Autonomous Last Mile Delivery Market by Platform (Aerial Delivery Drones (Cargo Drones, Delivery Drones), Ground Delivery Vehicles (Delivery Bots, Self-Driving Vans & Trucks)), Solution, Application, Payload Weight, Range and Region - Global Forecast to 2030

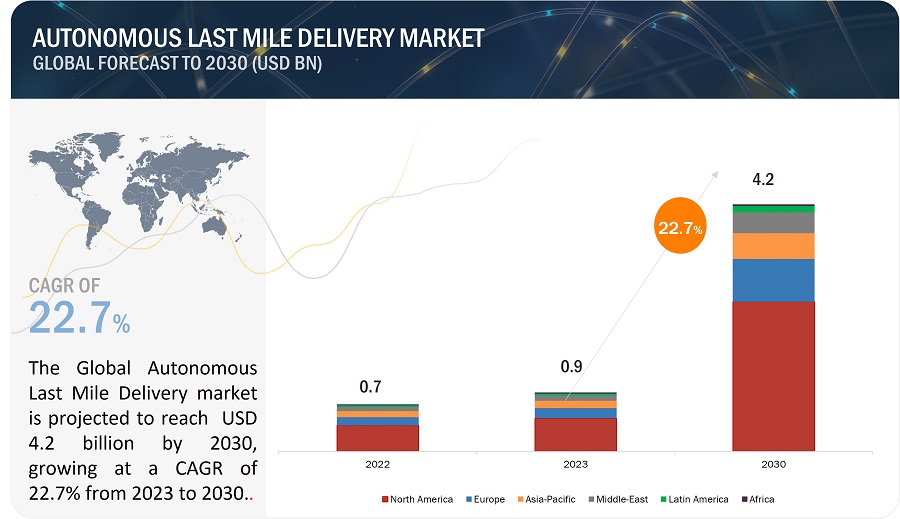

The Autonomous Last Mile Delivery Market is valued at USD 0.9 Billion in 2023 and is projected to reach USD 4.2 Billion by 2030, at a CAGR of 22.7%. The last mile, typically the final leg of the delivery process, is often the most complex and costly, requiring careful coordination and efficient execution to ensure timely and satisfactory deliveries. However, advancements in autonomous technologies have opened up a world of possibilities, offering a potential solution to these challenges. The emergence of autonomous last mile delivery systems has brought about a paradigm shift in the way goods are transported from distribution centers to consumers' doorsteps. These cutting-edge systems employ a range of technologies, including robotics, artificial intelligence, and advanced sensors, to enable self-driving vehicles, drones, and even humanoid robots to handle the last mile delivery process independently. By removing the need for human intervention, autonomous last mile delivery holds the promise of increased efficiency, cost-effectiveness, and improved customer experiences.

The use of sense and avoid systems in aerial delivery drones is continuously increasing due to enhanced safety and beyond visual line of sight features offered by them. These sense and avoidance systems use a combination of cameras, radar, LiDAR, and other systems to detect and avoid obstacles successfully. Sense and avoid systems are of cooperative and non-cooperative types. As a part of cooperative type sense and avoid systems, drones may utilize systems formerly intended for manned aviation, for instance, TCAS (traffic collision and avoidance systems) or ADS-B (automatic dependent surveillance-broadcast), which occasionally broadcast and receive, identity, position, as well as offer information. This solution is dependable on the function of all aircraft within the airspace and does not look after non-aviation obstacles. Non-co-operative sensors for sense and avoid solutions can be segmented into two groups – active and passive.

Active sensors such as radar, ultrasound, and LiDAR radiate a signal that is then reflected by an obstacle and detected again by the sensor. Passive sensors detect a signal given off by the object itself and comprise visual and infrared cameras. Non-cooperative sensors do not depend on a data link with another system to obtain information. The sense and avoid system is one of the major enabler technologies for beyond the visual line of sight (BVLOS) usage of drones and is essential for the extensive adoption of drones for parcel delivery. It is considered the biggest prospect in the overall UAV and drone market.

Autonomous Last Mile Delivery Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Autonomous Last Mile Delivery Market Dynamics

Driver-Aerial segment: Rapid growth and expansion of the e-commerce industry

Last-mile distribution is an extremely complicated industry vastly dependent on the local environment. City infrastructure differs from the crowded streets of Mumbai against the less thickly populated stretch of Munich to the sprawl of Los Angeles. Local regulations, the accessibility and cost of labor, traffic intensity, shopping behavior, and so o, all rely on where companies need to get their customers and ensure that deliveries are met on time without losses and in a cost-efficient approach. Like several allied industries, the last mile sector is undergoing a massive revolution propelled by rising customer requirements aided by technological progress. The growing demand for fast delivery of packages by consumers has led to the increased adoption of aerial delivery drones in the global e-commerce industry. While same-day deliveries are at 5% penetration in Europe currently, they are at 10% in China and are estimated to be 15% in the US by 2025. E-commerce has been a major driver for this accomplishment. In particular, the B2C market has grown higher than the B2B market. Key drivers for this development are urbanization and the growing purchasing power of the global middle class, along with an ever-expanding product range that is accessible online.

Corporations such as Uber and Deliv are investors in the same-day delivery market. Aerial delivery drones facilitate the quick delivery of products for retail and e-commerce companies. To enable the fast delivery of products, retailers are trying to lower their delivery lead times and enhance the flexibility and speed of deliveries by maintaining Stock-keeping Units (SKUs) assisted by drones. Aerial delivery drones are expected to help increase the delivery speed of products in crowded megacities. In addition, drone deliveries are also environmentally friendly (low carbon footprint and less energy consumption), which has led to a rise in the adoption of aerial delivery drones across the globe.

Driver-Ground Segment: Increased adoption of autonomous ground delivery vehicles due to advanced technological features

Ground delivery vehicles comprise advanced electronics to ensure their safe, reliable, and efficient operation. Several technological advancements are taking place in ground delivery vehicles in terms of improved power sources and data gathering and processing technologies. Lithium-ion batteries are predominantly used in ground delivery vehicles. However, hydrogen fuel cell batteries are expected to be used in autonomous ground vehicles in the future due to their excellent endurance and low weight. Moreover, manufacturers of ground delivery vehicles are also making efforts to incorporate sense and avoidance systems in their vehicles. Furthermore, technological advancements like sensor technology, AI, 5G technology, and several others are evolving the design and operations of ground delivery vehicles. Some instances are discussed below:

- For instance, 5G networks could pace up the transfer of large volumes of data and responsiveness of devices associated with the IoT network, along with the usage and processing of real-time data and data exchange with GPS or devices with built-in cameras (for instance, autonomous ground vehicles, i.e., AGVs).

- As technologies and AI algorithms have been developing, costs have decreased. While LiDAR units used to cost USD 85,000 until a few years back, the current price has decreased to well under USD 10,000. As that trend persists, the return on investment is growing, particularly for retailers such as grocers, where uninterrupted and repetitive deliveries could help them accomplish economies of scale on their investments.

- With the utilization of natural language processing, AI, and cloud computer networking, AGVs can boost the speed and efficiency of last-mile deliveries.

Thus, technological advancements in the field of ground delivery vehicles are expected to fuel the growth of the ground delivery vehicle market during the forecast period.

Restraints-Aerial Segment: Lack of required infrastructure to support operations of aerial delivery drones in emerging economies.

Autonomous mobility requires some basic infrastructure. Aerial delivery drones are expected to witness limited adoption in emerging economies due to the lack of adequate infrastructures, such as ground control stations and mobile towers outside urban areas, and cost considerations involved in their establishment. Moreover, the non-availability of required architecture in emerging economies such as India could make it difficult to have platforms to ensure smooth operations of aerial delivery drones.

Restraints-Ground Segment: Formulation and stringent implementation of regulations pertaining to operations of ground delivery vehicles.

Ground delivery vehicles must operate under a legal, regulatory framework to avoid accidents and traffic congestion. Most Western legal authorities hold manufacturers of these vehicles responsible for the tort of negligence if they cause any damage or injury to users or nearby humans. In 2021, concerned authorities in San Francisco passed some of the most restrictive regulatory laws for the use of ground delivery vehicles in the US. These laws were a result of people complaining about ground delivery vehicles crowding sidewalks and making transit difficult for pedestrians. Till March 2018, no startup in the country had secured permits for road testing of these vehicles. China is formulating new guidelines regarding the operation of unmanned vehicles on the streets. If heavily loaded (load capacity is up to 300 kilograms), these vehicles can crash, causing injuries to pedestrians and damage to public property. Hence, the US is planning to reduce the load-carrying capacity of ground delivery vehicles for their safe operation. Thus, the formulation and stringent implementation of various legal regulations acts as a restraint for the growth of ground delivery vehicles.

Opportunity-Aerial segment: Rise in technological advancements in delivery drones

Aerial delivery drones can be used to carry small items from one place to another at low costs. These drones can also make the supply chain smooth and cost-effective. The management of warehouses using aerial delivery drones and infrastructure solutions is viable as these drones presently can operate within a 5- to 10-mile radius only. However, with ongoing technological advancements such as wireless charging, IoT, 5G, AI, and machine learning (ML), aerial delivery drones are expected to be able to fly long distances and identify their location even in areas with limited GPS signals, as well carry out seamless and safe delivery of products. The integration of Unmanned Traffic Management (UTM) with drone logistics is expected to create growth opportunities for companies providing UTM solutions. In 2020, DHL (Germany) introduced a fully automated and intelligent smart drone delivery solution to deal with the last mile delivery challenges in metropolitan areas of China. DHL declared that the service lowered the delivery time from 40 to 8 minutes for an 8 km expanse and recovered expenses of up to 80% per delivery, with diminished energy consumption and carbon footprint compared to road transportation.

Opportunity-Ground Segment: Growing demand for AGVs in the delivery of healthcare supplies

The healthcare industry is experiencing a growing demand for Autonomous Guided Vehicles (AGVs) in the delivery of healthcare supplies. AGVs are designed to navigate through healthcare environments with precision and accuracy, ensuring timely and error-free delivery of critical supplies such as medications, lab specimens, and equipment. These vehicles are equipped with advanced sensors and mapping technology, enabling them to autonomously navigate complex hospital layouts, avoiding obstacles and following predefined routes. AGVs streamline the supply chain process in healthcare facilities by automating the delivery of supplies. These vehicles can efficiently transport items between different departments, eliminating the need for manual handling and reducing the time spent on logistics. By automating routine delivery tasks, healthcare staff can focus on providing patient care and other essential responsibilities. Healthcare facilities have specific requirements for supply delivery, such as maintaining controlled temperatures for medications or handling fragile medical devices. AGVs can be customized and equipped with specialized compartments or climate control systems to meet these unique needs. This adaptability ensures the safe and reliable transportation of sensitive healthcare supplies.

Challenge-Aerial Segment:Issues related to traffic management of aerial delivery drones

According to the Air Traffic Control Association (ATCA) of the US, the use of aerial delivery drones in civil airspace is one of the major challenges faced by the aviation industry of the country. Presently, aerial delivery drones are prohibited from flying in civil airspace except for certain companies that have received exemptions to conduct tests or demonstration flights. Another major concern is the secure and effective amalgamation of aerial delivery drones with existing air traffic systems. Presently, aerial delivery drones work under closed roofs.

However, in the coming years, aerial delivery drones developed to carry out different types of operations are expected to evolve in terms of increased inventory levels, enhanced characteristics, and better performance levels. These drones are likely to impact air traffic operations across the globe. Thus, appropriate analysis of the impact of allowing aerial delivery drones to fly in civilian airspace is expected to lead to the allocation of restricted airspace for aerial delivery drones used in civil & commercial applications. One such effort was made by NASA. NASA’s Ames Research Center (project duration April 2015-May, 2021) in California’s Silicon Valley set out to build a research platform that would assist in managing large numbers of drones flying at low altitudes alongside other airspace operators. Recognized as UAS Traffic Management, or UTM, the goal was to create a system that can incorporate drones safely and effectively into air traffic that has already been flying in low-altitude airspace. That way, package delivery and fun flights would not disturb helicopters, airplanes, and nearby airports, as well as safety drones being flown by first responders seeking to save lives.

Challenge-Ground Segment: Limited operational range of ground delivery vehicles

Ground delivery vehicles are preferred over aerial delivery drones due to fewer restrictions and regulations related to their operation than aerial delivery drones. Though the use of ground delivery vehicles is more advantageous than that of aerial delivery drones, several operational and technical drawbacks limit their operation. One such technical disadvantage is the short runtime. If ground delivery vehicles manufactured by all companies are taken into consideration, the average distance covered by these vehicles is 10 kilometers per charge, with their services limited to short distances. Ground delivery vehicles are designed to walk or travel on sidewalks, but not all of them can climb stairs. Navigation of ground delivery vehicles is also a key challenge faced by their manufacturers as it requires a set of tasks such as creating maps, localizing ground delivery vehicles in those maps, and making simultaneous motion plans according to them so that these vehicles can travel or operate easily in uncontrolled environments without any human intervention. Several manufacturers of ground delivery vehicles have developed robotic pilot models, and these manufacturers are proceeding with technological advancements and improvements in these pilot models after testing them under different conditions and circumstances.

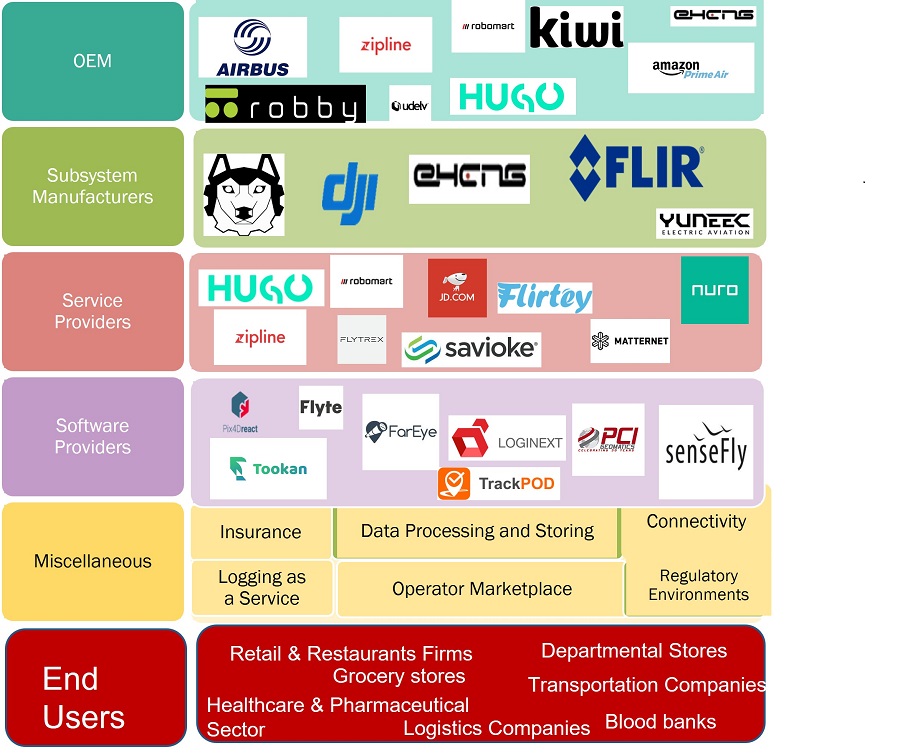

Market Ecosystem Map

The key stakeholders in the Autonomous Last Mile Delivery market ecosystem are the platform manufacturers, subsystem manufacturers, service providers, software providers, and miscellaneous (insurance companies), as well as the end users. The following figure lists some global platform manufacturers, subsystem providers, service providers, and software providers.

The market for delivery drones in the aerial segment and self-driving vans & trucks in the ground segment is projected to grow with higher CAGR.

Based on the platform, market in the aerial segment is divided into Cargo Drone and Delivery Drones, and for the ground segment, the market is divided into Delivery Bots and Self Driving Trucks and Vans. The delivery drones in the aerial segment and self-driving vans & trucks in the ground segment is projected to grow with a higher CAGR due to the increasing need for autonomous delivery solutions. Drones, self-driving vans, and trucks have immense potential as a last mile resource because they are faster and diminish the need for human intervention.

Long range segment (>20 Kilometers) is expected to lead both the aerial and ground autonomous last mile delivery markets, with higher CAGR during the forecast period.

Based on range, aerial and ground segments comprise of Short Range (< Kilometers) and long range segment (>20 Kilometers). The long-range segment is expected to lead both the aerial and ground autonomous last mile delivery markets during the forecast period. This is owing to high portability, increased efficiency, and low operating costs of aerial drone delivery services. Also, the need to curb pollution in big cities and need for long-range autonomous ground robots, which could reduce carbon dioxide emissions pose as the biggest driver for this market segment.

For Aerial Section, 5-10 Kilograms Payload Weight segment is expected to grow with highest CAGR, and for ground segment >10 kilograms segment is expected to grow with highest CAGR during the forecast period.

By Payload Weight, Aerial and Ground segments are divided into <5 kilograms, 5–10 kilograms, and >10 kilograms. The <5 kilograms segment is expected to lead the aerial autonomous last mile delivery markets due to the growing usage of drones in the healthcare sector. During the forecast period, the 5–10 kilograms segment is expected to lead the ground autonomous last mile delivery markets. China, South Korea, and other countries are formulating new guidelines to regulate the operations of ground delivery vehicles with weights of 5–10 kilograms on public streets to avoid injury to pedestrians and damage to public property in case of crashes or malfunctioning.

For both Aerial and Ground segments, the infrastructure solution segment is going to have the highest growth.

Based on the solution, the aerial delivery drone/ground delivery vehicle market is classified into hardware, software, and infrastructure. For both the Aerial and Ground segments, the infrastructure solution segment is going to have the highest growth. The development of robust infrastructure solutions supports the scalability and expansion of the drone and ground bot market. By equipping present airframes and autonomous delivery vehicles with state-of-the-art sensors and AI technology, the infrastructure solutions empower better navigation, obstacle avoidance, and seamless coordination within the operational ecosystem. The integration of advanced infrastructure solutions allows for efficient communication and synchronization between aerial delivery drones and ground delivery bots. This integration enhances the overall logistics and supply chain management processes, ensuring smooth and effective operations from end to end. As the market for aerial and ground delivery solutions continues to grow, the demand for advanced infrastructure solutions is expected to surge. This presents an opportunity for technology providers and manufacturers to offer reliable and efficient infrastructure solutions that can cater to the evolving needs of the industry, supporting the ongoing technological upgradation and optimization of drone and ground bot operations.

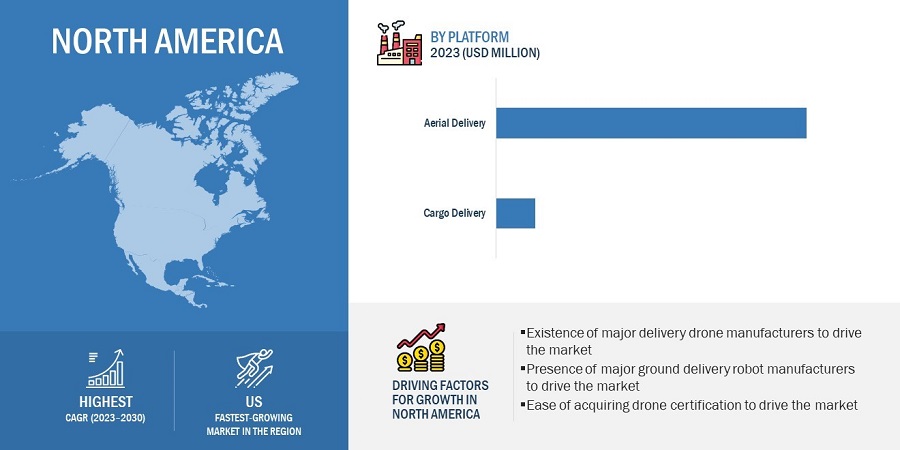

North America is expected to lead the market during the forecast period.

North America is projected to lead the autonomous last mile delivery market during the forecast period. The US is the largest market for autonomous last mile delivery in North America. North America has seen significant investment and partnerships in the ALMD sector. Major e-commerce companies, logistics providers, and retailers are actively exploring and implementing autonomous delivery solutions. Amazon (US), UPS (US), FedEx (US), and Walmart (US) have been piloting and deploying ALMD technologies to optimize delivery operations and improve customer satisfaction. Government support and regulatory frameworks are crucial in shaping the ALMD market in North America. Some states and cities have introduced pilot programs and regulations to test and regulate the operations of autonomous vehicles on public roads, providing a conducive environment for ALMD companies to operate and innovate.

Autonomous Last Mile Delivery Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

ALMD companies are Starship Technologies (US), JD.com (China), Nuro (US), Amazon (US), Kiwibot (US), Zipline (US), United Parcel Service (US), Wing (US), Flirtey (SkyDrop) and Matternet, Inc. (US). They have an established portfolio of reputable products and services, a robust market presence, strong business strategies, a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 0.9 Billion |

|

Projected Market Size |

USD 4.2 Billion |

|

CAGR |

22.7% |

|

Market size available for years |

2020-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By platform, application, solution, payload weight, and range |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East, Latin America, and Africa |

|

Companies covered |

Starship Technologies (US), JD.com (China), Nuro (US), Amazon (US), Kiwibot (US), Zipline (US), United Parcel Service (US), Wing (US), Flirtey (SkyDrop) and Matternet, Inc. (US) and few others. |

Autonomous Last Mile Delivery Market Highlights

This research report categorizes the Autonomous Last Mile Delivery (ALMD) market based on platform, application, solution, payload weight, and range.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Solution |

|

|

By Application |

|

|

By Payload Weight |

|

|

By Range |

|

Recent Developments

- In May 2023, Starship Technologies had a strategic partnership with Co-op and Wakefield Council to bring the advantages of autonomous grocery delivery to residents in Wakefield. This partnership aims to provide residents with a convenient and efficient way to receive their groceries through the use of Starship's autonomous robots. Initially, the service will be available to 13,000 residents across 6,500+ households in Wakefield.

- In May 2023, Waymo and Uber, have entered into a strategic partnership. The agreement entails Waymo, a subsidiary of Alphabet Inc., integrating its driverless vehicles onto Uber's ride-hailing and food delivery platform. This collaboration comes on the heels of Waymo's recent expansion of its commercial driverless service in Phoenix and the San Francisco area.

- In March 2023, Starship Technologies, the leading provider of autonomous delivery services, partnered with Trafford Council and Co-op to introduce robot food delivery to the streets of Greater Manchester. The service is initially available to 24,000 residents across 10,500 households in Sale. This launch in Greater Manchester marks Starship's expansion across the northern region of England. The company's robots have already gained popularity in various UK towns and cities, including Milton Keynes, Northampton, Bedford, Cambourne, Cambridge, and Leeds.

- In February 2023, Kiwibot secured a USD 10 million financing partnership with asset financing group Kineo Finance. The funding will be used to expand Kiwibot's fleet of autonomous robots and disrupt the delivery-as-a-service (DaaS) industry. The Colombian startup aims to revolutionize food delivery by utilizing high-driving robots equipped with GPS technology, advanced camera sensors, and artificial intelligence (AI).

- In December 2022, Grubhub teamed up with Kiwibot to introduce robot delivery services on college campuses throughout the United States. The collaboration between Kiwibot and Grubhub will debut with robot delivery services at the University of North Dakota during the next semester. Following its initial launch, robot delivery will expand to other schools. Kiwibot joins Grubhub's roster of partners, including Cartken and Starship, providing robot delivery on nearly a dozen campuses.

- In December 2022, Amazon officially launched its drone delivery service, Prime Air, in Lockeford, California, and College Station, Texas. The company has obtained FAA safety certification and has been working with local officials to introduce this innovative delivery method. When a customer places an order weighing under 5 pounds, a drone will fly to their backyard, drop off the package, and then return to base.

Frequently Asked Questions (FAQ):

What is the current size of the autonomous last mile delivery market?

The autonomous last mile delivery market is valued at USD 0.9 billion in 2023 and is projected to reach USD 4.2 billion by 2030, at a CAGR of 22.7%. North America is estimated to account for the largest share of the autonomous last mile delivery market in 2023.

Who are the winners in the autonomous last mile delivery market?

Some of the key players in the ALMD market are Starship Technologies (US), JD.com (China), Nuro (US), Amazon (US), Kiwibot (US), Zipline (US), United Parcel Service (US), Wing (US), Flirtey (SkyDrop) and Matternet (US).

What are some of the technological advancements in the market?

3D Printed Aerial and Ground robots, Improvements in battery technology, cloud robotics technology, wireless charging technology, computer vision, multi-sensor data fusion for effective navigation, etc., are some of the technological advancements in the market. 5G technology is also expected to provide increased control over the transportation of packages, right from delivery hubs to customers. Connected aerial delivery drones and ground delivery vehicles are expected to change the autonomous last mile delivery ecosystem as 5G networks are becoming highly prevalent in cities and offer customers and service providers real-time end-to-end visibility of operating infrastructures. This is expected to enable Vehicle-to-Vehicle (V2V) communications in real-time to avoid accidents and ensure their smooth functioning.

What are the factors driving the growth of the market?

The increase in the use of the internet and rapid growth of the e-commerce industry drive the demand for products to be acquired online, which needs an improved and efficient method to deliver the product to the customer. Therefore, various product delivery services, such as the use of drones and ground delivery vehicles, have been implemented by companies worldwide. In the last decade, there have been significant developments in technologies used to conduct autonomous last mile delivery of packages. These technologies have revolutionized the delivery capabilities of logistics service providers. The development of advanced and modular aerial delivery drones and ground delivery vehicles with superior technological capabilities like 3D printing and LiDAR, high efficiency, increased reliability, high payload capacity, and improved battery life have resulted in cost-effective and quick last mile delivery of packages. Significant investments have been made in R&D activities for product innovation. This chapter discusses technology trends, investment analysis, value chain analysis, use cases, and patents related to autonomous last mile delivery.

Which region is expected to grow most in the Forecast years?

The market in North America is projected to grow at the highest CAGR from 2023 to 2030, showcasing strong demand for ALMD in the region. The increasing spending by the US government organizations and private players and the deployment of autonomous last mile delivery solutions are key factors expected to drive the market in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICS: AUTONOMOUS LAST MILE DELIVERY MARKET (AERIAL DELIVERY DRONES)DRIVERS- Rising use of sense and avoid systems in aerial delivery drones- Expansion of e-commerce industry- Increased use of low-cost and light payload drones by startups for product delivery- Environmental sustainabilityRESTRAINTS- Lack of required infrastructure to support operations in emerging economies- Limited bandwidth and battery life of aerial delivery drones- Lack of charging infrastructure hinders long-endurance delivery missionsOPPORTUNITIES- Rise in technological advancements in delivery drones- Growth opportunities for vendors at different levels of value chain- Incorporation of IoT in ecosystem- Rising demand for fast, efficient, and reliable delivery servicesCHALLENGES- Issues related to traffic management- Safety and security issues- Lack of risk management framework and insurance cover

-

5.3 MARKET DYNAMICS: AUTONOMOUS LAST MILE DELIVERY MARKET (GROUND DELIVERY VEHICLES)DRIVERS- Increased use of autonomous ground delivery vehicles in retail and food- Increased adoption of autonomous ground delivery vehicles- Venture funding for developing next-level ground delivery vehiclesRESTRAINTS- Formulation and stringent implementation of regulations- Performance issues in untested environments and lack of appropriate decision-makingOPPORTUNITIES- Growing demand for AGVs in delivery of healthcare supplies- Rising e-commerce industry worldwideCHALLENGES- Limited operational range- Vulnerability of ground delivery vehicles to cyber threats- Risk of operational malfunctioning in populated areas

-

5.4 PRICING ANALYSISAVERAGE SELLING OF AUTONOMOUS LAST MILE DELIVERY DRONES/ VEHICLES/SERVICES IN 2021–2022

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 MARKET ECOSYSTEM MAP

- 5.7 VOLUME ANALYSIS

-

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AUTONOMOUS LAST MILE DELIVERY MARKET

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWERS OF SUPPLIERSBARGAINING POWERS OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 TRADE DATA STATISTICS

-

5.11 TARIFF AND REGULATORY LANDSCAPEGUIDELINES BY FEDERAL AVIATION ADMINISTRATION FOR DRONE OPERATIONS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 TECHNOLOGY EVOLUTION OF AUTONOMOUS LAST MILE DELIVERY MARKET

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDS3D-PRINTED AERIAL AND GROUND ROBOTSIMPROVEMENTS IN BATTERY TECHNOLOGYCLOUD ROBOTICS TECHNOLOGYWIRELESS CHARGING TECHNOLOGYCOMPUTER VISIONMULTI-SENSOR DATA FUSION FOR EFFECTIVE NAVIGATIONADVANCED ALGORITHMS AND ANALYTICSMACHINE LEARNING-POWERED ANALYTICS5G TECHNOLOGYBLOCKCHAIN

-

6.3 TECHNOLOGY ANALYSISSENSOR TECHNOLOGYAI-BASED PERCEPTION

-

6.4 CASE STUDY ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET: AERIAL DELIVERYUSE OF ZIPLINE DRONES FOR MEDICAL DELIVERY IN GHANAFLIRTEY TRANSFORMING MEDICAL SUPPLY DELIVERY WITH AUTONOMOUS DRONESPROJECT WING BY ALPHABET TO DELIVER FOOD AND MEDICINES IN AUSTRALIA

-

6.5 CASE STUDY ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET: GROUND DELIVERYUSE OF AUTONOMOUS DELIVERY BY FOODPANDA IN SINGAPOREDELIVERY FROM RESTAURANTS AND GROCERY STORESJD.COM BOTS UTILIZED FOR INDOOR LAST MILE DELIVERYAMAZON STARTED DELIVERING PARCELS USING GROUND DELIVERY ROBOTS NAMED SCOUT IN WASHINGTON

-

6.6 IMPACT OF MEGATRENDSLAST MILE DELIVERY AUTOMATIONE-MOBILITY AND GREEN INITIATIVERAPID URBANIZATION AND MEGACITY LOGISTICS

- 6.7 INNOVATION AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 AERIAL DELIVERY DRONESCARGO DRONES- Surging demand for same-day delivery and emergency supplies to drive segmentDELIVERY DRONES- Growing need for instantaneous delivery services to boost growth

-

7.3 GROUND DELIVERY VEHICLESDELIVERY BOTS- Growth of e-commerce to fuel segmentSELF-DRIVING VANS AND TRUCKS- Growing need for decongestion to lead to market growth

- 8.1 INTRODUCTION

-

8.2 AERIAL DELIVERY DRONESHARDWARE- Growing need for instantaneous delivery of food, medicine, and retail goods to increase demand- Airframe- Avionics- Propulsion system- PayloadINFRASTRUCTURE- Need for drone services in civil and commercial applications to drive segment- Ground control station (GCS)- Charging station- Vertiports/landing pad- Micro-fulfillment centerSOFTWARE- Ongoing technological upgrades and R&D to boost usage- Route planning and optimizing- Inventory management- Live tracking- Fleet management- Computer vision

-

8.3 GROUND DELIVERY VEHICLESHARDWARE- Growing need to curb traffic congestion in cities to drive segment- Navigation (GPS, LiDAR, sensors, radar, cameras)- Propulsion- OthersINFRASTRUCTURE- Technological evolution of autonomous ground vehicles to fuel segment growth- Ground control station (GCS)- Charging station- Micro-fulfillment centerSOFTWARE- Increasing demand for autonomous ground vehicles in warehouse automation to propel growth- Route planning and optimizing- Inventory management- Live tracking- Fleet management- Computer vision

- 9.1 INTRODUCTION

-

9.2 AERIAL DELIVERY DRONESLOGISTICS AND TRANSPORTATION- Increased demand for faster delivery to propel growth- Postal delivery- Package deliveryHEALTHCARE AND PHARMACEUTICALS- Rising need for fast and non-stop delivery of essential supplies to boost market- Medicine supply- Blood supply- Organ transport- Equipment transportRETAIL AND FOOD- Growing demand for instantaneous delivery of retail goods and food to drive segment- E-commerce- Grocery delivery- Food delivery

-

9.3 GROUND DELIVERY VEHICLESLOGISTICS AND TRANSPORTATION- Rising demand for autonomous deliveries due to flexibility of timing and distance to expand market growth- Postal delivery- Package deliveryRETAIL AND FOOD- Growing demand for affordable and fast delivery to drive market- E-commerce- Grocery delivery- Food delivery

- 10.1 INTRODUCTION

-

10.2 AERIAL DELIVERY DRONES<5 KILOGRAMS- Growing usage of drones in healthcare sector to drive segment5–10 KILOGRAMS- Rising use in retail sector to fuel demand>10 KILOGRAMS- Increased demand from e-commerce to drive segment

-

10.3 GROUND DELIVERY VEHICLES<5 KILOGRAMS- Growing demand for online food delivery services to drive segment5–10 KILOGRAMS- New regulatory upgrades boost demand>10 KILOGRAMS- Growth of logistics industry to fuel growth

- 11.1 INTRODUCTION

-

11.2 AERIAL DELIVERY DRONESSHORT RANGE (<20 KILOMETERS)- Growing usage of drones in civil and commercial applications to drive segmentLONG RANGE (>20 KILOMETERS)- Need for e-commerce services in remote locations to boost AUTONOMOUS LAST MILE DELIVERY Market segment

-

11.3 GROUND DELIVERY VEHICLESSHORT RANGE (<20 KILOMETERS)- Booming e-commerce industry to fuel growthLONG RANGE (>20 KILOMETERS)- Need to curb pollution in big cities to drive segment

- 12.1 INTRODUCTION

- 12.2 RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS: AERIAL DELIVERY- Existence of major delivery drone manufacturers to drive marketUS: GROUND DELIVERY- Presence of major ground delivery robot manufacturers to drive marketCANADA: AERIAL DELIVERY- Ease of acquiring drone certification to fuel marketCANADA: GROUND DELIVERY- Increasing grants and funds by government to propel market

-

12.4 EUROPEPESTLE ANALYSIS: EUROPEUK: AERIAL DELIVERY- Technological advancements by major drone delivery market players to drive marketUK: GROUND DELIVERY- Significant use of autonomous ground delivery vehicles in food and beverage industry to drive marketGERMANY: AERIAL DELIVERY- Growing demand for faster deliveries to fuel marketGERMANY: GROUND DELIVERY- Introduction of new-age four-legged delivery robots to propel market growthAUSTRIA: AERIAL DELIVERY- Availability of drone landing sites to drive marketAUSTRIA: GROUND DELIVERY- Continuous testing and innovations in autonomous driving technology to boost marketFRANCE: AERIAL DELIVERY- Support from government authorities to push market growthFRANCE: GROUND DELIVERY- Emergence of numerous startups for autonomous ground delivery robots to drive the marketDENMARK: AERIAL DELIVERY- Rise in testing of package deliveries via drones to drive marketDENMARK: GROUND DELIVERY- Growing demand for time-saving automated transport in warehouses to drive marketSWITZERLAND: AERIAL DELIVERY- Partnerships in favor of drone delivery services to drive marketSWITZERLAND: GROUND DELIVERY- Funding from intergovernmental organizations favoring advances in ground navigation systems to drive market

-

12.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA: AERIAL DELIVERY- Investments by technology players to drive AUTONOMOUS LAST MILE DELIVERY MarketCHINA: GROUND DELIVERY- Adoption of ground delivery vehicles in e-commerce to drive marketJAPAN: AERIAL DELIVERY- Advanced technological capabilities to drive marketJAPAN: GROUND DELIVERY- Emergence of new initiatives for urban development to drive marketINDIA: AERIAL DELIVERY- Rising focus of government on initiating aerial delivery services to drive marketINDIA: GROUND DELIVERY- Increasing investments by companies in last mile deliveries to drive marketAUSTRALIA: AERIAL DELIVERY- Government support and technological advancements to drive marketAUSTRALIA: GROUND DELIVERY- Increasing demand for instant and same-day deliveries to drive marketSOUTH KOREA: AERIAL DELIVERY- Need to supply essentials to remote locations to boost marketSOUTH KOREA: GROUND DELIVERY VEHICLES- Demand from food and beverage industry to drive marketNEW ZEALAND: AERIAL DELIVERY- Growing demand for food delivery services to drive marketNEW ZEALAND: GROUND DELIVERY- Growth of autonomous last mile delivery ecosystem to drive marketSINGAPORE: AERIAL DELIVERY- Established regulatory framework for drone delivery to push market growthSINGAPORE: GROUND DELIVERY- Launch of new pilot schemes to enable on-demand food and grocery deliveries to drive market

-

12.6 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTUAE: AERIAL DELIVERY- Flexible drone regulations to drive marketUAE: GROUND DELIVERY- Supportive government regulations to drive marketISRAEL: AERIAL DELIVERY- Growing interest by major players to offer services to expand marketISRAEL: GROUND DELIVERY- Rising demand for autonomous logistics infrastructure in healthcare to drive market

-

12.7 LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICABRAZIL: AERIAL DELIVERY- Approval from national agencies for drone delivery services to drive marketBRAZIL: GROUND DELIVERY- Mergers and acquisitions to help expand marketMEXICO: AERIAL DELIVERY- Growing demand for fast deliveries in healthcare to boost marketMEXICO: GROUND DELIVERY- Booming e-commerce sector to drive market

-

12.8 AFRICAPESTLE ANALYSIS: AFRICA

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS IN AUTONOMOUS LAST MILE DELIVERY MARKET: GROUND DELIVERY

- 13.3 RANKING ANALYSIS OF KEY PLAYERS: GROUND DELIVERY

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS: GROUND DELIVERY VEHICLE

- 13.5 AUTONOMOUS LAST MILE DELIVERY MARKET SHARE ANALYSIS: GROUND DELIVERY VEHICLES

- 13.6 KEY PLAYERS IN AUTONOMOUS LAST MILE DELIVERY MARKET: AERIAL DRONE DELIVERY

- 13.7 REVENUE ANALYSIS OF KEY PLAYERS: AERIAL DRONE DELIVERY

-

13.8 MARKET SHARE ANALYSIS – AERIAL DRONE DELIVERYGROUND DELIVERY- Nuro- JD.com, Inc.- Kiwibot- Starship Technologies- Amazon.com, Inc.AERIAL DELIVERY- United Parcel Services- Zipline- Wing- Matternet, Inc.- Flirtey (SkyDrop)

-

13.9 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE COMPANIESPARTICIPANTSCOMPANY FOOTPRINT

-

13.10 AUTONOMOUS LAST MILE DELIVERY MARKET, COMPETITIVE LEADERSHIP MAPPINGPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.11 COMPETITIVE SCENARIOAUTONOMOUS LAST MILE DELIVERY MARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSNURO, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJD.COM, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSTARSHIP TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKIWIBOT- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAMAZON.COM, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewALIBABA GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCATERPILLAR INC.- Business overview- Products/Services/Solutions offered- Recent developmentsCONTINENTAL AG- Business overview- Products/Services/Solutions offered- Recent developmentsPANASONIC CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsTELERETAIL- Business overview- Products/Services/Solutions offered- Recent developmentsUNSUPERVISED.AI- Business overview- Products/Services/Solutions offered- Recent developmentsUDELV, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsWAYMO LLC- Business overview- Products/Services/Solutions offered- Recent developmentsAETHON (ST ENGINEERING)- Business overview- Products/Services/Solutions offered- Recent developmentsBOXBOT- Business overview- Products/Services/Solutions offered- Recent developments

-

14.3 OTHER PLAYERSAUTOXNEOLIXROBOMARTELIPORTCRUISE LLC

-

15.1 INTRODUCTIONUNITED PARCEL SERVICE- Business overview- Products/Services/Solutions offered- Recent developmentsZIPLINE- Business overview- Products/Services/Solutions offered- Recent developments- Recent developments- MnM viewWING- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMATTERNET, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFLIRTEY (SKYDROP)- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDEUTSCHE POST DHL GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsAERODYNE GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsDRONE DELIVERY CANADA CORP.- Business overview- Products/Services/Solutions offered- Recent developmentsWORKHOUSE GROUP INC.- Business overview- Products/Services/Solutions offered- Recent developmentsSKYCART INC.- Business overview- Products/Services/Solutions offered- Recent developmentsAIRBUS- Business overview- Products/Services/Solutions offered- Recent developmentsUBER TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsWALMART- Business overview- Products/Services/Solutions offered- Recent developmentsGEOPOST (FORMERLY DPDGROUP)- Business overview- Products/Services/Solutions offered- Recent developmentsVOLOCOPTER GMBH- Business overview- Products/Services/Solutions offered- Recent developments

-

15.2 OTHER PLAYERSFLYTREXMANNA AEROWINGCOPTER GMBHELROY AIRSWOOP AERO

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 AUTONOMOUS LAST MILE DELIVERY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 COMPANY-WISE FUNDING RECEIVED FOR DRONE FOOD DELIVERY SERVICES

- TABLE 3 INSURANCE COVERAGE OFFERED

- TABLE 4 COMPANIES PROVIDING DRONE INSURANCE

- TABLE 5 LIST OF FUNDING RAISED BY VARIOUS COMPANIES IN AUTONOMOUS GROUND DELIVERY MARKET

- TABLE 6 AVERAGE PRICES OF AUTONOMOUS LAST MILE DELIVERY DRONES/ VEHICLES/ SERVICES IN 2021–2022

- TABLE 7 DERIVED VOLUME OF AUTONOMOUS LAST MILE DELIVERY DRONES/VEHICLES FROM 2020–2030

- TABLE 8 COUNTRY-WISE IMPORTS FOR DRONES, 2020–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS FOR DRONES, 2020–2022 (USD THOUSAND)

- TABLE 10 LIST OF IMPORT RATES OF VEHICLES AND INDUSTRIAL ROBOTS

- TABLE 11 DRONE REGULATION AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

- TABLE 12 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM (%)

- TABLE 14 KEY BUYING CRITERIA FOR AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- TABLE 15 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 AUTONOMOUS LAST MILE DELIVERY MARKET: KEY PATENTS (MAY 2019–MARCH 2022)

- TABLE 17 MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 18 AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 19 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 20 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 21 GROUND ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 22 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 23 AUTONOMOUS LAST MILE DELIVERY SOLUTION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 24 ALMD SOLUTION MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 25 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 26 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2023–2030 (USD MILLION)

- TABLE 27 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 28 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2023–2030 (USD MILLION)

- TABLE 29 ALMD APPLICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 30 AUTONOMOUS LAST MILE DELIVERY APPLICATION MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 31 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 32 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 33 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 34 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 35 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR HEALTHCARE AND PHARMACEUTICALS, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 36 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR HEALTHCARE AND PHARMACEUTICALS, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 37 AERIAL ALMD MARKET FOR RETAIL AND FOOD, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 38 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR RETAIL AND FOOD, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 39 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 40 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 41 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 42 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 43 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR FOOD AND RETAIL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 44 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR FOOD AND RETAIL, 2023–2030 (USD MILLION)

- TABLE 45 ALMD PAYLOAD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 46 AUTONOMOUS LAST MILE DELIVERY PAYLOAD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 47 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2020–2022 (USD MILLION)

- TABLE 48 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2023–2030 (USD MILLION)

- TABLE 49 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2020–2022 (USD MILLION)

- TABLE 50 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2023–2030 (USD MILLION)

- TABLE 51 AUTONOMOUS LAST MILE DELIVERY RANGE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 52 AUTONOMOUS LAST MILE DELIVERY RANGE MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 53 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2020–2022 (USD MILLION)

- TABLE 54 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 55 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2020–2022 (USD MILLION)

- TABLE 56 GROUND ALMD MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 57 ALMD MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 58 ALMD MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: ALMD MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 71 US: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 72 US: ALMD MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 73 US: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 74 US: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 75 US: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 76 US: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 77 US: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 78 US: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 79 US: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 80 US: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 81 US: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 82 US: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 83 US: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 84 US: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 85 US: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 86 US: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 87 CANADA: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 88 CANADA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 89 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 90 CANADA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 91 CANADA: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 93 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 94 CANADA: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 95 CANADA: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 96 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 97 CANADA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 98 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 99 CANADA: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 100 CANADA: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 101 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 102 CANADA: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 103 EUROPE: ALMD MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 105 EUROPE: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET , BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 107 EUROPE: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 108 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 109 EUROPE: MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 110 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 111 EUROPE: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 112 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 113 EUROPE: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 114 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 115 EUROPE: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 116 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 117 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 118 EUROPE: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 119 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 120 EUROPE: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 121 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 122 EUROPE: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 123 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 124 EUROPE: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 125 UK: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 126 UK: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 127 UK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 128 UK: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 129 UK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 130 UK: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 131 UK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 132 UK: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICAL APPLICATION, 2023–2030 (USD MILLION)

- TABLE 133 UK: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 134 UK: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 135 UK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 136 UK: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 137 UK: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 138 UK: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 139 UK: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 140 UK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 141 GERMANY: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 142 GERMANY: ALMD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 143 GERMANY: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 144 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 145 GERMANY: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 146 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 147 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 148 GERMANY: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 149 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 150 GERMANY: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 151 GERMANY: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 152 GERMANY: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 153 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 154 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 155 GERMANY: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 156 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 157 AUSTRIA: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 158 AUSTRIA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 159 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 160 AUSTRIA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 161 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 162 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 163 AUSTRIA: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 164 AUSTRIA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 165 AUSTRIA: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 166 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 167 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 168 AUSTRIA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 169 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 170 AUSTRIA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 171 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 172 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 173 FRANCE: MARKET IN, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 174 FRANCE: ALMD MARKET IN, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 175 FRANCE: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 176 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 177 FRANCE: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 178 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 179 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 180 FRANCE: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 181 FRANCE: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 182 FRANCE: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 183 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 184 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 185 FRANCE: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 186 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 187 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 188 FRANCE: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 189 DENMARK: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 190 DENMARK: ALMD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 191 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 192 DENMARK: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 193 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 194 DENMARK: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 195 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 196 DENMARK: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 197 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 198 DENMARK: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 199 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 200 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 201 DENMARK: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 202 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 203 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 204 DENMARK: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 205 SWITZERLAND: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 206 SWITZERLAND: ALMD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 207 SWITZERLAND: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 208 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 209 SWITZERLAND: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 210 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 211 SWITZERLAND: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 212 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 213 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 214 SWITZERLAND: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 215 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 216 SWITZERLAND: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 217 SWITZERLAND: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 218 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 219 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 220 SWITZERLAND: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: ALMD MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: AUTONOMOUS LAST MILE DELIVERY MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 224 ASIA PACIFIC: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 228 ASIA PACIFIC: MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 229 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 232 ASIA PACIFIC: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 238 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 240 ASIA PACIFIC: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 241 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 242 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 243 CHINA: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 244 CHINA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 245 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 246 CHINA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 247 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 248 CHINA: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 249 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 250 CHINA: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 251 CHINA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 252 CHINA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 253 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 254 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 255 CHINA: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 256 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 257 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 258 CHINA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 259 JAPAN: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 260 JAPAN: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 261 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 262 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 263 JAPAN: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 264 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 265 JAPAN: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 266 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 267 JAPAN: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 268 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 269 JAPAN: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 270 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 271 JAPAN: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 272 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 273 JAPAN: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD APPLICATION, 2020–2022 (USD MILLION)

- TABLE 274 JAPAN: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD APPLICATION, 2023–2030 (USD MILLION)

- TABLE 275 INDIA: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 276 INDIA: AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 277 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 278 INDIA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 279 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 280 INDIA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 281 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 282 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 283 INDIA: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 284 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 285 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 286 INDIA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 287 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 288 INDIA: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 289 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 290 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 291 AUSTRALIA: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 292 AUSTRALIA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 293 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 294 AUSTRALIA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 295 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 296 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 297 AUSTRALIA: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 298 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 299 AUSTRALIA: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 300 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 301 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 302 AUSTRALIA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 303 AUSTRALIA: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 304 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 305 AUSTRALIA: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 306 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 307 SOUTH KOREA: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 308 SOUTH KOREA: MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 309 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 310 SOUTH KOREA: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 311 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 312 SOUTH KOREA: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 313 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 314 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 315 SOUTH KOREA: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 316 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 317 SOUTH KOREA: MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 318 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 319 SOUTH KOREA: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 320 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 321 SOUTH KOREA: MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 322 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 323 NEW ZEALAND: MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 324 NEW ZEALAND: ALMD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 325 NEW ZEALAND: AUTONOMOUS LAST MILE DELIVERY MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 326 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 327 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 328 NEW ZEALAND: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 329 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 330 NEW ZEALAND: MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 331 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 332 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 333 NEW ZEALAND: AUTONOMOUS LAST MILE DELIVERY MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 334 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 335 NEW ZEALAND: MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 336 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 337 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 338 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)

- TABLE 339 SINGAPORE: ALMD MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 340 SINGAPORE: ALMD MARKET, BY PLATFORM, 2023–2030 (USD MILLION)

- TABLE 341 SINGAPORE: MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 342 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 343 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020–2022 (USD MILLION)

- TABLE 344 SINGAPORE: MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023–2030 (USD MILLION)

- TABLE 345 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020–2022 (USD MILLION)

- TABLE 346 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023–2030 (USD MILLION)

- TABLE 347 SINGAPORE: MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020–2022 (USD MILLION)

- TABLE 348 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023–2030 (USD MILLION)