Diabetes Care Devices Market Size, Growth, Share & Trends Analysis

Diabetes Care Devices Market by Product Type (Blood Glucose Monitoring (CGM), Insulin Delivery Devices (Insulin Pumps (Tethered), Insulin Pens, Pen Needles), Application) Disease Type (Type 1, Type 2), End User (Homecare/Self) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

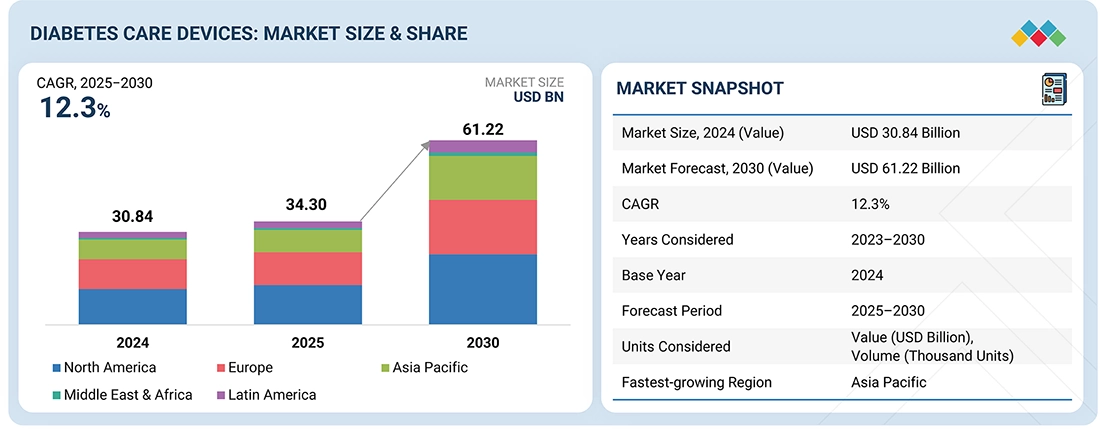

The global diabetes care devices market is projected to reach 61.22 billion in 2030 from USD 34.30 billion in 2025, at a CAGR of 12.3 % during the forecast period. Diabetes care devices are medical technologies designed to support the monitoring, management, and treatment of diabetes by helping patients and healthcare providers maintain optimal blood glucose control. These devices may include blood glucose monitoring systems (self-monitoring and continuous glucose monitors), insulin delivery devices (syringes, pens, pumps, and jet injectors), and digital diabetes management tools such as mobile applications and connected platforms. Depending on their application, they can range from routine self-care solutions to advanced therapeutic systems for intensive diabetes management. Diabetes care devices are widely used in both homecare and clinical settings.

KEY TAKEAWAYS

-

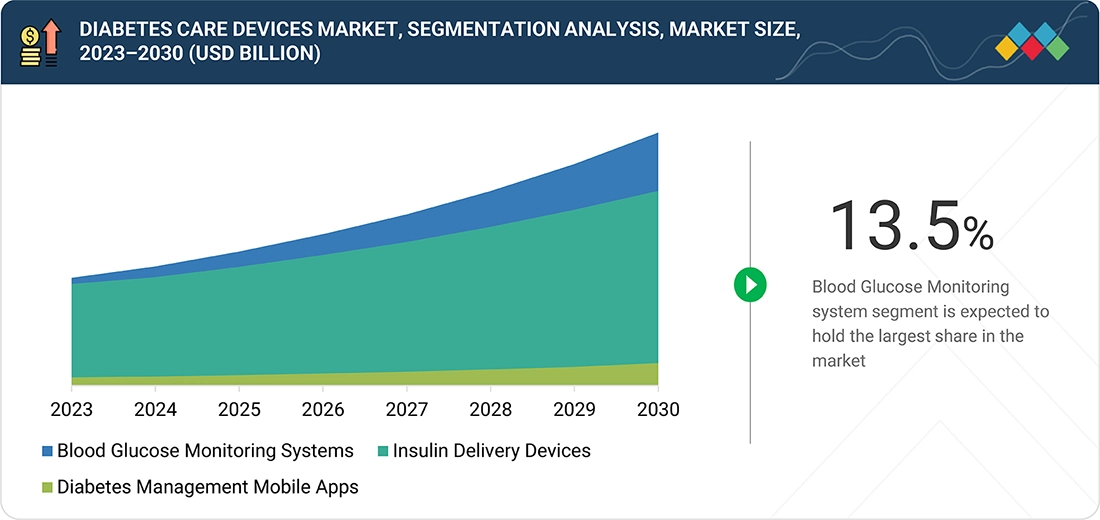

BY PRODUCTThe global diabetes care devices market is divided into three main segments: blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. The blood glucose monitoring systems segment held the maximum share in the market owing to its robust functional advantages and medical support. Accurate and frequent monitoring of the blood glucose levels helps the patients to take necessary action in the medication, diet, lifestyle and provides data to the healthcare practitioners which enables them to provide a customized treatment plan.

-

BY DISEASE TYPEType 2 diabetes accounted for the largest share of the global diabetes care devices market, as the condition is strongly linked to obesity, sedentary lifestyles, and poor dietary habits. The growing prevalence of type 2 diabetes, driven by rising processed food consumption, high sugar intake, and reduced physical activity, continues to fuel sustained demand for monitoring systems and insulin delivery devices.

-

BY PATIENT CARE SETTINGSDriven by their convenience, cost-effectiveness, and accessibility, self/home healthcare settings account for the largest share of the global diabetes care devices market. The growing use of user-friendly and portable devices, such as continuous glucose monitoring systems with smartphone connectivity, empowers patients to manage their condition in real-time, driving sustained adoption in this segment.

-

BY REGIONThe diabetes care devices market is segmented by region into North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa. Asia Pacific is estimated to grow the fastest, at a CAGR of 14.4%, driven by the rising prevalence of diabetes in large countries such as China and India, which is creating strong demand for blood glucose monitoring systems, insulin delivery devices, and other advanced diabetes care solutions.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. Abbott entered a landmark agreement to integrate data from its Libre CGM systems into Epic’s EHRs using Aura software, streamlining provider workflows and enhancing real-time diabetes management.

The diabetes care devices market is experiencing robust growth, primarily fueled by the accelerating global prevalence of diabetes and metabolic syndrome, which necessitates advanced and continuous glycemic monitoring. This growth is compounded by the rising demand for precision in managing the condition across continuous glucose monitoring (CGM), smart insulin pens, and automated insulin delivery (AID) systems.

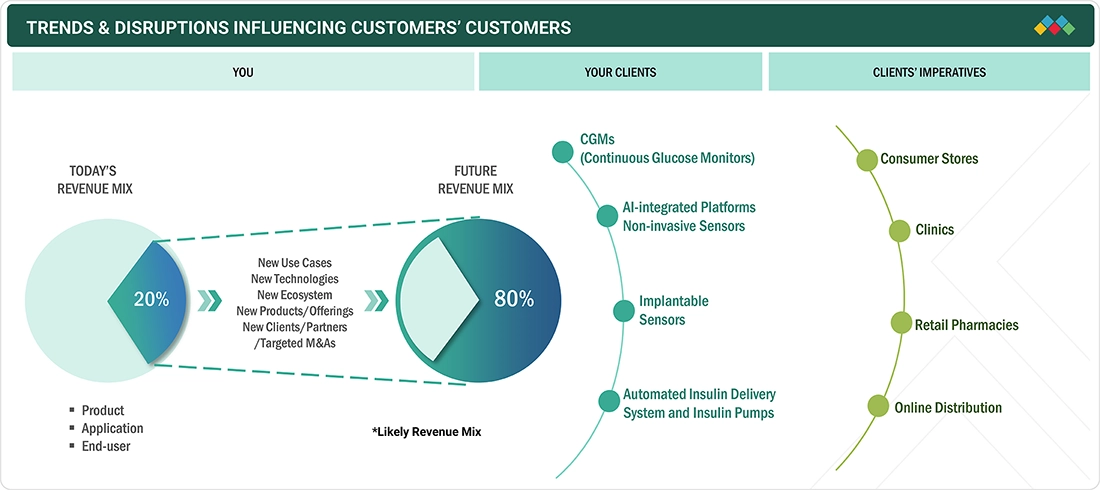

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The diabetes care devices market is undergoing a major transformation, marked by a decisive shift from traditional, reactive management to proactive, technology-driven care. The most significant disruption is the widespread adoption of continuous glucose monitoring (CGM) systems, which are rapidly displacing conventional finger-prick blood glucose meters. This trend is fueled by patient demand for convenience, real-time data, and a better understanding of glucose trends, which ultimately leads to improved health outcomes and a reduced burden of daily management. Complementing this is the rise of automated insulin delivery (AID) systems, or artificial pancreas technology, which integrate CGMs with insulin pumps to automatically adjust insulin dosage, providing a "closed loop" solution. The market is being revolutionized by the increasing role of digital health and artificial intelligence (AI). AI algorithms are now being used to analyze vast amounts of data from devices to provide predictive insights, personalize treatment plans, and offer remote patient monitoring capabilities, fundamentally reshaping how diabetes is diagnosed, managed, and treated.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging global diabetes patient population requiring continuous care

-

Rapidly growing aging and expanding elderly geriatric population

Level

-

Rising expenses of advanced diabetes devices

-

Limited awareness in emerging healthcare markets

Level

-

Enhanced diabetes management with advanced patient-implantable CGM devices

Level

-

Limited sensor durability leading to repeated and costly replacements

-

High cost and socio-economic disparities in access to diabetes care devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging global diabetes patient population requiring continuous care

A high prevalence of diabetes continues to be a key driver for the growth of the diabetes care devices market worldwide. The 2024 World Diabetes Day theme, “Breaking Barriers, Bridging Gaps”, highlights the urgent need to address the growing diabetes burden, especially in the WHO’s South-East Asia Region, where nearly 246 million adults are affected (2022). Over 60% remain undiagnosed, putting them at risk of severe complications like heart disease, kidney failure, and blindness. Progress is underway, with 23 million patients already on protocol-based care by mid-2024, moving toward the SEAHEARTS goal of 100 million on standard treatment by 2025. The IDF Diabetes Atlas 2025 reveals that 11.1% of adults (1 in 9) live with diabetes, with over 40% undiagnosed. By 2050, cases are projected to rise by 46%, affecting 1 in 8 adults (≈853 million). Over 90% have type 2 diabetes, largely influenced by socio-economic, demographic, environmental, and genetic factors. According to the above-mentioned data, the prevalence of diabetes is rising at an alarming rate, affecting millions of people across all age groups. The increasing cases are mainly due to changes in lifestyle, unhealthy dietary habits, and urbanization. As the number of people affected with diabetes increases the growing need for effective tools and diabetes management also increases.

Restraint: Rising expenses of advanced diabetes devices

Concerns related to high-cost act as a notable restraint in the diabetes care devices market. The advanced products such as insulin pumps, continuous glucose monitoring systems, smart insulin pens provide with superb accuracy and can be used with utmost convenience but are priced higher. These devices also require recurring expenses on related consumables such as the glucose strips cartridges which lead to an added financial burden. The situation is more challenging in few countries where the reimbursement policies are limited, making such technologies and products accessible only to a specific population. The higher cost of the devices decreases the penetration of the innovative technologies and also increases the gap between those who have access to advanced care and those who have to use the less efficient monitoring methods. Consequently, the high cost of diabetes care devices continues to act as a major restraint on overall market expansion.

Opportunity: Enhanced diabetes management with advanced patient-implantable CGM devices

The recent advancements, such as the patient-implantable continuous glucose monitoring devices, present a great opportunity for the diabetes care devices market and help in better diabetes management as they offer long-term, reliable glucose monitoring without the need for frequent replacement of the sensors. These devices make it very convenient for the patient as they reduce the burden of daily management and frequent changing of sensors. The implantable continuous glucose monitoring systems reduce the skin irritation issues, which are more common with the adhesive-based sensors, and provide the individual with freedom while performing daily activities. Also, their seamless integration with mobile applications and various digital health platforms provides continuous real-time monitoring and alerts to educate the patient about their health condition.

Challenge: Limited sensor durability leading to repeated and costly replacements

One of the significant challenges in the diabetes care devices market is the relatively short life span of the continuous glucose monitors, which last only 7 to 14 days; also, the frequent sensor replacement poses a challenge, leading to a financial burden. This issue is seen on a larger scale in low- and middle-income countries where the health infrastructure is limited, the reimbursement rate is lower, and higher out-of-pocket expenditure makes the technological advancement expensive. This leads to a larger portion of the population being inaccessible to the advanced technologies, which not only affects individual health but also constrains the overall market penetration.

Diabetes Care Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Continuous glucose monitoring (CGM) systems for real-time glucose tracking | Eliminates routine finger-pricks, provides continuous readings, improves diabetes control, and supports better lifestyle management |

|

Automated insulin delivery (AID) systems integrating insulin pumps with CGM | Closed-loop insulin delivery, reduces hypoglycemia risk, customizable insulin dosing, improves time-in-range |

|

Real-time CGM devices with smartphone connectivity for proactive diabetes management | High accuracy, seamless smartphone integration, customizable alerts, enables remote monitoring by caregivers |

|

Tubeless insulin pump technology for discreet, wearable insulin delivery | Wireless and needle-free operation, flexible lifestyle integration, reduces injection burden, and enhances convenience |

|

Blood glucose monitoring systems and digital diabetes management solutions | Reliable glucose testing, user-friendly meters, connectivity with apps for personalized insights, and cost-effective monitoring |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

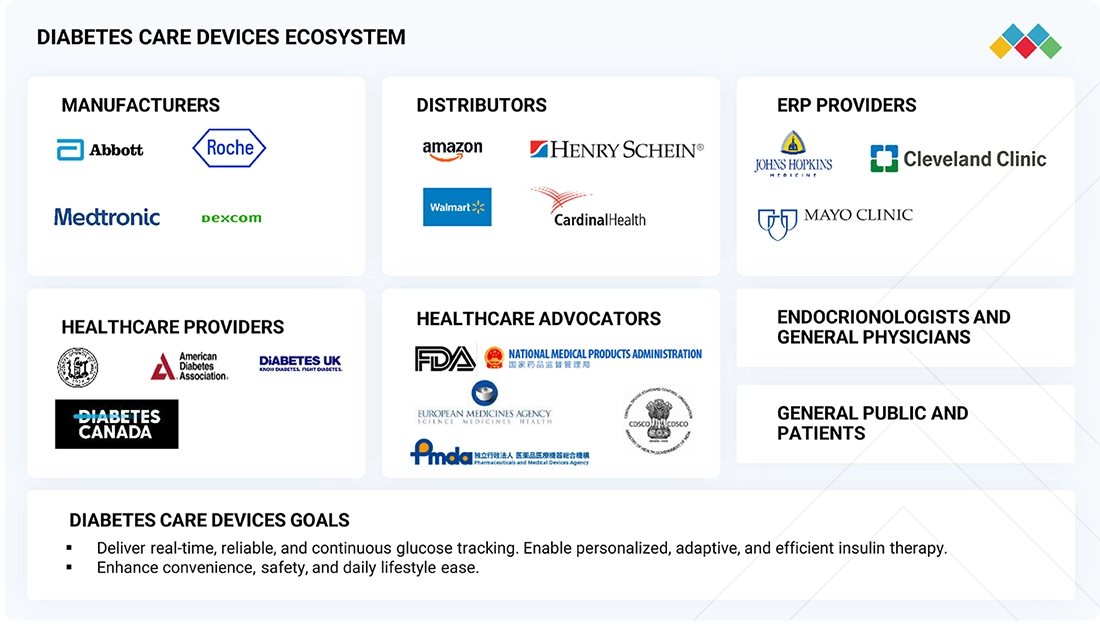

MARKET ECOSYSTEM

The diabetes care devices market operates within a complex ecosystem of stakeholders across product development, manufacturing, regulation, distribution, and clinical endorsement. Manufacturers such as Abbott, Medtronic, and Dexcom develop advanced technologies, including continuous glucose monitors (CGMs) and insulin pumps, aimed at improving accuracy, convenience, and patient outcomes. These companies focus on innovation to enhance real-time glucose monitoring and automated insulin delivery. Distributors, including major retailers like Amazon and specialized suppliers like Henry Schein, ensure widespread product availability by leveraging established supply chains and e-commerce platforms. Their role is crucial in bridging the gap between manufacturers and end-users, including patients and healthcare institutions. Regulatory authorities such as the US FDA and the European Medicines Agency (EMA) oversee product classification, clinical approvals, and safety compliance. Their evaluation ensures reliability and patient safety, while reimbursement policies from government bodies significantly influence the affordability and adoption of these devices in public healthcare systems. Healthcare providers, including endocrinologists and diabetologists, serve as key influencers. They play a critical role in prescribing, recommending, and integrating these devices into treatment plans, directly shaping patient adoption. Additionally, advocacy organizations like the American Diabetes Association and Diabetes UK contribute by driving awareness and publishing clinical practice guidelines, ultimately strengthening market adoption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Diabetes Care Devices Market, by Product

The global diabetes care devices market is divided into three main segments: Blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. The blood glucose monitoring system segment held the maximum share in the market owing to its robust functional advantages and medical support. Accurate and frequent monitoring of the blood glucose levels helps the patients to take necessary action in the medication, diet, and lifestyle, and provides data to the healthcare practitioners, which enables them to provide a customized treatment plan. The technological innovations, such as integration with mobile applications, have further increased the use of these devices due to the ease and convenience they provide. Additionally, the increase in prevalence of diabetes globally, along with an increase in awareness about the importance of early detection and self-management, has increased the demand for these devices.

Diabetes Care Devices Market, by Disease Type

Type 2 diabetes is set to be the leading segment in the diabetes care devices market, driven by its rising prevalence worldwide. Factors such as obesity, sedentary lifestyles, and fat accumulation in the abdominal area contribute to reduced insulin sensitivity. Additionally, changing dietary patterns, including higher consumption of processed and sugary foods, further fuel this growth. With the aging population more prone to the condition, the number of affected individuals continues to rise, solidifying type 2 diabetes as the dominant segment.

Diabetes Care Devices Market, by Patient Care Settings

The global diabetes care devices market is segmented by patient care settings into the following categories: self/home healthcare, hospitals & diabetes specialty clinics. Among these, the self/home healthcare segment is expected to garner the highest share in the market. For most patients suffering from type 1 and type 2 diabetes, testing at home is more convenient, cost-effective than visiting the clinic frequently. The accessibility of user-friendly devices, such as portable continuous glucose monitoring systems, which have the advanced feature of connecting to smartphones, enables patient to empower themselves to monitor their health in real-time and adjust their lifestyle and medications. The rising awareness about preventive care and the importance of glucose control has encouraged patients to use a glucose monitoring device in their daily routine.

REGION

Asia Pacific to be fastest-growing region in global diabetes care devices market during forecast period

The Asia Pacific region is estimated to record the highest CAGR globally during the forecast period, driven by multiple factors. The increasing prevalence of diabetes and other metabolic disorders is a key growth driver, supported by rising awareness of diabetes management and preventive care. Expanding middle-class incomes and shifting lifestyles, which contribute to greater health concerns, are further boosting demand. In addition, strong participation from both local and global players introducing region-specific products, along with the rapid growth of e-commerce and supportive government initiatives, is making diabetes care devices more accessible and accelerating adoption across the region.

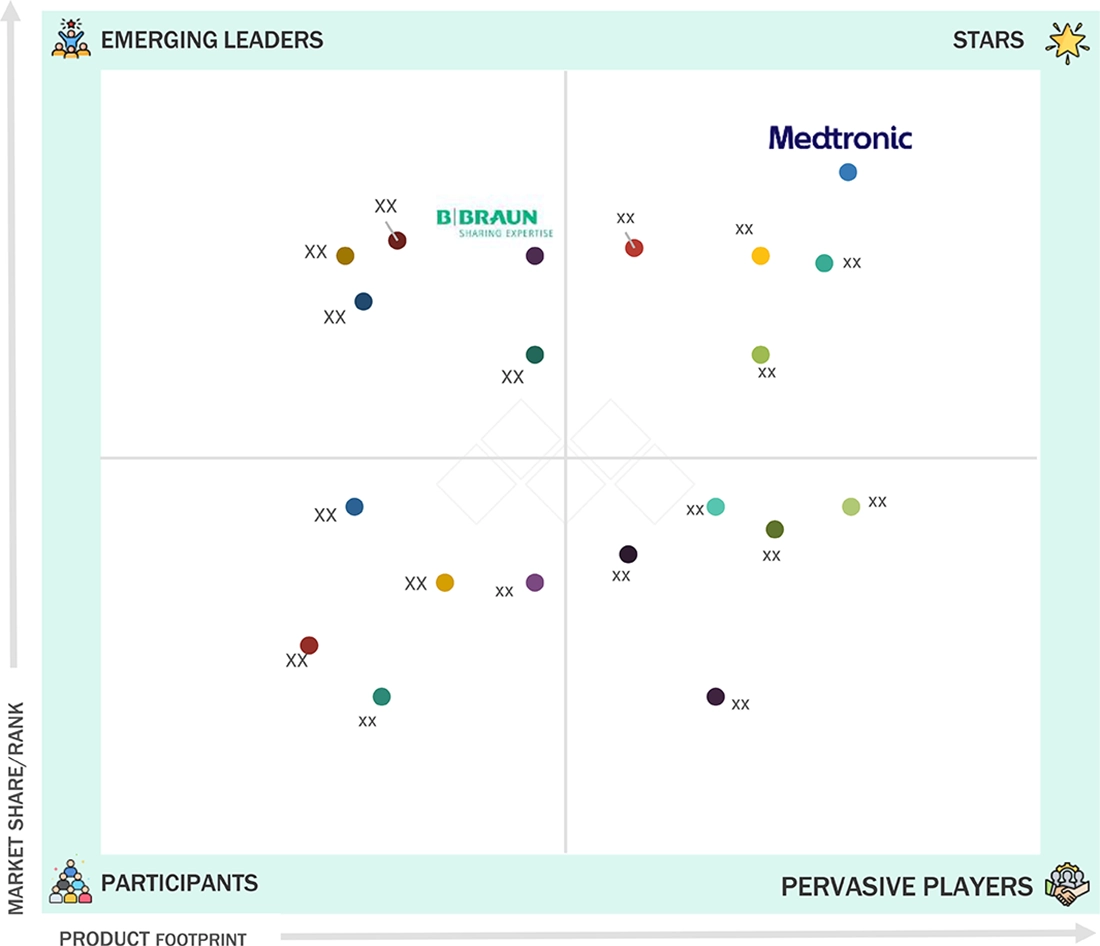

Diabetes Care Devices Market: COMPANY EVALUATION MATRIX

In the diabetes care devices market matrix, Medtronic Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. B Braun SE (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Medtronic Company dominates through reach, B Braun Se’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 30.84 Billion |

| Market Forecast, 2030 (Value) | USD 61.22 Billion |

| Growth Rate | CAGR of 12.3% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, GCC Countries, Middle East & Africa |

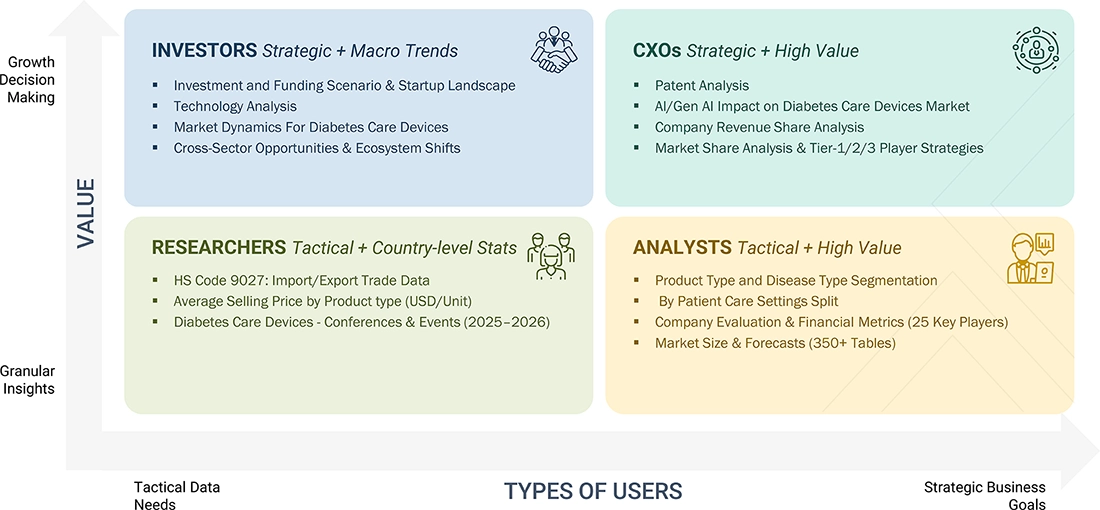

WHAT IS IN IT FOR YOU: Diabetes Care Devices Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for products such as self-monitoring blood glucose monitoring systems, continuous glucose monitoring systems, disposable insulin pens |

|

| Disease Prevalence |

|

|

RECENT DEVELOPMENTS

- April 2025 : Abbott entered a landmark agreement to integrate data from its Libre CGM systems into Epic’s EHRs using Aura software, streamlining provider workflows and enhancing real-time diabetes management.

- August 2024 : Abbott announced a global, first-of-its-kind partnership with Medtronic to develop an integrated continuous glucose monitoring (CGM) solution, combining Abbott’s latest FreeStyle Libre technology with Medtronic’s automated insulin delivery (AID) systems and smart insulin pens.

- September 2023 : Abbott announced the completion of its acquisition of Bigfoot Biomedical, a pioneer in smart insulin management systems, strengthening Abbott’s leadership in diabetes care by expanding its FreeStyle Libre® CGM portfolio and advancing its vision for integrated, personalized diabetes solutions.

- May 2023 : F. Hoffmann-La Roche Ltd (Switzerland) announced that it has started local manufacturing of its blood glucose monitoring device, Accu-Chek Active, in India.

Table of Contents

Methodology

The study involved four main activities to estimate the current size of the diabetes care devices market. First, extensive secondary research was conducted to gather information about the market, including related and parent markets. The next step was validating these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. Both top-down and bottom-up methods were used to develop a comprehensive estimate of the overall market size. Lastly, market segmentation and data triangulation techniques were employed to determine the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensive use of various sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the diabetes care devices market. It also helped obtain critical insights about key industry players, market classification, and segmentation based on current industry trends, down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, we conducted interviews with various sources from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, industry experts, including CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations involved in the diabetes care devices market, were interviewed. For the demand side, engagement with industry experts, purchase and sales managers, doctors, and personnel from research organizations was done. This primary research was essential to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

A breakdown of the primary respondents for the diabetes care devices market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the diabetes care devices market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the diabetes care devices market was determined from annual presentations by leading companies and publicly available secondary data. The share of products and services within the overall diabetes care devices market was calculated using secondary data and verified by primary participants to arrive at the total market size. Primary participants also further validated the data numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each stage, the assumptions and approaches were verified with industry experts contacted during primary research. Due to limitations in the data from secondary research, revenue estimates for individual companies (covering the overall diabetes care devices market and geographic market assessment) were determined based on a detailed analysis of their product offerings, geographic reach or strength (whether direct or through distributors or suppliers), and the market shares of leading players in specific regions and countries.

Global Diabetes Care Devices Market Size: Bottom-up and Top-down Approach

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures outlined below were applied, where appropriate, to complete the overall market analysis and obtain precise statistics for various segments. The data was triangulated by examining different factors and trends from both demand and supply perspectives. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The diabetes care devices market includes medical technologies and tools used for monitoring, managing, and treating diabetes. It features blood glucose monitoring systems (such as glucometers, continuous glucose monitors, test strips, and lancets), insulin delivery devices (including insulin pens, pumps, syringes, and automated delivery systems), and related accessories. These devices help track glucose accurately, deliver insulin effectively, and improve patient outcomes by enabling better disease control, reducing complications, and enhancing quality of life. The market serves patients, healthcare providers, and caregivers and is driven by technological innovations, the rising prevalence of diabetes, and increasing demand for connected, user-friendly solutions.

Stakeholders

- Diabetes Care Devices’ Manufacturing Companies

- Contract Manufacturers

- Distributors, Suppliers, and Channel Partners of Diabetes Care Devices

- Senior Management

- Finance Department

- Procurement Department

- Hospitals & Clinics

- E-commerce and Digital Platforms

- Retail Pharmacies and Supermarkets

- Academic & Research Institutes

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research and Consulting Service Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyse, and forecast the global diabetes care devices market by product type, disease type, patient care settings, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the diabetes care devices market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and the GCC countries

- To profile the key players in the diabetes care devices market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the diabetes care devices market

Key Questions Addressed by the Report

What is the expected addressable market value of the diabetes care devices market over 5 years?

The market is projected to reach USD 61.2 billion by 2030 from USD 34.3 billion in 2025, growing at a CAGR of 12.3% during the forecast period.

What are the strategies adopted by the top market players to penetrate emerging regions?

Major players are focusing on partnerships, expansions, distribution agreements, product launches, and obtaining product approvals to strengthen their presence in emerging markets.

Which segments have been included in this report?

The report includes segmentation by product type, disease type, patient care settings, and region.

Which region has the highest CAGR in the diabetes care devices market during the forecast period?

The Asia Pacific region is expected to register the highest CAGR due to the rising prevalence of diabetes, an expanding middle-class population, increased access to modern retail and e-commerce channels, growing urbanization, and supportive government initiatives.

Who are the top industry players in the global diabetes care devices market?

Leading companies in this market include F. Hoffmann-La Roche Ltd (Switzerland), Abbott Laboratories (US), Medtronic (Ireland), Dexcom (US), and Insulet Corporation (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Diabetes Care Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Diabetes Care Devices Market