Drone Market Analysis for Commercial & Industrial Applications

UAV (Drone) Market Size, Share & Trends by Type (Fixed Wing, Rotary Wing, Hybrid), Platform (Civil & Commercial, and Defense & Government), Sales Channel, Systems, Function, Industry, Application, Mode of Operation, MTOW, Range and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The overall UAV (Drone) Market (OEM + Aftermarket) is estimated to be USD 26.12 billion in 2025 and projected to reach USD 40.56 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The drone (UAV) market volume (OEM) is projected to grow from 596.94 thousand units in 2025 to reach 869.76 thousand by 2030. Technological advancements, such as improved autonomy, efficient power systems, and advanced sensing technology, have expanded the capabilities of UAVs, further driving their growth.

KEY TAKEAWAYS

- North America is expected to account for a 48.6% share of the UAV (drone) market in 2025.

- By type, the propulsion system segment is projected to dominate the market in 2025.

- By platform, the civil & commercial segment is expected to grow at the fastest rate from 2025 to 2030.

- By application, the commercial segment is projected to grow at the fastest rate of 25.4% from 2025 to 2030.

- DJI, Northrop Grumman, and Israel Aerospace Industries were identified as some of the star players in the UAV (drone) market, given their strong market share and product footprint.

- Shield AI, Delair, and Volocopter GmbH have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Industry for Unmanned Aerial Vehicles (UAVs) is predominantly driven by their diversified applications across the military, commercial, and recreational sectors. Innovations in UAV technology, including extended battery endurance, augmented payload capabilities, and sophisticated navigational technologies, have substantially widened their functional scope.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Several drone startups and manufacturers are seeking venture capital investments, partnerships, collaborations, and joint ventures to advance drone technology. This, in turn, is expected to aid in vital improvements in drones and related infrastructure and increase the customer base for drones.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising procurement of drones for military applications

-

Increasing use of UAVs in commercial applications

Level

-

Information about security risk and lack of standardized air traffic regulations

-

Lack of qualified and certified drone operators

Level

-

High investments in commercial drone industry

-

Use of UAV for cargo delivery in military operations

Level

-

Issues with hijacking and security of UAVs

-

Unpredictable weather conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising procurement of drones for military applications

Defense forces in various countries have increasingly used UAVs to carry out military operations, such as intelligence, surveillance, and reconnaissance (ISR) activities and battle damage management. For instance, the Fifth Generation C4ISR is a joint battle management system that can gather data, understand the data, and communicate freely with all the components.

Restraint: Information about security risk and lack of standardized air traffic regulations

According to the Air Traffic Control Association (ATCA) (US), the limited use of small drones in civil airspace is creating a hindrance to UAV (Drone) market growth in the country. Small commercial drones are prohibited from flying in the airspace around airports, except for certain companies that have received exemptions to conduct tests or demonstration flights

Opportunity: High investments in commercial drone industry

Investments in the drone industry have been increasing drastically since the COVID-19 pandemic (2020 and 2021. In the last five years, investments in this industry have increased at a CAGR of 48%. Between 2021 and 2022, the investments were corrected due to increased inflation, reduced consumer spending, and global recession.

Challenge: Issues with hijacking and security of UAVs

Drones face considerable security challenges, particularly concerning the risk of hijacking. Despite the encryption of communications between drones and remote controls, the prevalent use of identical encrypted codes makes hijacking a viable and straightforward target. Addressing the security aspects of military drones presents various technical difficulties that must be solved.

UAV (Drone) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed medium-altitude long-endurance (MALE) UAVs for intelligence, surveillance, and reconnaissance (ISR) in defense operations | Extended mission endurance for border security and battlefield monitoring, real-time transmission of intelligence to command centers |

|

Designed tactical UAVs like Aerosonde for military and civil applications, supporting force protection, maritime patrol, and disaster response | Rapid deployment in austere environments with minimal ground crew, multi-payload integration for flexible operations across missions |

|

Fielded combat-proven UAVs like the Hermes series, designed for reconnaissance, target acquisition, and precision strike coordination | High-altitude and long-range endurance for continuous ISR, seamless integration with artillery and airstrike systems for faster decision-making |

|

Developed UAV solutions ranging from rotary-wing drones for shipborne operations to experimental high-altitude UAVs for strategic reconnaissance | Enhanced resilience in GPS-denied or electronic warfare environments, scalable UAV designs for both tactical and strategic missions |

|

Supports crop spraying, infrastructure inspection, search-and-rescue, and mapping with AI-enabled imaging tools | Cost-effective aerial coverage for industries reducing manual inspection time, high-resolution mapping and monitoring to improve productivity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The key stakeholders in the UAV (Drone) market ecosystem are platform manufacturers, subsystem manufacturers, service providers, software providers, and miscellaneous (insurance companies). The following figure lists some global platform manufacturers, subsystem providers, service providers, and software providers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drone Market, By Sales Channel

The UAV sales channel segment, encompassing both OEM and aftermarket sectors, specifically MRO, replacement, simulation, and training, represents a critical area within the aerospace industry, driven by technological advancements and escalating demand for enhanced UAV capabilities and extended lifecycle management.

Drone Market, By System

The UAV (Drone) market has been segmented by system into vehicle, payload, data link, ground control station, and launch and recovery system. Each performs a different function and ensures the proper functioning of UAVs in different applications.

Drone Market, By Platform

The demand for UAVs in the defense and government platforms is projected to increase due to their use in intelligence, surveillance, reconnaissance activities, combat operations, and battle management applications. The civil and commercial segment is expected to grow for inspection and monitoring.

Drone Market, By Function

UAVs perform various functions, from transporting passengers to combat duties. Based on function, the UAV (Drone) market has been segmented into special-purpose drones, passenger drones, inspection and monitoring drones, surveying and mapping drones, spraying and seeding drones, cargo air vehicles, and others.

UAV (Drone) Market, By Industry

The UAV (drone) market has been segmented by industry into defense and security, logistics and transportation, agriculture, energy and power, construction and mining, media and entertainment, insurance, wildlife and forestry, and academics and research. Recent trends indicate robust growth across these industries, propelled by digital transformation and sustainability initiatives.

UAV (Drone) Market, By Application

By application, the UAV (Drone) market has been classified into military, commercial, government & law enforcement, and consumer. UAVs are widely employed in military applications for intelligence, surveillance, and reconnaissance (ISR), combat operations, and battle damage management.

UAV (Drone) Market, By Range

The UAV (Drone) market has been segmented by range into visual line of sight (VLOS), extended visual line of sight (EVLOS), and beyond visual line of sight (BVLOS). UAVs with different ranges are used in other operations. VLOS-range UAVs are used in easy operations that require pilots to be within the drone's range of vision.

UAV (Drone) Market, By Mode of Operation

By mode of operation, the UAV (Drone) market has been classified into remotely piloted, optionally piloted, and fully autonomous. The remotely piloted segment is projected to grow significantly during the forecast period, driven by the cost-effective usage of remotely piloted UAVs in several applications ranging from defense operations to surveys.

UAV (Drone) Market, By Type

The UAV (Drone) market has been categorized by type as fixed, rotary, and hybrid. The fixed-wing segment has been further divided into conventional takeoff and landing (CTOL) and vertical takeoff and landing (VTOL). In contrast, the rotary-wing segment has been classified into single-rotor and multirotor.

UAV (Drone) Market, By MTOW

Based on MTOW, the UAV (Drone) market has been segmented into <2 kg, 2–25 kg, 25–150 kg, 150–600 kg, 600–2000 kg, and >2000 kg—ranging from lightweight consumer and educational drones to medium and heavy tactical systems used in industrial and defense sectors. As the mass of a UAV is a fixed value, it is independent of the temperature or the altitude at which a drone is flying.

UAV (Drone) Market, By Technology

The UAV (Drone) market is evolving rapidly, driven by advancements across different technological segments, primarily categorized into conventional and AI-powered drones. Conventional drones rely on manual or pre-programmed control systems and continue to serve as the backbone of UAV operations due to their affordability, simplicity, and regulatory acceptance.

REGION

North America is expected to be the largest region in the global UAV (Drone) market.

The North American UAV (Drone) Market is projected to grow from USD 10.98 billion in 2025 to USD 16.17 billion by 2030 at a CAGR of 8.0%. Rising adoption across defense, public safety, infrastructure, and energy sectors, driven by the demand for long-range missions, high-precision data capture, and autonomous operations, continues to accelerate market expansion, supported by advancements in analytics, automation, and beyond-visual-line-of-sight (BVLOS) capabilities.

The European UAV (Drone) Market is projected to grow from USD 5.00 billion in 2025 to USD 7.98 billion by 2030 at a CAGR of 9.8%. The increasing adoption of UAVs across defense, border security, public safety, and critical infrastructure sectors, driven by demand for long-range surveillance, high-precision data acquisition, and autonomous flight operations, boosts market expansion. The growth is further supported by advancements in AI-enabled analytics, automation, and progress in BVLOS regulations, as well as the increasing integration of UAVs into commercial applications, including logistics, energy inspection, and environmental monitoring.

The Asia Pacific UAV (Drone) Market is expected to grow from USD 4.68 billion in 2025 to USD 8.18 billion by 2030, with a CAGR of 11.8%. The market growth is driven by rapid defense modernization, improved border surveillance needs, and increased investment in autonomous technologies. Growing commercial use in agriculture, infrastructure, and logistics, supported by regulatory reforms and expanding local manufacturing, is further promoting sustained growth throughout the region.

The Middle East UAV (Drone) Market is expected to reach USD 3.31 billion by 2030, from USD 1.70 billion in 2025, with a CAGR of 14.2%. This growth is driven by an increasing number of military modernization programs and rising reliance on unmanned aircraft systems for key military missions. The Middle East region is also experiencing healthy growth in the commercial drone sector, subject to demand from applications such as inspection, mapping, logistics, and energy-sector monitoring. Advancements in autonomous flight control, AI-enabled analytics, and BVLOS operational capabilities are further increasing the need for deploying new UAVs among the armed forces.

The US UAV (Drone) market is projected to grow from USD 10.75 billion in 2025 to USD 15.78 billion by 2030 at a CAGR of 8.0%. The market in the US is driven by investments in defense fleet modernization, reliance on unmanned systems for long-endurance intelligence, surveillance, and reconnaissance missions, and growing deployment of UAVs for border security and homeland protection. In addition, the US is witnessing growth in commercial UAV applications across various sectors, including inspection, mapping, and monitoring. Furthermore, the advancements in AI-based mission systems, autonomous flight control, BVLOS operational capabilities, and cybersecurity enhancements are boosting the deployment of UAVs for military and commercial platforms.

The UK UAV (Drone) market is expected to grow from USD 0.84 billion in 2025 to USD 1.48 billion by 2030 at a CAGR of 12.0%. The growth is driven by advancements in lightweight materials, high-resolution sensors, AI, autonomous navigation, communication systems, and battery efficiency. These are enhancing UAV performance, expanding mission versatility, and enabling cost-effective deployment in commercial logistics and defense operations with reduced human intervention.

UAV (Drone) Market: COMPANY EVALUATION MATRIX

In the UAV (Drone) market matrix, DJI (Star) leads with strong dominance and advanced UAV technologies, solidifying its leadership in the industry. Northrop Grumman Corporation (Emerging Leader) is maintaining a competitive global presence with robust UAV offerings, showing potential to strengthen its market position as global demand for drones expands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top UAV (Drone) Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 26.12 BN |

| Market Forecast in 2030 (value) | USD 40.56 BN |

| Growth Rate | 9.2% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Latin America, Africa |

WHAT IS IN IT FOR YOU: UAV (Drone) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| UAV Application Cross-arket Analysis | Further breakdown of the current application categories into more detailed sub-categories, along with historical data | Gain cross-market analysis to understand the penetration of each segment by application categorizations and observe consumption trends and shifts |

| UAV Propulsion Technology Deep Dive | Mapping UAV models by number and type of engines/propulsion technology deployed | Broader understanding of the UAV engine by model, along with technical capabilities across civil/commercial and defense & government applications |

| VTOL UAV, AI-powered UAV & Loitering Munition UAV Market & Competition Analysis | Further deep-dive on VTOL UAV market, AI-powered UAV market, and loitering Munition UAV market across regions and segments | Gain an understanding of how the companies are positioned based on segmentation footprint, financials, contracts, and developments, along with market size estimates and forecasts at the regional and segmental level |

| UAV Commercial Model Deep Dive | Market share by commercial UAV model, average selling price ranges, and operation cost per model | Help understand the complete commercial UAV landscape with key models and relevant statistics to determine their adoption |

RECENT DEVELOPMENTS

- July 2025 : DJI (China) unveiled three new agricultural drones, Agras T100, T70P, and T25P, to enhance large-scale, precision farming. The Agras T100 boasts a 40-liter spraying tank, dual atomization, and a 20-hectare/hour efficiency, ideal for expansive farmland. The T70P targets mid-scale operations with a 30-liter tank and smart terrain following, while the T25P offers portability and modularity for orchards and hilly regions, supporting spraying and spreading.

- June 2025 : Parrot Drone SAS (France) launched the ANAFI UKR, a sovereign micro-drone explicitly designed for tactical Intelligence, Surveillance, and Reconnaissance (ISR) missions. Developed in response to operational needs highlighted during the Ukraine conflict, the ANAFI UKR offers silent flight, high-resolution day/night imaging, secure communications, and GNSS-denied navigation, making it ideal for frontline deployment.

- February 2025 : Teledyne FLIR LLC (US) Defense received a contract for USD 15 million for Black Hornet 4 Nano-Drones. The contract was facilitated by Teledyne FLIR’s regional partner, European Logistic Partners (ELP) GmbH, Wuppertal, Germany. Black Hornet 4 represents the next generation of lightweight nano-drones. It provides enhanced covert situational awareness to small fighting units.

Table of Contents

Methodology

This research study on the UAV (drone) market extensively used secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the UAV (drone) market and assess the market’s growth prospects.

Secondary Research

The market share of companies in the UAV (drone) market was determined using the secondary data acquired through paid and unpaid sources, and by analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources for this research study included financial statements of companies offering UAV services, infrastructure and software providers, and various trade, business, and professional associations. Secondary data was collected and analyzed, and was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information on the UAV (drone) market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries in North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

Others include Sales Managers, Marketing Managers, and Product Managers.

Tiers of companies are based on their revenue in 2024. Here’s the categorization of tiers:

Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

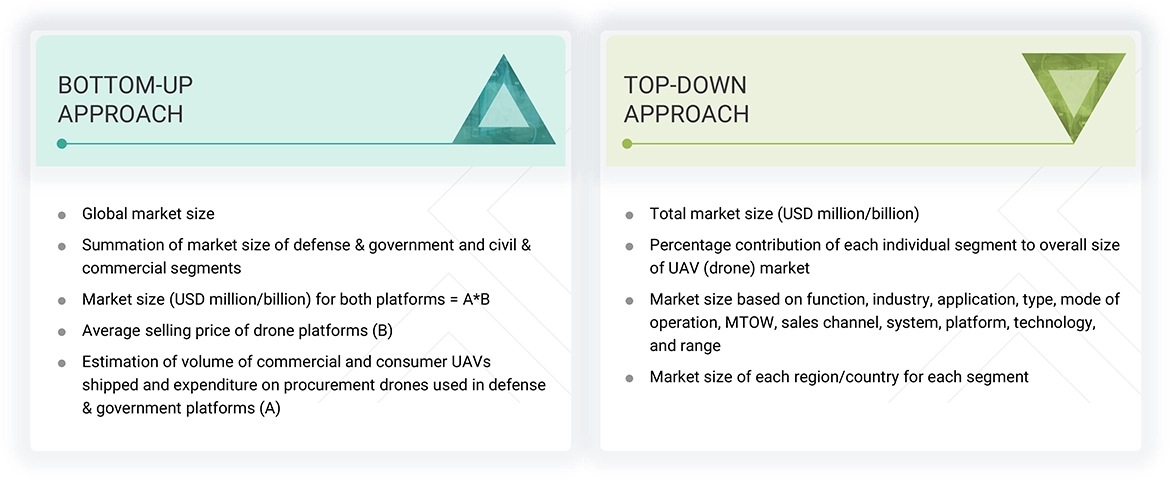

- Top-down and bottom-up approaches were used to estimate and validate the size of the UAV (drone) market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

UAV (Drone) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the UAV (drone) market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Unmanned aerial vehicles (UAVs) are remotely piloted, optionally piloted, or fully autonomous aerial vehicles that play a significant role in the defense and commercial sectors. They are commonly termed drones and are mostly known for their wide usage in various military missions, such as border surveillance and combat operations. These vehicles are also used for mapping, surveying, and determining the weather conditions of a specific area.

Key Stakeholders

- UAV (Drone) Suppliers

- UAV (Drone) Component Manufacturers

- UAV (Drone) Manufacturers

- UAV (Drone) Pilot Training Institutes

- Technology Support Providers

- UAV (Drone) Software/Hardware/Service and Solution Providers

- Regulatory Bodies

- UAV (Drone) Consultants

- Defense Forces

Report Objectives

- To define, describe, segment, and forecast the size of the UAV market based on platform, system, industry, application, mode of operation, maximum take-off weight (MTOW), type, range, sales channel, function, technology, and region

- To forecast the size of various market segments with respect to six major regions, namely North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to drone regulations across regions

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the estimated size of the UAV (drone) market in 2025?

The UAV (drone) market is estimated to be USD 22.60 billion in 2025.

Who are the winners in the UAV (drone) market?

The winners in the UAV (drone) market are DJI (China), Northrop Grumman Corporation (US), General Atomics (US), Israel Aerospace Industries Ltd. (Israel), and Teledyne FLIR LLC (US).

What are the factors driving the growth of the market?

- Rising procurement of UAVs (drones) for military applications

- Farm management optimization using agricultural drones

- Increasing use of drones in commercial applications

- Sensor and technology development

- Supportive government regulations and initiatives

What are some of the technological advancements in the market?

- Integration of artificial intelligence and Swarm Intelligence

- Advancements in communication links and sense-and-avoid systems

- Development of hybrid propulsion and extended endurance systems

Which region is estimated to account for the largest share of the UAV (drone) market in 2025?

North America is estimated to account for the largest share (48.6%) of the UAV (drone) market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UAV (Drone) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in UAV (Drone) Market

Kirill

Sep, 2019

We are a big agricultural business in Russia with over 100,000 hectares of irrigated land. We are interested in modern, sophisticated methods of control & security, such as the use of drones—not only quadcopters but also heavier fixed wing types—in monitoring. We are developing a business strategy to study the use of all classes of UAVs in Russian agriculture. Your report would be greatly appreciated after we have a look at the sample. Best wishes. Kirill Shilin. Marketing Manager. .

Ahmed

Sep, 2019

I am interested in the UAV market and segmentation for all sizes, including growth opportunities and recent trends in UAVs..

MEHDI

Feb, 2019

SIR, HOW DO YOU FORESEE THE GROWTH OF HEAVY CARGO/PASSENGER UAVs IN INDIA AND NEIGHBOURING COUNTRIES..

ilaria

Jul, 2019

We are interested in the market value of Automated Aerial Monitoring data (UAVs) in water enviromental monitoring for sea water Pollution Monitoring..

TUYIHIMBAZE

Aug, 2019

Hi, Thanks for the great research done around UAVs. I am interested in reading this global forecast so I can direct our business well. We have been training young people to make drones that can be used to solve some of the biggest challenges here in Africa. It will be of great support to have a document guiding us regarding the market and the types of drones across the world. Best Regards, Serge.

Ahmad

Feb, 2019

I research on the technological aspects of UAV development as a graduate researcher. I am preparing for a business start-up competition and am looking for some detailed insights into UAV market and growth..

Stewart

Aug, 2019

Assess overall Class II and II+ UAV market to determine economics of component manufacturers and technological innovation investment..

Bcharan

Nov, 2019

We are an upcoming start-up into drones. Before we start this business, we are doing due market research to understand the sales growth for drones. We need a customized report having the following details 1. UAV Market, By UAV Type in India 2. UAV Market, By Application 3. UAV Market, By Class (Small) 4. UAV Payloads, By Type 5. UAV Gimbals 6. UAV Market, By Point of Sale (OEM & Aftermarket) 7. UAV Market, By MTOW (<25 Kilograms, 25-150 Kilograms, >150 Kilograms) 8. UAV Market, By Region (India) .

Robert

Aug, 2019

I'm researching the market for UAV avionics to evaluate the business case for investment in next-generation avionics computing and fault tolerant systems..

Nasser

Aug, 2019

I am an investor in the UAV market, and and the Director of Malaysia's only indigenous UAS development and integration organization. I would like to view the information in your report. .

Mads

Aug, 2019

I'm working with the "International Business and Entrepreneurship" research group at the Department of Marketing and Management, where I am doing a project on the business aspects of the global UAV market. I am interested in all business intelligence on the global UAV industry. .

minwoo

Jul, 2019

We want to read your analysis to look at the possibility for the success of wireless charging for smart commercial drones..

MnM Analyst

Jun, 2019

With upcoming India UTM regulations in place for BVLOS UAVs, the expected market potential in short term would be for Light Cargo Delivery Drone especially e-commerce, retail, food delivery etc. The market growth for heavy lift drones will depend on the successful implementation of Light Cargo Delivery Drone as drone operations with heavy payloads are restricted by aviation authorities. In India, commercial drones operations are restricted and need special approvals from DGCA prior the flight. However, Indian UAV manufacturers are developing UAV prototypes, capable of lifting heavy payloads. For instance, In February 2019, Poeir Jets launches Heavy-lift Hybrid Drone with MTOW of 200 Kgs to be used for Cargo, Civil, Agriculture, Forestry, Defence and other strategic applications. Neighboring countries such as China and Malaysia are developing UAVs with MTOW capacity ranging from 800 Kgs to 5000 Kgs to be used for various commercial & military applications. Irrespective of the development in UAV industry, the growth of heavy lift drones market is subject to the regulatory approvals by the concerned aviation authorities. .

MOHAMMED

May, 2019

Dear Sir/Madam, We are looking for a UAV market research report customized for the MENA region. I am wondering about the cost of the customization, especially for the GCC region. Moreover, I would like to have a free sample of this report. Regards, Mohammed.

Grepow

Mar, 2020

We are a battery manufacturer, and the UAV drone battery is also one of our projects. In recent years, the development of UAV is very rapid, and the demand for customized drone battery is also in short supply..

sritej

Mar, 2019

We are planning to start a consultancy in the UAV Industry, and would like to analyse the market for the same. Thank you..

Bresca

Mar, 2019

Good evening. I am researching on the use of UAVs as a possible component in a communications solution for PPDR (Public Protection and Disaster Preparedness) scenarios..

User

Feb, 2022

What is the best cost for the report ? .

Priscilla

Jan, 2019

Understanding broad market segmentation and growth to help in evaluating commercial potential of disclosed technologies..