Insurance Telematics Market by Deployment Type, End User (Small and Medium Enterprises, and Large Enterprises), and by Region (North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America) - Global Forecast and Analysis to 2020

[107 pages Report] The insurance telematics market size is expected to grow from USD 857.2 Million in 2015 to USD 2.21 Billion in 2020, at a Compound Annual Growth Rate (CAGR) of 20.9%. Decreasing cost of connectivity solutions, increase in regulatory compliance and regulations, consumer’s interest for in-car connectivity, and rise in smartphone penetration are driving the market.

The report aims at estimating the market size and future growth potential of market across different segments, such as deployment types, end users, and regions. The base year considered for the study is 2014 and the market size is estimated from 2015 to 2020. Insurance and automotive companies are rapidly deploying insurance telematics solutions to monitor driver behavior, simplify road side assistance, effectively manage the claims, improve their security of insurance data, and achieve competitive advantage.

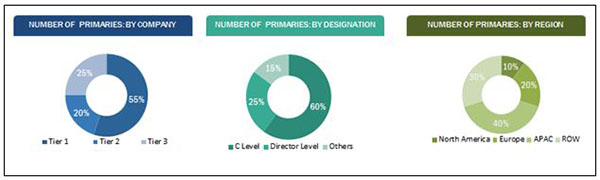

The research methodology used to estimate and forecast the insurance telematics market included capturing data on key vendor revenues through secondary research. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted below:

The insurance telematics market ecosystem consists of telematics service providers. such as Octo Telematics, TomTom Telematics, and Trimble Navigation; insurance companies such as Allstate Insurance and Aviva; telematics technology providers such as Davis Instruments and Meta Systems; automotive Original Equipment Manufacturers (OEMs) such as General Motors.

Target audience

- Insurance telematics service vendors

- System integrators

- IT developers

- Third party vendors

- Cloud service providers

- Network operators

- Infrastructure provider

- Government

- Regulatory and compliance agencies

Scope of the Report

The research report segments the insurance telematics market into the following submarkets:

By Deployment type:

- Cloud

- On-Premises

By Organization size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America insurance telematics market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The insurance telematics market size is expected to grow from USD 857.2 Million in 2015 to USD 2.21 Billion in 2020, at a Compound Annual Growth Rate (CAGR) of 20.9%.

The telematics market for industries such as insurance is anticipated to grow steadily in the next few years, due to decreasing cost of connectivity solutions, such as wireless and cellular modules and use of predictive analysis, enabling the end user to produce drive risk score from telematics data. Consumer’s enthusiasm for in-car connectivity and growth of smartphone penetration are driving the market.

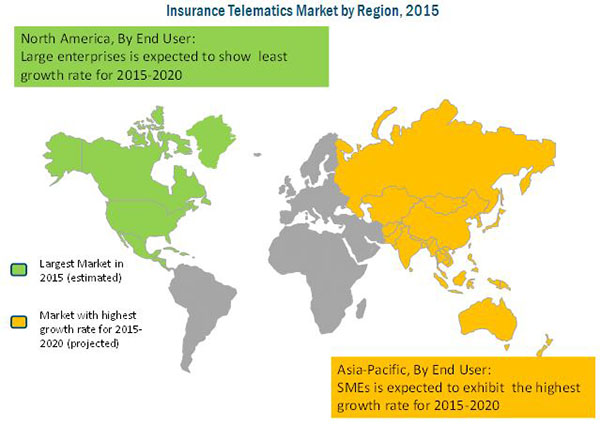

The insurance telematics market has been segmented by type of deployment, by end user, and by region. In terms of deployment type, on-premises deployment is expected to dominate the market with largest market size. In terms of end users, SMEs are estimated to exhibit the highest growth rate as they are adopting cloud-based insurance telematics solutions extensively. The market by region covers five major regional segments, namely, North America, Asia-Pacific (APAC), Europe, Latin America, and Middle East and Africa (MEA). North America is estimated to hold the largest market share of the overall insurance market in 2015. North America is expected to lead the overall market followed by Europe and MEA. North America is rapidly deploying the insurance telematics solutions due to the dynamic market environment. Latin America and APAC is also witnessing a record growth in demonstrating and adopting insurance telematics solution.

Educating consumers about insurance telematics and security issues associated with cloud and mobile technologies act as challenges for the market. However, the privacy concerns associated with private data of individuals and customers are restraining the growth of the market. Organic growths through partnerships, agreements and collaborations are the key strategies followed by the companies, such as Octo Telematics, Sierra Wireless, Inc., Agero Inc., Telogis, and TomTom Telematics. These strategies accounted for a share of 38% of the total strategic developments in the insurance telematics market. Furthermore, the companies such as Trimble Navigation, Verizon Enterprise Solutions, Octo Telematics, and Aplicom also adopted new product developments as an eminent strategy to expand their client base and enter new market spaces with improved solution capabilities. This strategy accounted for 35% share of the total strategic developments in this market. Mergers and acquisitions strategy accounted for 15% of the total strategic developments incorporated by the top insurance telematics companies, such as Sierra Wireless, MiX Telematics, Telogis, and Trimble Navigation.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitation

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in Market

4.2 Insurance Telematics Market, 2015-2020

4.3 Market, By Deployment Type and By Region, 2015

4.4 Lifecycle Analysis, By Region, 2015

5 Market Overview (Page No. - 29)

5.1 Introduction

5.1.1 By Deployment Type

5.1.2 By End User

5.1.3 By Region

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Consumer’s Enthusiasm for In-Car Connectivity

5.2.1.2 Growth of Smartphone Penetration

5.2.1.3 Decreasing Cost of Connectivity Solutions

5.2.1.4 Increase in Regulatory Compliance and Regulations

5.2.1.5 Increased Traction for Risk Assessment and Management

5.2.2 Restraints

5.2.2.1 Privacy Concerns Associated With Private Data of Individuals

5.2.2.2 Lack of Standardized System

5.2.3 Opportunities

5.2.3.1 Growing Impetus to IoT

5.2.3.2 Increased Demand of Insurance Telematics Across the Insurance and Automotive Sector

5.2.4 Challenges

5.2.4.1 Educating Consumers About Insurance Telematics

5.2.4.2 Security Issues Associated With Cloud and Mobile Technologies

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Insurance Telematics Market Analysis, By Deployment Type (Page No. - 41)

7.1 Introduction

7.2 Cloud

7.3 On-Premises

8 Insurance Telematics Market Analysis, By End User (Page No. - 46)

8.1 Introduction

8.2 SME

8.3 Large Enterprises

9 Geographic Analysis (Page No. - 51)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 65)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Launches

10.2.2 Partnerships, Agreements, and Collaborations

10.2.3 Mergers and Acquisitions

10.2.4 New Contracts

11 Company Profiles (Page No. - 71)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 Introduction

11.2 Verizon Enterprise Solutions

11.3 TOMTOM Telematics (TOMTOM)

11.4 Trimble Navigation

11.5 Mix Telematics

11.6 Sierra Wireless

11.7 Telogis

11.8 Masternaut Limited

11.9 Agero Inc.

11.10 Aplicom OY

11.11 Octo Telematics

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 97)

12.1 Industry Excerpts

12.2 More Developments

12.2.1 New Product Developments

12.2.2 Partnerships, Agreements and Collaborations

12.3 Discussion Guide

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (43 Tables)

Table 1 Insurance Telematics Market, 2013–2020 (USD Million, Y-O-Y %)

Table 2 Drivers: Impact Analysis

Table 3 Restraints: Impact Analysis

Table 4 Opportunities: Impact Analysis

Table 5 Challenges: Impact Analysis

Table 6 Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 7 Cloud: Market Size, By End User, 2013–2020 (USD Million)

Table 8 Cloud: Market Size, By Region, 2013–2020 (USD Million)

Table 9 On-Premises: Market Size, By End User, 2013–2020 (USD Million)

Table 10 On-Premises: Market Size, By Region, 2013–2020 (USD Million)

Table 11 Market Size, By End User, 2013–2020 (USD Million)

Table 12 SME: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 13 SME: Market Size, By Region, 2013–2020 (USD Million)

Table 14 Large Enterprise: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 15 Large Enterprise: Market Size, By Region, 2013–2020 (USD Million)

Table 16 Insurance Telematics Market Size, By Region, 2013–2020 (USD Million)

Table 17 North America: Market Size, By End User, 2013–2020 (USD Million)

Table 18 North America: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 19 North America: Market Size, By Country, 2013–2020 (USD Million)

Table 20 United States: Market Size, By End User, 2013–2020 (USD Million)

Table 21 Canada: Market Size, By End User, 2013–2020 (USD Million)

Table 22 Europe: Market Size, By End User, 2013–2020 (USD Million)

Table 23 Europe: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 24 Europe: Market Size, By Country, 2013–2020 (USD Million)

Table 25 United Kingdom: Market Size, By End User, 2013–2020 (USD Million)

Table 26 Germany: Market Size, By End User, 2013–2020 (USD Million)

Table 27 Others: Insurance Telematics Market Size, By End User, 2013–2020 (USD Million)

Table 28 Asia-Pacific: Market Size, By End User, 2013–2020 (USD Million)

Table 29 Asia-Pacific: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 30 Asia-Pacific: Market Size, By Country, 2013–2020 (USD Million)

Table 31 China: Market Size, By End User, 2013–2020 (USD Million)

Table 32 Japan: Market Size, By End User, 2013–2020 (USD Million)

Table 33 Others: Market Size, By End User, 2013–2020 (USD Million)

Table 34 Middle East and Africa: Market Size, By End User, 2013–2020 (USD Million)

Table 35 Middle East and Africa: Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 36 Latin America: Market Size, By End User, 2013–2020 (USD Million)

Table 37 Latin America: Insurance Telematics Market Size, By Deployment Type, 2013–2020 (USD Million)

Table 38 New Product Developments, 2013–2015

Table 39 Partnerships, Agreements, and Collaborations, 2013–2015

Table 40 Mergers and Acquisitions, 2013–2015

Table 41 New Contracts, 2013–2015

Table 42 New Product Developments, 2012-2014

Table 43 Partnerships, Agreements and Collaborations, 2012–2014

List of Figures (39 Figures)

Figure 1 Global Insurance Telematics Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation Approach

Figure 5 Market: Assumptions

Figure 6 Market Size, By Deployment Type (2015 vs 2020): On-Premises is Expected to Lead the Insurance Telematics Market

Figure 7 Market Size, By End User (2015 vs 2020): Large Enterprises Will Continue Dominating the Market

Figure 8 North America Dominates the Market While Asia-Pacific and Latin America Projecting Potential Growth, 2015

Figure 9 Growing Impetus of IoT is Expected to Act as an Attractive Market Opportunity

Figure 10 Large Enterprises are Expected to Account for the Largest Market Share in the Market During the Forecast Period

Figure 11 North America is Expected to Dominate the Insurance Telematics Market

Figure 12 Asia-Pacifc is Expected to Be in the High Growth Phase in the Coming Years

Figure 13 Market Segmentation: By Deployment Type

Figure 14 Market Segmentation: By End User

Figure 15 Market Segmentation: By Region

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Value Chain Analysis

Figure 18 Porter’s Five Forces Analysis: Insurance Telematics Market

Figure 19 Cloud Deployment Market Size is Expected to Grow Significantly During the Forecast Period

Figure 20 SME Segment is Expected to Exhibit Higher Growth Rate in the Market During the Forecast Period

Figure 21 Asia-Pacific is Emerging as A New Hotspot in the Market

Figure 22 Geographic Snapshot: North America is Expected to Continue to Have the Largest Market Size During the Forecast Period

Figure 23 Asia-Pacific is the Fastest Growing Market in the Market, By End User

Figure 24 North America Market Snapshot

Figure 25 Asia-Pacific Market Snapshot

Figure 26 Companies Adopted New Product Developments and Partnerships, Agreements, and Collaborations as the Key Growth Strategies From 2013 to 2015

Figure 27 Insurance Telematics Market Evaluation Framework

Figure 28 Battle for Market Share: New Product Launches Was the Key Strategy Adopted By Players

Figure 29 Geographic Revenue Mix of Major Players

Figure 30 Verizon Enterprise Solutions: Company Snapshot

Figure 31 Verizon Enterprise Solutions: SWOT Analysis

Figure 32 TOMTOM Telematics: Company Snapshot

Figure 33 TOMTOM Telematics: SWOT Analysis

Figure 34 Trimble Navigation: Company Snapshot

Figure 35 Trimble Navigation: SWOT Analysis

Figure 36 Mix Telematics: Company Snapshot

Figure 37 Mix Telematics: SWOT Analysis

Figure 38 Sierra Wireless: Company Snapshot

Figure 39 Sierra Wireless: SWOT Analysis

Growth opportunities and latent adjacency in Insurance Telematics Market