Semi-Trailer Market by Type (Flatbed, Lowboy, Dry Van, Refrigerated, Tankers and Others), Number of Axles (<3 Axles, 3-4 Axles, and >4 Axles), Tonnage (Below 25T, 25T-50T, 51T-100T, and Above 100T), Length, End-Use and Region - Global Forecast to 2025

The global semi-trailer market was valued at USD 29.5 billion in 2020 and is projected to reach USD 41.2 billion by 2025, growing at a CAGR of 5.6% during the forecast period. Road transportation is a widely utilized mode of transportation of goods because of wide inland connectivity in many regions and the cost advantages it offers over other modes of transportation. Increasing manufacturing activities, urbanization, need for effective transportation, and widening of the rural area road networks are major factors fueling the growth of the market. Semi-trailer market refers to the market for semi-trailers, which are substantial, multiple-wheeled trailer units intended to be fastened to a tractor unit and utilised for long-distance transportation of commodities and goods. Semi-trailers are frequently utilised in many different sectors, such as transportation, logistics, building, and agriculture.

In the semi-trailer market, four key trends are new logistics, electrification/alternative drives, autonomous trucks, and digitalization. Understanding the key trends in the market, various key players have started investing in the development of innovative technologies to be embedded in semi-trailers. For instance, in October 2019, Great Dane and Cortex entered a technological partnership surrounding the Fleet Pulse smart trailer solution. Together they aim to achieve solutions for refrigerated fleets as a seamless, single source of data from the combination of data from the combined trailer and reefer unit and eliminate the annoyance of multiple subscriptions. Similarly, in September 2020, Great Dane and Aurora Parts & Accessories, LLC entered a partnership to provide intelligent solutions to the goods mobility industry with Aurora’s aftermarket operational expertise, distribution services, and cutting-edge digital platforms. Further, companies are focusing on creating differentiating factors, price competitiveness, and technical capabilities. Currently, the largest share of value in a standard semi-trailer lies in chassis and structural elements; however, in coming years a clear shift toward connectivity systems is expected. A variety of factors influence the market, including economic conditions, fuel prices, regulations, and technological advancements. The market is expected to expand in the coming years, owing to rising demand for efficient and cost-effective transportation solutions, as well as the increasing popularity of online shopping and home delivery.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growth in end-use industries such as FMCG and Automotive

Despite the adverse effects of the COVID-19 pandemic, most OEMs restarted vehicle production in May 2020. For instance, Volkswagen, Nissan, Hyundai, and Honda reopened their plants in China; FCA, Honda, and Toyota restarted production in the US. Production in Europe has also resumed, to a limited extent. Considering these factors, global vehicle production is expected to grow at a CAGR of 3.3% from 2020 to 2025. This growth in vehicle production will lead to a directly proportional increase in the demand for semi-trailer for the transportation of vehicles.

Fast Moving Consumer Goods (FMCG) is one of the largest industries in the world in terms of revenue generation. The products have a short shelf life as they include perishable products such as meat, dairy products, fruit and vegetables, and baked goods, and these products have high consumer demand. The products are bought frequently, are consumed rapidly, are generally priced low, and are sold in large quantities. The FMCG industry can be segmented into personal care and food & beverage industries. Key drivers of the FMCG industry are rising income, growing population, brand consciousness, favourable policies, and digitalization of the purchasing process. In the FMCG sector, along with the changes in consumer demands, there has been shifts in the logistics of FMCG products. All this is supporting the growth of technologically advanced semi-trailer in the FMCG industry.

Opportunity: Electric semi-trailers

In the last decade, the automotive sector witnessed a scientific innovation, which has brought a paradigm shift from a gas engine vehicle to an electric vehicle. Automotive manufacturers, such as Tesla, General Motors, Volkswagen, BMW, Ford, Toyota, Kia Motors, and Daimler, have launched an electric car in the past decade. Electric semi-trailers can create a fantastic opportunity for OEMs and semi-trailer manufacturers soon. The innovation was earlier limited to passenger cars only. However, continuous efforts and curiosity have resulted in production of electric semi-trailers. In November 2020, DHL forged ahead with its emissions reduction and climate protection goals with the launch of four BYD Class 8 battery-electric semi-trailer trucks in the US. The semi-trailer truck allows the driver to stand as the steering wheel is placed in the centre with a touchscreen panel on both sides of the driver. Moreover, in November 2020, DHL expanded its green fleet with launch of electric tractor-trailer vehicles in the US. Electric semi-trailers can create a tremendous opportunity for environment-friendly transportation.

Challenge: Lightweight semi-trailers

In road haulage, the empty weight of a vehicle is a significant contributor to fuel consumption, resulting in CO2 emissions. Nowadays, the primary customer requirements for new urban articulated trailers are reduced weight, interchangeable bodies, and cost competitiveness. The application of lightweight materials in design needs to be explored to reduce the carbon footprint of road freight vehicles. There are a few regulations that determine the structural design of a typical road freight semi-trailer, providing large scope for innovation in design. When coupled with fuel-saving components, such as skirts and modern technologies, the overall fuel consumption and emissions from the vehicle can be reduced. OEMs have thus started introducing new models made from lightweight materials such as composites, aluminium, and high-strength steel. A major part of the dry van market in the US has shifted away from heavier sheet-and-post designs to composite models, which is also allowing fleets to extend lifecycles from 8–10 years to the range of 13–15 years. Lowering the overall weight of the trailer with strong materials is a challenge for OEMs and fleet operators for cost-saving and emission control.

Dry van semi-trailers segment is expected to be the fastest growing segment during the forecast period

By tonnage, the semi-trailer market is divided into four categories: below 25 T, 25-50 T, and 51-100 T, and above 100 t. The below 25 T segment dominates the market as most semi-trailers used for transportation such as dry vans, refrigerated semi-trailers, and tankers come under this category. Below 25 T semi-trailers are in high demand due to the lower cost of transportation than other categories along with a considerable amount of freight. In addition, the below 25 T category complies with legally permissible limits across most countries. Thus, the below 25 T segment is expected to continue dominating the market over the estimated period. The segment is followed by the 25-50 T segment, which are lowboy and flatbed semi-trailers.

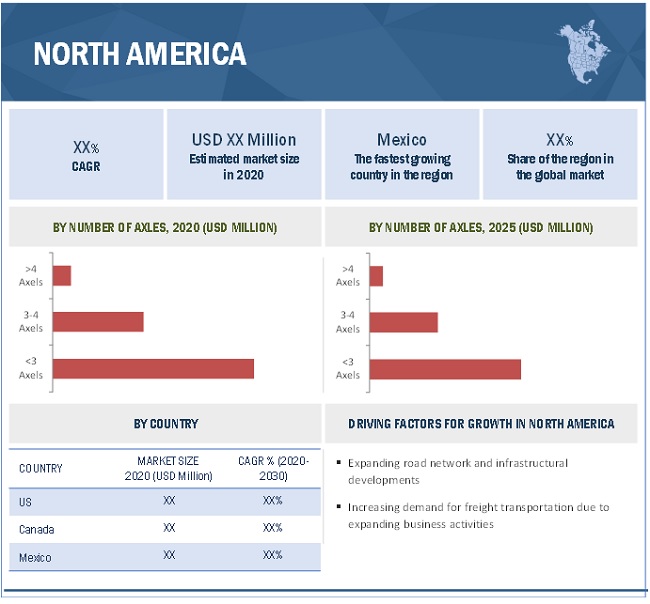

North America market is projected to hold the largest share, in terms of value, by 2025

The North American Free Trade Agreement (NAFTA), which allows free trade between the US, Canada, and Mexico, would lead to increased fleet operations in the region. This is expected to create a push in freight transportation because of increased business activities and consumer spending. Wabash, Hyundai Translead, Great Dane, and Utility Trailer are the key players operating in the North American semi-trailer market. These players are focusing on collaborations to launch technologically advanced semi-trailers. For instance, in 2020, Wabash National, along with eNow and Carrier Transicold’s all-electric refrigeration technologies, signed a partnership that offers thermally efficient, ecofriendly refrigerated hauling. The large gain in thermal efficiencies allows the customer to downsize the batteries required to haul cargo and increase the runtime on a battery setup. The North American semi trailer market is currently in its replacement cycle, with an aging semi-trailer population that needs to be replaced with technologically advanced semi-trailers. As a result, the North American semi trailer market is estimated to dominate the market, in terms of value, during the forecast period.

Asia Pacific is expected to emerge as the most promising market for construction and projected to continue the trend during the coming years as well. Continuously increasing infrastructure activities coupled with supportive investments from domestic and foreign investors are factors leading to the growth of the Asia Pacific semi-trailer market. The region has experienced growth in terms of the number of dams, airports, and hydroelectric projects. Some of the major projects driving the construction equipment market are Songdo International Business district in South Korea, China-Pakistan Economic Corridor, and Clark Green City in the Philippines. These Megaprojects have led to an increase in demand for semi-trailers for the transportation of heavy machinery, thereby driving the market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players considered in the analysis of the semi-trailer market are China International Marine Containers (China), Wabash National (US), Schmitz Cargobull AG (Germany), Utility Trailer Manufacturing Company (US), and Fahrzeugwerk Bernard Krone (Germany). These companies offer extensive products and solutions for the semi-trailer industry and have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

Scope of the Report

|

Report Attributes |

Details |

|

Market size: |

USD 29.5 billion in 2020 to USD 41.2 billion by 2025 |

|

Growth Rate: |

5.6% |

|

Largest Market: |

North America |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2021-2025 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

by Type (Flatbed, Lowboy, Dry Van, Refrigerated, Tankers and Others), Number of Axles (<3 Axles, 3-4 Axles, and >4 Axles), Tonnage (Below 25T, 25T-50T, 51T-100T, and Above 100T), Length, End-Use and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, and Rest of the World |

|

Report Highlights: |

New and improved representation of financial information, Company Evaluation Quadrant, etc. |

|

Key Market Opportunities: |

Electric semi-trailers |

|

Key Market Drivers: |

Growth in end-use industries such as FMCG and Automotive |

This research report categorizes the semi-trailer market based on type, number of axles, tonnage, length, end-use and region

Market, by Type

- Flatbed

- Lowboy

- Dry Van

- Refrigerated

- Tankers

- Others

Market, by Length

- Up to 45 Feet

- Above 45 Feet

Market, by Tonnage

- Below 25 T

- 25 T-50 T

- 51 T-100 T

- Above 100 T

Market, by Number of Axles

- <3 axles

- 3-4 axles

- 4 axles

Market, by End-Use

- Heavy Industry

- FMCG

- Chemical

- Automotive

- Oil & Gas

- Healthcare

- Logistics,

- Others

Market, by Region

- North America

- Asia Pacific

- Europe

- RoW

Recent Developments

- In March 2021, Great Dane, a leading manufacturer of semi-trailers and transportation equipment, announced the acquisition of Shepherd Trailers, a manufacturer of refrigerated trailers. The acquisition expands Great Dane's product offering and enhances its ability to serve customers in the refrigerated transportation market.

- In January 2021, Marmon Highway Technologies announced the acquisition of Fontaine Trailer Company, a leading manufacturer of semi-trailers. The acquisition expands Marmon's portfolio of transportation solutions and enhances its ability to serve customers in the North American market.

- In March 2021, Wabash National Corporation, a leading manufacturer of semi-trailers and liquid transportation systems, announced the acquisition of Supreme Industries, Inc., a manufacturer of truck bodies and specialty vehicles. The acquisition expands Wabash's product portfolio and enhances its position as a leading provider of commercial vehicles and transportation solutions.

Frequently Asked Questions (FAQ):

How big is the Semi-Trailer Market?

The semi-trailer market was valued at over $29.5 billion in 2020, and it is expected to reach a value of $41.2 billion by 2025, registering a CAGR of over 5.6% during the forecast period

How will market perform through 2025?

The global market is projected to reach USD 41.2 billion by 2025, growing at a CAGR of 5.6%, during the forecast period

What are the new market trends impacting the growth of the market?

One of the growing market trends is the use of advanced technologies such as telematics, autonomous driving, and stability control. Thus, increasing opportunities exist for telematics vendors to provide solutions and services with end-to-end asset visibility.

Which countries are considered in the European region?

The report covers market sizing for countries such as Germany, France, Italy, Spain, and UK.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES

1.2 PRODUCT DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS: SEMI-TRAILER MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 SEMI-TRAILER MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.1.3.1 List of primary participants

2.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.2.1 DEMAND-SIDE ANALYSIS

2.2.1.1 Growing logistics industry

2.2.1.2 Infrastructure: Road Network

2.2.2 SUPPLY-SIDE ANALYSIS

2.2.2.1 Technological advancements

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 MARKET SCOPE & ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

3.1 INTRODUCTION

FIGURE 9 SEMI-TRAILER MARKET DYNAMICS

FIGURE 10 MARKET, BY REGION, 2020–2025

FIGURE 11 MARKET, BY END-USE, 2020 VS. 2025

3.1.1 COVID-19 IMPACT ON MARKET, 2018–2025

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SEMI-TRAILER MARKET

FIGURE 12 GROWING SUPPLY CHAIN AND LOGISTICS NETWORK TO DRIVE THE MARKET

4.2 MARKET, BY REGION

FIGURE 13 NORTH AMERICA PROJECTED TO BE THE LARGEST MARKET, BY VALUE

4.3 MARKET, BY END-USE

FIGURE 14 LOGISTICS SEGMENT TO BE THE LARGEST, 2020 VS. 2025 (USD MILLION)

4.4 MARKET, BY TYPE

FIGURE 15 DRY VAN SEGMENT EXPECTED TO BE THE LARGEST, 2020 VS. 2025 (USD MILLION)

4.5 MARKET, BY LENGTH

FIGURE 16 ABOVE 45 FEET SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (USD MILLION)

4.6 MARKET, BY NUMBER OF AXLES

FIGURE 17 LESS THAN 3 AXLES SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (USD MILLION)

4.7 MARKET, BY TONNAGE

FIGURE 18 BELOW 25 T SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SEMI-TRAILER MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Expanding cold chain industry

5.2.1.2 Growth of end-use industries

5.2.2 RESTRAINTS

5.2.2.1 Local players in unorganized sector

5.2.3 OPPORTUNITIES

5.2.3.1 Semi-trailer platooning

5.2.3.2 Increasing use of advanced technologies

5.2.3.3 Electric semi-trailers

5.2.4 CHALLENGES

5.2.4.1 Lowering TCO and maintenance cost

5.2.4.2 Lightweight semi-trailers

5.2.5 IMPACT OF MARKET DYNAMICS

FIGURE 20 MARKET: IMPACT OF MARKET DYNAMICS

5.3 MACRO INDICATOR ANALYSIS

5.3.1 INTRODUCTION

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 MARKET

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: MARKET

FIGURE 22 INTENSITY OF COMPETITIVE RIVALRY IN THE MARKET IS CONSIDERED MEDIUM

TABLE 2 PORTER’S FIVE FORCES ANALYSIS

5.4.1.1 Competitive rivalry

FIGURE 23 LARGE NUMBER OF PLAYERS IN THE MARKET LEADS TO A MEDIUM DEGREE OF COMPETITION IN THE MARKET

5.4.1.2 Threat of new entrants

FIGURE 24 DESIGN-SPECIFIC REQUIREMENT ALONG WITH REGULATORY NORMS MAKES NEW ENTRY FAIRLY DIFFICULT

5.4.1.3 Threat of substitutes

FIGURE 25 LACK OF SUBSTITUTES FOR SEMI-TRAILER MAKES THREAT OF SUBSTITUTES LOW

5.4.1.4 Bargaining power of suppliers

FIGURE 26 LARGE NUMBER OF SUPPLIERS MAKES THE BARGAINING POWER OF SUPPLIERS MEDIUM

5.4.1.5 Bargaining power of buyers

FIGURE 27 SPECIFIC BUYER REQUIREMENT AND LARGE NUMBER OF SUPPLIERS MAKES THE BARGAINING POWER OF BUYERS MEDIUM

5.5 MARKET ECOSYSTEM

FIGURE 28 MARKET: ECOSYSTEM ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS: MARKET

5.6.1 RAW MATERIAL SUPPLIER

5.6.2 COMPONENT SUPPLIERS

5.6.3 SEMI-TRAILER SUPPLIERS

5.6.4 END USERS

5.7 TRENDS IMPACTING CUSTOMER’S BUSINESS

FIGURE 30 TRENDS IMPACTING CUSTOMER’S BUSINESS IN MARKET

5.8 REGULATORY LANDSCAPE

FIGURE 31 SEMI-TRAILER FUEL SAVING TECHNOLOGIES

TABLE 3 POLICIES PROMOTING SEMI-TRAILER FUEL SAVING TECHNOLOGIES

5.8.1 STANDARD TRAILER LENGTHS IN NORTH AMERICA AND EUROPE

FIGURE 32 GLOBAL EMISSION LEGISLATION

5.9 PATENT ANALYSIS

TABLE 4 PATENT ANALYSIS:MARKET

5.10 CASE STUDY ANALYSIS

TABLE 5 CASE STUDY ANALYSIS: AUTOMOTIVE MARKET

5.11 TECHNOLOGY ANALYSIS

TABLE 6 TECHNOLOGY ANALYSIS: MARKET

5.12 AVERAGE SELLING PRICE TREND

TABLE 7 NORTH AMERICA: SEMI-TRAILER, PRICE RANGE ANALYSIS, 2019 (USD)

TABLE 8 ASIA PACIFIC: SEMI-TRAILER, PRICE RANGE ANALYSIS, 2019 (USD)

TABLE 9 EUROPE: SEMI-TRAILER, PRICE RANGE ANALYSIS, 2019 (USD)

TABLE 10 ROW: SEMI-TRAILER, PRICE RANGE ANALYSIS, 2019 (USD)

5.13 MARKET, SCENARIOS (2020–2025)

FIGURE 33 FUTURE TRENDS & SCENARIO: MARKET, 2020–2025 (THOUSAND UNITS)

5.13.1 MOST LIKELY SCENARIO

TABLE 11MARKET (MOST LIKELY), BY REGION, 2018-2025 (‘000 UNITS)

5.13.2 OPTIMISTIC SCENARIO

TABLE 12 MARKET (OPTIMISTIC), BY REGION, 2018–2025 (‘000 UNITS)

5.13.3 PESSIMISTIC SCENARIO

TABLE 13 MARKET (PESSIMISTIC), BY REGION, 2018–2025 (‘000 UNITS)

6 GLOBAL MARKET, BY TYPE (Page No. - 67)

6.1 INTRODUCTION

6.1.1 ASSUMPTIONS FOR SEMI-TRAILER MARKET FORECASTING

6.1.2 RESEARCH METHODOLOGY FOR SEMI-TRAILER TYPE

6.1.3 OPINIONS FROM INDUSTRY EXPERTS

6.1.4 OPERATIONAL DATA

TABLE 14 TELEMATICS DATA AND POTENTIAL USE CASES

FIGURE 34 MARKET, BY TYPE, 2020 VS. 2025

TABLE 15 MARKET SIZE, BY TYPE, 2016–2019 (‘000 UNITS)

TABLE 16 MARKET SIZE, BY TYPE, 2020–2025 (‘000 UNITS)

TABLE 17 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 18 MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.2 FLATBED

TABLE 19 FLATBED: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 20 FLATBED: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 21 FLATBED: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 FLATBED: MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3 LOWBOY

TABLE 23 LOWBOY: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 24 LOWBOY: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 25 LOWBOY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 LOWBOY: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 DRY VAN

TABLE 27 DRY VAN: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 28 DRY VAN: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 29 DRY VAN: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 DRY VAN: MARKET, BY REGION, 2020–2025 (USD MILLION)

6.5 REFRIGERATED

TABLE 31 REFRIGERATED: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 32 REFRIGERATED: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 33 REFRIGERATED: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 REFRIGERATED: MARKET, BY REGION, 2020–2025 (USD MILLION)

6.6 TANKER

TABLE 35 TANKER: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 36 TANKER: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 37 TANKER: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 TANKER: MARKET, BY REGION, 2020–2025 (USD MILLION)

6.7 OTHERS

TABLE 39 OTHERS: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 40 OTHERS: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 41 OTHERS:MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 GLOBAL MARKET, BY LENGTH (Page No. - 83)

7.1 INTRODUCTION

7.1.1 ASSUMPTIONS FOR SEMI-TRAILER MARKET FORECASTING

7.1.2 RESEARCH METHODOLOGY FOR LENGTH SEGMENT

7.1.3 OPINIONS FROM INDUSTRY EXPERTS

FIGURE 35 MARKET, BY LENGTH, 2020 VS. 2025 (USD MILLION)

TABLE 43 MARKET, BY LENGTH, 2016–2019 (‘000 UNITS)

TABLE 44 MARKET, BY LENGTH, 2020–2025 (‘000 UNITS)

TABLE 45MARKET SIZE, BY LENGTH, 2016–2019 (USD MILLION)

TABLE 46 MARKET SIZE, BY LENGTH, 2020–2025 (USD MILLION)

7.2 UP TO 45 FEET

TABLE 47 UP TO 45 FEET:MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 48 UP TO 45 FEET: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 49 UP TO 45 FEET: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 UP TO 45 FEET: MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 ABOVE 45 FEET

TABLE 51 ABOVE 45 FEET: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 52 ABOVE 45 FEET: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 53 ABOVE 45 FEET: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 ABOVE 45 FEET: MARKET, BY REGION, 2020–2025 (USD MILLION)

8 GLOBAL MARKET, BY TONNAGE (Page No. - 90)

8.1 INTRODUCTION

8.1.1 ASSUMPTIONS FOR SEMI-TRAILER MARKET FORECASTING

8.1.2 RESEARCH METHODOLOGY FOR TONNAGE TYPE SEGMENT

8.1.3 OPINIONS FROM INDUSTRY EXPERTS

FIGURE 36 MARKET, BY TONNAGE, 2020 VS. 2025 (USD MILLION)

TABLE 55 MARKET, BY TONNAGE, 2016–2019 (‘000 UNITS)

TABLE 56 MARKET, BY TONNAGE, 2020–2025 (‘000 UNITS)

TABLE 57 MARKET, BY TONNAGE, 2016–2019 (USD MILLION)

TABLE 58 MARKET, BY TONNAGE, 2020–2025 (USD MILLION)

8.2 BELOW 25 TON

TABLE 59 BELOW 25 TON: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 60 BELOW 25 TON: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 61 BELOW 25 TON: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 BELOW 25 TON: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 25–50 TON

TABLE 63 25–50 TON: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 64 25–50 TON: MARKET SIZE, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 65 25–50 TON: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 25–50 TON: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.4 51–100 TON

TABLE 67 51–100 TON: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 68 51–100 TON: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 69 51–100 TON: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 51–100 TON: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.5 ABOVE 100 TON

TABLE 71 ABOVE 100 TON: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 72 ABOVE 100 TON: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 73 ABOVE 100 TON: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 ABOVE 100 TON: MARKET, BY REGION, 2020–2025 (USD MILLION)

9 GLOBAL MARKET, BY NUMBER OF AXLES (Page No. - 101)

9.1 INTRODUCTION

9.1.1 ASSUMPTIONS FOR SEMI-TRAILER MARKET FORECASTING

9.1.2 RESEARCH METHODOLOGY FOR NUMBER OF AXLES SEGMENT

9.1.3 OPINIONS FROM INDUSTRY EXPERTS

FIGURE 37 MARKET, BY NUMBER OF AXLES, 2020 VS. 2025 (USD MILLION)

TABLE 75 MARKET, BY NUMBER OF AXLES, 2016–2019 (‘000 UNITS)

TABLE 76 MARKET, BY NUMBER OF AXLES, 2020–2025 (‘000 UNITS)

TABLE 77 MARKET, BY NUMBER OF AXLES, 2016–2019 (USD MILLION)

TABLE 78 MARKET, BY NUMBER OF AXLES, 2020–2025 (USD MILLION)

9.2 <3 AXLES

TABLE 79 LESS THAN 3 AXLES: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 80 LESS THAN 3 AXLES: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 81 LESS THAN 3 AXLES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 LESS THAN 3 AXLES: MARKET, BY REGION, 2020–2025 (USD MILLION)

9.3 3–4 AXLES

TABLE 83 3-4 AXLES: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 84 3-4 AXLES: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 85 3-4 AXLES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 86 3-4 AXLES: MARKET, BY REGION, 2020–2025 (USD MILLION)

9.4 >4 AXLES

TABLE 87 MORE THAN 4 AXLES: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 88 MORE THAN 4 AXLES: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 89 MORE THAN 4 AXLES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 90 MORE THAN 4 AXLES: MARKET, BY REGION, 2020–2025 (USD MILLION)

10 GLOBAL MARKET, BY END-USE (Page No. - 110)

10.1 INTRODUCTION

10.1.1 ASSUMPTIONS FOR SEMI-TRAILER MARKET FORECASTING

10.1.2 RESEARCH METHODOLOGY FOR END-USE SEGMENT

10.1.3 OPINIONS FROM INDUSTRY EXPERTS

TABLE 91 WEIGHT AND VALUE OF FREIGHT SHIPMENTS BY DOMESTIC MODE IN 2017 IN THE US

FIGURE 38 USE CASES AND NEW LOGISTICS BUSINESS MODELS

FIGURE 39 MARKET, BY END-USE, 2020 VS. 2025 (USD MILLION)

TABLE 92 MARKET, BY END-USE, 2016–2019 (‘000 UNITS)

TABLE 93 MARKET, BY END-USE, 2020–2025 (‘000 UNITS)

TABLE 94 MARKET, BY END-USE, 2016–2019 (USD MILLION)

TABLE 95 MARKET, BY END-USE, 2020–2025 (USD MILLION)

10.2 AUTOMOTIVE

TABLE 96 AUTOMOTIVE: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 97 AUTOMOTIVE: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 98 AUTOMOTIVE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 99 AUTOMOTIVE: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.3 CHEMICAL

TABLE 100 VARIOUS OF TANK TRAILERS FOR BULK LIQUID & CHEMICAL TRANSPORTATION

FIGURE 40 SALES OF CHEMICALS, BY REGION, 2018 (USD BILLION)

TABLE 101 CHEMICAL: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 102 CHEMICAL: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 103 CHEMICAL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 104 CHEMICAL: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.4 FMCG

FIGURE 41 VALUE CHAIN OF FMCG SECTOR

TABLE 105 FMCG: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 106 FMCG: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 107 FMCG: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 108 FMCG: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.5 HEALTHCARE

TABLE 109 HEALTHCARE: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 110 HEALTHCARE: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 111 HEALTHCARE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 112 HEALTHCARE: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.6 HEAVY INDUSTRY

TABLE 113 TOP 10 COMPANIES IN MINING INDUSTRY

FIGURE 42 GOLD PRODUCTION IN 2019, BY COUNTRY (TONNES)

FIGURE 43 MINING PRODUCTION IN 2018, BY COUNTRY (MILLION METRIC TONNES)

FIGURE 44 CONSTRUCTION/MINING EQUIPMENT PRODUCTION (‘000 UNITS)

TABLE 114 HEAVY INDUSTRIES: EMI-TRAILER MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 115 HEAVY INDUSTRIES: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 116 HEAVY INDUSTRIES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 117 HEAVY INDUSTRIES: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.7 LOGISTICS

TABLE 118 LOGISTICS: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 119 LOGISTICS: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 120 LOGISTICS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 121 LOGISTICS: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.8 OIL & GAS

FIGURE 45 OIL CONSUMPTION, BY REGION, 2019 (TWH)

TABLE 122 OIL & GAS: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 123 OIL & GAS: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 124 OIL & GAS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 125 OIL & GAS: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.9 OTHERS

FIGURE 46 PULP PRODUCTION, 2018 VS. 2019 (’000 TONNES)

TABLE 126 OTHERS: MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 127 OTHERS: MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 128 OTHERS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 129 OTHERS: MARKET, BY REGION, 2020–2025 (USD MILLION)

11 GLOBAL SEMI-TRAILER MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

11.1.1 ASSUMPTIONS FOR MARKET FORECASTING

11.1.2 RESEARCH METHODOLOGY FOR SEMI-TRAILER, BY REGION

11.1.3 OPINIONS FROM INDUSTRY EXPERTS

FIGURE 47 SEMI-TRAILER MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 130 MARKET, BY REGION, 2016–2019 (‘000 UNITS)

TABLE 131 MARKET, BY REGION, 2020–2025 (‘000 UNITS)

TABLE 132 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 133 MARKET, BY REGION, 2020–2025 (USD MILLION)

11.2 ASIA PACIFIC

TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (UNITS)

TABLE 135 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (UNITS)

TABLE 136 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

11.2.1 CHINA

11.2.1.1 Government infrastructure spending and improving real estate to drive the market

TABLE 138 CHINA: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 139 CHINA: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 140 CHINA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 141 CHINA: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.2.2 INDIA

11.2.2.1 Expanding cold chain industry to drive the market

TABLE 142 INDIA: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 143 INDIA: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 144 INDIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 145 INDIA: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.2.3 JAPAN

11.2.3.1 Emphasis on adopting technologically advanced semi-trailers to drive the market

TABLE 146 JAPAN: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 147 JAPAN: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 148 JAPAN: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 149 JAPAN: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.2.4 SOUTH KOREA

11.2.4.1 Growth of export-based consumer electronics to drive the market

TABLE 150 SOUTH KOREA: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 151 SOUTH KOREA: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 152 SOUTH KOREA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 153 SOUTH KOREA: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.2.5 REST OF ASIA PACIFIC

TABLE 154 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 155 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 156 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.3 NORTH AMERICA

TABLE 158 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (UNITS)

TABLE 159 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (UNITS)

TABLE 160 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

11.3.1 US

11.3.1.1 Presence of strong healthcare industry to drive the market

TABLE 162 US: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 163 US: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 164 US: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 165 US: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Growing exports from US to drive the market

TABLE 166 CANADA: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 167 CANADA: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 168 CANADA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 169 CANADA: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Increasing number of US-based trailer manufacturers to drive the market

TABLE 170 MEXICO: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 171 MEXICO: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 172 MEXICO: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 173 MEXICO: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4 EUROPE

FIGURE 50 EUROPE: MARKET, 2020 VS. 2025 (USD MILLION)

TABLE 174 EUROPE: MARKET, BY COUNTRY, 2016–2019 (UNITS)

TABLE 175 EUROPE: MARKET, BY COUNTRY, 2020–2025 (UNITS)

TABLE 176 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 177 EUROPE: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Presence of largest semi-trailer manufacturers to drive the market

TABLE 178 GERMANY: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 179 GERMANY: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 180 GERMANY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 181 GERMANY: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.2 UK

11.4.2.1 Demand for customized semi-trailers to drive the market

TABLE 182 UK: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 183 UK: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 184 UK: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 185 UK: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 Established food & beverage industry to drive the market

TABLE 186 FRANCE: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 187 FRANCE: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 188 FRANCE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 189 FRANCE: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.4 SPAIN

11.4.4.1 Matured food processing and equipment industry to drive the market

TABLE 190 SPAIN: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 191 SPAIN: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 192 SPAIN: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 193 SPAIN: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.5 POLAND

11.4.5.1 Growing manufacturing industry to drive the market

TABLE 194 POLAND: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 195 POLAND: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 196 POLAND: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 197 POLAND: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.6 ITALY

11.4.6.1 Established transportation and logistics industries to drive the market

TABLE 198 ITALY: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 199 ITALY: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 200 ITALY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 201 ITALY: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 202 REST OF EUROPE: MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 203 REST OF EUROPE: MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 204 REST OF EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 205 REST OF EUROPE: MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

FIGURE 51 REST OF THE WORLD (ROW): SEMI-TRAILER MARKET, 2020 VS. 2025 (USD MILLION)

TABLE 206 REST OF THE WORLD (ROW): SEMI-TRAILER MARKET, BY COUNTRY, 2016–2019 (UNITS)

TABLE 207 REST OF THE WORLD (ROW): SEMI-TRAILER MARKET, BY COUNTRY, 2020–2025 (UNITS)

TABLE 208 REST OF THE WORLD (ROW): SEMI-TRAILER MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 209 REST OF THE WORLD (ROW): SEMI-TRAILER MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Promising logistics environment to drive the market

TABLE 210 BRAZIL: SEMI-TRAILER MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 211 BRAZIL: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 212 BRAZIL: SEMI-TRAILER MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 213 BRAZIL: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.5.2 RUSSIA

11.5.2.1 Growing domestic freight transportation to drive the market

TABLE 214 RUSSIA: SEMI-TRAILER MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 215 RUSSIA: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 216 RUSSIA: SEMI-TRAILER MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 217 RUSSIA: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.5.3 REST OF ROW

TABLE 218 REST OF ROW: SEMI-TRAILER MARKET, BY TYPE, 2016–2019 (UNITS)

TABLE 219 REST OF ROW: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (UNITS)

TABLE 220 REST OF ROW: SEMI-TRAILER REST OF ROW: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 221 REST OF ROW: SEMI-TRAILER MARKET, BY TYPE, 2020–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 183)

12.1 SEMI-TRAILER MARKET EVALUATION FRAMEWORK

FIGURE 52 MARKET EVALUATION FRAMEWORK

12.2 OVERVIEW

FIGURE 53 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET

12.3 MARKET SHARE ANALYSIS FOR MARKET

FIGURE 54 MARKET SHARE ANALYSIS, 2019

12.4 MARKET RANKING ANALYSIS FOR MARKET

FIGURE 55 MARKET RANKING ANALYSIS, 2019

12.5 COVID-19 IMPACT ON SEMI-TRAILER COMPANIES

12.6 COMPETITIVE SCENARIO

12.6.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

TABLE 222 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/ AGREEMENTS, 2018–2020

12.6.2 NEW PRODUCT DEVELOPMENTS

TABLE 223 NEW PRODUCT DEVELOPMENTS, 2018–2020

12.6.3 MERGERS & ACQUISITIONS, 2017–2020

TABLE 224 MERGERS & ACQUISITIONS, 2017–2020

12.6.4 EXPANSIONS, 2017–2020

TABLE 225 EXPANSIONS, 2017–2020

12.7 COMPETITIVE LEADERSHIP MAPPING FOR MARKET

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE

12.7.4 EMERGING COMPANIES

FIGURE 56 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.8 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 57 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

12.9 BUSINESS STRATEGY EXCELLENCE

FIGURE 58 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

12.10 SEMI-TRAILER TELEMATICS PROVIDER: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 59 SEMI-TRAILER TELEMATICS PROVIDER, 2019

13 COMPANY PROFILES (Page No. - 197)

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

13.1 CHINA INTERNATIONAL MARINE CONTAINERS

FIGURE 60 CHINA INTERNATIONAL MARINE CONTAINERS: COMPANY SNAPSHOT

TABLE 226 CIMC: SUPPLY CONTRACTS

TABLE 227 CIMC: AGREEMENTS

TABLE 228 CIMC: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS

13.2 WABASH NATIONAL

FIGURE 61 WABASH NATIONAL: COMPANY SNAPSHOT

TABLE 229 WABASH NATIONAL: NEW PRODUCT LAUNCHES

TABLE 230 WABASH NATIONAL: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/ACQUISITIONS

13.3 SCHMITZ CARGOBULL

FIGURE 62 SCHMITZ CARGOBULL: COMPANY SNAPSHOT

TABLE 231 SCHMITZ CARGOBULL: NEW PRODUCT LAUNCHES

TABLE 232 SCHMITZ CARGOBULL: EXPANSIONS

TABLE 233 SCHMITZ CARGOBULL: SUPPLY CONTRACTS

TABLE 234 SCHMITZ CARGOBULL: JOINT VENTURE/PARTNERSHIP/COLLABORATION

TABLE 235 SCHMITZ CARGOBULL: MERGER & ACQUISITION

13.4 GREAT DANE

TABLE 236 GREAT DANE: NEW PRODUCT LAUNCHES

TABLE 237 GREAT DANE: EXPANSIONS

TABLE 238 GREAT DANE: JOINT VENTURE/PARTNERSHIP/COLLABORATION

13.5 UTILITY TRAILER MANUFACTURING COMPANY

TABLE 239 UTILITY TRAILER MANUFACTURING: NEW PRODUCT LAUNCHES

TABLE 240 UTILITY TRAILER MANUFACTURING: EXPANSIONS

13.6 FAHRZEUGWERK BERNARD KRONE

FIGURE 63 FAHRZEUGWERK BERNARD: COMPANY SNAPSHOT

TABLE 241 FAHRZEUGWERK BERNARD KRONE: EXPANSIONS

TABLE 242 FAHRZEUGWERK BERNARD KRONE: SUPPLY CONTRACTS

TABLE 243 FAHRZEUGWERK BERNARD KRONE: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS

13.7 KÖGEL TRAILER

TABLE 244 KOGEL TRAILER: NEW PRODUCT LAUNCHES

TABLE 245 KOGEL TRAILER: EXPANSIONS

13.8 HYUNDAI TRANSLEAD

TABLE 246 HYUNDAI TRANSLEAD: EXPANSIONS

13.9 LAMBERET

TABLE 247 LAMBERET: EXPANSIONS

13.10 WILHELM SCHWARZMUËLLER

FIGURE 64 WILHELM SCHWARZMUËLLER: COMPANY SNAPSHOT

TABLE 248 WILHELM SCHWARZMUËLLER: NEW PRODUCT LAUNCHES

TABLE 249 WILHELM SCHWARZMUËLLER: MERGERS & ACQUISITIONS

13.11 STOUGHTON TRAILERS, LLC

13.12 FELLING TRAILERS

13.13 KENTUCKY TRAILERS

13.14 PITTS TRAILERS

13.15 PREMIER TRAILERS

13.16 WIELTON SA

13.17 SDC TRAILERS LTD.

13.18 DENNISON TRAILERS LTD

13.19 KASSBOHRER

13.20 VAN HOOL

13.21 MONTRACON

13.22 RAC GERMANY

13.23 SATRAC

13.24 VAZRON

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 229)

14.1 KEY INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the semi-trailer market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example International Council on Clean Transportation (ICCT), CLCCR International Association of the Body and Trailer Building Industry, global trailer magazines, corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and other semi-trailer manufacturers & associations] have been used to identify and collect information useful for an extensive commercial study of the semi-trailer market.

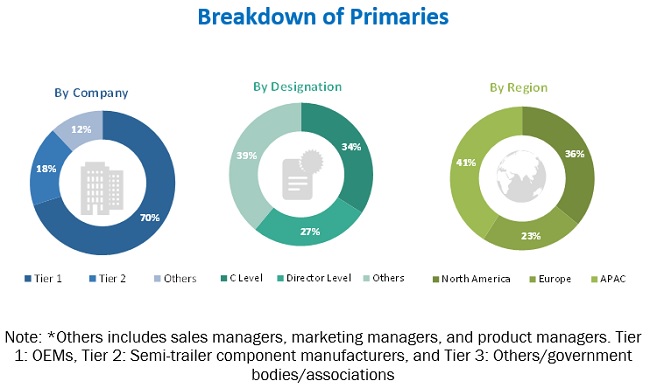

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across major regions, namely, Asia Pacific, Europe, North America and Rest of world (RoW). Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the global semi-trailer market and other dependent submarkets, as mentioned below:

- Key players in the global semi-trailer market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the global semi-trailer market was determined by using secondary sources and verified through primary sources.

- All key macro-indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the semi-trailer market in terms of value (USD million) and volume (units)

- To define, describe, and forecast the market based on type, length, tonnage, number of axles, end-use industry, and region

- To segment and forecast the market size by type (flatbed, lowboy, dry van, refrigerated, tankers, and others)

- To segment and forecast the market size by length (Up to 45 Feet and Above 45 Feet)

- To segment and forecast the market size by tonnage (below 25 T, 25 T-50 T, 51 T-100 T, and above 100 T)

- To segment and forecast the market size by number of axles (<3 axles, 3-4 axles, and >4 axles)

- To segment and forecast the market size by end-use (heavy industry, FMCG, chemical, automotive, oil & gas, healthcare, logistics, and others)

- To segment and forecast the market size, by region (Asia Pacific, Europe, North America, and RoW)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the ranking of key players operating in the market

- To understand the dynamics of competitors in the market and distinguish them into star, emerging leaders, pervasive, and participants according to their product portfolio strength and business strategies

- To analyze recent developments, joint ventures, mergers & acquisitions, supply contracts, new product launches, collaborations, and other activities carried out by key industry players in the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the overall market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Semi-Trailer Market, By Number of Axles, at the country-level (For countries covered in the report)

- Semi-Trailer Market, By End-Use, at the country-level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Semi-Trailer Market

MarketsandMarkets provided the market size and growth forecast by Type at a regional level and also at a country level, however by End-User Industries is provided at a regional level only, however my analyst mentioned that we can update this study and in the new version we can deliver the market size by End-Users at a country level as well. The contents/data coverage of the Semi-Trailer Market report will be updated including the sales volumes and revenues for the year 2021 onwards to 2027, considering 2021 sales revenues of key top players as the base year for estimation, their performance in 2021/2022 thus far and investments data of each of the top key players as the base year for estimating the 2022 revenues and forecast the market to 2027. Historical data will be provided from 2019 onwards.Market share analysis of key players will be provided for the year 2021, including their revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis will be provided for all global and regional players.

How do emerging markets offer revenue expansion opportunities in Semi-Trailer Market?