload efficiency, and autonomous flight performance. The increasing demand for hybrid propulsion systems, lightweight composite airframes, and extended-range mission capabilities is driving the development of advanced fixed-wing VTOL platforms optimized for both defense and commercial operations. These UAVs combine vertical lift with efficient forward-flight aerodynamics, reducing operational costs while maximizing mission flexibility. Ongoing innovations in electric propulsion, energy-dense battery systems, and AI-based flight control are transforming platform design and performance. Furthermore, collaborations between OEMs, defense agencies, and specialized system integrators are accelerating the integration of advanced sensors, modular payloads, and autonomous navigation technologies. As a result, the market is witnessing a shift toward next-generation UAV systems that are capable of multi-mission adaptability, have longer endurance, and a reduced logistical footprint across both military and industrial domains.

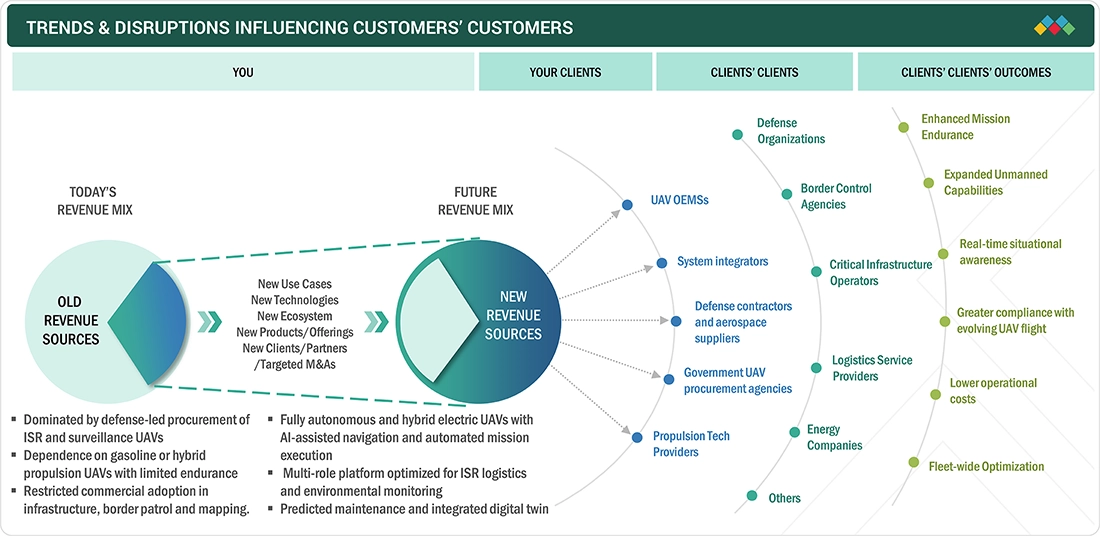

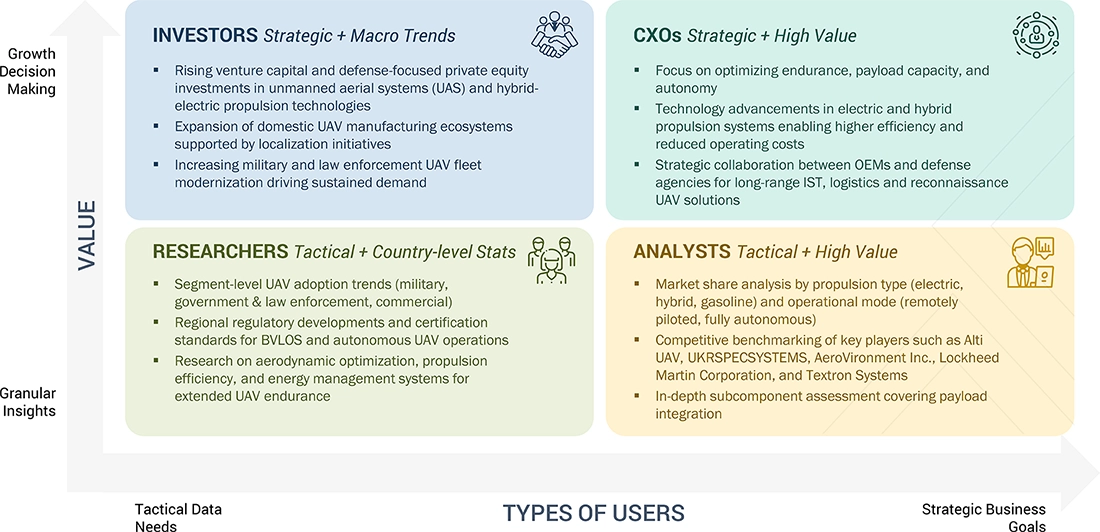

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing demand for advanced, high-endurance, and autonomous UAV platforms is reshaping the global fixed-wing VTOL UAV market. Defense-led procurement programs remain a core driver, with increasing adoption of ISR and tactical surveillance UAVs that combine vertical take-off capability with extended-range endurance. The ongoing modernization of military fleets and the integration of AI-based flight control systems are expanding operational flexibility, particularly in complex terrains and contested environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing Use in Military and Security Applications

-

Expansion of BVLOS and Autonomous Flight Regulations

Level

-

Fragmented Regulatory Frameworks and Certification Delays

-

Energy Density and Power Limitations of Electric Systems

Level

-

Advancements in Hybrid Electric and Hydrogen Proulsion Technologies

-

Growth of Defense Modernization Programs

Level

-

Complex Airworthiness Certification for VTOL Configurations

-

Market Fragmentation Across Competing Platform Archiechtues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Increasing Use in Military and Security Applications

Fixed-wing VTOL UAVs are increasingly favored by defense agencies due to their ability to combine the endurance of fixed-wing aircraft with the flexibility of rotary systems. The capacity to carry modular payloads such as EO/IR cameras, synthetic aperture radar, and communication relays enhances their multi-mission adaptability. Defense modernization initiatives worldwide increasingly include fixed-wing VTOL systems as cost-effective force multipliers, supporting operational autonomy and reducing pilot risk in contested environments.

Fragmented Regulatory Frameworks and Certification Delays

The absence of unified global regulations for UAV operations continues to restrain the widespread adoption of fixed-wing VTOL systems. Certification and airworthiness requirements vary significantly across jurisdictions, particularly for UAVs above 25 kg or operating Beyond Visual Line of Sight (BVLOS). Civil aviation authorities in Europe, North America, and Asia maintain differing standards for safety assessment, autonomous flight, and detect-and-avoid systems, leading to time-consuming and costly validation processes. Moreover, the dual-use nature of certain UAV technologies raises export control complexities, limiting cross-border commercialization.

Advancements in Hybrid Electric and Hydrogen Proulsion Technologies

Ongoing development in hybrid-electric and hydrogen-based propulsion systems offers significant opportunities for extending the endurance and mission flexibility of fixed-wing VTOL UAVs. Hybrid-electric systems combine fuel-based range with electric efficiency, allowing sustained flight durations exceeding ten hours with reduced emissions and vibration levels.

Complex Airworthiness Certification for VTOL configurtions

Achieving airworthiness certification for fixed-wing VTOL UAVs remains one of the most significant technical and administrative challenges in the industry. These systems combine two distinct flight regimes—rotary lift for vertical take-off and fixed-wing aerodynamics for cruise flight—requiring validation under multiple certification categories. Aviation regulators are still developing standardized testing protocols for hybrid configurations, covering critical parameters such as transition stability, propulsion redundancy, and flight control reliability.

fixed-wing-vtol-uav-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops fixed-wing VTOL UAVs such as the Jump 20 to enhance tactical endurance and ISR mission capability through runway-independent operation and modular payload integration. | Improves operational flexibility and autonomy for defense users, enabling extended surveillance and reconnaissance missions in remote or contested environments |

|

Designs hybrid fixed-wing VTOL UAVs like the CW-007 for commercial-grade aerial mapping, inspection, and monitoring with long-duration flight stability and automated navigation | Enhances data precision and mission efficiency across industrial operations while reducing operator workload through autonomous flight management |

|

Produces modular fixed-wing VTOL UAVs such as the PD-2 UAS optimized for tactical reconnaissance, border surveillance, and crisis response applications | Delivers high mission reliability and multi-sensor adaptability, ensuring persistent situational awareness and reduced ground infrastructure needs |

|

Develops the Aerosonde HQ, a fixed-wing VTOL UAV designed for long-endurance intelligence, surveillance, and reconnaissance missions with hybrid take-off capability and autonomous flight control | Enhances mission persistence and operational versatility, allowing continuous ISR operations from confined or unprepared sites with reduced logistical footprint and improved mission readiness |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

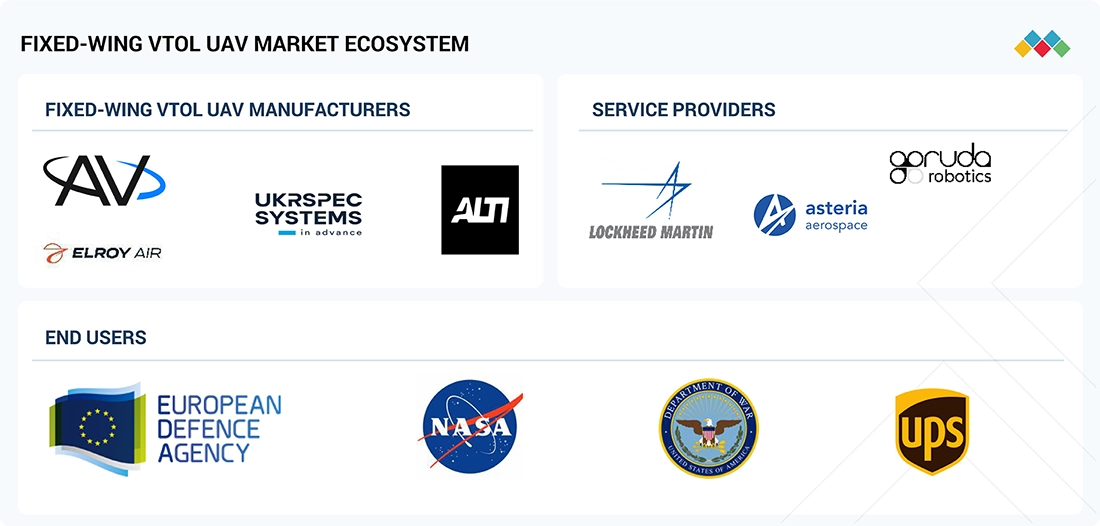

MARKET ECOSYSTEM

Fixed-wing VTOL UAV manufacturers, service providers, and end users are the key stakeholders in the market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as the major influencers in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fixed Wing VTOL UAV Market, By Application

Fixed-wing VTOL UAVs are increasingly being adopted across military operations for their ability to combine long-endurance fixed-wing performance with vertical take-off and landing capability.

Fixed Wing VTOL UAV Market, By Range

BVLOS-capable fixed-wing VTOL UAVs are witnessing rapid adoption due to their suitability for long-range surveillance, logistics, and defense operations.

Fixed Wing VTOL UAV Market, By MTOW

Fixed-wing VTOL UAVs under 25 kilograms are gaining traction across commercial, governmental, and tactical operations due to their ease of deployment and minimal regulatory burden.

Fixed Wing VTOL UAV Market, By Mode of Operation

Fully autonomous fixed-wing VTOL UAVs are witnessing rapid market expansion, driven by advances in onboard processing, artificial intelligence, and autonomous decision-making.

Fixed Wing VTOL UAV Market, By Endurance

Fixed-wing VTOL UAVs with endurance below five hours are primarily utilized for missions requiring agility, rapid deployment, and minimal setup time.

REGION

Middle East to be fastest-growing fixed-wing VTOL UAV market during forecast period

The Middle East is projected to be the fastest-growing market, fueled by massive VTOL UAV deliveries, expanding networks, and rising defense procurement across Saudi Arabia and the UAE.

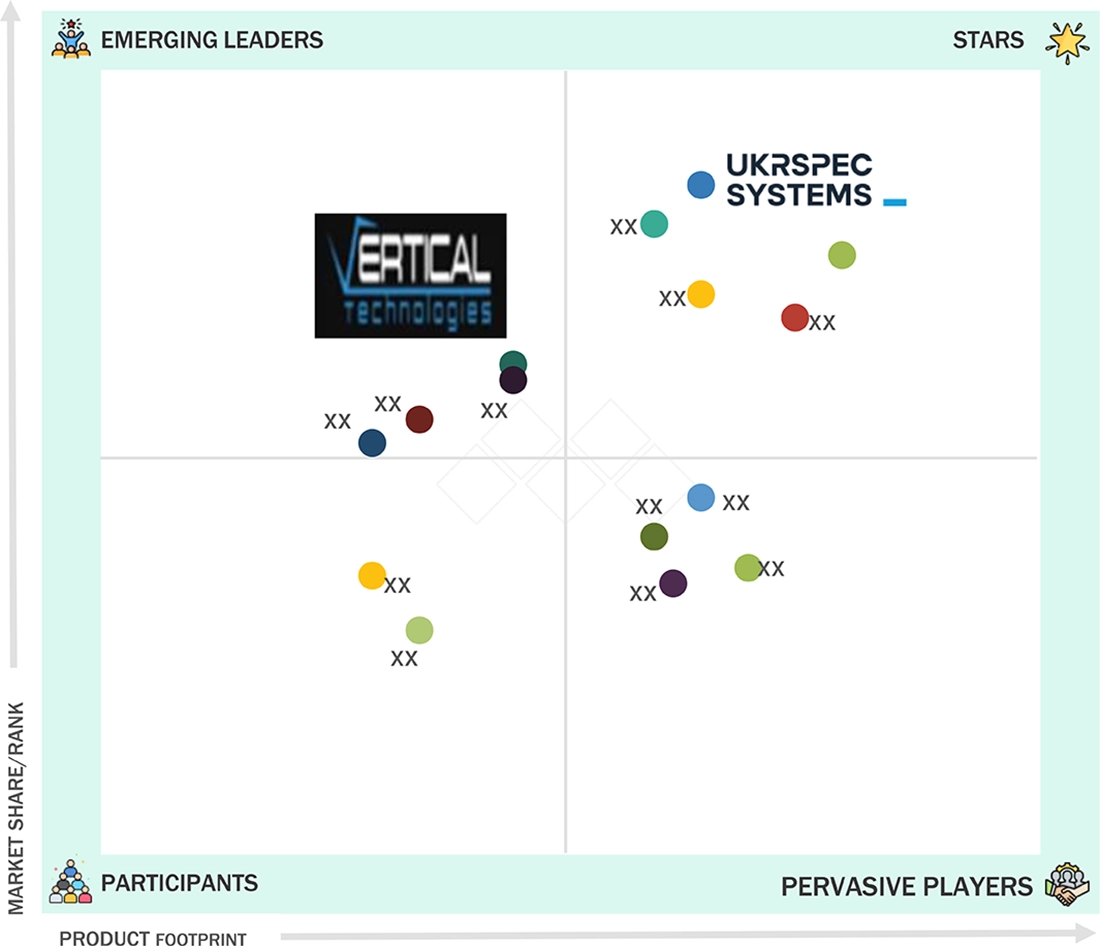

fixed-wing-vtol-uav-market: COMPANY EVALUATION MATRIX

In the global fixed-wing VTOL UAV market matrix, UKRSPECSYSTEMS (Ukraine) is a star player with an established portfolio of products and services, a robust market presence, and strong business strategies. On the other hand, Vertical Technologies (Netherlands) is an emerging leader focusing on product innovations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ALTI UAS

- UKRSPECSYSTEMS LLC

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Textron Inc.

- Vertical Technologies

- Carbonix

- ideaForge

- Quantum Systems GmbH

- BlueBird Aero Systems Ltd

- Autel Robotics

- Threod Systems

- Garuda Robotics Pte. Ltd.

- Asteria Aerospace Limited

- JOUAV

- A-TechSyn

- ElevonX

- AVY

- Elroy Air

- Wingtra

- Fixar-Aero LLC

- Flightwave Aerospace Systems

- Censys Technologies

- Skyeton

- VTOL Aviation India Pvt. Ltd.

- Alti UAS

- UKRSPECSYSTEMS LLC

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.67 Billion |

| Revenue Forecast in 2030 | USD 1.20 Billion |

| Growth Rate | CAGR of 11.7% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Application: Military, Government & Law Enforcement, Commercial, By Range: Visual Line of Sight (VLOS), Extended Visual Line of Sight (EVLOS), Beyond Line of Sight (BLOS), By Mode of Operation: Remotely Piloted, Optionally Piloted, Fully Autonomous,By Endurance: <5 Hours, 5–10 Hours, >10 Hours, By Propulsion Type: Electric, Hybrid, Gasoline |

| Regional Scope | North America, Europe, Asia Pacific, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: fixed-wing-vtol-uav-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights into direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- February 2024 : AeroVironment Inc. (US) entered into a strategic partnership with Korean Air (South Korea) to jointly develop and adapt the JUMP 20 fixed-wing VTOL system for regional defense applications. The collaboration focuses on technology transfer, platform customization, and integrated payload development to support Korea’s tactical surveillance and border monitoring missions.

- May 2024 : AeroVironment Inc. (US) signed a memorandum of understanding with the National Chung-Shan Institute of Science and Technology (Taiwan) to co-develop advanced fixed-wing VTOL UAVs. The partnership aims to expand production capability and integrate hybrid-electric propulsion architectures for next-generation reconnaissance systems.

- June 2024 : Textron Systems (US) partnered with the US Navy’s Naval Air Systems Command to expand its Aerosonde family of fixed-wing VTOL UAVs. The partnership includes continued deployment support, enhanced maritime endurance capabilities, and data-link integration for naval ISR operations.

- September 2024 : UKRSPECSYSTEMS (Ukraine) announced a strategic manufacturing collaboration with a UK-based defense consortium to produce the PD-2 fixed-wing VTOL UAV domestically in the UK. The initiative supports supply chain resilience and export readiness for European defense markets.

- March 2025 : Lockheed Martin Corporation (US), through its Sikorsky division, unveiled the Nomad™ program focused on scalable fixed-wing VTOL drones for long-endurance missions. The development was initiated under a technology partnership with the US Air Force Research Laboratory, supporting the evolution of autonomous logistics and ISR operations.

Table of Contents

Methodology

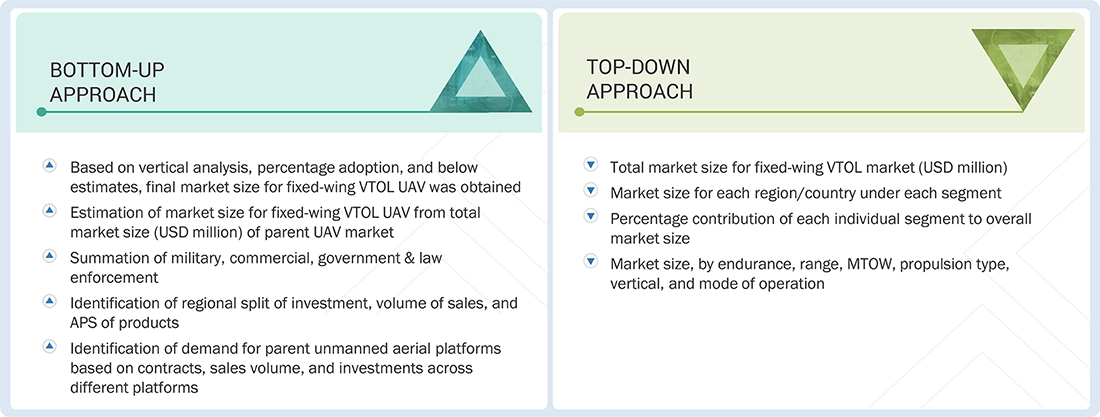

The study involved four key stages to estimate the current size of the global fixed-wing VTOL UAV market. Comprehensive secondary research was first undertaken to gather information on the fixed-wing VTOL UAV industry, its adjacent unmanned systems markets, and its broader aerospace context. This stage included collecting data on market dynamics, product portfolios, operational trends, and technological advancements. The findings, assumptions, and preliminary sizing were then validated through primary research involving interviews with key stakeholders across the value chain, including OEMs, subsystem manufacturers, technology developers, and end users. Both top-down and bottom-up analytical approaches were applied to ensure consistency, followed by data triangulation to finalize market estimates and segment-level sizing.

Secondary Research

During the secondary research phase, data were collected from a wide range of credible public and proprietary sources to establish the foundation of the market assessment. Sources included government databases and defense procurement reports; corporate filings, annual reports, and press releases from UAV manufacturers; investor presentations; and certified market studies. Additional insights were drawn from aerospace and defense journals, research publications, and articles authored by recognized experts, along with directories and industry databases focusing on unmanned aerial systems and autonomous flight technologies.

Primary Research

Extensive primary research was conducted to validate data collected through secondary sources and to refine market segmentation. Interviews were carried out with industry experts representing both demand and supply sides across key regions, including North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America. Participants included UAV manufacturers, propulsion system suppliers, defense procurement officials, and regulatory authorities. Primary information was gathered through structured questionnaires, emails, and telephonic discussions to obtain first-hand perspectives on technological developments, regional demand patterns, and market growth trajectories.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were employed to estimate and validate the size of the global fixed-wing VTOL UAV market. The research methodology used to determine market size included the

following steps and considerations:

- Key players in the fixed-wing VTOL UAV market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the fixed-wing VTOL UAV market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Fixed-Wing VTOL UAV Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

The fixed-wing VTOL UAV market encompasses unmanned aerial systems that integrate the aerodynamic efficiency of fixed-wing aircraft with the vertical take-off and landing capability of rotary-wing platforms. These UAVs are designed to operate without the need for runways, enabling both vertical lift and sustained forward flight. This hybrid configuration allows for extended endurance, higher cruising speeds, and greater payload capacity compared to conventional multirotor UAVs. Fixed-wing VTOL UAVs are employed across military, commercial, and governmental applications, including ISR, mapping, logistics, and disaster management.

Fixed-wing VTOL UAVs are equipped with advanced propulsion systems, autonomous navigation, and modular payload interfaces. They offer enhanced operational flexibility and cost efficiency. The growing demand for long-endurance unmanned platforms, combined with advancements in hybrid propulsion and AI-based control systems, is driving the expansion of the global fixed-wing VTOL UAV market.

Key Stakeholders

- Raw Material Suppliers

- Heat Exchanger Manufacturers

- Aircraft System Manufacturers

- System Integrators

- Technology Support Providers

- Distributors and Component Suppliers

- Maintenance, Repair, and Overhaul (MRO) Companies

- Government and Regulatory Agencies

- Research and Development Organizations

Report Objectives

- To define, describe, and forecast the fixed-wing VTOL UAV market based on application, range, MTOW, mode of operation, endurance, propulsion, point of sale, and region

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, the Middle East, and the Rest of the World

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the market, along with a market share analysis and revenue analysis of key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the fixed-wing VTOL UAV market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the fixed-wing VTOL UAV market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fixed-Wing VTOL UAV Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fixed-Wing VTOL UAV Market

User

May, 2020

I am interested in knowing how Fixed wing VTOL drones fits with future market demands for product delivery in medical, e-commerce, etc..

Kate

May, 2020

Hi , kindly provide market analysis by leading players for autonomous drones. Thanks.