The commercial vehicle telematics software market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly Interviews with experts from the core and related industries, preferred commercial vehicle telematics providers, third-party service providers, consulting service providers, end-users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, commercial vehicle telematics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, business functions, applications, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various Interviews with Experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and commercial vehicle telematics expertise; related key executives from commercial vehicle telematics software vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Commercial vehicle telematics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Commercial vehicle telematics solutions and services, which would impact the overall commercial vehicle telematics software market.

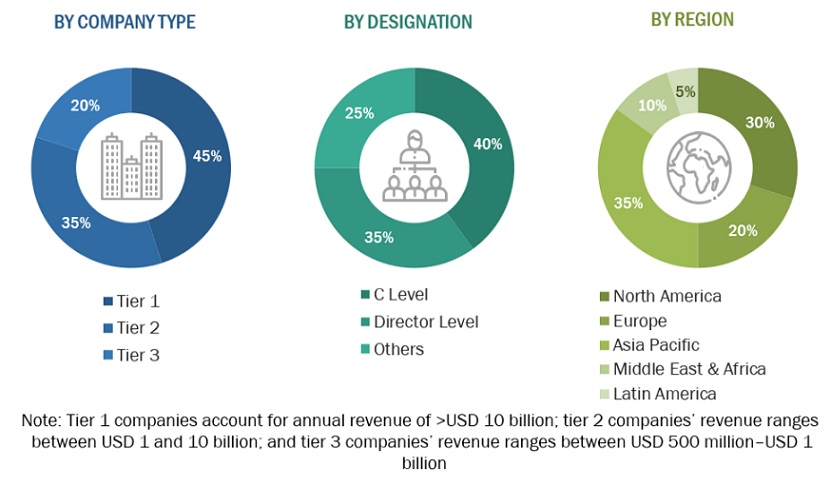

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

DESIGNATION

|

|

Robert Bosch

|

-

Director Intelligent and Connected Sensors and Systems

|

|

Mercedes-Benz

|

|

|

Verizon Labs

|

-

Principal Engineer - Data Science/Data Engineering

|

|

Sierra Wireless

|

-

Director - Asset Tracking Product

|

|

JLG Industries

|

-

Head of Telematics Program

|

|

Geotab

|

-

Director Leasing and Rental

-

Head- Transportation & Logistics Technology

|

|

Association of Equipment Manufacturers

|

-

VP Construction & Utility

|

|

GearJoT

|

|

|

TomTom

|

-

Director of EMEA Strategic Partnerships

|

|

Ford Motor Company

|

-

Director of Infotainment & EESE-APAC

|

|

Daimler Trucks

|

-

Senior Software Developer- Autonomous Driving

|

Commercial Vehicle Telematics Software Market Size Estimation

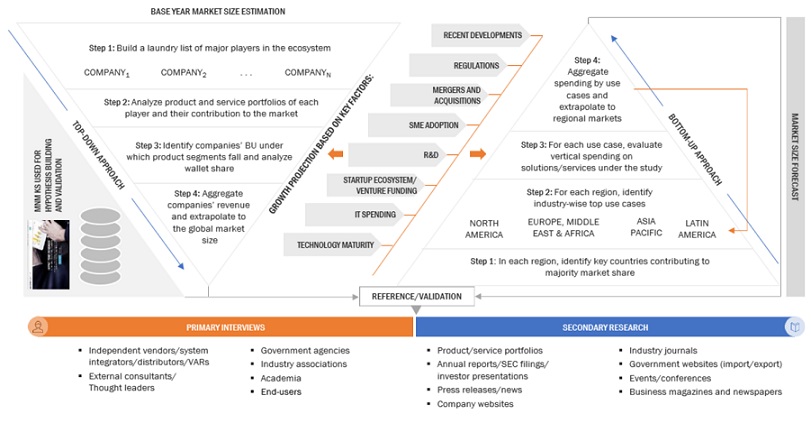

In the bottom-up approach, the adoption rate of commercial vehicle telematics solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of Commercial vehicle telematics solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the commercial vehicle telematics software market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major commercial vehicle telematics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall commercial vehicle telematics software market size and segments’ size were determined and confirmed using the study.

Global Commercial Vehicle Telematics Software Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the commercial vehicle telematics software market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major commercial vehicle telematics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Commercial vehicle telematics software market size and segments’ size were determined and confirmed using the study.

Commercial Vehicle Telematics Software Market Definition

Commercial vehicle telematics software refers to software solutions that utilize GPS tracking, communication systems, and data analytics to monitor and manage fleets of commercial vehicles. These software enable real-time tracking of vehicle locations, performance metrics, and driver behavior, providing valuable insights to fleet managers. They facilitate efficient route planning, maintenance scheduling, and fuel management, ultimately optimizing overall fleet operations. Additionally, commercial vehicle telematics software often includes features such as remote diagnostics, driver safety monitoring, and vehicle maintenance alerts, contributing to improved safety, cost-effectiveness, and operational efficiency for businesses relying on a fleet of vehicles.

Stakeholders

-

Application design and software developers

-

Commercial vehicle telematics vendors

-

Business analysts

-

Cloud service providers

-

Consulting service providers

-

Fleet owners & operators

-

Distributors and Value-added Resellers (VARs)

-

Government agencies

-

Independent Software Vendors (ISV)

-

Managed service providers

-

Market research and consulting firms

-

Support and maintenance service providers

-

System Integrators (SIs)/migration service providers

-

Automotive OEMs

-

Technology providers

Report Objectives

-

To define, describe, and predict the commercial vehicle telematics software market by offering (software and services), propulsion type, vehicle type, sales channel, end-user, and region

-

To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

-

To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

-

To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To profile key players and comprehensively analyze their market rankings and core competencies.

-

To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

-

To analyze the impact of recession across all the regions across the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the North American commercial vehicle telematics software market

-

Further breakup of the European market

-

Further breakup of the Asia Pacific market

-

Further breakup of the Middle Eastern & African market

-

Further breakup of the Latin America market

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Commercial Vehicle Telematics Software Market