Automotive Telematics Market

Automotive Telematics Market by Service (E-call, Remote Diagnostics, IRA, SVA), Connectivity (Cellular, Satellite), Vehicle Type (PC, LCV, Bus, Truck), Form Type, Offering, EV Type, Aftermarket, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

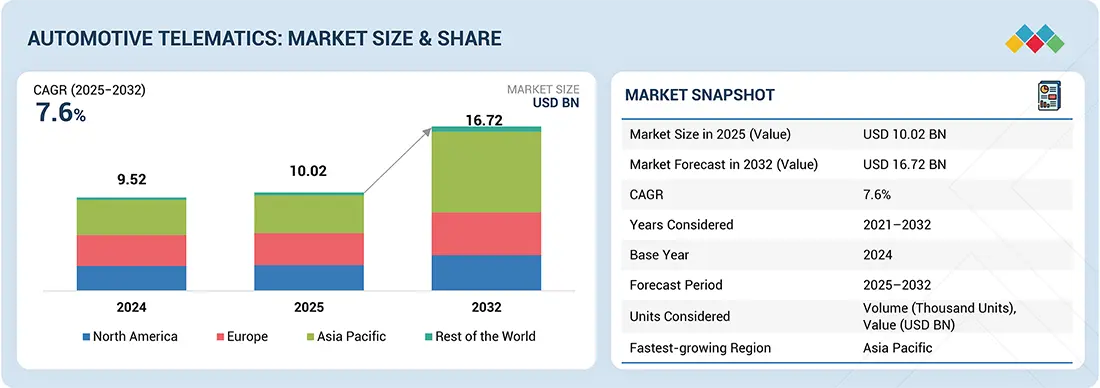

The automotive telematics market size is expected to grow from USD 10.02 billion in 2025 to USD 16.72 billion by 2032, achieving a CAGR of 7.6%. Fleet management solutions are being adopted more widely, especially among logistics and transportation companies, and these solutions are increasingly supported by telematics systems. Regulatory measures, such as Europe’s eCall system (mandatory since April 2018) and India’s AIS-140 vehicle tracking mandate (implemented in April 2018), are further promoting the integration of telematics. Additionally, the growing shift toward electric and autonomous vehicles is contributing to market expansion, as these vehicles rely on advanced data systems for battery health monitoring, navigation, and automation.

Global Automotive Telematics Market Overview

How Big Is the Automotive Telematics Market?

- 2024 Market Value: USD 9.52 Billion

- 2025 Estimated Value: USD 10.02 billion

- 2032 Forecast Value: USD 16.72 Billion

- CAGR (2025–2032): 7.6%

- Largest Region (2024): Asia Pacific

- Leading Connectivity Type: Cellular connectivity

- Top Application Segment: Passenger Car

- Fastest-Growing Country: China

KEY TAKEAWAYS

-

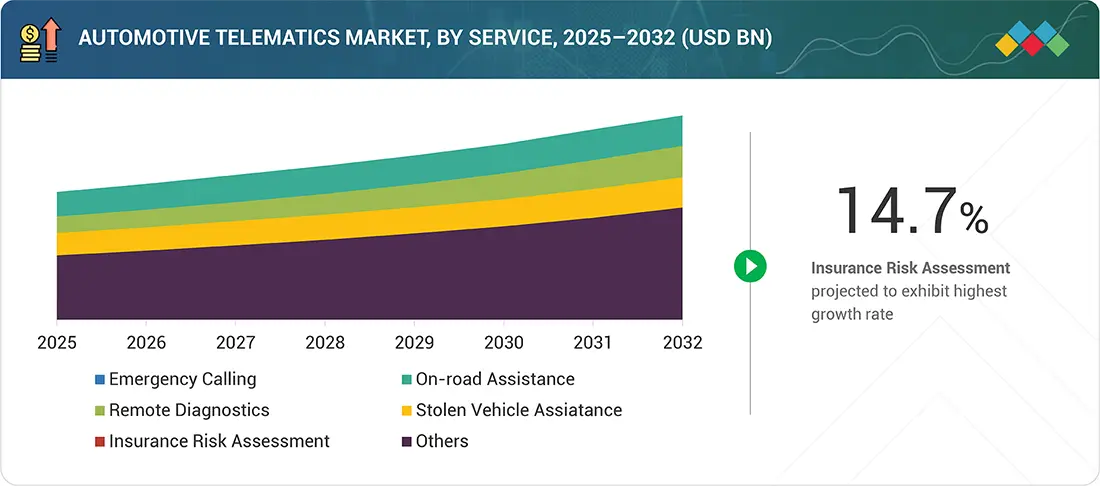

BY SERVICEThe automotive telematics market is segmented into emergency calling, stolen vehicle assistance, insurance risk assessment, on-road assistance, remote diagnostics, and other services. Insurance risk assessment is expected to grow at the highest rate due to rising demand for usage-based insurance, which leverages real-time driving data to calculate personalized premiums.

-

BY VEHICLE TYPEThe passenger car segment is expected to dominate the market, driven by rising consumer demand for connected features, greater adoption of advanced safety systems, and the growing use of smart navigation, remote diagnostics, and emergency assistance services that encourage telematics integration in passenger vehicles.

-

BY CONNECTIVITYAutomotive telematics providers are partnering with satellite network operators to develop hybrid connectivity systems that combine cellular 4G/5G connectivity and satellite networks. New TCUs are being designed with built-in satellite features to enable global V2X communication and emergency services.

-

BY FORM TYPEThe automotive telematics market, by form type, is segmented into embedded and integrated. Embedded telematics is expected to lead the market, due to its deep integration within the vehicle's electronic architecture, enabling efficient access to vehicle data for remote diagnostics, emergency response, and software updates.

-

BY REGIONAsia Pacific is projected to lead the market, due to increasing adoption in passenger cars and commercial fleets, especially for urban mobility, ride-hailing, and last-mile delivery. Rising EV adoption and OEM-backed connected platforms such as Tata's IRA, Hyundai's BlueLink, and Suzuki Connect are also accelerating telematics integration.

-

COMPETITIVE LANDSCAPELeading automotive telematics control unit providers, including LG Electronics (South Korea), HARMAN International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany), offer comprehensive connectivity solutions such as real-time vehicle tracking, remote diagnostics, predictive maintenance, driver behavior analysis, and integrated fleet management platforms. They also stand out by providing value-added services like OTA updates, insurance telematics, in-vehicle infotainment, emergency assistance, and seamless integration with OEM systems to improve safety, efficiency, and user experience.

The automotive telematics market is shifting toward comprehensive telematics packages, where OEMs and Tier-1 suppliers are offering combined telematics packages that include real-time diagnostics, predictive maintenance, driver behavior analysis, and fuel efficiency tools. For instance, Volvo's Dynafleet system integrates multiple services such as real-time vehicle tracking, fuel efficiency monitoring, driver behavior analysis, and predictive maintenance into a single platform. Further, usage-based insurance (UBI) is also growing rapidly, due to its ability to offer personalized premiums based on actual driving behavior, promoting safer driving and cost savings for consumers.

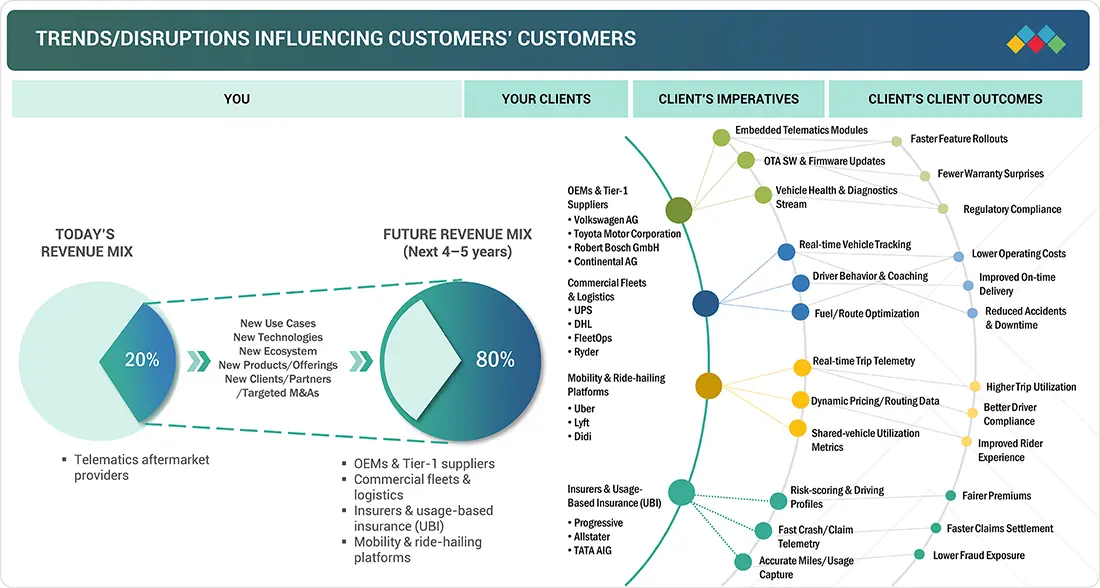

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The automotive telematics market is transitioning from hardware-based models to new revenue sources, including connected service subscriptions, fleet platforms, and telematics for electric vehicles (EVs). There is an increasing emphasis on autonomous driving, connected car technologies, and software defined vehicles (SDVs), which will further influence market growth. The Asia Pacific region is emerging as a key area for growth due to rising vehicle sales. Additionally, stricter government regulations regarding safety and reliability are accelerating the adoption of telematics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand for connected vehicles and in-car digital services

-

Telematics-driven optimization in fleet management and logistics

Level

-

Regulatory complexities around usage-based insurance models

-

Data privacy and cybersecurity concerns

Level

-

High emphasis on vehicle safety and security through mandates

-

Convergence of advanced analytics, generative Al, and smart city integration

Level

-

Limited user acceptance and behavioral resistance

-

Absence of industry-wide standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand for connected vehicles and in-car digital services

Consumers are increasingly expecting vehicles to provide seamless digital experiences, prompting automakers to incorporate telematics with features like real-time navigation, remote diagnostics, and emergency support. Systems such as GM OnStar, BMW ConnectedDrive, and Ford SYNC 4 demonstrate how telematics is becoming a key feature that differentiates vehicles and generates recurring revenue.

Restraint: Regulatory complexities around usage-based insurance models

The implementation of usage-based insurance is limited by stringent data privacy regulations, regional regulatory variations, and consumer apprehensions regarding data sharing. Although initiatives such as Progressive's Snapshot and Allstate's Drivewise have achieved success within the US, regulatory challenges in Europe and Asia restrict their scalability and impede overall market growth.

Opportunity: Expansion of IoT and next-gen connectivity technologies

The deployment of 5G, V2X, and cloud platforms is transforming telematics from simple GPS tracking into predictive, real-time ecosystems. This change allows OEMs, insurers, and SaaS providers to generate revenue from advanced services like OTA updates, predictive maintenance, and low-latency safety applications, opening up significant growth opportunities.

Challenge: Limited user acceptance and behavioral resistance

Despite technical readiness, many drivers perceive telematics as intrusive surveillance, leading to resistance in both personal and commercial use cases. Overcoming these barriers requires cultural adaptation, transparent data usage policies, and incentive mechanisms to ensure broader acceptance of telematics solutions.

automotive-telematics-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrate telematics into connected car platforms for safety, infotainment, predictive maintenance, and remote diagnostics | Strengthens brand differentiation Enables subscription-based revenue streams Improves customer satisfaction and retention |

|

Develop of telematics control units (TCUs), software stacks, and IoT platforms for connected vehicles | Expands supplier partnerships with OEMs Drives innovation in connected vehicle ecosystems Unlocks recurring service revenue |

|

Provide 4G/5G connectivity for telematics, enabling vehicle-to-cloud (V2C) and vehicle-to-everything (V2X) communication | Monetizes network services through automotive vertical Supports real-time vehicle tracking and safety features Strengthens role in mobility-as-a-service (MaaS) |

|

Host telematics platforms, big data analytics, and AI-driven telematics applications | Provides scalable infrastructure for connected services Enables advanced analytics for predictive maintenance Builds strategic partnerships across automotive value chain |

|

Offer satellite-based telematics for remote areas, fleet management, and logistics tracking where terrestrial networks are limited | Extends telematics services to underserved geographies Ensures reliable connectivity in remote regions Enables global fleet monitoring and safety compliance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

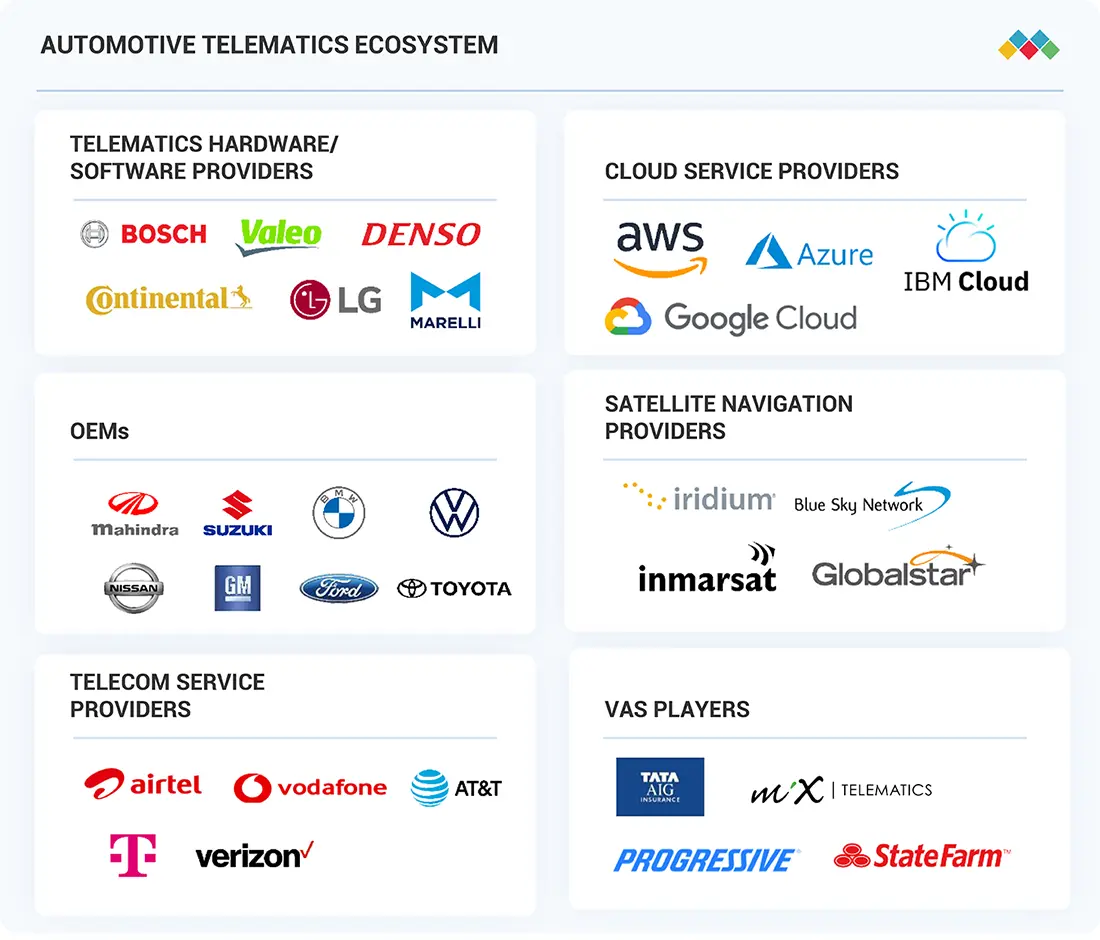

MARKET ECOSYSTEM

The ecosystem analysis highlights various players represented by OEMs, telematics hardware/software providers, cloud service providers, satellite navigation providers, telecom service providers, and VAS players. A few major telematics hardware/software providers include LG Electronics (South Korea), HARMAN International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Telematics Market, By Vehicle Type

The passenger car segment will dominate due to high production volumes, strong consumer demand for connected features, and the adoption of advanced safety systems. Smart navigation, remote diagnostics, and emergency assistance are accelerating telematics penetration, with OEMs such as Toyota, Honda, and Nissan offering connected services as standard or optional features.

Automotive Telematics Market, By Form Type

Embedded telematics will lead the market as it integrates deeply with vehicle electronics, enabling efficient remote diagnostics, emergency response, and OTA updates. Regulatory mandates in China and the EU, along with platforms such as Hyundai BlueLink and Toyota Connected Services, are driving widespread adoption.

Automotive Telematics Market, By Offering

The hardware segment will hold the largest share due to the growing use of TCUs, eSIMs, antennas, and sensors supporting connectivity and safety. With 4G/5G adoption rising, OEMs are investing in advanced hardware for faster processing, supported by suppliers such as Robert Bosch GmbH, Continental AG, and LG Electronics

Automotive Telematics Market, By Connectivity

Cellular connectivity will lead the market given its scalability and ability to support real-time navigation, diagnostics, and emergency services. The global phase-out of 2G/3G is pushing automakers and fleets to upgrade to 4G/5G, ensuring uninterrupted safety-critical operations and reliable fleet management.

Automotive Telematics Market, By Fleet Management Service

Operation management services will hold a major share as fleets demand real-time visibility, route optimization, and driver monitoring. Platforms such as Geotab, Verizon Connect, and Trimble provide dashboards with live tracking, maintenance alerts, and analytics, streamlining multi-vehicle operations.

Automotive Telematics Market, By Service

Insurance risk assessment will grow fast with the rising adoption of usage-based insurance that leverages real-time driving data for personalized premiums. Insurers use telematics to improve underwriting and reduce fraud, supported by regulatory focus on data transparency and consumer interest in lower costs.

Electric & Hybrid Vehicle Telematics Market, By Vehicle Type

The BEV segment will dominate, driven by government incentives across India, China, the US, and Europe. BEVs rely on advanced telematics for battery management, charging, and energy optimization, with OEMs like Tesla, BMW, and Hyundai integrating platforms such as BlueLink to enable remote monitoring, diagnostics, and enhanced user experience.

Electric & Hybrid Vehicle Telematics Market, By Service

Insurance risk assessment will capture a large share as UBI adoption rises, leveraging telematics to offer personalized premiums. With EVs and hybrids equipped with embedded telematics, insurers can track driving behavior for fair pricing, exemplified by Tesla's UBI program in select US states based on real-time safety scores.

Automotive Telematics Aftermarket, By Vehicle Type

The light commercial vehicle segment will grow fastest due to booming e-commerce, last-mile delivery, and regulatory mandates for tracking in Europe and Asia. Fleet operators widely adopt aftermarket telematics on models such as Ford Transit Custom and Mercedes-Benz Vito for fuel monitoring, geofencing, and driver analytics to cut costs and ensure compliance.

REGION

Asia Pacific is expected to be the largest region in the global Automotive Telematics Market during the forecast period

Telematics growth in Asia Pacific is driven by increasing adoption in both passenger and commercial vehicles, particularly for urban mobility, ride-hailing, and last-mile delivery. Countries such as China, Japan, South Korea, and India are investing heavily in smart mobility, 5G infrastructure, and EV adoption, which further supports telematics integration. OEMs, including Tata Motors, Suzuki, Hyundai, Toyota, Nissan, and Mahindra, provide telematics platforms such as iRA, Suzuki Connect, BlueLink, and AdrenoX, offering services like remote control, vehicle tracking, diagnostics, and safety alerts.

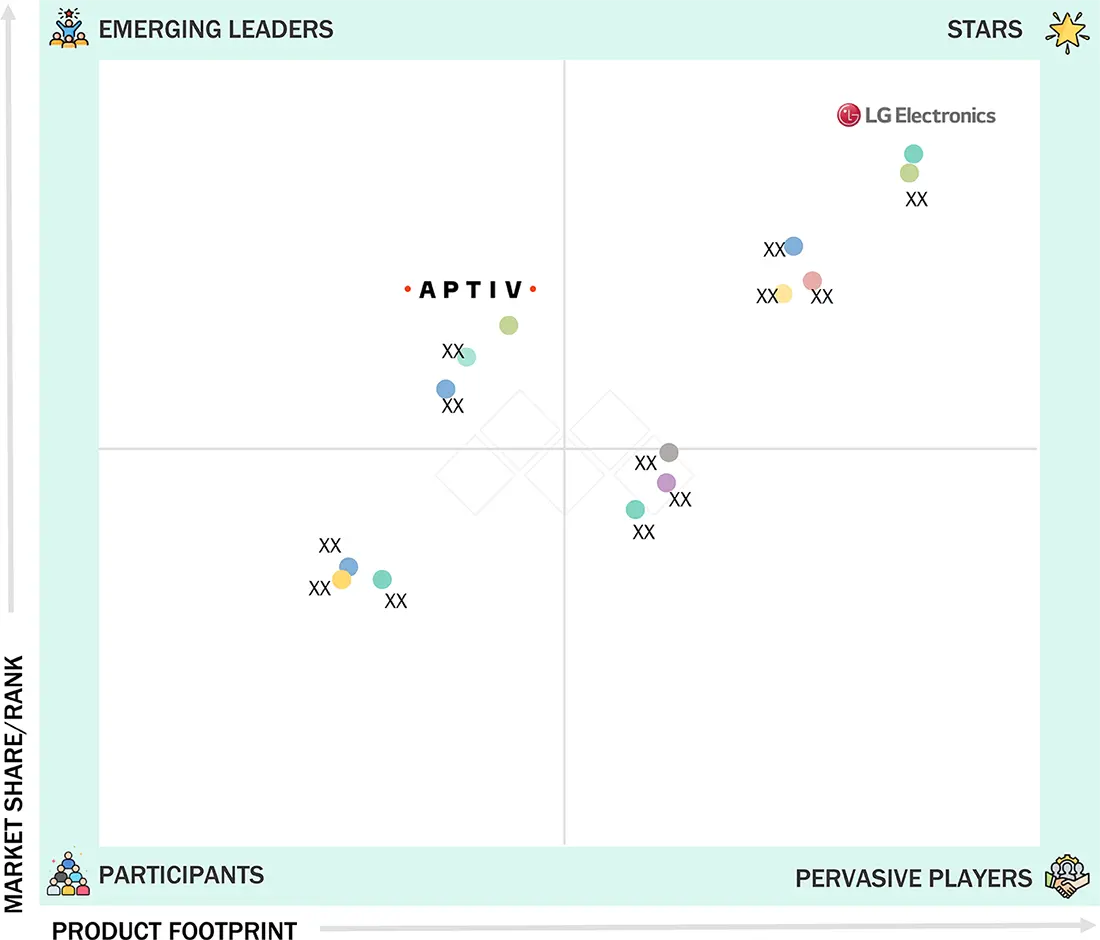

automotive-telematics-market: COMPANY EVALUATION MATRIX

In the automotive telematics market matrix, LG Electronics (Star) leads with a strong global presence and a broad portfolio of telematics and connectivity solutions. Aptiv (Emerging Leader) is gaining traction with innovative telematics platforms and growing partnerships with OEMs. While LG Electronics dominates with scale, Aptiv shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- LG Electronics (South Korea)

- Harman International (US)

- Denso Corporation (Japan)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Aptiv (Ireland)

- Valeo (France)

- Visteon Corporation (US)

- Marelli Holdings Co., Ltd. (Japan)

- Infineon Technologies AG (Germany)

- Ficosa Internacional, S.A. (Spain)

- CalAmp (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 10.02 Billion |

| Revenue Forecast in 2030 | USD 16.72 Billion |

| Growth Rate | CAGR of 7.6% from 2025-2032 |

| Actual Data | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Thousand Units), Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: automotive-telematics-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading OEM (Japan) | Benchmarking of connected car telematics platforms, subscription revenue model analysis, integration roadmap of telematics with ADAS | Enables new revenue streams via subscription models, supports long-term digital services strategy, strengthens competitive differentiation |

| Telematics Service Provider (US) | Study on fleet management solutions, analysis of regulatory frameworks (FMCSA, ELD mandates), competitive profiling of Verizon Connect, Geotab, and Trimble | Ensures regulatory compliance in North America, strengthen product positioning, targets growth in commercial fleets |

| Insurance Company (Europe | Evaluation of usage-based insurance (UBI) telematics adoption, data monetization opportunities from connected vehicles, assessment of driver behavior analytics platforms | Supports UBI product launch, identifies new revenue channels from data, improves risk assessment accuracy |

| Logistics & Delivery Company (India) | Cost-benefit analysis of telematics for last-mile logistics, Mapping vendors across Southeast Asia, ROI framework for IoT-enabled telematics | Optimizes delivery fleet efficiency, reduces fuel & maintenance costs, improves customer experience via real-time tracking |

| Global Tier-2 Sensor Supplier (South Korea) | Telematics control unit (TCU) supplier landscape, integration opportunities with 5G and C-V2X modules, competitive mapping of chipset providers | Guides investment next-gen TCU products, strengthens OEM collaboration, spots new business opportunities in 5G-enabled telematics |

RECENT DEVELOPMENTS

- 5/1/2025 12:00:00 AM : LG Electronics (South Korea) showcased its advanced Internet of Things - Non-Terrestrial Networks (IoT-NTN) technology at the 5G Automotive Association (5GAA) conference in Paris, France. The company demonstrated a vehicle equipped with next-generation telematics control units (TCUs) based on IoT-NTN. This technology combines satellite communication with high-altitude platform stations to deliver connectivity in areas where traditional networks like 3G, 4G, or 5G are unavailable. LG's new solution also includes AI-powered voice compression technology, improving the performance of its IoT-NTN system.

- 4/1/2025 12:00:00 AM : At the Advanced Clean Transportation Expo 2025, Continental AG (Germany) showcased a compact unit that integrates telematics, infotainment, and vehicle body control applications.

- 3/1/2025 12:00:00 AM : At the Mobile World Congress (MWC) in Barcelona, Spain, HARMAN International (US) showcased Ready Connect as the industry's first TCU with built-in satellite communication capabilities, enabling continuous connectivity anywhere, anytime. Developed in partnership with Non-Terrestrial Network (NTN) service provider Skylo, the solution uses 3GPP-standard satellite communication and offers a modular upgrade path from 4G to 5G and eventually to satellite connectivity, making it future-ready.

- 12/1/2024 12:00:00 AM : Valeo (France) launched a new software solution called Valeo Assist, powered by Amazon Web Services (AWS). This solution enhances remote assistance by gathering data from the vehicle and its surroundings to provide faster and more effective support during emergencies (eCall), breakdowns or accidents (bCall), and service requests (sCall).

- 9/1/2024 12:00:00 AM : Bosch Global Software, a subsidiary of Robert Bosch GmbH (Germany), collaborated with Cummins Inc. and KPIT to launch Eclipse CANought, a new open-source project focused on commercial vehicle telematics. This project is part of the broader Eclipse Software Defined Vehicle (SDV) initiative, which aims to lower the cost of developing telematics applications for commercial vehicles. Eclipse CANought aims to develop industry-specific features by standardizing and securing access to the Controller Area Network (CAN) bus, which connects the various Electronic Control Units (ECUs) within a vehicle.

- 8/1/2024 12:00:00 AM : Continental Engineering Services, a subsidiary of Continental AG (Germany), partnered with HOLON Mover to equip its vehicles with TCUs. These TCUs serve as a key component in modern software-defined vehicles, enabling secure and efficient communication.

Table of Contents

Methodology

The study encompassed four primary tasks to determine the present and future scope of the automotive telematics market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. The complete market size was estimated by using both top-down and bottom-up methodologies. Following this, the market breakdown and data triangulation approaches were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, International Organization of Motor Vehicle Manufacturers (OICA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive telematics market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as sizing estimates on the automotive telematics market and forecast, future technology trends, and upcoming technologies in the automotive telematics market. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides were interviewed to understand their views on the abovementioned points.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive telematics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Automotive Telematics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment and data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Automotive telematics refers to the integration of telecommunications and informatics systems in vehicles to enable real-time data communication. It combines GPS, onboard diagnostics, and wireless technologies to monitor and manage vehicle performance, location, and driver behavior. Telematics systems are widely used for navigation, fleet management, vehicle tracking, insurance, and safety applications.

Stakeholders

- Authorized Service Centers and Independent Aftermarket Service Providers

- Automobile Organizations/Associations and Government Bodies

- Automobile Original Equipment Manufacturers (OEMs)

- Automotive Camera Manufacturers

- Automotive Component Manufacturers

- Automotive Research Organizations

- Automotive TCU and ECU Manufacturers

- Automotive Telematics Hardware Suppliers

- Automotive Telematics Service Providers

- Automotive Telematics Software and Platform Providers

- Autonomous Driving Platform Providers

- EV and EV Component Manufacturers

- Internet Service Providers

- Vehicle Safety Regulatory Bodies

Report Objectives

- To segment and forecast the size of the automotive telematics market in terms of volume (thousand units) and value (USD million)

- To define, describe, and forecast the market based on service, vehicle type, form type, fleet management service, offering, aftermarket based on vehicle type, EV service, EV type, connectivity, and region

-

To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size by service (emergency calling, stolen vehicle assistance, insurance risk assessment, on-road assistance, remote diagnostics, and others)

- To segment and forecast the market size by form type (embedded and integrated)

- To segment and forecast the market size by fleet management service (operations management, vehicle maintenance and diagnostics, fleet analytics and reporting, and others)

- To segment and forecast the market size by offering (hardware and software)

- To segment and forecast the market size by aftermarket based on vehicle type (passenger car, light commercial vehicle, and heavy commercial vehicle)

- To segment and forecast the market size by EV service (emergency calling, stolen vehicle assistance, insurance risk assessment, on-road assistance, remote diagnostics, and others)

- To segment and forecast the market size by EV type [battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and fuel cell electric vehicle (FCEV)]

- To segment and forecast the market size by connectivity (satellite and cellular)

- To segment and forecast the market size by vehicle type (passenger car, light commercial vehicle, truck, and bus)

- To forecast the market size by region [North America, Europe, Asia Pacific, and the Rest of the World (RoW)]

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Impact of AI/Gen AI

- Trend and Disruption Impact

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- MNM insights on Automotive Telematics Market Trends in India

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments and launches, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- AUTOMOTIVE TELEMATICS MARKET, BY service, at country level

- automotive telematics market, by offering, at country level

- automotive telematics market, by vehicle type, at country level

Company Information

- Profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the global automotive telematics market?

The global automotive telematics market is projected to grow to USD 16.72 billion by 2032 from USD 10.02 billion in 2025 at a CAGR of 7.6% during the forecast period.

Who are the key players in the global automotive telematics market?

The automotive telematics market is dominated by major players, including LG Electronics (South Korea), HARMAN International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany).

Which region is projected to be the largest automotive telematics market?

The Asia Pacific region is projected to lead the automotive telematics market, driven by a combination of regulatory mandates, growing automobile demand, and technological advancements.

Which country is likely to generate significant demand for telematics in the Asia Pacific region?

China is projected to hold the largest share of the automotive telematics market due to high vehicle production from domestic and international OEMs, government support for manufacturing, and rising premium and connected vehicle demand, which increases the adoption of telematics in vehicles.

What are the key market trends impacting the growth of the automotive telematics market?

Increasing adoption of connected and autonomous vehicles, regulatory mandates for vehicle tracking and safety, rising demand for UBI, and the shift toward software-defined vehicles enabling OTA updates and data-driven services are driving the automotive telematics market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Telematics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Automotive Telematics Market

Nilesh

Jun, 2019

I am trying to understand the spending trends on automotive between different functions/domains like ADAS, infotainment, telematics etc.