Drone Simulator Market by Application (Commercial, Military), Component (Software, Hardware), Device Type (Augmented Reality, Virtual Reality), Drone Type (Fixed Wing, Rotary Wing), System Type, and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Drone Simulator Market is experiencing significant growth driven by increasing demand for training solutions across various industries, including aviation, agriculture, and military applications. Technological advancements in simulation software and hardware have enhanced the realism and effectiveness of AI in drone training, allowing users to practice complex maneuvers and scenarios in a safe environment. These simulators not only reduce training costs but also improve operational efficiency and safety by providing pilots with hands-on experience without the risks associated with real-world flying. As the drone industry continues to expand, the need for effective training solutions will further propel the growth of the drone simulator market.

Drone Simulator Market Size & Growth

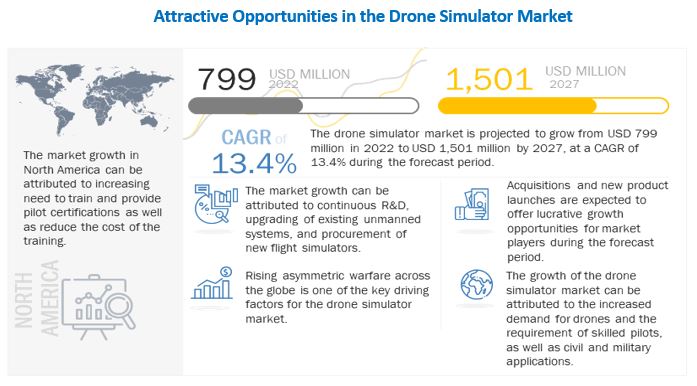

The Drone Simulator Market Size is expected to grow at a CAGR of 13.4% from 2022 to 2027, reaching USD 1,501 Million by 2027. A drone simulator is a computer system and software solution that provides an artificial environment for drone flight training. Pilots can learn to simulate unmanned aircraft and payloads while ensuring high-level safety and security. The drone flight simulation includes different devices such as flight controls, simulator screens, and software support for pilot training and operation. Affordability of simulator training, increasing demand for drones in commercial and military applications, and intellectual capabilities are driving the demand for drone simulators.

In the coming years, the drone simulator industry is expected to witness various technological developments such as advancements in the synthetic training system, innovation in UAVs and their payloads, and the emergence of 3D simulation provisions for UAV training.

To know about the assumptions considered for the study, Request for Free Sample Report

Drone Simulator Market Analysis

Drone Simulator Market Trends

Drone Simulator Market Dynamics:

Driver: Affordability of simulator training

Training pilots using a drone simulator is affordable compared to the training that involves using actual drones. Training with actual drones can be costly and is prone to accidents, which may damage the drone. Hence, it is considered to provide virtual training to the pilot to help control the drone even before they operate in real-time. Drone simulators can be used multiple times to train pilots for longer. Drone training institutions are employing drone simulators to train pilots. For instance, L-3 Link Simulation and Training (US) and the University of North Dakota offer MQ-1 Predator and MQ-9 Reaper Unmanned Aerial System (UAS) training opportunities for students and US government agencies. The drone simulator market is expected to increase owing to the low cost of simulation training.

Restraint: Stringent government regulations and lack of air traffic management

Unmanned aerial systems (UAS) and flight operations involve high-risk air travel, especially beyond the visual line of sight. Their operations over long distances increase the probability of accidents, property damage, and economic losses. Hence, several countries have stringent regulations for deploying UAVs near airports, international borders, government buildings, no-fly zone areas, temporary flight restriction areas due to lack of air traffic management, and safety and security issues. According to the US Air Traffic Control Association (ATCA), the use of drones in civil airspace is one of the major challenges faced by the aviation industry of the country. Presently, drones are prohibited from flying in civil airspace except for certain companies that have received exemptions to conduct tests and carry out demonstration flights.

In addition to regulations, the UAS industry lacks trained professionals to operate drones due to a low number of training and certification institutes. Complex terrains and extreme environmental conditions in various parts of the globe make it difficult to deploy air transportation services. These factors hamper the growth of the drone market, in turn, the growth of the simulator market.

Opportunity: Improvements in operational regulatory frameworks

The first 500 exemptions approved by the Federal Aviation Administration (FAA) of the US from the 1,500 petitions filed and evaluated by the Association of Unmanned Vehicle Systems International (AUVSI) in 2015 were rendered to more than 20 key industries, including real estate, aerial surveying, and photography, agriculture, etc., with aerial inspection being the top 5 categories stated in approved applications. More than 80% of the applicants were small companies, while among the well-established companies who obtained exemptions were Chevron (US), Amazon (US), and Dow Chemical Company (US). However, exemptions were provided to operators in 48 states of the country.

In June 2016, the US Federal Aviation Administration (FAA) formulated rules to legalize the operations of commercial drones in the country. The well-defined regulations by the FAA assist service providers in managing their drones securely in the national airspace. In July 2016, Flirtey (US), in collaboration with 7-Eleven (US), performed an FAA-approved drone delivery from a store to a home in the US. In March 2018, Flirtey got approval from the FAA to carry out drone deliveries below the visual line of sight in Nevada (US). DHL (Germany) has been toiling on the delivery of parcels using UAVs or drones. In October 2018, the company finished testing an automated delivery drone, Parcelcopter. The test lasted 3 months, and this drone made 130 autonomous loading and unloading tours under variable conditions. In June 2019, Amazon Prime Air (US) obtained FAA authorization to test its delivery drones

Challenge: Fully automated drones

Advanced drone software can make the drones autonomous. They do not require a pilot to fly and control. Drone software is not only designed to maneuver the drones, but it also provides a system to monitor the surrounding. Drones can perform tasks independently and collect and send the required information to the user. Thus, this decreases the need for trained drone pilots, which is a challenge for the drone simulator market. In 2016, Airobotics Solutions (Israel) developed an Optimus drone that can launch, fly, land, and maintain on its own. It can be used in seaports, power plants, mines, and oil & gas.

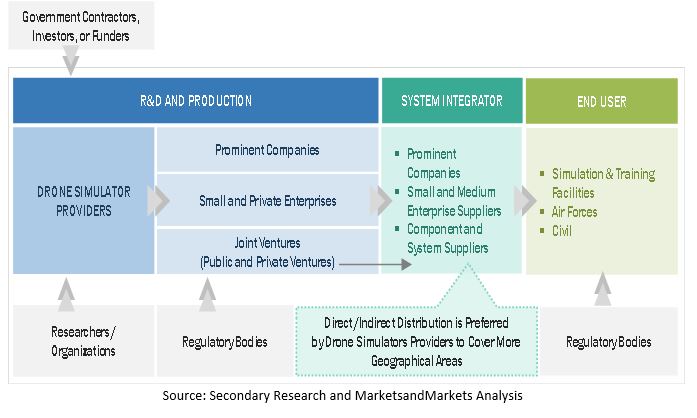

Drone Simulator Market Ecosystem

Prominent companies and startups that provide simulators and their services, distributors/suppliers/retailers, and end customers are the key stakeholders in the drone simulator market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries serve as the major influencers in the market.

Drone Simulator Market Segmentation

The software segment is projected to grow at the highest CAGR during the forecast period

The drone simulator market, based on components, has been segmented into hardware and software. The software consists of sophisticated programs developed for enacting real-life situations for training pilots. Hardware includes all physical parts of drone simulators, such as display devices and controllers. The hardware segment dominates the drone simulator market. Simulator technology is a virtual representation of a real UAV-based training system utilized by commercial pilots and special forces commanders worldwide. The simulator comprises several pieces, electronic chips, a monitor, radar, communication intelligence, and other components. These components were designed to provide the pilot with a realistic experience. Sensor, GPS, and navigation developments are helping to improve simulator systems by allowing them to replicate realistic real-world situations.

The fixed wing segment projected to lead the drone simulator market during the forecast period

Based on the drone type, the drone simulator market has been segmented into the fixed wing and rotary wing. Generally, fixed-wing drones are used in military applications, whereas rotary-wing drones, such as helicopters and quadcopters, are used in commercial applications. The fixed-wing segment is likely to dominate the global drone simulator market. Armed forces all across the world deploy fixed-wing drones in military and defense activities. Several military missions are carried out in various terrains and elevations, focusing on long-distance endurance. Furthermore, the greater structural benefits of conducting long-distance surveillance drive demand in the industry. The rotary-wing segment is predicted to develop substantially in the next years due to the growing use of quadcopters and multicopters. These lightweight load carriers are utilized worldwide for surveillance, logistics, aerial photography, videography, and transportation.

To know about the assumptions considered for the study, download the pdf brochure

Regional Analysis - Drone Simulator Market

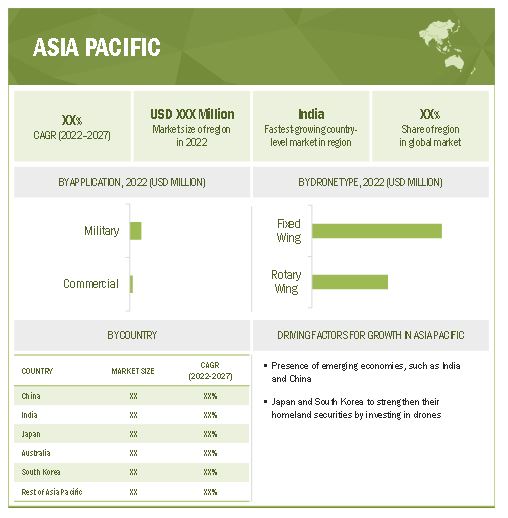

Asia Pacific witnessed the highest CAGR during the forecasted period

The Asia Pacific region's market growth can be attributed to innovations in simulation technologies to manufacture low-cost commercial drones. This is a significant factor in the region's drone simulator market growth. China, Australia, India, and Japan contribute to the growth of the drone simulator market in the Asia Pacific region. China is a major player in the Asia Pacific drone simulator market and a leader in manufacturing advanced drones for commercial applications.

Top Drone Simulator Companies - Key Market Players

The drone simulator companies are dominated by a few globally established players such as CAE Inc. (Canada), Israel Aerospace Industries Ltd. (Israel), Leonardo S.p.A. (Italy), Zen Technologies Limited (India), Havelsan A.S. (Turkey), General Atomics Aeronautical Systems, Inc. (US), Simlat UAS & ISR Training Solutions (Israel), and ST Engineering (Singapore).

Drone Simulator Industry Overview

Scope of the Drone Simulator Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 799 Million in 2022 |

| Projected Market Size |

USD 1,501 Million by 2027 |

| CAGR |

13.4 % |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

By component, drone type, system type, application, device type, and region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East, and the Rest of the World |

|

Companies Covered |

CAE Inc. (Canada), Israel Aerospace Industries Ltd. (Israel), Leonardo S.p.A. (Italy), Zen Technologies Limited (India), Havelsan A.S. (Turkey), General Atomics Aeronautical Systems, Inc. (US), Simlat UAS & ISR Training Solutions (Israel), and others |

This research report categorizes the drone Simulator Market based on component, drone type, system type, application, device type, and region

Drone Simulator Market, By Application

- Commercial

- Military

Drone Simulator Market, By System Type

- Fixed

- Portable

Drone Simulator Market, By Component

- Hardware

- Software

Drone Simulator Market, By Drone Type

- Fixed Wing

- Rotary Wing

Drone Simulator Market, By Device Type

- Augmented reality

- Virtual Reality

Flight Simulator Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In February 2022, France has agreed to continue contractor logistics support for its MQ-9A Reaper fleet with General Atomics-Aeronautical Systems Inc (GA-ASI). It is a follow-on contract to support the French Air and Space Force with aircraft components, spares, and accessories; training equipment and simulator software; upgrades to the Predator Mission Aircrew Training System (PMATS).

- In July 2021, Indra Sistemas SA created the SIMCUI, a multi-purpose and interoperable simulation system that is portable and easy to deploy anywhere. It has the potential to cut the time necessary to teach a civilian or military pilot for any plane, whether fixed wing, rotary wing or remotely piloted.

- In June 2021, Israel Aerospace Industries signed a contract with an Asian country to provide unmanned aerial systems (UAS) for the Heron UAV. This includes maintenance, upgrades, and simulation training.

Frequently Asked Questions (FAQs):

What is the current size of the drone Simulator market?

The drone Simulator market is projected to grow from USD 799 million in 2022 to USD 1,501 million by 2027, at a CAGR of 13.4% from 2022 to 2027.

Who are the winners in the drone simulator market?

CAE Inc. (Canada), Israel Aerospace Industries Ltd. (Israel), Leonardo S.p.A. (Italy), Zen Technologies Limited (India), Havelsan A.S. (Turkey), General Atomics Aeronautical Systems, Inc. (US), Simlat UAS & ISR Training Solutions (Israel), and ST Engineering (Singapore) are some of the winners in the market.

What are the key segments covered in the market?

By drone type (fixed wing and rotary wing), by application (commercial and military), component (hardware and software), system type (Fixed and portable), and by device type (virtual reality and augmented reality) in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 DRONE SIMULATOR MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 DRONE SIMULATOR MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 DRONE SIMULATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Insights from industry experts

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 KEY PRIMARY SOURCES

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 7 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 PORTABLE SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 9 MILITARY SEGMENT TO LEAD DRONE SIMULATOR MARKET DURING FORECAST PERIOD

FIGURE 10 AUGMENTED REALITY TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 FIXED WING SEGMENT TO ACQUIRE HIGHEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR DRONE SIMULATORS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE SIMULATOR MARKET

FIGURE 13 DEMAND FOR DRONE SIMULATORS TO TRAIN MILITARY PILOTS TO DRIVE MARKET

4.2 DRONE SIMULATORS MARKET, BY APPLICATION

FIGURE 14 COMMERCIAL SEGMENT EXPECTED TO GROW AT HIGHEST CAGR FROM 2022–2027

4.3 MARKET, BY COMPONENT

FIGURE 15 HARDWARE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

4.4 MARKET, BY DRONE TYPE

FIGURE 16 FIXED WING TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

4.5 DRONE SIMULATOR MARKET, BY DEVICE TYPE

FIGURE 17 VIRTUAL REALITY ESTIMATED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

4.6 DRONE SIMULATORS MARKET, BY COUNTRY

FIGURE 18 DRONE SIMULATOR MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRONE SIMULATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Government funding for military drones

TABLE 3 DEFENSE SPENDING OF MAJOR ECONOMIES

5.2.1.2 Growing prominence of intensified military training

TABLE 4 NUMBER OF ACTIVE CONFLICTS WORLDWIDE

5.2.1.3 Adoption of UAVs in civil and commercial applications

5.2.1.4 Full-scale conversion of drones for war simulation

5.2.1.5 Affordability of simulator training

5.2.1.6 Increased capabilities of drone simulators

5.2.2 RESTRAINTS

5.2.2.1 Complexity of drone simulator systems

5.2.2.2 Stringent government regulations and lack of air traffic management

5.2.3 OPPORTUNITIES

5.2.3.1 Lack of skilled and trained personnel

5.2.3.2 Improvements in operational regulatory frameworks

TABLE 5 UAV REGULATIONS OVERVIEW, BY COUNTRY

5.2.4 CHALLENGES

5.2.4.1 Fully automated drones

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE SIMULATOR MARKET

FIGURE 20 REVENUE SHIFT FOR DRONE SIMULATORS MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

5.5 DRONE SIMULATOR MARKET ECOSYSTEM

FIGURE 22 MARKET ECOSYSTEM MAP

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

TABLE 6 DRONE SIMULATOR MARKET ECOSYSTEM

5.6 USE CASE ANALYSIS

5.6.1 USE CASE: DRONE SIMULATOR FOR AGRICULTURE

5.6.2 USE CASE: MISSION TRAINER FOR UAVS

5.7 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE ANALYSIS OF DRONE SIMULATORS IN 2021

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 DRONE SIMULATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOLUTIONS

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOLUTIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 DRONE REGULATIONS AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

5.10.2 NORTH AMERICA

5.10.2.1 US

TABLE 17 US: FAA RULES AND GUIDELINES FOR DRONE OPERATIONS

5.10.2.2 Canada

TABLE 18 CANADA: RULES AND GUIDELINES FOR DRONE OPERATIONS

5.10.3 EUROPE

5.10.3.1 UK

TABLE 19 UK: CAA RULES AND GUIDELINES FOR DRONE OPERATIONS

5.10.3.2 Germany

TABLE 20 GERMANY: RULES AND GUIDELINES FOR DRONE OPERATIONS

5.10.3.3 France

TABLE 21 FRANCE: RULES AND GUIDELINES FOR DRONE OPERATIONS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 22 DRONE SIMULATOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 INDUSTRY TRENDS (Page No. - 76)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ADVANCEMENTS IN SYNTHETIC TRAINING SYSTEMS

6.2.2 INNOVATIONS IN DRONES/UAVS

6.2.3 3D SIMULATION PROVISIONS FOR UAV TRAINING

6.2.4 MANNED-UNMANNED TEAMING (MUM-T)

6.2.5 FOG COMPUTING

6.2.6 REAL-TIME OPERATING SYSTEM (RTOS)

6.2.7 COMPUTER VISION

6.2.8 ADVANCED ALGORITHMS AND ANALYTICS

6.2.9 MACHINE LEARNING-POWERED ANALYTICS

6.3 DRONE SIMULATOR APPLICATIONS AND TRENDS

6.3.1 SPORTS

6.3.2 PAYLOAD TRAINING

6.3.3 TRAINING FOR LICENSING/FLYING

6.3.4 MILITARY GAMING/EXERCISES

FIGURE 26 DRONE SIMULATOR APPLICATIONS

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN ANALYSIS

6.5 IMPACT OF MEGATRENDS

6.5.1 ARTIFICIAL INTELLIGENCE

6.6 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 23 INNOVATIONS AND PATENT REGISTRATIONS, (2020—2022)

7 DRONE SIMULATOR MARKET, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

FIGURE 28 MILITARY PLATFORM TO LEAD DRONE SIMULATORS MARKET DURING FORECAST PERIOD

TABLE 24 MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 MILITARY

7.2.1 DEMAND FOR EFFICIENCY AND EFFECTIVENESS IN PILOT TRAINING

7.3 COMMERCIAL

7.3.1 PILOT LICENSING AND NEW REGULATIONS FOR DRONE OPERATIONS

8 DRONE SIMULATOR MARKET, BY COMPONENT (Page No. - 88)

8.1 INTRODUCTION

FIGURE 29 HARDWARE COMPONENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 26 MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 27 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

8.2 SOFTWARE

8.2.1 CONTROLLED TRAINING AND EASE OF INSTALLATION

8.3 HARDWARE

8.3.1 INTEGRATED INTO MULTIPLE SENSORS

9 DRONE SIMULATOR MARKET, BY SYSTEM (Page No. - 91)

9.1 INTRODUCTION

FIGURE 30 FIXED SYSTEMS TO LEAD DRONE SIMULATORS MARKET

TABLE 28 MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 29 MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

9.2 FIXED

9.2.1 MILITARY DRONE PILOT TRAINING TO DRIVE SEGMENT

9.3 PORTABLE

9.3.1 ADOPTION OF DRONES FOR INDUSTRIAL AND TRAINING REQUIREMENTS

10 DRONE SIMULATOR MARKET, BY DEVICE TYPE (Page No. - 94)

10.1 INTRODUCTION

FIGURE 31 VIRTUAL REALITY DEVICE TYPE SEGMENT TO LEAD MARKET

TABLE 30 MARKET, BY DEVICE TYPE, 2019–2021 (USD MILLION)

TABLE 31 MARKET, BY DEVICE TYPE, 2022–2027 (USD MILLION)

10.2 AUGMENTED REALITY

10.2.1 AUGMENTED TECHNOLOGIES FOR ENHANCED EXPERIENCE

10.3 VIRTUAL REALITY

10.3.1 AFFORDABLE TECHNOLOGY

11 DRONE SIMULATOR MARKET, BY DRONE TYPE (Page No. - 98)

11.1 INTRODUCTION

FIGURE 32 FIXED WING SEGMENT PROJECTED TO LEAD MARKET

TABLE 32 MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 33 MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

11.2 FIXED WING

11.2.1 HIGHLY SKILLED PILOTS FOR DRONE OPERATIONS

11.3 ROTARY WING

11.3.1 INCREASING ADOPTION OF QUADCOPTERS AND SIMULATION PROGRAMS TO AID SEGMENT GROWTH

12 REGIONAL ANALYSIS (Page No. - 101)

12.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECASTED PERIOD

TABLE 34 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 34 NORTH AMERICA: DRONE SIMULATOR MARKET SNAPSHOT

TABLE 36 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Increased demand for drone training institutes

TABLE 46 US: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 47 US: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 48 US: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 49 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 50 US: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 51 US: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Change in current regulatory landscape

TABLE 52 CANADA: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 53 CANADA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 54 CANADA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 55 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 56 CANADA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 57 CANADA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 35 EUROPE: DRONE SIMULATOR MARKET SNAPSHOT

TABLE 58 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Increased demand for commercial drone simulators

TABLE 68 UK: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 69 UK: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 70 UK: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 71 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 72 UK: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 73 UK: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3.3 RUSSIA

12.3.3.1 Procurement of military drones to increase demand for simulators

TABLE 74 RUSSIA: DRONE SIMULATORS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 75 RUSSIA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 76 RUSSIA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 77 RUSSIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 78 RUSSIA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 79 RUSSIA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 New rules to enhance safety

TABLE 80 GERMANY: DRONE SIMULATORS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Rising demand for drone pilots for industrial applications

TABLE 86 FRANCE: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 88 FRANCE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Updated regulations to increase demand for new drones

TABLE 92 ITALY: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 93 ITALY: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 94 ITALY: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 95 ITALY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 96 ITALY: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 97 ITALY: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Demand for skilled and trained drone operators

TABLE 98 REST OF EUROPE: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: DRONE SIMULATOR MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Increasing presence of market players

TABLE 114 CHINA: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 115 CHINA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 116 CHINA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 117 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 118 CHINA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 119 CHINA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Drones for commercial applications to fuel market growth

TABLE 120 JAPAN: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 121 JAPAN: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 122 JAPAN: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 JAPAN: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 125 JAPAN: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Customized drone simulators

TABLE 126 INDIA: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 127 INDIA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 128 INDIA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 129 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 130 INDIA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 131 INDIA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Demand for new commercial and military pilots

TABLE 132 SOUTH KOREA: DRONE SIMULATORS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 133 SOUTH KOREA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 134 SOUTH KOREA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 135 SOUTH KOREA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 136 SOUTH KOREA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 137 SOUTH KOREA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4.6 AUSTRALIA

12.4.6.1 New regulations and standards to acquire remote pilot licenses

TABLE 138 AUSTRALIA: DRONE SIMULATORS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 139 AUSTRALIA: TEM, 2022–2027 (USD MILLION)

TABLE 140 AUSTRALIA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 141 AUSTRALIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 142 AUSTRALIA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 143 AUSTRALIA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Established regulatory framework and industry-driven applications

TABLE 144 REST OF ASIA PACIFIC: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 146 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 37 MIDDLE EAST: DRONE SIMULATOR MARKET SNAPSHOT

TABLE 150 MIDDLE EAST: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 151 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 152 MIDDLE EAST: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 153 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 157 MIDDLE EAST: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 158 MIDDLE EAST: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 159 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 UAE

12.5.2.1 Manufactures advanced drone systems

TABLE 160 UAE: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 161 UAE: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 162 UAE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 163 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 UAE: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 165 UAE: DRONE SIMULATOR MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Demand for new pilots and technicians to counter drone threats

TABLE 166 SAUDI ARABIA: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 167 SAUDI ARABIA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 168 SAUDI ARABIA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 169 SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 170 SAUDI ARABIA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 171 SAUDI ARABIA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.5.4 REST OF MIDDLE EAST

12.5.4.1 Inspection, surveying, and monitoring to drive market

TABLE 172 REST OF MIDDLE EAST: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 173 REST OF MIDDLE EAST: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

FIGURE 38 REST OF THE WORLD: DRONE SIMULATOR MARKET SNAPSHOT

TABLE 178 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 179 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 REST OF THE WORLD: MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 183 REST OF THE WORLD: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 184 REST OF THE WORLD: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 185 REST OF THE WORLD: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 186 REST OF THE WORLD: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 187 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.1 LATIN AMERICA

12.6.1.1 Procurement of advanced training and virtual trainer technology systems

TABLE 188 LATIN AMERICA: DRONE SIMULATOR MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Demand for trained pilots to increase

TABLE 194 AFRICA: DRONE SIMULATORS MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 195 AFRICA: MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 196 AFRICA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 197 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 198 AFRICA: MARKET, BY DRONE TYPE, 2019–2021 (USD MILLION)

TABLE 199 AFRICA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

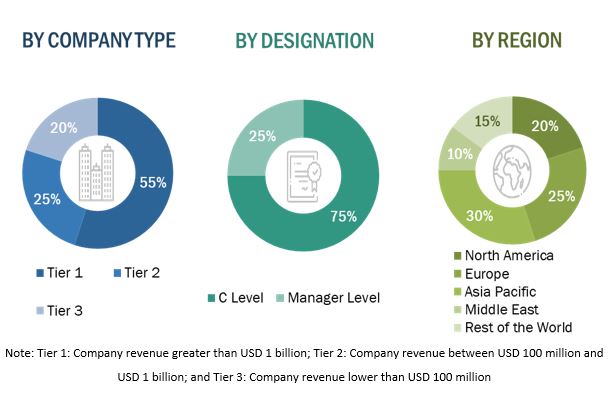

This research study involved the extensive usage of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information on the drone simulator market. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources have been interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the growth of the drone simulator market during the period under consideration.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The data for North America was also collected from secondary sources, such as Homeland Security of the US and the Federal Aviation Administration (FAA). Similarly, the data for various regions have been accumulated from federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations, among other primary respondents, further validated.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from drone simulator product/solution vendors; system integrators; professional and managed service providers; industry associations; independent solution consultants and importers; distributors; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the drone simulator market. The following figure in this subsection represents the overall market size estimation process employed for this study.

The research methodology used to estimate the market size also includes the following details:

- Key players in the market have been identified through secondary research, and their market shares have been determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-down approach

Data Triangulation

Following the evaluation of the total market size (as described above), the market was divided into segments and subsegments. Data triangulation and market breakdown processes were used to complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by evaluating numerous elements and trends from the drone simulator market's demand and supply sides.

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the flight simulator market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for five regions, including North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, as well as significant nations within each of these areas.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders

Available customizations

MarketsandMarkets provides customizations in addition to market data to meet the individual demands of businesses. The following report customization options are available:

Product Evaluation

- The product matrix provides a thorough comparison of each company's product portfolio.

Regional Examination

- Further segmentation of the market at the national level

Information About the Company

- Additional market participants will be thoroughly examined and profiled (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Simulator Market