European Medical Devices Market by Type (Diagnostic Imaging, Endoscopy Equipment, Respiratory Care, Cardiac Monitoring Devices, Haemodialysis Devices, Ophthalmic Devices, Anesthesia Monitoring), End User (Hospitals, Home-care) & Region - Global Forecast to 2025

Market Growth Outlook Summary

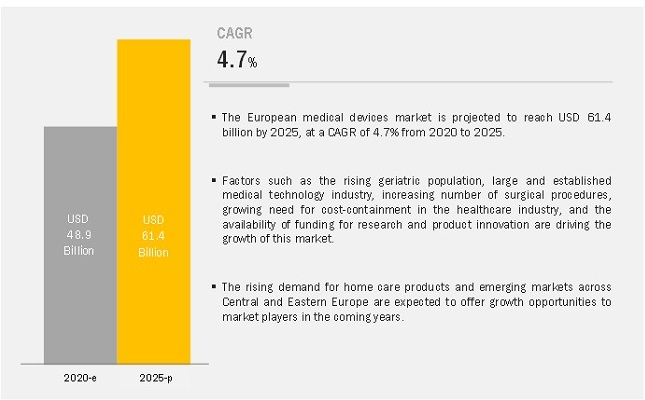

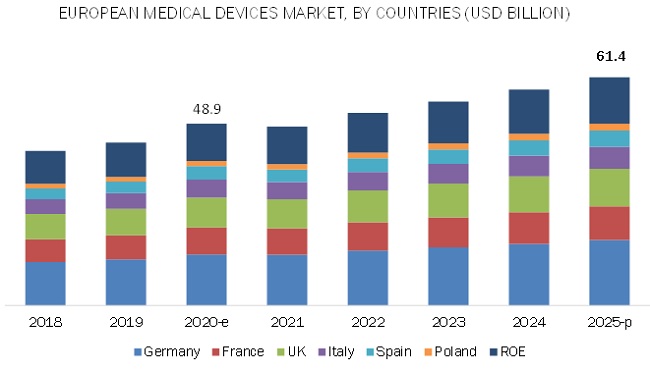

European medical devices market growth forecasted to transform from $48.9 billion in 2020 to $61.4 billion by 2025, driven by a CAGR of 4.7%. Key growth drivers include an aging population, advancements in medical technology, and an increasing number of surgical procedures, alongside the need for cost containment in healthcare. The market is segmented by device type, with the anesthesia monitoring segment anticipated to grow the fastest due to technological advancements and rising surgical demand. Poland is projected to experience the fastest growth, driven by an increasing elderly population and rising demand for home care medical devices. Major players in the market include Siemens Healthineers, GE Healthcare, Philips, and Medtronic. Recent developments feature new product introductions and strategic partnerships, such as Philips' launch of the E30 ventilator and its collaboration with the Paracelsus Clinic to modernize imaging systems.

The anesthesia monitoring segment of the european medical devices industry is projected to grow at the highest CAGR during the forecast period

Based on device type, the european medical devices market has been segmented into orthopedic devices, diagnostic imaging systems, endoscopy devices, ophthalmic devices, interventional cardiology devices, cardiac monitoring and cardiac rhythm management devices, respiratory care devices, ventilators, anesthesia monitoring devices, dialysis devices, and diabetic care devices. Technological advancements and the growth in the number of surgical procedures have driven the demand for anesthesia monitoring devices in Europe. There is also a rapid growth in the market for targeted anesthesia agent dosing to ensure patient safety using different evolving technologies, such as bispectral index monitoring and neuromuscular monitoring.

Poland is expected to grow at the fastest rate in the European medical devices industry during the forecast period.

While Germany held the largest share in the european medical devices market in 2019, Poland is expected to grow the fastest during the forecast period. While the market for medical devices in the country is currently immature as compared to other developed nations and consists majorly of imported products, it is projected to expand during the forecast period owing to factors such as the rising geriatric population and the growing demand for medical devices in home care settings. The market shows opportunities for expansion in the areas of diagnostic, surgical, cardiovascular, oncology, and nuclear medicine.

Some of the major players in the European medical devices market are Siemens Healthineers (Germany), GE Healthcare (US), Philips (Netherlands), Abbott (US), Medtronic (Ireland), Stryker (US), Boston Scientific (US), Olympus(Japan), B. Braun (Germany), Fujifilm (Japan), ResMed (US), Masimo (US), and KARL STORZ (Germany).

Scope of the European Medical Devices Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$48.9 billion |

|

Projected Revenue Size by 2025 |

$61.4 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 4.7% |

|

Market Driver |

Rising geriatric population |

|

Market Opportunity |

Growing demand for out-of-hospital care |

The research report categorizes the european medical devices market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

- Imaging Systems

- Endoscopy Devices

- Interventional Cardiology Devices

- Cardiac Monitoring and Cardiac Rhythm Management Devices

- Ventilators

- Orthopedic Devices

- Ophthalmic Devices

- Diabetes Care Devices

- Dialysis Devices

- Anesthesia Monitoring

- Respiratory Care Devices

By End User

- Hospital and Clinic Care Settings

- Home-care Settings

By Region

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Rest of Europe (RoE)

Recent Developments of European Medical Devices Industry:

- In 2020, Philips introduced the new Philips Respironics E30 ventilator to help free up ICU units to fight the COVID-19 pandemic

- In 2020, Royal Philips entered into an 8-year strategic partnership with the Paracelsus Clinic for continuously modernizing its imaging systems.

- In 2019, B Braun acquired Nephtec GmbH; this acquisition strengthened the company’s dialysate concentrate portfolio in Europe

- In 2019, Medtronic partnered with Karl Storz that was aimed at strengthening Medtronic’s upcoming robotic-assisted surgical platform with the three-dimensional vision system from KARL STORZ.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global european medical devices market?

The global european medical devices market boasts a total revenue value of $61.4 billion by 2025.

What is the estimated growth rate (CAGR) of the global european medical devices market?

The global european medical devices market has an estimated compound annual growth rate (CAGR) of 4.7% and a revenue size in the region of $48.9 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENT

1 INTRODUCTION (Page No. - 14)

1.1 OBJECTIVES OF THE STUDY

1.2 EUROPEAN MEDICAL DEVICES INDUSTRY DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY SOURCES

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 EUROPEAN MEDICAL DEVICES MARKET OVERVIEW

4.2 EUROPEAN MEDICAL DEVICES INDUSTRY BY END USER & COUNTRY (2019)

4.3 COUNTRY MIX: EUROPEAN MEDICAL DEVICES INDUSTRY

4.4 EUROPEAN MEDICAL DEVICES INDUSTRY: DEVELOPING VS. DEVELOPED COUNTRIES

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 KEY MARKET DRIVERS

5.2.1.1 Rising geriatric population

5.2.1.2 Large and established medical technology industry

5.2.1.3 Increasing number of surgical procedures

5.2.1.4 Availability of funding for research and product innovation

5.2.1.5 Growing need for cost-containment in the healthcare industry

5.2.2 RESTRAINTS

5.2.2.1 Fiscal unsustainability due to wasteful spending

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for out-of-hospital care

5.2.3.2 Emerging markets across Central and Eastern Europe

5.2.4 CHALLENGES

5.2.4.1 Compliance issues with new MDR regulations

5.2.4.2 Non-compliance to the Golden Rule

5.2.5 BURNING ISSUES

5.2.5.1 Postponement of non-emergency elective surgeries

5.2.5.2 Medical device supply chain disruption

6 INDUSTRY INSIGHTS (Page No. - 45)

6.1 IMPACT OF COVID-19 ON THE EUROPEAN MEDICAL DEVICES MARKET

6.2 RECLASSIFICATION OF MEDICAL DEVICES UNDER THE NEW MDR REGULATIONS

6.2.1 CLASSIFICATION OF NON-INVASIVE DEVICES

6.2.2 CLASSIFICATION ON INVASIVE DEVICES

6.2.3 CLASSIFICATION OF ACTIVE DEVICES

6.2.4 CLASSIFICATION OF NANOMATERIALS

6.2.5 SPECIAL RULES

6.3 MANAGED EQUIPMENT SERVICE PROVIDERS AND GROUP PURCHASING

6.4 REMOTE PATIENT MANAGEMENT

6.5 USE OF ARTIFICIAL INTELLIGENCE IN MEDICAL DEVICES

7 EUROPEAN MEDICAL DEVICES MARKET, BY DEVICE TYPE (Page No. - 53)

7.1 INTRODUCTION

7.2 ORTHOPEDIC DEVICES

7.3 ENDOSCOPY DEVICES

7.4 DIAGNOSTIC IMAGING SYSTEMS

7.5 INTERVENTIONAL CARDIOLOGY DEVICES

7.6 CARDIAC MONITORING & CARDIAC RHYTHM MANAGEMENT DEVICES

7.7 OPHTHALMIC DEVICES

7.8 RESPIRATORY CARE DEVICES

7.9 DIALYSIS DEVICES

7.10 DIABETES CARE DEVICES

7.11 ANESTHESIA MONITORING DEVICES

7.12 VENTILATORS

8 MEDICAL DEVICES MARKET, BY END USER (Page No. - 78)

8.1 INTRODUCTION

8.2 HOSPITALS AND CLINICAL CARE SETTINGS

8.3 HOME CARE SETTINGS

9 MEDICAL DEVICES MARKET, BY REGION (Page No. - 81)

9.1 INTRODUCTION

9.2 GERMANY

9.2.1 GERMANY IS THE LARGEST MARKET FOR MEDICAL DEVICES IN EUROPE

9.3 UK

9.3.1 UTILIZATION OF HOSPITAL SERVICES IS 25% LOWER IN THE UK THAN THE EU AVERAGE

9.4 FRANCE

9.4.1 TECHNOLOGICAL EXPERTISE AND INNOVATIONS ARE ATTRACTING MARKET PLAYERS TO COMPETE IN THE MEDICAL DEVICES MARKET IN FRANCE

9.5 ITALY

9.5.1 REGIONAL AND ECONOMIC DISPARITIES IN THE COUNTRY CAN HAMPER THE GROWTH OF THE HEALTHCARE INDUSTRY

9.6 SPAIN

9.6.1 GROWING DEMAND FOR PRIMARY CARE TO DRIVE MARKET GROWTH IN SPAIN

9.7 POLAND

9.7.1 RISING GERIATRIC POPULATION AND INCREASING DEMAND FOR HOME HEALTHCARE TO DRIVE MARKET GROWTH IN POLAND

9.8 REST OF EUROPE

10 COMPETITIVE LANDSCAPE (Page No. - 106)

10.1 INTRODUCTION

10.2 PRODUCT PORTFOLIO MATRIX

10.3 COMPETITIVE SITUATION AND TRENDS

10.3.1 PRODUCT LAUNCHES

10.3.2 ACQUISITIONS

10.3.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 110)

(Business Overview, Products Offered, and Recent Developments)*

11.1 SIEMENS HEALTHINEERS (SUBSIDIARY OF SIEMENS GROUP)

11.2 GE HEALTHCARE

11.3 PHILIPS

11.4 ABBOTT

11.5 OLYMPUS

11.6 B. BRAUN MELSUNGEN AG

11.7 FUJIFILM

11.8 BOSTON SCIENTIFIC CORPORATION

11.9 MEDTRONIC

11.10 SMITH & NEPHEW

11.11 STRYKER CORPORATION

11.12 RESMED

11.13 MASIMO

11.14 KARL STORZ

11.15 OTHER COMPANIES

11.15.1 VIMEX ENDOSCOPY

11.15.2 ENDOTEC MEDICAL SYSTEMS

11.15.3 THERAPIXEL

11.15.4 MULTIWAVE IMAGING SA

11.15.5 QUANTA DIALYSIS TECHNOLOGIES

*Details on Business Overview, Products Offered, and Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 173)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

LIST OF TABLES (76 TABLES)

TABLE 1 STANDARD CURRENCY CONVERSION RATES

TABLE 2 EU: MACROECONOMIC AND INFRASTRUCTURAL INDICATORS

TABLE 3 EXAMINATIONS PERFORMED PER 100,000 INHABITANTS USING IMAGING EQUIPMENT IN HOSPITALS AND AMBULATORY CARE CENTERS

TABLE 4 EUROPE: WASTEFUL SPENDING, BY COUNTRY

TABLE 5 SURGICAL CASE TYPES BASED ON INDICATION AND URGENCY

TABLE 6 EUROPE: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 7 NUMBER OF HIP AND KNEE REPLACEMENT SURGICAL PROCEDURES (2011 VS. 2017)

TABLE 8 EUROPE: ORTHOPEDIC DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 NUMBER OF ENDOSCOPY PROCEDURES, BY TYPE (2018)

TABLE 10 EUROPE: ENDOSCOPY DEVICES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 11 EUROPE: ENDOSCOPY DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 EUROPE: ENDOSCOPES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 EUROPE: VISUALIZATION SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 EUROPE: OTHER ENDOSCOPY INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 EUROPE: ENDOSCOPY ACCESSORIES MARKET, BY COUNTRY, 2028–2025 (USD MILLION)

TABLE 16 AGE-RELATED DISEASES AND ASSOCIATED DIAGNOSTIC MODALITIES

TABLE 17 PERCENT INCREASE OF DIAGNOSTIC IMAGING UNITS IN HOSPITALS AND AMBULATORY HEALTH CENTERS PER 100,000 INHABITANTS, BY COUNTRY (2013 VS. 2017)

TABLE 18 EUROPE: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 EUROPE: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 EUROPE: X-RAY SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 EUROPE: MRI SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 EUROPE: ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 EUROPE: CT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 EUROPE: NUCLEAR IMAGING SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 25 EUROPE: MAMMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 NUMBER OF DEATHS DUE TO ISCHEMIC HEART DISEASE, 2017

TABLE 27 NUMBER OF SURGICAL OPERATIONS AND PROCEDURES RELATED TO THE CIRCULATORY SYSTEM, PER 100,000 INHABITANTS

TABLE 28 EUROPE: INTERVENTIONAL CARDIOLOGY DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 PREVALENCE OF FACTORS THAT AFFECT CVD IN ESC MEMBER COUNTRIES

TABLE 30 EUROPE: CARDIAC MONITORING AND CARDIAC RHYTHM MANAGEMENT DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 PREVALENCE OF AGE-RELATED MACULAR DEGENERATION IN THE GERIATRIC POPULATION (50 YEARS & ABOVE), BY COUNTRY, 2013 VS. 2023

TABLE 32 TOTAL NUMBER OF CATARACT SURGERIES PERFORMED IN 2015 AND 2017, BY COUNTRY

TABLE 33 NUMBER OF GLAUCOMA PATIENTS, BY COUNTRY, 2013 VS. 2020 VS. 2040 (IN MILLION)

TABLE 34 DIABETES POPULATION IN EUROPE, 2017 VS. 2045 (MILLION)

TABLE 35 EUROPE: OPHTHALMIC DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 GEOGRAPHIC PREVALENCE OF COPD ACROSS EUROPE, 2017

TABLE 37 EUROPE: RESPIRATORY CARE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 PREVALENCE OF RRT ACROSS EUROPEAN COUNTRIES, 2015–2017

TABLE 39 EUROPE: DIALYSIS DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 NUMBER OF ADULTS (AGED 20-79) WITH DIABETES (IN THOUSAND)

TABLE 41 EUROPE: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: ANESTHESIA MONITORING DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: VENTILATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MEDICAL DEVICES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: MEDICAL DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 GERMANY: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 47 GERMANY: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 48 GERMANY: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 UK: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 51 UK: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 52 UK: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 UK: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 FRANCE: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 55 FRANCE: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 56 FRANCE: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 FRANCE: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 ITALY: NUMBER OF ELDERLY PEOPLE WITH ATRIAL FIBRILLATION (IN THOUSAND)

TABLE 59 ITALY: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 60 ITALY: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 61 ITALY: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 ITALY: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 SPAIN: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 64 SPAIN: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 65 SPAIN: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 SPAIN: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 POLAND: MACROECONOMIC FACTORS AFFECTING THE MEDICAL DEVICES MARKET

TABLE 68 POLAND: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 69 POLAND: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 POLAND: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 ROE: MEDICAL DEVICES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 72 ROE: DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 ROE: ENDOSCOPY DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 PRODUCT LAUNCHES (2017–2020)

TABLE 75 ACQUISITIONS (2017–2020)

TABLE 76 JOINT VENTURES AND PARTNERSHIPS (2017–2020)

LIST OF FIGURES (38 FIGURES)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE AND DESIGNATION

FIGURE 3 EUROPEAN MEDICAL DEVICES INDUSTRY SIZE ESTIMATION

FIGURE 4 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 EUROPEAN MEDICAL DEVICES MARKET, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

FIGURE 7 EUROPEAN MEDICAL DEVICES INDUSTRY, BY DEVICE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 EUROPEAN MEDICAL DEVICES INDUSTRY, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

FIGURE 10 GERMANY ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

FIGURE 11 GERMANY WILL CONTINUE TO DOMINATE THE EUROPEAN MEDICAL DEVICES INDUSTRY DURING THE FORECAST PERIOD

FIGURE 12 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

FIGURE 13 EUROPEAN MEDICAL DEVICES INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 14 EU: DISTRIBUTION OF POPULATION, BY AGE (2010 VS. 2020 VS. 2030)

FIGURE 15 DISEASE TRENDS IN EU-28 (AS OF 2016)

FIGURE 16 NUMBER OF SURGICAL PROCEDURES PERFORMED IN HOSPITAL SETTINGS

FIGURE 17 COMPANIES AND THEIR R&D AS A PERCENTAGE OF REVENUE (2019)

FIGURE 18 INCREASING NUMBER OF LONG-TERM CARE BEDS IN NURSING AND RESIDENTIAL CARE FACILITIES TO PROVIDE OPPORTUNITIES IN REMOTE PATIENT MONITORING

FIGURE 19 DEVIATION FROM GOLDEN RULE, BY COUNTRY (2018)

FIGURE 20 LEADING CAUSES OF DISEASE-RELATED DEATHS IN GERMANY (AS OF 2017)

FIGURE 21 LEADING CAUSES OF DISEASE-RELATED DEATHS IN THE UK (AS OF 2017)

FIGURE 22 LEADING CAUSES OF DISEASE-RELATED DEATHS IN FRANCE (AS OF 2017)

FIGURE 23 LEADING CAUSES OF DISEASE-RELATED DEATHS IN ITALY (AS OF 2017)

FIGURE 24 LEADING CAUSES OF DISEASE-RELATED DEATHS IN SPAIN (AS OF 2017)

FIGURE 25 LEADING CAUSES OF DISEASE-RELATED DEATHS IN POLAND (AS OF 2017)

FIGURE 26 KEY DEVELOPMENTS IN THE EUROPEAN MEDICAL DEVICES MARKET BETWEEN JANUARY 2017 AND APRIL 2020

FIGURE 27 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2019)

FIGURE 28 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT (2019)

FIGURE 29 PHILIPS: COMPANY SNAPSHOT (2019)

FIGURE 30 ABBOTT: COMPANY SNAPSHOT (2019)

FIGURE 31 OLYMPUS: COMPANY SNAPSHOT (2019)

FIGURE 32 B. BRAUN: COMPANY SNAPSHOT (2019)

FIGURE 33 FUJIFILM: COMPANY SNAPSHOT (2018)

FIGURE 34 BOSTON SCIENTIFIC: COMPANY SNAPSHOT (2019)

FIGURE 35 MEDTRONIC: COMPANY SNAPSHOT (2018)

FIGURE 36 STRYKER CORPORATION: COMPANY SNAPSHOT (2018)

FIGURE 37 RESMED: COMPANY SNAPSHOT (2018)

FIGURE 38 MASIMO: COMPANY SNAPSHOT (2018)

This study involved the extensive use of both primary and secondary sources. The research process included a study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the European medical devices market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

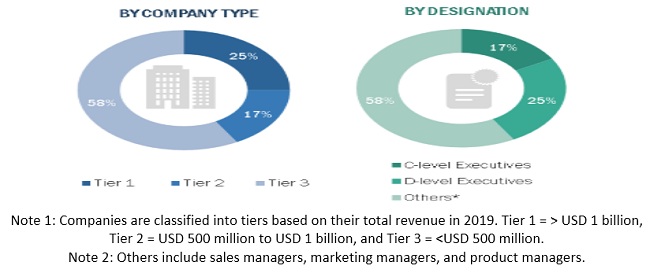

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, presidents, vice presidents, marketing managers, product managers, sales executives, business development executives, and technology & innovation directors of companies manufacturing and distributing medical devices. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To arrive at the total market size, the size of each of the device type segment was arrived at by using data triangulation from different approaches, including primary insights, secondary sources, and MnM data repository. Each of the approaches was then weighted based on the level of assumptions to arrive at the total market size for each device type. The market sizes of all device types were combined to arrive at the final market using the bottom-up approach.

Data Triangulation

After arriving at the market size, the total European medical devices market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the European medical devices market by device type and end user

- To provide detailed information about the factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players in the European medical devices market

- To forecast the size of the medical devices market in Germany, France, the UK, Spain, Italy, Poland, and the Rest of Europe

- To profile key players in the European medical devices market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as mergers, acquisitions, product and technology development, and the R&D activities of leading players operating in the European medical devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the Rest of Europe medical devices market into Switzerland, the Netherlands, Belgium, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Medical Devices Market