Australia Intelligent Transport System (ITS) Market by Application, System (ATMS, ATIS, ITS- Enabled Transportation Pricing System, APTS and CVO), and Territory (New South Wales, Victoria, Queensland, Western Australia, Rest of Australia) - Forecast to 2020

ITS Australia market refer to information and communication technologies applied in transport infrastructure and vehicles for improved mobility, safety, and sustainability. It improves transport outcomes and traffic management such as transport productivity, transport safety, travel reliability, and reduced traffic congestion. Australia Intelligent transportation systems market report is segregated based on systems, applications, and territorial regions. Applications in fleet management and asset monitoring, collision avoidance systems and parking availability systems are expected to drive the market. This is due to investments by central and local governments to improve transportation systems and reduce congestion by adopting new technologies. This report is based on system types such as advanced traffic management system, advanced traveler information system, ITS-enabled transportation pricing system, advanced public transportation system, and commercial vehicle operation.

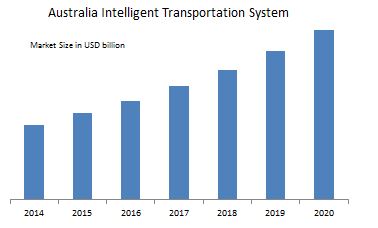

The report profiles companies active in this field. It provides the competitive landscape of key players that includes their key growth strategies. The report also focuses on giving a detailed view of the complete ITS Australia market with regards to different applications as well as territorial regions. The market is estimated to reach $1,130.2 Million by 2020 at a CAGR of 14.41% between 2015 and 2020.

Major players in the ITS Australia market include the Thales Group (France), Redflex Holding Ltd. (Australia), Vix Technology (Australia), Kapsch TrafficCom AG (Austria), and Sigtec Pty Ltd. (Australia). Several recent expansions and acquisitions, new product launches, and contracts among other strategies are discussed in the report.

Scope of the report

This research report categorizes the market based on system, application, and territory; it also covers the market size forecast between 2015 and 2020.

On the basis of the system:

Systems for this market include advanced traffic management system, advanced traveler information system, ITS-enabled transportation pricing system, advanced public transportation system and commercial vehicle operation which have been described in detail in this report.

On the basis of application area:

Applications areas have been categorized into fleet management and asset monitoring, traffic monitoring system, traffic signal control system, collision avoidance system, variable traffic message sign, parking availability system, traffic enforcement camera and automotive telematics.

On the basis of territory:

Territories covered are New South Wales, Victoria, Queensland, Western Australia, and the Rest of Australia.

The report also identifies drivers, restraints, opportunities, and current trends for the ITS Australia market . Apart from the market segmentation, the report includes the critical market data and qualitative information for each technology type along with qualitative analyses such as the Porter’s five force analysis, industry breakdown analysis, and value chain analysis.

Intelligent transportation systems have successfully been applied in transportation and traffic management systems. With the demand for continuous improvement in transportation systems, the ITS Australia market is expected to have a wide scope of applications in areas such as fleet management and asset monitoring, traffic monitoring systems, collision avoidance systems, variable traffic management signs, parking availability systems and traffic enforcement cameras. Budget allocations by central and local governments for the same are expected to be one of the drivers for the growth of the ITS Australia market during the forecast period.

Territory wise, the market has been segmented into New South Wales, Victoria, Queensland, Western Australia, and the Rest of Australia. New South Wales accounts for a large market share followed by Victoria and Queensland. The market in Western Australia is expected to grow at the highest rate during the forecast period. The Rest of Australia region which includes cities such as Adelaide and Hobart accounts for a small market share at present; however, it is expected to grow during the forecast period due to the increasing requirement of ITS in this region. Hence, the subsequent need for ITS is expected to rise in Australia.

Key drivers for the intelligent transportation systems ecosystem in Australia are increasing government funding and support and the need to reduce congestion and increase road safety. This market, in spite of its exceptional demand, has some restraints in terms of its growth; the key restraints are the lack of interoperability and standardization, and high installation cost. The demand for smart vehicles and driverless cars can be a major opportunity for this market.

The report focuses on giving a detailed view of the complete market with regards to application areas and territories, with detailed segmentations, combined with the qualitative analysis of each and every aspect of the segmentation. All the numbers, at every level of detail, are estimated till 2020 to give a detail of the potential size of this market.

Some of the major companies in the market include the Thales Group (France), Redflex Holding Ltd. (Australia), Vix Technology (Australia), Kapsch TrafficCom AG (Austria), and Sigtec PTY Ltd. (Australia).

Table Of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Design (Page No. - 14)

2.1 Market Size Estimation

2.1.1 Bottom-Up Approach

2.1.2 Top-Down Approach

2.2 Market Breakdown and Data Trangulation

2.3 Market Share Estimation

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.4 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 24)

4.1 Opportunities in the Australia ITS Market

4.2 ITS Australia market Growth, By Application

4.3 ITS Australia market Growth, By Systems

4.4 ITS Australia market Size Based on Territories (2015 - 2020)

4.5 ITS Australia Market: Applications

5 Market Overview (Page No. - 27)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Government Support and Funding

5.3.1.2 Need to Increase Safety on Roads and Reduce Congestion

5.3.1.3 Requirement to Reduce the Impact of Vehicular Pollution on the Environment

5.3.2 Restraints

5.3.2.1 Lack of Interoperability and Standardization

5.3.2.2 High Setup Cost

5.3.3 Opportunity

5.3.3.1 Smart Vehicles and Driverless Cars

5.3.4 Challenges

5.3.4.1 Privacy and Legal Implications

5.3.4.2 Adopting to Uniform Standards

6 Industry Trends (Page No. - 36)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Degree of Competition

7 Australia ITS Market, By System (Page No. - 45)

7.1 Introduction

7.1.1 Advanced Traffic Management System (ATMS)

7.1.2 Advanced Traveler Information System (ATIS)

7.1.3 ITS-Enabled Transportation Pricing System

7.1.4 Advanced Public Transportation System (APTS)

7.1.5 Commercial Vehicle Operation (COV)

8 Australia ITS Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Fleet Management and Asset Monitoring

8.3 Traffic Monitoring System

8.4 Traffic Signal Control System

8.5 Collision Avoidance System

8.6 Variable Traffic Message Sign

8.7 Parking Availability System

8.8 Traffic Enforcement Camera

8.9 Automotive Telematics

9 Australia ITS Market, By Territory (Page No. - 62)

9.1 Introduction

9.2 New South Wales

9.3 Victoria

9.4 Queensland

9.5 Western Australia (WA)

9.6 The Rest of Australia

10 Competitive Landscape (Page No. - 71)

10.1 Overview

10.2 ITS Australia Market Share Analysis, Australia ITS Market

10.3 Competitive Situation and Trends

10.3.1 New Product Launches

10.3.2 Partnerships

10.3.3 Contracts

10.3.4 Expansions and Acquisitions

11 Company Profile (Page No. - 77)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Kapsch Trafficcom

11.2 Sigtec Pty Ltd.

11.3 Redflex Holdings Limited

11.4 Thales Group

11.5 VIX Technology

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 89)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Related Reports

List of Tables (30 Tables)

Table 1 ITS Australia Market Size, By Territory, 2014–2020 ($Million)

Table 2 Safety Features of ITS

Table 3 Driver Analysis

Table 4 Restraint Analysis

Table 5 Opportunity Analysis

Table 6 ITS Australia Market, By System, 2014–2020 ($Million)

Table 7 Advanced Traffic Management System Market Size, By Application, 2014-2020, ($Million)

Table 8 Advanced Traveler Information System Market Size, By Application, 2014-2020, ($Million)

Table 9 ITS-Enabled Transportation Pricing System Markets Size, By Application, 2014–2020 ($Million)

Table 10 Advanced Public Transportation System Market Size, By Application, 2014–2020 ($Million)

Table 11 Commercial Vehicle Operation Market Size, By Application, 2014–2020 ($Million)

Table 12 ITS Australia Market, By Application, 2014–2020 ($Million)

Table 13 Fleet Management and Asset Monitoring Market Size, By System, 2014–2020, ($Million)

Table 14 Traffic Monitoring System Market Size, By System, 2014-2020, ($Million)

Table 15 Traffic Signal Control System Market Size, By System, 2014–2020 ($Million)

Table 16 Collision Avoidance System Market Size, By System, 2014–2020 ($Million)

Table 17 Variable Traffic Messgae Sign Market Size, By System, 2014–2020 ($Million)

Table 18 Parking Availability System Market Size, By System, 2014-2020, ($Million)

Table 19 Traffic Enforcement Camera Market Size, By System, 2014-2020, ($Million)

Table 20 Automotive Telematics Market Size, By System, 2014-2020, ($Million)

Table 21 ITS Australia Market Size, By Territory, 2014–2020 ($Million)

Table 22 New South Wales: ITS Australia Market Size, By Application, 2014–2020 ($Million)

Table 23 Victoria: ITS Australia Market Size, By Application, 2014–2020 ($Million)

Table 24 Queensland : ITS Market Size, By Application, 2014–2020 ($Million)

Table 25 Western Australia: ITS Market Size, By Application, 2014–2020 ($Million)

Table 26 The Rest of Australia: ITS Market Size, By Application, 2014–2020 ($Million)

Table 27 New Product Launches, 2014-2015

Table 28 Partnerships 2009–2015

Table 29 Contracts, 2010–2015

Table 30 Expansions and Acquisitions, 2010–2015

List of Figures (34 Figures)

Figure 1 ITS Australia Market: Research Design

Figure 2 ITS Australia Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 ITS Australia Market Size Estimation Methodology: Top-Down Approach

Figure 4 Breakdown of Primary Interviews: By Company Type and Designation

Figure 5 ITS Australia Market: Data Triangulation Model

Figure 6 ITS Australia Market, By System, (2014–2020)

Figure 7 ITS Australia Market, By Application, 2014 vs 2020

Figure 8 Attractive Opportunities in the ITS Market in Australia (2014–2020)

Figure 9 The Application in Fleet Management and Asset Monitoring is Expected to Register the Highest Growth Rate During the Forecast Period

Figure 10 Advanced Traffic Management System Accounted for the Largest Share of the ITS Market Based on Systems

Figure 11 New South Wales Had the Largest Market Size in the Australia ITS Market Based on Territories

Figure 12 The Application in Traffic Signal Control Systems is Expected to Have the Largest Market Size

Figure 13 Australia ITS Market - Segmentation

Figure 14 Drivers, Restraints, Opportunity and Challenges for the Australia Intelligent Transportation System Market

Figure 15 Value Chain Analysis: Original Design Manufacturers and Solution Providers Add Major Value

Figure 16 Porter’s Analysis

Figure 17 Porters Analysis: Australia ITS Market

Figure 18 Threat of New Entrants

Figure 19 Threat of Substitutes

Figure 20 Bargaining Power of Suppliers

Figure 21 Bargaining Power of Buyers

Figure 22 Degree of Competition

Figure 23 ITS Australia Market Size, By System ($Million)

Figure 24 ITS Australia Market Snapshot

Figure 25 Western Australia—An Attractive Destination for the ITS Market

Figure 26 Companies Adopted Contracts and New Product Launches as Key Growth Strategies

Figure 27 Australia: ITS Market Share, By Key Player, 2014

Figure 28 Battle for Market Share: Contracts Was the Key Strategy Adopted

Figure 29 Kapsch Trafficcom: Company Snapshot

Figure 30 Kapsch Trafficcom AG: SWOT Analysis

Figure 31 Redflex Holdings Limited: Company Snapshot

Figure 32 Redflex Holding Ltd. : SWOT Analysis

Figure 33 Thales Group :Company Snapshot

Figure 34 Thales Group : SWOT Analysis

Growth opportunities and latent adjacency in Australia Intelligent Transport System (ITS) Market