Small Drones (UAV) Market Size, Share & Analysis, 2025 To 2030

Small Drones (UAV) Market by Application (Combat, ISR, Inspection, Survey & Mapping, Agriculture, Delivery, Search & Rescue), Platform (Nano, Micro, Mini), Type (Fixed Wing VTOL, Multi Rotor, Hybrid), Mode of Operation, Power Source, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

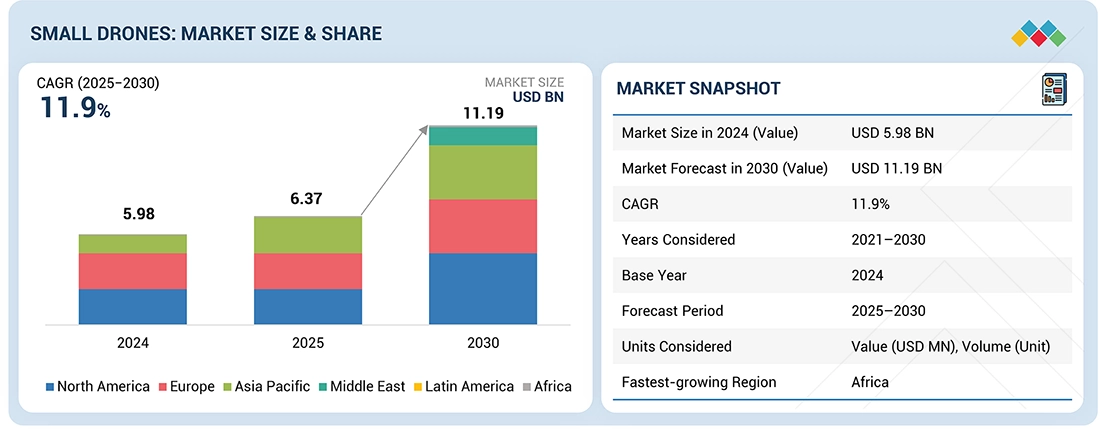

The Small Drones Market is projected to grow from USD 11.19 billion by 2030, from USD 6.37 billion in 2025, at a CAGR of 11.9%. The procurement volume of small drones is projected to grow from 669.9 thousand units in 2025 to 973.4 thousand units by 2030. The increasing use of drones for civil and commercial applications, such as agriculture, delivery services, and media, is driving demand. Additionally, military procurement is on the rise, particularly for intelligence and surveillance purposes. Supportive government regulations are fostering a favorable environment for drone development, and the growing need for small patrol drones for marine border security is contributing to the market’s expansion.

KEY TAKEAWAYS

- North America is expected to account for a 37.7% share of the small drones market in 2025.

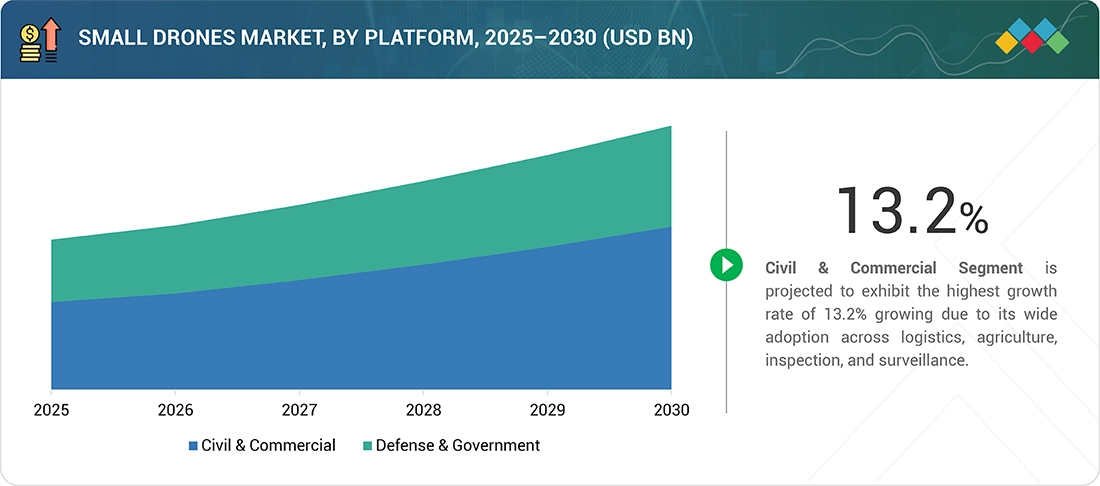

- By platform, the civil and commercial segment is projected to grow at the fastest CAGR of 13.2%.

- By type, the hybrid segment is projected to grow at the fastest rate of 14.5%.

- By application, the commercial segment is expected to account for the largest share of the small drones market during the forecast period.

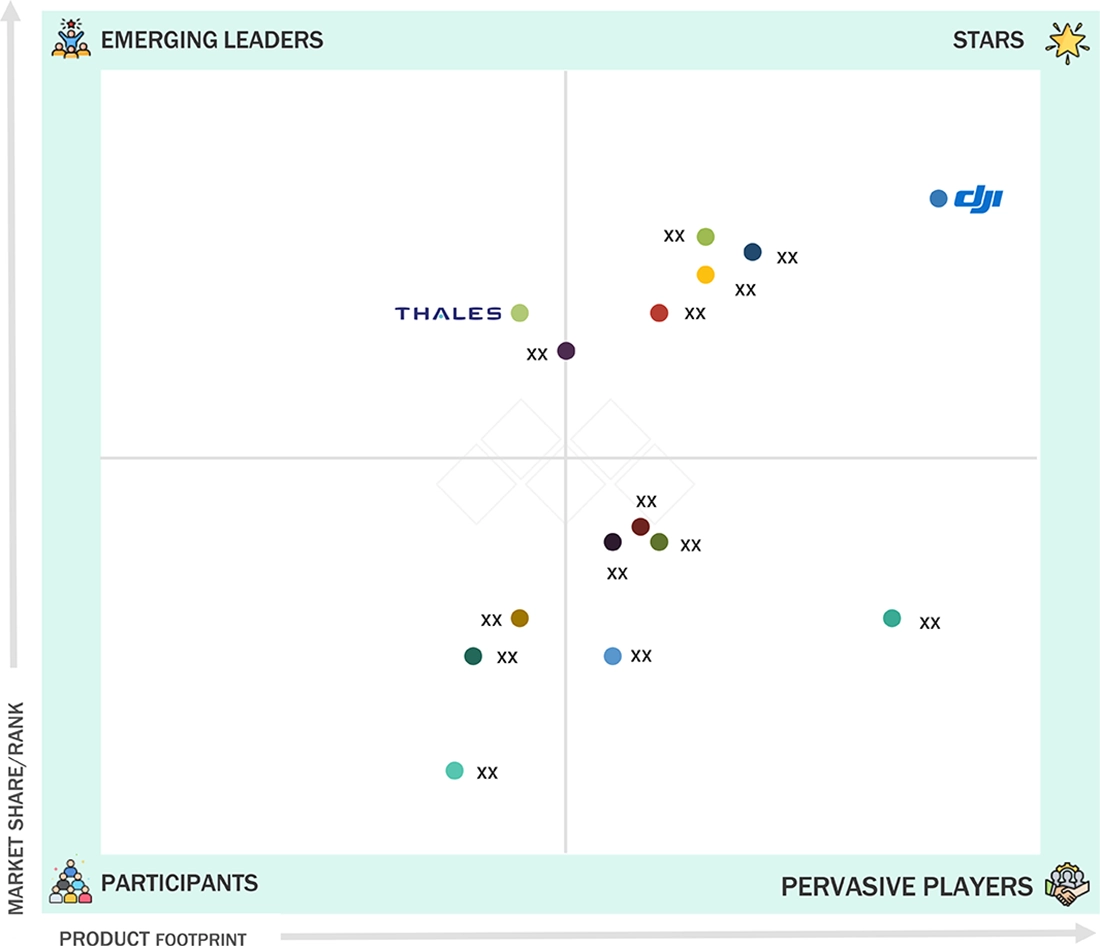

- DJI, IAI, and Lockheed Martin Corporation were identified as some of the star players in the small drones market, given their strong market share and product footprint.

- Shield AI, Microdrones, and Turkish Aerospace Industries, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future growth of Small Drones Industry will be driven by advancements in autonomous flight technology, improved battery efficiency, and expanding commercial and defense applications. Increasing integration of AI, IoT, and real-time data analytics will enhance operational capability and broaden use across sectors such as logistics, agriculture, infrastructure inspection, and surveillance.

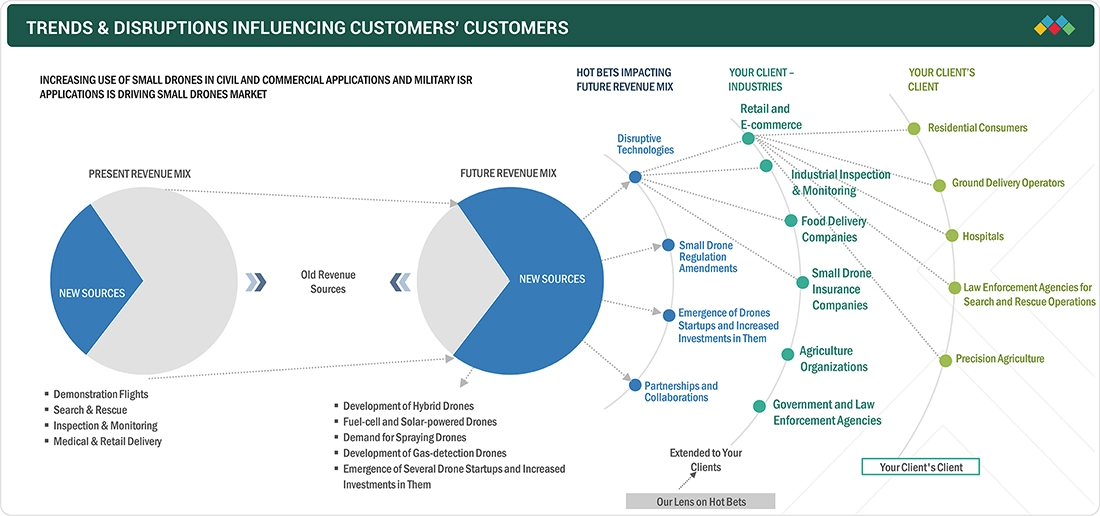

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The small drones market is projected to register a CAGR of 11.9% by value during the forecast period. Several small drone providers are seeking venture capital investments, partnerships, collaborations, and joint ventures to advance drone technology. This, in turn, is expected to aid in vital improvements in drone platforms, infrastructures, software, and services with an increased customer base for drones.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Extensive use of small drones in civil and commercial applications

-

Rising procurement for military applications

Level

-

Information security risk and inadequate air traffic regulations

-

Shortage of certified drone operators

Level

-

High public and private sector investments

-

Enhancing critical infrastructure protection and law enforcement with aerial remote sensing

Level

-

Lack of sustainable power sources to improve endurance

-

Safety and privacy concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Extensive use of small drones in civil and commercial applications

The small drone market is expanding rapidly as industries adopt unmanned aerial systems for diverse applications such as precision agriculture, infrastructure inspection, surveying, logistics, and disaster management. Civil and commercial operators leverage drones for mapping, monitoring, and delivery, improving efficiency and reducing operational costs across sectors.

Restraint: Information security risk and inadequate air traffic regulations

The market faces key restraints around cybersecurity, safety, and fragmented regulations. Drones’ ability to capture sensitive data increases vulnerability to hacking and misuse, while inconsistent airspace rules hinder cross-border operations. Although the U.S. and Europe lead integration efforts, many emerging regions still lack cohesive frameworks, limiting commercial scalability.

Opportunity: High public and private sector investments

Strong funding from governments and private investors is accelerating small-drone innovation. Public agencies invest in smart-city, defense, and disaster-response programs, while corporates back R&D in AI navigation, swarm autonomy, and sensor fusion. Key markets such as China, the U.S., and India are promoting test corridors and local manufacturing to boost adoption.

Challenge: Lack of sustainable power sources to improve endurance

Limited endurance from conventional lithium-ion batteries constrains long-range and continuous missions. Frequent recharging reduces operational efficiency, and while hybrid-electric and hydrogen fuel solutions show promise, their high cost and regulatory complexity delay adoption. The absence of high-density, sustainable energy storage remains a core barrier to market maturity.

Small Drones (UAV) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

DJI has developed advanced small drones such as the Mavic 3 Enterprise and Phantom series, extensively used in commercial sectors including surveying, precision agriculture, public safety, and inspection operations. These systems integrate AI-driven obstacle avoidance and multispectral imaging for high-precision missions. | Offers superior reliability and imaging accuracy with user-friendly operation and cost-efficient scalability, enabling large-scale adoption across civil, industrial, and infrastructure applications. |

|

Parrot produces the ANAFI USA and ANAFI Ai, small drones designed for government, defense, and enterprise operations. These platforms focus on secure data processing, encryption, and 4G connectivity for real-time mission execution. | Ensures secure and compliant data handling with real-time cloud connectivity, lightweight construction, and high mobility, ideal for inspection, mapping, and tactical applications. |

|

IAI manufactures BirdEye and Mini Panther UAVs for ISR (Intelligence, Surveillance, and Reconnaissance) and tactical defense missions. These drones deliver long-endurance performance with integrated battlefield intelligence. | Provides extended flight duration up to 24 hours, reliable ISR capabilities, and seamless defense network integration, enhancing situational awareness and operational command. |

|

Lockheed Martin develops the Indago 4 small UAS, deployed in defense, law enforcement, and industrial inspection roles, emphasizing rugged design, portability, and secure communication systems. | Offers up to 50 minutes of endurance, low acoustic signature for stealth operations, encrypted communications, and adaptability for both defense and commercial applications. |

|

AeroVironment manufactures small drones such as Raven, Puma, and Wasp AE, proven platforms used extensively by U.S. defense forces for tactical reconnaissance and surveillance missions. | Delivers battle-tested endurance and reliability with hand-launch portability, real-time intelligence capability, and rapid deployment efficiency in contested or high-risk environments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The small drone market ecosystem includes platform manufacturers, subsystem suppliers, software developers, and service providers that support UAV development and operations. The ecosystem focuses on improving endurance, sensor performance, connectivity, and avionics integration while adopting AI-based analytics and mission software. These participants enable broader use of small drones across commercial, defense, and enterprise applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Small Drone Market By Platform

The civil & commercial segment will lead the small drone market due to its wide adoption across multiple high-demand applications such as logistics, agriculture, infrastructure inspection, and surveillance. E-commerce companies are actively piloting drones for last-mile delivery, while farmers increasingly use them for precision farming and crop monitoring. Infrastructure and energy sectors rely on drones for safe, cost-effective asset inspections. Coupled with supportive regulations, AI integration, and cost efficiency, these factors drive rapid scalability, making this segment the market’s primary growth engine.

Small Drone Market By Application

The commercial segment is set to dominate the small drone market by application as businesses prioritize automation, real-time data collection, and operational efficiency. Enterprises in construction, mining, and oil & gas are rapidly adopting drones to reduce manpower needs and accelerate project timelines. Media and entertainment industries increasingly rely on drones for advanced aerial imaging and live event coverage. Financial institutions and insurers are deploying them for rapid damage assessments.

Small Drone Market By Type

The rotary-wing segment will lead the small drone market by type because of its superior maneuverability, vertical takeoff and landing (VTOL) capability, and ability to hover in place. These features make rotary-wing drones highly versatile for urban, industrial, and defense applications where space is limited and precision is critical. They are widely adopted for inspection of infrastructure, law enforcement, border surveillance, and aerial photography. Their compact design, ease of control, and adaptability to varied payloads give them a significant edge over fixed-wing and hybrid configurations.

Small Drone Market By Mode of Operation

The optionally piloted segment is expected to lead the small drone market because it combines the flexibility of autonomous operations with the safety and regulatory acceptance of human oversight. This hybrid model allows drones to operate in complex environments where full autonomy is restricted, while still delivering efficiency gains. Industries such as defense, emergency response, and cargo transport value this dual capability for long-range missions, high payload operations, and compliance with evolving airspace rule

Small Drone Market By Power Source

The battery-operated segment is projected to lead the small drone market due to its affordability, ease of deployment, and technological advancements in lithium-ion and lithium-polymer cells. These drones are lightweight, cost-effective, and ideal for short to medium-range missions in agriculture, photography, surveying, and inspection. Rapid charging solutions, swappable batteries, and increasing energy densities further enhance operational efficiency.

REGION

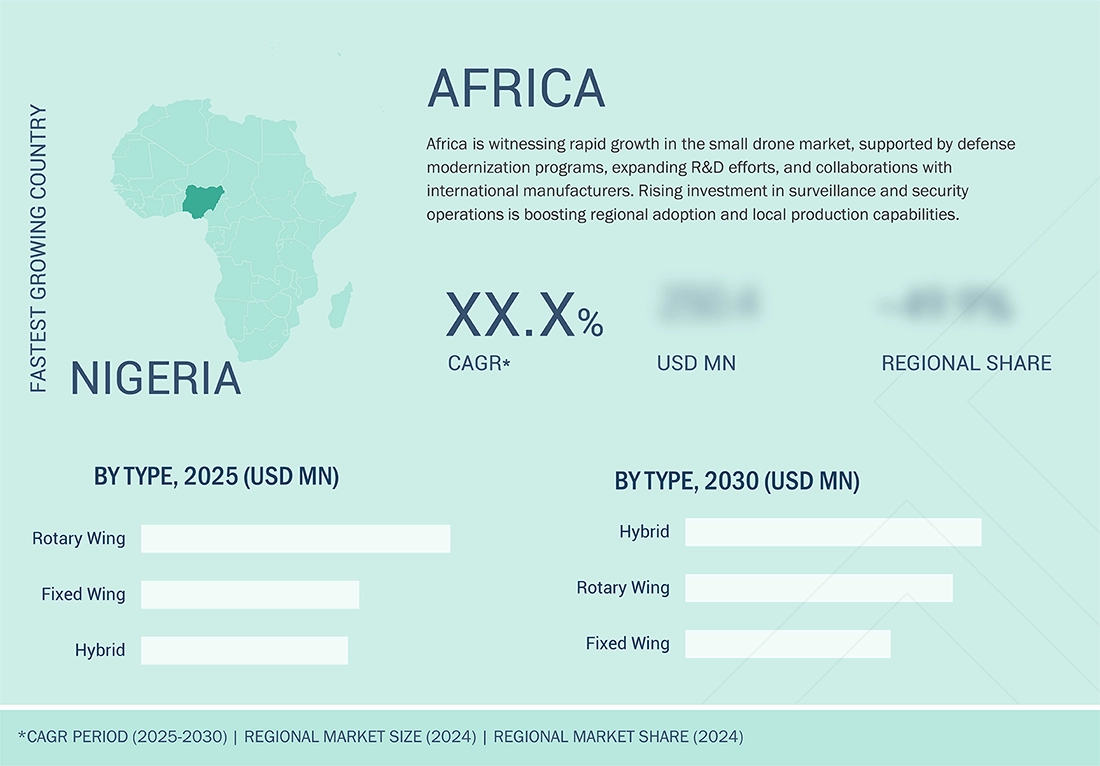

Africa to be fastest-growing region in global small drones market during forecast period

The small drones market in Africa is expanding rapidly, supported by defense modernization, local R&D initiatives, and partnerships with global manufacturers. Increasing investments in surveillance and security applications are strengthening regional production and adoption of small drones.

Small Drones (UAV) Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the Small Drone market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. DJI is positioned as a leading player with a strong focus on advanced battery technologies, while General Atomics is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Small Drones (UAV) Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.98 Billion |

| Market Forecast in 2030 (value) | USD 11.19 Billion |

| Growth Rate | CAGR of 11.9 % from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Latin America, and Africa |

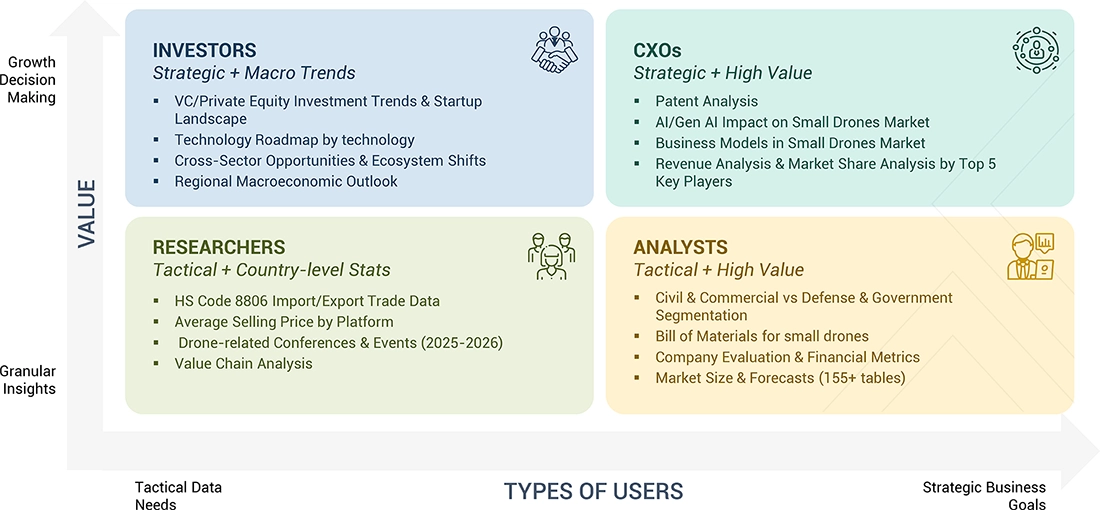

WHAT IS IN IT FOR YOU: Small Drones (UAV) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Small Drones Market Study Update |

|

|

RECENT DEVELOPMENTS

- February 2025 : AeroVironment, Inc. (US) received a USD 288 million delivery order for Switchblade loitering munition systems under the US Army’s Directed Requirement for Lethal Unmanned Systems. The order is part of a multi-year contract awarded in August 2024, with a ceiling of USD 990 million

- October 2024 : AeroVironment, Inc. (US) received a USD 54.9 million delivery order for Switchblade loitering munition systems under an existing indefinite delivery, indefinite quantity (IDIQ) contract. The award includes an additional contract ceiling of USD 743 million and supports the US Army and allied partners, including Lithuania, Romania, and Sweden. Work will be performed in Simi Valley, California, with completion expected by June 30, 2026.

- September 2024 : Lithuanian Ministry of Defense received its first batch of Parrot Anafi quadcopters under a USD 40.2 million contract with Deftools (Lithuania) to expand its unmanned aerial system (UAS) fleet.

- August 2024 : AeroVironment, Inc. (US) secured a USD 990 million IDIQ contract from the US Army’s Directed Requirement (DR) for Lethal Unmanned Systems (LUS) to equip infantry battalions with Switchblade loitering munitions. The five-year contract, awarded by Army Contracting Command-Aberdeen Proving Ground, enhances precision strikes against armored and moving targets.

- May 2024 : Lockheed Martin Corporation (US) collaborated with Grupo Oesía, a Spanish multinational specializing in technological and digital engineering, to develop innovative solutions in UAS, USV, and other autonomous platforms

Table of Contents

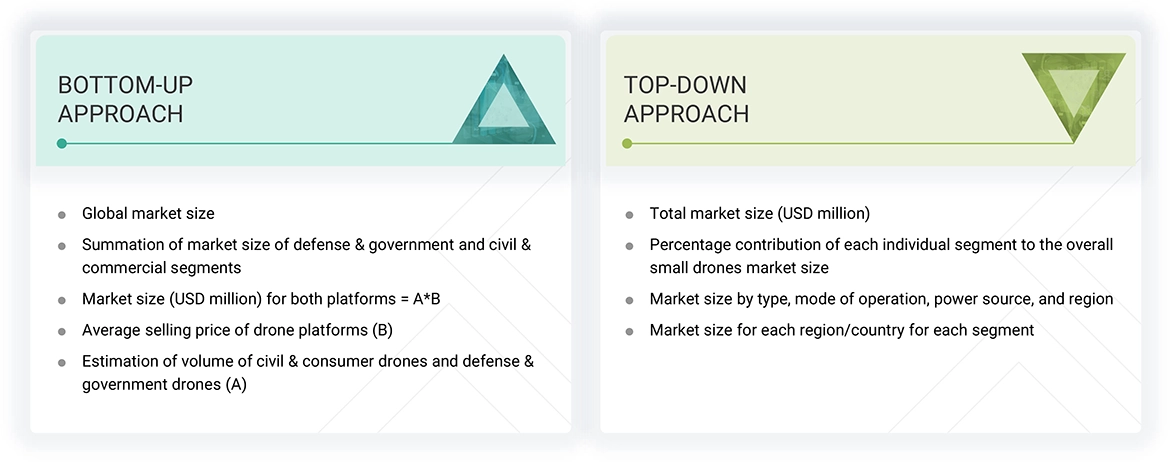

Methodology

The research study on the small drones market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews of primary respondents, including industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the market and assess the market’s growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different segments.

Secondary Research

The share of companies in the small drones market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the small drones market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Others include sales, marketing, and product managers.

The tiers of companies have been defined based on their total revenue as of 2024. Tier 1 = >USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the small drones market. The research methodology used to estimate the market size includes the following details.

Key market players were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and subject matter experts of leading companies operating in the small drones market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the small drones market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Small Drones Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the small drones market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from the demand and supply sides. The small drones market size was also validated using top-down and bottom-up approaches.

Market Definition

Small drones, or small unmanned aerial vehicles (SUAVs), are remotely piloted aerial vehicles that play significant roles in the defense and commercial sectors. These drones are used in various missions, such as military attacks and border surveillance. They are also used for mapping, surveying, determining weather conditions, and enforcing regional laws.

Key Stakeholders

- Drone manufacturers

- Component suppliers

- Government and regulatory bodies

- Military and defense organizations

- Commercial sector companies

- Drone service providers

- Technology developers

- End users

Report Objectives

- To define, describe, segment, and forecast the size of the small drones market based on platform, application, type, mode of operation, and power source

- To forecast the size of various market segments within six regions: North America, Europe, Asia Pacific, Middle East, Africa, and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To provide an overview of the regulatory landscape with respect to drone detection regulations

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying growth strategies adopted by leading players, such as acquisitions, contracts, partnerships, and product launches

- To identify detailed financial positions, key products, and unique selling points of leading players

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of market segments at the country level

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

- AI in small drones: Small drones use AI to make smart flying decisions, such as avoiding crashes and tracking objects.

- LiDAR drones: These drones use laser beams to scan and create accurate 3D maps for surveys and inspections.

- Swarm technology: It allows many drones to fly together to finish missions faster and more efficiently.

- Autonomous take-off and landing systems: These systems help drones lift off and land without user manual control.

- Inspection drones for confined spaces: These drones are built to safely check small or risky places that are hard for people to reach.

- Multi-sensor data fusion for small drone navigation: This technology mixes signals from many sensors to guide drones safely and accurately.

- Increased adoption of drones in civil and commercial sectors

- Rising military procurement

- Favorable government regulations and initiatives

- Growing demand for small patrolling drones for marine border security

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Small Drones (UAV) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Small Drones (UAV) Market