Medical Tapes and Bandages Market by Product (Tape (Fabric, Paper, Plastic), Bandage (Gauze, Adhesive, Cohesive, Elastic, Compression)), Application (Surgery, Trauma, Ulcer, Sports, Burns), End User (Hospital, ASC, Clinic, Homecare) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global medical tapes and bandages market growth forecasted to transform from $7.1 billion in 2021 to $8.6 billion by 2026, driven by a CAGR of 4.0%. The major factors expected to drive market growth during the forecast period are rising geriatric populations and increased demand for post-surgical rehabilitation products.

Medical Tapes and Bandages Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Medical Tapes and Bandages Market Dynamics

Driver: Growing prevalence of diseases and conditions affecting wound healing capabilities

Chronic wounds mainly include wounds such as diabetic foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds. A diabetic foot ulcer is a major complication of diabetes. As diabetes slows down the healing process, all types of ulcers, other chronic and acute wounds, even minor cuts, take longer to heal, prolonging treatment types, which in turn increases consumption of medical tapes and bandages used for dressings and re-dressings. Furthermore, because of the long healing times, minor cuts can become chronic wounds, increasing the demand for dressings.

Below mentioned are some important statistics related to the major complications associated with diabetes:

- According to the International Diabetes Federation (IDF), the global diabetic cases will increase from 415.0 million in 2015 to 642.0 million by 2040.

- The CDC estimates that one in three American adults will have diabetes by 2050.

- The risk of amputation is 25 times more in diabetic patients than those without diabetes (Source: IDF).

- It also reported that more than 100 million adults in the US alone are diabetic or prediabetic. Nearly 25% of diabetics in the US develop foot ulcers during their lifetime, while as much as 15% of the total diabetic population suffers from diabetic foot ulcers (DFUs).

Opportunity: Growth potential in emerging economies

Emerging markets such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities to players operating in the medical tapes and bandages industry. This can primarily be attributed to the rising trend of medical tourism in these emerging countries. The availability of high-quality surgical treatments at lower costs is the key factor attracting patients to these countries for elective surgeries. The increasing popularity of cosmetic surgeries and the developing healthcare infrastructure in emerging countries are the other major factors that are expected to offer growth opportunities to market players. In order to leverage the high growth opportunities for medical tapes and bandages in emerging markets, manufacturers are strategically focusing on expanding their presence in these markets.

Regulatory policies in the Asia-Pacific region are more adaptive and business-friendly due to the less stringent regulations and data requirements. Moreover, the increasing competition in mature markets will further compel the manufacturers of medical tapes and bandages to focus on emerging markets.

Restraint: Rising awareness about advanced wound care products

Advanced wound care accelerates the healing process for many chronic wounds by providing and promoting a moist environment. As basic/traditional wound care products take a large amount of time to heal wounds and are less effective in certain types of wounds, advanced wound care products are being used as first-line therapy wherever infection control and healing speed are major concerns. Considering their effectiveness, coupled with the limitations of basic/traditional wound dressings, advanced and active wound care products are expected to cannibalise the market for medical bandages and tapes in the coming years.

Challenge: Increasing pricing pressure on market players

In response to increasing government pressure to reduce healthcare costs, a number of healthcare providers have partnered with group purchasing organisations (GPOs) and integrated health networks (IHNs). These organisations aggregate the purchasing volume of their members and bargain for a competitive price with suppliers as well as manufacturers of surgical devices. GPOs and IHNs negotiate heavily for the bulk purchase of surgical products.

For instance, IPC Group Purchasing (IPC) supplies medical products, including bandages, dressings, medical tapes, and many other products from 3M, Covidien, ConvaTec, CareFusion, Welch Allyn, and a number of other companies to its network of 21 hospitals. Because of the volume of purchases, IPC negotiates prices with its suppliers and passes the savings on to its customers. As a result, through bulk purchasing, IPC supplies all medical products to its customers at a 15% lower price.

This trend of bulk purchasing is increasing the pricing pressure on market players and decreasing their profit margins. Furthermore, small and medium-sized manufacturers that offer a limited range of medical tapes and bandages are facing a significant burden owing to the increasing power of GPOs and IHNs in the US. However, it is expected that the rising focus on the development of low-cost products will reduce the impact of this challenge to a certain extent in the coming years.

In terms Application, the surgical wound treatment segment is expected to account for the largest share of the medical tapes and bandages industry.

Based on application, the medical tapes and bandages market is segmented into surgical wound, traumatic wound, burn injury, ulcer, sports injury, and other treatments. The large share of this application is due to increasing number of surgeries across the globe.

In terms of product segment, bandages segment is expected to account for the largest share of the global medical tapes and bandages industry during the forecast period.

Based on products, the medical tapes and bandages market is segmented into medical tapes and bandages. Large share is attributed to bandages segment as bandages protect wounds from trauma, bacteria, and dirt; absorb fluid from draining wounds; and maintain a moist environment to expedite healing.

The hospitals segment is expected to register the highest CAGR of global medical tapes and bandages industry during the forecast period

Based on end-users, the medical tapes and bandages market has been segmented based on end-user category—, hospitals, ambulatory surgery centers, clinics, home care settings and other end users. Only hospitals have the infrastructure and personnel required to treat ailments such as chronic wounds, burns, and traumatic and laceration cases. Such treatments utilize all types of medical tapes and bandages. For example, almost all major surgeries require pre-and post-surgery catheter insertion, which involves the use of medical tapes to secure.

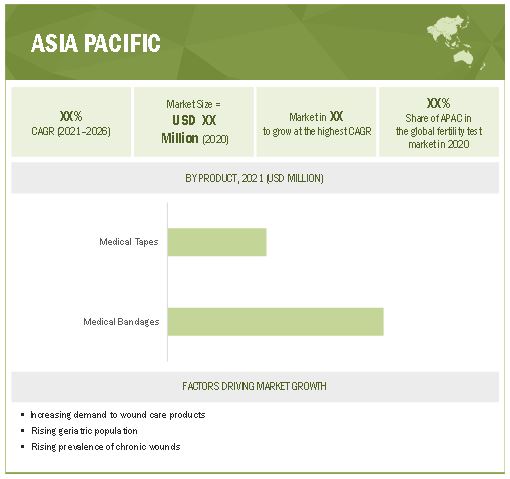

Asia Pacific market is expected to grow at the highest CAGR of global medical tapes and bandages industry during the forecast period.

The Asia Pacific market of the medical tapes and bandages market is projected to register the highest CAGR during the forecast period. The market growth in Asia Pacific can be attributed to increasing demand for wound care products, rising geriatric population, and increasing prevalence of chronic wounds in the region. North America dominated the global medical tapes and bandages industry in 2020

Prominent players in the medical tapes and bandages market include 3M Company (US), Johnson & Johnson (US), Cardinal Health Inc. (US), Medline Industries Inc.(US), Essity (Sweden), McKesson Corporation (US), Integra Lifesciences Holdings Corporation (US), Smith & Nephew Plc., (US), B. Braun Melsungen AG (Germany), PAUL HARTMANN AG (Germany), Beiersdorf AG (Germany), Nitto Denko Corporation (Japan), Mölnlycke Healthcare (Sweden), Coloplast A/S (Denmark), and Nichiban (Japan).

Scope of the Medical Tapes and Bandages Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

USD 7.1 billion |

|

Projected Revenue Size by 2026 |

USD 8.6 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 4.0% |

|

Market Driver |

Growing prevalence of diseases and conditions affecting wound healing capabilities |

|

Market Opportunity |

Growth potential in emerging economies |

This study categorizes the global medical tapes and bandages market to forecast revenue and analyze trends in each of the following submarkets:

By Application

- Surgical Wound Treatment

- Traumatic Wound Treatment

- Ulcer Treatment

- Sports Injury Treatment

- Burn Injury Treatment

- Other Applications

By Product

- Bandages

- Medical Tapes

By End User

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Home Care Settings

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments of Medical Tapes and Bandages Industry

- In April 2021, Essity acquired Bayport Brands which gave Essity distribution rights of the wound care technology Sorbact in Australia and New Zeland from Bayport Brands this will further accelerate the growth in the wound care market.

- In April 2020, Medline Industries partnered with Yale New Haven for the exclusive supply of medical supplies along with supply chain and logistics solutions.

- In October 2019, 3M Company acquired Acelity Inc. will further accelerate 3M as a leader in advanced wound care, which is a significant and growing market segment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the medical tapes and bandages market?

The medical tapes and bandages market boasts a total revenue value of USD 8.6 billion by 2026.

What is the estimated growth rate (CAGR) of the medical tapes and bandages market?

The global medical tapes and bandages market has an estimated compound annual growth rate (CAGR) of 4.0% and a revenue size in the region of USD 7.1 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 MEDICAL TAPES AND BANDAGES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Indicative list of secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

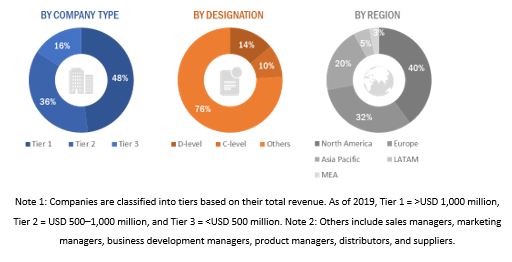

FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

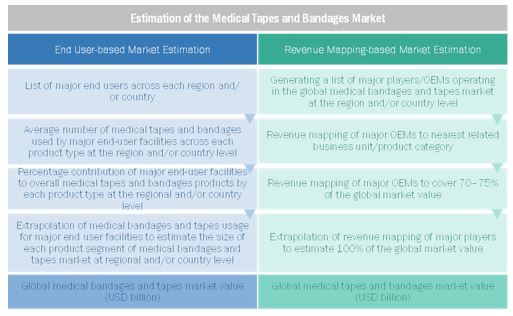

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 END USER-BASED MARKET ESTIMATION

2.2.2 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: GLOBAL MARKET

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 9 MARKET, BY APPLICATION,2021 VS. 2026 (USD MILLION)

FIGURE 10 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 MARKET OVERVIEW

FIGURE 12 INCREASING NUMBER OF SURGERIES EXPECTED TO DRIVE MARKET

4.2 MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 13 BANDAGES SEGMENT PROJECTED TO DOMINATE THE MARKET DURING FORECAST PERIOD

4.3 APAC: MARKET, BY COUNTRY AND APPLICATION (2020)

FIGURE 14 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.4 GLOBAL MARKET, BY END USER, 2021 VS. 2026

FIGURE 15 HOSPITALS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET DURING FORECAST PERIOD

4.5 MEDICAL TAPES AND BANDAGES: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 GLOBAL MARKET IN INDIA EXPECTED TO GROW THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS: DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of diseases and conditions affecting wound healing capabilities

5.2.1.1.1 Growth in surgical procedures/operations

FIGURE 18 NUMBER OF C-SECTION DELIVERIES PER 1,000 LIVE-BIRTHS GLOBALLY (2017)

TABLE 1 PERCENTAGE INCREASE IN THE NUMBER OF SURGERIES PERFORMED IN THE US

5.2.1.1.2 Rapid growth in aging population

5.2.1.1.3 Rising incidence of chronic wounds

TABLE 2 AGE-SPECIFIC PREVALENCE OF DIABETIC FOOT ULCERS, BY GENDER

5.2.1.1.4 High incidence of obesity

5.2.1.2 Increasing number of traumatic wounds

TABLE 3 DEMOGRAPHICS OF MAJOR ROAD ACCIDENTS

5.2.1.3 Increased spending on chronic and surgical wounds

5.2.2 RESTRAINTS

5.2.2.1 Rising awareness about advanced wound care products

5.2.3 OPPORTUNITIES

5.2.3.1 Growth potential in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Increasing pricing pressure on market players

TABLE 4 GLOBAL MARKET PRICING ANALYSIS (USD)

5.3 ECOSYSTEM COVERAGE: PARENT MARKET (WOUND CARE MARKET)

5.4 REGULATORY ANALYSIS

5.4.1 US

TABLE 5 REGULATORY PATHWAYS FOR WOUND CARE PRODUCT CATEGORIES IN THE US

5.4.2 INDIA

TABLE 6 CLASSIFICATION FOR WOUND CARE PRODUCT CATEGORIES IN THE INDIA

5.4.3 PATENT ANALYSIS

TABLE 7 PATENT DETAILS

5.5 VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 OVERVIEW

TABLE 8 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.2 THREAT OF NEW ENTRANTS

FIGURE 20 THREAT OF NEW ENTRANTS

5.7.3 THREAT OF SUBSTITUTES

FIGURE 21 THREAT OF SUBSTITUTES

5.7.4 BARGAINING POWER OF SUPPLIERS

FIGURE 22 BARGAINING POWER OF SUPPLIERS

5.7.5 BARGAINING POWER OF BUYERS

FIGURE 23 BARGAINING POWER OF BUYERS

5.7.6 DEGREE OF COMPETITION

FIGURE 24 DEGREE OF COMPETITION

5.8 COVID-19 IMPACT

6 MEDICAL TAPES AND BANDAGES MARKET, BY PRODUCT (Page No. - 76)

6.1 INTRODUCTION

TABLE 9 MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 10 MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

6.2 BANDAGES

6.2.1 GROWING SURGICAL AND TRAUMATIC WOUND CASES IS BOOSTING THE MARKET GROWTH

TABLE 11 BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 12 BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 13 BANDAGES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 14 BANDAGES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 15 BANDAGES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 16 BANDAGES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 17 BANDAGES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 18 BANDAGES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.2.2 GAUZE BANDAGES

TABLE 19 GAUZE BANDAGES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 20 GAUZE BANDAGES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 21 GAUZE BANDAGES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 22 GAUZE BANDAGES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 23 GAUZE BANDAGES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 24 GAUZE BANDAGES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.2.3 ADHESIVE BANDAGES

TABLE 25 ADHESIVE BANDAGES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 26 ADHESIVE BANDAGES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 27 ADHESIVE BANDAGES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 28 ADHESIVE BANDAGES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 29 ADHESIVE BANDAGES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 30 ADHESIVE BANDAGES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.2.4 COHESIVE AND ELASTIC BANDAGES

TABLE 31 COHESIVE AND ELASTIC BANDAGES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 32 COHESIVE AND ELASTIC BANDAGES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 33 COHESIVE AND ELASTIC BANDAGES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 34 COHESIVE AND ELASTIC BANDAGES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 35 COHESIVE AND ELASTIC BANDAGES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 36 COHESIVE AND ELASTIC BANDAGES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.2.5 OTHER BANDAGES

TABLE 37 OTHER BANDAGES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 38 OTHER BANDAGES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 39 OTHER BANDAGES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 40 OTHER BANDAGES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 41 OTHER BANDAGES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 42 OTHER BANDAGES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.3 MEDICAL TAPES

6.3.1 GROWING SURGICAL AND TRAUMATIC WOUND CASES IS BOOSTING THE MARKET GROWTH

TABLE 43 MEDICAL TAPES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 45 MEDICAL TAPES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 46 MEDICAL TAPES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 47 MEDICAL TAPES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 48 MEDICAL TAPES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 49 MEDICAL TAPES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 50 MEDICAL TAPES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.3.2 FABRIC TAPES

TABLE 51 FABRIC TAPES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 52 FABRIC TAPES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 53 FABRIC TAPES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 54 FABRIC TAPES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 55 FABRIC TAPES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 56 FABRIC TAPES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.3.3 PAPER TAPES

TABLE 57 PAPER TAPES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 58 PAPER TAPES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 59 PAPER TAPES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 60 PAPER TAPES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 61 PAPER TAPES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 62 PAPER TAPES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.3.4 PLASTIC TAPES

TABLE 63 PLASTIC TAPES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 64 PLASTIC TAPES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 65 PLASTIC TAPES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 66 PLASTIC TAPES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 67 PLASTIC TAPES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 68 PLASTIC TAPES MARKET, BY END USER, 2024–2026 (USD MILLION)

6.3.5 OTHER TAPES

TABLE 69 OTHER TAPES MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 70 OTHER TAPES MARKET, BY REGION, 2024–2026 (USD MILLION)

TABLE 71 OTHER TAPES MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 72 OTHER TAPES MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 73 OTHER TAPES MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 74 OTHER TAPES MARKET, BY END USER, 2024–2026 (USD MILLION)

7 MEDICAL TAPES AND BANDAGES MARKET, BY APPLICATION (Page No. - 103)

7.1 INTRODUCTION

TABLE 75 MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 76 MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

7.2 SURGICAL WOUND TREATMENT

7.2.1 INCREASING NUMBER OF SURGERIES EXPECTED TO BOOST THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 77 MARKET FOR SURGICAL WOUND TREATMENT, BY REGION, 2019–2023 (USD MILLION)

TABLE 78 MARKET FOR SURGICAL WOUND TREATMENT, BY REGION, 2024–2026 (USD MILLION)

7.3 TRAUMATIC WOUND TREATMENT

7.3.1 INITIATIVES TO REDUCE DEATHS DUE TO ROAD ACCIDENTS WILL DRIVE THE MARKET

TABLE 79 NUMBER OF DEATHS DUE TO ROAD ACCIDENT BY COUNTRY (DEATHS PER 1 MILLION INHABITANTS) (2005-2017)

TABLE 80 GLOBAL MARKET FOR TRAUMATIC WOUND TREATMENT, BY REGION, 2019–2023 (USD MILLION)

TABLE 81 MARKET FOR TRAUMATIC WOUND TREATMENT, BY REGION, 2024–2026 (USD MILLION)

7.4 ULCER TREATMENT

7.4.1 CONSUMPTION OF TAPES AND BANDAGES FOR ULCER TREATMENT HAS INCREASED

TABLE 82 TREATMENT OF PRESSURE ULCERS

TABLE 83 MARKET FOR ULCER TREATMENT, BY REGION, 2019–2023 (USD MILLION)

TABLE 84 MARKET FOR ULCER TREATMENT, BY REGION, 2024–2026 (USD MILLION)

7.5 SPORTS INJURY TREATMENT

7.5.1 INCREASE IN SPORTS AND RECREATIONAL ACTIVITIES WILL DRIVE MARKET GROWTH

TABLE 85 MARKET FOR SPORTS INJURY TREATMENT, BY REGION, 2019–2023 (USD MILLION)

TABLE 86 MARKET FOR SPORTS INJURY TREATMENT, BY REGION, 2024–2026 (USD MILLION)

7.6 BURN INJURY TREATMENT

7.6.1 INCREASING NUMBER OF BURN INJURIES ACROSS THE GLOBE CONTRIBUTE MAJORLY TO THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 87 MARKET FOR BURN INJURY TREATMENT, BY REGION, 2019–2023 (USD MILLION)

TABLE 88 MARKET FOR BURN INJURY TREATMENT, BY REGION, 2024–2026 (USD MILLION)

7.7 OTHER APPLICATIONS

TABLE 89 MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2023 (USD MILLION)

TABLE 90 MARKET FOR OTHER APPLICATIONS, BY REGION, 2024–2026 (USD MILLION)

8 MEDICAL TAPES AND BANDAGES MARKET, BY END USER (Page No. - 115)

8.1 INTRODUCTION

TABLE 91 MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 92 MARKET, BY END USER, 2024–2026 (USD MILLION)

8.2 HOSPITALS

8.2.1 INCREASE IN THE NUMBER OF SURGICAL PROCEDURES EXPECTED TO DRIVE THE MARKET

TABLE 93 MARKET FOR HOSPITALS, BY REGION, 2019–2023 (USD MILLION)

TABLE 94 MARKET FOR HOSPITALS, BY REGION, 2024–2026 (USD MILLION)

8.3 AMBULATORY SURGERY CENTERS

8.3.1 RISING NUMBER OF AMBULATORY SURGERY CENTERS IS DRIVING THE MARKET

TABLE 95 MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2019–2023 (USD MILLION)

TABLE 96 MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2024–2026 (USD MILLION)

8.4 CLINICS

8.4.1 INCREASING NUMBER OF SPORTS INJURY EXPECTED TO DRIVE THE SEGMENT

TABLE 97 MARKET FOR CLINICS, BY REGION, 2019–2023 (USD MILLION)

TABLE 98 MARKET FOR CLINICS, BY REGION, 2024–2026 (USD MILLION)

8.5 HOME CARE SETTINGS

8.5.1 LONGER HEALING TIME IS BOOSTING THE GROWTH OF THIS SEGMENT

TABLE 99 GLOBAL MARKET FOR HOME CARE SETTINGS, BY REGION, 2019–2023 (USD MILLION)

TABLE 100 MARKET FOR HOME CARE SETTINGS, BY REGION, 2024–2026 (USD MILLION)

8.6 OTHER END USERS

TABLE 101 MARKET FOR OTHER END USERS, BY REGION, 2019–2023 (USD MILLION)

TABLE 102 MARKET FOR OTHER END USERS, BY REGION, 2024–2026 (USD MILLION)

9 MEDICAL TAPES AND BANDAGES MARKET, BY REGION (Page No. - 123)

9.1 INTRODUCTION

TABLE 103 GLOBAL MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 104, GLBOAL MARKET, BY REGION, 2024–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: MEDICAL TAPES AND BANDAGES INDUSTRY SNAPSHOT

TABLE 105 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 110 NORTH AMERICA: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 112 NORTH AMERICA: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY APPLICATION, 2024–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY END USER, 2024–2026 (USD MILLION)

9.2.1 US

TABLE 117 US: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 118 US: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 119 US: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 120 US: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 121 US: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 122 US: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

9.2.2 CANADA

TABLE 123 CANADA: INCIDENCE OF DIABETES, 2019 VS. 2029

TABLE 124 CANADA: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 125 CANADA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 126 CANADA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 127 CANADA: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 128 CANADA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 129 CANADA: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.3 EUROPE

TABLE 130 EUROPE: PREVALENCE OF DIABETES (20–79 YEARS), 2019 VS. 2045

TABLE 131 EUROPE: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY COUNTRY, 2024–2026 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 135 EUROPE: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 136 EUROPE: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 137 EUROPE: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 138 EUROPE: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 140 EUROPE: MARKET, BY APPLICATION, 2023–2026 (USD MILLION)

TABLE 141 EUROPE: MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY END USER, 2024–2026 (USD MILLION)

9.3.1 GERMANY

TABLE 143 GERMANY: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 144 GERMANY: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 145 GERMANY: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 146 GERMANY: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 147 GERMANY: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 148 GERMANY: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

9.3.2 UK

TABLE 149 UK: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 150 UK: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 151 UK: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 152 UK: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 153 UK: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 154 UK: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.3.3 FRANCE

TABLE 155 FRANCE: MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 156 FRANCE: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 157 FRANCE: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 158 FRANCE: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 159 FRANCE: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 160 FRANCE: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.3.4 ITALY

TABLE 161 ITALY: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 162 ITALY: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 163 ITALY: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 164 ITALY: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 165 ITALY: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 166 ITALY: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.3.5 SPAIN

TABLE 167 SPAIN: , BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 168 SPAIN: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 169 SPAIN: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 170 SPAIN: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 171 SPAIN: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 172 SPAIN: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 173 ROE: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 174 ROE: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 175 ROE: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 176 ROE: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 177 ROE: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 178 ROE: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 179 APAC: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 180 APAC: MARKET, BY COUNTRY, 2024–2026 (USD MILLION)

TABLE 181 APAC: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 182 APAC: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 183 APAC: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 184 APAC: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 185 APAC: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 186 APAC: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 187 APAC: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 188 APAC: MARKET, BY APPLICATION, 2023–2026 (USD MILLION)

TABLE 189 APAC: MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 190 APAC: MARKET, BY END USER, 2024–2026 (USD MILLION)

9.4.1 JAPAN

TABLE 191 JAPAN: MARKET, BY PRODUCT,2019–2023 (USD MILLION)

TABLE 192 JAPAN: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 193 JAPAN: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 194 JAPAN: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 195 JAPAN: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 196 JAPAN: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4.2 CHINA

TABLE 197 CHINA: MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 198 CHINA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 199 CHINA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 200 CHINA: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 201 CHINA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 202 CHINA: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4.3 INDIA

TABLE 203 INDIA: MARKET, BY PRODUCT,2019–2023 (USD MILLION)

TABLE 204 INDIA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 205 INDIA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 206 INDIA: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 207 INDIA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 208 INDIA: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4.4 AUSTRALIA

TABLE 209 AUSTRALIA: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 210 AUSTRALIA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 211 AUSTRALIA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 212 AUSTRALIA: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 213 AUSTRALIA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 214 AUSTRALIA: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4.5 SOUTH KOREA

TABLE 215 SOUTH KOREA: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 216 SOUTH KOREA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 217 SOUTH KOREA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 218 SOUTH KOREA: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 219 SOUTH KOREA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 220 SOUTH KOREA: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 221 TOTAL DIABETES-RELATED HEALTH EXPENDITURE, 2019 VS. 2030 (USD MILLION)

TABLE 222 ROAPAC: MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT,2019–2023 (USD MILLION)

TABLE 223 ROAPAC: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 224 ROAPAC: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 225 ROAPAC: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 226 ROAPAC: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 227 ROAPAC: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.5 LATIN AMERICA

TABLE 228 LATIN AMERICA: , BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET,BY COUNTRY, 2024–2026 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 232 LATIN AMERICA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 233 LATIN AMERICA: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 234 LATIN AMERICA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 235 LATIN AMERICA: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2026 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET, BY END USER, 2024–2026 (USD MILLION)

9.5.1 BRAZIL

TABLE 240 BRAZIL: MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 241 BRAZIL: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 242 BRAZIL: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 243 BRAZIL: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 244 BRAZIL: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 245 BRAZIL: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.5.2 MEXICO

TABLE 246 MEXICO: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 247 MEXICO: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 248 MEXICO: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 249 MEXICO: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 250 MEXICO: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 251 MEXICO: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 252 ROLATAM: MARKET, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 253 ROLATAM: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 254 ROLATAM: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 255 ROLATAM: MEDICAL BANDAGES MARKET, BY TYPE, 2023–2026 (USD MILLION)

TABLE 256 ROLATAM: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 257 ROLATAM: MEDICAL TAPES MARKET, BY TYPE, 2023–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 RISING PREVALENCE OF DIABETES IN THIS REGION TO SUPPORT THE MARKET GROWTH

TABLE 258 MEA: MEDICAL TAPES AND BANDAGES INDUSTRY, BY PRODUCT, 2019–2023 (USD MILLION)

TABLE 259 MEA: MARKET, BY PRODUCT, 2024–2026 (USD MILLION)

TABLE 260 MEA: MEDICAL BANDAGES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 261 MEA: MEDICAL BANDAGES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 262 MEA: MEDICAL TAPES MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 263 MEA: MEDICAL TAPES MARKET, BY TYPE, 2024–2026 (USD MILLION)

TABLE 264 MEA: MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

TABLE 265 MEA: MARKET, BY APPLICATION, 2023–2026 (USD MILLION)

TABLE 266 MEA: MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 267 MEA: MARKET, BY END USER, 2024–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 192)

10.1 OVERVIEW

10.2 KEY STRATEGIES

10.3 GLOBAL MARKET SHARE ANALYSIS (2020)

TABLE 268 MEDICAL TAPES AND BANDAGES MARKET: DEGREE OF COMPETITION

FIGURE 27 3M COMPANY HELD THE LEADING POSITION IN THE MARKET IN 2020

10.4 COMPETITIVE LEADERSHIP MAPPING

10.5 VENDOR INCLUSION CRITERIA

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 28 GLBOAL MEDICAL TAPES AND BANDAGES INDUSTRY: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2020

10.6 COMPETITIVE LEADERSHIP MAPPING: EMERGING COMPANIES/SMES/STARTUPS (2020)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 29 GLOBAL MEDICAL TAPES AND BANDAGES INDUSTRY: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2020 (SME/START-UPS)

10.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 269 PRODUCT FOOTPRINT OF COMPANIES

TABLE 270 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 271 APPLICATION FOOTPRINT OF COMPANIES

TABLE 272 REGIONAL FOOTPRINT OF COMPANIES

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS

TABLE 273 MEDICAL TAPES AND BANDAGES INDUSTRY: PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS, JANUARY 2017–APRIL 2021

10.8.2 EXPANSIONS

TABLE 274 MARKET: EXPANSIONS, JANUARY 2017–APRIL 2021

10.8.3 OTHER STRATEGIES

TABLE 275 OTHER STRATEGIES, JANUARY 2017–APRIL 2021

11 COMPANY PROFILES (Page No. - 207)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 KEY PLAYERS

11.1.1 MCKESSON CORPORATION

TABLE 276 MCKESSON CORPORATION: BUSINESS OVERVIEW

FIGURE 30 MCKESSON CORPORATION: COMPANY SNAPSHOT

TABLE 277 MCKESSON CORPORATION: PRODUCTS OFFERED

TABLE 278 GLOBAL MARKET: OTHERS, NOVEMBER 2018

11.1.2 3M COMPANY

TABLE 279 3M COMPANY: BUSINESS OVERVIEW

FIGURE 31 3M COMPANY: COMPANY SNAPSHOT (2020)

TABLE 280 3M COMPANY: PRODUCTS OFFERED

TABLE 281 GLOBAL MARKET: PRODUCT LAUNCHES, JANUARY 2017 TO APRIL 2021

TABLE 282 GLOBAL MARKET: DEALS,JANUARY 2017 TO APRIL 2021

11.1.3 INTEGRA LIFESCIENCES HOLDING CORPORATION

TABLE 283 INTEGRA LIFESCIENCES HOLDING CORPORATION: BUSINESS OVERVIEW

FIGURE 32 INTEGRA LIFESCIENCES HOLDING CORPORATION: COMPANY SNAPSHOT

TABLE 284 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: PRODUCTS OFFERED

TABLE 285 GLOBAL MARKET: DEALS,JANUARY 2017 TO APRIL 2021

11.1.4 JOHNSON & JOHNSON

TABLE 286 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 33 JOHNSON & JOHNSON: COMPANY SNAPSHOT

TABLE 287 JOHNSON & JOHNSON: PRODUCTS OFFERED

11.1.5 SMITH & NEPHEW PLC

TABLE 288 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 34 SMITH & NEPHEW PLC: COMPANY SNAPSHOT

TABLE 289 SMITH & NEPHEW PLC: PRODUCTS OFFERED

TABLE 290 MARKET: DEALS

TABLE 291 GLOBAL MARKET: OTHERS

11.1.6 MEDLINE INDUSTRIES, INC.

TABLE 292 MEDLINE INDUSTRIES, INC.: BUSINESS OVERVIEW

TABLE 293 MEDLINE INDUSTRIES: PRODUCTS OFFERED

TABLE 294 MARKET: DEALS, JANUARY 2017 TO APRIL 2021

11.1.7 B. BRAUN MELSUNGEN AG

TABLE 295 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 35 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

TABLE 296 B. BRAUN MELSUNGEN AG: PRODUCTS OFFERED

11.1.8 CARDINAL HEALTH, INC.

TABLE 297 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 36 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

TABLE 298 CARDINAL HEALTH, INC.: PRODUCTS OFFERED

11.1.9 PAUL HARTMANN AG

TABLE 299 PAUL HARTMANN AG: BUSINESS OVERVIEW

FIGURE 37 PAUL HARTMANN AG: COMPANY SNAPSHOT

TABLE 300 PAUL HARTMANN AG: PRODUCTS OFFERED

11.1.10 BEIERSDORF AG

TABLE 301 BEIERSDORF AG: BUSINESS OVERVIEW

FIGURE 38 BEIERSDORF AG: COMPANY SNAPSHOT (2020)

TABLE 302 BEIERSDORF AG: PRODUCTS OFFERED

11.1.11 NITTO DENKO CORPORATION

TABLE 303 NITTO DENKO CORPORATION: BUSINESS OVERVIEW

FIGURE 39 NITTO DENKO CORPORATION: COMPANY SNAPSHOT (2019)

TABLE 304 NITTO DENKO CORPORATION: PRODUCTS OFFERED

TABLE 305 GLOBAL MARKET: OTHERS, JANUARY 2017 TO APRIL 2021

11.1.12 ESSITY

TABLE 306 ESSITY: BUSINESS OVERVIEW

FIGURE 40 ESSITY: COMPANY SNAPSHOT (2020)

TABLE 307 ESSITY: PRODUCTS OFFERED

TABLE 308 GLOBAL MARKET: DEALS, 2017 TO 2021

11.1.13 MÖLNLYCKE HEALTHCARE

TABLE 309 MÖLNLYCKE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 41 MÖLNLYCKE HEALTH CARE: COMPANY SNAPSHOT (2020)

TABLE 310 MÖLNLYCKE HEALTHCARE: PRODUCTS OFFERED

TABLE 311 GLOBAL MARKET: OTHERS, JANUARY 2017 TO APRIL 2021

11.1.14 COLOPLAST A/S

FIGURE 42 COLOPLAST A/S: COMPANY SNAPSHOT (2020)

TABLE 312 COLOPLAST A/S: BUSINESS OVERVIEW

TABLE 313 COLOPLAST A/S: PRODUCTS OFFERED

11.1.15 NICHIBAN CO. LTD.

TABLE 314 NICHIBAN CO. LTD.: BUSINESS OVERVIEW

TABLE 315 NICHIBAN CO. LTD.: PRODUCTS OFFERED

11.2 OTHER COMPANIES

11.2.1 LOHMANN & RAUSCHER INTERNATIONAL GMBH & CO. KG

11.2.2 URGO MEDICAL

11.2.3 MILLIKEN HEALTHCARE

11.2.4 DYNAREX CORPORATION

11.2.5 WINNER MEDICAL GROUP, INC.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 249)

12.1 INTRODUCTION

12.1.1 LIMITATION

12.2 COMPRESSION THERAPY MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

TABLE 316 COMPRESSION THERAPY MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 317 COMPRESSION GARMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 318 COMPRESSION GARMENTS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 319 COMPRESSION STOCKINGS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 320 COMPRESSION BANDAGES AND WRAPS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 321 OTHER COMPRESSION GARMENTS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 322 COMPRESSION PUMPS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 323 COMPRESSION BRACES MARKET, BY REGION, 2017–2025 (USD MILLION)

12.3 ORTHOPAEDIC BRACES AND SUPPORT MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

TABLE 325 ORTHOPEDIC BRACES AND SUPPORTS MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 326 KNEE BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 327 KNEE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 328 ANKLE BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 329 ANKLE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 330 FOOT WALKERS AND ORTHOSES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 331 FOOT WALKERS AND ORTHOSES MARKET, BY REGION, 2020—2025 (USD MILLION)

TABLE 332 BACK, HIP, AND SPINE BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 333 BACK, HIP, AND SPINE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 334 SHOULDER BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 335 SHOULDER BRACES AND SUPPORTS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 336 ELBOW BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 337 ELBOW BRACES AND SUPPORTS MARKET, BY REGION, 2020—2025 (USD MILLION)

TABLE 338 HAND & WRIST BRACES AND SUPPORTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 339 HAND & WRIST BRACES AND SUPPORTS MARKET, BY REGION, 2020—2025 (USD MILLION)

TABLE 340 FACIAL BRACES & SUPPORTS MARKET, BY REGION,2016–2019 (USD MILLION)

TABLE 341 FACIAL BRACES & SUPPORTS MARKET, BY REGION, 2020—2025 (USD MILLION)

13 APPENDIX (Page No. - 259)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical tapes and bandages market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global medical tapes and bandages market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global market and other dependent submarkets.

- Key players in the global medical tapes and bandages market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for detailed insights (both qualitative and quantitative trends) on the market.

- All percentage shares, splits, and breakdowns for the global market were determined by using secondary sources and verified through primary sources.

- All the key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added to detailed inputs, analyzed, and presented in this report.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall size of the global medical tapes and bandages market through the above-mentioned methodology, this market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the medical tapes and bandages market based on product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the global market (such as drivers, restraints, challenges, opportunities, and regulatory landscape, among others)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the global market

- To analyze the opportunities in the global market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key global players and comprehensively analyze their market shares and core competencies

- To provide a five-year forecast for various market segments in terms of revenue with respect to five main regions, namely, North America (includes the US and Canada), Europe (includes Germany, the UK, France, Italy, and Spain), Asia Pacific (includes Japan, China, India, Australia, and South Korea), Latin America (includes Brazil and Mexico), and the Middle East & Africa

- To track and analyze competitive developments such as product launches; agreements, partnerships, and joint ventures; mergers and acquisitions; and research and development activities in the medical tapes and bandages market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the global medical tapes and bandages market report:

Product analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company information

- Detailed analysis and profiling of additional market players (up to five)

Geographic analysis

- Further breakdown of the Rest of Europe market into Belgium, Austria, Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America market into Argentina and Colombia, among other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Tapes and Bandages Market

Looking forward to gain more insights on the global Medical Tapes and Bandages Market

What are the growth opportunities in Medical Tapes and Bandages Market?

Can you enlighten us on geographical growth analysis in Medical Tapes and Bandages Market?