OTC Braces & Supports Market by Product (Knee, Ankle, Hip, Spine, Shoulder, Elbow, Hand, Wrist), Type (Soft, Rigid, Hinged), Application (Preventive, OA, Ligament Injury, Compression), Distribution (Pharmacies, E-com, clinics) - Global Forecast to 2027

Updated on : April 25, 2023

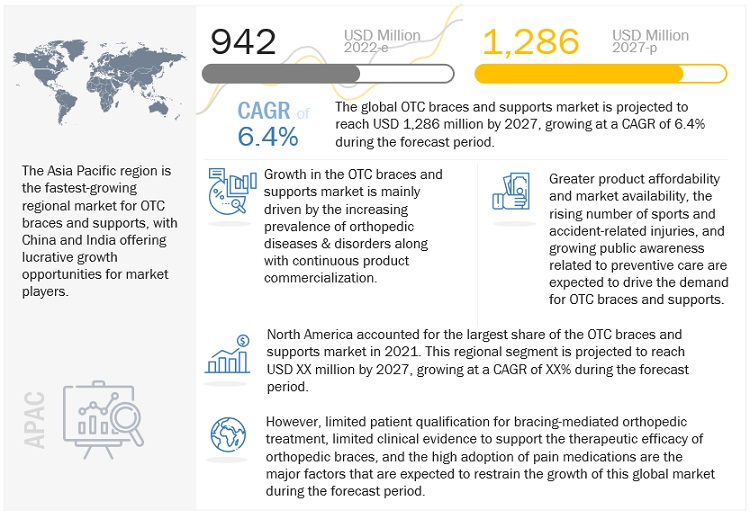

The global OTC braces & supports market in terms of revenue was estimated to be worth $942 million in 2022 and is poised to reach $1,286 million by 2027, growing at a CAGR of 6.4% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is driven by the rising sport and road injuries, increased sport participation and growing awareness of preventory measures.

Global OTC Braces & Supports Market Trend

e- estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

OTC braces & supports Market Dynamics

Driver: Increasing incidence of orthopedic disorders

The prevalence of major orthopedic disorders is increasing worldwide, and orthopedic injury is a major public health concern. The rising diseases and disorders such as osteoarthritis, rheumatoid arthritis, osteoporotic fractures, and carpal tunnel syndrome are the factors contributing for this concern. Another key indicator is the rising obese population globally as obese individuals are at a greater risk of orthopedic & musculoskeletal injuries and diabetes. , driving the growth of the otc braces and supports market. Otc braces and supports offer several benefits, such as better affordability, higher efficacy, greater patient comfort, and ease of use compared to conventional products. Due to these benefits, key players are increasingly developing specialized products for the treatment of various orthopedic diseases as well as to address the unmet market needs.

Opportunity: Increased sales of off-the-shelf products through e-commerce platforms

OTC braces (such as ankle braces, wrist/hand braces, shoulder braces, elbow braces, and facial braces) are increasingly being sold by retailers (off-the-shelf) and e-commerce websites since their use does not require supervision. Patients regularly use such products to prevent injuries. Governments and insurance bodies across major countries increasingly recognize the effective patient care offered by such products and are thus supportive of online sales, greater reimbursement, and insurance coverage. Therefore, increasing sales of orthopedic braces through e-commerce websites and off-the-shelf channels and the greater availability of reimbursements for such products across mature markets are expected to offer significant growth opportunities for manufacturers of OTC braces and supports.

Restraint: Limited patient qualification, limited options to customize and limited clinical evidence to support efficacy of orthopedic braces

Bracing and support products are utilized to effectively manage orthopedic disorders and diseases, with physicians and orthopedic surgeons considering these products clinically necessary for specific conditions. However, in several cases (depending on the severity of the disease and its side effects as well as the patient’s physiology & age), patients do not qualify for bracing products.

Innovative orthopedic braces are increasingly being adopted by major end-user facilities (such as hospitals, surgical centers, and orthopedic clinics) across developed markets such as the US, Germany, the UK, and Japan. However, end-user facilities across emerging and less-developed markets are reluctant to adopt novel products due to a lack of awareness and affordability. These users also prefer to utilize traditional/well-established products with proven clinical evidence to support their therapeutic/diagnostic role.

Challenge: Significant adoption of pain medication and limited reimbursement coverage

Topical, oral, and parenteral pain medications are widely used to effectively manage pain associated with musculoskeletal disorders such as tendinitis, carpal tunnel syndrome, and osteoarthritis. Although otc braces are used as part of a noninvasive approach for pain management during compression therapy (cold, hot, or conventional compression therapy), the adoption of pain medication for such applications is high owing to the low awareness about the benefits of otc braces as well as the unfavorable reimbursement scenario for these products, creating a challenge for this market.

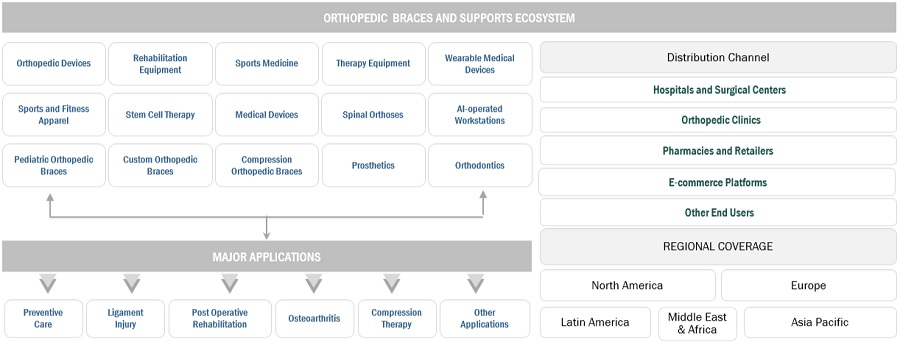

OTC braces and supports Ecosystem/Market Map

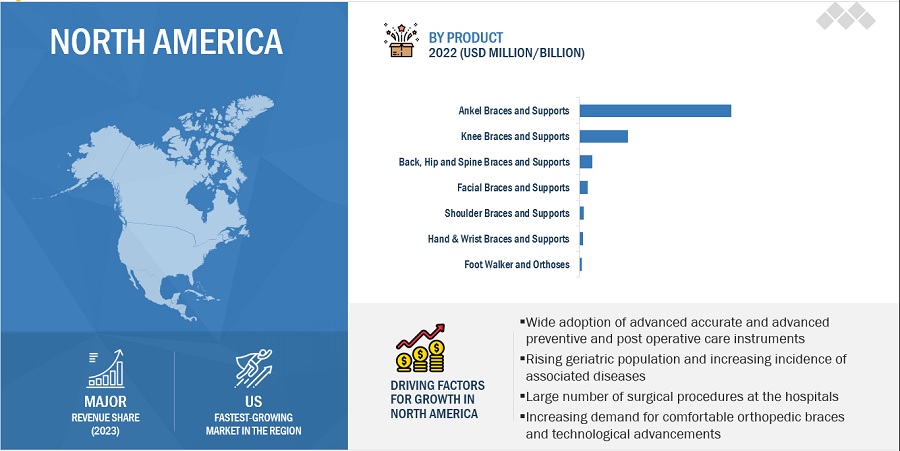

The knee braces and supports segment of otc braces & supports market expected to grow at the highest rate during the forecast period, by product

Based on product, the market is segmented into knee braces and supports; ankle braces and supports; back, hip, & spine braces and supports; foot walkers and orthoses; hand & wrist braces and supports; shoulder braces and supports; elbow braces and supports; and facial braces and supports. The knee braces and supports segment is expected to grow the most in the forecast period mainly because these products have many advantages such as side support, reduced knee rotation, limit injury during movement, and protect against risk of injury after surgery.

Preventive care segment held in the largest share in the otc braces & supports market, by application

Based on the application, the market is segmented into preventive care, ligament injury, osteoarthritis, compression tsherapy, and other applications. The preventive care segment is expected to carry the largest share of the market. Growing public population in sports and athletic activities, rising geriatric population, easy access to off-the-shelf bracing products and overall prevention post orthopedic surgical procedures are factors that contribute to preventive care holding large share in the market.

Pharmacies and retailers segment expected to have the largest share in the otc braces & supports market, by distribution channel

Based on the distribution channel, the market is classified into pharmacies & retailers, e-commerce platforms, orthopedic clinics and hospitals. Pharmacies and retailers are expected to hold the largest distribution channel segment in the otc braces and supports market. The development of this market segment is mainly driven by wide availability of orthopedic devices and products through retailers & pharmacies, increasing adoption of ready to use products for ligament sprain & foot injuries in most of the countries (due to ease of access), and the increasing public awareness and acceptance of the benefits of orthopedic braces used in preventive care.

North America accounted for the largest share of the otc braces & supports market

The global market is segmented into five major regions namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America has the largest market share of the otc orthopedic braces and supports market. Market growth is due to the growth and commercialization of new, advantageous orthopedic devices, suitable reimbursements & insurance schemes for major orthopedic surgical procedures, government supported regulations for product marketing and supply, and participation in sporting activities.

To know about the assumptions considered for the study, download the pdf brochure

The otc braces & supports market is dominated by players such as 3M Company (US), DJO Global, Inc. (US), Bird & Cronin (US), Essity (Sweden), and Zimmer Biomet Holdings, Inc (US).

OTC Braces & Supports Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$942 million |

|

Projected Revenue by 2027 |

$1,286 million |

|

Revenue Rate |

Poised to grow at a CAGR of 6.4% |

|

Market Driver |

Increasing incidence of orthopedic disorders |

|

Market Opportunity |

Increased sales of off-the-shelf products through e-commerce platforms |

This report categorizes the otc braces and supports market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Knee Braces and Supports

- Ankle Braces and Supports

- Foot Walkers and Orthoses

- Back, Hip & Spine Braces and Supports

- Shoulder Braces and Supports

- Elbow Braces and Supports

- Hand/Wrist Braces and Supports

- Facial Braces and Supports

By Application

- Preventive Care

- Ligament Injury Repair

- Osteoarthritis

- Compression Therapy

- Other Applications

By Distribution Channel

- Pharmacies and Retailers

- E-Commerce Platforms

- Orthopedic Clinics & Hospitals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments

- In July 2021, DJO Global (Enovis) acquired Mathys AG Bettalach (Switzerland). The acquisition expanded the Medical Technology segment’s reconstructive product portfolio with Mathys’ complimentary surgical solutions.

- In April 2021, DJO Global (Enovis) acquired MedShape, Inc. (US) to expand its foot and ankle platform.

- In November 2021, Ottobock Healthcare (Germany) acquired SuitX (US). This acquisition helped expand the company’s exoskeleton network under the global brand ‘Paexo.’

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the OTC braces & supports market?

The OTC braces & supports market boasts a total revenue value of $1,286 million by 2027.

What is the estimated growth rate (CAGR) of the OTC braces & supports market?

The global market for OTC braces & supports has an estimated compound annual growth rate (CAGR) of 6.4% and a revenue size in the region of $942 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 1 OTC BRACES AND SUPPORTS: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primary interviews

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS (OTC BRACES AND SUPPORTS)

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.3.1.2 Approach 2: Presentations of companies and primary interviews

2.3.1.3 Growth forecast

2.3.1.4 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 6 OTC BRACES AND SUPPORTS: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE

2.6 ASSUMPTIONS

2.7 LIMITATIONS AND RISK ASSESSMENT

2.7.1 LIMITATIONS

2.7.2 RISK ASSESSMENT: OTC BRACES AND SUPPORTS

2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 OTC BRACES & SUPPORTS MARKET OVERVIEW

FIGURE 12 INCREASING PREVALENCE OF ORTHOPEDIC DISEASES & DISORDERS TO DRIVE DEMAND FOR ORTHOPEDIC BRACES AND SUPPORTS TILL 2027

4.2 MARKET, BY PRODUCT, 2022 VS. 2027

FIGURE 13 KNEE BRACES AND SUPPORTS SEGMENT TO DOMINATE MARKET IN 2027

4.3 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 14 PREVENTIVE CARE SEGMENT TO DOMINATE MARKET IN 2027

4.4 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027

FIGURE 15 PHARMACIES AND RETAILERS TO HOLD LARGEST SHARE

4.5 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 OTC BRACES & SUPPORTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of orthopedic diseases and disorders

FIGURE 18 OBESE POPULATION (AS A PERCENTAGE OF TOTAL POPULATION) IN OECD COUNTRIES (2020)

5.2.1.2 Continuous product commercialization

5.2.1.3 Greater product affordability and market availability

5.2.1.4 Rising number of sports and accident-related injuries

FIGURE 19 US: INJURIES CAUSED BY VARIOUS SPORTS ACTIVITIES (2020)

5.2.1.5 Growing public awareness about preventive care

5.2.2 RESTRAINTS

5.2.2.1 Limited patient qualification for bracing-mediated orthopedic treatment

5.2.2.2 Limited options to customize OTC braces and supports

5.2.2.3 Limited clinical evidence to support efficacy of orthopedic braces

5.2.3 OPPORTUNITIES

5.2.3.1 Increased sales of off-the-shelf products through e-commerce platforms

5.2.3.2 Expansion and promotion initiatives by major manufacturers

5.2.4 CHALLENGES

5.2.4.1 Significant adoption of pain medication

5.2.4.2 Limited reimbursement coverage

5.3 PRICING ANALYSIS

TABLE 1 AVERAGE SELLING PRICE OF OTC BRACES AND SUPPORT PRODUCTS (2022)

5.4 PATENT ANALYSIS

FIGURE 20 PATENT ANALYSIS FOR SOFT & ELASTIC BRACES AND SUPPORTS

5.4.1 LIST OF KEY PATENTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 22 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM/MARKET MAP

FIGURE 23 MARKET: ECOSYSTEM/MARKET MAP

5.7.1 MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.1 NORTH AMERICA

5.9.1.1 US

5.9.1.2 Canada

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.3.1 China

TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.9.3.2 Japan

TABLE 9 JAPAN MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.9.3.3 India

5.9.4 LATIN AMERICA

5.9.4.1 Brazil

5.9.4.2 Mexico

5.9.5 MIDDLE EAST

5.9.6 AFRICA

5.10 TRADE ANALYSIS

TABLE 10 IMPORT DATA FOR ORTHOPEDIC OR FRACTURE APPLIANCES, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 11 EXPORT DATA FOR ORTHOPEDIC OR FRACTURE APPLIANCES, BY COUNTRY, 2017–2021 (USD MILLION)

5.11 TECHNOLOGY ANALYSIS

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 24 REVENUE SHIFT IN MARKET

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OTC BRACES AND SUPPORTS

5.14.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR OTC BRACES AND SUPPORTS

TABLE 14 KEY BUYING CRITERIA FOR OTC BRACES AND SUPPORTS

5.15 CASE STUDY

6 OTC BRACES & SUPPORTS MARKET, BY PRODUCT (Page No. - 79)

6.1 INTRODUCTION

TABLE 15 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 KNEE BRACES AND SUPPORTS

6.2.1 RISING GERIATRIC POPULATION AND OBESITY TO DRIVE MARKET

TABLE 16 KNEE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 KNEE BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 18 KNEE BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.3 ANKLE BRACES AND SUPPORTS

6.3.1 HIGHER PREVALENCE OF ANKLE INJURIES AND RISING CASES OF ANKLE OSTEOARTHRITIS TO DRIVE MARKET

TABLE 19 ANKLE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 ANKLE BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 21 ANKLE BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.4 FOOT WALKERS AND ORTHOSES

6.4.1 RISING INCIDENCE OF DIABETES AND INCREASING DEMAND FOR FOOT WALKERS TO BOOST PRODUCT ADOPTION

TABLE 22 FOOT WALKERS AND ORTHOSES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 FOOT WALKERS AND ORTHOSES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 24 FOOT WALKERS AND ORTHOSES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.5 BACK, HIP, AND SPINE BRACES AND SUPPORTS

6.5.1 RISING INCIDENCE OF SPINAL AND HIP INJURIES DUE TO ROAD ACCIDENTS AND SPORTS INJURIES TO SUPPORT MARKET GROWTH

TABLE 25 BACK, HIP, AND SPINE BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 BACK, HIP, AND SPINE BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 27 BACK, HIP, AND SPINE BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.6 SHOULDER BRACES AND SUPPORTS

6.6.1 GROWING DEMAND FOR SHOULDER REPLACEMENT PROCEDURES TO PUSH MARKET GROWTH

TABLE 28 SHOULDER BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 SHOULDER BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 30 SHOULDER BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.7 ELBOW BRACES AND SUPPORTS

6.7.1 LIMITATIONS OF ELBOW SURGERIES AND PATIENT PREFERENCE FOR PAIN MEDICATION TO RESTRAIN MARKET

TABLE 31 ELBOW BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 ELBOW BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 33 ELBOW BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.8 HAND AND WRIST BRACES AND SUPPORTS

6.8.1 HIGHER MARKET AVAILABILITY OF PRODUCTS TO ENSURE END-USER DEMAND

TABLE 34 HAND AND WRIST BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 HAND AND WRIST BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 36 HAND AND WRIST BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

6.9 FACIAL BRACES AND SUPPORTS

6.9.1 DEMAND FOR FACIAL RECONSTRUCTION SURGERIES AND RISING CONGENITAL CRANIAL DEFORMITIES TO BOOST PRODUCT DEMAND

FIGURE 27 NUMBER OF PLASTIC SURGERY (FACIAL) PROCEDURES WORLDWIDE (AS OF 2020)

TABLE 37 FACIAL BRACES AND SUPPORTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 38 FACIAL BRACES AND SUPPORTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 39 FACIAL BRACES AND SUPPORTS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

7 OTC BRACES & SUPPORTS MARKET, BY TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 28 MARKET: BY TYPE

7.2 SOFT AND ELASTIC BRACES AND SUPPORTS

7.2.1 ADVANTAGES SUCH AS EASE OF USE AND FLEXIBILITY TO DRIVE MARKET

7.3 HARD BRACES AND SUPPORTS

7.3.1 SUPPORTIVE REIMBURSEMENT SCENARIO AND RISING PREVALENCE OF TARGET DISEASES TO DRIVE MARKET

7.4 HINGED BRACES AND SUPPORTS

7.4.1 RISING GERIATRIC POPULATION AND INCREASING NUMBER OF LIGAMENT INJURIES TO DRIVE MARKET

8 OTC BRACES & SUPPORTS MARKET, BY APPLICATION (Page No. - 96)

8.1 INTRODUCTION

TABLE 40 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PREVENTIVE CARE

8.2.1 RISING PARTICIPATION IN SPORT-RELATED ACTIVITIES AND CREDIBLE CLINICAL EVIDENCE SUPPORTING EFFICACY OF OTC BRACES AND SUPPORTS TO DRIVE MARKET GROWTH

TABLE 41 MARKET FOR PREVENTIVE CARE, BY REGION, 2020–2027 (USD MILLION)

8.3 LIGAMENT INJURY REPAIR

TABLE 42 MARKET FOR LIGAMENT INJURY REPAIR, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 MARKET FOR LIGAMENT INJURY REPAIR, BY TYPE, 2020–2027 (USD MILLION)

8.3.1 ACL INJURIES

8.3.1.1 Rising participation in sports such as football, basketball, and skiing to increase incidence of ACL injuries

TABLE 44 MARKET FOR ACL INJURIES, BY REGION, 2020–2027 (USD MILLION)

8.3.2 LCL INJURIES

8.3.2.1 Rising reimbursement for LCL-related surgical procedures to boost product adoption

TABLE 45 MARKET FOR LCL INJURIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 MARKET FOR OTHER LIGAMENT INJURIES, BY REGION, 2020–2027 (USD MILLION)

8.4 OSTEOARTHRITIS

8.4.1 RISING OSTEOARTHRITIS CASES AND PUBLIC AWARENESS OF SIDE EFFECTS OF ORAL MEDICATION FOR PAIN MANAGEMENT TO DRIVE GROWTH

TABLE 47 MARKET FOR OSTEOARTHRITIS, BY REGION, 2020–2027 (USD MILLION)

8.5 COMPRESSION THERAPY

8.5.1 INNOVATION AND DEVELOPMENT OF TECHNOLOGICALLY ADVANCED COMPRESSION BRACES TO SUPPORT MARKET GROWTH

TABLE 48 MARKET FOR COMPRESSION THERAPY, BY REGION, 2020–2027 (USD MILLION)

8.6 OTHER APPLICATIONS

TABLE 49 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

9 OTC BRACES & SUPPORTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 105)

9.1 INTRODUCTION

TABLE 50 MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

9.2 PHARMACIES AND RETAILERS

9.2.1 WIDE AVAILABILITY OF ORTHOPEDIC BRACING PRODUCTS THROUGH RETAILERS & PHARMACIES TO SUPPORT GROWTH

TABLE 51 MARKET FOR PHARMACIES AND RETAILERS, BY REGION, 2020–2027 (USD MILLION)

9.3 E-COMMERCE PLATFORMS

9.3.1 RISING PREFERENCE FOR E-COMMERCE FOR DISTRIBUTION TO BOOST MARKET

TABLE 52 MARKET FOR E-COMMERCE PLATFORMS, BY REGION, 2020–2027 (USD MILLION)

9.4 ORTHOPEDIC CLINICS AND HOSPITALS

9.4.1 INCREASE IN AMBULATORY CARE UNITS ACROSS MATURE MARKETS TO SUPPORT GROWTH

TABLE 53 MARKET FOR ORTHOPEDIC CLINICS AND HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

10 OTC BRACES & SUPPORTS MARKET, BY REGION (Page No. - 110)

10.1 INTRODUCTION

TABLE 54 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICAN OTC BRACES & SUPPORTS MARKET: GEOGRAPHIC SNAPSHOT

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to retain dominant share in North American market

TABLE 59 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 61 US: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising incidence of bone-related degenerative diseases to drive demand for OTC braces and supports

TABLE 62 CANADA: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 63 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising geriatric population in Germany to ensure continuous demand for orthopedic braces & supports

TABLE 69 PRODUCT LAUNCHES IN GERMANY, 2019–2022

TABLE 70 GERMANY: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Increasing sports injuries to drive UK market

TABLE 73 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 74 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 UK: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Growing prevalence of musculoskeletal injuries and rising obese population to drive market

TABLE 76 FRANCE: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing public awareness of preventive care for musculoskeletal injuries to drive market

TABLE 79 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 80 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing availability of OTC braces & supports to boost growth

TABLE 82 SPAIN: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 83 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 85 ROE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 87 ROE: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 APAC GEOGRAPHIC SNAPSHOT

TABLE 88 ASIA PACIFIC: OTC BRACES & SUPPORTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan to dominate Asia Pacific MARKET

TABLE 92 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 93 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Expanding target patient population and modernization of healthcare facilities to form key market drivers

TABLE 95 CHINA: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 96 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing number of hip & knee surgeries to support market

TABLE 98 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 99 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 101 ROAPAC: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 102 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 ROAPAC: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 104 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Increasing incidence of hip fractures to drive market growth

TABLE 108 BRAZIL: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 109 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Rising orthopedic degenerative disease prevalence to support market

TABLE 111 MEXICO: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 112 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 113 MEXICO: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 114 ROLATAM: OTC BRACES & SUPPORTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 115 ROLATAM: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 ROLATAM: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST AND AFRICA

TABLE 117 MEA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 118 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 MEA: MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 153)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 120 STRATEGIES ADOPTED BY MANUFACTURERS

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN OTC BRACES & SUPPORTS MARKET

11.4 MARKET SHARE ANALYSIS

11.4.1 GLOBAL MARKET

FIGURE 32 MARKET SHARE, BY KEY PLAYERS (2021)

TABLE 121 MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT (2021)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 33 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 34 MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

11.7 COMPETITIVE BENCHMARKING

11.7.1 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

FIGURE 35 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 122 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 123 COMPANY PRODUCT & SERVICE FOOTPRINT

TABLE 124 COMPANY REGIONAL FOOTPRINT

TABLE 125 MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.8 COMPETITIVE SCENARIO

TABLE 126 KEY PRODUCT LAUNCHES

TABLE 127 DEALS

12 COMPANY PROFILES (Page No. - 164)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 3M

TABLE 128 3M: BUSINESS OVERVIEW

FIGURE 36 3M: COMPANY SNAPSHOT (2021)

12.1.2 BIRD & CRONIN

TABLE 129 BIRD & CRONIN: BUSINESS OVERVIEW

FIGURE 37 BIRD & CRONIN: COMPANY SNAPSHOT (2021)

12.1.3 DJO LLC (ENOVIS)

TABLE 130 DJO: BUSINESS OVERVIEW

FIGURE 38 DJO: COMPANY SNAPSHOT (2021)

12.1.4 ESSITY

TABLE 131 ESSITY: BUSINESS OVERVIEW

FIGURE 39 ESSITY: COMPANY SNAPSHOT (2021)

12.1.5 ZIMMER BIOMET HOLDINGS

TABLE 132 ZIMMER BIOMET HOLDINGS: BUSINESS OVERVIEW

FIGURE 40 ZIMMER BIOMET HOLDINGS: COMPANY SNAPSHOT (2021)

12.1.6 ÖSSUR

TABLE 133 ÖSSUR: BUSINESS OVERVIEW

FIGURE 41 ÖSSUR: COMPANY SNAPSHOT (2021)

12.1.7 OTTOBOCK HEALTHCARE

TABLE 134 OTTOBOCK HEALTHCARE: BUSINESS OVERVIEW

12.1.8 DEROYAL INDUSTRIES

TABLE 135 DEROYAL INDUSTRIES: BUSINESS OVERVIEW

12.1.9 BAUERFEIND AG

TABLE 136 BAUERFEIND AG: BUSINESS OVERVIEW

12.1.10 PRIM SA

TABLE 137 PRIM SA: BUSINESS OVERVIEW

FIGURE 42 PRIM SA: COMPANY SNAPSHOT (2021)

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 MEDI GMBH & CO. KG

12.2.2 MUELLER SPORTS MEDICINE

12.2.3 BREG

12.2.4 THUASNE GROUP

12.2.5 TRULIFE GROUP

12.2.6 FOUNDATION WELLNESS

12.2.7 BECKER ORTHOPEDIC

12.2.8 NEO G

12.2.9 FRANK STUBBS COMPANY

12.2.10 ORLIMAN S.L.U.

12.2.11 NIPPON SIGMAX

12.2.12 ALCARE

12.2.13 MCDAVID

12.2.14 UNITED MEDICARE

12.2.15 VISSCO REHABILITATION AIDS

13 APPENDIX (Page No. - 267)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

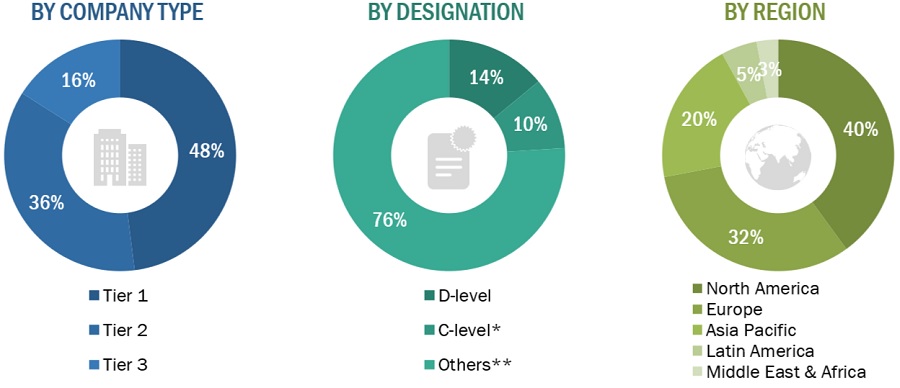

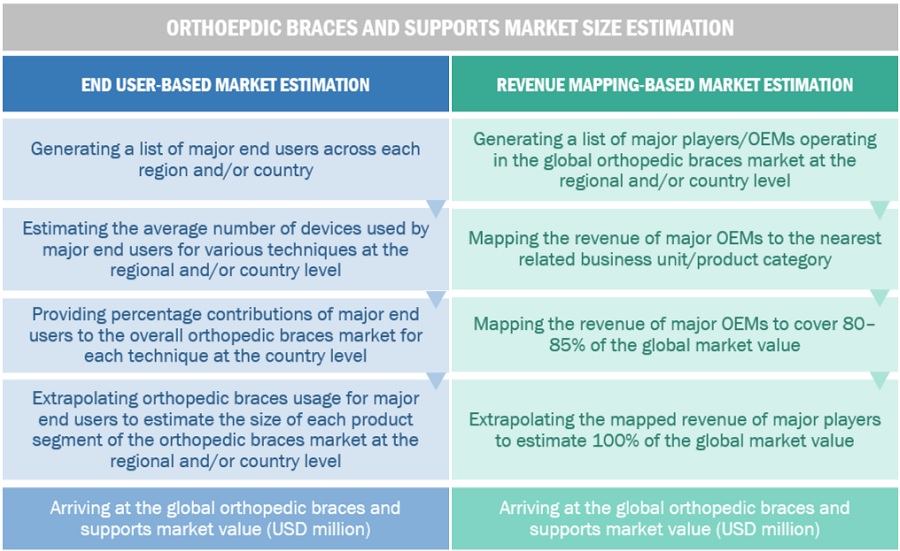

This study involved four major activities in estimating the current size of the otc braces & supports market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the otc braces & supports market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the otc braces & supports market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Otc braces and supports Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global otc braces & supports market, by product, application, distribution channel, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall otc braces & supports market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Otc braces & supports market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

Additional five company profiles of players operating in the otc braces & supports market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in OTC Braces & Supports Market